Credit

USD IG & HY Cash Spreads Widened Today, With Bonds Falling Despite Lower Rates

Home builders have seen considerable widening in their single-name CDS spreads, with weakening housing data and rising rates hitting them hard in the past 10 days

Published ET

5Y USD CDS Spreads for Toll Brothers, Beazer Homes, KB Home | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.08% today, with investment grade down -0.09% and high yield down -0.03% (YTD total return: -0.86%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.196% today (Month-to-date: -1.30%; Year-to-date: -1.78%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.065% today (Month-to-date: -0.17%; Year-to-date: 3.71%)

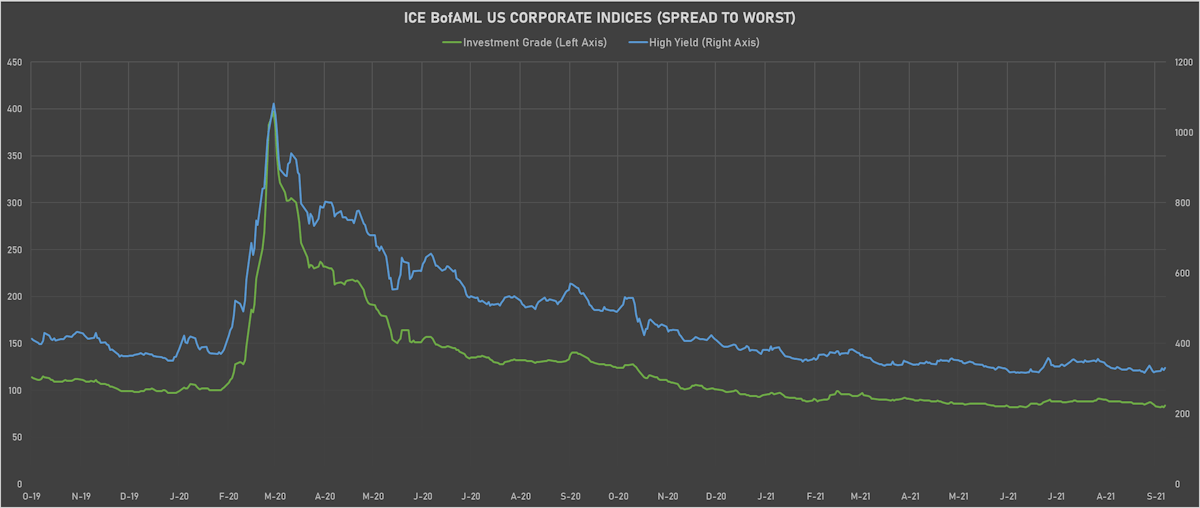

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 84.0 bp (YTD change: -14.0 bp)

- ICE BofA US High Yield Index spread to worst up 7.0 bp, now at 331.0 bp (YTD change: -59.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +3.2%)

- New issues: US$ 12.3bn in dollars and € 1.9bn in euros

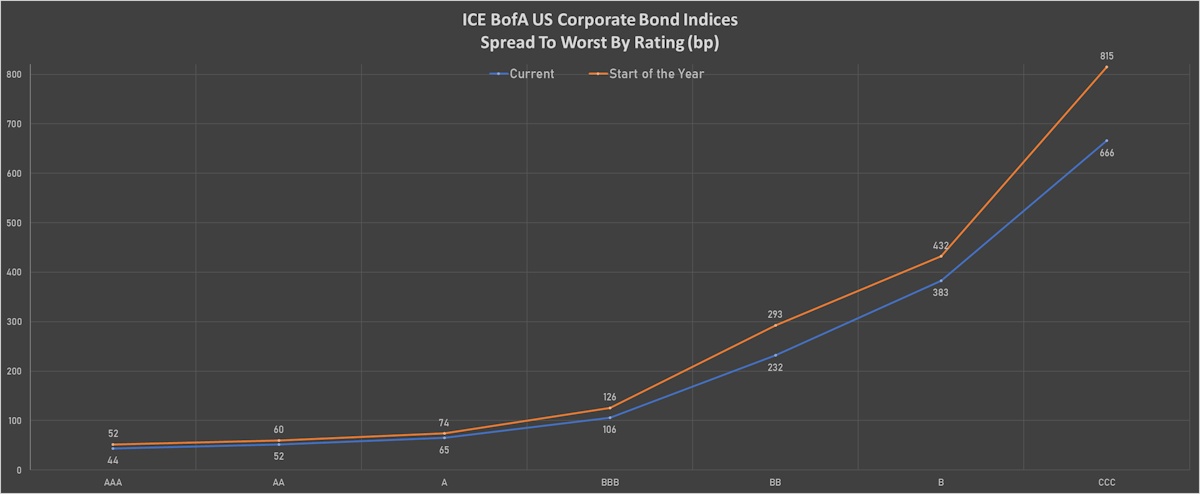

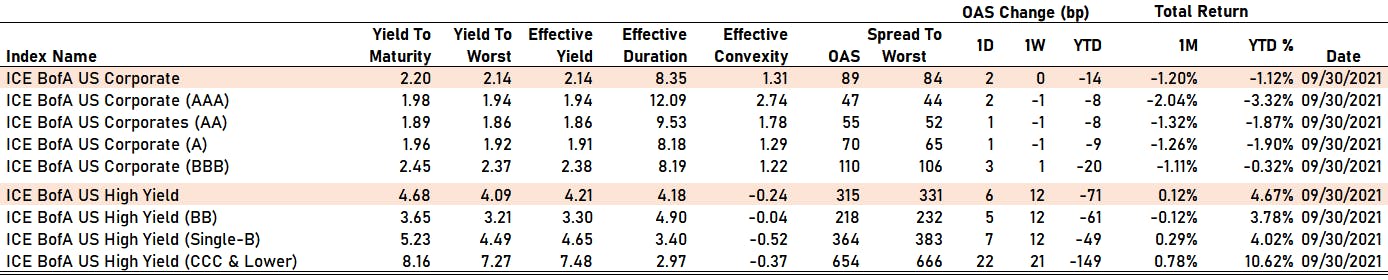

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 2 bp at 47 bp

- AA up by 1 bp at 55 bp

- A up by 1 bp at 70 bp

- BBB up by 3 bp at 110 bp

- BB up by 5 bp at 218 bp

- B up by 7 bp at 364 bp

- CCC up by 22 bp at 654 bp

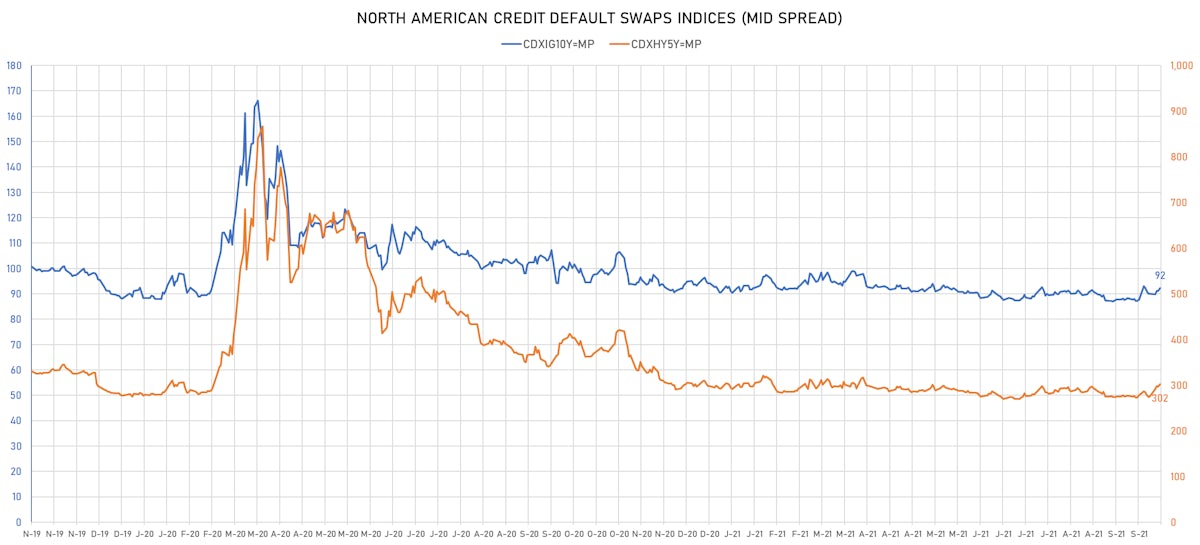

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.1 bp, now at 92bp (YTD change: +1.7bp)

- Markit CDX.NA.HY 5Y up 4.9 bp, now at 302bp (YTD change: +8.7bp)

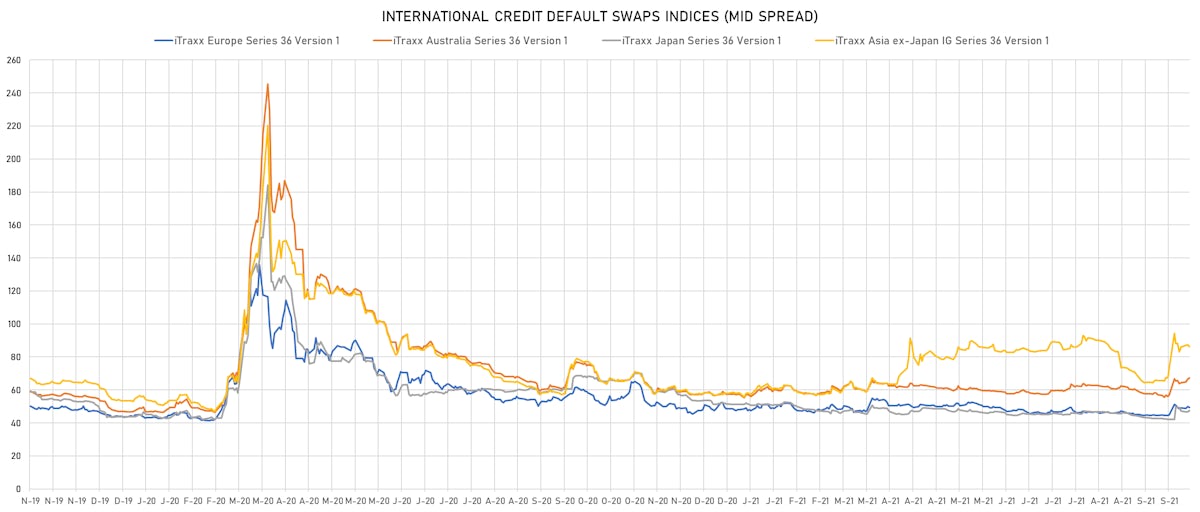

- Markit iTRAXX Europe up 0.5 bp, now at 50bp (YTD change: +2.1bp)

- Markit iTRAXX Japan unchanged at 48bp (YTD change: -3.8bp)

- Markit iTRAXX Asia Ex-Japan down 1.8 bp, now at 84bp (YTD change: +26.4bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 201.9 bp to 1,579.1bp (1Y range: 941-7,695bp)

- Genworth Holdings Inc (Country: US; rated: B2): down 29.0 bp to 477.4bp (1Y range: 447-681bp)

- Pactiv LLC (Country: US; rated: Caa1): up 17.7 bp to 446.3bp (1Y range: 232-458bp)

- NRG Energy Inc (Country: US; rated: Ba1): up 18.3 bp to 157.2bp (1Y range: 108-219bp)

- Kohls Corp (Country: US; rated: BBB): up 19.2 bp to 147.5bp (1Y range: 101-332bp)

- Toll Brothers Inc (Country: US; rated: Ba1): up 20.5 bp to 119.3bp (1Y range: 82-138bp)

- CCO Holdings LLC (Country: US; rated: WR): up 21.8 bp to 141.3bp (1Y range: 94-157bp)

- Nordstrom Inc (Country: US; rated: Ba1): up 23.1 bp to 267.9bp (1Y range: 211-684bp)

- CSC Holdings LLC (Country: US; rated: LGD3 - 30%): up 24.9 bp to 321.9bp (1Y range: -322bp)

- KB Home (Country: US; rated: Ba2): up 29.1 bp to 183.0bp (1Y range: 129-211bp)

- Beazer Homes USA Inc (Country: US; rated: B2): up 35.6 bp to 360.9bp (1Y range: 231-363bp)

- Macy's Inc (Country: US; rated: Ba2): up 37.4 bp to 246.9bp (1Y range: 190-1,212bp)

- Navient Corp (Country: US; rated: Ba3): up 67.6 bp to 325.7bp

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 23.1 bp to 193.0bp (1Y range: -193bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): down 23.0 bp to 189.5bp (1Y range: 190-514bp)

- Air France KLM SA (Country: FR; rated: B-): down 9.4 bp to 384.3bp (1Y range: 384-1,211bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 9.5 bp to 236.3bp (1Y range: 188-267bp)

- Ineos Group Holdings SA (Country: LU; rated: LGD5 - 88%): up 10.3 bp to 229.5bp (1Y range: 199-447bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 12.5 bp to 436.2bp (1Y range: 339-852bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 13.1 bp to 123.7bp (1Y range: 107-227bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 13.2 bp to 255.6bp (1Y range: 222-297bp)

- Novafives SAS (Country: FR; rated: Caa1): up 16.5 bp to 685.8bp (1Y range: 660-1,205bp)

- Boparan Finance PLC (Country: GB; rated: WR): up 17.0 bp to 1,047.2bp (1Y range: 478-1,075bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 17.4 bp to 531.1bp (1Y range: 358-651bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 26.5 bp to 298.7bp (1Y range: 259-734bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 27.1 bp to 574.1bp (1Y range: 464-1,187bp)

- Lagardere SA (Country: FR; rated: B): up 28.9 bp to 143.4bp (1Y range: 143-350bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 42.4 bp to 419.4bp (1Y range: 333-472bp)

USD BOND ISSUES

- American Finance Trust Inc (Real Estate Investment Trust | New York City, United States | Rating: BB+): US$500m Senior Note (US02608AAA79), fixed rate (4.50% coupon) maturing on 30 September 2028, priced at 100.00 (original spread of 320 bp), non callable

- 180 Medical Inc (Health Care Supply | Oklahoma City, United Kingdom | Rating: NR): US$500m Senior Note (USU68355AA17), fixed rate (3.88% coupon) maturing on 15 October 2029, priced at 100.00 (original spread of 253 bp), callable (8nc3)

- Becle SAB de CV (Retail Stores - Food/Drug | Alvaro Obregon, Mexico | Rating: BBB): US$800m Senior Note (USP0929YAA49), fixed rate (2.50% coupon) maturing on 14 October 2031, priced at 98.98 (original spread of 114 bp), callable (10nc10)

- Blue Owl Finance LLC (Financial - Other | Rating: BBB): US$350m Senior Note (US09581JAC09), fixed rate (4.13% coupon) maturing on 7 October 2051, priced at 97.51 (original spread of 255 bp), callable (30nc30)

- Cobra Acquisitionco LLC (Financial - Other | Rating: B-): US$400m Senior Note (US19106CAA45), fixed rate (6.38% coupon) maturing on 1 November 2029, priced at 100.00 (original spread of 519 bp), callable (8nc3)

- Consolidated Energy Finance SA (Financial - Other | Strassen, Switzerland | Rating: B+): US$525m Senior Note (US20914UAF30), fixed rate (5.63% coupon) maturing on 15 October 2028, priced at 100.00 (original spread of 453 bp), callable (7nc3)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$200m Note (XS2394051002) zero coupon maturing on 20 October 2055, priced at 100.00, callable (34nc5)

- Guatemala, Republic of (Government) (Sovereign | Guatemala City, Guatemala | Rating: BB-): US$500m Bond (USP5015VAM83), fixed rate (3.70% coupon) maturing on 7 October 2033, priced at 97.63, non callable

- Guatemala, Republic of (Government) (Sovereign | Guatemala City, Guatemala | Rating: BB-): US$500m Bond (US401494AU31), fixed rate (4.65% coupon) maturing on 7 October 2041, priced at 97.46, non callable

- LSF11 A5 Holdco LLC (Financial - Other | Rating: B-): US$350m Senior Note (US50221DAA72), fixed rate (6.63% coupon) maturing on 15 October 2029, priced at 100.00 (original spread of 524 bp), callable (8nc1m)

- Mozart Debt Merger Sub Inc (Financial - Other | Rating: B+): US$4,500m Note (US62482BAA08), fixed rate (3.88% coupon) maturing on 1 April 2029, priced at 100.00 (original spread of 251 bp), callable (7nc3)

- Mozart Debt Merger Sub Inc (Financial - Other | Rating: NR): US$2,500m Senior Note (US62482BAB80), fixed rate (5.25% coupon) maturing on 1 October 2029, priced at 100.00 (original spread of 394 bp), callable (8nc3)

- Northwest Fiber LLC (Telecommunications | Everett | Rating: B): US$350m Note (US667449AD42), fixed rate (4.75% coupon) maturing on 30 April 2027, priced at 100.00 (original spread of 365 bp), callable (6nc2)

- Welltec International ApS (Oilfield Machinery and Services | Alleroed, Denmark | Rating: B-): US$325m Note (US95039LAA61), fixed rate (8.25% coupon) maturing on 15 October 2026, priced at 100.00 (original spread of 724 bp), callable (5nc2)

EUR BOND ISSUES

- American Tower Corp (Real Estate Investment Trust | Boston, United States | Rating: BBB-): €500m Senior Note (XS2393701284), fixed rate (0.40% coupon) maturing on 15 February 2027, priced at 99.41 (original spread of 107 bp), callable (5nc5)

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A): €140m Senior Note (XS2394144609), fixed rate (0.62% coupon) maturing on 15 October 2041, priced at 100.00, non callable

- Consolidated Energy Finance SA (Financial - Other | Strassen, Switzerland | Rating: B+): €250m Senior Note (XS2393692434), fixed rate (5.00% coupon) maturing on 15 October 2028, priced at 100.00 (original spread of 540 bp), callable (7nc3)

- Laender No 61 (Official and Muni | Germany | Rating: NR): €1,000m Jumbo Landesschatzanweisung (DE000A3MP5P6), fixed rate (0.01% coupon) maturing on 8 October 2027, priced at 101.20 (original spread of 33 bp), non callable

NEW LOANS

- Midland Cogeneration Venture (BBB-), signed a US$ 330m Term Loan maturing on 09/28/28, to be used for project finance

NEW ISSUES IN SECURITIZED CREDIT

- Penta CLO 2021-2 Designated Activity Co issued a floating-rate CLO in 8 tranches, for a total of € 409 m. Highest-rated tranche offering a spread over the floating rate of 101bp, and the lowest-rated tranche a spread of 890bp. Bookrunners: Morgan Stanley International Ltd

- GS Mortgage Securities Corp Trust 2021-Ip issued a floating-rate CMBS in 6 tranches, for a total of US$ 453 m. Highest-rated tranche offering a spread over the floating rate of 95bp, and the lowest-rated tranche a spread of 455bp. Bookrunners: Goldman Sachs & Co

- Golden Creek Asset Trust 2021-Nqm5 issued a fixed-rate RMBS in 5 tranches, for a total of US$ 337 m. Highest-rated tranche offering a yield to maturity of 1.26%, and the lowest-rated tranche a yield to maturity of 2.59%. Bookrunners: Credit Suisse

- Farm 2021-1 Mortgage Trust issued a fixed-rate Agency RMBS in 2 tranches, for a total of US$ 300 m. Bookrunners: Credit Suisse

- Lendingpoint 2021-B Asset Securitization Trust issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 400 m. Highest-rated tranche offering a yield to maturity of 1.11%, and the lowest-rated tranche a yield to maturity of 6.12%. Bookrunners: Credit Suisse, Guggenheim Securities LLC

- Aqua Finance Trust 2021-A issued a fixed-rate ABS backed by consumer loan in 3 tranches, for a total of US$ 759 m. Highest-rated tranche offering a yield to maturity of 1.54%, and the lowest-rated tranche a yield to maturity of 3.14%. Bookrunners: Credit Suisse, Goldman Sachs & Co, KeyBanc Capital Markets Inc