Credit

Rates Drove Performance Today With Spreads Mostly Unchanged Across The Credit Complex

Goldman Sachs priced a US$ 9bn, 5-tranche offering, bringing their total issuance for the year to $38.8bn according to LCD, just behind BofA's $39.2 bn YTD total

Published ET

No US HY Default Since June | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.07% today, with investment grade up 0.07% and high yield up 0.01% (YTD total return: -0.96%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.079% today (Month-to-date: 0.08%; Year-to-date: -1.70%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.059% today (Month-to-date: -0.27%; Year-to-date: 3.44%)

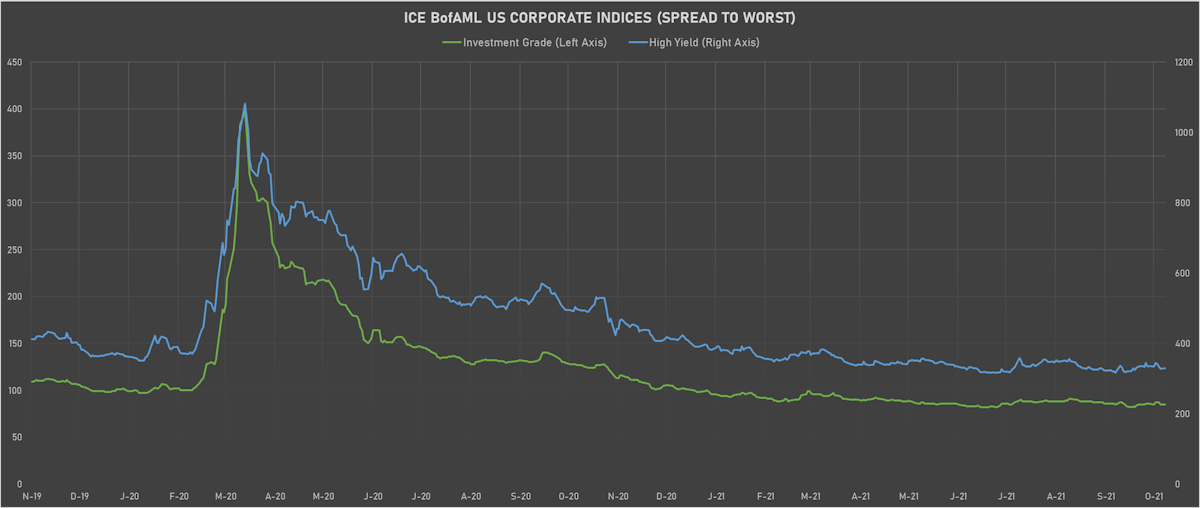

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 85.0 bp (YTD change: -13.0 bp)

- ICE BofA US High Yield Index spread to worst up 1.0 bp, now at 329.0 bp (YTD change: -61.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +3.2%)

- New issues: US$ 20.2bn in dollars and € .8bn in euros

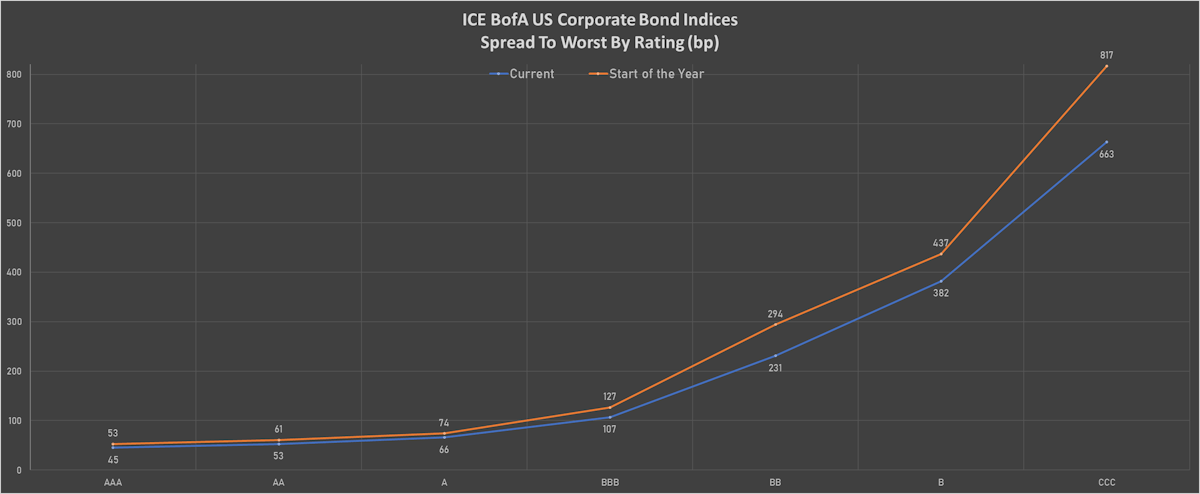

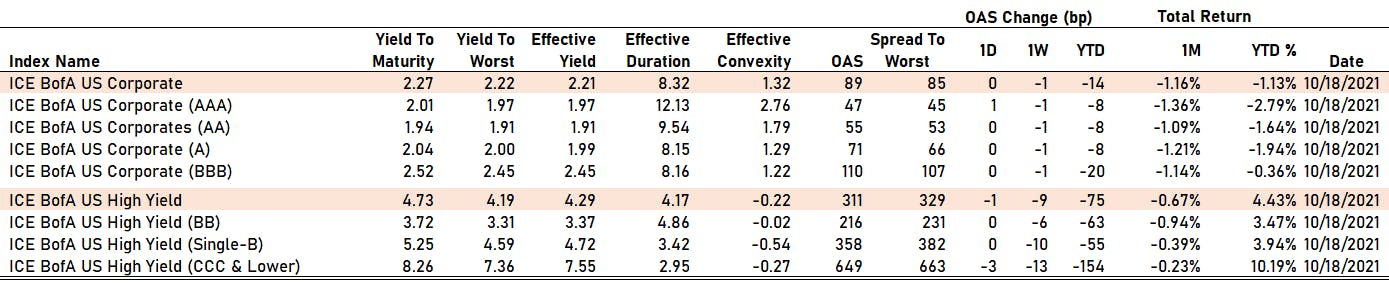

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 47 bp

- AA unchanged at 55 bp

- A unchanged at 71 bp

- BBB unchanged at 110 bp

- BB unchanged at 216 bp

- B unchanged at 358 bp

- CCC down by -3 bp at 649 bp

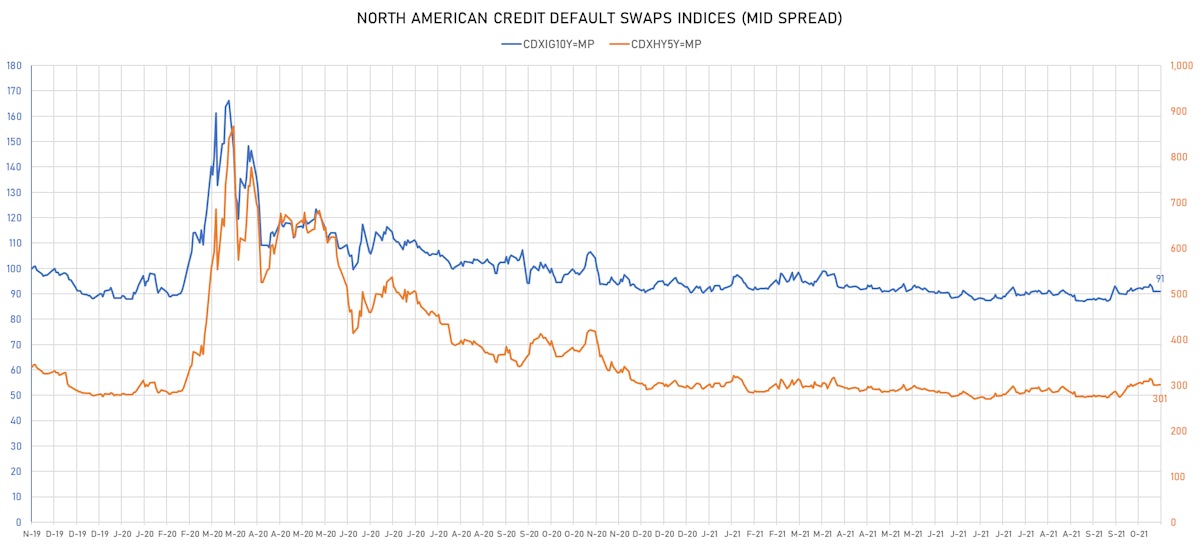

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.1 bp, now at 91bp (YTD change: +0.5bp)

- Markit CDX.NA.HY 5Y up 0.9 bp, now at 301bp (YTD change: +7.3bp)

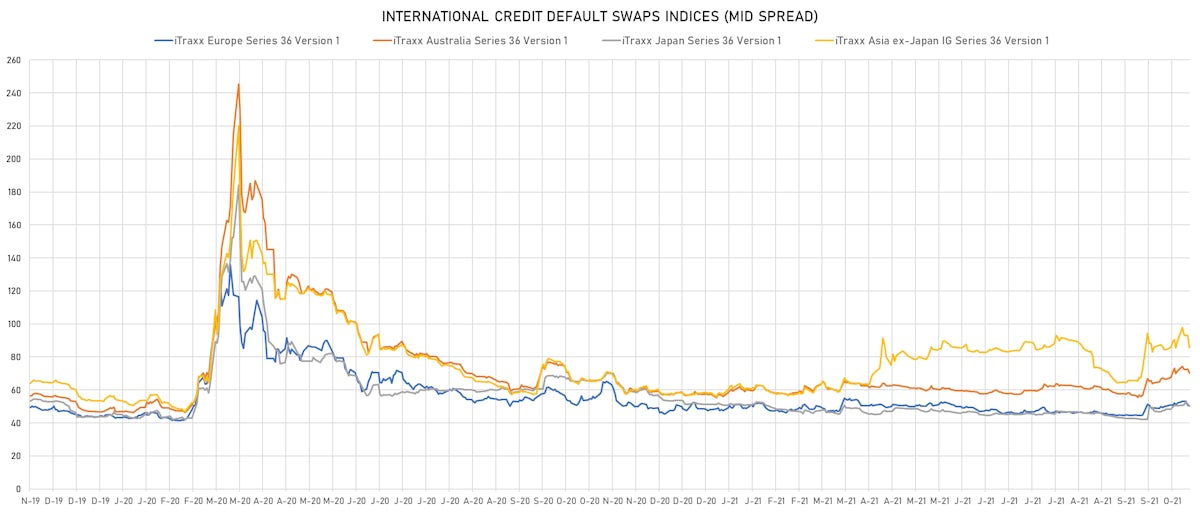

- Markit iTRAXX Europe up 0.5 bp, now at 51bp (YTD change: +2.9bp)

- Markit iTRAXX Japan down 0.4 bp, now at 50bp (YTD change: -1.7bp)

- Markit iTRAXX Asia Ex-Japan down 0.5 bp, now at 85bp (YTD change: +27.2bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 93.0 bp to 1,428.4bp (1Y range: 941-7,695bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): down 56.2 bp to 283.8bp (1Y range: 284-776bp)

- Office Depot Inc (Country: US; rated: WR): down 34.8 bp to 419.9bp (1Y range: 420-583bp)

- Murphy Oil Corp (Country: US; rated: Ba3): down 28.3 bp to 316.6bp (1Y range: 280-763bp)

- MGM Resorts International (Country: US; rated: WD): down 26.6 bp to 194.3bp (1Y range: 173-361bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): down 22.4 bp to 401.5bp (1Y range: 336-449bp)

- Meritor Inc (Country: US; rated: Ba3): down 17.9 bp to 216.2bp (1Y range: 164-266bp)

- Xerox Corp (Country: US; rated: LGD4 - 56%): down 16.1 bp to 274.5bp (1Y range: 158-282bp)

- Genworth Holdings Inc (Country: US; rated: B2): down 15.7 bp to 443.1bp (1Y range: 443-681bp)

- Macy's Inc (Country: US; rated: Ba2): down 15.5 bp to 285.0bp (1Y range: 190-1,201bp)

- Beazer Homes USA Inc (Country: US; rated: B2): down 15.0 bp to 365.0bp (1Y range: 231-388bp)

- CSC Holdings LLC (Country: US; rated: LGD3 - 30%): up 20.0 bp to 361.5bp (1Y range: -362bp)

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): up 33.0 bp to 873.0bp (1Y range: 606-1,202bp)

- Turkiye Is Bankasi AS (Country: TR; rated: WD): up 39.0 bp to 626.1bp (1Y range: 482-759bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 42.4 bp to 625.1bp (1Y range: 464-1,181bp)

- CMA CGM SA (Country: FR; rated: Ba3): down 40.3 bp to 316.8bp (1Y range: 259-734bp)

- TUI AG (Country: DE; rated: B3-PD): down 32.5 bp to 611.7bp (1Y range: 609-1,799bp)

- Novafives SAS (Country: FR; rated: Caa1): down 32.0 bp to 744.0bp (1Y range: 660-1,205bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 28.7 bp to 450.4bp (1Y range: 333-481bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 28.3 bp to 377.9bp (1Y range: 339-806bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 21.0 bp to 177.4bp (1Y range: 166-267bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 17.4 bp to 251.5bp (1Y range: 222-293bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): down 16.5 bp to 206.7bp (1Y range: 154-273bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 14.4 bp to 221.5bp (1Y range: 217-397bp)

- Boparan Finance PLC (Country: GB; rated: WR): down 13.7 bp to 1,193.3bp (1Y range: 528-1,206bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 12.8 bp to 250.0bp (1Y range: 206-456bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 12.4 bp to 622.9bp (1Y range: 358-641bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): down 9.2 bp to 175.3bp (1Y range: 174-447bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 8.6 bp to 262.4bp (1Y range: 188-280bp)

USD BOND ISSUES

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$300m Bond (US3130APLB91), fixed rate (0.85% coupon) maturing on 28 October 2024, priced at 100.00 (original spread of 78 bp), callable (3nc3m)

- Goldman Sachs Group Inc (Banking | New York City, United States | Rating: BBB+): US$3,000m Senior Note (US38141GYN86), floating rate maturing on 21 October 2032, priced at 100.00 (original spread of 105 bp), callable (11nc10)

- Micron Technology Inc (Electronics | Boise, United States | Rating: BBB-): US$500m Senior Note (US595112BT91), fixed rate (3.37% coupon) maturing on 1 November 2041, priced at 100.00 (original spread of 159 bp), callable (20nc20)

- Micron Technology Inc (Electronics | Boise, Idaho, United States | Rating: BBB-): US$500m Senior Note (US595112BU64), fixed rate (3.48% coupon) maturing on 1 November 2051, priced at 100.00 (original spread of 147 bp), callable (30nc30)

- Micron Technology Inc (Electronics | Boise, United States | Rating: BBB-): US$1,000m Senior Note (US595112BS19), fixed rate (2.70% coupon) maturing on 15 April 2032, priced at 100.00 (original spread of 112 bp), callable (10nc10)

- National Rural Utilities Cooperative Finance Corp (Financial - Other | Dulles, United States | Rating: A-): US$400m Senior Note (US63743HEY45), fixed rate (1.00% coupon) maturing on 18 October 2024, priced at 99.91 (original spread of 30 bp), with a make whole call

- National Rural Utilities Cooperative Finance Corp (Financial - Other | Dulles, United States | Rating: A-): US$350m Senior Note (US63743HFA59), floating rate (SOFR + 33.0 bp) maturing on 18 October 2024, priced at 100.00, non callable

- Tidewater Inc (Oil and Gas | Houston, Texas, United States | Rating: NR): US$175m Bond (NO0011129579), fixed rate (8.50% coupon) maturing on 16 November 2026, callable (5nc2)

- ASB Bank Ltd (Banking | Auckland, Australia | Rating: A+): US$500m Senior Note (US00216LAE39), fixed rate (2.38% coupon) maturing on 22 October 2031, priced at 99.02 (original spread of 90 bp), non callable

- ASB Bank Ltd (Banking | Auckland, Australia | Rating: A+): US$700m Senior Note (US00216LAD55), fixed rate (1.63% coupon) maturing on 22 October 2026, priced at 99.60 (original spread of -5 bp), non callable

- Korea Development Bank (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$500m Senior Note (US500630DN56), fixed rate (1.38% coupon) maturing on 25 April 2027, priced at 99.47 (original spread of 30 bp), non callable

- Korea Development Bank (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$300m Senior Note (US500630DP05), fixed rate (2.00% coupon) maturing on 25 October 2031, priced at 99.53 (original spread of 70 bp), non callable

- Korea Development Bank (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$700m Senior Note (US500630DM73), fixed rate (0.75% coupon) maturing on 25 January 2025, priced at 99.56 (original spread of 15 bp), non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$5,000m Unsecured Note (XS2218201262), floating rate maturing on 1 November 2031, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$1,000m Unsecured Note (XS2218203557), fixed rate (2.10% coupon) maturing on 29 October 2028, priced at 100.00, non callable

EUR BOND ISSUES

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €335m Bond (FR0014006284), fixed rate (0.12% coupon) maturing on 30 June 2026, priced at 100.00, non callable

- Credit Mutuel Arkea SA (Banking | Le Relecq-Kerhuon, France | Rating: AA-): €500m Note (FR00140065E6), fixed rate (0.88% coupon) maturing on 25 October 2031, priced at 99.33 (original spread of 109 bp), non callable