Credit

US Investment Grade Corporate Bonds Fall With Higher Long-Term Rates, While HY Cash Does OK On Tighter Spreads

A decent amount of issuance in both dollars and euros today; Thermo Fisher's US$ 5.85bn in 5 tranches was the largest corporate offering

Published ET

ICE BofAML US Corporate Spreads To Worst By Rating | Sources: ϕpost chart, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.37% today, with investment grade down -0.40% and high yield down -0.05% (YTD total return: -1.33%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.480% today (Month-to-date: -0.40%; Year-to-date: -2.17%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.087% today (Month-to-date: -0.18%; Year-to-date: 3.53%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 85.0 bp (YTD change: -13.0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 326.0 bp (YTD change: -64.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +3.2%)

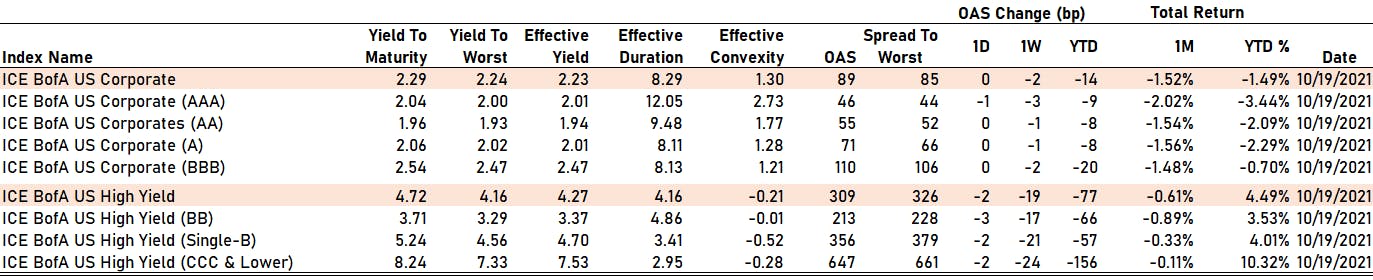

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 46 bp

- AA unchanged at 55 bp

- A unchanged at 71 bp

- BBB unchanged at 110 bp

- BB down by -3 bp at 213 bp

- B down by -2 bp at 356 bp

- CCC down by -2 bp at 647 bp

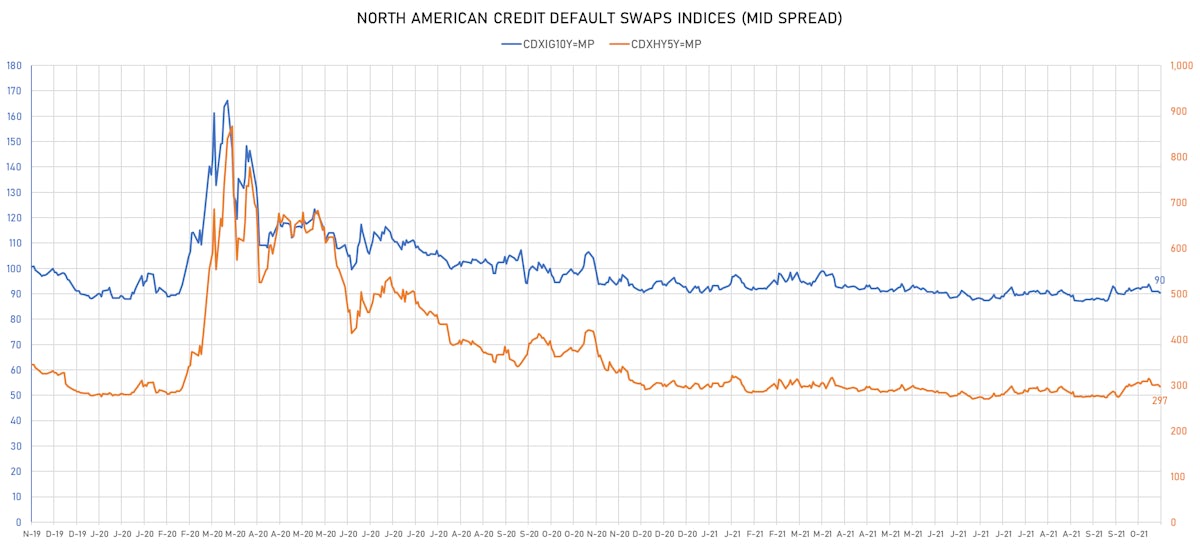

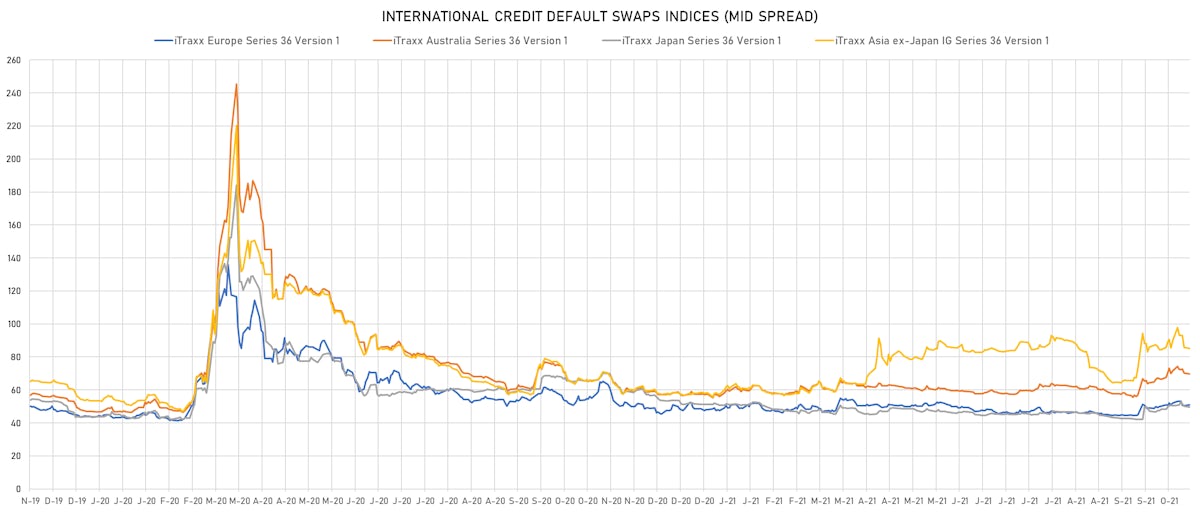

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.7 bp, now at 90bp (YTD change: -0.2bp)

- Markit CDX.NA.HY 5Y down 3.7 bp, now at 297bp (YTD change: +3.6bp)

- Markit iTRAXX Europe down 0.9 bp, now at 50bp (YTD change: +2.1bp)

- Markit iTRAXX Japan down 0.3 bp, now at 49bp (YTD change: -2.0bp)

- Markit iTRAXX Asia Ex-Japan down 1.2 bp, now at 84bp (YTD change: +26.0bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Turkiye Garanti Bankasi AS (Turkey) | Coupon: 5.88% | Maturity: 16/3/2023 | Rating: B | ISIN: XS1576037284 | Z-spread up by 64.1 bp to 293.8 bp, with the yield to worst at 3.0% and the bond now trading down to 103.5 cents on the dollar (1Y price range: 100.0-105.4).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 48.5 bp to 605.9 bp (CDS basis: 36.6bp), with the yield to worst at 6.7% and the bond now trading up to 90.8 cents on the dollar (1Y price range: 71.0-93.1).

- Issuer: SoftBank Group Corp (Minato-ku, Japan) | Coupon: 3.13% | Maturity: 6/1/2025 | Rating: BB+ | ISIN: XS2362416294 | Z-spread down by 50.9 bp to 292.3 bp, with the yield to worst at 3.4% and the bond now trading up to 97.8 cents on the dollar (1Y price range: 96.9-100.1).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B+ | ISIN: USU98347AK05 | Z-spread down by 52.7 bp to 368.9 bp, with the yield to worst at 4.3% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 101.0-108.3).

- Issuer: Metinvest BV (S-GRAVENHAGE, Netherlands) | Coupon: 7.65% | Maturity: 1/10/2027 | Rating: B+ | ISIN: XS2233227516 | Z-spread down by 53.4 bp to 465.4 bp, with the yield to worst at 5.6% and the bond now trading up to 109.0 cents on the dollar (1Y price range: 100.8-112.8).

- Issuer: HPCL-Mittal Energy Ltd (Noida, India) | Coupon: 5.25% | Maturity: 28/4/2027 | Rating: BB- | ISIN: XS1599758940 | Z-spread down by 54.2 bp to 359.6 bp, with the yield to worst at 4.6% and the bond now trading up to 102.3 cents on the dollar (1Y price range: 100.0-104.3).

- Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread down by 60.0 bp to 740.8 bp, with the yield to worst at 7.5% and the bond now trading up to 95.9 cents on the dollar (1Y price range: 94.5-103.4).

- Issuer: Gemdale Ever Prosperity Investment Ltd (#N/A, Hong Kong) | Coupon: 4.95% | Maturity: 12/8/2024 | Rating: BB- | ISIN: XS2357443410 | Z-spread down by 75.2 bp to 624.0 bp, with the yield to worst at 6.5% and the bond now trading up to 95.0 cents on the dollar (1Y price range: 93.3-102.0).

- Issuer: Periama Holdings LLC (Baytown, Texas (US)) | Coupon: 5.95% | Maturity: 19/4/2026 | Rating: BB- | ISIN: XS2224065289 | Z-spread down by 75.9 bp to 324.4 bp, with the yield to worst at 4.1% and the bond now trading up to 106.6 cents on the dollar (1Y price range: 104.1-109.3).

- Issuer: JSW Steel Ltd (Mumbai, India) | Coupon: 3.95% | Maturity: 5/4/2027 | Rating: BB- | ISIN: USY44680RV38 | Z-spread down by 94.1 bp to 271.0 bp, with the yield to worst at 3.9% and the bond now trading up to 99.7 cents on the dollar (1Y price range: 94.6-99.8).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread down by 142.8 bp to 742.3 bp, with the yield to worst at 8.0% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 93.5-102.4).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread down by 290.8 bp to 854.5 bp, with the yield to worst at 8.7% and the bond now trading up to 92.4 cents on the dollar (1Y price range: 87.1-105.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 3.63% | Maturity: 24/9/2024 | Rating: CCC+ | ISIN: XS2055091784 | Z-spread up by 46.2 bp to 231.6 bp (CDS basis: -36.5bp), with the yield to worst at 1.8% and the bond now trading down to 104.3 cents on the dollar (1Y price range: 102.3-108.5).

- Issuer: Banca Popolare di Sondrio ScpA (Sondrio, Italy) | Coupon: 2.38% | Maturity: 3/4/2024 | Rating: BB+ | ISIN: XS1975757789 | Z-spread up by 41.9 bp to 102.5 bp, with the yield to worst at 0.7% and the bond now trading down to 103.9 cents on the dollar (1Y price range: 103.4-104.8).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread down by 22.3 bp to 550.1 bp, with the yield to worst at 5.2% and the bond now trading up to 94.0 cents on the dollar (1Y price range: 92.6-102.1).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.75% | Maturity: 31/10/2024 | Rating: BB- | ISIN: XS2066703989 | Z-spread down by 22.8 bp to 140.7 bp, with the yield to worst at 1.0% and the bond now trading up to 101.6 cents on the dollar (1Y price range: 100.7-102.9).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.38% | Maturity: 25/5/2026 | Rating: BB | ISIN: FR0014000NZ4 | Z-spread down by 23.6 bp to 226.8 bp (CDS basis: -56.7bp), with the yield to worst at 2.1% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 99.5-102.9).

- Issuer: CyrusOne LP (Dallas, Texas (US)) | Coupon: 1.45% | Maturity: 22/1/2027 | Rating: BB+ | ISIN: XS2089972629 | Z-spread down by 23.7 bp to 156.8 bp, with the yield to worst at 1.5% and the bond now trading up to 99.6 cents on the dollar (1Y price range: 99.5-103.1).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 6.00% | Maturity: 31/1/2025 | Rating: BB- | ISIN: XS2198213956 | Z-spread down by 24.5 bp to 355.1 bp, with the yield to worst at 3.2% and the bond now trading up to 107.8 cents on the dollar (1Y price range: 106.2-111.5).

- Issuer: Spie SA (Cergy-Pontoise, France) | Coupon: 2.63% | Maturity: 18/6/2026 | Rating: BB | ISIN: FR0013426376 | Z-spread down by 25.8 bp to 188.5 bp, with the yield to worst at 1.5% and the bond now trading up to 103.4 cents on the dollar (1Y price range: 102.4-105.1).

- Issuer: ACS Actividades de Construccion y Servicios SA (Madrid, Spain) | Coupon: 1.38% | Maturity: 17/6/2025 | Rating: BB+ | ISIN: XS2189592616 | Z-spread down by 31.2 bp to 137.4 bp, with the yield to worst at 1.1% and the bond now trading up to 100.6 cents on the dollar (1Y price range: 100.5-103.4).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | Z-spread down by 32.1 bp to 205.9 bp, with the yield to worst at 1.9% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 98.8-103.1).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 1.75% | Maturity: 11/4/2024 | Rating: BB | ISIN: FR0013413556 | Z-spread down by 32.9 bp to 113.4 bp, with the yield to worst at 0.7% and the bond now trading up to 102.0 cents on the dollar (1Y price range: 100.2-103.0).

- Issuer: Cellnex Finance Company SA (Madrid, Spain) | Coupon: 0.75% | Maturity: 15/11/2026 | Rating: BB+ | ISIN: XS2300292617 | Z-spread down by 37.8 bp to 117.7 bp, with the yield to worst at 1.1% and the bond now trading up to 98.1 cents on the dollar (1Y price range: 98.2-100.3).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 3.10% | Maturity: 21/1/2026 | Rating: BB | ISIN: XS2281299763 | Z-spread down by 43.5 bp to 353.4 bp, with the yield to worst at 3.3% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 96.0-100.3).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B | ISIN: XS1881005976 | Z-spread down by 49.8 bp to 411.1 bp (CDS basis: -62.9bp), with the yield to worst at 3.7% and the bond now trading up to 102.1 cents on the dollar (1Y price range: 93.9-106.4).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: BB- | ISIN: XS1731858715 | Z-spread down by 51.7 bp to 555.2 bp, with the yield to worst at 5.1% and the bond now trading up to 93.4 cents on the dollar (1Y price range: 86.6-102.1).

USD BOND ISSUES

- Avantor Funding Inc (Chemicals | Center Valley, United States | Rating: NR): US$800m Senior Note (US05352TAB52), fixed rate (3.88% coupon) maturing on 1 November 2029, priced at 100.00 (original spread of 242 bp), callable (8nc3)

- Carnival Corp (Leisure | Miami, United States | Rating: B): US$2,000m Senior Note (US143658BR27), fixed rate (6.00% coupon) maturing on 1 May 2029, priced at 100.00 (original spread of 453 bp), callable (7nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$120m Bond (US3133ENCC21), fixed rate (1.98% coupon) maturing on 27 October 2031, priced at 100.00 (original spread of 188 bp), callable (10nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133ENCA64), fixed rate (0.70% coupon) maturing on 25 October 2024, priced at 100.00 (original spread of -2 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$800m Bond (US3133ENBS81), floating rate (SOFR + 2.5 bp) maturing on 27 October 2023, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$106m Bond (US3130APLZ69), fixed rate (1.44% coupon) maturing on 3 December 2026, priced at 100.00 (original spread of 138 bp), callable (5nc3m)

- Lamb Weston Holdings Inc (Retail Stores - Food/Drug | Eagle, United States | Rating: BB+): US$700m Senior Note (US513272AE49), fixed rate (4.38% coupon) maturing on 31 January 2032, priced at 100.00 (original spread of 274 bp), callable (10nc5)

- Lamb Weston Holdings Inc (Retail Stores - Food/Drug | Eagle, United States | Rating: BB+): US$970m Senior Note (US513272AD65), fixed rate (4.13% coupon) maturing on 31 January 2030, priced at 100.00 (original spread of 259 bp), callable (8nc3)

- Summit Midstream Holdings LLC (Financial - Other | The Woodlands, United States | Rating: BB-): US$700m Note (US86614WAE66), fixed rate (8.50% coupon) maturing on 15 October 2026, priced at 98.50 (original spread of 773 bp), callable (5nc2)

- Thermo Fisher Scientific Inc (Electronics | Waltham, United States | Rating: BBB+): US$500m Senior Note (US883556CQ39), floating rate (SOFR + 53.0 bp) maturing on 18 October 2024, priced at 100.00, callable (3nc1)

- AngloGold Ashanti Ltd (Metals/Mining | Johannesburg, South Africa | Rating: BB+): US$750m Senior Note (US03512TAF84), fixed rate (3.38% coupon) maturing on 1 November 2028, priced at 99.79 (original spread of 195 bp), callable (7nc7)

- China, People's Republic of (Government) (Sovereign | Beijing, China (Mainland) | Rating: A+): US$1,000m Bond (US60367QAC78), fixed rate (1.75% coupon) maturing on 26 October 2031, priced at 99.00 (original spread of 23 bp), non callable

- China, People's Republic of (Government) (Sovereign | Beijing, China (Mainland) | Rating: A+): US$500m Senior Note (US60367QAD51), fixed rate (2.50% coupon) maturing on 26 October 2051, priced at 97.82 (original spread of 53 bp), non callable

- China, People's Republic of (Government) (Sovereign | Beijing, China (Mainland) | Rating: A+): US$1,000m Bond (US60367QAA13), fixed rate (0.75% coupon) maturing on 26 October 2024, priced at 99.94 (original spread of 6 bp), non callable

- China, People's Republic of (Government) (Sovereign | Beijing, China (Mainland) | Rating: A+): US$1,500m Bond (US60367QAB95), fixed rate (1.25% coupon) maturing on 26 October 2026, priced at 99.88 (original spread of 12 bp), non callable

- Corporacion Andina de Fomento (Supranational | Caracas, Venezuela | Rating: A+): US$1,000m Senior Note (US219868CE41), fixed rate (1.25% coupon) maturing on 26 October 2024, priced at 99.67 (original spread of 65 bp), non callable

- Corporacion Nacional del Cobre de Chile (Metals/Mining | Santiago, Chile | Rating: A-): US$780m Senior Note (USP3143NBN32), fixed rate (3.70% coupon) maturing on 30 January 2050, priced at 97.75 (original spread of 175 bp), callable (28nc28)

- Kommunalbanken AS (Agency | Oslo, Norway | Rating: AAA): US$1,250m Senior Note (US50048MDD92), fixed rate (1.13% coupon) maturing on 26 October 2026, priced at 99.48 (original spread of 9 bp), with a make whole call

- Mirae Asset Securities Co Ltd (Securities | Seoul, South Korea | Rating: BBB): US$4,000m Index Linked Security (KR6MD00024A3) zero coupon maturing on 24 October 2024, priced at 100.00, non callable

- NRW Bank (Agency | Dusseldorf, Germany | Rating: AA): US$1,000m Senior Note (XS2401605360), fixed rate (0.75% coupon) maturing on 25 October 2024, priced at 99.66 (original spread of 17 bp), non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$5,000m Unsecured Note (XS2218201262), floating rate maturing on 1 November 2031, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$16m Unsecured Note (XS2218203557), fixed rate (2.10% coupon) maturing on 29 October 2028, priced at 100.00, non callable

- PSP Capital Inc (Financial - Other | Montreal, Canada | Rating: AAA): US$1,000m Senior Note (US69376Q2B87), fixed rate (1.63% coupon) maturing on 26 October 2028, priced at 99.99 (original spread of 17 bp), non callable

- SCIL IV LLC (Financial - Other | United Kingdom | Rating: BB-): US$760m Note (US78397UAA88), fixed rate (5.38% coupon) maturing on 1 November 2026, priced at 100.00 (original spread of 423 bp), callable (5nc2)

EUR BOND ISSUES

- ACEF Holding SCA (Financial - Other | Luxembourg, France | Rating: NR): €500m Senior Note (XS2401704189), fixed rate (1.25% coupon) maturing on 26 April 2030, priced at 99.29 (original spread of 157 bp), callable (9nc8)

- Bremen Free Hanseatic, City of (Official and Muni | Bremen, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000A3E5V47), fixed rate (0.15% coupon) maturing on 24 October 2031, priced at 99.56 (original spread of 32 bp), non callable

- Cassa Centrale Raiffeisen dell Alto Adige SpA (Banking | Bolzano, Italy | Rating: BBB): €150m Note (XS2401565630), fixed rate (0.85% coupon) maturing on 26 October 2026, priced at 99.81 (original spread of 132 bp), non callable

- DBS Bank Ltd (Banking | Singapore | Rating: AA-): €750m Covered Bond (Other) (XS2401439174), fixed rate (0.01% coupon) maturing on 26 October 2026, priced at 99.98 (original spread of 50 bp), non callable

- DZ Hyp AG (Mortgage Banking | Hamburg, Germany | Rating: A+): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000A3E5UY4), fixed rate (0.01% coupon) maturing on 26 October 2026, priced at 100.47 (original spread of 37 bp), non callable

- KfW (Agency | Frankfurt, Germany | Rating: AAA): €3,000m Inhaberschuldverschreibung (DE000A3E5XK7) zero coupon maturing on 15 November 2024, priced at 101.20 (original spread of 22 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: AA-): €500m Note (DE000LB2V833), fixed rate (0.38% coupon) maturing on 28 February 2028, priced at 99.24 (original spread of 85 bp), non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €250m Inhaberschuldverschreibung (DE000NWB2Q74), fixed rate (0.18% coupon) maturing on 26 October 2033, priced at 100.00, callable (12nc1)

- SCIL IV LLC (Financial - Other | United Kingdom | Rating: BB-): €325m Note (XS2401849315), fixed rate (4.38% coupon) maturing on 1 November 2026, priced at 100.00 (original spread of 483 bp), callable (5nc2)

- SCIL IV LLC (Financial - Other | United Kingdom | Rating: BB-): €325m Note (XS2401851485), floating rate (EU03MLIB + 437.5 bp) maturing on 1 November 2026, priced at 100.00, callable (5nc1)

- Toyota Motor Finance Netherlands BV (Financial - Other | Amsterdam, Japan | Rating: A+): €750m Senior Note (XS2400997131) zero coupon maturing on 27 October 2025, priced at 99.62 (original spread of 63 bp), non callable