Credit

Rates Still In The Driver's Seat For US IG Bonds, While Cash Spreads Were Slightly Lower For HY

Not an incredible amount of corporate bond issuance today, but Taiwan's TSMC Arizona priced a US$4.5bn offering in 4 tranches (5Y, 10Y, 20Y, 30Y)

Published ET

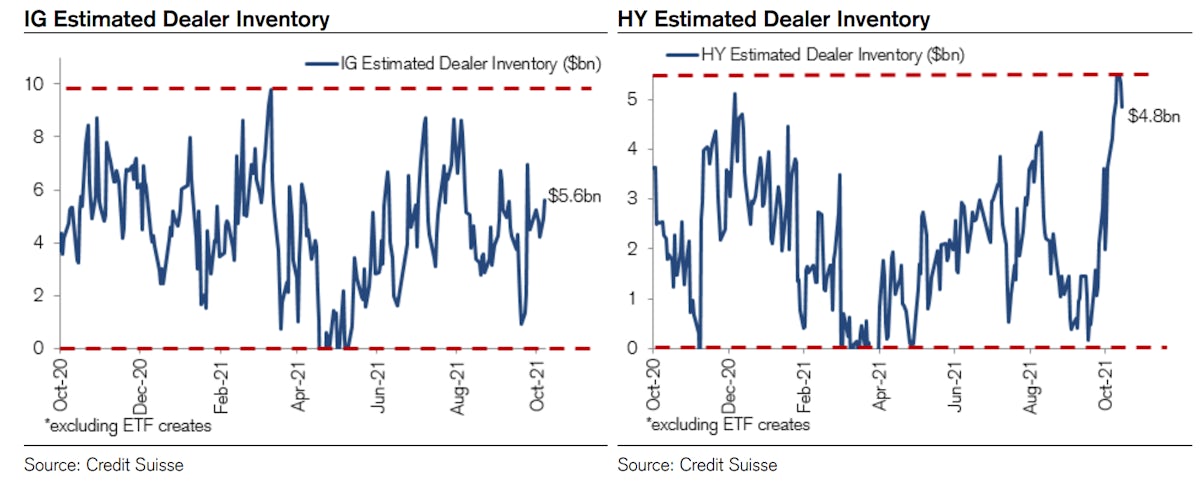

Dealer Inventory Has Rebounded Strongly In Recent Weeks | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.18% today, with investment grade down -0.20% and high yield down -0.04% (YTD total return: -1.51%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.272% today (Month-to-date: -0.67%; Year-to-date: -2.43%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.014% today (Month-to-date: -0.16%; Year-to-date: 3.54%)

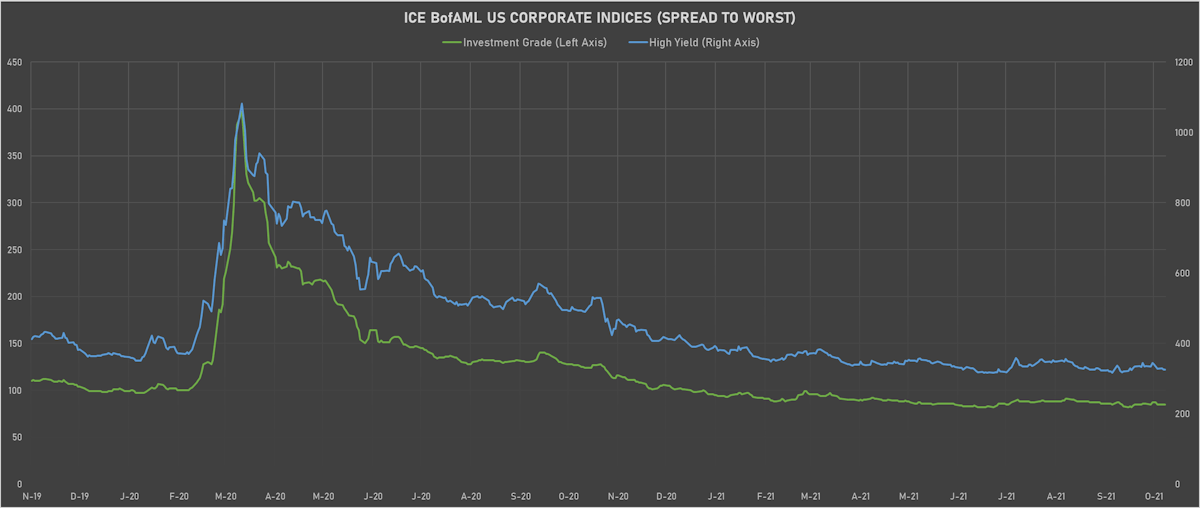

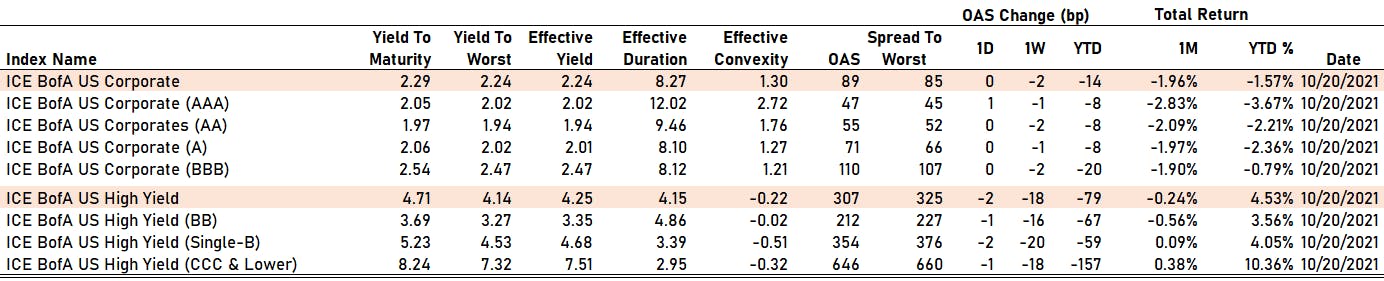

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 85.0 bp (YTD change: -13.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 325.0 bp (YTD change: -65.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up (YTD total return: +3.2%)

- New issues: US$ 17.0bn in dollars and € 6.4bn in euros

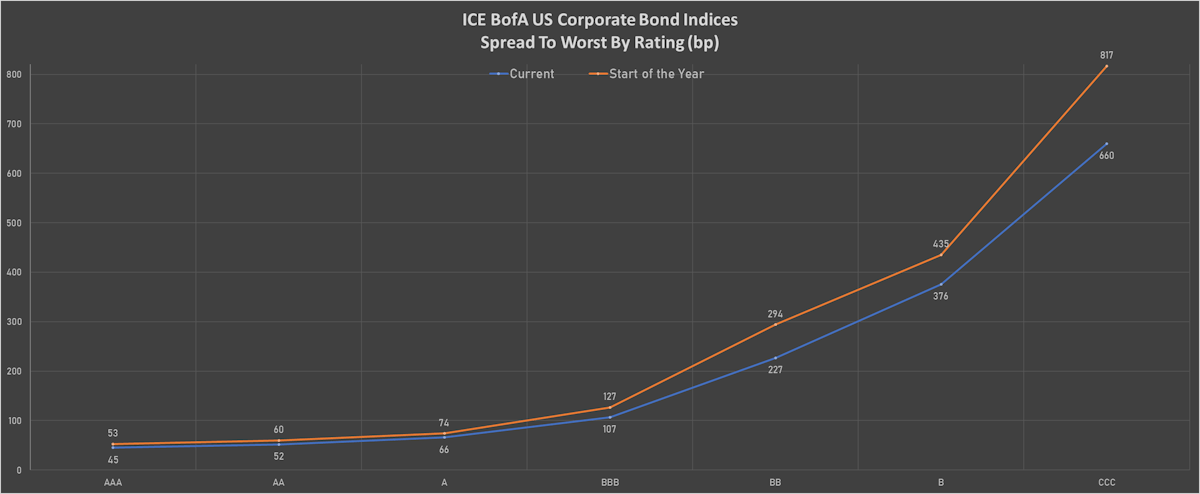

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 47 bp

- AA unchanged at 55 bp

- A unchanged at 71 bp

- BBB unchanged at 110 bp

- BB down by -1 bp at 212 bp

- B down by -2 bp at 354 bp

- CCC down by -1 bp at 646 bp

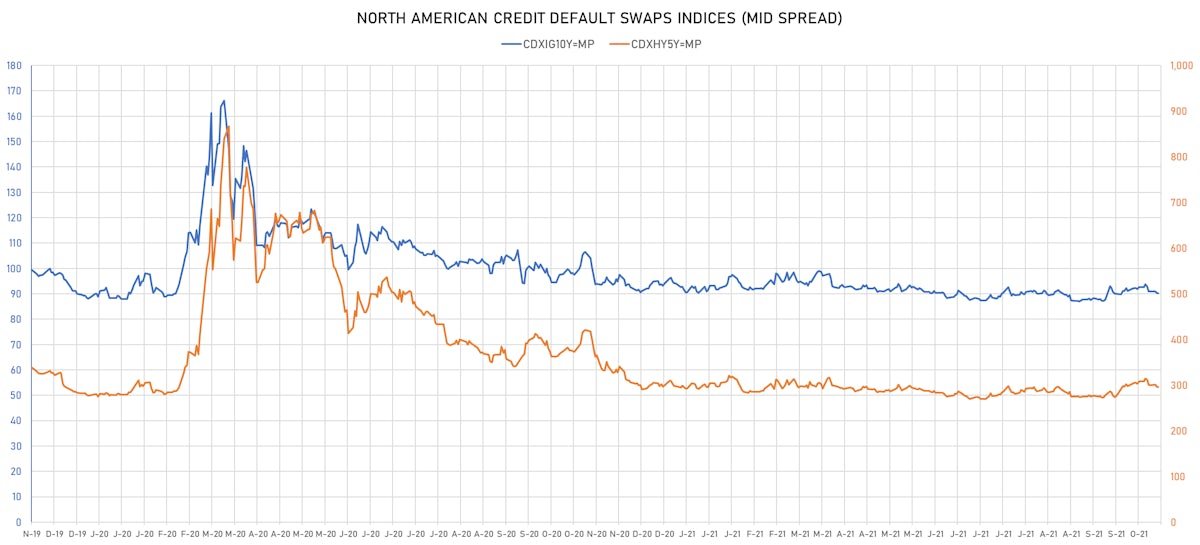

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.2 bp, now at 90bp (YTD change: +bp)

- Markit CDX.NA.HY 5Y down 1.4 bp, now at 295bp (YTD change: +bp)

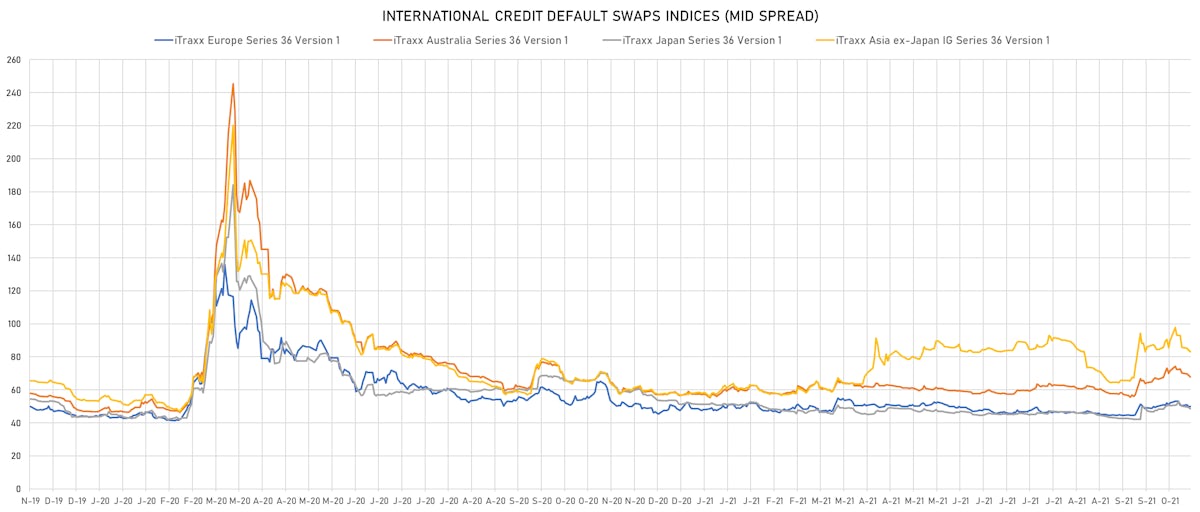

- Markit iTRAXX Europe down 0.2 bp, now at 50bp (YTD change: +1.9bp)

- Markit iTRAXX Japan down 0.7 bp, now at 49bp (YTD change: -2.7bp)

- Markit iTRAXX Asia Ex-Japan down 1.0 bp, now at 83bp (YTD change: +25.0bp)

USD BOND ISSUES

- Alliant Holdings Intermediate LLC (Life Insurance | Newport Beach, United States | Rating: B): US$225m Note (USU0188CAG97), fixed rate (4.25% coupon) maturing on 15 October 2027, priced at 100.50 (original spread of 280 bp), callable (6nc2)

- Alliant Holdings Intermediate LLC (Life Insurance | Newport Beach, United States | Rating: CCC+): US$450m Senior Note (US01883LAD55), fixed rate (5.88% coupon) maturing on 1 November 2029, priced at 100.00 (original spread of 437 bp), callable (8nc3)

- Bank of New York Mellon (Banking | New York City, United States | Rating: AA-): US$700m Senior Note (US06406RAX52), fixed rate (0.85% coupon) maturing on 25 October 2024, priced at 99.94 (original spread of 17 bp), callable (3nc3)

- Bank of New York Mellon (Banking | New York City, New York, United States | Rating: AA-): US$400m Senior Note (US06406RAY36), floating rate (SOFR + 20.0 bp) maturing on 25 October 2024, priced at 100.00, callable (3nc3)

- Bank of New York Mellon (Banking | New York City, United States | Rating: AA-): US$400m Senior Note (US06406RAZ01), fixed rate (1.90% coupon) maturing on 25 January 2029, priced at 99.94 (original spread of 45 bp), callable (7nc7)

- Finnvera Oyj (Agency | Helsinki, Finland | Rating: NR): US$1,000m Senior Note (US31808LAE20), fixed rate (1.13% coupon) maturing on 27 October 2026, priced at 99.46 (original spread of 9 bp), non callable

- Gtlk Europe Capital DAC (Financial - Other | Russia | Rating: NR): US$600m Senior Note (XS2010027451), fixed rate (4.35% coupon) maturing on 27 February 2029, priced at 100.00 (original spread of 289 bp), non callable

- Hualu International Finance (BVI) Ltd (Financial - Other | Road Town, British Virgin Islands | Rating: NR): US$300m Bond (XS2393957167), fixed rate (2.20% coupon) maturing on 27 October 2026, priced at 100.00, non callable

- Indofood CBP Sukses Makmur Tbk PT (Food Processors | Jakarta, Dki Jakarta, Hong Kong | Rating: BBB-): US$400m Senior Note (XS2399788277), fixed rate (4.81% coupon) maturing on 27 April 2052, priced at 100.00 (original spread of 270 bp), callable (31nc30)

- Indofood CBP Sukses Makmur Tbk PT (Food Processors | Jakarta, Dki Jakarta, Hong Kong | Rating: BBB-): US$600m Senior Note (XS2399787899), fixed rate (3.54% coupon) maturing on 27 April 2032, priced at 100.00 (original spread of 190 bp), callable (11nc10)

- Muang Thai Life Assurance PCL (Life Insurance | Bangkok, Bangkok Metropolis, Thailand | Rating: BBB+): US$400m Subordinated Note (XS2396503505), fixed rate (3.55% coupon) maturing on 27 January 2037, priced at 99.99 (original spread of 240 bp), callable (15nc5)

- Rothesay Life PLC (Financial - Other | London, United Kingdom | Rating: A): US$400m Junior Subordinated Note (XS2399976195), fixed rate (4.88% coupon) perpetual , priced at 100.00 (original spread of 358 bp), callable (Pnc5)

- Shinhan Investment Corp (Securities | Seoul, South Korea | Rating: A-): US$6,580m Index Linked Security (KR6SH0002D98) zero coupon maturing on 21 October 2024, priced at 100.00, non callable

- TSMC Arizona Corp (Financial - Other | Rating: NR): US$1,250m Senior Note (US872898AA96), fixed rate (1.75% coupon) maturing on 25 October 2026, priced at 99.98 (original spread of 60 bp), with a make whole call

- TSMC Arizona Corp (Financial - Other | Rating: NR): US$1,000m Senior Note (US872898AE19), fixed rate (3.25% coupon) maturing on 25 October 2051, priced at 98.66 (original spread of 120 bp), with a make whole call

- TSMC Arizona Corp (Financial - Other | Rating: NR): US$1,000m Senior Note (US872898AD36), fixed rate (3.13% coupon) maturing on 25 October 2041, priced at 98.90 (original spread of 110 bp), with a make whole call

- TSMC Arizona Corp (Financial - Other | Rating: NR): US$1,250m Senior Note (US872898AC52), fixed rate (2.50% coupon) maturing on 25 October 2031, priced at 99.56 (original spread of 90 bp), with a make whole call

EUR BOND ISSUES

- Chrome Bidco SAS (Financial - Other | Paris, Sweden | Rating: NR): €300m Note (XS2401605287), fixed rate (3.50% coupon) maturing on 31 May 2028, callable (7nc3)

- Chrome Bidco SAS (Financial - Other | Paris, Sweden | Rating: NR): €300m Note (XS2401604801), fixed rate (3.50% coupon) maturing on 31 May 2028, priced at 99.75, callable (7nc3)

- Chrome Holdco SAS (Financial - Other | Paris, Sweden | Rating: B): €200m Senior Note (XS2401605444), fixed rate (5.00% coupon) maturing on 31 May 2029, priced at 100.00 (original spread of 528 bp), callable (8nc3)

- Deutsche Pfandbriefbank AG (Banking | Garching Bei Muenchen, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000A3T0X22), fixed rate (0.25% coupon) maturing on 27 October 2025, priced at 99.75 (original spread of 88 bp), non callable

- Engie SA (Oil and Gas | Paris, France | Rating: BBB+): €750m Bond (FR0014005ZQ6), fixed rate (1.00% coupon) maturing on 26 October 2036, priced at 98.30 (original spread of 104 bp), callable (15nc15)

- Engie SA (Oil and Gas | Paris, France | Rating: BBB+): €750m Bond (FR0014005ZP8), fixed rate (0.38% coupon) maturing on 26 October 2029, priced at 98.62 (original spread of 82 bp), callable (8nc8)

- Hitachi Capital (UK) PLC (Financial - Other | Staines, Japan | Rating: A-): €325m Senior Note (XS2402064559) zero coupon maturing on 29 October 2024, priced at 99.72 (original spread of 73 bp), callable (3nc3)

- Investitionsbank Schleswig Holstein (Agency | Kiel, Germany | Rating: NR): €500m Inhaberschuldverschreibung (DE000A2TR182), fixed rate (0.01% coupon) maturing on 27 October 2028, priced at 99.83 (original spread of 38 bp), non callable

- Korea Housing Finance Corp (Agency | Busan, South Korea | Rating: AA-): €550m Covered Bond (Other) (XS2388377827), fixed rate (0.26% coupon) maturing on 27 October 2028, priced at 100.00 (original spread of 61 bp), non callable

- Societe Generale SFH SA (Financial - Other | Puteaux, France | Rating: NR): €750m Obligation de Financement de l'Habitat (Covered Bond) (FR00140067I3), fixed rate (0.01% coupon) maturing on 29 October 2029, priced at 99.14 (original spread of 39 bp), non callable

- Unedic (Service - Other | Paris, France | Rating: AA): €1,000m Bond (FR00140065C0), fixed rate (0.50% coupon) maturing on 20 March 2029, priced at 103.08 (original spread of -3 bp), non callable

- ZF Finance GmbH (Financial - Other | Friedrichshafen, Baden-Wuerttemberg, Germany | Rating: BB+): €500m Senior Note (XS2399851901), fixed rate (2.25% coupon) maturing on 3 May 2028, priced at 99.26 (original spread of 276 bp), callable (7nc6)