Credit

Lower Rates Bring Gains Across USD Bonds, Despite A Widening In HY Cash Spreads

In the USD primary bond market, the two largest offerings today were Citigroup's US$ 4bn in 3 tranches and NextEra Energy's 1.3bn in a single tranche (indexed on SOFR)

Published ET

Pactiv And Olin Corp Have Seen Their 5Y USD CDS Spreads Tighten This Week After Significantly Widening Over The Previous Month | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.56% today, with investment grade up 0.59% and high yield up 0.22% (YTD total return: -0.54%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.70% today (Month-to-date: 0.65%; Year-to-date: -1.14%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.04% today (Month-to-date: -0.26%; Year-to-date: 3.45%)

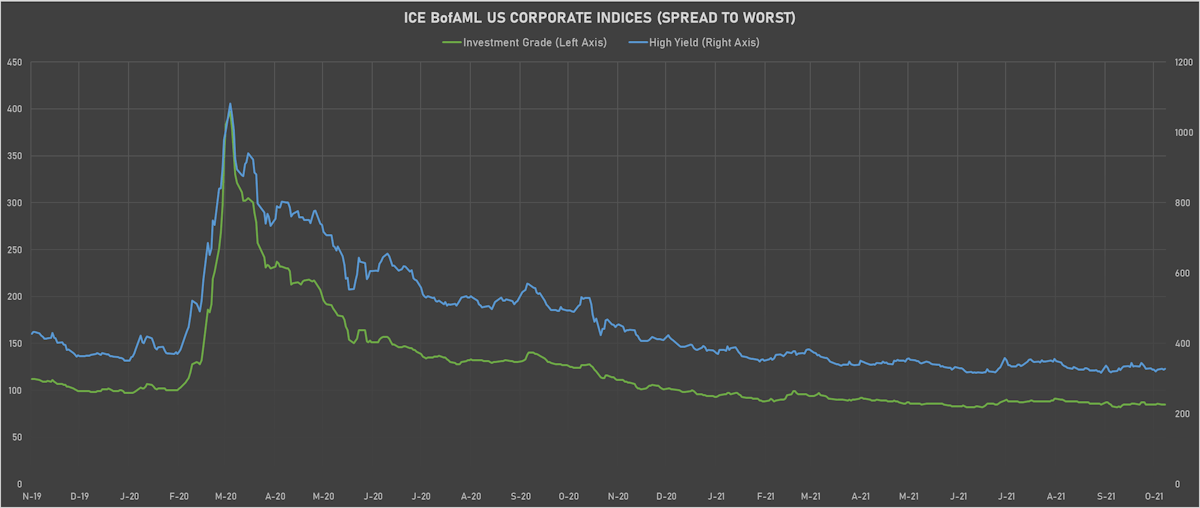

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 85.0 bp (YTD change: -13.0 bp)

- ICE BofA US High Yield Index spread to worst up 2.0 bp, now at 328.0 bp (YTD change: -62.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +3.2%)

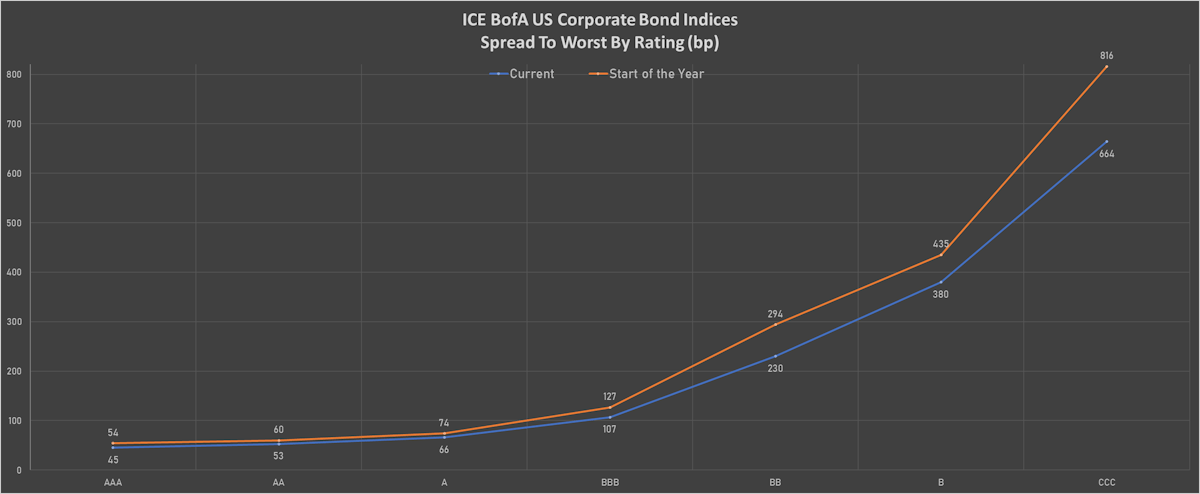

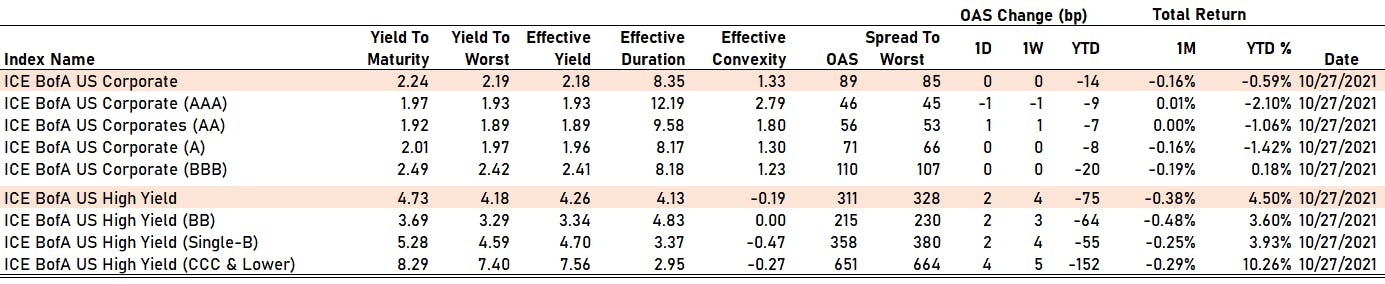

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 46 bp

- AA up by 1 bp at 56 bp

- A unchanged at 71 bp

- BBB unchanged at 110 bp

- BB up by 2 bp at 215 bp

- B up by 2 bp at 358 bp

- CCC up by 4 bp at 651 bp

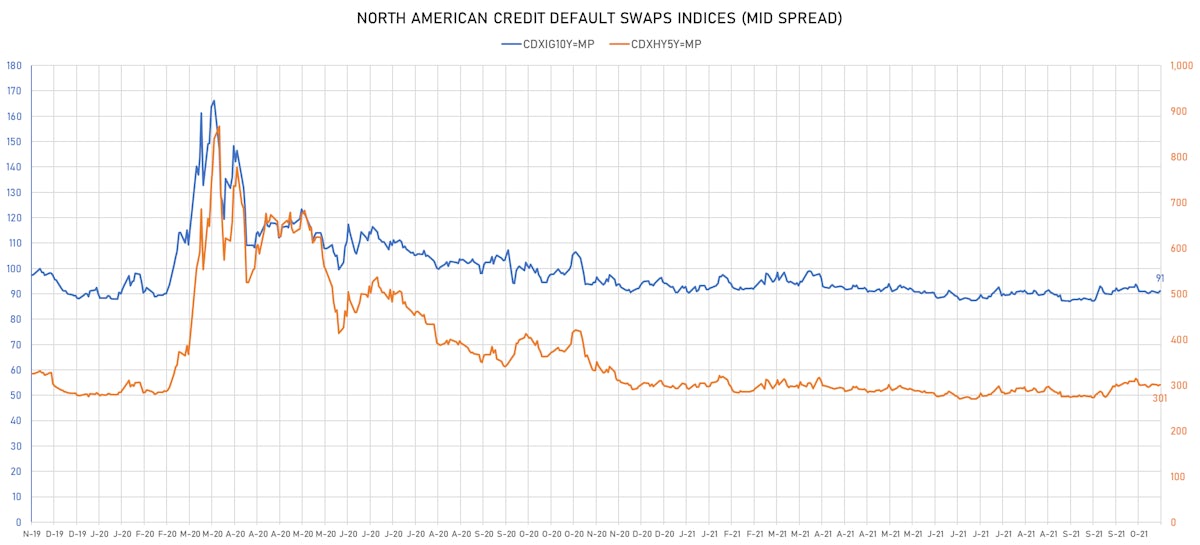

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.7 bp, now at 91bp (YTD change: +0.6bp)

- Markit CDX.NA.HY 5Y up 3.0 bp, now at 301bp (YTD change: +8.2bp)

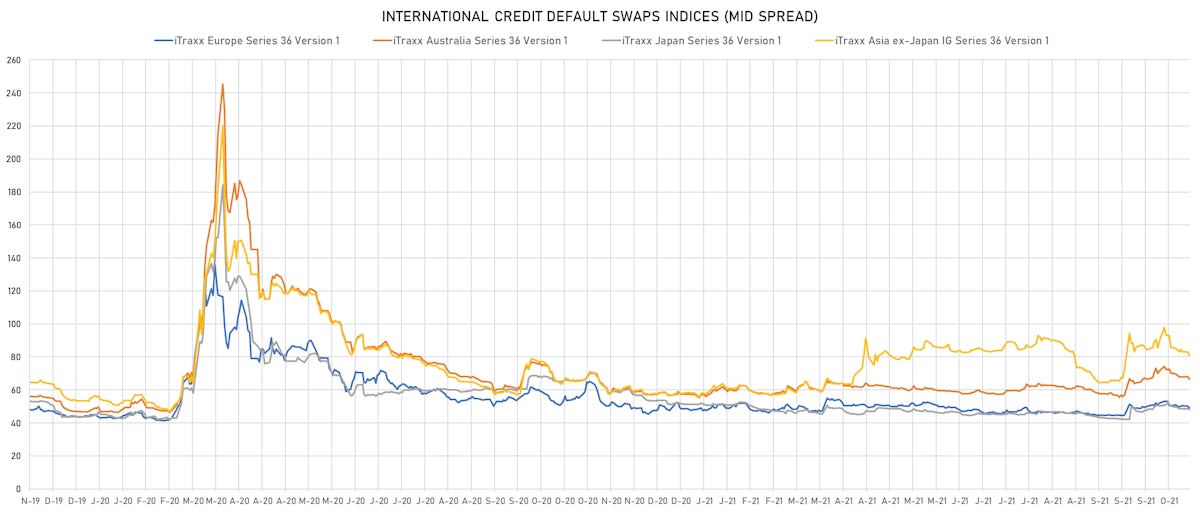

- Markit iTRAXX Europe unchanged at 49bp (YTD change: +1.1bp)

- Markit iTRAXX Japan down 0.5 bp, now at 48bp (YTD change: -3.5bp)

- Markit iTRAXX Asia Ex-Japan down 1.8 bp, now at 79bp (YTD change: +21.1bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Mattel Inc (Country: US; rated: Ba2): down 22.8 bp to 185.7bp (1Y range: 183-375bp)

- Olin Corp (Country: US; rated: WR): down 18.7 bp to 176.8bp (1Y range: 146-277bp)

- Pactiv LLC (Country: US; rated: Caa1): down 18.1 bp to 444.4bp (1Y range: 232-472bp)

- MBIA Inc (Country: US; rated: Ba3): down 17.0 bp to 399.3bp (1Y range: 365-696bp)

- Tegna Inc (Country: US; rated: Ba3): up 11.9 bp to 400.7bp (1Y range: 148-401bp)

- Murphy Oil Corp (Country: US; rated: Ba3): up 13.8 bp to 334.5bp (1Y range: 280-763bp)

- American Airlines Group Inc (Country: US; rated: B2): up 15.0 bp to 713.6bp (1Y range: 596-2,968bp)

- Staples Inc (Country: US; rated: B2): up 17.9 bp to 1,067.1bp (1Y range: 652-1,306bp)

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): up 20.2 bp to 886.2bp (1Y range: 606-1,202bp)

- Rite Aid Corp (Country: US; rated: B3): up 20.5 bp to 977.9bp (1Y range: 497-990bp)

- Amkor Technology Inc (Country: US; rated: BB): up 21.0 bp to 159.3bp (1Y range: 107-171bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): up 21.0 bp to 417.7bp (1Y range: 336-449bp)

- Xerox Corp (Country: US; rated: LGD4 - 56%): up 30.6 bp to 297.6bp (1Y range: 158-298bp)

- Talen Energy Supply LLC (Country: US; rated: B3): up 56.7 bp to 3,037.8bp (1Y range: 875-5,047bp)

- Transocean Inc (Country: KY; rated: Caa3): up 71.2 bp to 1,546.9bp (1Y range: 941-7,695bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Ineos Group Holdings SA (Country: LU; rated: LGD5 - 88%): down 56.6 bp to 207.7bp (1Y range: 199-447bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 41.0 bp to 409.0bp (1Y range: 333-481bp)

- CMA CGM SA (Country: FR; rated: Ba3): down 16.5 bp to 308.6bp (1Y range: 259-734bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 11.3 bp to 688.7bp (1Y range: 464-1,181bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 10.3 bp to 168.1bp (1Y range: 166-267bp)

- Stena AB (Country: SE; rated: B2-PD): down 9.3 bp to 445.3bp (1Y range: 401-745bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 9.2 bp to 192.5bp (1Y range: -193bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 6.7 bp to 161.1bp (1Y range: 107-227bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 6.3 bp to 244.6bp (1Y range: 222-293bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 9.9 bp to 395.4bp (1Y range: 339-806bp)

- Air France KLM SA (Country: FR; rated: B-): up 10.1 bp to 419.4bp (1Y range: 390-1,211bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 14.1 bp to 242.0bp (1Y range: 217-397bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 15.8 bp to 638.2bp (1Y range: 358-646bp)

- British Telecommunications PLC (Country: GB; rated: Baa2): up 17.8 bp to 103.3bp (1Y range: 63-103bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 58.4 bp to 227.5bp (1Y range: 145-272bp)

SELECTED RECENT USD BOND ISSUES

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$1,000m Senior Note (US172967ND99), floating rate maturing on 3 November 2025, priced at 100.00, callable (4nc3)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$1,750m Senior Note (US172967NE72), floating rate maturing on 3 November 2032, priced at 100.00, callable (11nc9)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$1,250m Senior Note (US172967NF48), floating rate maturing on 3 November 2042, priced at 100.00, callable (21nc20)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$600m Bond (US3130APQ811), fixed rate (1.00% coupon) maturing on 8 November 2024, priced at 100.00, callable (3nc1m)

- International Bank for Reconstruction and Development (Supranational | Washington, United States | Rating: AAA): US$5,000m Bond (US459058KA05), fixed rate (1.63% coupon) maturing on 3 November 2031, priced at 99.92 (original spread of 9 bp), non callable

- NextEra Energy Capital Holdings Inc (Financial - Other | Juno Beach, Florida, United States | Rating: A-): US$1,300m Senior Debenture (US65339KBX72), floating rate (SOFR + 40.0 bp) maturing on 3 November 2023, priced at 100.00, callable (2nc6m)

- SLM Corp (Financial - Other | Newark Delaware, Delaware, United States | Rating: BB+): US$500m Senior Note (US78442PGE07), fixed rate (3.13% coupon) maturing on 2 November 2026, priced at 99.43 (original spread of 211 bp), callable (5nc5)

- American Airlines Pass Through Trust 2021-1B (Financial - Other | Rating: BB+): US$202m Enhanced Equipment Trust Certificate (US02376LAA35), fixed rate (3.95% coupon) maturing on 11 January 2032, priced at 100.00 (original spread of 280 bp), with a make whole call

- BANK OF CHINA LTD (LONDON BRANCH) (Banking | London, China (Mainland) | Rating: NR): US$300m Senior Note (XS2400956020), fixed rate (1.00% coupon) maturing on 2 November 2024, priced at 99.75 (original spread of 32 bp), non callable

- CA Magnum Holdings (Financial - Other | Ebene, Mauritius | Rating: B+): US$1,010m Note (US12674CAA18), fixed rate (5.38% coupon) maturing on 31 October 2026, priced at 100.00 (original spread of 421 bp), callable (5nc2)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0459862099), fixed rate (1.75% coupon) maturing on 18 November 2027, priced at 100.00, non callable

- Prudential PLC (Life Insurance | London, United Kingdom | Rating: A): US$1,000m Senior Subordinated Note (XS2403426427), fixed rate (2.95% coupon) maturing on 3 November 2033, priced at 100.00, callable (12nc7)

- Wuhan Metro Group Co Ltd (Transportation - Other | Wuhan, China (Mainland) | Rating: A-): US$400m Senior Note (XS2388876745), fixed rate (1.58% coupon) maturing on 3 November 2024, priced at 99.90 (original spread of 83 bp), non callable

SELECTED RECENT EUR BOND ISSUES

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A-): €1,000m Note (XS2404651163), fixed rate (1.00% coupon) maturing on 4 November 2031, priced at 99.82 (original spread of 119 bp), non callable

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: AAA): €150m Hypothekenpfandbrief (Covered Bond) (DE000BLB9P76), floating rate (EU06MLIB + 85.0 bp) maturing on 4 November 2024, priced at 102.80, non callable

- Blackstone Private Credit Fund (Financial - Other | New York City, New York, United States | Rating: NR): €500m Senior Note (XS2403519601), fixed rate (1.75% coupon) maturing on 30 November 2026, priced at 99.79 (original spread of 226 bp), callable (5nc5)

- Bouygues SA (Conglomerate/Diversified Mfg | Paris, Ile-De-France, France | Rating: A-): €800m Bond (FR0014006CS9), fixed rate (0.50% coupon) maturing on 11 February 2030, priced at 99.77 (original spread of 81 bp), callable (8nc8)

- CK Hutchison Europe Finance 21 Ltd (Financial - Other | Rating: A): €500m Senior Note (XS2402178300), fixed rate (0.75% coupon) maturing on 2 November 2029, priced at 99.96 (original spread of 108 bp), callable (8nc8)

- CK Hutchison Europe Finance 21 Ltd (Financial - Other | Rating: A): €500m Senior Note (XS2402178565), fixed rate (1.00% coupon) maturing on 2 November 2033, priced at 98.97 (original spread of 127 bp), callable (12nc12)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A): €250m Inhaberschuldverschreibung (DE000DFK0MK0), fixed rate (0.10% coupon) maturing on 4 November 2024, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A): €250m Inhaberschuldverschreibung (DE000DFK0MM6), fixed rate (0.43% coupon) maturing on 4 November 2026, priced at 100.00, non callable

- Piraeus Financial Holdings SA (Banking | Athina, Attiki, Greece | Rating: CCC+): €500m Note (XS2400040460), fixed rate (3.88% coupon) maturing on 3 November 2027, priced at 100.00 (original spread of 439 bp), callable (6nc5)

- Sherwood Financing PLC (Financial - Other | London, United Kingdom | Rating: NR): €640m Note (XS2010027535), floating rate (Euro 3M LIBOR + 462.5 bp) maturing on 15 November 2027, priced at 100.00 (original spread of 503 bp), callable (6nc1)

- Sherwood Financing PLC (Financial - Other | London, United Kingdom | Rating: NR): €400m Note (XS2010027022), fixed rate (4.50% coupon) maturing on 15 November 2026, priced at 100.00 (original spread of 499 bp), callable (5nc2)

- Sparebank 1 Boligkreditt As (Mortgage Banking | Stavanger, Rogaland, Norway | Rating: A): €1,000m Covered Bond (Other) (XS2404591161), fixed rate (0.05% coupon) maturing on 3 November 2028, priced at 99.69 (original spread of 43 bp), non callable

- Triodos Bank NV (Banking | Zeist, Utrecht, Netherlands | Rating: NR): €250m Subordinated Note (XS2401175927), fixed rate (2.25% coupon) maturing on 5 February 2032, priced at 99.50 (original spread of 282 bp), callable (10nc5)

- UBS Group AG (Banking | Zurich, Zuerich, Switzerland | Rating: A-): €1,250m Bond (CH1142231690), fixed rate (0.88% coupon) maturing on 3 November 2031, priced at 99.93 (original spread of 106 bp), non callable

- UBS Group AG (Banking | Zurich, Zuerich, Switzerland | Rating: A-): €1,250m Bond (CH1142231682), fixed rate (0.25% coupon) maturing on 3 November 2026, priced at 99.57 (original spread of 90 bp), callable (5nc4)

NEW LOANS

- TechTronic Industries Co Ltd, signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/26/24 and initial pricing is set at LIBOR +68bps.