Credit

Cash Spreads Up Today, HY Bonds Down, IG Up As Rates Fall At The Long End Of The Yield Curve

IFR Weekly Totals For US Bond Issuance: IG saw 41 Tranches for US$53.130bn (2021 YTD volume US$1.285trn well below 2020 YTD US$1.628trn), And HY 12 Tranches for US$8.765bn (2021 YTD volume US$416.371bn still ahead of 2020 YTD US$438.404bn)

Published ET

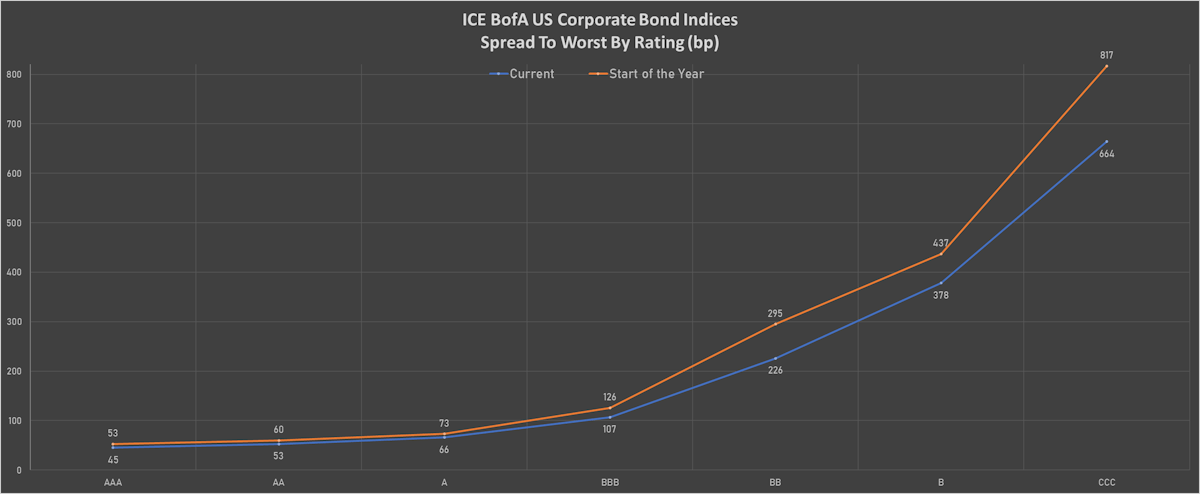

The Spread Between CCCs And BBs Has Been Widening Since July | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.29% today, with investment grade up 0.33% and high yield down -0.01% (YTD total return: -1.39%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.233% today (Month-to-date: -0.90%; Year-to-date: -2.66%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.057% today (Month-to-date: -0.22%; Year-to-date: 3.49%)

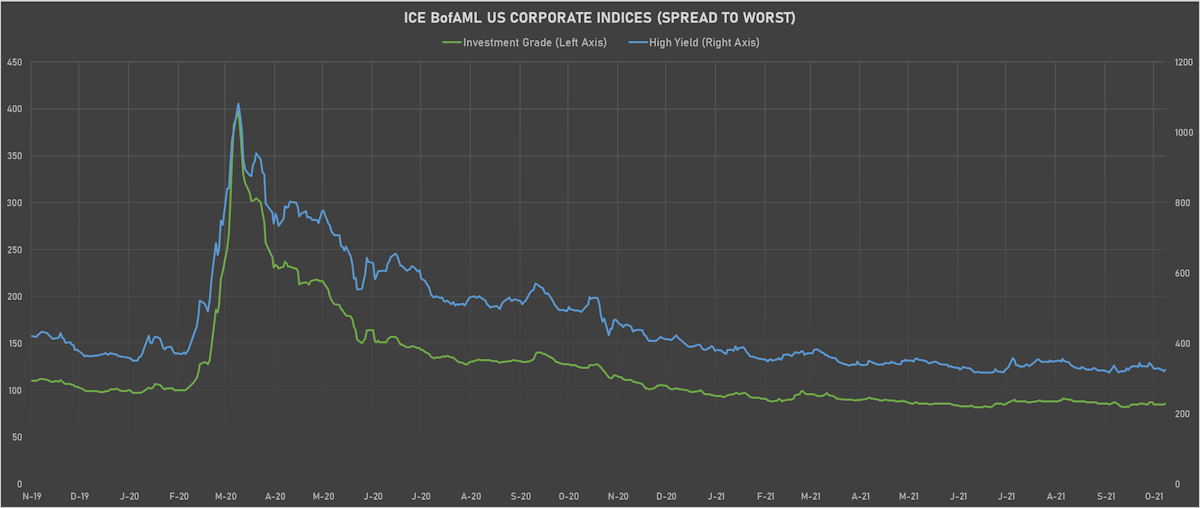

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 325.0 bp (YTD change: -65.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.03% today (YTD total return: +3.2%)

- New issues: US$ 2.3bn in dollars and € 2.2bn in euros

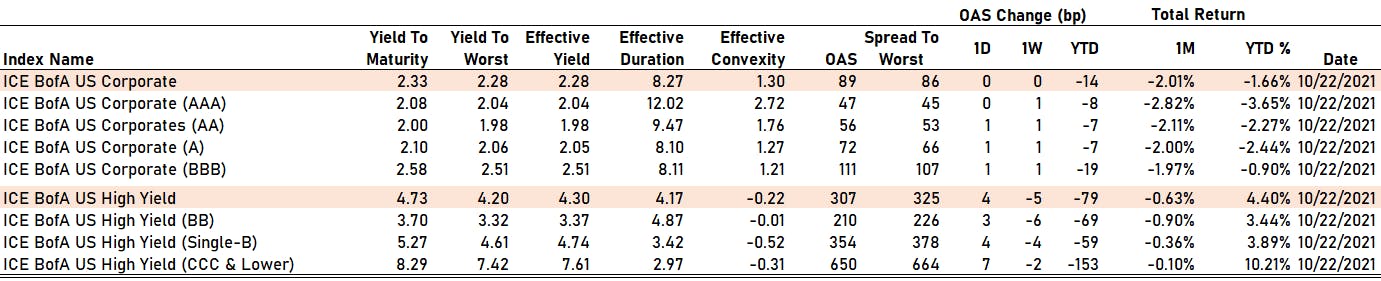

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 47 bp

- AA up by 1 bp at 56 bp

- A up by 1 bp at 72 bp

- BBB up by 1 bp at 111 bp

- BB up by 3 bp at 210 bp

- B up by 4 bp at 354 bp

- CCC up by 7 bp at 650 bp

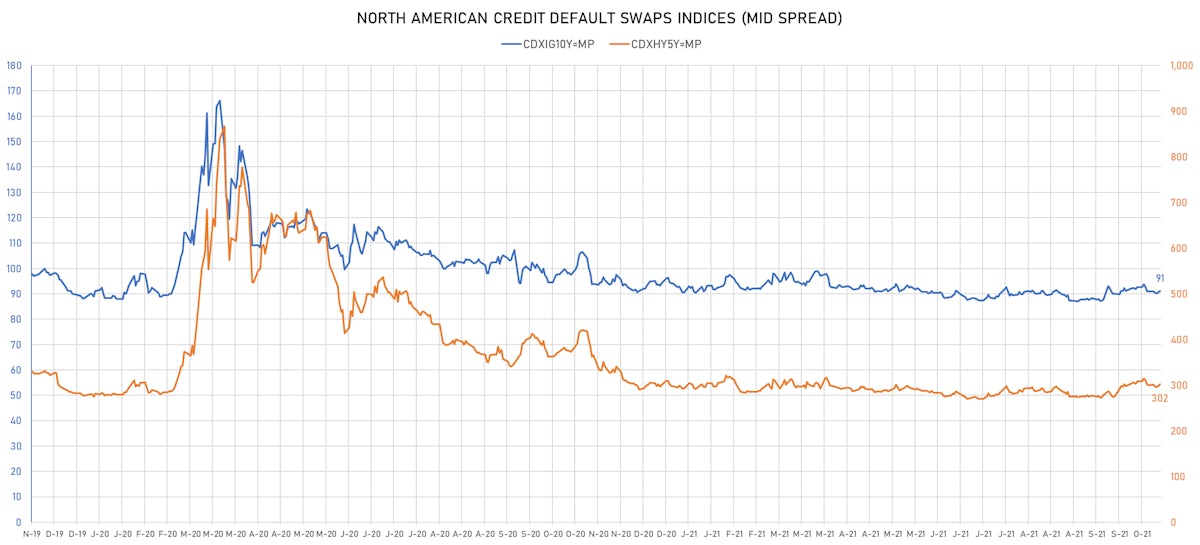

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.6 bp, now at 91bp (YTD change: +0.7bp)

- Markit CDX.NA.HY 5Y up 3.7 bp, now at 302bp (YTD change: +8.8bp)

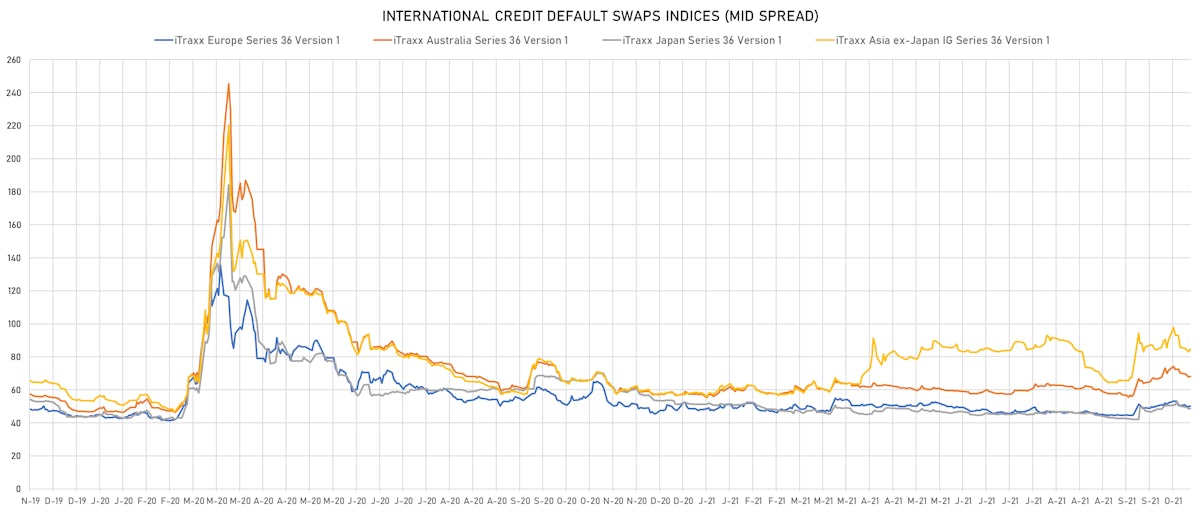

- Markit iTRAXX Europe up 0.1 bp, now at 50bp (YTD change: +2.4bp)

- Markit iTRAXX Japan unchanged at 48bp (YTD change: -2.9bp)

- Markit iTRAXX Asia Ex-Japan down 1.6 bp, now at 83bp (YTD change: +25.0bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread up by 115.8 bp to 674.4 bp, with the yield to worst at 7.0% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 94.5-103.4).

- Issuer: Turkiye Garanti Bankasi AS (Turkey) | Coupon: 5.88% | Maturity: 16/3/2023 | Rating: B | ISIN: XS1576037284 | Z-spread up by 77.2 bp to 301.7 bp, with the yield to worst at 3.2% and the bond now trading down to 103.4 cents on the dollar (1Y price range: 100.0-105.4).

- Issuer: Akbank TAS (Turkey) | Coupon: 5.00% | Maturity: 24/10/2022 | Rating: B | ISIN: USM0375YAK49 | Z-spread up by 59.7 bp to 252.4 bp (CDS basis: 173.4bp), with the yield to worst at 2.6% and the bond now trading down to 102.1 cents on the dollar (1Y price range: 99.2-103.1).

- Issuer: Rolls-Royce PLC (BIRMINGHAM, United Kingdom) | Coupon: 5.75% | Maturity: 15/10/2027 | Rating: BB- | ISIN: USG76237AC37 | Z-spread down by 48.3 bp to 222.0 bp (CDS basis: -34.2bp), with the yield to worst at 3.4% and the bond now trading up to 111.3 cents on the dollar (1Y price range: 104.5-111.9).

- Issuer: Periama Holdings LLC (Baytown, Texas (US)) | Coupon: 5.95% | Maturity: 19/4/2026 | Rating: BB- | ISIN: XS2224065289 | Z-spread down by 48.8 bp to 272.2 bp, with the yield to worst at 3.6% and the bond now trading up to 108.5 cents on the dollar (1Y price range: 104.1-109.3).

- Issuer: JSW Steel Ltd (Mumbai, India) | Coupon: 3.95% | Maturity: 5/4/2027 | Rating: BB- | ISIN: USY44680RV38 | Z-spread down by 51.8 bp to 249.2 bp, with the yield to worst at 3.6% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 94.6-100.7).

- Issuer: Saka Energi Indonesia PT (Jakarta Selatan, Indonesia) | Coupon: 4.45% | Maturity: 5/5/2024 | Rating: B | ISIN: USY7140VAA80 | Z-spread down by 53.2 bp to 531.1 bp, with the yield to worst at 5.7% and the bond now trading up to 96.4 cents on the dollar (1Y price range: 81.5-98.8).

- Issuer: SoftBank Group Corp (Minato-ku, Japan) | Coupon: 3.13% | Maturity: 6/1/2025 | Rating: BB+ | ISIN: XS2362416294 | Z-spread down by 54.2 bp to 268.2 bp, with the yield to worst at 3.3% and the bond now trading up to 98.4 cents on the dollar (1Y price range: 96.9-100.1).

- Issuer: Metinvest BV (S-GRAVENHAGE, Netherlands) | Coupon: 8.50% | Maturity: 23/4/2026 | Rating: B+ | ISIN: XS1806400708 | Z-spread down by 55.2 bp to 404.5 bp, with the yield to worst at 4.9% and the bond now trading up to 112.5 cents on the dollar (1Y price range: 105.0-115.1).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread down by 57.8 bp to 236.6 bp (CDS basis: 143.7bp), with the yield to worst at 3.2% and the bond now trading up to 109.8 cents on the dollar (1Y price range: 106.5-110.3).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 70.7 bp to 215.2 bp, with the yield to worst at 2.5% and the bond now trading up to 103.0 cents on the dollar (1Y price range: 98.4-103.7).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 86.9 bp to 577.5 bp (CDS basis: 48.3bp), with the yield to worst at 6.5% and the bond now trading up to 91.4 cents on the dollar (1Y price range: 71.0-93.1).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread down by 108.1 bp to 815.1 bp, with the yield to worst at 8.4% and the bond now trading up to 93.1 cents on the dollar (1Y price range: 87.1-105.8).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread down by 180.6 bp to 756.3 bp, with the yield to worst at 8.1% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 93.5-102.4).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread up by 33.8 bp to 355.6 bp, with the yield to worst at 3.2% and the bond now trading down to 108.3 cents on the dollar (1Y price range: 99.6-111.6).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.00% | Maturity: 14/7/2024 | Rating: BB- | ISIN: XS2363244513 | Z-spread up by 23.4 bp to 214.5 bp (CDS basis: -67.2bp), with the yield to worst at 1.8% and the bond now trading down to 100.2 cents on the dollar (1Y price range: 98.0-102.2).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 3.63% | Maturity: 24/9/2024 | Rating: CCC+ | ISIN: XS2055091784 | Z-spread up by 20.3 bp to 233.9 bp (CDS basis: -28.7bp), with the yield to worst at 1.9% and the bond now trading down to 104.2 cents on the dollar (1Y price range: 102.3-108.5).

- Issuer: Thyssenkrupp AG (Essen, Germany) | Coupon: 2.50% | Maturity: 25/2/2025 | Rating: B+ | ISIN: DE000A14J587 | Z-spread up by 19.0 bp to 232.7 bp (CDS basis: -27.3bp), with the yield to worst at 1.9% and the bond now trading down to 101.1 cents on the dollar (1Y price range: 100.1-103.9).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.38% | Maturity: 25/5/2026 | Rating: BB | ISIN: FR0014000NZ4 | Z-spread down by 19.8 bp to 220.5 bp (CDS basis: -51.2bp), with the yield to worst at 2.1% and the bond now trading up to 100.9 cents on the dollar (1Y price range: 99.5-102.9).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.13% | Maturity: 19/9/2025 | Rating: BB- | ISIN: XS1684385161 | Z-spread down by 26.8 bp to 337.8 bp, with the yield to worst at 3.0% and the bond now trading up to 99.6 cents on the dollar (1Y price range: 98.6-105.5).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread down by 37.4 bp to 369.8 bp, with the yield to worst at 3.5% and the bond now trading up to 96.8 cents on the dollar (1Y price range: 96.2-99.4).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | Z-spread down by 51.9 bp to 415.1 bp (CDS basis: -60.8bp), with the yield to worst at 3.8% and the bond now trading up to 101.8 cents on the dollar (1Y price range: 93.9-106.4).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.50% | Maturity: 26/7/2024 | Rating: BB- | ISIN: XS1652965085 | Z-spread down by 236.7 bp to 573.1 bp, with the yield to worst at 5.2% and the bond now trading up to 90.0 cents on the dollar (1Y price range: 80.9-99.2).

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$300m Bond (US3133ENCP34), floating rate (AB3DM + 3.5 bp) maturing on 1 November 2023, priced at 100.00, non callable

- Labl Inc (Industrials - Other | Green Bay, United States | Rating: CCC+): US$460m Senior Note (US50168QAD79), fixed rate (8.25% coupon) maturing on 1 November 2029, priced at 100.00 (original spread of 671 bp), callable (8nc3)

- Labl Inc (Industrials - Other | Green Bay, United States | Rating: B-): US$500m Note (USU5022TAC00), fixed rate (5.88% coupon) maturing on 1 November 2028, priced at 99.29 (original spread of 455 bp), callable (7nc3)

- Option Care Health Inc (Health Care Facilities | Bannockburn, United States | Rating: B-): US$500m Senior Note (US68404LAA08), fixed rate (4.38% coupon) maturing on 31 October 2029, priced at 100.00 (original spread of 287 bp), callable (8nc3)

- International Finance Corporation IFC Ltd (Supranational | London, United Kingdom | Rating: AAA): US$500m Senior Note (US45950VQM18), floating rate (SOFR + 9.0 bp) maturing on 3 April 2024, priced at 100.00, non callable

EUR BOND ISSUES

- 4finance SA (Financial - Other | Luxembourg, Cyprus | Rating: NR): €175m Bond (NO0011128316), fixed rate (10.75% coupon) maturing on 26 October 2026 (original spread of 1,150 bp), callable (5nc3)

- Burger King France SAS (Restaurants | La Plaine Saint-Denis, Ile-De-France, France | Rating: B-): €620m Note (XS2403031912), floating rate (EU03MLIB + 475.0 bp) maturing on 1 November 2026, priced at 100.00, callable (5nc1)

- JP Morgan Structured Products BV (Financial - Other | Amsterdam, Noord-Holland, United States | Rating: NR): €215m Senior Note (XS2168724875) zero coupon maturing on 3 November 2056, priced at 100.00, non callable

- Madrid, Community of (Official and Muni | Madrid, Spain | Rating: A-): €200m Bond (ES00001010F8), fixed rate (1.44% coupon) maturing on 26 October 2049, priced at 100.00, non callable

- Midco GB SAS (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €235m Senior Note (XS2402071760), fixed rate (7.75% coupon) maturing on 1 November 2027, priced at 100.00 (original spread of 810 bp), callable (6nc2)

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €250m Inhaberschuldverschreibung (DE000NWB2Q74), fixed rate (0.18% coupon) maturing on 26 October 2033, priced at 100.00, callable (12nc1)

- Schleswig-Holstein, State of (Official and Muni | Kiel, Schleswig-Holstein, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000SHFM824), fixed rate (0.01% coupon) maturing on 29 October 2026, non callable

NEW ISSUES IN SECURITIZED CREDIT

- RESIMAC Series 2021-2NC issued a floating-rate RMBS in 2 tranches, for a total of US$ 540 m. Highest-rated tranche offering a spread over the floating rate of 65bp, and the lowest-rated tranche a spread of 74bp. Bookrunners: Commonwealth Bank of Australia, National Australia Bank Ltd, Deutsche Bank, Citigroup Global Markets Inc, Standard Chartered Bank