Credit

High Yield USD Bonds Close Nearly Unchanged, With A Drop In Cash Spreads Compensating For Higher Rates At The Front End Of The Yield Curve

Not much happening stateside in terms of corporate issuance, but there were a few large deals priced in Europe including French telecom company Iliad's dual currency offering of € 1.85 bn + US$ 2.1 bn in 4 tranches

Published ET

ICE BofAML US Corporate IG & HY Spreads To Worst | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.26% today, with investment grade up 0.29% and high yield up 0.04% (YTD total return: -1.04%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.42% today (Month-to-date: -0.03%; Year-to-date: -1.81%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.033% today (Month-to-date: -0.55%; Year-to-date: 3.15%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 341.0 bp (YTD change: -49.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +3.2%)

- New issues: US$ 4.3bn in dollars and € 15.3bn in euros

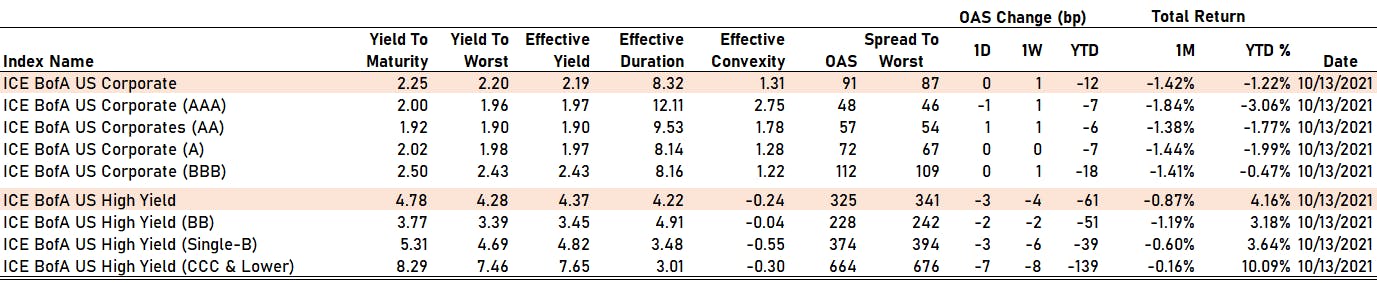

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 48 bp

- AA up by 1 bp at 57 bp

- A unchanged at 72 bp

- BBB unchanged at 112 bp

- BB down by -2 bp at 228 bp

- B down by -3 bp at 374 bp

- CCC down by -7 bp at 664 bp

CDS INDICES (mid-spreads)

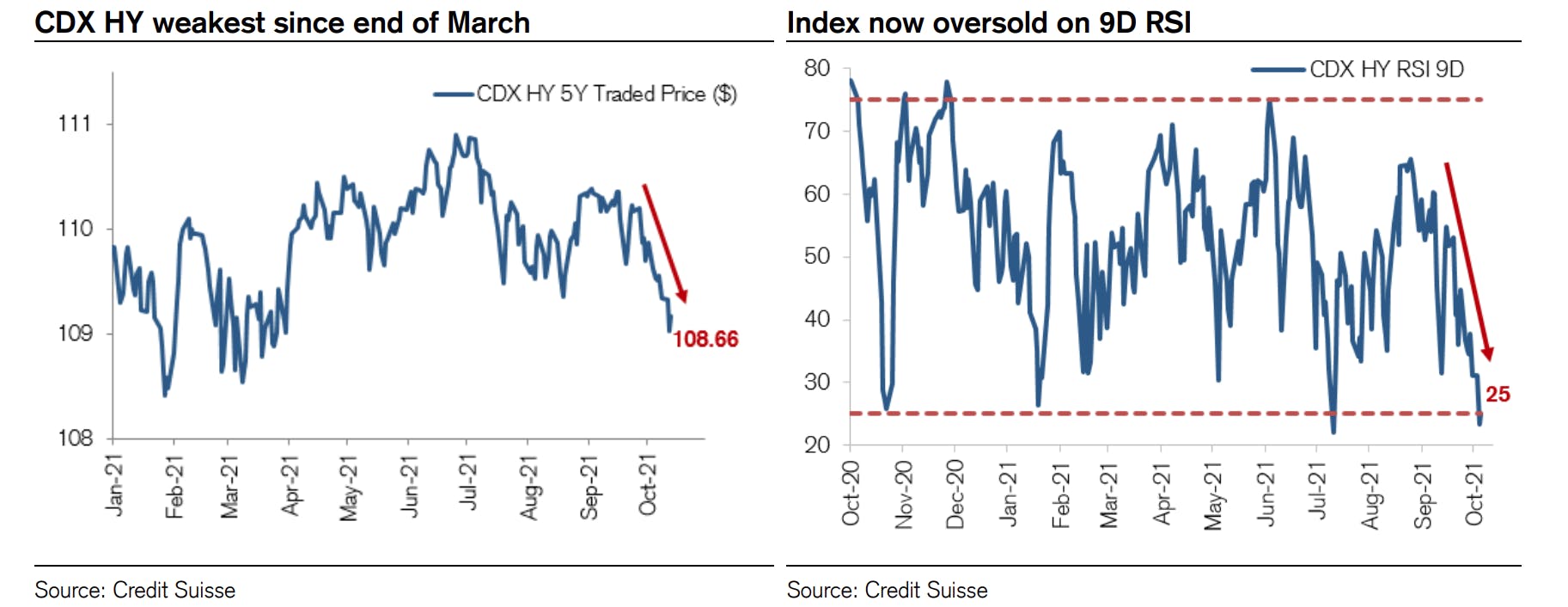

- Markit CDX.NA.IG 5Y down 0.9 bp, now at 93bp (YTD change: +2.3bp)

- Markit CDX.NA.HY 5Y down 3.6 bp, now at 311bp (YTD change: +18.0bp)

- Markit iTRAXX Europe unchanged at 53bp (YTD change: +5.1bp)

- Markit iTRAXX Japan up 1.9 bp, now at 53bp (YTD change: +1.4bp)

- Markit iTRAXX Asia Ex-Japan down 0.1 bp, now at 93bp (YTD change: +34.9bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 4.95% | Maturity: 12/8/2024 | Rating: BB- | ISIN: XS2357443410 | Z-spread up by 235.1 bp to 739.2 bp, with the yield to worst at 7.6% and the bond now trading down to 92.5 cents on the dollar (1Y price range: 93.5-102.0).

- Issuer: Gemdale Ever Prosperity Investment Ltd (#N/A, Hong Kong) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread up by 224.7 bp to 800.8 bp, with the yield to worst at 8.1% and the bond now trading down to 94.8 cents on the dollar (1Y price range: 94.5-103.4).

- Issuer: JSW Steel Ltd (Mumbai, India) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread up by 71.7 bp to 297.7 bp, with the yield to worst at 3.9% and the bond now trading down to 111.0 cents on the dollar (1Y price range: 106.5-114.8).

- Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 5.25% | Maturity: 28/4/2027 | Rating: BB- | ISIN: XS1599758940 | Z-spread up by 60.8 bp to 413.7 bp, with the yield to worst at 5.0% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 100.0-104.3).

- Issuer: Buckeye Partners LP (Houston, Texas (US)) | Coupon: 3.95% | Maturity: 5/4/2027 | Rating: BB- | ISIN: USY44680RV38 | Z-spread up by 45.7 bp to 347.8 bp, with the yield to worst at 4.5% and the bond now trading down to 96.5 cents on the dollar (1Y price range: 94.6-99.5).

- Issuer: Fidelity Bank PLC (Victoria Island, Nigeria) | Coupon: 3.88% | Maturity: 15/8/2029 | Rating: BB- | ISIN: USU15662AF37 | Z-spread up by 40.0 bp to 278.8 bp, with the yield to worst at 4.1% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 97.8-101.6).

- Issuer: Pakistan Water and Power Development Authority (Lahore, Pakistan) | Coupon: 4.88% | Maturity: 15/5/2028 | Rating: BB | ISIN: USU5256PAC50 | Z-spread up by 38.2 bp to 225.7 bp, with the yield to worst at 3.5% and the bond now trading down to 107.3 cents on the dollar (1Y price range: 105.3-112.0).

- Issuer: Tata Motors Ltd (Mumbai, India) | Coupon: 7.00% | Maturity: 1/2/2024 | Rating: CCC+ | ISIN: USW8758PAK22 | Z-spread up by 37.4 bp to 502.8 bp (CDS basis: -116.3bp), with the yield to worst at 5.1% and the bond now trading down to 103.1 cents on the dollar (1Y price range: 96.2-105.5).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 5.95% | Maturity: 19/4/2026 | Rating: BB- | ISIN: XS2224065289 | Z-spread up by 34.1 bp to 368.5 bp, with the yield to worst at 4.4% and the bond now trading down to 105.1 cents on the dollar (1Y price range: 104.1-109.3).

- Issuer: Turkiye Sinai Kalkinma Bankasi AS (Istanbul, Turkey) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 36.9 bp to 237.0 bp, with the yield to worst at 2.6% and the bond now trading up to 102.9 cents on the dollar (1Y price range: 98.4-103.6).

- Issuer: Nexa Resources SA (Luxembourg, Luxembourg) | Coupon: 4.15% | Maturity: 15/4/2025 | Rating: BB+ | ISIN: USU70842AB21 | Z-spread down by 38.2 bp to 121.4 bp (CDS basis: -72.6bp), with the yield to worst at 2.0% and the bond now trading up to 106.5 cents on the dollar (1Y price range: 105.2-110.0).

- Issuer: Metinvest BV (S-GRAVENHAGE, Netherlands) | Coupon: 8.50% | Maturity: 23/3/2025 | Rating: CCC | ISIN: USP989MJBQ34 | Z-spread down by 58.1 bp to 1,099.4 bp, with the yield to worst at 11.1% and the bond now trading up to 91.6 cents on the dollar (1Y price range: 74.9-93.8).

- Issuer: Ecobank Transnational Incorporated SA (LOME, Togo) | Coupon: 4.45% | Maturity: 5/5/2024 | Rating: B | ISIN: USY7140VAA80 | Z-spread down by 70.9 bp to 532.3 bp, with the yield to worst at 5.6% and the bond now trading up to 96.6 cents on the dollar (1Y price range: 81.5-98.8).

- Issuer: Grupo de Inversiones Suramericana SA (Medellin, Colombia) | Coupon: 8.25% | Maturity: 9/7/2024 | Rating: B | ISIN: XS1843433472 | Z-spread down by 71.5 bp to 614.1 bp, with the yield to worst at 6.3% and the bond now trading up to 103.8 cents on the dollar (1Y price range: 101.8-107.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Banco BPM SpA (Verona, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread up by 40.5 bp to 369.3 bp, with the yield to worst at 3.3% and the bond now trading down to 108.2 cents on the dollar (1Y price range: 99.6-111.6).

- Issuer: Banca Popolare di Sondrio ScpA (Sondrio, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | Z-spread up by 33.3 bp to 346.7 bp, with the yield to worst at 3.1% and the bond now trading down to 101.1 cents on the dollar (1Y price range: 89.0-104.3).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 2.50% | Maturity: 25/2/2025 | Rating: B+ | ISIN: DE000A14J587 | Z-spread up by 25.4 bp to 225.3 bp (CDS basis: -15.4bp), with the yield to worst at 1.9% and the bond now trading down to 101.6 cents on the dollar (1Y price range: 100.1-103.9).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 22.2 bp to 561.5 bp, with the yield to worst at 5.5% and the bond now trading down to 93.6 cents on the dollar (1Y price range: 92.7-102.1).

- Issuer: Thyssenkrupp AG (Essen, Germany) | Coupon: 3.38% | Maturity: 15/5/2025 | Rating: BB | ISIN: XS1227287221 | Z-spread up by 15.8 bp to 159.3 bp (CDS basis: -64.6bp), with the yield to worst at 1.1% and the bond now trading down to 106.2 cents on the dollar (1Y price range: 106.1-108.7).

- Issuer: Wienerberger AG (Wien, Austria) | Coupon: 2.00% | Maturity: 2/5/2024 | Rating: BB+ | ISIN: AT0000A20F93 | Z-spread up by 15.5 bp to 72.3 bp (CDS basis: 305.7bp), with the yield to worst at 0.3% and the bond now trading down to 104.0 cents on the dollar (1Y price range: 104.0-105.2).

- Issuer: SIG Combibloc PurchaseCo SARL (Munsbach, Luxembourg) | Coupon: 1.63% | Maturity: 28/4/2028 | Rating: BB+ | ISIN: XS2332552541 | Z-spread up by 13.5 bp to 139.4 bp (CDS basis: 7.4bp), with the yield to worst at 1.2% and the bond now trading down to 101.3 cents on the dollar (1Y price range: 98.5-103.7).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 1.63% | Maturity: 3/2/2025 | Rating: BB- | ISIN: XS1558491855 | Z-spread up by 13.2 bp to 143.4 bp (CDS basis: -46.5bp), with the yield to worst at 1.0% and the bond now trading down to 101.4 cents on the dollar (1Y price range: 98.8-103.0).

- Issuer: Louis Dreyfus Co BV (Rotterdam, Netherlands) | Coupon: 2.00% | Maturity: 14/7/2024 | Rating: BB- | ISIN: XS2363244513 | Z-spread up by 12.8 bp to 203.1 bp (CDS basis: -49.0bp), with the yield to worst at 1.6% and the bond now trading down to 100.7 cents on the dollar (1Y price range: 98.0-102.2).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B | ISIN: XS1881005976 | Z-spread down by 28.2 bp to 441.3 bp (CDS basis: -65.7bp), with the yield to worst at 4.0% and the bond now trading up to 101.1 cents on the dollar (1Y price range: 93.9-106.4).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | Z-spread down by 36.0 bp to 178.2 bp, with the yield to worst at 1.3% and the bond now trading up to 103.7 cents on the dollar (1Y price range: 97.5-105.8).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB- | ISIN: XS2010029663 | Z-spread down by 111.6 bp to 756.1 bp, with the yield to worst at 7.2% and the bond now trading up to 86.8 cents on the dollar (1Y price range: 81.0-105.4).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: BB- | ISIN: XS2283224231 | Z-spread down by 147.3 bp to 619.4 bp, with the yield to worst at 5.9% and the bond now trading up to 84.8 cents on the dollar (1Y price range: 77.0-99.6).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: BB- | ISIN: XS1713464524 | Z-spread down by 186.8 bp to 481.6 bp, with the yield to worst at 4.5% and the bond now trading up to 93.3 cents on the dollar (1Y price range: 84.6-105.6).

USD BOND ISSUES

- EPR Properties (Real Estate Investment Trust | Kansas City, United States | Rating: BB+): US$400m Senior Note (US26884UAG40), fixed rate (3.60% coupon) maturing on 15 November 2031, priced at 99.17 (original spread of 215 bp), callable (10nc10)

- IOI Investment (L) Bhd (Financial - Other | Putrajaya, Putrajaya, Malaysia | Rating: NR): US$200m Unsecured Note (XS2399889893), fixed rate (2.13% coupon) maturing on 27 October 2026, priced at 100.00, non callable

- IOI Investment (L) Bhd (Financial - Other | Putrajaya, Putrajaya, Malaysia | Rating: NR): US$300m Unsecured Note (XS2399889976), fixed rate (3.00% coupon) maturing on 27 October 2031, priced at 100.00, non callable

- Iliad Holding SAS (Financial - Other | Paris, France | Rating: B+): US$900m Note (US449691AC82), fixed rate (7.00% coupon) maturing on 15 October 2028, priced at 100.00 (original spread of 562 bp), callable (7nc3)

- Iliad Holding SAS (Financial - Other | Paris, France | Rating: B+): US$1,200m Note (US449691AA27), fixed rate (6.50% coupon) maturing on 15 October 2026, priced at 100.00 (original spread of 543 bp), callable (5nc2)

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB-): US$200m Unsecured Note (XS2395954998), fixed rate (2.50% coupon) maturing on 14 October 2031, priced at 100.00, non callable

- Metalloinvest Finance DAC (Financial - Other | Dublin, Cyprus | Rating: BBB-): US$650m Senior Note (XS2400040973), fixed rate (3.38% coupon) maturing on 22 October 2028, priced at 100.00 (original spread of 200 bp), callable (7nc7)

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): US$197m Unsecured Note (XS2397369476) zero coupon maturing on 20 June 2051, priced at 50.66, non callable

- Xinhu (BVI) 2018 Holding Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$250m Senior Note (XS2396507241), fixed rate (11.00% coupon) maturing on 28 September 2024, priced at 99.99, callable (3nc2)

EUR BOND ISSUES

- Berlin, State of (Official and Muni | Berlin, Germany | Rating: AA+): €500m Jumbo Landesschatzanweisung (DE000A3H2Y57), fixed rate (0.13% coupon) maturing on 20 October 2031, priced at 99.35 (original spread of 32 bp), non callable

- Blackstone Property Partners Europe Holdings SARL (Financial - Other | Luxembourg, Luxembourg | Rating: BBB): €600m Senior Note (XS2398745922), fixed rate (1.00% coupon) maturing on 20 October 2026, priced at 99.97 (original spread of 149 bp), callable (5nc5)

- Blackstone Property Partners Europe Holdings SARL (Financial - Other | Luxembourg, Luxembourg | Rating: BBB): €500m Senior Note (XS2398745849), fixed rate (0.13% coupon) maturing on 20 October 2023, priced at 99.92 (original spread of 88 bp), callable (2nc2)

- Blackstone Property Partners Europe Holdings SARL (Financial - Other | Luxembourg, Luxembourg | Rating: BBB): €500m Senior Note (XS2398746144), fixed rate (1.63% coupon) maturing on 20 April 2030, priced at 99.74 (original spread of 192 bp), callable (9nc8)

- Compagnie de Financement Foncier SA (Financial - Other | Paris, France | Rating: NR): €750m Obligation Fonciere (Covered Bond) (FR0014006276), fixed rate (0.01% coupon) maturing on 25 October 2027, priced at 100.20 (original spread of 41 bp), non callable

- Compagnie de Financement Foncier SA (Financial - Other | Paris, France | Rating: NR): €750m Obligation Fonciere (Covered Bond) (FR0014006268), fixed rate (0.60% coupon) maturing on 25 October 2041, priced at 99.70 (original spread of 56 bp), non callable

- Cooperatieve Rabobank UA (Banking | Utrecht, Netherlands | Rating: A+): €2,500m Bond (NL0015000MC0), fixed rate (0.13% coupon) maturing on 14 October 2025, priced at 101.65 (original spread of 100,000 bp), non callable

- Flemish, Community of (Official and Muni | Brussels, Belgium | Rating: AA): €1,500m Bond (BE0002826072), fixed rate (0.30% coupon) maturing on 20 October 2031, priced at 99.66, non callable

- FNM SpA (Railroads | Milan, Milano, Italy | Rating: BBB-): €650m Senior Note (XS2400296773), fixed rate (0.75% coupon) maturing on 20 October 2026, priced at 99.82 (original spread of 130 bp), callable (5nc5)

- Hera SpA (Gas Utility - Local Distrib | Bologna, Italy | Rating: BBB): €500m Senior Note (XS2399933386), fixed rate (1.00% coupon) maturing on 25 April 2034, priced at 99.11 (original spread of 121 bp), callable (13nc12)

- Iliad Holding SAS (Financial - Other | Paris, Ile-De-France, France | Rating: BB): €1,100m Note (XS2397781357), fixed rate (5.13% coupon) maturing on 15 October 2026, priced at 100.00 (original spread of 562 bp), callable (5nc2)

- Iliad Holding SAS (Financial - Other | Paris, Ile-De-France, France | Rating: BB): €750m Note (XS2397781944), fixed rate (5.63% coupon) maturing on 15 October 2028, priced at 100.00 (original spread of 599 bp), callable (7nc3)

- International Bank for Reconstruction and Development (Supranational | Washington, United States | Rating: AAA): €2,000m Bond (XS2400299363), fixed rate (0.70% coupon) maturing on 22 October 2046, priced at 99.98 (original spread of 50 bp), non callable

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): €150m Unsecured Note (XS2395954642) zero coupon maturing on 15 October 2033, priced at 100.00, non callable

- Kookmin Bank (Banking | Seoul, South Korea | Rating: A): €500m Covered Bond (Other) (XS2393768788), fixed rate (0.05% coupon) maturing on 19 October 2026, priced at 100.00 (original spread of 54 bp), non callable

- Macquarie Bank Ltd (London Branch) (Banking | London, Australia | Rating: NR): €500m Unsecured Note (XS2400358474), floating rate maturing on 20 October 2023, priced at 100.00, non callable

- Unedic (Service - Other | Paris, France | Rating: AA): €1,000m Bond (FR00140062F0), fixed rate (1.25% coupon) maturing on 28 March 2027, priced at 107.58 (original spread of 14 bp), non callable

- Wuestenrot Bausparkasse AG (Banking | Ludwigsburg, Germany | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (DE000WBP0BB8), fixed rate (0.13% coupon) maturing on 19 October 2029, priced at 99.97 (original spread of 40 bp), non callable

NEW LOANS

- McGraw Hill LLC, signed a US$ 575m Term Loan B maturing on 07/30/28, to be used for acquisition financing