Credit

Spreads Widen Across The US Credit Complex, With Rates Volatility And Decreased Inflows Weighing

$3bn offerings from JP Morgan and American Express priced today, while Raytheon added $2.1bn in a pretty good day for investment grade issuance, despite the recent rise in new issue concessions

Published ET

New Issue Concessions For US IG Bonds | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.18% today, with investment grade down -0.19% and high yield down -0.09% (YTD total return: -0.88%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.209% today (Month-to-date: -0.21%; Year-to-date: -1.64%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.027% today (Month-to-date: -0.03%; Year-to-date: 3.37%)

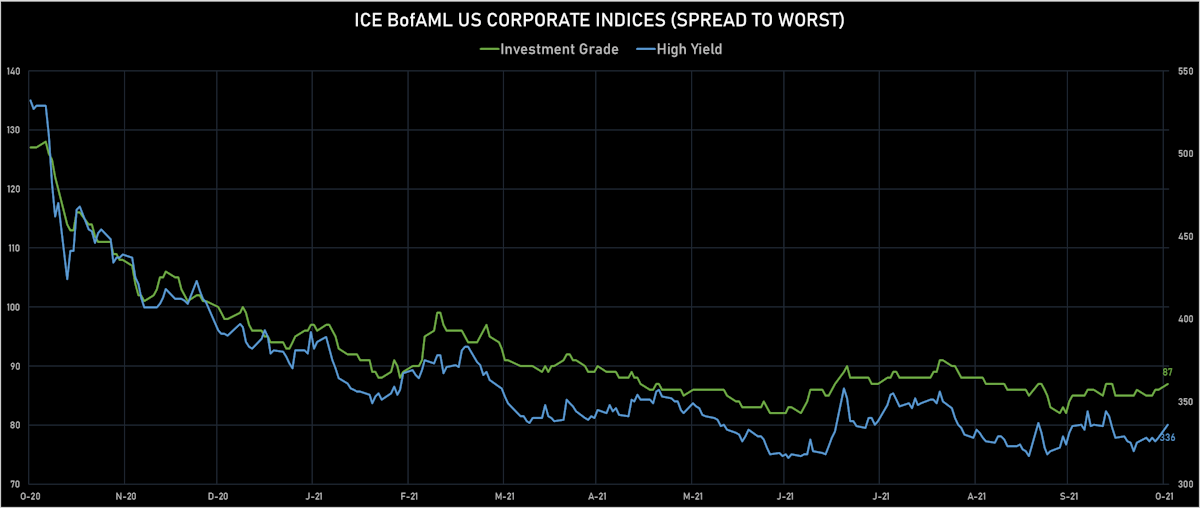

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst up 8.0 bp, now at 336.0 bp (YTD change: -54.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.03% today (YTD total return: +3.2%)

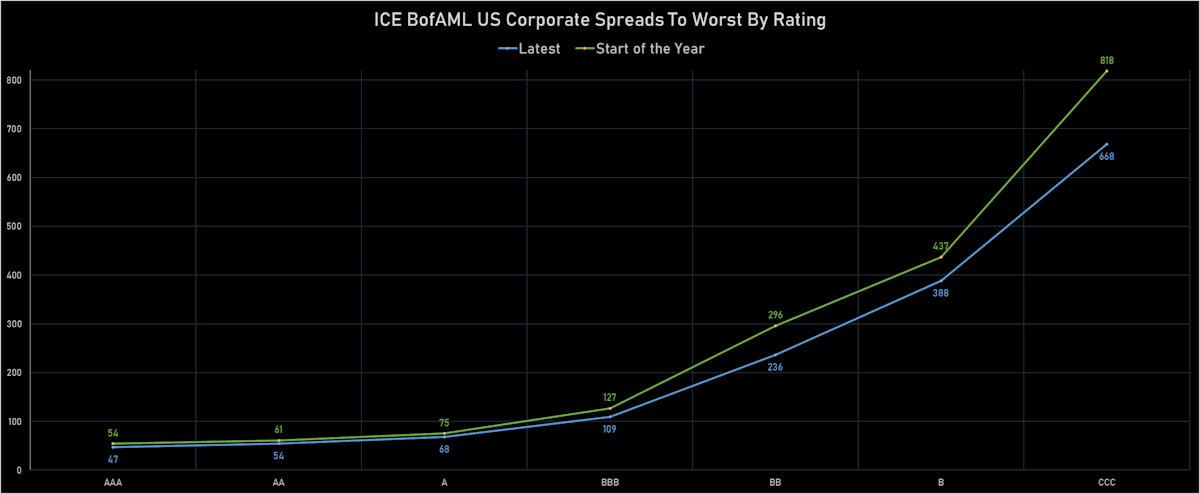

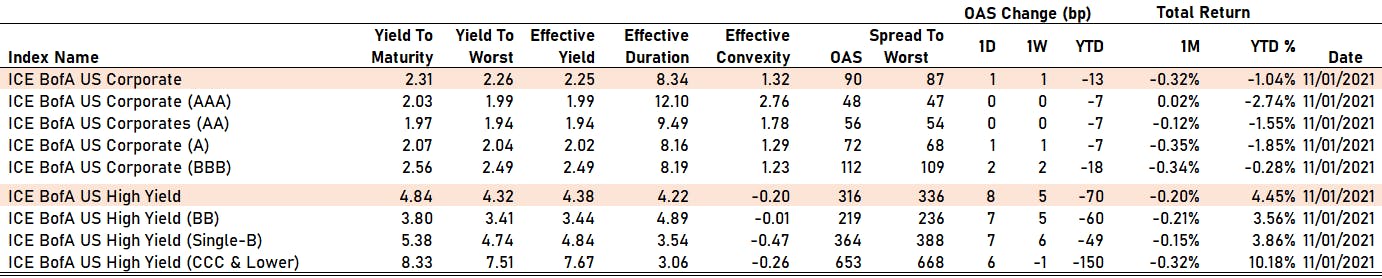

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 48 bp

- AA unchanged at 56 bp

- A up by 1 bp at 72 bp

- BBB up by 2 bp at 112 bp

- BB up by 7 bp at 219 bp

- B up by 7 bp at 364 bp

- CCC up by 6 bp at 653 bp

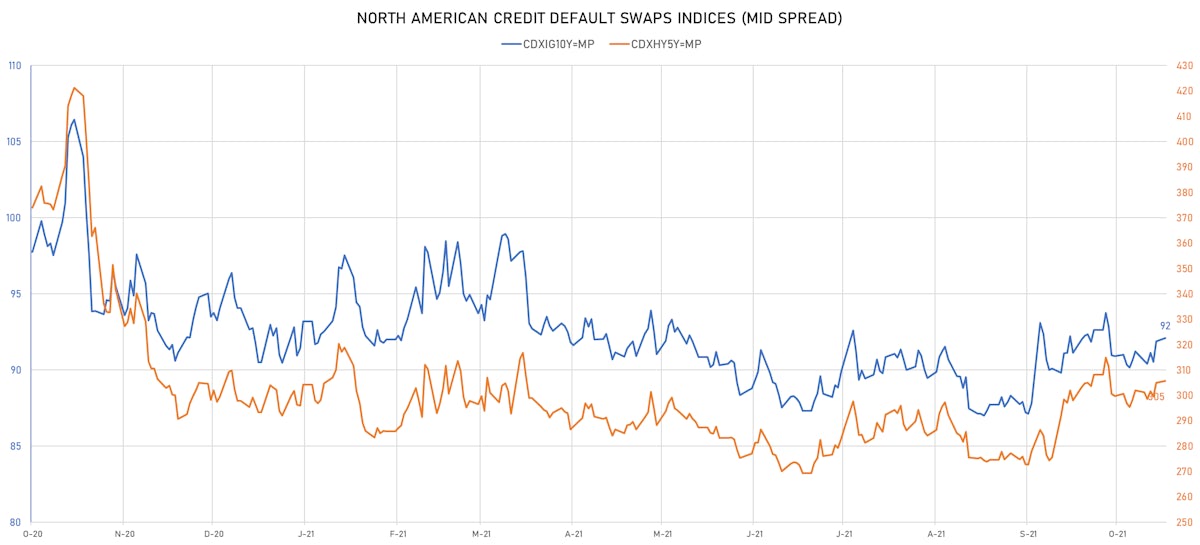

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.2 bp, now at 92bp (YTD change: +1.6bp)

- Markit CDX.NA.HY 5Y up 0.9 bp, now at 306bp (YTD change: +12.5bp)

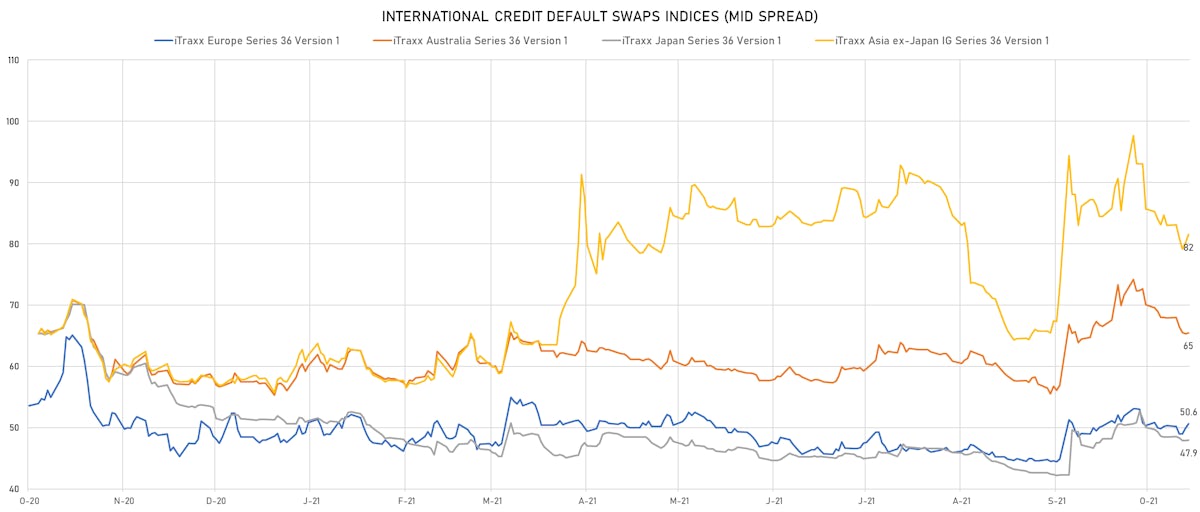

- Markit iTRAXX Europe up 0.3 bp, now at 51bp (YTD change: +3.0bp)

- Markit iTRAXX Japan up 0.1 bp, now at 48bp (YTD change: -3.3bp)

- Markit iTRAXX Asia Ex-Japan up 0.1 bp, now at 82bp (YTD change: +23.5bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread up by 170.1 bp to 1,066.9 bp, with the yield to worst at 10.8% and the bond now trading down to 87.8 cents on the dollar (1Y price range: 87.1-105.8).

- Issuer: Hopson Development Holdings Ltd (Bermuda) | Coupon: 6.80% | Maturity: 28/12/2023 | Rating: B+ | ISIN: XS2353028298 | Z-spread up by 127.6 bp to 1,035.0 bp, with the yield to worst at 10.5% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 83.6-99.9).

- Issuer: StoneCo Ltd (George Town, Cayman Islands) | Coupon: 3.95% | Maturity: 16/6/2028 | Rating: BB- | ISIN: USG85158AA43 | Z-spread up by 61.9 bp to 461.1 bp, with the yield to worst at 5.8% and the bond now trading down to 89.0 cents on the dollar (1Y price range: 89.0-100.0).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Z-spread up by 61.3 bp to 1,400.3 bp, with the yield to worst at 14.6% and the bond now trading down to 70.6 cents on the dollar (1Y price range: 56.6-76.3).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 57.6 bp to 785.3 bp, with the yield to worst at 8.5% and the bond now trading down to 100.1 cents on the dollar (1Y price range: 93.5-102.4).

- Issuer: JSW Steel Ltd (Mumbai, India) | Coupon: 3.95% | Maturity: 5/4/2027 | Rating: BB- | ISIN: USY44680RV38 | Z-spread up by 37.2 bp to 293.0 bp, with the yield to worst at 4.0% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 94.6-100.8).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B+ | ISIN: USU98347AL87 | Z-spread up by 35.6 bp to 395.5 bp, with the yield to worst at 5.0% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 100.0-108.1).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 30.7 bp to 707.3 bp, with the yield to worst at 7.9% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 97.1-105.9).

- Issuer: Banco Safra SA (Cayman Islands Branch) (George Town, Cayman Islands) | Coupon: 4.13% | Maturity: 8/2/2023 | Rating: BB- | ISIN: US05964TAQ22 | Z-spread down by 29.6 bp to 163.3 bp, with the yield to worst at 1.8% and the bond now trading up to 102.6 cents on the dollar (1Y price range: 102.2-104.8).

- Issuer: CALC Bond 3 Ltd (British Virgin Islands) | Coupon: 5.50% | Maturity: 8/3/2024 | Rating: BB | ISIN: XS1574821143 | Z-spread down by 30.2 bp to 907.1 bp, with the yield to worst at 9.1% and the bond now trading up to 91.5 cents on the dollar (1Y price range: 79.0-95.3).

- Issuer: Turkiye Is Bankasi AS (Ankara, Turkey) | Coupon: 6.13% | Maturity: 25/4/2024 | Rating: B- | ISIN: XS1578203462 | Z-spread down by 31.1 bp to 430.2 bp (CDS basis: 182.1bp), with the yield to worst at 4.9% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 97.0-105.0).

- Issuer: Bank Muscat SAOG (Muscat, Oman) | Coupon: 4.88% | Maturity: 14/3/2023 | Rating: BB- | ISIN: XS1789474274 | Z-spread down by 31.8 bp to 219.3 bp, with the yield to worst at 2.4% and the bond now trading up to 103.0 cents on the dollar (1Y price range: 101.3-104.5).

- Issuer: Turkiye Vakiflar Bankasi TAO (#N/A, Turkey) | Coupon: 5.50% | Maturity: 1/10/2026 | Rating: B+ | ISIN: XS2386558113 | Z-spread down by 33.1 bp to 524.6 bp, with the yield to worst at 6.3% and the bond now trading up to 96.4 cents on the dollar (1Y price range: 94.9-99.9).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 5.50% | Maturity: 1/11/2023 | Rating: B+ | ISIN: USU85656AE39 | Z-spread down by 45.8 bp to 179.1 bp, with the yield to worst at 2.2% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 103.4-105.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: BB | ISIN: XS2288109676 | Z-spread up by 32.2 bp to 236.0 bp (CDS basis: 6.7bp), with the yield to worst at 2.4% and the bond now trading down to 94.2 cents on the dollar (1Y price range: 94.0-100.1).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 5.50% | Maturity: 24/2/2025 | Rating: BB- | ISIN: XS0213101073 | Z-spread down by 20.6 bp to 278.9 bp (CDS basis: -36.0bp), with the yield to worst at 2.5% and the bond now trading up to 108.8 cents on the dollar (1Y price range: 104.9-110.4).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread down by 20.9 bp to 367.8 bp, with the yield to worst at 3.5% and the bond now trading up to 96.6 cents on the dollar (1Y price range: 96.2-99.4).

- Issuer: CyrusOne LP (Dallas, Texas (US)) | Coupon: 1.45% | Maturity: 22/1/2027 | Rating: BB+ | ISIN: XS2089972629 | Z-spread down by 23.1 bp to 126.3 bp, with the yield to worst at 1.2% and the bond now trading up to 100.6 cents on the dollar (1Y price range: 99.4-103.1).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread down by 28.0 bp to 232.2 bp (CDS basis: -54.0bp), with the yield to worst at 2.1% and the bond now trading up to 101.9 cents on the dollar (1Y price range: 97.9-103.7).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 1.74% | Maturity: 19/7/2024 | Rating: BB | ISIN: XS2116728895 | Z-spread down by 42.7 bp to 131.4 bp (CDS basis: -11.6bp), with the yield to worst at 1.0% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 98.7-102.6).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.50% | Maturity: 26/7/2024 | Rating: BB- | ISIN: XS1652965085 | Z-spread down by 49.5 bp to 487.4 bp, with the yield to worst at 4.5% and the bond now trading up to 91.9 cents on the dollar (1Y price range: 80.9-99.2).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.13% | Maturity: 15/10/2024 | Rating: BB- | ISIN: XS1439749281 | Z-spread down by 51.3 bp to 256.7 bp, with the yield to worst at 2.3% and the bond now trading up to 96.3 cents on the dollar (1Y price range: 92.5-96.8).

SELECTED RECENT USD BOND ISSUES

- American Express Co (Banking | New York City, United States | Rating: BBB+): US$1,100m Senior Note (US025816CM94), fixed rate (1.65% coupon) maturing on 4 November 2026, priced at 99.84 (original spread of 50 bp), callable (5nc5)

- American Express Co (Banking | New York City, United States | Rating: BBB+): US$500m Senior Note (US025816CL12), floating rate (SOFR + 65.0 bp) maturing on 4 November 2026, priced at 100.00, callable (5nc5)

- American Express Co (Banking | New York City, New York, United States | Rating: BBB+): US$800m Senior Note (US025816CK39), fixed rate (0.75% coupon) maturing on 3 November 2023, priced at 99.99 (original spread of 25 bp), non callable

- American Express Co (Banking | New York City, United States | Rating: BBB+): US$600m Senior Note (US025816CJ65), floating rate (SOFR + 23.0 bp) maturing on 3 November 2023, priced at 100.00, non callable

- Duke Realty Partnership Ltd (Service - Other | Indianapolis, Indiana, United States | Rating: BBB+): US$500m Senior Note (US264414AX11), fixed rate (2.25% coupon) maturing on 15 January 2032, priced at 98.82 (original spread of 82 bp), callable (10nc10)

- Invitation Homes Operating Partnership LP (Financial - Other | Dallas, Texas, United States | Rating: BBB-): US$400m Senior Note (US46188BAC63), fixed rate (2.70% coupon) maturing on 15 January 2034, priced at 99.81 (original spread of 115 bp), callable (12nc12)

- Invitation Homes Operating Partnership LP (Financial - Other | Dallas, Texas, United States | Rating: BBB-): US$600m Senior Note (US46188BAB80), fixed rate (2.30% coupon) maturing on 15 November 2028, priced at 99.87 (original spread of 87 bp), callable (7nc7)

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$3,000m Senior Note (US46647PCR55), floating rate maturing on 8 November 2032, priced at 100.00, callable (11nc10)

- Molina Healthcare Inc (Health Care Facilities | Long Beach, United States | Rating: BB-): US$750m Senior Note (USU60868AE36), fixed rate (3.88% coupon) maturing on 15 May 2032, priced at 100.00, callable (11nc10)

- Nationstar Mortgage Holdings Inc (Mortgage Banking | Coppell, United States | Rating: B+): US$600m Senior Note (US63861CAE93), fixed rate (5.75% coupon) maturing on 15 November 2031, priced at 100.00 (original spread of 418 bp), callable (10nc5)

- Navient Corp (Financial - Other | Wilmington, United States | Rating: BB-): US$750m Senior Note (US63938CAM01), fixed rate (5.50% coupon) maturing on 15 March 2029, priced at 100.00 (original spread of 404 bp), callable (7nc7)

- Raytheon Technologies Corp (Aerospace | Waltham, United States | Rating: BBB+): US$1,100m Senior Note (US75513ECP43), fixed rate (3.03% coupon) maturing on 15 March 2052, priced at 99.96 (original spread of 105 bp), callable (30nc30)

- Raytheon Technologies Corp (Aerospace | Waltham, Massachusetts, United States | Rating: BBB+): US$1,000m Senior Note (US75513ECN94), fixed rate (2.38% coupon) maturing on 15 March 2032, priced at 99.98 (original spread of 80 bp), callable (10nc10)

- Republic Services Inc (Service - Other | Phoenix, United States | Rating: BBB): US$700m Senior Note (US760759BA74), fixed rate (2.38% coupon) maturing on 15 March 2033, priced at 99.79 (original spread of 83 bp), callable (11nc11)

- Ryder System Inc (Service - Other | Medley, Florida, United States | Rating: BBB): US$300m Senior Note (US78355HKS75), fixed rate (1.75% coupon) maturing on 1 September 2026, priced at 99.88 (original spread of 60 bp), callable (5nc5)

- Southwestern Electric Power Co (Utility - Other | Columbus, United States | Rating: BBB): US$650m Senior Note (US845437BT80), fixed rate (3.25% coupon) maturing on 1 November 2051, priced at 99.64 (original spread of 130 bp), callable (30nc30)

SELECTED RECENT EUR BOND ISSUES

- Compagnie Immobiliere de Belgique SA (Home Builders | Brussels, Bruxelles-Capitale, Belgium | Rating: NR): €125m Bond (BE0002827088), fixed rate (3.00% coupon) maturing on 12 May 2028, priced at 101.88, non callable

- Hellenic Bank PCL (Banking | Nicosia, Cyprus | Rating: B): €200m Unsecured Note (XS2404028156) maturing on 2 November 2026, priced at 100.00, non callable

NEW LOANS

- Watlow Elec Mnfg Co, signed a US$ 512m Term Loan B maturing on 03/19/28, to be used for general corporate purposes.

NEW ISSUES IN SECURITIZED CREDIT

- Benchmark 2021-B30 Mortgage Trust issued a fixed-rate CMBS in 8 tranches, for a total of US$ 811 m. Highest-rated tranche offering a yield to maturity of 1.19%, and the lowest-rated tranche a yield to maturity of 2.63%. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc, Deutsche Bank Securities Inc, Citigroup Global Markets Inc

- Eagle Re 2021-2 Ltd issued a floating-rate RMBS in 5 tranches, for a total of US$ 484 m. Highest-rated tranche offering a spread over the floating rate of 155bp, and the lowest-rated tranche a spread of 500bp. Bookrunners: Credit Suisse, Goldman Sachs & Co, Barclays Capital Group, RBC Capital Markets, Citigroup Global Markets Inc, Bank of America Merrill Lynch

- Med Trust 2021-Mdln issued a floating-rate CMBS in 8 tranches, for a total of US$ 2,119 m. Highest-rated tranche offering a spread over the floating rate of 95bp, and the lowest-rated tranche a spread of 525bp. Bookrunners: Goldman Sachs & Co, Morgan Stanley International Ltd, JP Morgan & Co Inc, Barclays Capital Group, Bank of America Merrill Lynch

- Cajun Global 2021-1 issued a fixed-rate ABS backed by business cashflow in 1 tranche offering a yield to maturity of 3.93%, for a total of US$ 225 m. Bookrunners: Barclays Capital Group