Credit

Cash Spreads Drop Slightly In US High Yield, Unchanged For Investment Grade

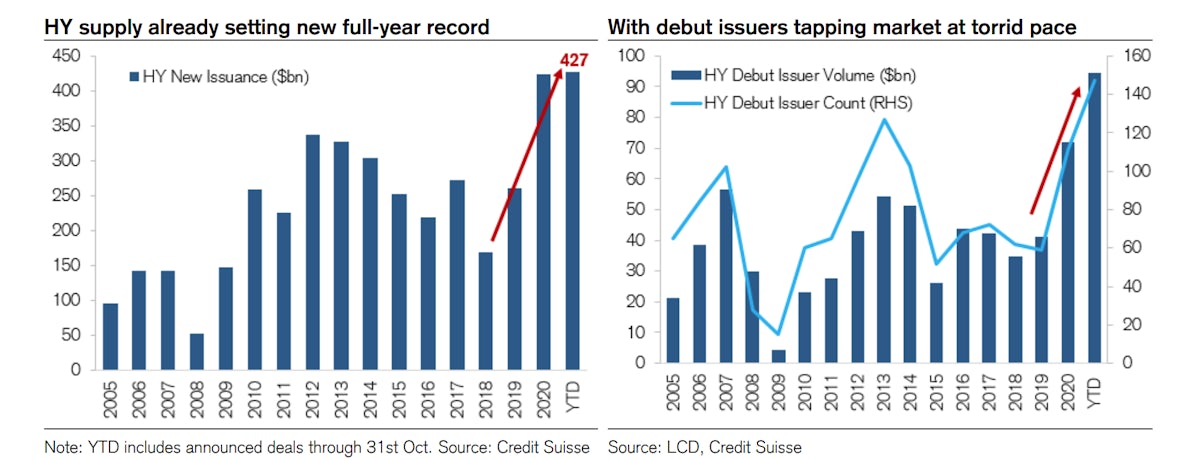

With 2 months to go in the year, high yield issuance has already surpassed the 2020 record, helped by the large number of debut issuers hitting the market

Published ET

High Yield Issuance Year To Date | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.27% today, with investment grade up 0.28% and high yield up 0.12% (YTD total return: -1.09%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.425% today (Month-to-date: -0.05%; Year-to-date: -1.83%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.039% today (Month-to-date: -0.29%; Year-to-date: 3.41%)

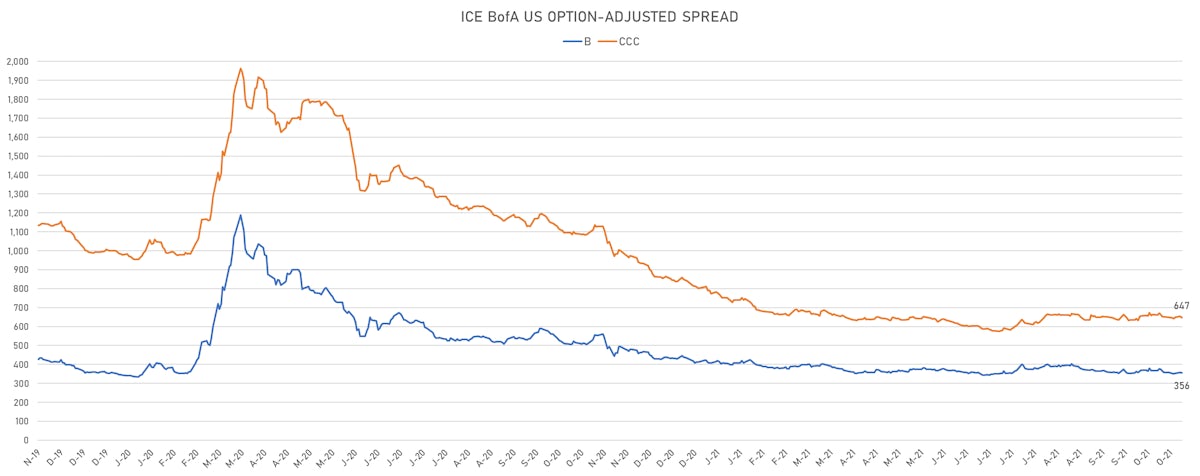

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 85.0 bp (YTD change: -13.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 326.0 bp (YTD change: -64.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +3.2%)

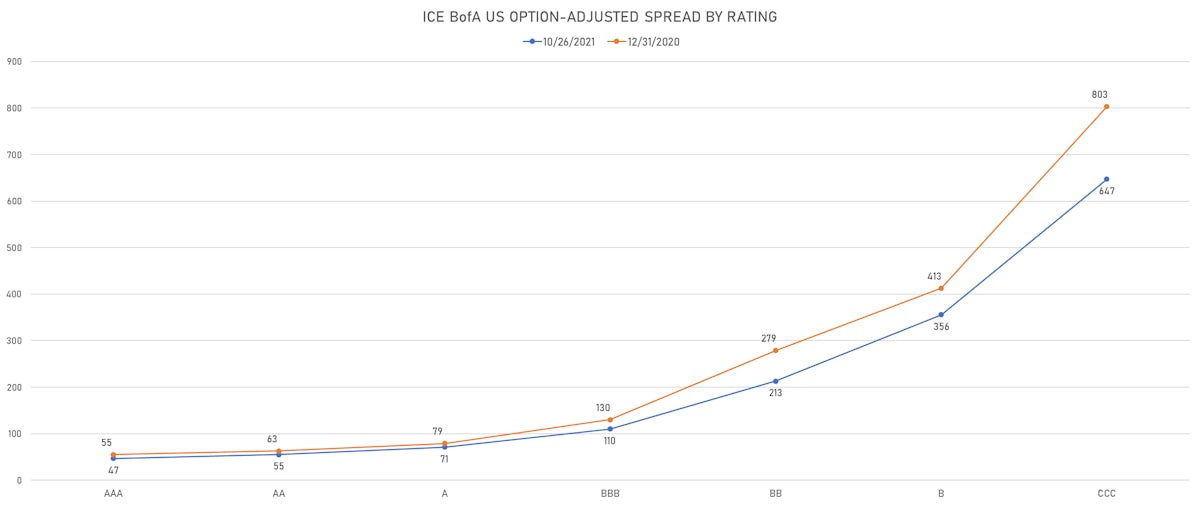

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 47 bp

- AA down by -1 bp at 55 bp

- A unchanged at 71 bp

- BBB unchanged at 110 bp

- BB down by -1 bp at 213 bp

- B down by -2 bp at 356 bp

- CCC down by -7 bp at 647 bp

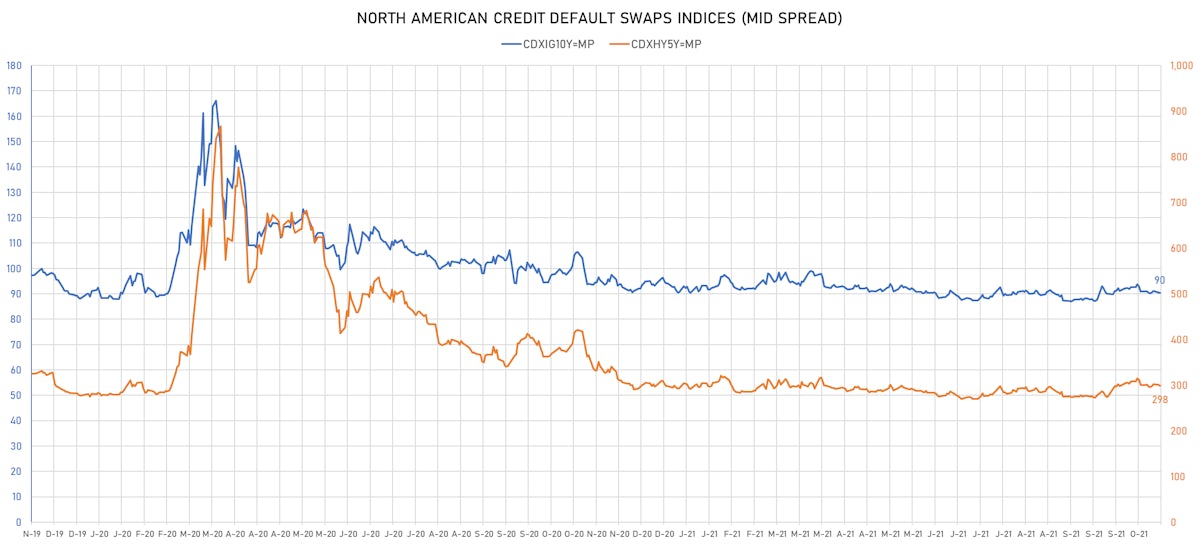

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.2 bp, now at 90bp (YTD change: -0.1bp)

- Markit CDX.NA.HY 5Y down 2.7 bp, now at 298bp (YTD change: +5.3bp)

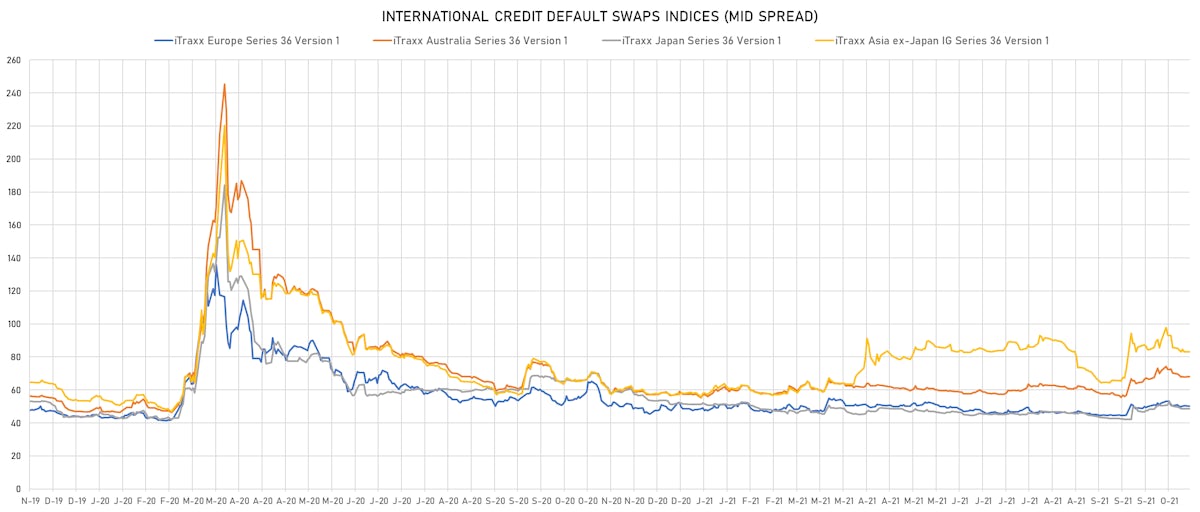

- Markit iTRAXX Europe down 1.2 bp, now at 49bp (YTD change: +1.0bp)

- Markit iTRAXX Japan down 0.2 bp, now at 48bp (YTD change: -3.0bp)

- Markit iTRAXX Asia Ex-Japan down 2.2 bp, now at 81bp (YTD change: +22.9bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread up by 98.0 bp to 896.8 bp, with the yield to worst at 9.2% and the bond now trading down to 91.4 cents on the dollar (1Y price range: 87.1-105.8).

- Issuer: JSM Global SARL (Luxembourg, Luxembourg) | Coupon: 4.75% | Maturity: 20/10/2030 | Rating: BB | ISIN: USL5788AAA99 | Z-spread up by 45.7 bp to 384.4 bp, with the yield to worst at 5.3% and the bond now trading down to 95.4 cents on the dollar (1Y price range: 95.3-107.7).

- Issuer: BRF SA (ITAJAI, Brazil) | Coupon: 3.95% | Maturity: 22/5/2023 | Rating: BB- | ISIN: USP1905CAD22 | Z-spread up by 43.6 bp to 259.6 bp, with the yield to worst at 2.7% and the bond now trading down to 101.4 cents on the dollar (1Y price range: 100.3-104.6).

- Issuer: Turkiye Vakiflar Bankasi TAO (Turkey) | Coupon: 5.50% | Maturity: 1/10/2026 | Rating: B+ | ISIN: XS2386558113 | Z-spread up by 41.1 bp to 559.2 bp, with the yield to worst at 6.6% and the bond now trading down to 94.9 cents on the dollar (1Y price range: 94.9-99.9).

- Issuer: StoneCo Ltd (George Town, Cayman Islands) | Coupon: 3.95% | Maturity: 16/6/2028 | Rating: BB- | ISIN: USG85158AA43 | Z-spread up by 40.8 bp to 401.0 bp, with the yield to worst at 5.2% and the bond now trading down to 91.9 cents on the dollar (1Y price range: 91.8-100.0).

- Issuer: Turkiye Sinai Kalkinma Bankasi AS (Istanbul, Turkey) | Coupon: 5.88% | Maturity: 14/1/2026 | Rating: B- | ISIN: XS2281369301 | Z-spread up by 38.8 bp to 546.7 bp, with the yield to worst at 6.2% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 93.5-103.1).

- Issuer: Ultrapar International SA (Luxembourg, Luxembourg) | Coupon: 5.25% | Maturity: 6/6/2029 | Rating: BB+ | ISIN: USL9412AAB37 | Z-spread up by 37.5 bp to 331.6 bp, with the yield to worst at 4.6% and the bond now trading down to 103.3 cents on the dollar (1Y price range: 102.6-112.1).

- Issuer: Banco BTG Pactual SA (Cayman Islands Branch) (Cayman Islands) | Coupon: 5.50% | Maturity: 31/1/2023 | Rating: BB- | ISIN: US05971BAD10 | Z-spread up by 36.2 bp to 216.5 bp, with the yield to worst at 2.3% and the bond now trading down to 103.7 cents on the dollar (1Y price range: 103.5-107.3).

- Issuer: Klabin Austria GmbH (Wien, Austria) | Coupon: 3.20% | Maturity: 12/1/2031 | Rating: BB+ | ISIN: USA35155AE99 | Z-spread up by 35.7 bp to 280.7 bp, with the yield to worst at 4.3% and the bond now trading down to 91.0 cents on the dollar (1Y price range: 90.3-100.4).

- Issuer: Rede d'Or Finance SARL (Luxembourg, Luxembourg) | Coupon: 4.50% | Maturity: 22/1/2030 | Rating: BB | ISIN: USL7915TAA09 | Z-spread up by 35.2 bp to 330.4 bp, with the yield to worst at 4.7% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 97.5-104.9).

- Issuer: Banco Safra SA (Cayman Islands Branch) (George Town, Cayman Islands) | Coupon: 4.13% | Maturity: 8/2/2023 | Rating: BB- | ISIN: US05964TAQ22 | Z-spread up by 35.2 bp to 194.3 bp, with the yield to worst at 2.1% and the bond now trading down to 102.3 cents on the dollar (1Y price range: 102.3-104.8).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 39.5 bp to 267.5 bp, with the yield to worst at 3.0% and the bond now trading up to 101.8 cents on the dollar (1Y price range: 98.4-103.7).

- Issuer: Gemdale Ever Prosperity Investment Ltd (Hong Kong) | Coupon: 4.95% | Maturity: 12/8/2024 | Rating: BB- | ISIN: XS2357443410 | Z-spread down by 130.5 bp to 480.7 bp, with the yield to worst at 5.2% and the bond now trading up to 98.4 cents on the dollar (1Y price range: 93.3-102.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: CCC+ | ISIN: XS2270393379 | Z-spread up by 27.5 bp to 224.2 bp, with the yield to worst at 1.9% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 93.7-102.9).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread up by 22.8 bp to 262.5 bp (CDS basis: -80.7bp), with the yield to worst at 2.2% and the bond now trading down to 101.3 cents on the dollar (1Y price range: 97.9-103.7).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 19.3 bp to 317.4 bp, with the yield to worst at 2.8% and the bond now trading down to 99.2 cents on the dollar (1Y price range: 97.9-101.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 5.25% | Maturity: 17/3/2055 | Rating: BB | ISIN: XS0214965963 | Z-spread up by 16.6 bp to 395.9 bp (CDS basis: -97.8bp), with the yield to worst at 4.0% and the bond now trading down to 115.7 cents on the dollar (1Y price range: 114.2-126.9).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread down by 17.0 bp to 373.6 bp, with the yield to worst at 3.5% and the bond now trading up to 96.7 cents on the dollar (1Y price range: 96.2-99.4).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 3/2/2025 | Rating: BB- | ISIN: XS1558491855 | Z-spread down by 19.8 bp to 110.3 bp (CDS basis: -25.9bp), with the yield to worst at 0.7% and the bond now trading up to 102.3 cents on the dollar (1Y price range: 98.8-103.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB+ | ISIN: XS2361254597 | Z-spread down by 22.0 bp to 367.6 bp, with the yield to worst at 3.5% and the bond now trading up to 96.5 cents on the dollar (1Y price range: 94.4-100.0).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: BB- | ISIN: XS2283224231 | Z-spread down by 34.8 bp to 534.4 bp, with the yield to worst at 5.1% and the bond now trading up to 87.6 cents on the dollar (1Y price range: 77.0-99.6).

SELECTED RECENT USD BOND ISSUES

- Ally Financial Inc (Financial - Other | Detroit, Michigan, United States | Rating: BBB-): US$750m Senior Note (US02005NBP42), fixed rate (2.20% coupon) maturing on 2 November 2028, priced at 98.64 (original spread of 95 bp), callable (7nc7)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$127m Bond (US3133ENCS72), fixed rate (2.20% coupon) maturing on 1 November 2033, priced at 100.00 (original spread of 208 bp), callable (12nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$495m Bond (US3133ENCY41), floating rate (SOFR + 4.0 bp) maturing on 2 November 2023, priced at 100.00, callable (2nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133ENDA55), fixed rate (1.74% coupon) maturing on 1 November 2028, priced at 100.00 (original spread of 164 bp), callable (7nc3m)

- Kinder Morgan Inc (Gas Utility - Pipelines | Houston, Texas, United States | Rating: BBB): US$500m Senior Note (US49456BAU52), fixed rate (1.75% coupon) maturing on 15 November 2026, priced at 99.83 (original spread of 60 bp), callable (5nc5)

- Roblox Corp (Information/Data Technology | San Mateo, California, United States | Rating: BB): US$1,000m Senior Note (US771049AA15), fixed rate (3.88% coupon) maturing on 1 May 2030, priced at 100.00 (original spread of 234 bp), callable (9nc3)

- Dah Sing Bank Ltd (Banking | Hong Kong | Rating: BBB+): US$300m Subordinated Note (XS2393542548), fixed rate (3.00% coupon) maturing on 2 November 2031, priced at 99.39 (original spread of 195 bp), callable (10nc5)

- EI Sukuk Company Ltd (Financial - Other | George Town, United Arab Emirates | Rating: NR): US$500m Islamic Sukuk (Hybrid) (XS2392596180), fixed rate (2.08% coupon) maturing on 2 November 2026, priced at 100.00 (original spread of 80 bp), non callable

- Erste Abwicklungsanstalt (Agency | Dusseldorf, Germany | Rating: AA): US$1,000m Senior Note (XS2403919702), fixed rate (0.88% coupon) maturing on 30 October 2024, priced at 99.89 (original spread of 14 bp), non callable

- Gray Escrow II Inc (Financial - Other | Rating: BB-): US$1,300m Senior Note (US389286AA34), fixed rate (5.38% coupon) maturing on 15 November 2031, priced at 100.00 (original spread of 376 bp), callable (10nc5)

- ICBCIL Finance Co Ltd (Financial - Other | China (Mainland) | Rating: A): US$600m Senior Note (XS2393949065), fixed rate (1.63% coupon) maturing on 2 November 2024, priced at 99.92 (original spread of 88 bp), non callable

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A): US$1,500m Senior Note (US78016EYH43), fixed rate (2.30% coupon) maturing on 3 November 2031, priced at 99.88 (original spread of 70 bp), with a make whole call

SELECTED RECENT EUR BOND ISSUES

- Almaviva The Italian Innovation Company SpA (Information/Data Technology | Rome, Roma, Italy | Rating: B+): €350m Note (XS2403514552), fixed rate (4.88% coupon) maturing on 30 October 2026, priced at 100.00 (original spread of 531 bp), callable (5nc2)

- Canadian Imperial Bank of Commerce (Banking | Toronto, Canada | Rating: A+): €250m Covered Bond (Other) (XS2404257854), fixed rate (0.01% coupon) maturing on 7 October 2026, priced at 100.09 (original spread of 45 bp), non callable

- Hamburg Commercial Bank AG (Banking | Hamburg, Germany | Rating: BBB): €500m Hypothekenpfandbrief (Covered Bond) (DE000HCB0BC0), fixed rate (0.10% coupon) maturing on 2 November 2028, priced at 99.89 (original spread of 46 bp), non callable

- Hessen, State of (Official and Muni | Wiesbaden, Germany | Rating: AA+): €500m Inhaberschuldverschreibung (DE000A1RQD92), fixed rate (0.13% coupon) maturing on 10 October 2031, priced at 99.51 (original spread of 30 bp), non callable

- Procter & Gamble Co (Consumer Products | Cincinnati, United States | Rating: AA-): €600m Senior Note (XS2404214020), fixed rate (0.90% coupon) maturing on 4 November 2041, priced at 99.51 (original spread of 91 bp), with a make whole call

- Procter & Gamble Co (Consumer Products | Cincinnati, United States | Rating: AA-): €500m Senior Note (XS2404213485), fixed rate (0.35% coupon) maturing on 5 May 2030, priced at 99.87 (original spread of 60 bp), with a make whole call

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Sweden | Rating: A+): €500m Subordinated Note (XS2404247384), fixed rate (0.75% coupon) maturing on 3 November 2031, priced at 99.60 (original spread of 129 bp), callable (10nc5)

- Swedbank AB (Banking | Sundbyberg, Sweden | Rating: A+): €1,000m Note (XS2404027935), fixed rate (0.25% coupon) maturing on 2 November 2026, priced at 99.99 (original spread of 71 bp), non callable