Credit

USD Cash Spreads Widen But Bonds Rise With Lower Rates Across The Curve

Israeli pharma company Teva Pharmaceutical was the leading corporate bond issuer today, printing a dual currency offering that raised € 2.6bn and US$ 2bn

Published ET

Brazil & Colombia 5Y Sovereign USD CDS Spreads | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.21% today, with investment grade up 0.23% and high yield up 0.07% (YTD total return: -0.67%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.270% today (Month-to-date: 0.06%; Year-to-date: -1.38%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.052% today (Month-to-date: 0.03%; Year-to-date: 3.42%)

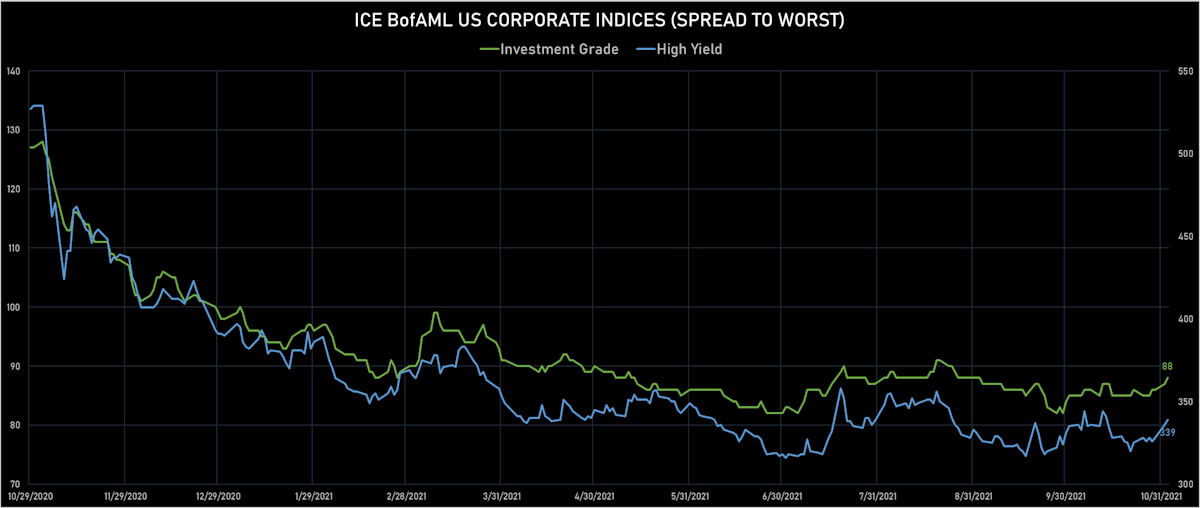

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst up 3.0 bp, now at 339.0 bp (YTD change: -51.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +3.2%)

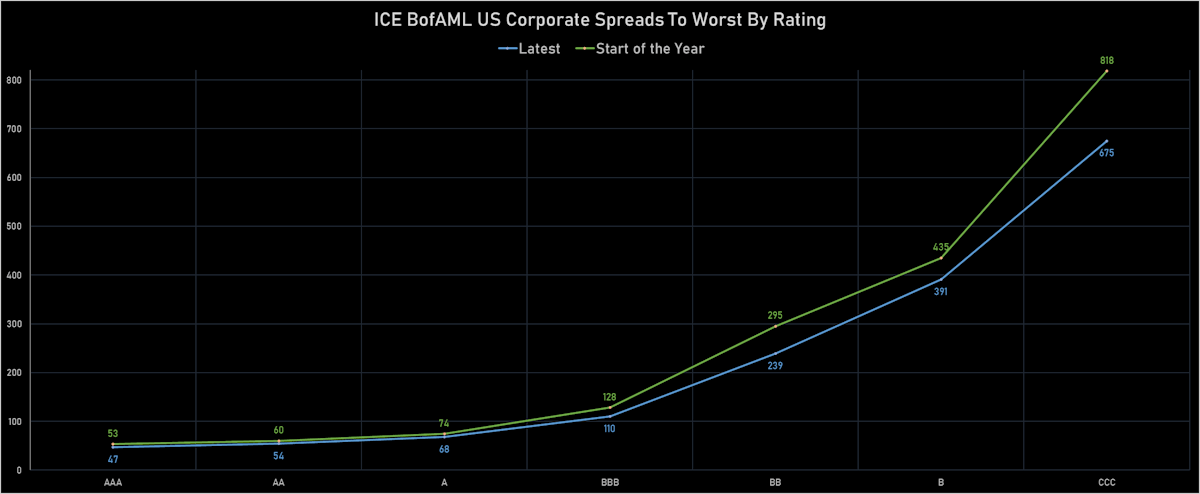

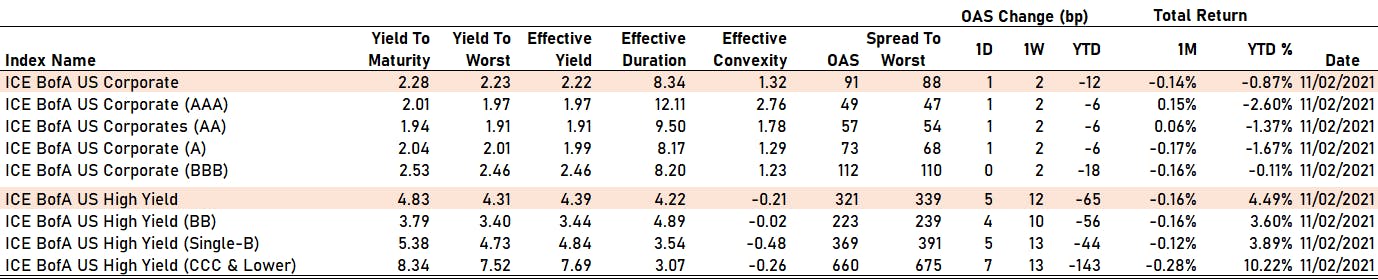

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 49 bp

- AA up by 1 bp at 57 bp

- A up by 1 bp at 73 bp

- BBB unchanged at 112 bp

- BB up by 4 bp at 223 bp

- B up by 5 bp at 369 bp

- CCC up by 7 bp at 660 bp

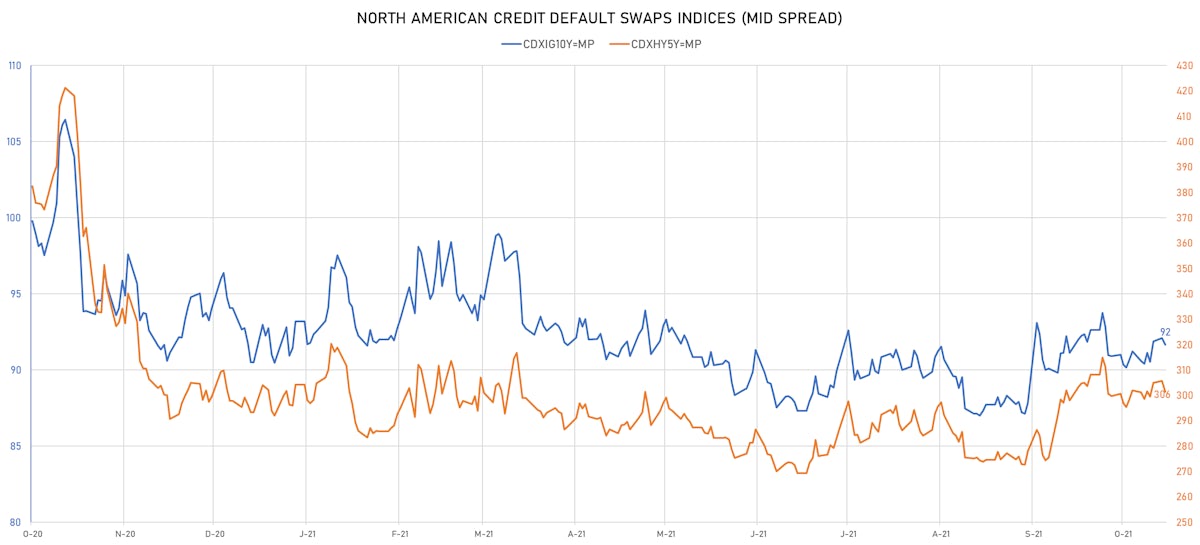

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.4 bp, now at 92bp (YTD change: +1.1bp)

- Markit CDX.NA.HY 5Y down 4.5 bp, now at 301bp (YTD change: +8.1bp)

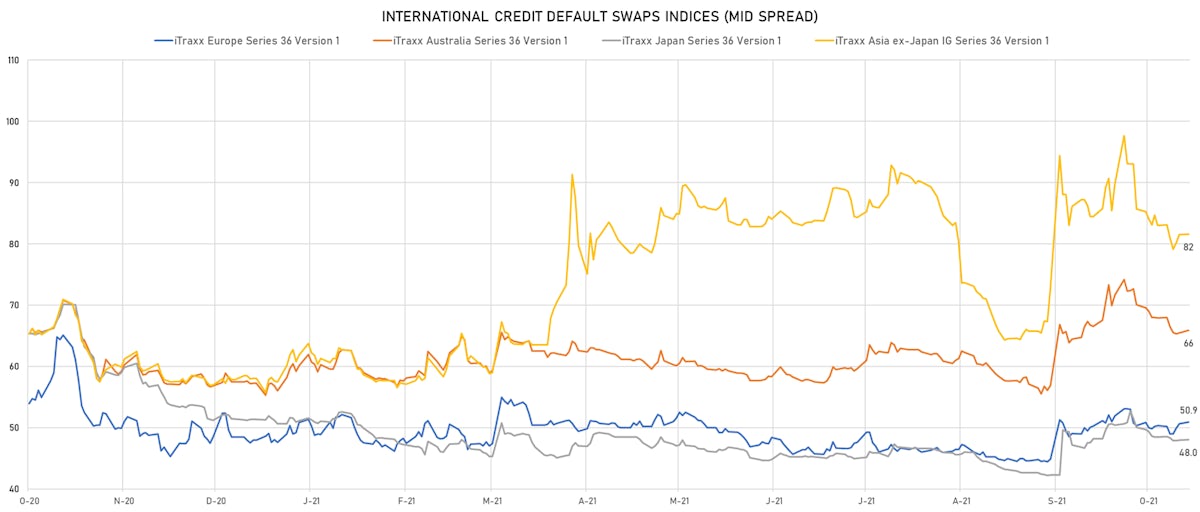

- Markit iTRAXX Europe down 0.4 bp, now at 51bp (YTD change: +2.6bp)

- Markit iTRAXX Japan up 0.1 bp, now at 48bp (YTD change: -3.3bp)

- Markit iTRAXX Asia Ex-Japan up 1.0 bp, now at 83bp (YTD change: +24.5bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Avis Budget Group Inc (Country: US; rated: CCC): down 33.9 bp to 174.2bp (1Y range: 174-604bp)

- Genworth Holdings Inc (Country: US; rated: B2): down 26.6 bp to 404.2bp (1Y range: 404-681bp)

- MBIA Inc (Country: US; rated: Ba3): down 17.5 bp to 382.3bp (1Y range: 365-676bp)

- Petroleos Mexicanos (Country: MX; rated: BBB+): down 16.8 bp to 343.0bp (1Y range: 323-569bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): down 14.5 bp to 284.7bp (1Y range: 285-776bp)

- Italy, Republic of (Government) (Country: IT; rated: BBB+): up 13.1 bp to 84.2bp (1Y range: 69-123bp)

- Domtar Corp (Country: US; rated: Ba2): up 13.2 bp to 412.4bp (1Y range: 65-412bp)

- Greece, Republic of (Government) (Country: GR; rated: BB): up 13.3 bp to 87.0bp (1Y range: 69-138bp)

- Colombia, Republic of (Government) (Country: CO; rated: BB+): up 13.5 bp to 167.5bp (1Y range: 85-175bp)

- Realogy Group LLC (Country: US; rated: B2): up 16.4 bp to 310.3bp (1Y range: 278-464bp)

- Vale SA (Country: BR; rated: WR): up 19.6 bp to 203.5bp (1Y range: 126-211bp)

- Brazil, Federative Republic of (Government) (Country: BR; rated: B): up 24.6 bp to 253.7bp (1Y range: 141-254bp)

- Petroleo Brasileiro SA Petrobras (Country: BR; rated: Ba1): up 27.0 bp to 283.7bp (1Y range: 175-284bp)

- Transocean Inc (Country: KY; rated: Caa3): up 93.3 bp to 1,640.4bp (1Y range: 941-7,398bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Ineos Group Holdings SA (Country: LU; rated: Ba2-PD): down 75.5 bp to 132.2bp (1Y range: 132-438bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 51.3 bp to 586.8bp (1Y range: 358-646bp)

- Air France KLM SA (Country: FR; rated: B-): down 11.7 bp to 407.7bp (1Y range: 390-1,189bp)

- CMA CGM SA (Country: FR; rated: Ba3): down 10.6 bp to 298.0bp (1Y range: 259-734bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 8.7 bp to 267.2bp (1Y range: 188-280bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): up 9.1 bp to 201.7bp (1Y range: -202bp)

- Rexel SA (Country: FR; rated: WR): up 9.3 bp to 146.1bp (1Y range: -146bp)

- British Telecommunications PLC (Country: GB; rated: Baa2): up 9.3 bp to 112.7bp (1Y range: 63-113bp)

- Thyssenkrupp AG (Country: DE; rated: B1): up 10.1 bp to 257.4bp (1Y range: 206-444bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 11.6 bp to 216.1bp (1Y range: 154-273bp)

- TUI AG (Country: DE; rated: B3-PD): up 14.5 bp to 679.1bp (1Y range: 607-1,565bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): up 15.3 bp to 193.4bp (1Y range: 149-218bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 15.7 bp to 704.4bp (1Y range: 464-1,092bp)

- Novafives SAS (Country: FR; rated: Caa1): up 28.8 bp to 772.0bp (1Y range: 660-1,205bp)

- Boparan Finance PLC (Country: GB; rated: WR): up 31.9 bp to 1,269.6bp (1Y range: 528-1,280bp)

SELECTED RECENT USD BOND ISSUES

- Arthur J Gallagher & Co (Financial - Other | Rolling Meadows, United States | Rating: BBB): US$350m Senior Note (US04316JAB52), fixed rate (3.05% coupon) maturing on 9 March 2052, priced at 98.97 (original spread of 115 bp), callable (30nc30)

- Arthur J. Gallagher (Bermuda) Holding Partnership (Financial - Other | United States | Rating: NR): US$400m Senior Note (US04316JAA79), fixed rate (2.40% coupon) maturing on 9 November 2031, priced at 99.57 (original spread of 90 bp), callable (10nc10)

- Corporate Office Properties LP (Real Estate Investment Trust | Columbia, Maryland, United States | Rating: BBB-): US$400m Senior Note (US22003BAP13), fixed rate (2.90% coupon) maturing on 1 December 2033, priced at 99.53 (original spread of 140 bp), callable (12nc12)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$118m Bond (US3133ENDM93), fixed rate (0.74% coupon) maturing on 1 October 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$282m Bond (US3133ENDJ64), floating rate (SOFR + 8.0 bp) maturing on 8 November 2024, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$250m Bond (US3130APSV82), fixed rate (2.00% coupon) maturing on 23 February 2032, priced at 100.00, callable (10nc1)

- Jane Street Group LLC (Financial - Other | New York City, New York, United States | Rating: BB-): US$600m Note (US47077WAA62), fixed rate (4.50% coupon) maturing on 15 November 2029, priced at 100.00 (original spread of 307 bp), callable (8nc3)

- PACCAR Financial Corp (Financial - Other | Bellevue, Washington, United States | Rating: A+): US$300m Senior Note (US69371RR571), fixed rate (0.90% coupon) maturing on 8 November 2024, priced at 99.99 (original spread of 18 bp), non callable

- Amipeace Ltd (Financial - Other | Tortola, China (Mainland) | Rating: NR): US$600m Senior Note (XS2390145006), fixed rate (1.75% coupon) maturing on 9 November 2026, priced at 99.22 (original spread of 75 bp), non callable

- Deutsche Bank AG (New York Branch) (Banking | New York City, Germany | Rating: NR): US$750m Note (US251526CL15), floating rate (SOFR + 50.0 bp) maturing on 8 November 2023, priced at 100.00, non callable

- National Power Company Ukrenergo PJSC (Utility - Other | Kiev, Kiev, Ukraine | Rating: NR): US$825m Senior Note (XS2404309754), fixed rate (6.88% coupon) maturing on 9 November 2026, priced at 100.00 (original spread of 573 bp), non callable

- Teva Pharmaceutical Finance Netherlands III BV (Financial - Other | Amsterdam, Israel | Rating: BB-): US$1,000m Senior Note (US88167AAQ40), fixed rate (5.13% coupon) maturing on 9 May 2029, priced at 100.00 (original spread of 370 bp), callable (8nc7)

- Teva Pharmaceutical Finance Netherlands III BV (Financial - Other | Amsterdam, Israel | Rating: BB-): US$1,000m Senior Note (US88167AAP66), fixed rate (4.75% coupon) maturing on 9 May 2027, priced at 100.00 (original spread of 353 bp), callable (5nc5)

SELECTED RECENT EUR BOND ISSUES

- Danone SA (Food Processors | Paris, Ile-De-France, France | Rating: BBB+): €700m Bond (FR0014006FE2), fixed rate (0.52% coupon) maturing on 9 November 2030, priced at 100.00 (original spread of 76 bp), callable (9nc9)

- General Mills Inc (Food Processors | Minneapolis, United States | Rating: BBB): €500m Senior Note (XS2405467528), fixed rate (0.13% coupon) maturing on 15 November 2025, priced at 99.74 (original spread of 74 bp), callable (4nc4)

- Goldman Sachs Group Inc (Banking | New York City, New York, United States | Rating: BBB+): €1,000m Senior Note (XS2404642923), fixed rate (0.88% coupon) maturing on 9 May 2029, priced at 99.93 (original spread of 123 bp), callable (8nc7)

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €500m Senior Note (XS2405489092), fixed rate (0.05% coupon) maturing on 31 January 2031, priced at 99.78 (original spread of 0 bp), non callable

- Remni SpA (Financial - Other | Milan, Italy | Rating: NR): €110m Bond (IT0005461501), floating rate (EU06MLIB + 0.0 bp) maturing on 4 November 2028, priced at 100.00, non callable

- Saxony-Anhalt, State of (Official and Muni | Magdeburg, Sachsen-Anhalt, Germany | Rating: AA): €1,000m Jumbo Landesschatzanweisung (DE000A3MP7P2), fixed rate (0.01% coupon) maturing on 9 November 2026, priced at 100.63 (original spread of 34 bp), non callable

- Sparebank 1 SR Bank ASA (Banking | Stavanger, Rogaland, Norway | Rating: A-): €500m Note (XS2406010285), fixed rate (0.25% coupon) maturing on 9 November 2026, priced at 99.84 (original spread of 76 bp), non callable

- TenneT Holding BV (Utility - Other | Arnhem, Gelderland, Netherlands | Rating: A-): €1,000m Senior Note (XS2406569579), fixed rate (0.88% coupon) maturing on 16 June 2035, priced at 99.52 (original spread of 98 bp), callable (14nc13)

- Teva Pharmaceutical Finance Netherlands II BV (Financial - Other | Amsterdam, Israel | Rating: NR): €1,500m Senior Note (XS2406607171), fixed rate (4.38% coupon) maturing on 9 May 2030, priced at 100.00 (original spread of 465 bp), callable (9nc8)

- Teva Pharmaceutical Finance Netherlands II BV (Financial - Other | Amsterdam, Israel | Rating: NR): €1,100m Senior Note (XS2406607098), fixed rate (3.75% coupon) maturing on 9 May 2027, priced at 100.00 (original spread of 422 bp), callable (5nc5)

- Volvo Treasury AB (Financial - Other | Goeteborg, Vastra Gotalands, Sweden | Rating: NR): €600m Senior Note (XS2402009539) zero coupon maturing on 9 May 2024, priced at 100.22 (original spread of 59 bp), callable (2nc2)

NEW LOANS

- Parts Authority Inc, signed a US$ 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/28/25 and initial pricing is set at LIBOR +175bps

- Penn Pharmaceutical Services L, signed a US$ 510m Term Loan B, to be used for acquisition financing. It matures on 11/30/27 and initial pricing is set at LIBOR +375bps

- Penn Pharmaceutical Services L, signed a US$ 140m Term Loan, to be used for acquisition financing. It matures on 11/30/28 and initial pricing is set at LIBOR +700bps

- United Natural Foods Inc (B-), signed a US$ 844m Term Loan B, to be used for general corporate purposes. It matures on 10/22/25 and initial pricing is set at LIBOR +325bps