Credit

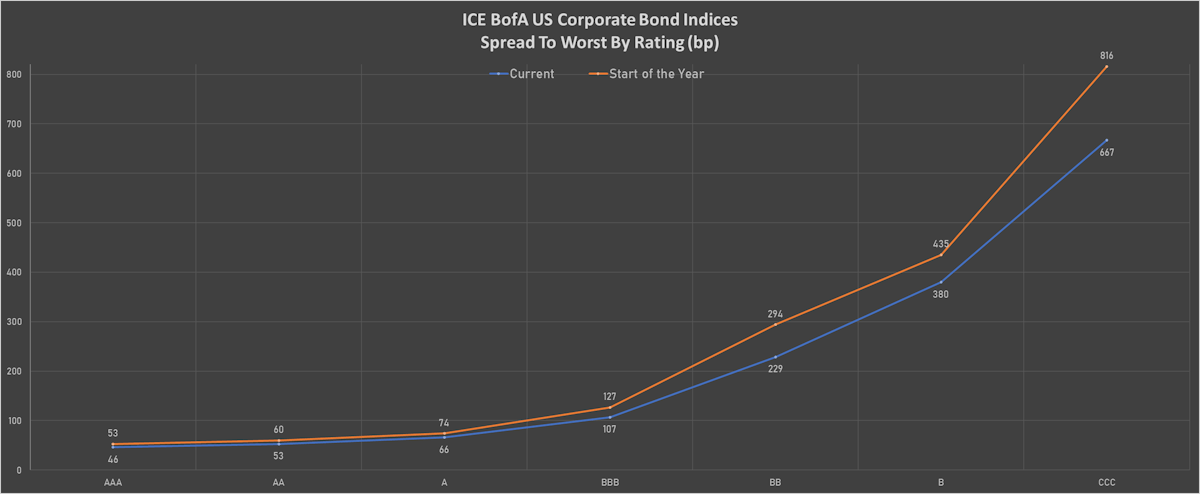

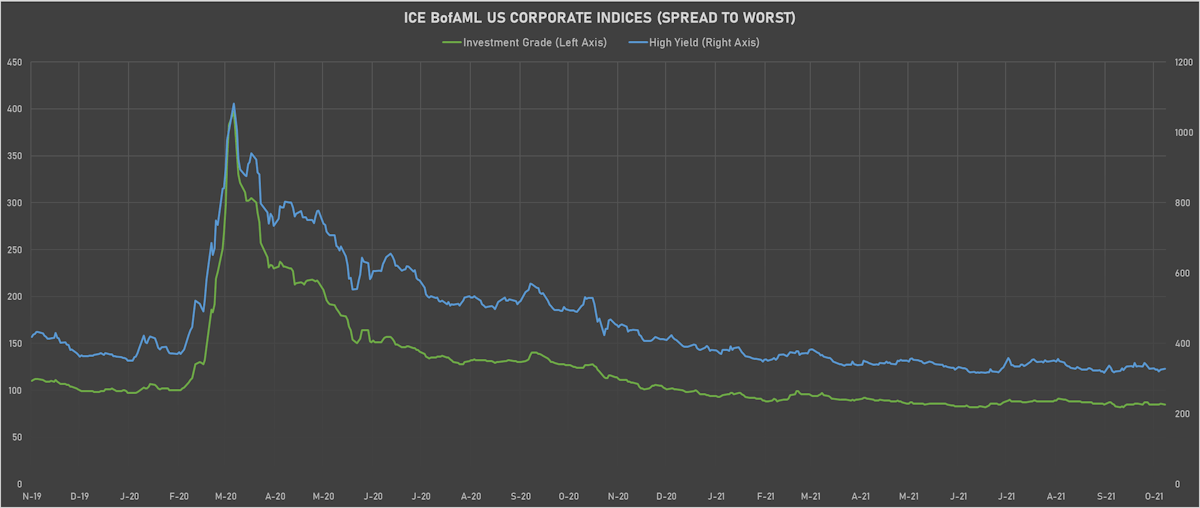

Despite Repeated All-Time Highs In US Equities This Year, High Yield Spreads Have Failed To Make New Lows

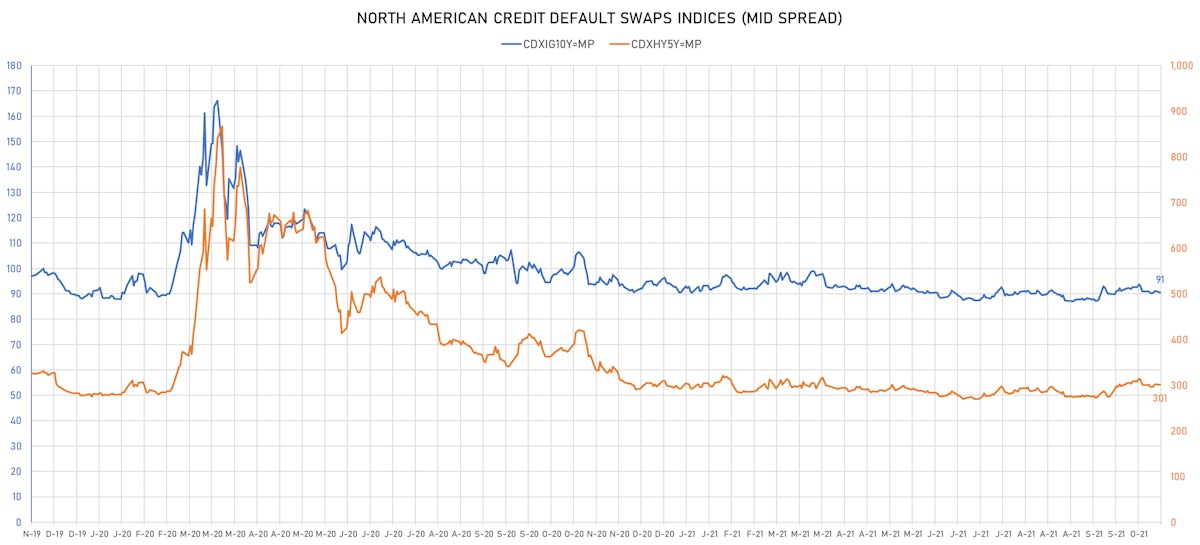

With the Fed about to start policy normalization, credit markets are anticipating higher future default rates, something that is visible in credit curves (for example, the tightening between 5Y and 3Y high yield CDS spreads since March)

Published ET

Spread between CDX.NA.HY 5Y & 3Y Tenors | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.04% today, with investment grade up 0.05% and high yield down -0.01% (YTD total return: -1.35%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.08% today (Month-to-date: -0.47%; Year-to-date: -2.24%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.008% today (Month-to-date: -0.33%; Year-to-date: 3.37%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 85.0 bp (YTD change: -13.0 bp)

- ICE BofA US High Yield Index spread to worst up 3.0 bp, now at 328.0 bp (YTD change: -62.0 bp)

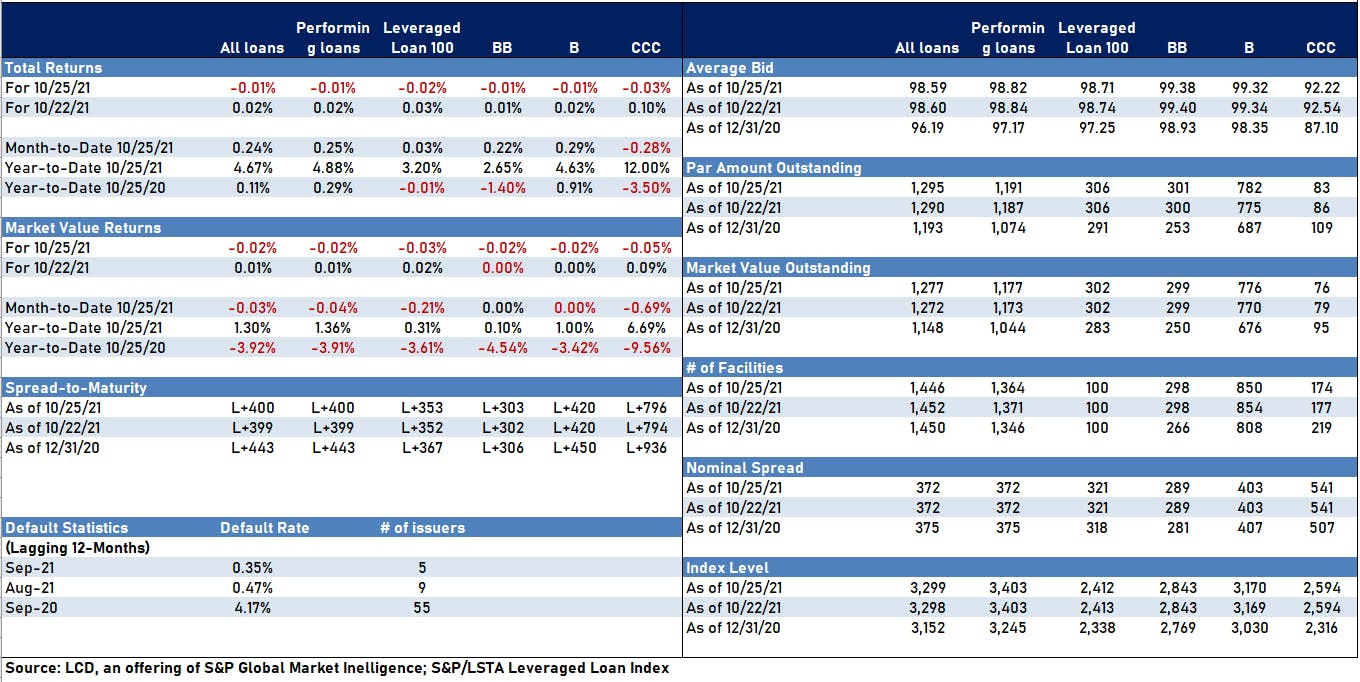

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +3.2%)

- New issues: US$ 5.8bn in dollars and € 3.7bn in euros

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 48 bp

- AA unchanged at 56 bp

- A down by -1 bp at 71 bp

- BBB down by -1 bp at 110 bp

- BB up by 4 bp at 214 bp

- B up by 4 bp at 358 bp

- CCC up by 4 bp at 654 bp

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.6 bp, now at 91bp (YTD change: +0.1bp)

- Markit CDX.NA.HY 5Y down 0.8 bp, now at 301bp (YTD change: +8.0bp)

- Markit iTRAXX Europe down 0.2 bp, now at 50bp (YTD change: +2.2bp)

- Markit iTRAXX Japan up 0.1 bp, now at 49bp (YTD change: -2.8bp)

- Markit iTRAXX Asia Ex-Japan up 0.1 bp, now at 83bp (YTD change: +25.1bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- MBIA Inc (Country: US; rated: Ba3): down 15.8 bp to 405.5bp (1Y range: 365-696bp)

- Tenet Healthcare Corp (Country: US; rated: B2): down 15.1 bp to 277.0bp (1Y range: 242-469bp)

- Macy's Inc (Country: US; rated: Ba2): down 13.0 bp to 259.5bp (1Y range: 190-1,201bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 13.7 bp to 417.3bp (1Y range: 291-1,214bp)

- Murphy Oil Corp (Country: US; rated: Ba3): up 14.4 bp to 329.3bp (1Y range: 280-763bp)

- Petroleo Brasileiro SA Petrobras (Country: BR; rated: Ba1): up 15.6 bp to 253.3bp (1Y range: 175-266bp)

- Turkiye Is Bankasi AS (Country: TR; rated: WD): up 18.9 bp to 636.9bp (1Y range: 482-759bp)

- Vale SA (Country: BR; rated: WR): up 20.7 bp to 187.0bp (1Y range: 126-215bp)

- Staples Inc (Country: US; rated: B2): up 21.3 bp to 1,060.5bp (1Y range: 652-1,306bp)

- Tegna Inc (Country: US; rated: Ba3): up 22.8 bp to 393.4bp (1Y range: 148-393bp)

- Transocean Inc (Country: KY; rated: Caa3): up 64.9 bp to 1,501.2bp (1Y range: 941-7,695bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Altice Finco SA (Country: LU; rated: Caa1): down 27.4 bp to 421.4bp (1Y range: 333-481bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): down 13.5 bp to 93.7bp (1Y range: -94bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 10.8 bp to 210.9bp (1Y range: 154-273bp)

- Air France KLM SA (Country: FR; rated: B-): up 11.7 bp to 418.0bp (1Y range: 390-1,211bp)

- Novafives SAS (Country: FR; rated: Caa1): up 12.2 bp to 753.4bp (1Y range: 660-1,205bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 17.2 bp to 236.7bp (1Y range: 217-397bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 17.4 bp to 394.2bp (1Y range: 339-806bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 34.4 bp to 651.3bp (1Y range: 358-651bp)

- TUI AG (Country: DE; rated: B3-PD): up 63.4 bp to 683.1bp (1Y range: 607-1,799bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 70.8 bp to 738.9bp (1Y range: 464-1,181bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 91.5 bp to 254.8bp (1Y range: 145-272bp)

USD BOND ISSUES

- American Airlines Inc (Airline | Fort Worth, United States | Rating: B-): US$758m Enhanced Equipment Trust Certificate (US02379KAA25), fixed rate (2.88% coupon) maturing on 11 January 2036, priced at 100.00 (original spread of 124 bp), with a make whole call

- SVB Financial Group (Banking | Santa Clara, United States | Rating: BBB): US$650m Senior Note, fixed rate (1.80% coupon) maturing on 28 October 2026, priced at 99.88 (original spread of 65 bp), callable (5nc5)

- Synchrony Financial (Financial - Other | Stamford, United States | Rating: BBB-): US$750m Senior Note (US87165BAR42), fixed rate (2.88% coupon) maturing on 28 October 2031, priced at 99.89 (original spread of 127 bp), callable (10nc10)

- Minsur SA (Metals/Mining | San Borja, Peru | Rating: BB+): US$500m Senior Note (US60447KAB61), fixed rate (4.50% coupon) maturing on 28 October 2031, priced at 98.03, non callable

- Viking Cruises Ltd (Transportation - Other | Woodland Hills | Rating: CCC+): US$150m Senior Note (USG9363BAH36), fixed rate (7.00% coupon) maturing on 15 February 2029, priced at 99.50 (original spread of 561 bp), callable (7nc2)

- Yuanta Securities Korea Co Ltd (Securities | Seoul, Taiwan | Rating: NR): US$2,955m Index Linked Security (KR6YT0000JW3) zero coupon maturing on 22 October 2024, priced at 100.00, non callable

EUR BOND ISSUES

- A2A SpA (Utility - Other | Milan, Italy | Rating: BBB): €500m Senior Note (XS2403533263), fixed rate (1.00% coupon) maturing on 2 November 2033, priced at 99.20 (original spread of 118 bp), callable (12nc12)

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: NR): €500m Oeffenlicher Pfandbrief (Covered Bond) (DE000BLB6JL6), fixed rate (0.13% coupon) maturing on 2 November 2029, priced at 99.87 (original spread of 39 bp), non callable

- HOWOGE Wohnungsbaugesellschaft mbH (Home Builders | Berlin, Germany | Rating: NR): €700m Senior Note (DE000A3H3GG2), fixed rate (1.13% coupon) maturing on 1 November 2033, priced at 99.76 (original spread of 126 bp), callable (12nc12)

- HOWOGE Wohnungsbaugesellschaft mbH (Home Builders | Berlin, Germany | Rating: NR): €500m Senior Note (DE000A3H3GF4), fixed rate (0.63% coupon) maturing on 1 November 2028, priced at 99.83 (original spread of 99 bp), callable (7nc7)

- HOWOGE Wohnungsbaugesellschaft mbH (Home Builders | Berlin, Germany | Rating: NR): €500m Senior Note (DE000A3H3GE7) zero coupon maturing on 1 November 2024, priced at 99.81 (original spread of 71 bp), callable (3nc3)

- Nordea Bank Abp (Banking | Helsinki, Finland | Rating: A-): €1,000m Note (XS2403444677), fixed rate (0.50% coupon) maturing on 2 November 2028, priced at 99.66 (original spread of 88 bp), non callable

NEW LOANS

- LRS Holdings LLC (B), signed a US$ 123m Term Loan B, to be used for general corporate purposes. It matures on 08/12/28 and initial pricing is set at LIBOR +425bps

- TricorBraun Inc (B+), signed a US$ 150m Term Loan B, to be used for acquisition financing. It matures on 03/03/28 and initial pricing is set at LIBOR +325bps