Credit

IG & HY Cash Spreads Tighter Except CCCs, But IG Bonds Falls With Higher Rates

Weekly volume of new USD bonds (IFR data): US$18.25bn for IG in 17 tranches (2021 YTD volume US$1.232trn vs 2020 YTD US$1.603trn), $8.31bn for HY in 12 tranches (2021 YTD volume US$407.456bn vs 2020 YTD US$358.989bn)

Published ET

Performance Of Recent USD Issues | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.22% today, with investment grade down -0.25% and high yield unchanged (YTD total return: -1.03%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.317% today (Month-to-date: 0.00%; Year-to-date: -1.77%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.034% today (Month-to-date: -0.21%; Year-to-date: 3.50%)

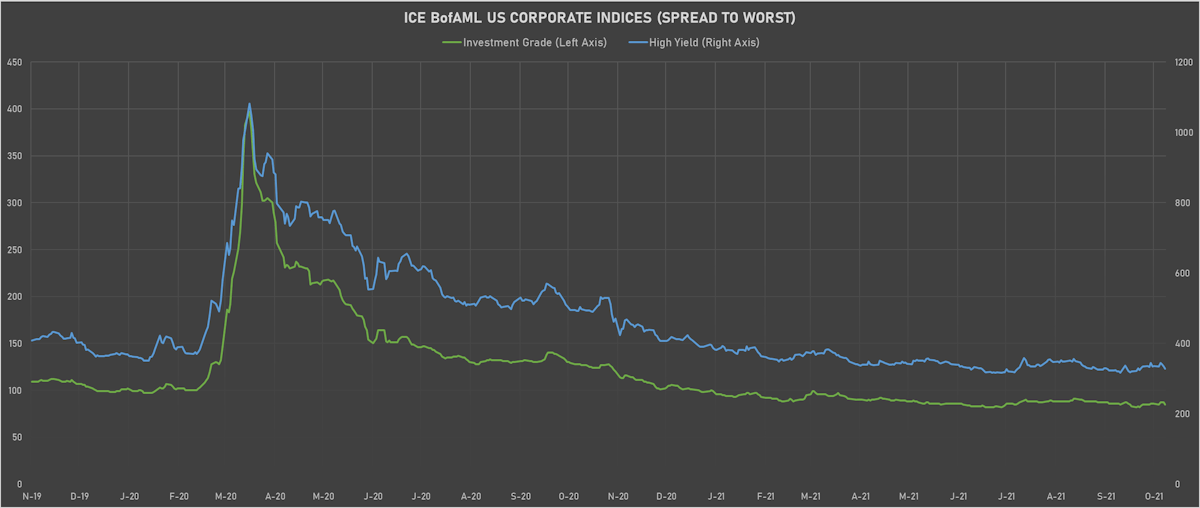

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 85.0 bp (YTD change: -13.0 bp)

- ICE BofA US High Yield Index spread to worst down -6.0 bp, now at 328.0 bp (YTD change: -62.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +3.2%)

- New issues: US$ 4.8bn in dollars and € .6bn in euros

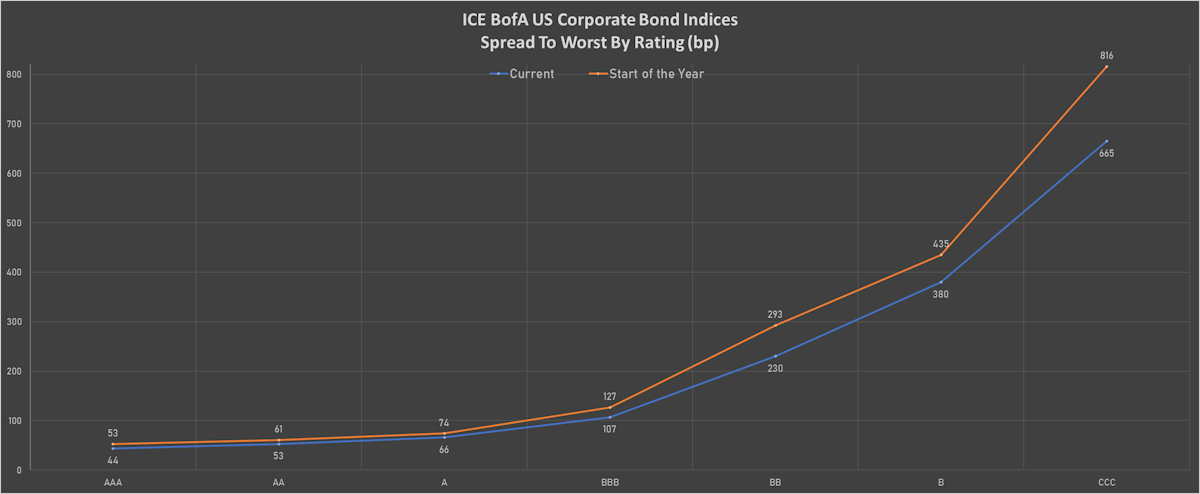

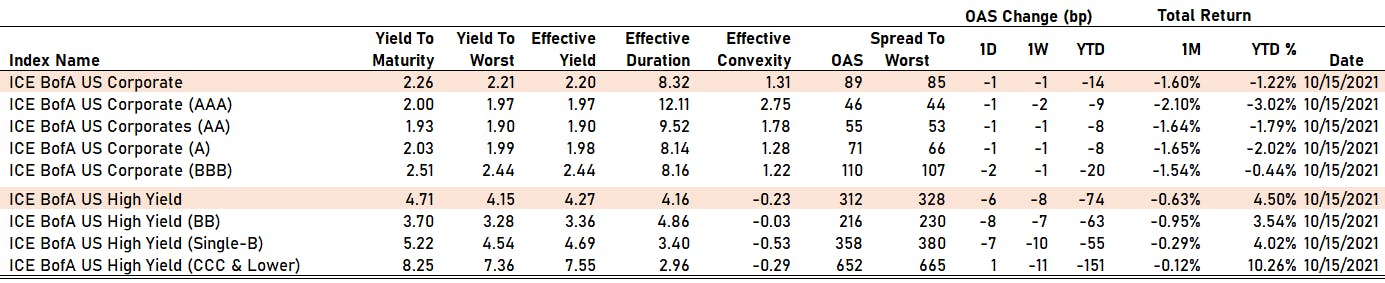

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 46 bp

- AA down by -1 bp at 55 bp

- A down by -1 bp at 71 bp

- BBB down by -2 bp at 110 bp

- BB down by -8 bp at 216 bp

- B down by -7 bp at 358 bp

- CCC up by 1 bp at 652 bp

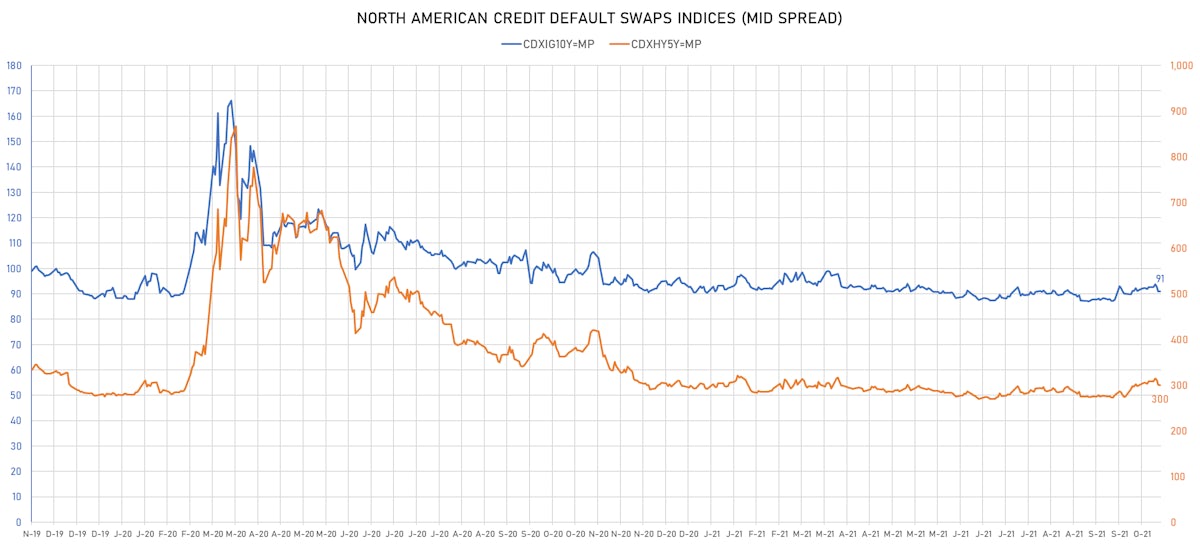

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.1 bp, now at 91bp (YTD change: +0.4bp)

- Markit CDX.NA.HY 5Y down 0.9 bp, now at 300bp (YTD change: +6.5bp)

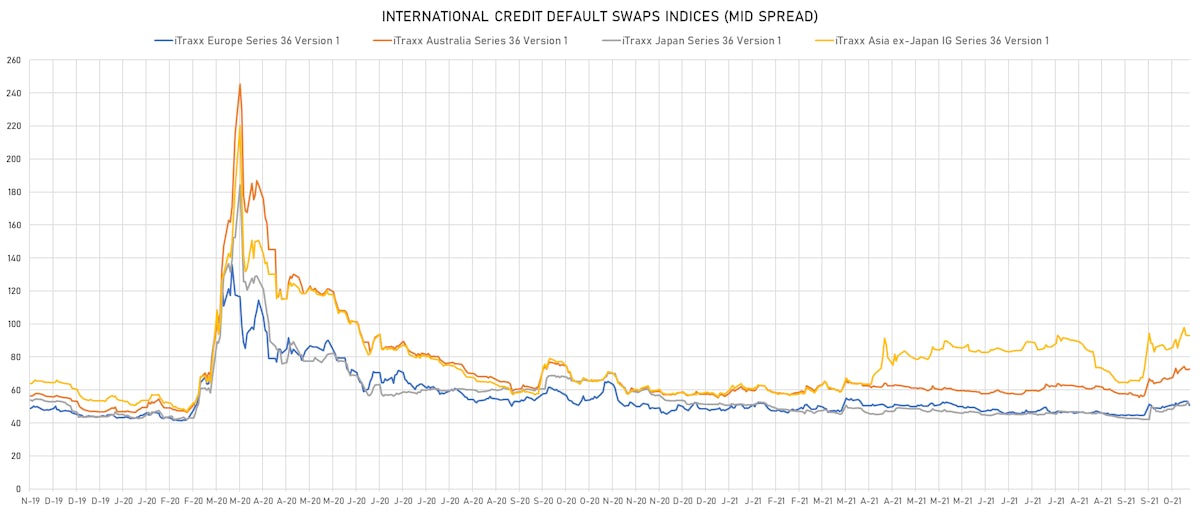

- Markit iTRAXX Europe down 0.4 bp, now at 50bp (YTD change: +2.4bp)

- Markit iTRAXX Japan down 1.4 bp, now at 50bp (YTD change: -1.3bp)

- Markit iTRAXX Asia Ex-Japan down 7.3 bp, now at 86bp (YTD change: +27.6bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Seazen Group Ltd (Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread up by 308.6 bp to 1,018.4 bp, with the yield to worst at 10.2% and the bond now trading down to 88.9 cents on the dollar (1Y price range: 87.1-105.8).

- Issuer: China Hongqiao Group Ltd (Cayman Islands) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread up by 268.2 bp to 792.1 bp, with the yield to worst at 8.0% and the bond now trading down to 94.9 cents on the dollar (1Y price range: 94.5-103.4).

- Issuer: Metropolitan Edison Co (Akron, Ohio (US)) | Coupon: 4.00% | Maturity: 15/4/2025 | Rating: BB+ | ISIN: USU5919UAE92 | Z-spread up by 40.1 bp to 204.0 bp (CDS basis: -150.5bp), with the yield to worst at 2.9% and the bond now trading down to 103.4 cents on the dollar (1Y price range: 103.4-109.0).

- Issuer: Yapi ve Kredi Bankasi AS (Turkey) | Coupon: 5.85% | Maturity: 21/6/2024 | Rating: B | ISIN: XS1634372954 | Z-spread down by 40.0 bp to 413.8 bp, with the yield to worst at 4.7% and the bond now trading up to 102.6 cents on the dollar (1Y price range: 97.8-104.0).

- Issuer: Turkiye Garanti Bankasi AS (Turkey) | Coupon: 5.88% | Maturity: 16/3/2023 | Rating: B | ISIN: XS1576037284 | Z-spread down by 43.3 bp to 236.0 bp, with the yield to worst at 2.5% and the bond now trading up to 104.4 cents on the dollar (1Y price range: 100.0-105.4).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B+ | ISIN: USU98347AL87 | Z-spread down by 47.1 bp to 358.2 bp, with the yield to worst at 4.6% and the bond now trading up to 102.0 cents on the dollar (1Y price range: 100.3-108.1).

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 4.15% | Maturity: 15/4/2025 | Rating: BB+ | ISIN: USU70842AB21 | Z-spread down by 55.9 bp to 88.7 bp (CDS basis: -39.1bp), with the yield to worst at 1.7% and the bond now trading up to 107.4 cents on the dollar (1Y price range: 105.2-110.0).

- Issuer: Huarong Leasing Management Hong Kong Co Ltd (Hong Kong) | Coupon: 5.65% | Maturity: 28/10/2022 | Rating: BB | ISIN: XS2051747538 | Z-spread down by 60.8 bp to 339.6 bp, with the yield to worst at 3.4% and the bond now trading up to 102.0 cents on the dollar (1Y price range: 99.0-102.8).

- Issuer: Nexa Resources SA (Luxembourg) | Coupon: 5.38% | Maturity: 4/5/2027 | Rating: BB | ISIN: USP98118AA38 | Z-spread down by 67.3 bp to 268.5 bp, with the yield to worst at 3.7% and the bond now trading up to 107.0 cents on the dollar (1Y price range: 103.1-111.4).

- Issuer: Aag FH LP (Canada) | Coupon: 9.75% | Maturity: 15/7/2024 | Rating: B- | ISIN: USC33027AA82 | Z-spread down by 68.4 bp to 980.6 bp, with the yield to worst at 10.1% and the bond now trading up to 98.1 cents on the dollar (1Y price range: 96.0-99.8).

- Issuer: Centrais Eletricas Brasileiras SA (Brasilia, Brazil) | Coupon: 3.63% | Maturity: 4/2/2025 | Rating: BB- | ISIN: USP22835AA30 | Z-spread down by 73.6 bp to 242.8 bp (CDS basis: -95.8bp), with the yield to worst at 3.0% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 99.1-104.1).

- Issuer: Metinvest BV (S-GRAVENHAGE, Netherlands) | Coupon: 8.50% | Maturity: 23/4/2026 | Rating: B+ | ISIN: XS1806400708 | Z-spread down by 75.3 bp to 408.8 bp, with the yield to worst at 4.9% and the bond now trading up to 112.8 cents on the dollar (1Y price range: 105.0-115.1).

- Issuer: Rail Capital Markets PLC (London, United Kingdom) | Coupon: 8.25% | Maturity: 9/7/2024 | Rating: B | ISIN: XS1843433472 | Z-spread down by 93.4 bp to 593.3 bp, with the yield to worst at 6.2% and the bond now trading up to 104.1 cents on the dollar (1Y price range: 101.8-107.0).

- Issuer: Ecobank Transnational Incorporated SA (LOME, Togo) | Coupon: 9.50% | Maturity: 18/4/2024 | Rating: B- | ISIN: XS1826862556 | Z-spread down by 98.1 bp to 499.4 bp, with the yield to worst at 5.2% and the bond now trading up to 109.0 cents on the dollar (1Y price range: 106.5-109.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 0.88% | Maturity: 9/5/2024 | Rating: BB- | ISIN: XS1819575066 | Z-spread down by 215.7 bp to 150.7 bp (CDS basis: -46.9bp), with the yield to worst at 1.0% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 93.6-99.6).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 19/1/2024 | Rating: BB | ISIN: XS1347748607 | Z-spread down by 255.6 bp to 113.1 bp (CDS basis: -19.7bp), with the yield to worst at 0.7% and the bond now trading up to 106.4 cents on the dollar (1Y price range: 106.2-107.8).

- Issuer: Banca Popolare di Sondrio ScpA (Sondrio, Italy) | Coupon: 2.38% | Maturity: 3/4/2024 | Rating: BB+ | ISIN: XS1975757789 | Z-spread down by 263.0 bp to 107.3 bp, with the yield to worst at 0.6% and the bond now trading up to 104.0 cents on the dollar (1Y price range: 103.4-104.8).

- Issuer: Banco BPM SpA (Verona, Italy) | Coupon: 2.50% | Maturity: 21/6/2024 | Rating: BB | ISIN: XS2016160777 | Z-spread down by 283.7 bp to 84.2 bp, with the yield to worst at 0.4% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 105.1-106.1).

- Issuer: Wienerberger AG (Wien, Austria) | Coupon: 2.00% | Maturity: 2/5/2024 | Rating: BB+ | ISIN: AT0000A20F93 | Z-spread down by 301.8 bp to 66.1 bp (CDS basis: 311.8bp), with the yield to worst at 0.2% and the bond now trading up to 104.2 cents on the dollar (1Y price range: 104.0-105.2).

- Issuer: Orano SA (Chatillon, France) | Coupon: 2.75% | Maturity: 8/3/2028 | Rating: BB+ | ISIN: FR0013533031 | Z-spread down by .0 bp to 219.2 bp, with the yield to worst at 2.0% and the bond now trading up to 103.4 cents on the dollar (1Y price range: 103.2-106.0).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.13% | Maturity: 4/10/2027 | Rating: BB | ISIN: FR0013451416 | Z-spread down by .0 bp to 266.1 bp (CDS basis: -47.8bp), with the yield to worst at 2.4% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 91.1-95.8).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 2.50% | Maturity: 7/10/2027 | Rating: BB+ | ISIN: XS2240978085 | Z-spread down by .0 bp to 114.5 bp, with the yield to worst at 1.0% and the bond now trading up to 107.9 cents on the dollar (1Y price range: 105.3-109.9).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread down by .0 bp to 290.2 bp, with the yield to worst at 2.8% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 96.3-100.9).

- Issuer: Verallia SAS (Courbevoie, France) | Coupon: 1.63% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: FR0014003G27 | Z-spread down by .0 bp to 129.9 bp, with the yield to worst at 1.2% and the bond now trading up to 102.1 cents on the dollar (1Y price range: 99.0-103.5).

- Issuer: Nokia Oyj (Espoo, Finland) | Coupon: 3.13% | Maturity: 15/5/2028 | Rating: BB | ISIN: XS2171872570 | Z-spread down by .0 bp to 139.3 bp (CDS basis: -20.9bp), with the yield to worst at 1.2% and the bond now trading up to 110.7 cents on the dollar (1Y price range: 108.4-113.4).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 1.25% | Maturity: 10/9/2027 | Rating: BB | ISIN: XS1199954691 | Z-spread down by .0 bp to 142.3 bp, with the yield to worst at 1.3% and the bond now trading up to 99.4 cents on the dollar (1Y price range: 93.2-103.7).

- Issuer: Esselunga SpA (Pioltello, Italy) | Coupon: 1.88% | Maturity: 25/10/2027 | Rating: BB+ | ISIN: XS1706922256 | Z-spread down by .0 bp to 100.6 bp, with the yield to worst at 0.8% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 103.6-107.0).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Z-spread down by .0 bp to 233.8 bp, with the yield to worst at 2.2% and the bond now trading up to 101.2 cents on the dollar (1Y price range: 99.0-105.7).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | Z-spread down by .0 bp to 163.8 bp, with the yield to worst at 1.5% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 98.4-105.3).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread down by .0 bp to 311.9 bp (CDS basis: -59.9bp), with the yield to worst at 2.9% and the bond now trading up to 103.7 cents on the dollar (1Y price range: 97.6-105.3).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.88% | Maturity: 12/2/2028 | Rating: BB- | ISIN: XS2301390089 | Z-spread down by .0 bp to 148.9 bp (CDS basis: -21.7bp), with the yield to worst at 1.3% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 97.5-104.8).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: BB- | ISIN: XS1568888777 | Z-spread down by .0 bp to 491.4 bp (CDS basis: -111.9bp), with the yield to worst at 4.8% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 97.7-103.3).

USD BOND ISSUES

- Bank of America Corp (Banking | Charlotte, United States | Rating: A-): US$3,250m Senior Note (US06051GKD06), floating rate maturing on 20 October 2032, priced at 100.00 (original spread of 98 bp), callable (11nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133ENBX76), fixed rate (1.90% coupon) maturing on 21 October 2030, priced at 100.00 (original spread of 40 bp), callable (9nc3m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$150m Bond (US3130APKP96), fixed rate (2.00% coupon) maturing on 21 October 2032, priced at 100.00, callable (11nc1)

- Sonic Automotive Inc (Retail Stores - Other | Charlotte, United States | Rating: BB): US$500m Senior Note (US83545GBE17), fixed rate (4.88% coupon) maturing on 15 November 2031, priced at 100.00 (original spread of 338 bp), callable (10nc5)

- Tidewater Inc (Oil and Gas | Houston, Texas, United States | Rating: NR): US$175m Bond (NO0011129587), fixed rate (8.50% coupon) maturing on 19 October 2026, priced at 98.50, callable (5nc3)

- Albion Financing 2 SARL (Financial - Other | Luxembourg | Rating: NR): US$450m Senior Note (US013305AA52), fixed rate (8.75% coupon) maturing on 15 April 2027, priced at 100.00 (original spread of 729 bp), callable (5nc2)

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$200m Note (XS2394051002) zero coupon maturing on 20 October 2055, priced at 100.00, callable (34nc5)

EUR BOND ISSUES

- Albion Financing 1 SARL (Financial - Other | Luxembourg | Rating: NR): €450m Note (XS2399700959), fixed rate (5.25% coupon) maturing on 15 October 2026, priced at 100.00 (original spread of 580 bp), callable (5nc2)

- Infront ASA (Publishing | Oslo, Oslo, Norway | Rating: NR): €130m Bond (NO0011130155), floating rate (EU03MLIB + 425.0 bp) maturing on 28 October 2026, callable (5nc3)