Credit

Despite The Mid-Day Reversal In Equities, US HY Cash Spreads Widened Significantly Today

Macquarie Group and PepsiCo both issued US$ 3bn in new bonds today, while in sovereign credit South Korea, the United Arab Emirates and Slovakia also priced USD offerings

Published ET

iBOXX USD Liquid IG & HY Bonds Total Returns | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.003% today (Month-to-date: -0.02%; Year-to-date: -1.80%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.284% today (Month-to-date: -0.38%; Year-to-date: 3.32%)

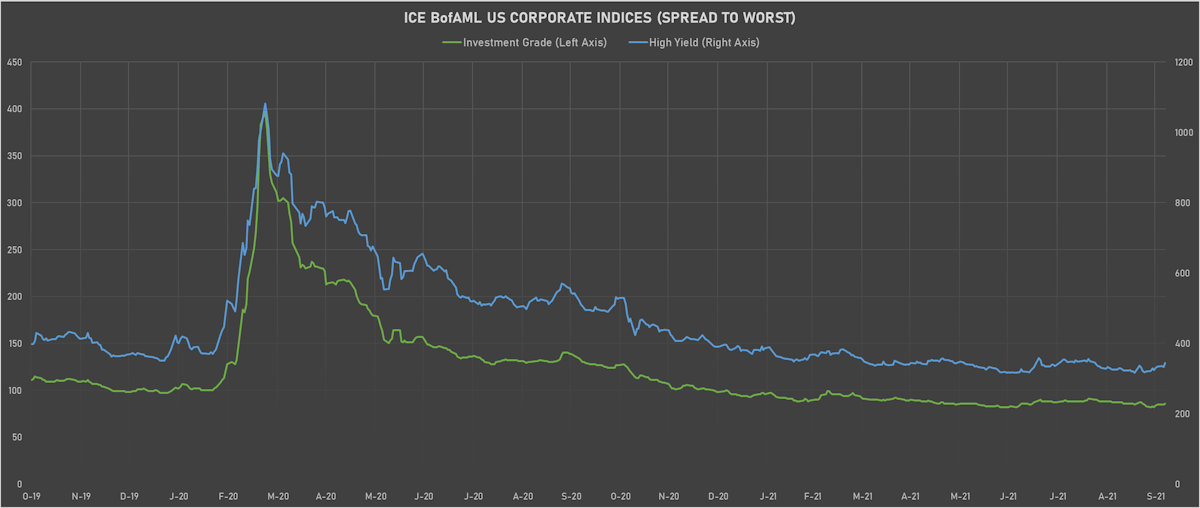

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst up 11.0 bp, now at 344.0 bp (YTD change: -46.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +3.1%)

- New issues: US$ 13.1bn in dollars and € 14.4bn in euros

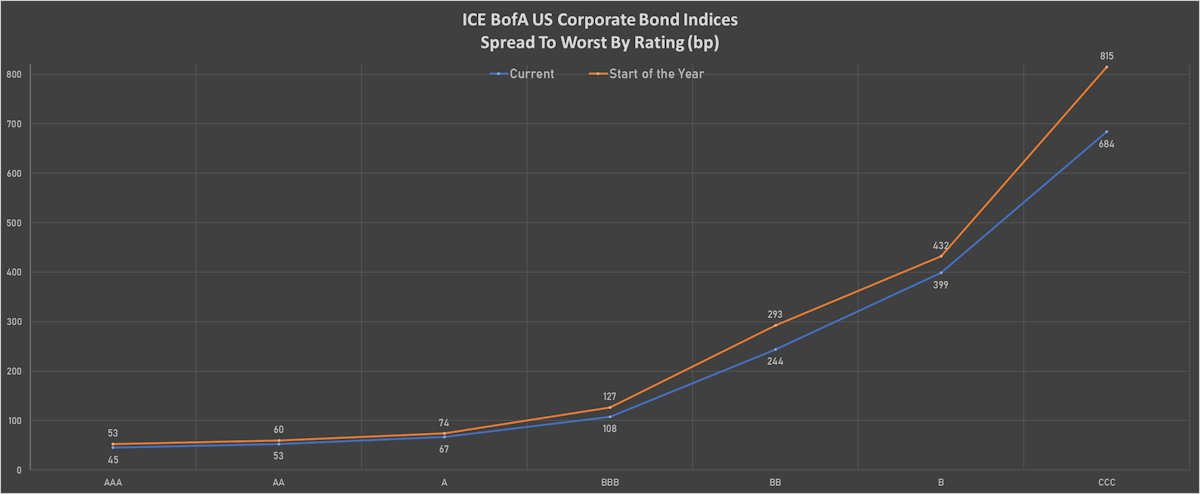

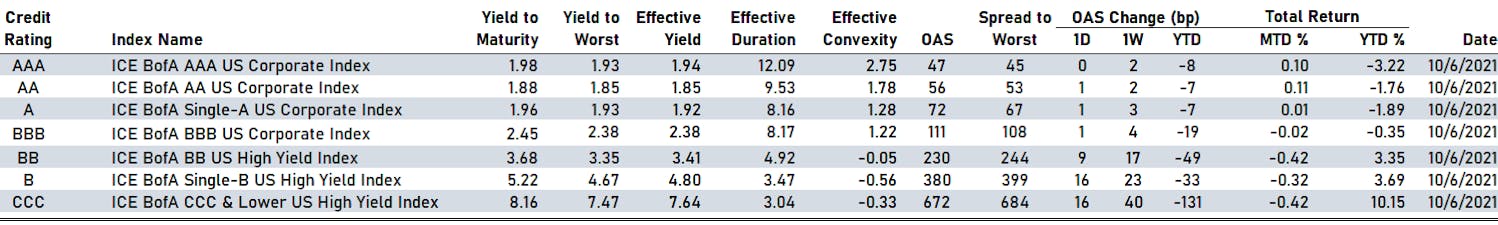

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 47 bp

- AA up by 1 bp at 56 bp

- A up by 1 bp at 72 bp

- BBB up by 1 bp at 111 bp

- BB up by 9 bp at 230 bp

- B up by 16 bp at 380 bp

- CCC up by 16 bp at 672 bp

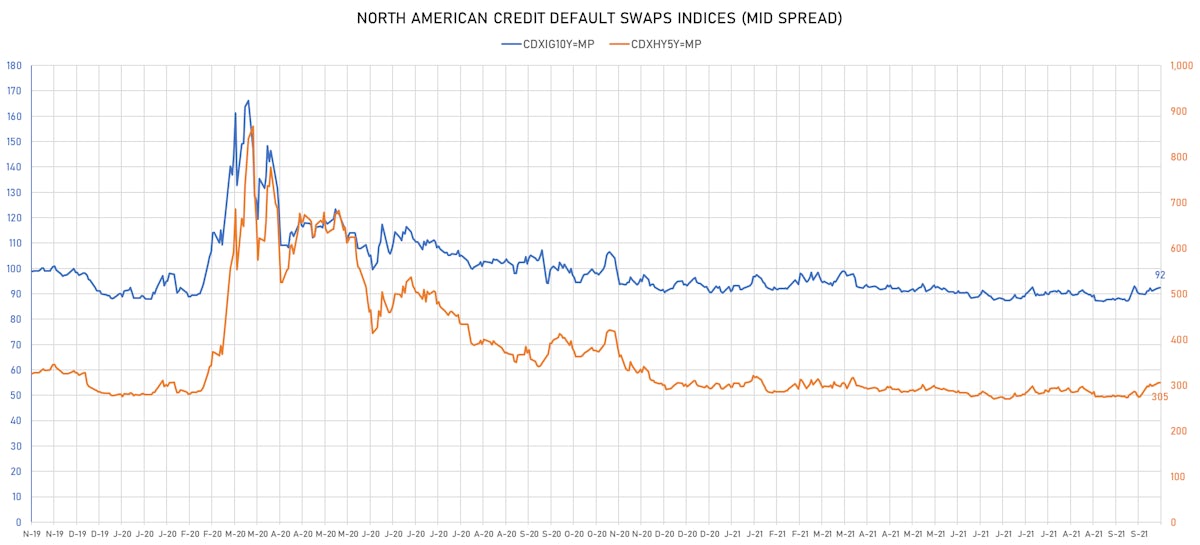

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.1 bp, now at 92bp (YTD change: +1.9bp)

- Markit CDX.NA.HY 5Y up 0.3 bp, now at 305bp (YTD change: +11.8bp)

- Markit iTRAXX Europe up 1.3 bp, now at 52bp (YTD change: +4.1bp)

- Markit iTRAXX Japan up 0.9 bp, now at 51bp (YTD change: -0.8bp)

- Markit iTRAXX Asia Ex-Japan up 1.4 bp, now at 91bp (YTD change: +32.6bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 109.9 bp to 940.9 bp, with the yield to worst at 9.8% and the bond now trading down to 96.6 cents on the dollar (1Y price range: 93.5-102.4).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread up by 89.9 bp to 786.8 bp, with the yield to worst at 7.9% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 94.3-105.8).

- Issuer: Grupo de Inversiones Suramericana SA (Medellin, Colombia) | Coupon: 5.50% | Maturity: 29/4/2026 | Rating: BB+ | ISIN: USG42036AB25 | Z-spread up by 78.4 bp to 271.0 bp, with the yield to worst at 3.5% and the bond now trading down to 107.3 cents on the dollar (1Y price range: 107.0-114.6).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread up by 78.3 bp to 320.9 bp, with the yield to worst at 3.3% and the bond now trading down to 101.1 cents on the dollar (1Y price range: 98.4-103.4).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 8.50% | Maturity: 23/3/2025 | Rating: CCC | ISIN: USP989MJBQ34 | Z-spread up by 49.9 bp to 1,154.4 bp, with the yield to worst at 11.5% and the bond now trading down to 90.5 cents on the dollar (1Y price range: 74.9-93.8).

- Issuer: Globo Comunicacoes e Participacoes SA (Rio de Janeiro, Brazil) | Coupon: 4.84% | Maturity: 8/6/2025 | Rating: BB | ISIN: USP47773AN93 | Z-spread up by 48.9 bp to 307.9 bp, with the yield to worst at 3.6% and the bond now trading down to 103.1 cents on the dollar (1Y price range: 103.1-106.4).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Z-spread up by 46.9 bp to 237.6 bp, with the yield to worst at 3.1% and the bond now trading down to 106.3 cents on the dollar (1Y price range: 106.0-109.9).

- Issuer: Pakistan Water and Power Development Authority (Lahore, Pakistan) | Coupon: 7.50% | Maturity: 4/6/2031 | Rating: B- | ISIN: XS2348591707 | Z-spread up by 43.8 bp to 693.3 bp, with the yield to worst at 8.0% and the bond now trading down to 95.5 cents on the dollar (1Y price range: 95.0-101.9).

- Issuer: Sappi Papier Holding GmbH (Gratkorn, Austria) | Coupon: 7.50% | Maturity: 15/6/2032 | Rating: B+ | ISIN: XS0149581935 | Z-spread up by 42.5 bp to 524.4 bp, with the yield to worst at 6.2% and the bond now trading down to 106.8 cents on the dollar (1Y price range: 97.8-111.5).

- Issuer: Western Global Airlines LLC (Estero, Florida (US)) | Coupon: 10.38% | Maturity: 15/8/2025 | Rating: B- | ISIN: USU95558AA72 | Z-spread up by 41.6 bp to 639.2 bp, with the yield to worst at 6.9% and the bond now trading down to 110.5 cents on the dollar (1Y price range: 110.5-113.3).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 40.6 bp to 725.0 bp, with the yield to worst at 7.9% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 97.8-105.9).

- Issuer: Metinvest BV (S-GRAVENHAGE, Netherlands) | Coupon: 8.50% | Maturity: 23/4/2026 | Rating: B | ISIN: XS1806400708 | Z-spread up by 40.4 bp to 502.7 bp, with the yield to worst at 5.7% and the bond now trading down to 109.6 cents on the dollar (1Y price range: 105.0-115.1).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread down by 43.8 bp to 238.5 bp, with the yield to worst at 3.3% and the bond now trading up to 114.5 cents on the dollar (1Y price range: 106.5-114.5).

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Z-spread down by 54.9 bp to 1,092.4 bp, with the yield to worst at 11.1% and the bond now trading up to 95.8 cents on the dollar (1Y price range: 93.8-107.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB+ | ISIN: XS2010029663 | Z-spread up by 223.4 bp to 935.6 bp, with the yield to worst at 8.9% and the bond now trading down to 81.8 cents on the dollar (1Y price range: 81.8-105.4).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | Z-spread up by 36.2 bp to 318.3 bp, with the yield to worst at 2.9% and the bond now trading down to 96.4 cents on the dollar (1Y price range: 96.4-102.9).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.75% | Maturity: 31/10/2024 | Rating: BB- | ISIN: XS2066703989 | Z-spread up by 30.3 bp to 158.1 bp, with the yield to worst at 1.1% and the bond now trading down to 101.4 cents on the dollar (1Y price range: 100.7-102.9).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread up by 28.4 bp to 325.3 bp, with the yield to worst at 2.8% and the bond now trading down to 110.1 cents on the dollar (1Y price range: 99.6-111.6).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | Z-spread up by 23.5 bp to 244.3 bp, with the yield to worst at 2.1% and the bond now trading down to 102.2 cents on the dollar (1Y price range: 99.7-106.6).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B | ISIN: XS2010037682 | Z-spread up by 23.3 bp to 477.4 bp (CDS basis: -40.5bp), with the yield to worst at 4.3% and the bond now trading down to 110.2 cents on the dollar (1Y price range: 102.3-116.4).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread up by 23.0 bp to 374.2 bp, with the yield to worst at 3.4% and the bond now trading down to 97.2 cents on the dollar (1Y price range: 96.4-99.4).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.00% | Maturity: 29/5/2026 | Rating: BB- | ISIN: XS2265369657 | Z-spread up by 23.0 bp to 272.9 bp (CDS basis: -70.1bp), with the yield to worst at 2.3% and the bond now trading down to 102.0 cents on the dollar (1Y price range: 95.7-103.2).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 1.36% | Maturity: 7/2/2025 | Rating: BB | ISIN: XS1767930586 | Z-spread up by 20.0 bp to 204.1 bp (CDS basis: -67.4bp), with the yield to worst at 1.6% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 97.2-101.6).

- Issuer: Banco BPM SpA (Verona, Italy) | Coupon: 0.88% | Maturity: 15/7/2026 | Rating: BB | ISIN: XS2365097455 | Z-spread down by 153.9 bp to 117.4 bp, with the yield to worst at 0.8% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 99.4-100.4).

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$350m Bond (US3133ENAT73), floating rate (SOFR + 3.0 bp) maturing on 13 October 2023, priced at 100.00, callable (2nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$160m Bond (US3133ENAW03), fixed rate (1.52% coupon) maturing on 12 October 2028, priced at 100.00 (original spread of 23 bp), callable (7nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$250m Bond (US3133ENAU47), fixed rate (0.27% coupon) maturing on 12 October 2023, priced at 100.00, callable (2nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$300m Bond (US3133ENAR18), floating rate (PRQ + -315.5 bp) maturing on 12 October 2023, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$150m Bond (US3130APH653), fixed rate (0.61% coupon) maturing on 25 October 2024, priced at 100.00 (original spread of 55 bp), callable (3nc3m)

- Group 1 Automotive Inc (Retail Stores - Other | Houston, United States | Rating: BB+): US$200m Senior Note (USU03903AF57), fixed rate (4.00% coupon) maturing on 15 August 2028, priced at 100.25 (original spread of 269 bp), callable (7nc2)

- PepsiCo Inc (Beverage/Bottling | Purchase, United States | Rating: A+): US$1,250m Senior Note (US713448FE31), fixed rate (1.95% coupon) maturing on 21 October 2031, priced at 99.63 (original spread of 47 bp), callable (10nc10)

- Trulieve Cannabis Corp (Pharmaceuticals | Quincy, United States | Rating: NR): US$350m Senior Note (CA89788CAD61), fixed rate (8.00% coupon) maturing on 6 October 2026, non callable

- Banco de Credito e Inversiones (Banking | Las Condes, Chile | Rating: A-): US$500m Bond (US05890MAB90), fixed rate (2.88% coupon) maturing on 14 October 2031, priced at 98.24 (original spread of 155 bp), callable (10nc10)

- Federation of Caisses Desjardins Du Quebec (Banking | Levis, Canada | Rating: A+): US$750m Covered Bond (Other) (US31430WJB19), fixed rate (1.20% coupon) maturing on 14 October 2026, priced at 99.81 (original spread of 25 bp), non callable

- Korea, Republic of (Government) (Sovereign | Seoul, Seoul, South Korea | Rating: AA-): US$500m Senior Note (US50064FAU84), fixed rate (1.75% coupon) maturing on 15 October 2031, priced at 99.83 (original spread of 25 bp), non callable

- Macquarie Group Ltd (Financial - Other | Sydney, Australia | Rating: BBB+): US$1,250m Senior Note (US55608KAZ84), floating rate maturing on 14 January 2033, priced at 100.00, callable (11nc10)

- Macquarie Group Ltd (Financial - Other | Sydney, Australia | Rating: BBB+): US$500m Senior Note (US55608KAX37), floating rate maturing on 14 April 2028, priced at 100.00, callable (7nc6)

- Macquarie Group Ltd (Financial - Other | Sydney, Australia | Rating: BBB+): US$850m Senior Note (US55608JBA51), floating rate maturing on 14 October 2025, priced at 100.00, callable (4nc3)

- Macquarie Group Ltd (Financial - Other | Sydney, Australia | Rating: BBB+): US$400m Senior Note (US55608KBB08), floating rate (SOFR + 71.0 bp) maturing on 14 October 2025, priced at 100.00, callable (4nc3)

- Ontario, Province of (Official and Muni | Toronto, Canada | Rating: A+): US$1,000m Senior Note (US68323AFJ88), fixed rate (1.80% coupon) maturing on 14 October 2031, priced at 99.70 (original spread of 33 bp), non callable

- United Arab Emirates (Government) (Sovereign | Abu Dhabi, United Arab Emirates | Rating: AA-): US$2,000m Senior Note (US31424EAB83), fixed rate (3.25% coupon) maturing on 19 October 2061, priced at 100.00 (original spread of 118 bp), non callable

- United Arab Emirates (Government) (Sovereign | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: AA-): US$1,000m Senior Note (US31424EAC66), fixed rate (2.88% coupon) maturing on 19 October 2041, priced at 96.99 (original spread of 105 bp), non callable

- United Arab Emirates (Government) (Sovereign | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: AA-): US$1,000m Senior Note (XS2397053757), fixed rate (2.00% coupon) maturing on 19 October 2031, priced at 97.94 (original spread of 70 bp), non callable

EUR BOND ISSUES

- Bank Gospodarstwa Krajowego (Agency | Warsaw, Poland | Rating: A-): €500m Senior Note (XS2397082939), fixed rate (0.38% coupon) maturing on 13 October 2028, priced at 99.61 (original spread of 85 bp), non callable

- Brandenburg, State of (Official and Muni | Potsdam, Germany | Rating: AAA): €700m Jumbo Landesschatzanweisung (DE000A3E5SG5), fixed rate (0.60% coupon) maturing on 13 October 2051, priced at 98.97 (original spread of 33 bp), non callable

- CNP Assurances SA (Life Insurance | Paris, France | Rating: BBB+): €500m Bond (FR0014005X99), floating rate maturing on 12 October 2053, priced at 98.94 (original spread of 219 bp), callable (32nc12)

- Commonwealth Bank of Australia (Banking | Sydney, Australia | Rating: A+): €1,250m Covered Bond (Other) (XS2397077426), fixed rate (0.13% coupon) maturing on 15 October 2029, priced at 99.73 (original spread of 50 bp), non callable

- Heimstaden Bostad Treasury BV (Financial - Other | Amsterdam, Noord-Holland, Norway | Rating: NR): €1,250m Senior Note (XS2397239000), fixed rate (0.25% coupon) maturing on 13 October 2024, priced at 99.99 (original spread of 96 bp), callable (3nc3)

- Heimstaden Bostad Treasury BV (Financial - Other | Amsterdam, Noord-Holland, Norway | Rating: NR): €750m Senior Note (XS2397252011), fixed rate (1.63% coupon) maturing on 13 October 2031, priced at 99.85 (original spread of 182 bp), callable (10nc10)

- Heimstaden Bostad Treasury BV (Financial - Other | Amsterdam, Noord-Holland, Norway | Rating: NR): €750m Senior Note (XS2397252102), fixed rate (1.00% coupon) maturing on 13 April 2028, priced at 99.73 (original spread of 150 bp), callable (7nc6)

- Kaixo Bondco Telecom SA (Financial - Other | Rating: NR): €500m Senior Note (XS2397198487), fixed rate (5.13% coupon) maturing on 30 September 2029, priced at 100.00 (original spread of 566 bp), callable (8nc3)

- Lorca Telecom Bondco SA (Financial - Other | Alcobendas | Rating: NR): €1,550m Note (XS2397086252), fixed rate (4.00% coupon) maturing on 18 September 2027, priced at 100.00 (original spread of 451 bp), callable (6nc2)

- SG Issuer SA (Banking | Luxembourg, France | Rating: A): €110m Unsecured Note (XS2347892015) zero coupon maturing on 7 October 2024, priced at 100.00, non callable

- SG Issuer SA (Financial - Other | Luxembourg, France | Rating: NR): €110m Unsecured Note (XS2347893336) zero coupon maturing on 7 October 2024, priced at 100.00, non callable

- Slovak Republic (Government) (Sovereign | Bratislava, Slovakia | Rating: A): €1,000m Bond (SK4000019857), fixed rate (1.00% coupon) maturing on 13 October 2051, priced at 99.85, non callable

- Tennis Bidco SpA (Financial - Other | Rating: NR): €150m Bond (IT0005460594), floating rate (EU01MLIB + 0.0 bp) maturing on 6 October 2028, priced at 100.00, non callable

- Thermo Fisher Scientific (Finance I) BV (Financial - Other | Breda, Noord-Brabant, United States | Rating: BBB+): €1,750m Senior Note (XS2366407018), fixed rate (0.80% coupon) maturing on 18 October 2030, priced at 99.81 (original spread of 110 bp), callable (9nc9)

- Thermo Fisher Scientific (Finance I) BV (Financial - Other | Breda, Noord-Brabant, United States | Rating: BBB+): €1,500m Senior Note (XS2366415110), fixed rate (1.13% coupon) maturing on 18 October 2033, priced at 99.73 (original spread of 134 bp), callable (12nc12)

- Thermo Fisher Scientific (Finance I) BV (Financial - Other | Breda, Noord-Brabant, United States | Rating: BBB+): €1,250m Senior Note (XS2366415201), fixed rate (1.63% coupon) maturing on 18 October 2041, priced at 98.17 (original spread of 169 bp), callable (20nc20)

- Thermo Fisher Scientific (Finance I) BV (Financial - Other | Breda, United States | Rating: BBB+): €750m Senior Note (XS2366415540), fixed rate (2.00% coupon) maturing on 18 October 2051, priced at 99.33 (original spread of 174 bp), callable (30nc30)

NEW LOANS

- LaserShip Inc, signed a US$ 650m Term Loan B, to be used for acquisition financing. It matures on 05/03/28 and initial pricing is set at LIBOR +450bps

- LaserShip Inc, signed a US$ 225m Term Loan, to be used for acquisition financing. It matures on 05/03/29 and initial pricing is set at LIBOR +750bps

- Tate & Lyle PLC (BBB), signed a US$ 1,060m Term Loan, to be used for leveraged buyout.

NEW ISSUES IN SECURITIZED CREDIT

- Rate Mortgage Trust 2021-J3 issued a fixed-rate RMBS in 4 tranches, for a total of US$ 378 m. Bookrunners: Goldman Sachs & Co, Bank of America Merrill Lynch

- Freddie Mac Spc Series K-132 issued a fixed-rate Agency CMBS in 2 tranches, for a total of US$ 1,006 m. Highest-rated tranche offering a yield to maturity of 1.51%, and the lowest-rated tranche a yield to maturity of 1.69%. Bookrunners: Morgan Stanley International Ltd, JP Morgan & Co Inc

- Freddie Mac Spc Series K-J35 issued a fixed-rate Agency CMBS in 2 tranches, for a total of US$ 256 m. Highest-rated tranche offering a yield to maturity of 0.81%, and the lowest-rated tranche a yield to maturity of 1.64%. Bookrunners: Wells Fargo Securities LLC, Bank of America Merrill Lynch