Credit

USD Corporate Spreads Pretty Stable On Friday, Though Bond Prices Fell On Higher Rates

Weekly totals for USD corporate bonds issuance (IFR data): US$27.625bn in 40 Tranches for IG, US$7.74bn in 16 Tranches for HY (2021 YTD HY volume at $ 399.1 bn vs 2020 YTD $ 353.9 bn)

Published ET

Spread On USD Debt (XS2357443410) Issued By Chinese Real Estate Developer Gemdale Ever Prosperity | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.31% today, with investment grade down -0.33% and high yield down -0.12% (YTD total return: -1.60%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.415% today (Month-to-date: -0.86%; Year-to-date: -2.62%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.130% today (Month-to-date: -0.35%; Year-to-date: 3.35%)

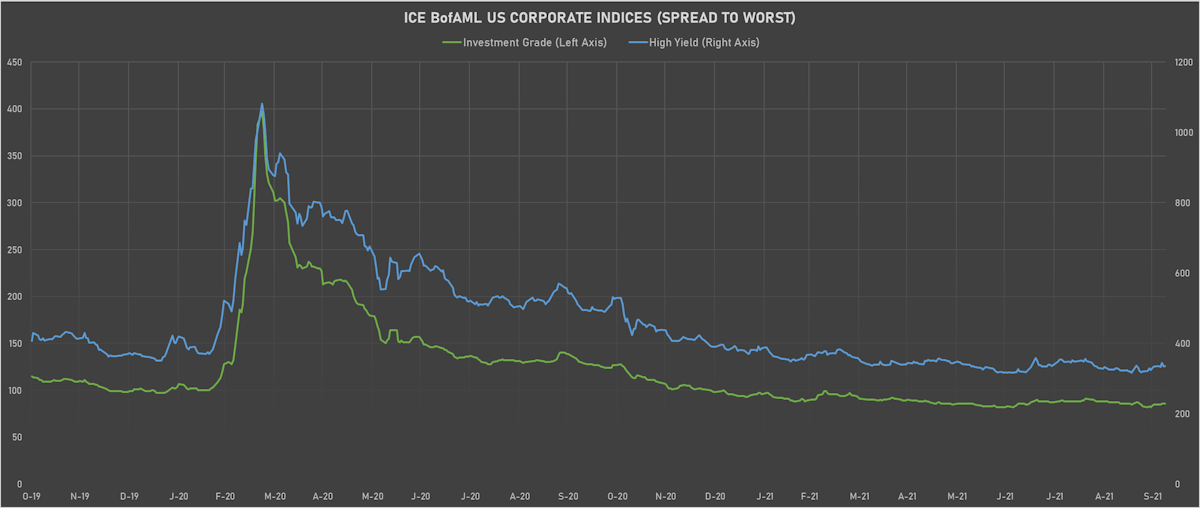

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst up 1.0 bp, now at 336.0 bp (YTD change: -54.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: +3.2%)

- New issues: US$ 800M in dollars and € 3.8bn in euros

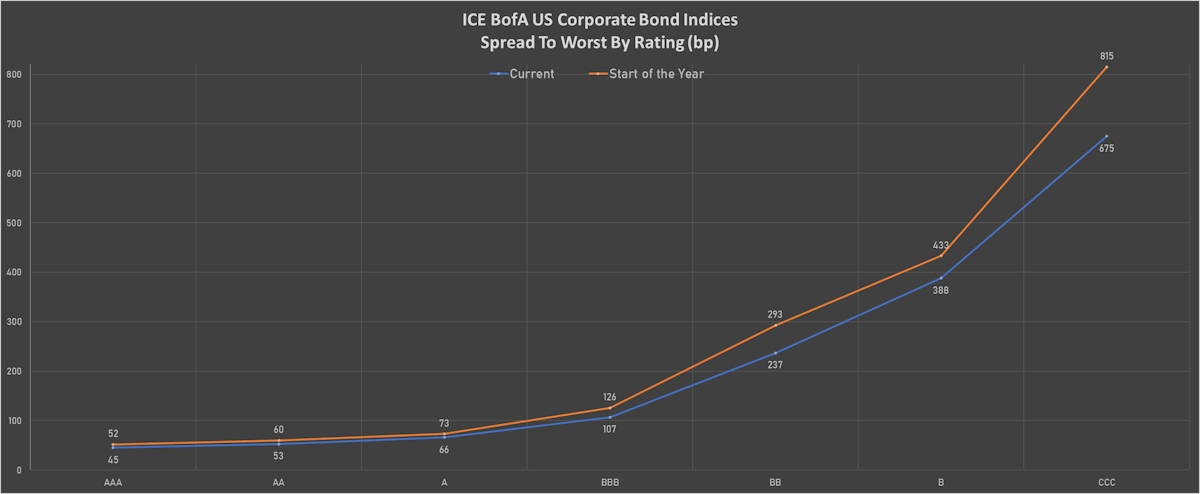

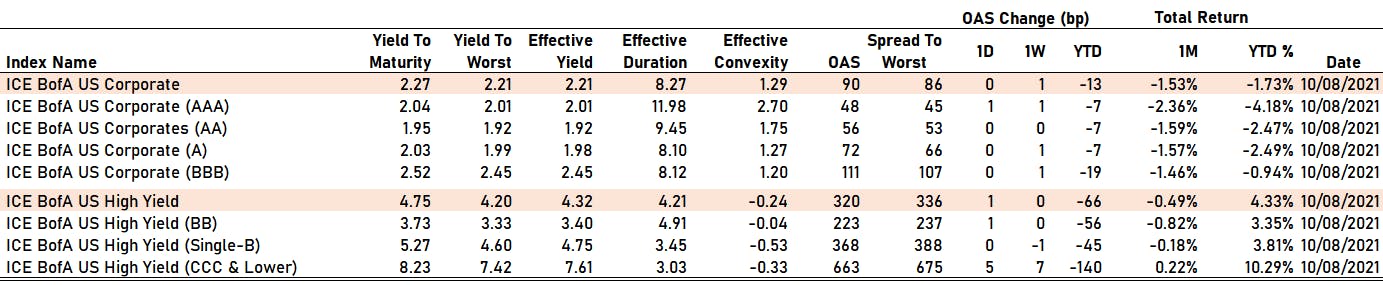

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 48 bp

- AA unchanged at 56 bp

- A unchanged at 72 bp

- BBB unchanged at 111 bp

- BB up by 1 bp at 223 bp

- B unchanged at 368 bp

- CCC up by 5 bp at 663 bp

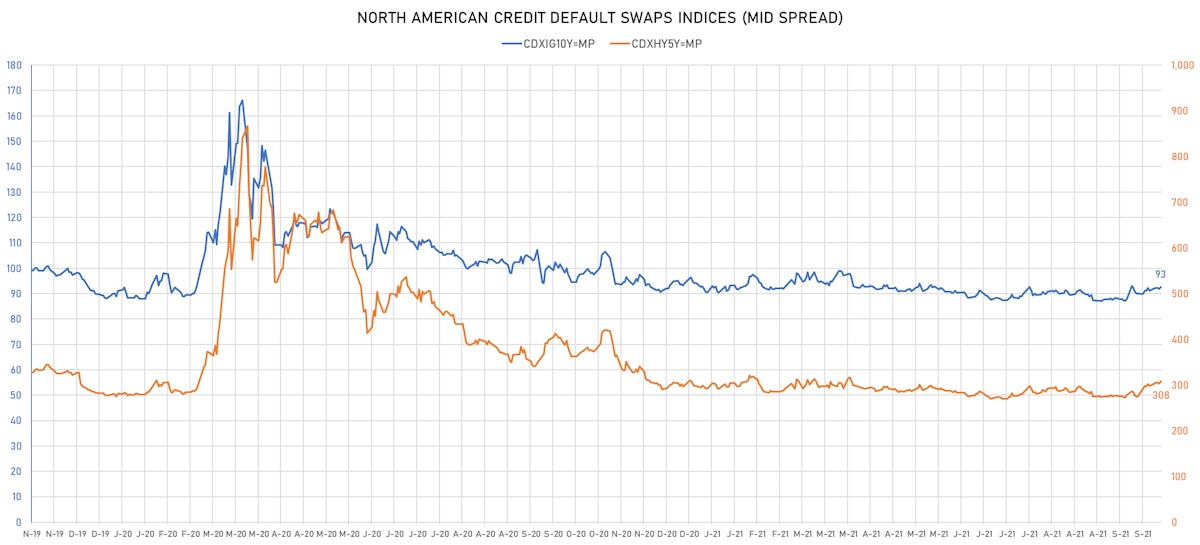

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.8 bp, now at 93bp (YTD change: +2.1bp)

- Markit CDX.NA.HY 5Y up 4.6 bp, now at 308bp (YTD change: +14.9bp)

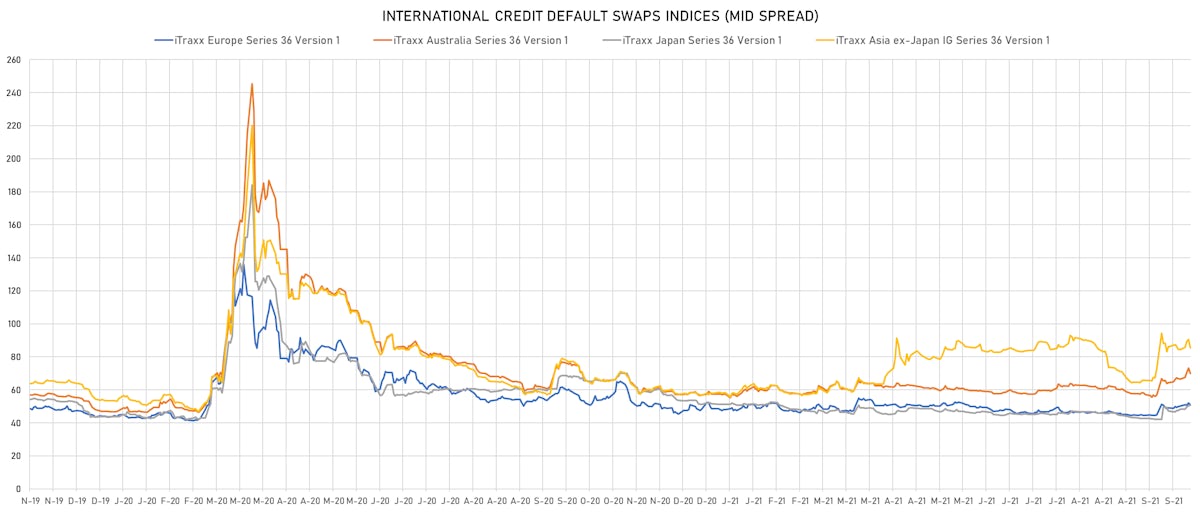

- Markit iTRAXX Europe up 1.0 bp, now at 52bp (YTD change: +4.0bp)

- Markit iTRAXX Japan down 0.2 bp, now at 50bp (YTD change: -0.9bp)

- Markit iTRAXX Asia Ex-Japan up 4.4 bp, now at 90bp (YTD change: +31.7bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 127.1 bp to 961.1 bp, with the yield to worst at 10.0% and the bond now trading down to 95.9 cents on the dollar (1Y price range: 93.5-102.4).

- Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 4.95% | Maturity: 12/8/2024 | Rating: BB- | ISIN: XS2357443410 | Z-spread up by 82.5 bp to 544.6 bp, with the yield to worst at 5.6% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 97.3-102.0).

- Issuer: HanesBrands Inc (Winston-Salem, North Carolina (US)) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread up by 46.7 bp to 575.2 bp, with the yield to worst at 5.8% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 99.4-103.4).

- Issuer: Sappi Papier Holding GmbH (Gratkorn, Austria) | Coupon: 4.13% | Maturity: 1/3/2025 | Rating: B+ | ISIN: USU05638AB41 | Z-spread up by 46.3 bp to 266.9 bp, with the yield to worst at 3.2% and the bond now trading down to 102.0 cents on the dollar (1Y price range: 102.0-104.4).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 10.50% | Maturity: 16/10/2022 | Rating: B- | ISIN: XS1692930404 | Z-spread up by 42.3 bp to 400.9 bp, with the yield to worst at 4.0% and the bond now trading down to 106.1 cents on the dollar (1Y price range: 104.4-108.5).

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread up by 39.0 bp to 272.9 bp, with the yield to worst at 2.9% and the bond now trading down to 102.2 cents on the dollar (1Y price range: 98.4-103.4).

- Issuer: Turkiye Vakiflar Bankasi TAO (Turkey) | Coupon: 5.50% | Maturity: 1/10/2026 | Rating: B+ | ISIN: XS2386558113 | Z-spread down by 32.4 bp to 505.2 bp, with the yield to worst at 6.0% and the bond now trading up to 97.6 cents on the dollar (1Y price range: 95.0-99.9).

- Issuer: Aag FH LP (Canada) | Coupon: 5.88% | Maturity: 16/3/2023 | Rating: B | ISIN: XS1576037284 | Z-spread down by 33.5 bp to 244.5 bp, with the yield to worst at 2.5% and the bond now trading up to 104.4 cents on the dollar (1Y price range: 100.0-105.4).

- Issuer: Nexa Resources SA (Luxembourg, Luxembourg) | Coupon: 8.50% | Maturity: 27/6/2029 | Rating: CCC- | ISIN: USP989MJBP50 | Z-spread down by 35.3 bp to 1,176.1 bp, with the yield to worst at 12.9% and the bond now trading up to 78.0 cents on the dollar (1Y price range: 59.9-81.0).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 3.63% | Maturity: 4/2/2025 | Rating: BB- | ISIN: USP22835AA30 | Z-spread down by 38.0 bp to 277.9 bp (CDS basis: -129.4bp), with the yield to worst at 3.2% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 99.1-104.1).

- Issuer: Yapi ve Kredi Bankasi AS (Turkey) | Coupon: 5.38% | Maturity: 4/5/2027 | Rating: BB | ISIN: USP98118AA38 | Z-spread down by 38.4 bp to 300.2 bp, with the yield to worst at 4.0% and the bond now trading up to 105.6 cents on the dollar (1Y price range: 103.1-111.4).

- Issuer: Huarong Leasing Management Hong Kong Co Ltd (Shanghai, Hong Kong) | Coupon: 9.75% | Maturity: 15/7/2024 | Rating: B- | ISIN: USC33027AA82 | Z-spread down by 41.3 bp to 1,007.6 bp, with the yield to worst at 10.3% and the bond now trading up to 97.8 cents on the dollar (1Y price range: 96.0-99.8).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 8.50% | Maturity: 23/4/2026 | Rating: B | ISIN: XS1806400708 | Z-spread down by 43.8 bp to 450.9 bp, with the yield to worst at 5.2% and the bond now trading up to 111.4 cents on the dollar (1Y price range: 105.0-115.1).

- Issuer: Ecobank Transnational Incorporated SA (LOME, Togo) | Coupon: 9.50% | Maturity: 18/4/2024 | Rating: B- | ISIN: XS1826862556 | Z-spread down by 67.7 bp to 529.1 bp, with the yield to worst at 5.4% and the bond now trading up to 108.6 cents on the dollar (1Y price range: 106.5-109.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB+ | ISIN: XS2010029663 | Z-spread up by 160.7 bp to 817.3 bp, with the yield to worst at 7.8% and the bond now trading down to 85.1 cents on the dollar (1Y price range: 81.0-105.4).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: BB+ | ISIN: XS1713464524 | Z-spread up by 34.8 bp to 599.5 bp, with the yield to worst at 5.6% and the bond now trading down to 89.1 cents on the dollar (1Y price range: 84.6-105.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 21.9 bp to 534.5 bp, with the yield to worst at 5.1% and the bond now trading down to 94.9 cents on the dollar (1Y price range: 94.0-102.1).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | Z-spread up by 21.6 bp to 311.6 bp, with the yield to worst at 2.8% and the bond now trading down to 96.6 cents on the dollar (1Y price range: 96.3-102.9).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 1.75% | Maturity: 31/10/2024 | Rating: BB- | ISIN: XS2066703989 | Z-spread up by 17.4 bp to 154.4 bp, with the yield to worst at 1.1% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 100.7-102.9).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 6.00% | Maturity: 31/1/2025 | Rating: BB- | ISIN: XS2198213956 | Z-spread up by 17.0 bp to 368.7 bp, with the yield to worst at 3.2% and the bond now trading down to 107.7 cents on the dollar (1Y price range: 107.0-111.5).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 2.00% | Maturity: 14/7/2024 | Rating: BB- | ISIN: XS2363244513 | Z-spread up by 16.9 bp to 186.9 bp (CDS basis: -36.7bp), with the yield to worst at 1.4% and the bond now trading down to 101.2 cents on the dollar (1Y price range: 98.0-102.2).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.39% | Maturity: 17/2/2026 | Rating: BB | ISIN: XS2013574384 | Z-spread up by 14.3 bp to 206.1 bp (CDS basis: -50.1bp), with the yield to worst at 1.7% and the bond now trading down to 102.2 cents on the dollar (1Y price range: 96.7-105.5).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread up by 14.0 bp to 343.9 bp, with the yield to worst at 3.0% and the bond now trading down to 109.3 cents on the dollar (1Y price range: 99.6-111.6).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread up by 13.2 bp to 391.8 bp, with the yield to worst at 3.4% and the bond now trading down to 96.4 cents on the dollar (1Y price range: 96.4-99.4).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.25% | Maturity: 22/9/2026 | Rating: BB+ | ISIN: XS2388910270 | Z-spread up by 12.3 bp to 301.1 bp, with the yield to worst at 2.7% and the bond now trading down to 97.2 cents on the dollar (1Y price range: 97.2-99.7).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread down by 12.8 bp to 423.8 bp, with the yield to worst at 4.1% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 93.5-99.9).

- Issuer: Banco BPM SpA (Verona, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: CCC+ | ISIN: XS2270393379 | Z-spread down by 22.9 bp to 175.4 bp, with the yield to worst at 1.3% and the bond now trading up to 101.4 cents on the dollar (1Y price range: 93.7-102.9).

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$115m Bond (US3133ENAX85), fixed rate (1.98% coupon) maturing on 14 October 2031, priced at 100.00 (original spread of 37 bp), callable (10nc1)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$300m Bond (US3130APJ220), fixed rate (0.66% coupon) maturing on 28 October 2024, priced at 100.00 (original spread of 8 bp), callable (3nc3m)

- Castlelake Aviation Finance DAC (Financial - Other | Rating: B+): US$420m Senior Note (US14856HAA68), fixed rate (5.00% coupon) maturing on 15 April 2027, priced at 100.00 (original spread of 394 bp), callable (5nc2)

EUR BOND ISSUES

- Banco Bilbao Vizcaya Argentaria SA (Banking | Bilbao, Spain | Rating: AA+): €2,000m Cedula Hipotecaria (Covered Bond) (ES0413211A42), floating rate maturing on 20 October 2026, non callable

- Bubbles Bidco SpA (Financial - Other | Rating: NR): €350m Bond (IT0005458739), floating rate (EU03MLIB + 925.0 bp) maturing on 30 September 2028, priced at 100.00, non callable

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €335m Bond (FR0014005WO8), fixed rate (0.27% coupon) maturing on 11 October 2028, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9U5F1), floating rate maturing on 8 November 2028, priced at 100.00, non callable

- Eleving Group SA (Financial - Other | Luxembourg, Luxembourg | Rating: NR): €150m Note (XS2393240887), fixed rate (9.50% coupon) maturing on 18 October 2026, priced at 100.00, callable (5nc2)

NEW LOANS

- Help/Systems LLC, signed a US$ 195m Term Loan B, to be used for acquisition financing. It matures on 11/14/26 and initial pricing is set at LIBOR +400bps

- Help/Systems LLC, signed a US$ 145m Term Loan, to be used for acquisition financing. It matures on 11/14/27 and initial pricing is set at LIBOR +675bps

- Leonardo SPA (BB+), signed a € 600m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/07/24.

- Leonardo SPA (BB+), signed a € 1,800m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/07/26.

- Maguey Dutch Aviation Bv, signed a US$ 1,400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 11/07/24 and initial pricing is set at LIBOR +150bps

- Erndtebruecker Eisenwerk Gmbh, signed a € 107m Guarantee Facility, to be used for general corporate purposes. It matures on 01/00/00.

- Erndtebruecker Eisenwerk Gmbh, signed a € 181m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/00/00.

- San Miguel Corp, signed a US$ 700m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 10/07/26 and initial pricing is set at LIBOR +163bps

- Openpay Group Ltd, signed a US$ 136m Mezzanine Debt, to be used for general corporate purposes.

- Openpay Group Ltd, signed a US$ 136m Revolving Credit Facility, to be used for general corporate purposes. It matures on 04/07/24.

NEW ISSUES IN SECURITIZED CREDIT

- Freddie Mac Wi-K133 issued a fixed-rate Agency CMBS in 1 tranche offering a yield to maturity of 1.86%, for a total of US$ 180 m. Bookrunners: Morgan Stanley International Ltd, JP Morgan & Co Inc

- Prpm Series 2021-Rpl2 LLC issued a fixed-rate RMBS in 5 tranches, for a total of US$ 224 m. Highest-rated tranche offering a yield to maturity of 1.46%, and the lowest-rated tranche a yield to maturity of 4.13%. Bookrunners: Nomura Securities Co Ltd, Goldman Sachs & Co

- Onemain Direct Auto Receivables Trust 2021-1 issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,000 m. Highest-rated tranche offering a yield to maturity of 0.87%, and the lowest-rated tranche a yield to maturity of 1.62%. Bookrunners: Societe Generale SA, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Mizuho Securities USA Inc