Credit

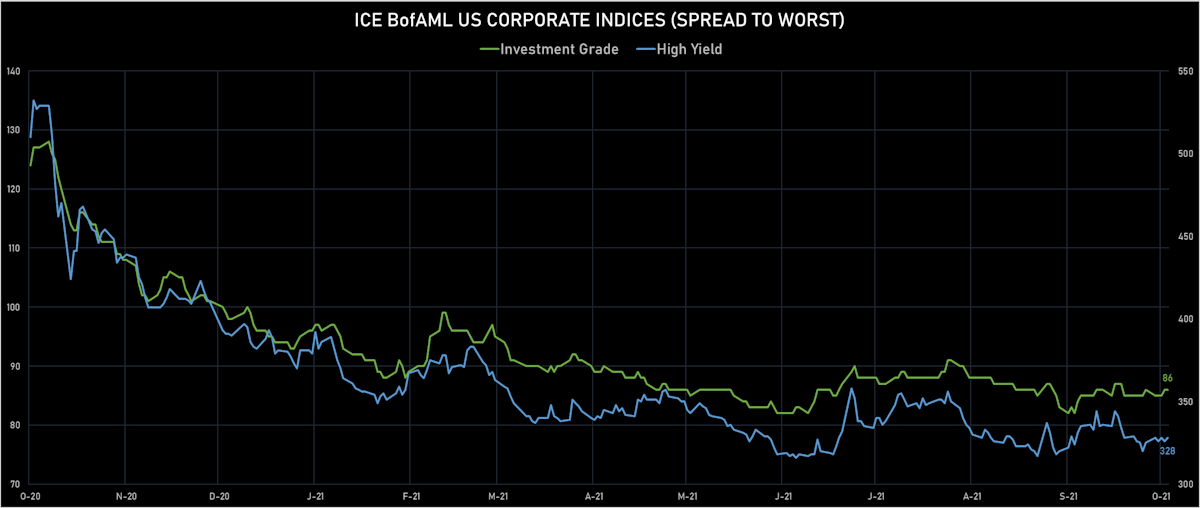

High Yield Cash Spreads Widen To Close Out A Month Where The Performance Of Credit And Equities Diverged Slightly

IFR Volumes for US Bond Issuance: this week saw US$4.9bn in 7 tranches for HY (October total: $30.6bn in 50 tranches) and $23bn in 28 tranches for IG (October total: US$122bn in 126 tranches)

Published ET

S&P 1500 Price Index & ICE BofAML US High Yield Index, With Their 20-Day Log Correlation | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.05% today, with investment grade up 0.05% and high yield unchanged (YTD total return: -0.70%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.048% today (Month-to-date: 0.35%; Year-to-date: -1.44%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.065% today (Month-to-date: -0.31%; Year-to-date: 3.40%)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +3.2%)

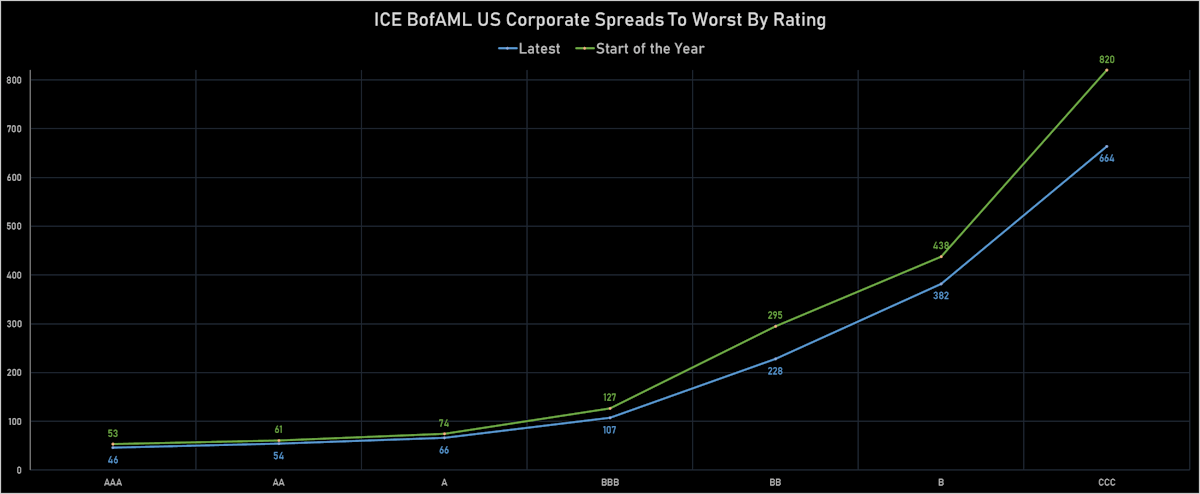

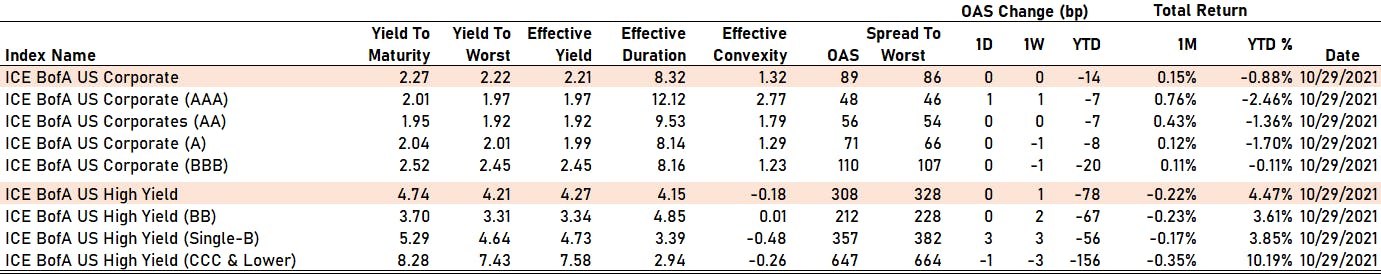

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 48 bp

- AA unchanged at 56 bp

- A unchanged at 71 bp

- BBB unchanged at 110 bp

- BB unchanged at 212 bp

- B up by 3 bp at 357 bp

- CCC down by -1 bp at 647 bp

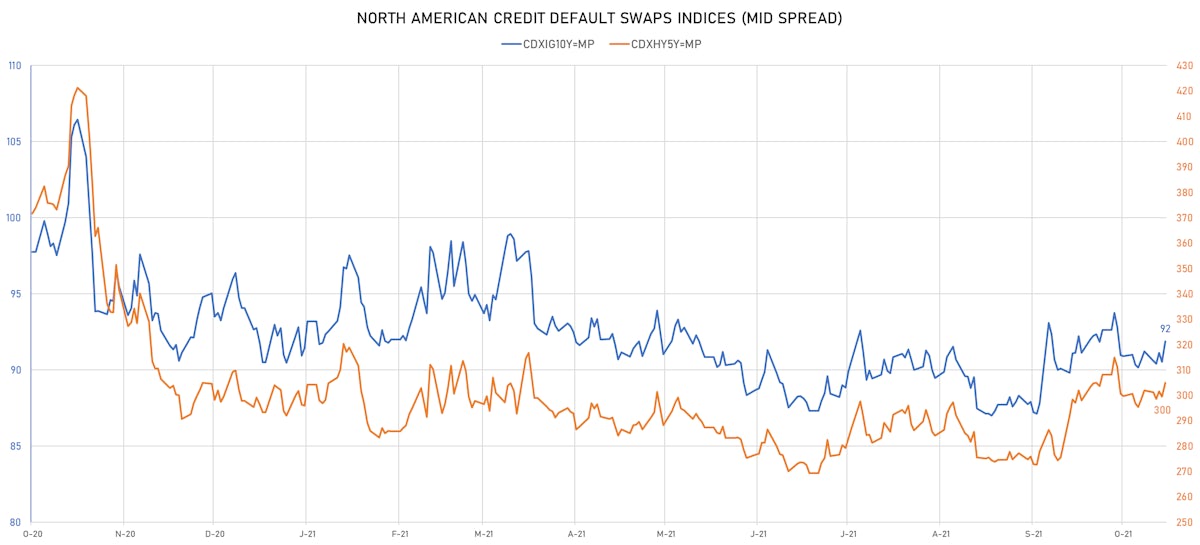

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.3 bp, now at 92bp (YTD change: +1.4bp)

- Markit CDX.NA.HY 5Y up 5.3 bp, now at 305bp (YTD change: +11.7bp)

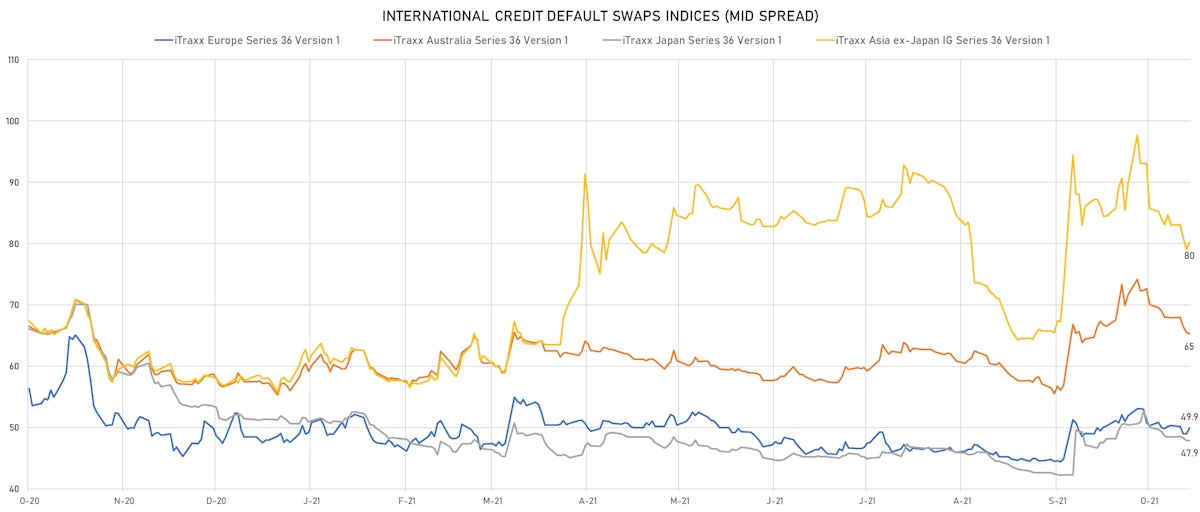

- Markit iTRAXX Europe up 0.8 bp, now at 51bp (YTD change: +2.7bp)

- Markit iTRAXX Japan unchanged at 48bp (YTD change: -3.4bp)

- Markit iTRAXX Asia Ex-Japan up 1.4 bp, now at 82bp (YTD change: +23.4bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Talen Energy Supply LLC (Country: US; rated: B3): down 42.5 bp to 2,795.1bp (1Y range: 875-5,047bp)

- Petroleos Mexicanos (Country: MX; rated: BBB+): down 37.6 bp to 338.6bp (1Y range: 323-569bp)

- Pactiv LLC (Country: US; rated: Caa1): down 25.1 bp to 436.4bp (1Y range: 232-472bp)

- MBIA Inc (Country: US; rated: Ba3): down 23.4 bp to 383.0bp (1Y range: 365-696bp)

- Mattel Inc (Country: US; rated: Ba2): down 21.7 bp to 186.1bp (1Y range: 183-373bp)

- Genworth Holdings Inc (Country: US; rated: B2): down 18.8 bp to 421.0bp (1Y range: 421-681bp)

- NRG Energy Inc (Country: US; rated: Ba1): up 14.2 bp to 204.1bp (1Y range: 108-219bp)

- Amkor Technology Inc (Country: US; rated: BB): up 17.2 bp to 164.0bp (1Y range: 107-173bp)

- Brazil, Federative Republic of (Government) (Country: BR; rated: B): up 20.8 bp to 247.8bp (1Y range: 141-248bp)

- Petroleo Brasileiro SA Petrobras (Country: BR; rated: Ba1): up 21.7 bp to 274.2bp (1Y range: 175-274bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): up 25.6 bp to 426.2bp (1Y range: 336-449bp)

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): up 31.9 bp to 896.5bp (1Y range: 606-1,202bp)

- Xerox Corp (Country: US; rated: LGD4 - 56%): up 35.6 bp to 303.5bp (1Y range: 158-304bp)

- Rite Aid Corp (Country: US; rated: B3): up 40.2 bp to 989.0bp (1Y range: 497-990bp)

- Transocean Inc (Country: KY; rated: Caa3): up 130.7 bp to 1,632.8bp (1Y range: 941-7,398bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Ineos Group Holdings SA (Country: LU; rated: Ba2-PD): down 129.6 bp to 134.9bp (1Y range: 135-447bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 44.1 bp to 694.8bp (1Y range: 464-1,181bp)

- Boparan Finance PLC (Country: GB; rated: WR): down 42.8 bp to 1,246.5bp (1Y range: 528-1,280bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 33.8 bp to 617.5bp (1Y range: 358-646bp)

- CMA CGM SA (Country: FR; rated: Ba3): down 27.1 bp to 299.3bp (1Y range: 259-734bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): down 23.7 bp to 231.2bp (1Y range: 145-272bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 13.0 bp to 156.3bp (1Y range: 107-227bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 8.7 bp to 412.7bp (1Y range: 333-481bp)

- Air France KLM SA (Country: FR; rated: B-): down 8.6 bp to 409.4bp (1Y range: 390-1,211bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 7.8 bp to 169.7bp (1Y range: 166-267bp)

- Stena AB (Country: SE; rated: B2-PD): down 7.8 bp to 449.9bp (1Y range: 401-745bp)

- Thyssenkrupp AG (Country: DE; rated: B1): up 7.9 bp to 256.2bp (1Y range: 206-456bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): up 9.5 bp to 237.5bp (1Y range: 194-393bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 14.4 bp to 408.6bp (1Y range: 339-806bp)

- British Telecommunications PLC (Country: GB; rated: Baa2): up 16.3 bp to 106.7bp (1Y range: 63-107bp)

SELECTED RECENT USD BOND ISSUES

- Asteroid Private Merger Sub Inc (Financial - Other | Delaware, United States | Rating: NR): US$350m Senior Note (US04625PAA93), fixed rate (8.50% coupon) maturing on 15 November 2029, priced at 100.00 (original spread of 717 bp), callable (8nc3)

- Xcel Energy Inc (Utility - Other | Minneapolis, United States | Rating: BBB+): US$300m Senior Note (US98388MAC10), fixed rate (2.35% coupon) maturing on 15 November 2031, priced at 99.72 (original spread of 82 bp), callable (10nc10)

- Xcel Energy Inc (Utility - Other | Minneapolis, United States | Rating: BBB+): US$500m Senior Note (US98388MAB37), fixed rate (1.75% coupon) maturing on 15 March 2027, priced at 99.78 (original spread of 62 bp), callable (5nc5)

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): US$115m Unsecured Note (XS2403427821), floating rate maturing on 30 November 2029, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Bluestar Finance Holdings Ltd (Financial - Other | China (Mainland) | Rating: NR): €600m Unsecured Note (XS2401556480) maturing on 1 November 2026, priced at 100.00, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €200m Unsecured Note (XS2403291078), fixed rate (1.03% coupon) maturing on 25 May 2040, priced at 100.00, non callable

NEW LOANS

- Lear Corp (BBB-), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/29/26 and initial pricing is set at LIBOR +125.000bps

- Granite Holdings Us (CCC+), signed a US$ 250m Delayed Draw Term Loan, to be used for general corporate purposes acquisition financing. It matures on 09/30/26 and initial pricing is set at LIBOR +400bps

NEW ISSUES IN SECURITIZED CREDIT

- Cajun Global 2021-1 issued a fixed-rate ABS backed by business cashflow in 1 tranche offering a yield to maturity of 3.93%, for a total of US$ 225 m. Bookrunners: Barclays Capital Group