Credit

Cash Spreads Tighten, But Tough Day For IG Bonds With The Large Upward Shift In The Yield Curve

Decent day for USD bond issuers, with a few sizeable deals priced, led by $ 1.8 bn in 3 tranches from American Tower Corporation and a $ 1.5 bn single-trancher from Nordea

Published ET

USIG Investment Grade ETF, Intraday Prices | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.64% today, with investment grade down -0.70% and high yield down -0.11% (YTD total return: 0.00%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.81% today (Month-to-date: -0.03%; Year-to-date: -0.52%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.01% today (Month-to-date: 0.23%; Year-to-date: 4.13%)

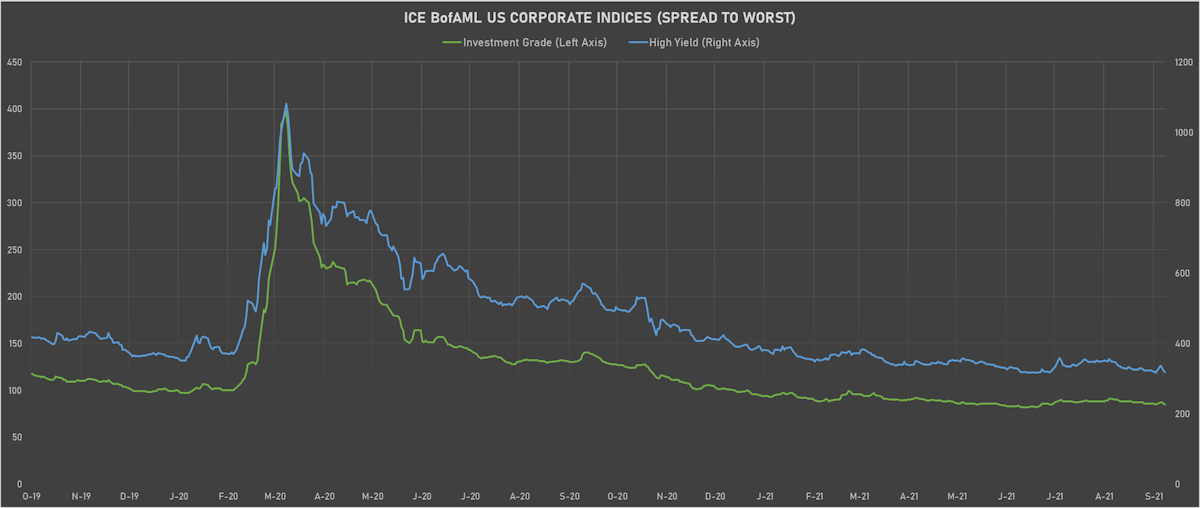

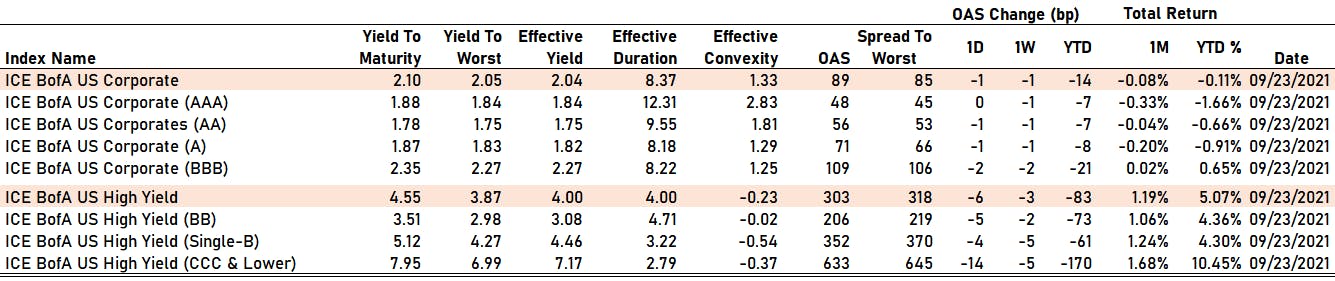

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 85.0 bp (YTD change: -13.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 318.0 bp (YTD change: -72.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: +3.1%)

- New issues: US$ 10.4bn in dollars and € 3.4bn in euros

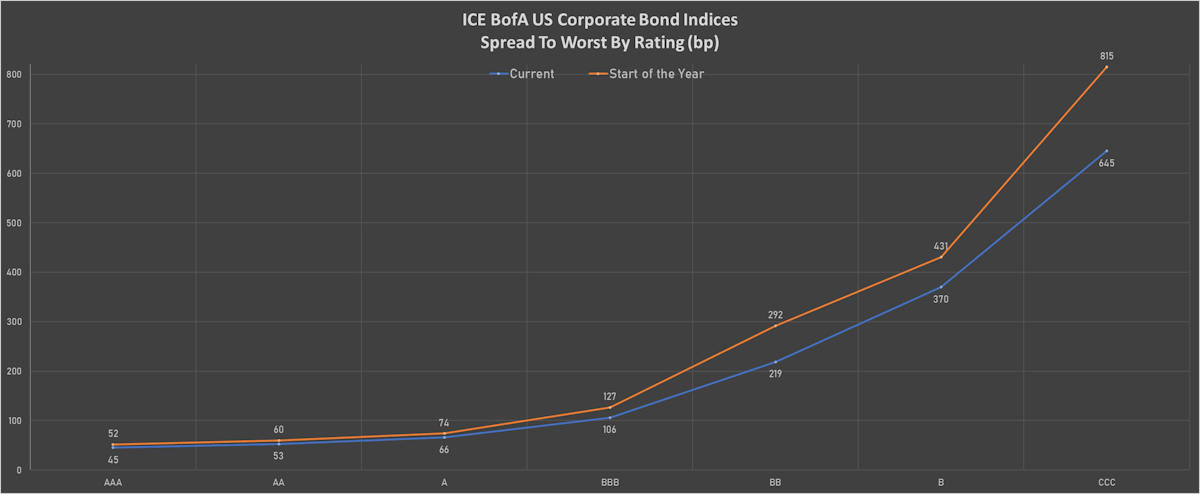

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 48 bp

- AA down by -1 bp at 56 bp

- A down by -1 bp at 71 bp

- BBB down by -2 bp at 109 bp

- BB down by -5 bp at 206 bp

- B down by -4 bp at 352 bp

- CCC down by -14 bp at 633 bp

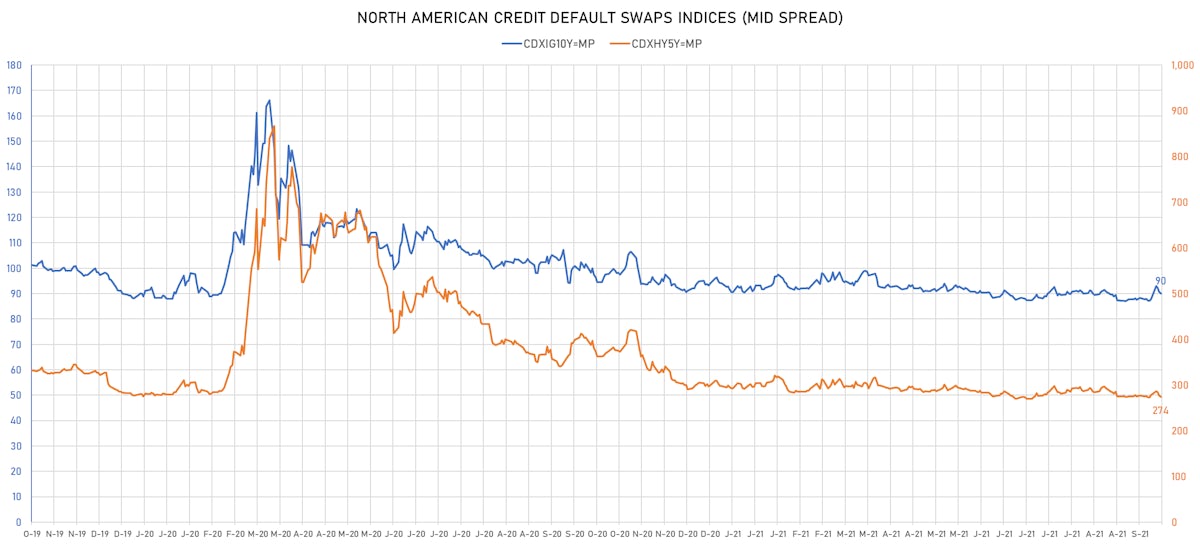

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.7 bp, now at 90bp (YTD change: -0.5bp)

- Markit CDX.NA.HY 5Y down 2.3 bp, now at 274bp (YTD change: -18.9bp)

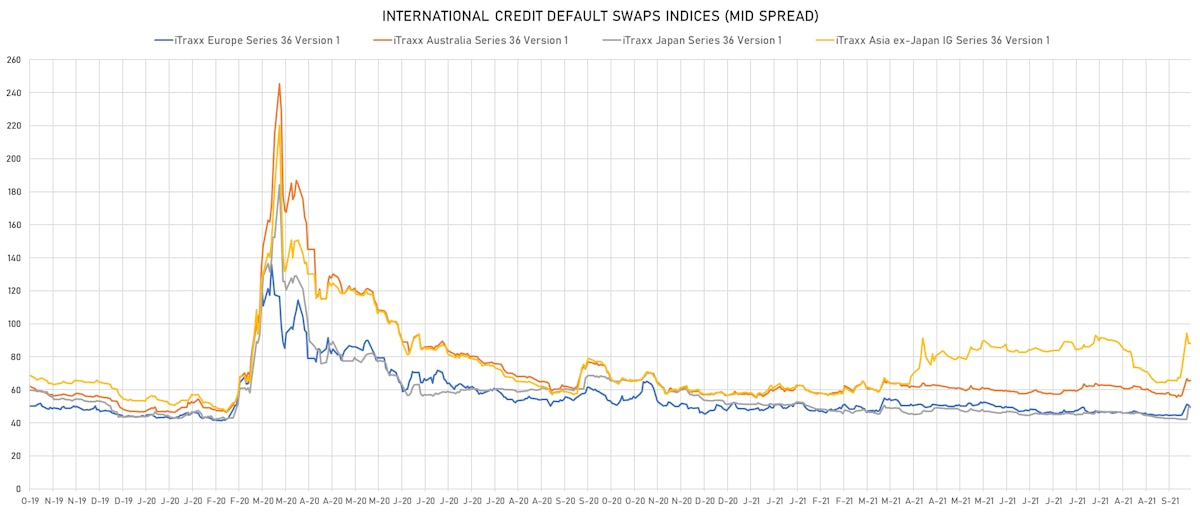

- Markit iTRAXX Europe down 0.9 bp, now at 49bp (YTD change: +0.6bp)

- Markit iTRAXX Japan unchanged at 49bp (YTD change: -2.0bp)

- Markit iTRAXX Asia Ex-Japan down 5.0 bp, now at 83bp (YTD change: +24.9bp)

USD BOND ISSUES

- American Tower Corp (Real Estate Investment Trust | Boston, United States | Rating: BBB-): US$600m Senior Note (US03027XBR08), fixed rate (1.45% coupon) maturing on 15 September 2026, priced at 99.48 (original spread of 63 bp), callable (5nc5)

- American Tower Corp (Real Estate Investment Trust | Boston, United States | Rating: BBB-): US$700m Senior Note (US03027XBS80), fixed rate (2.30% coupon) maturing on 15 September 2031, priced at 99.44 (original spread of 95 bp), callable (10nc10)

- Cano Health LLC (Health Care Supply | Miami, United States | Rating: NR): US$300m Senior Note (US13782CAA80), fixed rate (6.25% coupon) maturing on 1 October 2028, priced at 100.00 (original spread of 508 bp), callable (7nc3), ended the day at 102.5-103

- Catalent Pharma Solutions Inc (Pharmaceuticals | Somerset, United States | Rating: BB-): US$650m Senior Note (US14879EAK47), fixed rate (3.50% coupon) maturing on 1 April 2030, priced at 100.00 (original spread of 220 bp), callable (9nc4)

- Duke Energy Corp (Utility - Other | Charlotte, United States | Rating: BBB-): US$500m Junior Subordinated Debenture (US26441CBP95), fixed rate (3.25% coupon) maturing on 15 January 2082, priced at 100.00 (original spread of 232 bp), callable (60nc5)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$300m Bond (US3130APBH71), fixed rate (0.57% coupon) maturing on 30 September 2024, priced at 100.00 (original spread of 53 bp), callable (3nc3m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$250m Bond (US3130APB870), fixed rate (1.10% coupon) maturing on 13 October 2026, priced at 100.00 (original spread of 104 bp), callable (5nc3m)

- Kilroy Realty LP (Service - Other | Los Angeles, United States | Rating: BBB): US$450m Senior Note (US49427RAR30), fixed rate (2.65% coupon) maturing on 15 November 2033, priced at 99.96 (original spread of 125 bp), callable (12nc12)

- Prospect Capital Corp (Financial - Other | New York City, United States | Rating: BBB-): US$300m Senior Note (US74348TAW27), fixed rate (3.44% coupon) maturing on 15 October 2028, priced at 98.27 (original spread of 250 bp), callable (7nc7)

- PS Logistics: $300mm 7.875% 8NC3 unsecured notes due 2029, priced at 100, ended the day at 100.75-101.5.

- Roller Bearing Company of America Inc (Machinery | Fairfield, United States | Rating: B+): US$500m Senior Note (US775631AD66), fixed rate (4.38% coupon) maturing on 15 October 2029, priced at 100.00 (original spread of 311 bp), callable (8nc3)

- Viavi Solutions Inc (Electronics | San Jose, United States | Rating: BB+): US$400m Senior Note (US925550AF21), fixed rate (3.75% coupon) maturing on 1 October 2029, priced at 100.00 (original spread of 245 bp), callable (8nc3)

- Bank of China Ltd (Sydney Branch) (Banking | Sydney, New South Wales, China (Mainland) | Rating: NR): US$300m Senior Note (XS2388372273), fixed rate (0.75% coupon) maturing on 29 September 2024, priced at 99.75 (original spread of 33 bp), non callable

- Bank of Ireland Group PLC (Banking | Dublin, Ireland | Rating: BBB-): US$1,000m Senior Note (XS2390393838), fixed rate (2.03% coupon) maturing on 30 September 2027, priced at 100.00 (original spread of 110 bp), callable (6nc5)

- Carriage Purchaser Inc (Financial - Other | Rating: CCC+): US$300m Senior Note (US14445LAA52), fixed rate (7.88% coupon) maturing on 15 October 2029, priced at 100.00 (original spread of 690 bp), callable (8nc3)

- Dornoch Debt Merger Sub Inc (Financial - Other | Rating: NR): US$665m Senior Note (US25830JAA97), fixed rate (6.63% coupon) maturing on 15 October 2029, priced at 100.00 (original spread of 536 bp), callable (8nc3)

- Gol Finance SA (Financial - Other | Luxembourg, Brazil | Rating: NR): US$150m Senior Note (USL4441RAE64), fixed rate (8.00% coupon) maturing on 30 June 2026, priced at 100.75, callable (5nc1)

- Gunvor Group Ltd (Oil and Gas | Nicosia, Cyprus | Rating: NR): US$300m Bond (XS2362619053), fixed rate (6.25% coupon) maturing on 30 September 2026, priced at 100.00 (original spread of 534 bp), callable (5nc5)

- Nordea Bank Abp (Banking | Helsinki, Finland | Rating: AA-): US$1,500m Note (US65559D2E87), fixed rate (1.50% coupon) maturing on 30 September 2026, priced at 99.88 (original spread of 60 bp), non callable

- Taiwan Semiconductor Manufacturing Co Ltd (Electronics | Hsinchu, Taiwan | Rating: AA-): US$1,000m Senior Note (TW000F168026), fixed rate (3.10% coupon) maturing on 23 September 2051, priced at 100.00, callable (30nc5)

- Xinhu (BVI) 2018 Holding Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$250m Senior Note (XS2387698926), fixed rate (11.00% coupon) maturing on 28 September 2024, priced at 100.00, callable (3nc2)

EUR BOND ISSUES

- Arval Service Lease SA (Financial - Other | Paris, France | Rating: A-): €500m Bond (FR0014005OL1) zero coupon maturing on 1 October 2025, priced at 99.67 (original spread of 75 bp), callable (4nc4)

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9U5B0), floating rate maturing on 18 October 2028, priced at 100.00, non callable

- EC Finance PLC (Financial - Other | London, United Kingdom | Rating: NR): €500m Note (XS2389986899), fixed rate (3.00% coupon) maturing on 15 October 2026, priced at 100.00 (original spread of 360 bp), callable (5nc2)

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A): €150m Inhaberschuldverschreibung (AT0000A2TKB3), fixed rate (0.20% coupon) maturing on 2 November 2028, priced at 100.00, non callable

- National Bank of Canada (Banking | Montreal, Canada | Rating: A-): €750m Covered Bond (Other) (XS2390837495), fixed rate (0.01% coupon) maturing on 29 September 2026, priced at 101.05 (original spread of 42 bp), non callable

- Stadshypotek AB (Mortgage Banking | Stockholm, Sweden | Rating: AA-): €1,000m Covered Bond (Other) (XS2391570418), fixed rate (0.01% coupon) maturing on 30 September 2030, priced at 99.66 (original spread of 43 bp), non callable

NEW LOANS

- Rugsusa Llc, signed a US$ 500m Term Loan B maturing on 10/07/28, to be used for a leveraged buyout

NEW ISSUES IN SECURITIZED CREDIT

- Glenbeigh 2 Issuer Designated Activity Co issued a floating-rate RMBS in 1 tranche offering a spread over the floating rate of 90bp, for a total of € 466 m. Bookrunners: Citi

- Tagus Sociedade De Titularizacao De Creditos SA issued a floating-rate ABS backed by auto receivables in 7 tranches, for a total of € 297 m. Highest-rated tranche offering a spread over the floating rate of 70bp, and the lowest-rated tranche a spread of 549bp. Bookrunners: Deutsche Bank

- New Residential Mortgage Loan Trust 2021-Nqm3 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 237 m. Highest-rated tranche offering a yield to maturity of 1.16%, and the lowest-rated tranche a yield to maturity of 4.05%. Bookrunners: Nomura Securities Co Ltd, Credit Suisse, Amherst Securities Corp, Goldman Sachs & Co

- Colt 2021-Hx1 Mortgage Loan Trust issued a fixed-rate RMBS in 7 tranches, for a total of US$ 312 m. Highest-rated tranche offering a yield to maturity of 1.11%, and the lowest-rated tranche a yield to maturity of 4.27%. Bookrunners: Credit Suisse, Goldman Sachs & Co, Morgan Stanley International Ltd

- Sunrun Demeter Issuer 2021-2 LLC issued a fixed-rate ABS backed by certificates in 1 tranche offering a yield to maturity of 2.27%, for a total of US$ 447 m. Bookrunners: Credit Suisse, Deutsche Bank Securities Inc, Bank of America Merrill Lynch

- ZH Trust 2021-2 issued a fixed-rate ABS backed by rental income in 2 tranches, for a total of US$ 700 m. Highest-rated tranche offering a yield to maturity of 2.35%, and the lowest-rated tranche a yield to maturity of 3.51%. Bookrunners: Credit Suisse, Goldman Sachs & Co, Citigroup Global Markets Inc

- Freddie Mac Spc Series K-1521 issued a fixed-rate Agency CMBS in 2 tranches, for a total of US$ 795 m. Highest-rated tranche offering a yield to maturity of 1.72%, and the lowest-rated tranche a yield to maturity of 1.95%. Bookrunners: Deutsche Bank Securities Inc, Wells Fargo Securities LLC