Credit

Spreads Tighten Across The Credit Complex, In Line With The Excellent Performance Of US Equities

Morgan Stanley stepped up to the plate as soon as their earnings quiet period ended, printing US$ 5bn in two tranches for the largest USD corporate bond offering today

Published ET

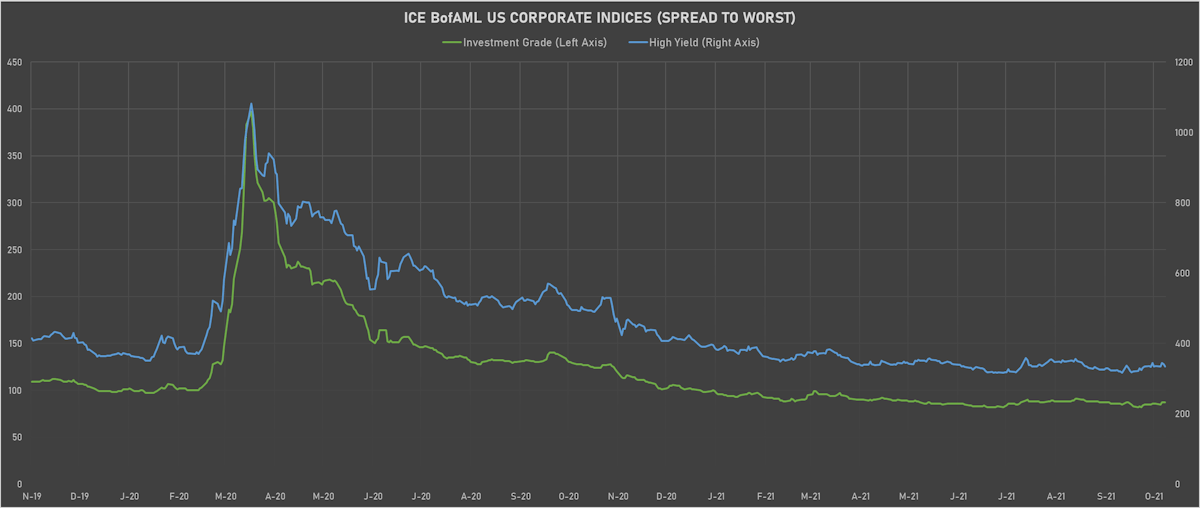

Domestic USD HY Cash Spreads Have Done Much Better Than CDS Spreads This Year | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.23% today, with investment grade up 0.23% and high yield up 0.28% (YTD total return: -0.81%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.357% today (Month-to-date: 0.32%; Year-to-date: -1.46%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.310% today (Month-to-date: -0.24%; Year-to-date: 3.47%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst down -7.0 bp, now at 334.0 bp (YTD change: -56.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged today (YTD total return: +3.2%)

- New issues: US$ 11.0bn in dollars and € 4.4bn in euros

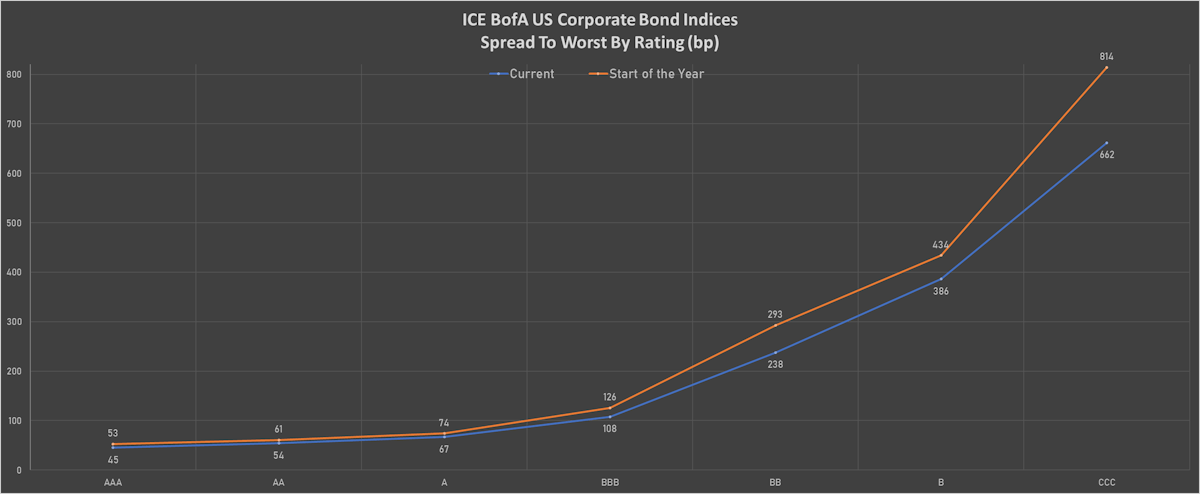

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 47 bp

- AA down by -1 bp at 56 bp

- A unchanged at 72 bp

- BBB unchanged at 112 bp

- BB down by -4 bp at 224 bp

- B down by -9 bp at 365 bp

- CCC down by -13 bp at 651 bp

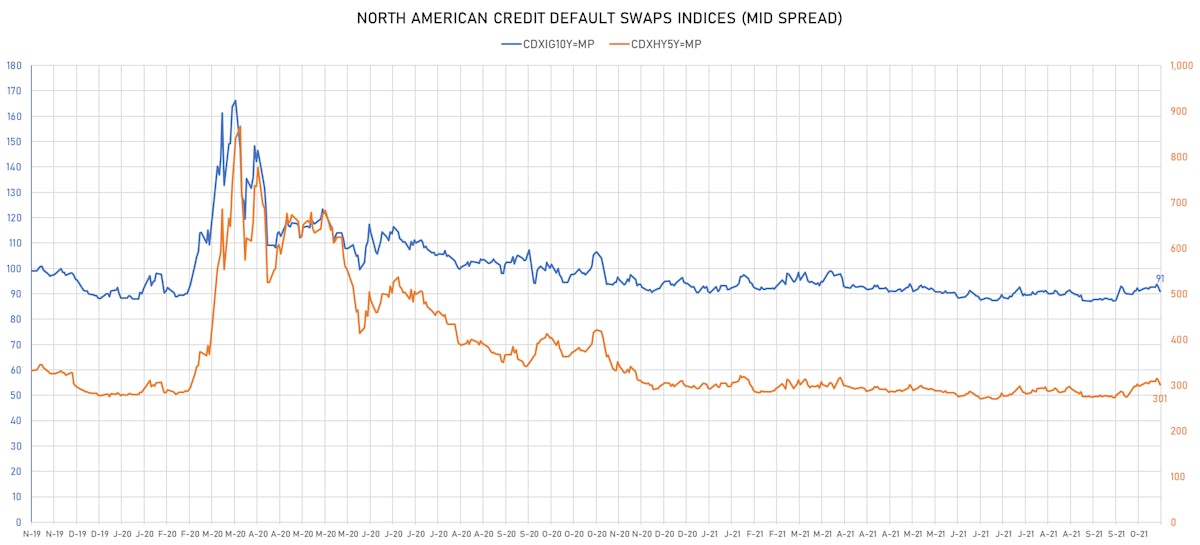

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.9 bp, now at 91bp (YTD change: +0.4bp)

- Markit CDX.NA.HY 5Y down 10.6 bp, now at 301bp (YTD change: +7.4bp)

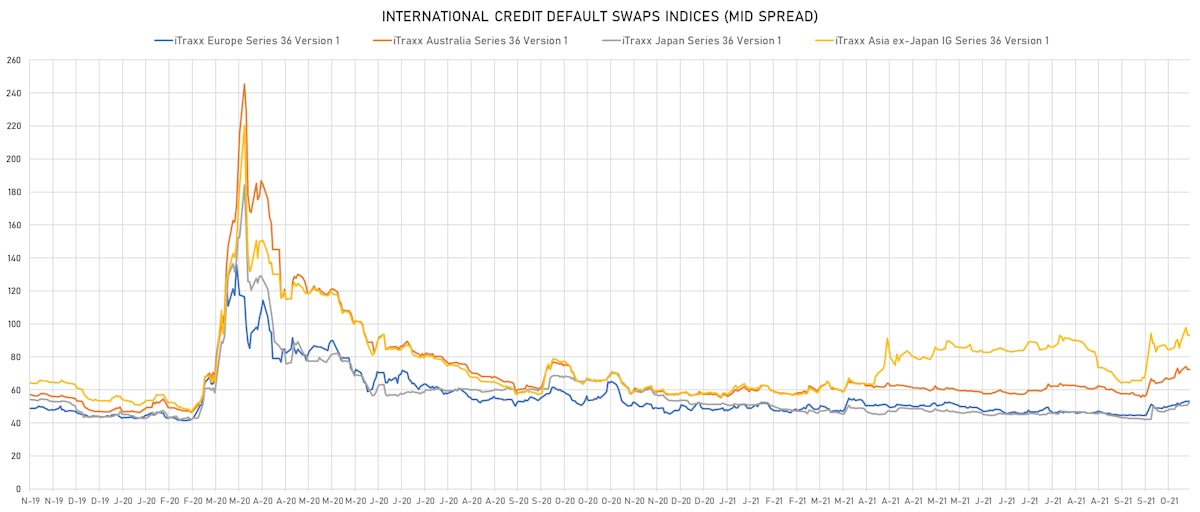

- Markit iTRAXX Europe down 2.2 bp, now at 51bp (YTD change: +2.8bp)

- Markit iTRAXX Japan down 1.3 bp, now at 51bp (YTD change: +0.1bp)

- Markit iTRAXX Asia Ex-Japan unchanged at 93bp (YTD change: +34.9bp)

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$105m Bond (US3133ENBP43), fixed rate (1.11% coupon) maturing on 20 October 2026, priced at 100.00, callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$200m Bond (US3133ENBN94), fixed rate (0.34% coupon) maturing on 20 October 2023, priced at 99.94 (original spread of -1 bp), callable (2nc6m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$325m Bond (US3133ENBK55), fixed rate (1.14% coupon) maturing on 20 October 2026, priced at 100.00, callable (5nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$300m Bond (US3133ENBG44), floating rate (SOFR + 3.0 bp) maturing on 20 October 2023, priced at 100.00, callable (2nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$130m Bond (US3133ENBM12), fixed rate (0.63% coupon) maturing on 21 October 2024, priced at 99.94 (original spread of 2 bp), callable (3nc1)

- Glatfelter Corp (Conglomerate/Diversified Mfg | Charlotte, United States | Rating: BB): US$500m Senior Note (USU3764PAA94), fixed rate (4.75% coupon) maturing on 15 November 2029, priced at 100.00 (original spread of 336 bp), callable (8nc3)

- Morgan Stanley (Banking | New York City, New York, United States | Rating: BBB+): US$2,500m Senior Note (US61747YEH45), floating rate maturing on 20 October 2032, priced at 100.00, callable (11nc10)

- Pennantpark Investment Corp (Financial - Other | New York City, United States | Rating: NR): US$165m Senior Note (US708062AD65), fixed rate (4.00% coupon) maturing on 1 November 2026, priced at 99.44 (original spread of 307 bp), callable (5nc5)

- Vertiv Group Corp (Machinery | Columbus, United States | Rating: BB-): US$850m Note (US92535UAB08), fixed rate (4.13% coupon) maturing on 15 November 2028, priced at 100.00 (original spread of 278 bp), callable (7nc3)

- Weatherford International Ltd (Oilfield Machinery and Services | Houston, United States | Rating: NR): US$1,600m Senior Note (US947075AU14), fixed rate (8.63% coupon) maturing on 30 April 2030, priced at 100.00 (original spread of 720 bp), callable (9nc3)

- Bank Hapoalim BM (Banking | Tel Aviv-Yafo, Israel | Rating: A): US$1,000m Subordinated Note (IL0066204707), fixed rate (3.26% coupon) maturing on 21 January 2032, priced at 100.00, callable (10nc5)

- Braskem Idesa SAPI (Financial - Other | Mexico City, Brazil | Rating: B+): US$1,200m Note (USP1850NAB75), fixed rate (6.99% coupon) maturing on 20 February 2032, priced at 99.94, callable (10nc5)

- Central American Bank for Economic Integration (Supranational | Tegucigalpa, Francisco Morazan, Honduras | Rating: AA-): US$400m Unsecured Note (XS2400634924), floating rate maturing on 28 October 2024, priced at 100.00, non callable

- Empire Resorts Inc (Gaming | Monticello | Rating: B+): US$300m Note (US292052AF45), fixed rate (7.75% coupon) maturing on 1 November 2026, priced at 100.00 (original spread of 670 bp), callable (5nc2)

- Manitoba, Province of (Official and Muni | Winnipeg, Manitoba, Canada | Rating: A+): US$1,000m Senior Debenture (US563469UY98), fixed rate (1.50% coupon) maturing on 25 October 2028, priced at 99.64 (original spread of 20 bp), non callable

EUR BOND ISSUES

- Danish Ship Finance A/S (Mortgage Banking | Kobenhavn | Rating: BBB+): €500m Covered Bond (Other) (DK0004133139), fixed rate (0.37% coupon) maturing on 21 June 2028, non callable

- FinecoBank Banca Fineco SpA (Banking | Reggio Nell'Emilia, Italy | Rating: BBB): €500m Note (XS2398807383), floating rate maturing on 21 October 2027, priced at 99.71 (original spread of 109 bp), callable (6nc5)

- Groupe des Assurances du Credit Mutuel SA (Financial - Other | Strasbourg, Grand Est, France | Rating: NR): €750m Bond (FR0014006144), floating rate maturing on 21 April 2042, priced at 99.77 (original spread of 206 bp), callable (21nc10)

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): €150m Unsecured Note (XS2395954642) zero coupon maturing on 15 October 2033, priced at 100.00, non callable

- Macquarie Bank Ltd (London Branch) (Banking | London, Australia | Rating: NR): €500m Unsecured Note (XS2400358474), floating rate maturing on 20 October 2023, priced at 100.00, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €150m Unsecured Note (XS2400783762), fixed rate (0.91% coupon) maturing on 15 February 2041, priced at 100.00, non callable

- Societe Fonciere Lyonnaise SA (Real Estate Investment Trust | Paris, Spain | Rating: BBB+): €500m Bond (FR00140060E7), fixed rate (0.50% coupon) maturing on 21 April 2028, priced at 99.23 (original spread of 107 bp), callable (7nc6)

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Japan | Rating: A-): €750m Covered Bond (Other) (XS2395267052), fixed rate (0.28% coupon) maturing on 25 October 2028, priced at 100.00 (original spread of 70 bp), non callable

- Wesfarmers Ltd (Conglomerate/Diversified Mfg | Perth, Western Australia, Australia | Rating: A-): €600m Senior Note (XS2399154181), fixed rate (0.95% coupon) maturing on 21 October 2033, priced at 100.00 (original spread of 113 bp), callable (12nc12)