Credit

High Yield Bonds Rebound As Cash Spreads Tighten, While IG Falls On Higher Rates

Kyndryl Holdings, IBM's managed infrastructure services spinoff, was the largest corporate bond issuer today, raising US$ 2.4 bn in 4 tranches for the business

Published ET

Credit Default Rates In The US & Europe | Source: Credit Suisse

QUICK SUMMARY

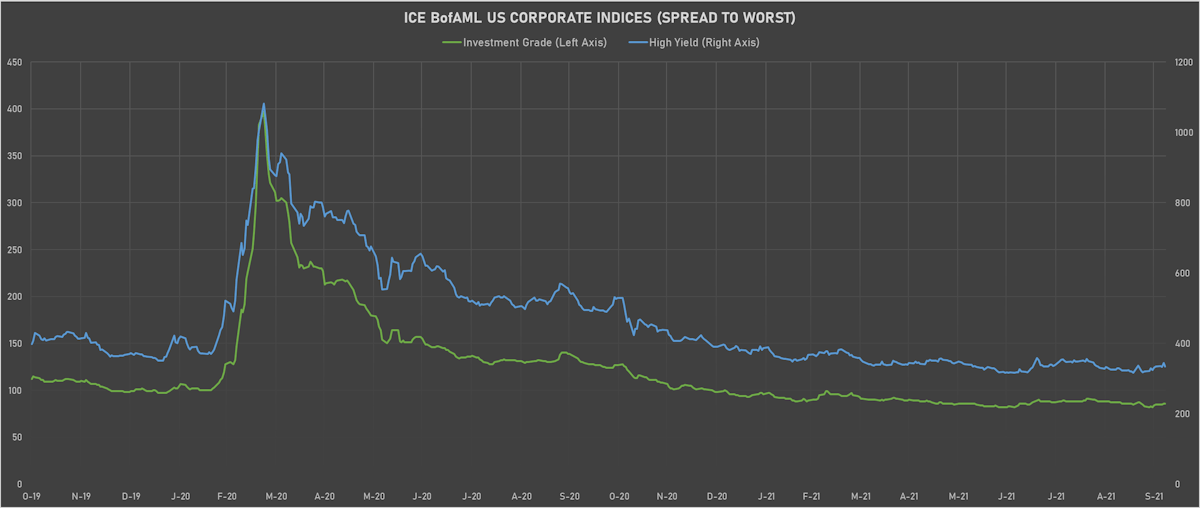

- S&P 500 Bond Index was down -0.34% today, with investment grade down -0.39% and high yield up 0.05% (YTD total return: -1.29%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.421% today (Month-to-date: -0.44%; Year-to-date: -2.22%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.160% today (Month-to-date: -0.22%; Year-to-date: 3.48%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -9.0 bp, now at 335.0 bp (YTD change: -55.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +3.2%)

- New issues: US$ 8.4bn in dollars and € 400m in euros

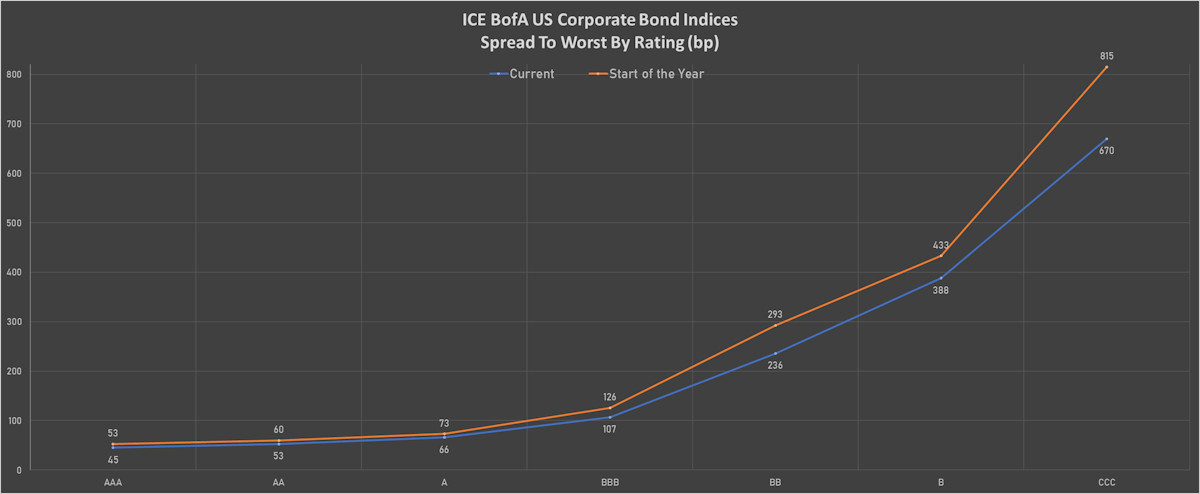

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 47 bp

- AA unchanged at 56 bp

- A unchanged at 72 bp

- BBB unchanged at 111 bp

- BB down by -8 bp at 222 bp

- B down by -12 bp at 368 bp

- CCC down by -14 bp at 658 bp

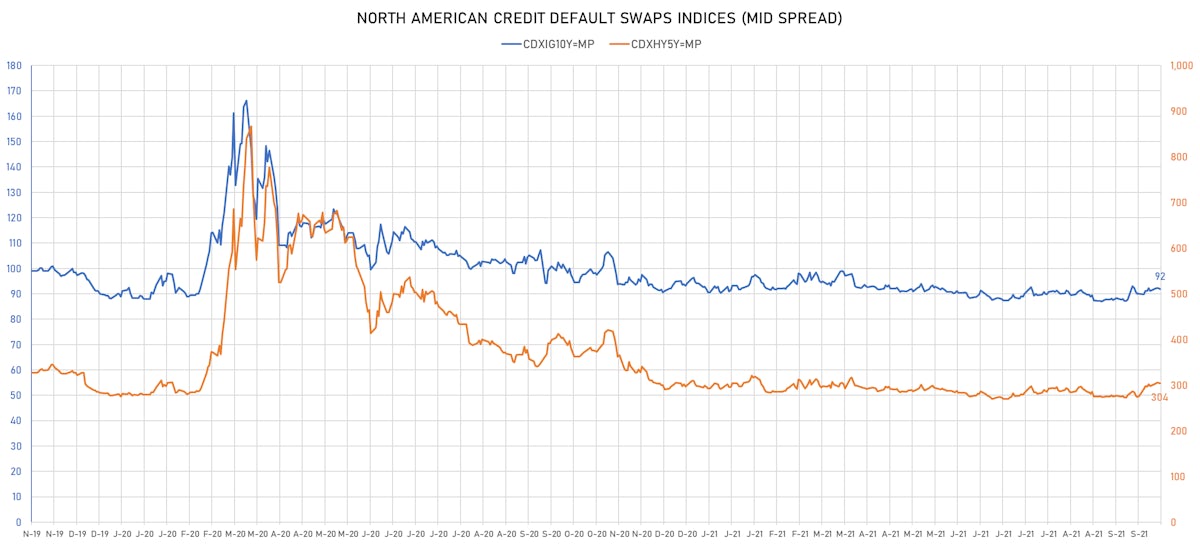

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.4 bp, now at 92bp (YTD change: +1.4bp)

- Markit CDX.NA.HY 5Y down 1.0 bp, now at 304bp (YTD change: +10.8bp)

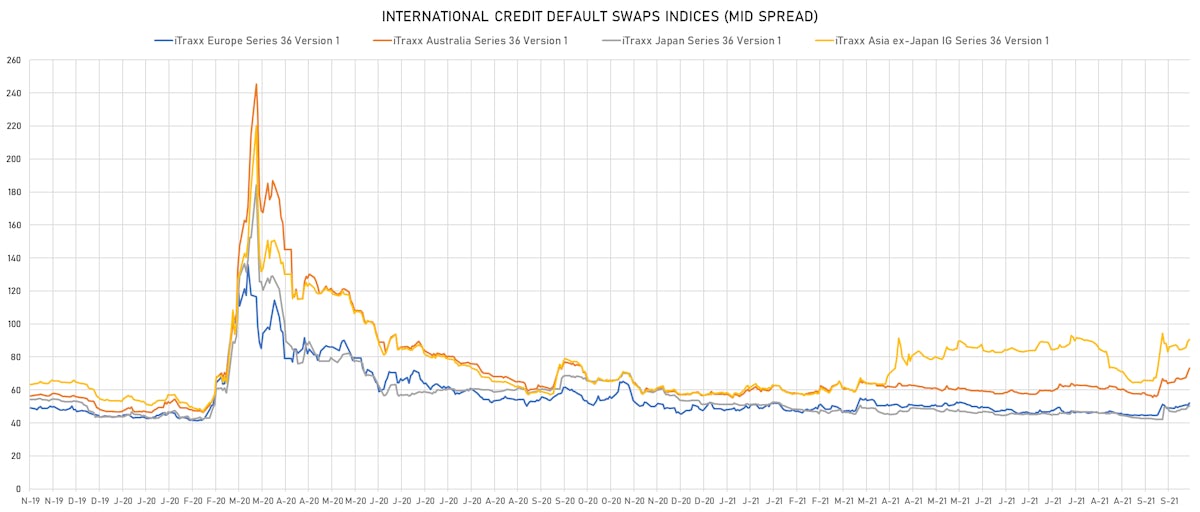

- Markit iTRAXX Europe down 1.1 bp, now at 51bp (YTD change: +3.0bp)

- Markit iTRAXX Japan up 0.1 bp, now at 51bp (YTD change: -0.7bp)

- Markit iTRAXX Asia Ex-Japan down 5.2 bp, now at 85bp (YTD change: +27.4bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 46.7 bp to 1,512.1bp (1Y range: 941-7,695bp)

- Office Depot Inc (Country: US; rated: WR): down 15.7 bp to 458.1bp (1Y range: 458-583bp)

- Genworth Holdings Inc (Country: US; rated: B2): down 14.6 bp to 460.6bp (1Y range: 447-681bp)

- Kohls Corp (Country: US; rated: BBB): up 16.4 bp to 159.2bp (1Y range: 101-330bp)

- Turkiye Is Bankasi AS (Country: TR; rated: WD): up 19.0 bp to 608.0bp (1Y range: 482-759bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): up 21.0 bp to 380.7bp (1Y range: 277-404bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): up 22.3 bp to 175.3bp (1Y range: 124-401bp)

- Nordstrom Inc (Country: US; rated: Ba1): up 22.5 bp to 285.8bp (1Y range: 211-684bp)

- Staples Inc (Country: US; rated: B2): up 23.6 bp to 1,034.4bp (1Y range: 652-1,306bp)

- NRG Energy Inc (Country: US; rated: Ba1): up 26.9 bp to 190.3bp (1Y range: 108-219bp)

- Calpine Corp (Country: US; rated: LGD5 - 88%): up 27.9 bp to 340.0bp (1Y range: 173-349bp)

- Macy's Inc (Country: US; rated: Ba2): up 31.0 bp to 284.8bp (1Y range: 190-1,201bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): up 31.0 bp to 494.7bp (1Y range: 363-495bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Tui AG (Country: DE; rated: WR): down 76.0 bp to 621.8bp (1Y range: 609-1,799bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 13.9 bp to 423.6bp (1Y range: 339-813bp)

- Rexel SA (Country: FR; rated: WR): up 10.0 bp to 125.4bp (1Y range: -125bp)

- Air France KLM SA (Country: FR; rated: B-): up 10.7 bp to 395.6bp (1Y range: 390-1,211bp)

- Nationwide Building Society (Country: GB; rated: A1): up 11.0 bp to 52.1bp (1Y range: 52-58bp)

- Thyssenkrupp AG (Country: DE; rated: B1): up 16.0 bp to 250.3bp (1Y range: 206-456bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 16.5 bp to 447.4bp (1Y range: 333-467bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): up 16.8 bp to 218.2bp (1Y range: 194-393bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 19.0 bp to 262.7bp (1Y range: 188-279bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 20.1 bp to 595.4bp (1Y range: 464-1,181bp)

- Ineos Group Holdings SA (Country: LU; rated: LGD5 - 88%): up 23.9 bp to 257.2bp (1Y range: 199-447bp)

- Novafives SAS (Country: FR; rated: Caa1): up 26.4 bp to 724.9bp (1Y range: 660-1,205bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 38.8 bp to 341.8bp (1Y range: 259-734bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 44.1 bp to 576.3bp (1Y range: 358-603bp)

- Boparan Finance PLC (Country: GB; rated: WR): up 81.8 bp to 1,143.0bp (1Y range: 478-1,143bp)

USD BOND ISSUES

- Api Escrow Corp (Financial - Other | United States | Rating: NR): US$300m Senior Note (US00185PAA93), fixed rate (4.75% coupon) maturing on 15 October 2029, priced at 100.00 (original spread of 343 bp), callable (8nc3)

- Blackstone Private Credit Fund (Financial - Other | New York City, United States | Rating: BBB-): US$350m Senior Note (USU0926HAC44), fixed rate (2.63% coupon) maturing on 15 December 2026, priced at 98.80 (original spread of 186 bp), callable (5nc5)

- BroadStreet Partners Inc (Financial - Other | Columbus, United States | Rating: B): US$325m Senior Note (USU11091AB80), fixed rate (5.88% coupon) maturing on 15 April 2029, priced at 98.25, callable (8nc3)

- Conduent Business Services LLC (Service - Other | Florham Park, New Jersey, United States | Rating: BB-): US$520m Note (US20679LAB71), fixed rate (6.00% coupon) maturing on 1 November 2029, priced at 100.00 (original spread of 465 bp), callable (8nc3)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$200m Bond (US3130APHG35), fixed rate (0.61% coupon) maturing on 26 September 2024, priced at 100.00 (original spread of 54 bp), callable (3nc3m)

- John Deere Capital Corp (Financial - Other | Reno, United States | Rating: A): US$600m Senior Note (US24422EVV81), floating rate (SOFR + 20.0 bp) maturing on 11 October 2024, priced at 100.00, non callable

- John Deere Capital Corp (Financial - Other | Reno, United States | Rating: A): US$400m Senior Note (US24422EVW64), fixed rate (1.30% coupon) maturing on 13 October 2026, priced at 99.81 (original spread of 32 bp), non callable

- Physicians Realty LP (Real Estate Investment Trust | Milwaukee, United States | Rating: BBB): US$500m Senior Note (US71943UAA25), fixed rate (2.63% coupon) maturing on 1 November 2031, priced at 99.79 (original spread of 108 bp), callable (10nc10)

- Athabasca Oil Corp (Oil and Gas | Calgary, Canada | Rating: CCC): US$350m Note (US04682RAE71), fixed rate (9.75% coupon) maturing on 1 November 2026, priced at 97.00 (original spread of 951 bp), callable (5nc3)

- Deutsche Pfandbriefbank AG (Banking | Garching Bei Muenchen, Bayern, Germany | Rating: BBB+): US$750m Hypothekenpfandbrief (Covered Bond) (DE000A3E5KY5), fixed rate (0.88% coupon) maturing on 11 October 2024, priced at 99.95, non callable

- Harbour Energy PLC (Oil and Gas | London, United Kingdom | Rating: BB-): US$500m Senior Note (US411618AB75), fixed rate (5.50% coupon) maturing on 15 October 2026, priced at 100.00 (original spread of 450 bp), callable (5nc2)

- Kyndryl Holdings Inc (Service - Other | Armonk | Rating: BBB-): US$650m Senior Note (US50155QAE08), fixed rate (3.15% coupon) maturing on 15 October 2031, priced at 99.75 (original spread of 160 bp), callable (10nc10)

- Kyndryl Holdings Inc (Service - Other | Armonk | Rating: BBB-): US$550m Senior Note (US50155QAG55), fixed rate (4.10% coupon) maturing on 15 October 2041, priced at 99.55 (original spread of 205 bp), callable (20nc20)

- Kyndryl Holdings Inc (Service - Other | Armonk | Rating: BBB-): US$500m Senior Note (US50155QAC42), fixed rate (2.70% coupon) maturing on 15 October 2028, priced at 99.92 (original spread of 135 bp), callable (7nc7)

- Kyndryl Holdings Inc (Service - Other | Armonk | Rating: BBB-): US$700m Senior Note (US50155QAA85), fixed rate (2.05% coupon) maturing on 15 October 2026, priced at 99.87 (original spread of 105 bp), callable (5nc5)

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: BBB+): US$150m Senior Note (XS2390147804) zero coupon maturing on 13 October 2056, priced at 100.00, callable (35nc5)

- OT Merger Corp (Financial - Other | Rating: B-): US$300m Senior Note (US688777AA92), fixed rate (7.88% coupon) maturing on 15 October 2029, priced at 100.00 (original spread of 646 bp), callable (8nc3)

- Ontario Teachers' Cadillac Fairview Properties Trust (Financial - Other | Canada | Rating: A+): US$800m Senior Note (US68327LAD82), fixed rate (2.50% coupon) maturing on 15 October 2031, priced at 98.94 (original spread of 105 bp), callable (10nc10)

EUR BOND ISSUES

- BCP V Modular Services Finance PLC (Financial - Other | Canary Wharf, Bermuda | Rating: NR): €435m Senior Note (XS2397448429), fixed rate (6.75% coupon) maturing on 30 November 2029, priced at 100.00 (original spread of 710 bp), callable (8nc3)

NEW LOANS

- Synaptics Inc (BB-), signed a US$ 600m Term Loan B maturing on 10/26/28, to be used for a leveraged buyout

NEW ISSUES IN SECURITIZED CREDIT

- Red & Black Auto Italy Srl issued a floating-rate ABS backed by auto receivables in 4 tranches, for a total of € 1,162 m. Highest-rated tranche offering a spread over the floating rate of 70bp, and the lowest-rated tranche a spread of 285bp. Bookrunners: Societe Generale SA

- Goldentree Loan Management Us CLO 2 Ltd issued a floating-rate CLO in 2 tranches, for a total of US$ 528 m. Highest-rated tranche offering a spread over the floating rate of 91bp, and the lowest-rated tranche a spread of 140bp. Bookrunners: Wells Fargo Securities LLC