Credit

HY Cash Spreads Widen, IG Tighten To Close Out The Week

Modest amount of USD corporate bond issuance this week, with higher interest rate volatility before and after the FOMC: US$ 15.8 bn in 26 Tranches for IG, $ 10.8 bn in 20 Tranches for HY (IFR data)

Published ET

Nordstrom and Gap Both Saw A Significant Widening In Their 5Y USD CDS Spreads This Week | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.23% today, with investment grade down -0.24% and high yield down -0.15% (YTD total return: -0.23%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.24% today (Month-to-date: -0.26%; Year-to-date: -0.75%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.11% today (Month-to-date: 0.12%; Year-to-date: 4.02%)

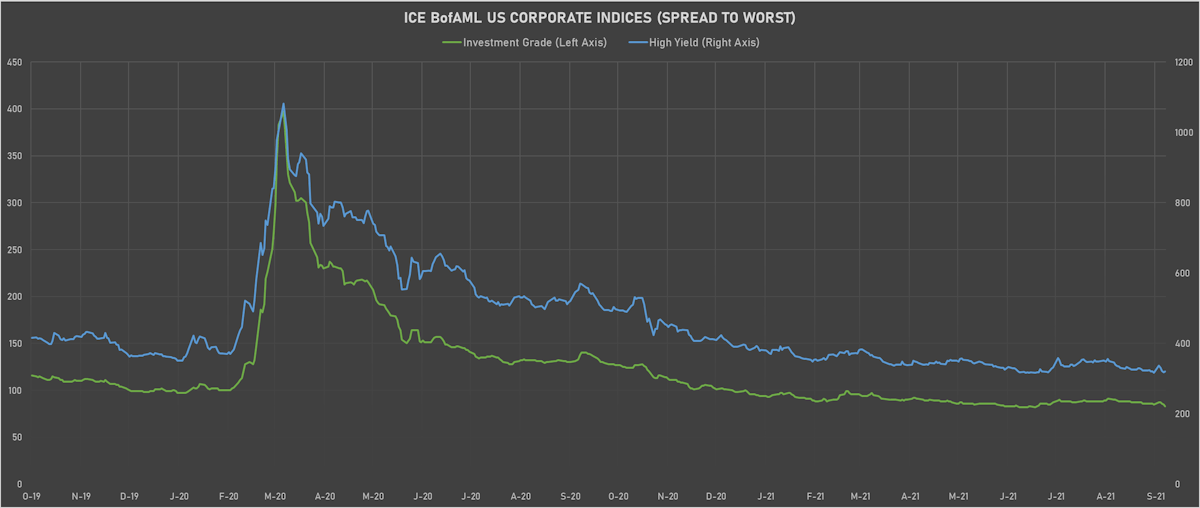

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 83.0 bp (YTD change: -15.0 bp)

- ICE BofA US High Yield Index spread to worst up 2.0 bp, now at 320.0 bp (YTD change: -70.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +3.1%)

- New issues: US$ 6.3bn in dollars and € 2.9bn in euros

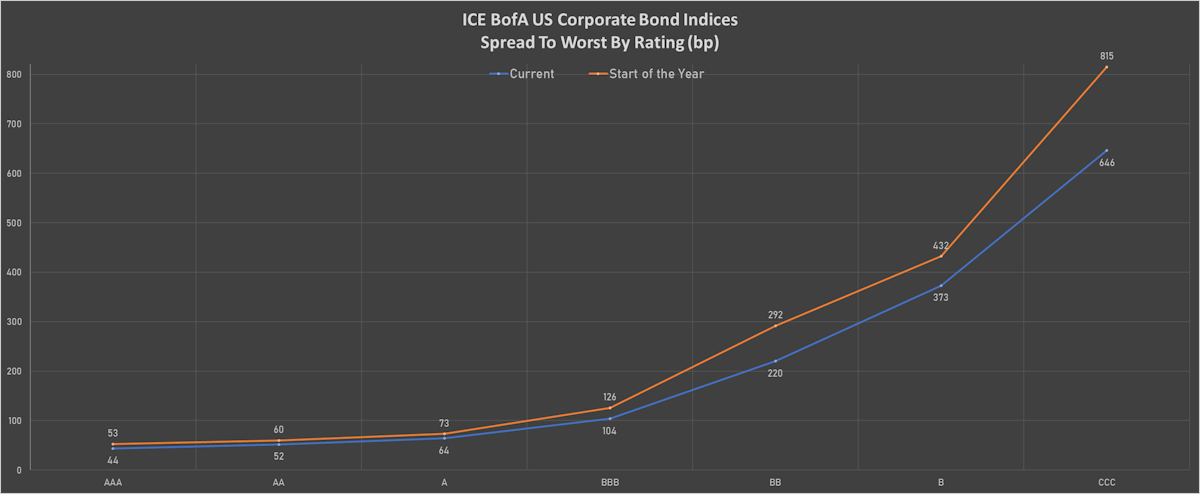

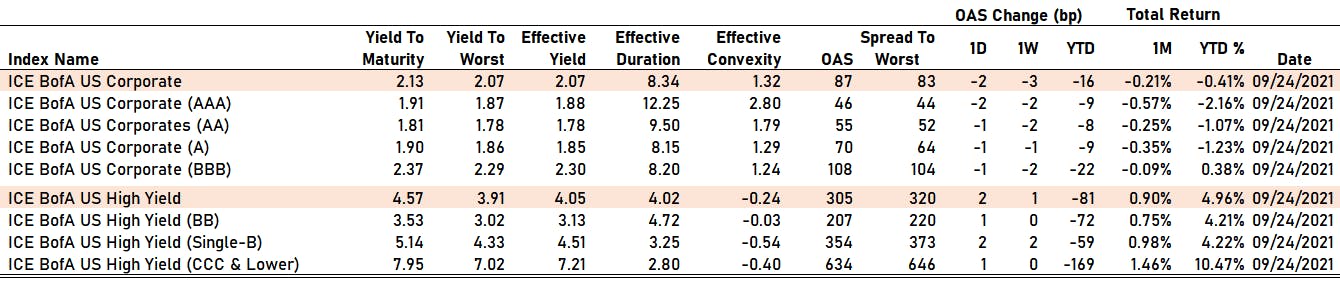

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -2 bp at 46 bp

- AA down by -1 bp at 55 bp

- A down by -1 bp at 70 bp

- BBB down by -1 bp at 108 bp

- BB up by 1 bp at 207 bp

- B up by 2 bp at 354 bp

- CCC up by 1 bp at 634 bp

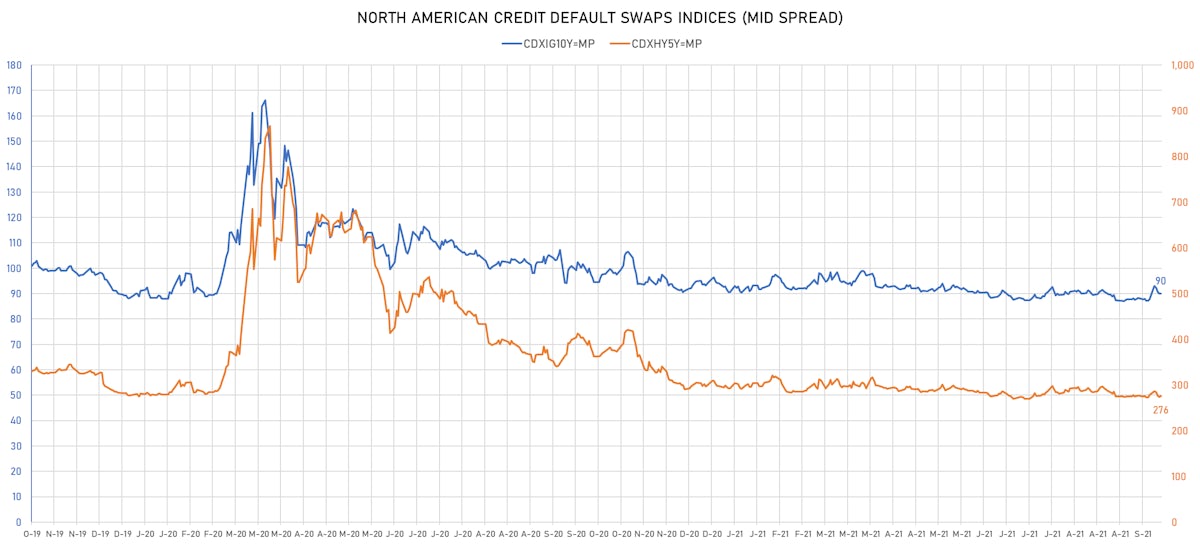

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.1 bp, now at 90bp (YTD change: -0.4bp)

- Markit CDX.NA.HY 5Y up 1.2 bp, now at 276bp (YTD change: -17.7bp)

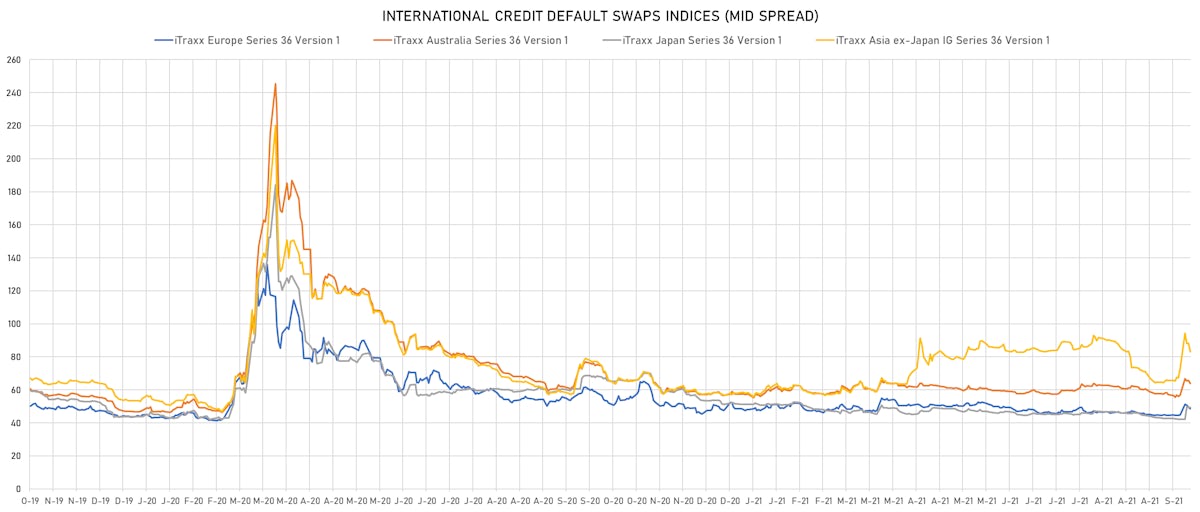

- Markit iTRAXX Europe up 0.5 bp, now at 49bp (YTD change: +1.1bp)

- Markit iTRAXX Japan down 2.2 bp, now at 47bp (YTD change: -4.2bp)

- Markit iTRAXX Asia Ex-Japan up 3.1 bp, now at 86bp (YTD change: +28.0bp)

USD BOND ISSUES

- Blackstone Mortgage Trust Inc (Real Estate Investment Trust | New York City, United States | Rating: B+): US$400m Note (US09257WAD20), fixed rate (3.75% coupon) maturing on 15 January 2027, priced at 100.00 (original spread of 274 bp), callable (5nc5)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$300m Bond (US3130APCH62), fixed rate (1.13% coupon) maturing on 29 September 2026, priced at 100.00 (original spread of 108 bp), callable (5nc3m)

- Altice France SA (Telecommunications | Saint-Denis, Luxembourg | Rating: B): US$2,000m Note (US02156LAH42), fixed rate (5.50% coupon) maturing on 15 October 2029, priced at 100.00 (original spread of 452 bp), callable (8nc3)

- Clearway Energy Operating LLC (Financial - Other | Princeton | Rating: BB): US$350m Senior Note (US18539UAE55), fixed rate (3.75% coupon) maturing on 15 January 2032, priced at 100.00 (original spread of 237 bp), callable (10nc5)

- Consensus Cloud Solutions Inc (Financial - Other | Los Angeles | Rating: B+): US$500m Senior Note (US20848VAB18), fixed rate (6.50% coupon) maturing on 15 October 2028, priced at 100.00 (original spread of 525 bp), callable (7nc5)

- Consensus Cloud Solutions Inc (Financial - Other | Los Angeles | Rating: B+): US$305m Senior Note (US20848VAA35), fixed rate (6.00% coupon) maturing on 15 October 2026, priced at 100.00 (original spread of 505 bp), callable (5nc2)

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A): US$150m Inhaberschuldverschreibung (AT0000A2TKM0), fixed rate (1.51% coupon) maturing on 30 September 2026, priced at 100.00, non callable

- NATWEST MARKETS PLC (Banking | Edinburgh, United Kingdom | Rating: A-): US$300m Senior Note (US63906YAE86), floating rate (SOFR + 76.0 bp) maturing on 29 September 2026, priced at 100.00, non callable

- NATWEST MARKETS PLC (Banking | Edinburgh, United Kingdom | Rating: A-): US$1,000m Senior Note (US63906YAD04), fixed rate (1.60% coupon) maturing on 29 September 2026, priced at 99.98 (original spread of 65 bp), non callable

- Sberbank Rossii PAO (Banking | Moscow, Moscow, Russia | Rating: BBB): US$990m Bond (RU000A103QW8) zero coupon maturing on 14 November 2031, priced at 100.00, non callable

EUR BOND ISSUES

- Altice France SA (Telecommunications | Saint-Denis, Ile-De-France, Luxembourg | Rating: B): €800m Note (XS2390217276), fixed rate (4.25% coupon) maturing on 15 October 2029, priced at 100.00 (original spread of 464 bp), callable (8nc3)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: AAA): €1,250m Hypothekenpfandbrief (Covered Bond) (DE000DL19V89), floating rate (EU03MLIB + 90.0 bp) maturing on 27 September 2027, priced at 105.38, non callable

- EOF-ZMG US Residential Holdco LLC (Financial - Other | Wilmington, Delaware, United States | Rating: NR): €260m Bond (XS2312742864), fixed rate (4.50% coupon) maturing on 31 December 2027, priced at 100.00, non callable

- RRE 8 Loan Management DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: AAA): €303m Bond (XS2379452639), floating rate maturing on 15 October 2036, priced at 100.00, non callable

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB-): €250m Senior Note (XS2390849664), floating rate maturing on 22 October 2031, priced at 100.00, non callable

NEW LOANS

- Pool Corp, signed a US$ 750m Revolving Credit Facility and a US$ 250m Delayed Draw Term Loan maturing on 09/27/26 , to be used for general corporate purposes.

- F W Webb Company, signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/30/26 and initial pricing is set at LIBOR +150bps

- EPR Properties (BBB-), signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/07/25 and initial pricing is set at LIBOR +120bps

NEW ISSUES IN SECURITIZED CREDIT

- Bumper Be issued a floating-rate ABS backed by auto receivables in 2 tranches, for a total of € 628 m. Highest-rated tranche offering a spread over the floating rate of 35bp, and the lowest-rated tranche a spread of 85bp. Bookrunners: BNP Paribas SA, ING