Credit

High Yield Overperformed Today, With Tighter Spreads And Short Durations Countering Rising Rates

A fairly good day for USD corporate bond issuance, with multiple offerings raising over a billion dollars, including MUFG's US$ 3bn in 3 tranches and Frontier Communications' $1bn in a single tranche

Published ET

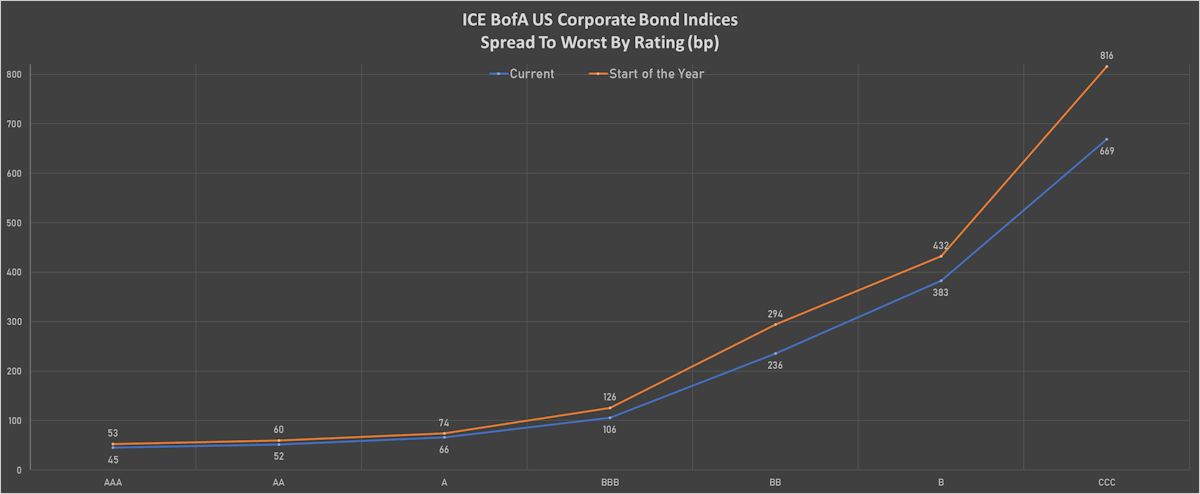

ICE BofAML US Corporate Spreads By Rating | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.38% today, with investment grade down -0.40% and high yield down -0.15% (YTD total return: -0.98%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.330% today (Month-to-date: -0.02%; Year-to-date: -1.80%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.006% today (Month-to-date: -0.10%; Year-to-date: 3.61%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 85.0 bp (YTD change: -13.0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 333.0 bp (YTD change: -57.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: +3.1%)

- New issues: US$ 11.7bn in dollars and € 1.3bn in euros

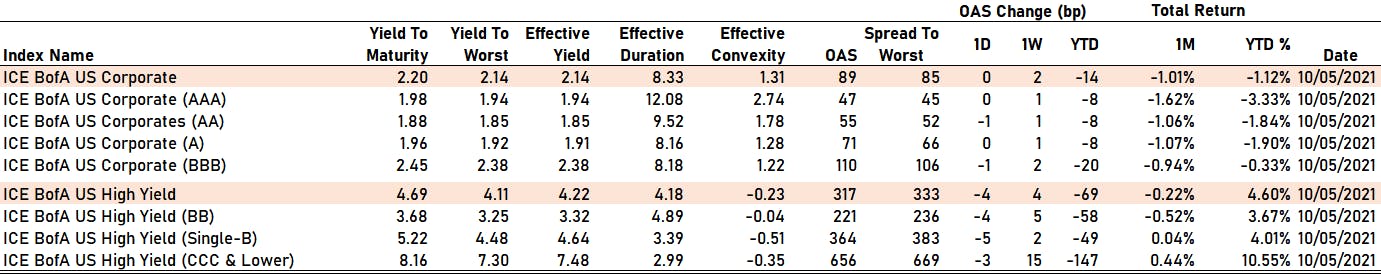

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 47 bp

- AA down by -1 bp at 55 bp

- A unchanged at 71 bp

- BBB down by -1 bp at 110 bp

- BB down by -4 bp at 221 bp

- B down by -5 bp at 364 bp

- CCC down by -3 bp at 656 bp

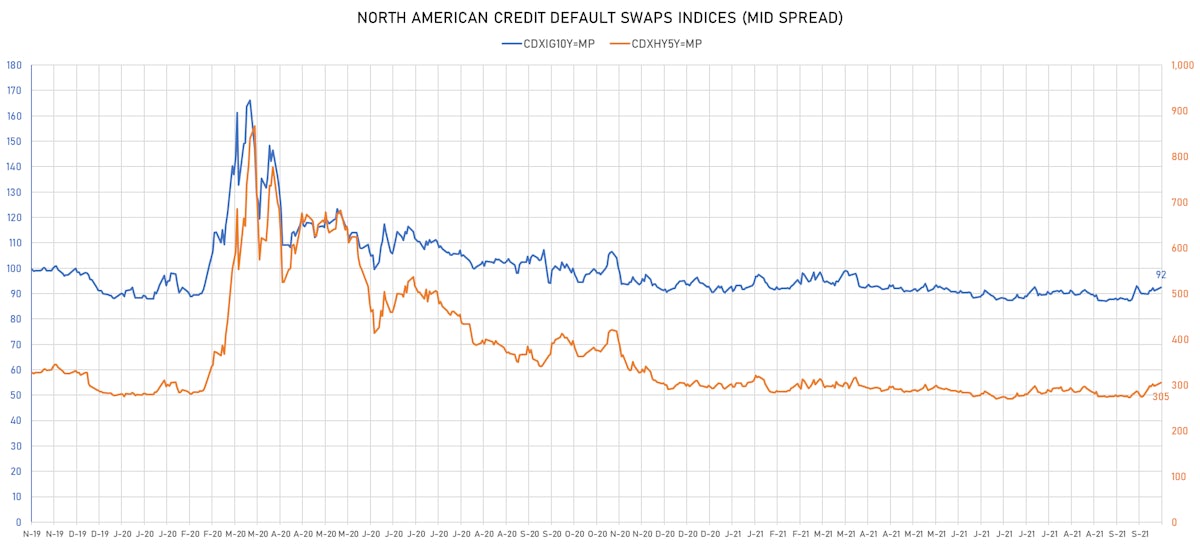

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.4 bp, now at 92bp (YTD change: +1.9bp)

- Markit CDX.NA.HY 5Y up 1.4 bp, now at 305bp (YTD change: +11.6bp)

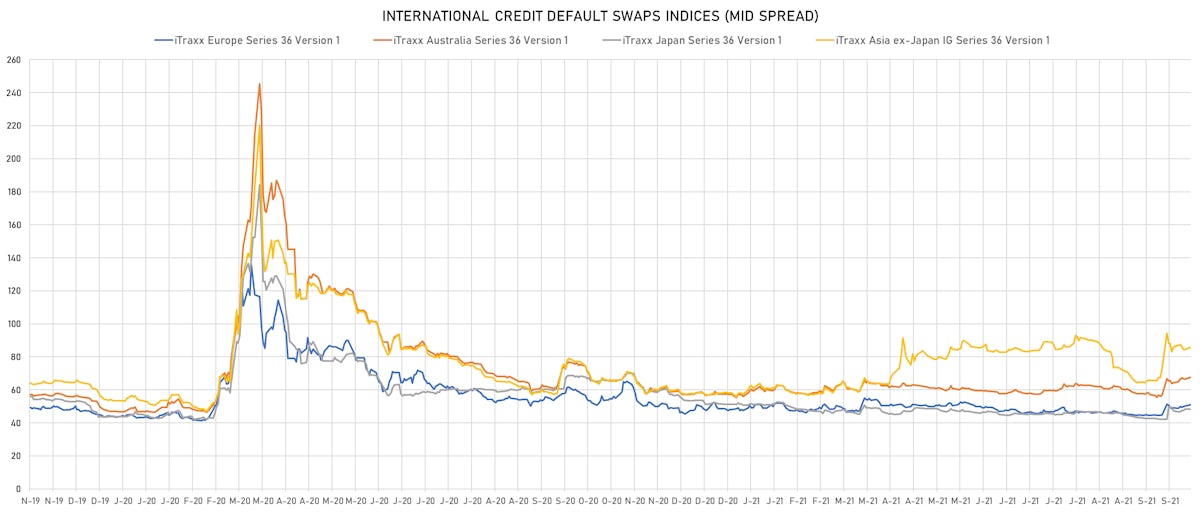

- Markit iTRAXX Europe down 0.3 bp, now at 51bp (YTD change: +2.8bp)

- Markit iTRAXX Japan up 1.4 bp, now at 50bp (YTD change: -1.7bp)

- Markit iTRAXX Asia Ex-Japan up 3.5 bp, now at 89bp (YTD change: +31.1bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 173.8 bp to 1,425.4bp (1Y range: 941-7,695bp)

- Office Depot Inc (Country: US; rated: WR): down 25.9 bp to 465.2bp (1Y range: 465-583bp)

- American Airlines Group Inc (Country: US; rated: B2): down 21.2 bp to 709.3bp (1Y range: 596-2,968bp)

- Nordstrom Inc (Country: US; rated: Ba1): up 20.4 bp to 273.2bp (1Y range: 211-684bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): up 20.6 bp to 168.5bp (1Y range: 124-401bp)

- Kohls Corp (Country: US; rated: BBB): up 21.1 bp to 150.5bp (1Y range: 101-330bp)

- NRG Energy Inc (Country: US; rated: Ba1): up 21.3 bp to 174.8bp (1Y range: 108-219bp)

- Navient Corp (Country: US; rated: Ba3): up 21.4 bp to 325.4bp (1Y range: -325bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): up 23.1 bp to 477.0bp (1Y range: 363-514bp)

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): up 28.2 bp to 784.4bp (1Y range: 606-1,202bp)

- Staples Inc (Country: US; rated: B2): up 32.2 bp to 1,025.1bp (1Y range: 652-1,306bp)

- Tegna Inc (Country: US; rated: Ba3): up 35.9 bp to 340.8bp (1Y range: 148-341bp)

- Macy's Inc (Country: US; rated: Ba2): up 54.1 bp to 275.3bp (1Y range: 190-1,201bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Rolls-Royce PLC (Country: GB; rated: BB-): down 13.9 bp to 188.6bp (1Y range: 186-475bp)

- Lagardere SA (Country: FR; rated: B): up 9.7 bp to 149.8bp (1Y range: 150-350bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 11.1 bp to 583.8bp (1Y range: 464-1,181bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): up 12.0 bp to 208.5bp (1Y range: 194-393bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 12.7 bp to 264.4bp (1Y range: 222-293bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 12.7 bp to 209.8bp (1Y range: 154-273bp)

- Ineos Group Holdings SA (Country: LU; rated: LGD5 - 88%): up 17.4 bp to 242.6bp (1Y range: 199-447bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 17.9 bp to 545.0bp (1Y range: 358-627bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 18.8 bp to 187.6bp (1Y range: 166-267bp)

- Thyssenkrupp AG (Country: DE; rated: B1): up 19.5 bp to 246.6bp (1Y range: 206-472bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 25.7 bp to 258.3bp (1Y range: 188-262bp)

- Novafives SAS (Country: FR; rated: Caa1): up 40.3 bp to 722.0bp (1Y range: 660-1,205bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 48.2 bp to 340.4bp (1Y range: 259-734bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 57.1 bp to 451.9bp (1Y range: 333-467bp)

- Boparan Finance PLC (Country: GB; rated: WR): up 72.6 bp to 1,105.2bp (1Y range: 478-1,105bp)

USD BOND ISSUES

- American Campus Communities Inc (Real Estate Investment Trust | Austin, United States | Rating: BBB): US$400m Senior Note (US024836AH19), fixed rate (2.25% coupon) maturing on 15 January 2029, priced at 99.93 (original spread of 95 bp), callable (7nc7)

- Autodesk Inc (Information/Data Technology | San Rafael California, United States | Rating: BBB): US$1,000m Senior Note (US052769AH94), fixed rate (2.40% coupon) maturing on 15 December 2031, priced at 99.70 (original spread of 90 bp), callable (10nc10)

- Bain Capital Specialty Finance Inc (Securities | Boston, United States | Rating: BBB-): US$300m Senior Note (US05684BAC19), fixed rate (2.55% coupon) maturing on 13 October 2026, priced at 98.93 (original spread of 180 bp), callable (5nc5)

- Bonanza Creek Energy Inc (Oil and Gas | Denver, United States | Rating: B+): US$400m Senior Note (US097793AE35), fixed rate (5.00% coupon) maturing on 15 October 2026, priced at 100.00 (original spread of 403 bp), callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$155m Bond (US3133ENAM21), fixed rate (2.34% coupon) maturing on 14 October 2036, priced at 100.00 (original spread of 64 bp), callable (15nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$450m Bond (US3133ENAL48), fixed rate (0.29% coupon) maturing on 12 October 2023, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$145m Bond (US3133ENAK64), floating rate (SOFR + 6.0 bp) maturing on 8 October 2024, priced at 100.00, non callable

- Frontier Communications Holdings LLC (Financial - Other | Norwalk, United States | Rating: CCC+): US$1,000m Note (USU3151BAA18), fixed rate (6.00% coupon) maturing on 15 January 2030, priced at 100.00 (original spread of 500 bp), callable (8nc3)

- Gannett Holdings LLC (Financial - Other | Chelmsford, United States | Rating: B-): US$400m Note (US36474GAA31), fixed rate (6.00% coupon) maturing on 1 November 2026, priced at 100.00 (original spread of 502 bp), callable (5nc2)

- General Mills Inc (Food Processors | Minneapolis, United States | Rating: BBB): US$500m Senior Note (US370334CQ51), fixed rate (2.25% coupon) maturing on 14 October 2031, priced at 99.92 (original spread of 73 bp), callable (10nc10)

- Sunoco LP (Oil and Gas | Dallas, United States | Rating: BB-): US$800m Senior Note (US86765LAU17), fixed rate (4.50% coupon) maturing on 30 April 2030, priced at 100.00 (original spread of 319 bp), callable (9nc4)

- Thor Industries Inc (Automotive Manufacturer | Elkhart, United States | Rating: BB-): US$500m Senior Note (US885160AA99), fixed rate (4.00% coupon) maturing on 15 October 2029, priced at 100.00 (original spread of 263 bp), callable (8nc3)

- WP Carey Inc (Real Estate Investment Trust | New York City, United States | Rating: BBB): US$350m Senior Note (US92936UAJ88), fixed rate (2.45% coupon) maturing on 1 February 2032, priced at 99.05 (original spread of 103 bp), callable (10nc10)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$1,250m Senior Note (US606822BZ65), fixed rate (1.64% coupon) maturing on 13 October 2027, priced at 100.00 (original spread of 67 bp), callable (6nc5)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$750m Bond (US606822CB88), fixed rate (2.49% coupon) maturing on 13 October 2032, priced at 100.00 (original spread of 97 bp), callable (11nc10)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$1,000m Senior Note (US606822CA06), fixed rate (0.96% coupon) maturing on 11 October 2025, priced at 100.00 (original spread of 45 bp), callable (4nc3)

- Nationwide Building Society (Financial - Other | Swindon, United Kingdom | Rating: A): US$1,000m Note (US63859UBH59), fixed rate (1.50% coupon) maturing on 13 October 2026, priced at 99.64 (original spread of 60 bp), non callable

- Owl Rock Capital Corporation III (Financial - Other | New York City | Rating: NR): US$325m Senior Note (US69122JAA43), fixed rate (3.13% coupon) maturing on 13 April 2027, priced at 99.97 (original spread of 215 bp), callable (6nc5)

EUR BOND ISSUES

- Hypo Vorarlberg Bank AG (Banking | Bregenz, Vorarlberg, Austria | Rating: A-): €500m Hypothekenpfandbrief Jumbo (Covered Bond) (XS2396616455), fixed rate (0.01% coupon) maturing on 12 October 2029, priced at 99.67 (original spread of 43 bp), non callable

- Sparebanken Vest Boligkreditt As (Banking | Bergen, Norway | Rating: NR): €750m Covered Bond (Other) (XS2397352233), fixed rate (0.01% coupon) maturing on 11 November 2026, priced at 100.98 (original spread of 40 bp), non callable

NEW LOANS

- Grand Pharma Sphere, signed a US$ 300m Revolving Credit / Term Loan, to be used for refinancing and returning bank debt. It matures on 10/05/24 and initial pricing is set at LIBOR +310bps

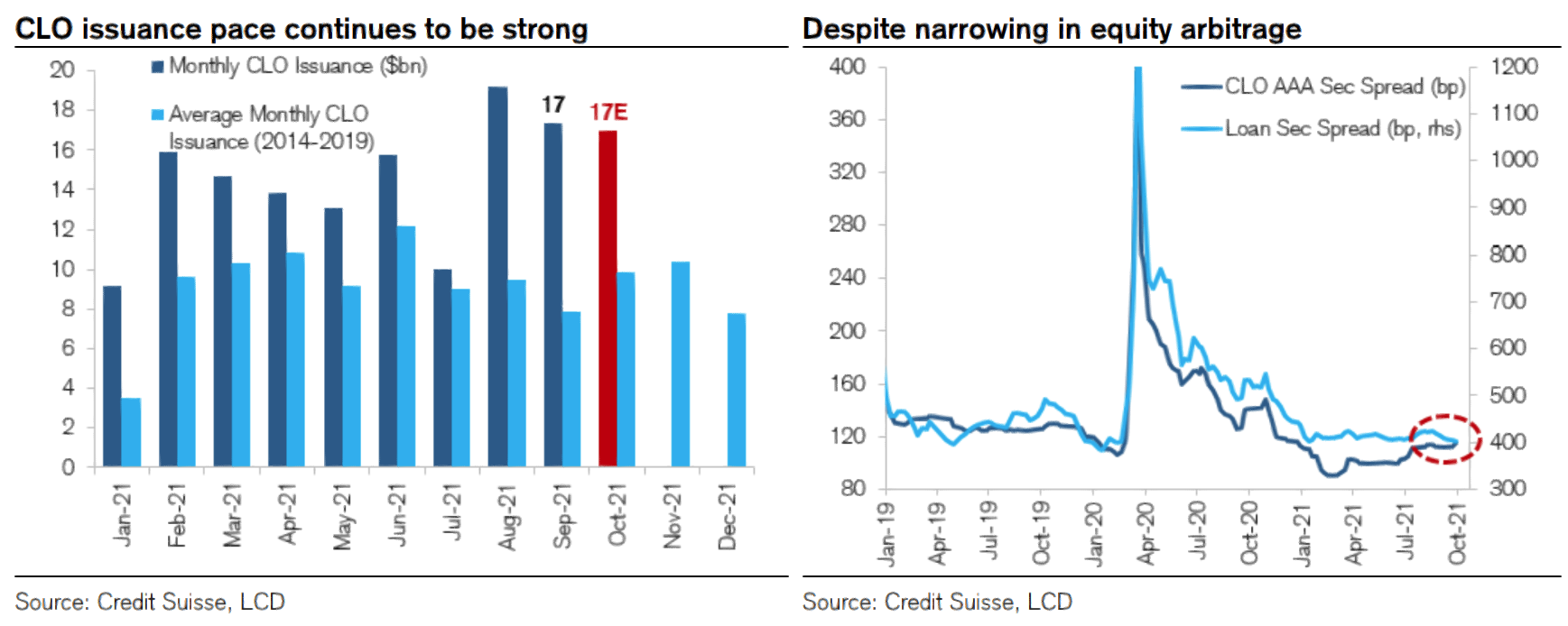

NEW ISSUES IN SECURITIZED CREDIT

- Apidos CLO Xxxvii issued a floating-rate CLO in 6 tranches, for a total of US$ 506 m. Highest-rated tranche offering a spread over the floating rate of 113bp, and the lowest-rated tranche a spread of bp. Bookrunners: Deutsche Bank Securities Inc

- Luxe Trust 2021-Trip issued a floating-rate CMBS in 6 tranches, for a total of US$ 1,536 m. Highest-rated tranche offering a spread over the floating rate of 105bp, and the lowest-rated tranche a spread of 325bp. Bookrunners: Goldman Sachs & Co, Bank of America Merrill Lynch