Credit

Spreads Tighten Across The US Credit Complex, IG Prices Fall With Higher Rates

Very little issuance today in US dollars or Euros, but a few Chinese issuers printed dollar bonds, including investment grade real estate developer Jinan Urban Construction International with a $500m 3Y senior note yielding 2.30% (155 bp spread to US Treasuries)

Published ET

ICE BofA China Dollar Issuers High Yield vs Investment Grade Total Return Indices | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.25% today, with investment grade down -0.27% and high yield down -0.04% (YTD total return: -0.92%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.208% today (Month-to-date: -0.15%; Year-to-date: -1.58%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.006% today (Month-to-date: 0.02%; Year-to-date: 3.42%)

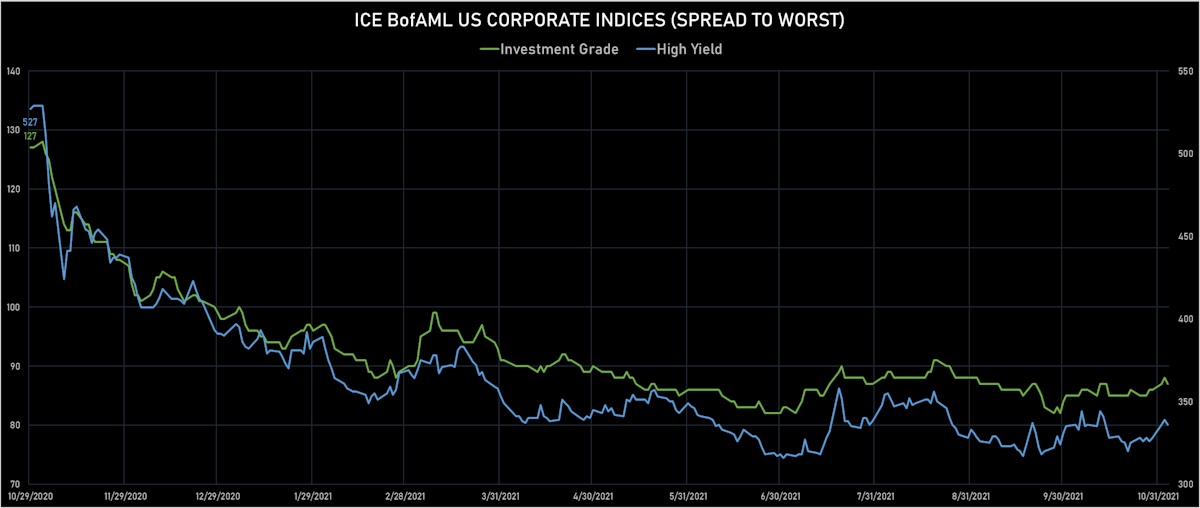

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 336.0 bp (YTD change: -54.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.03% today (YTD total return: +3.2%)

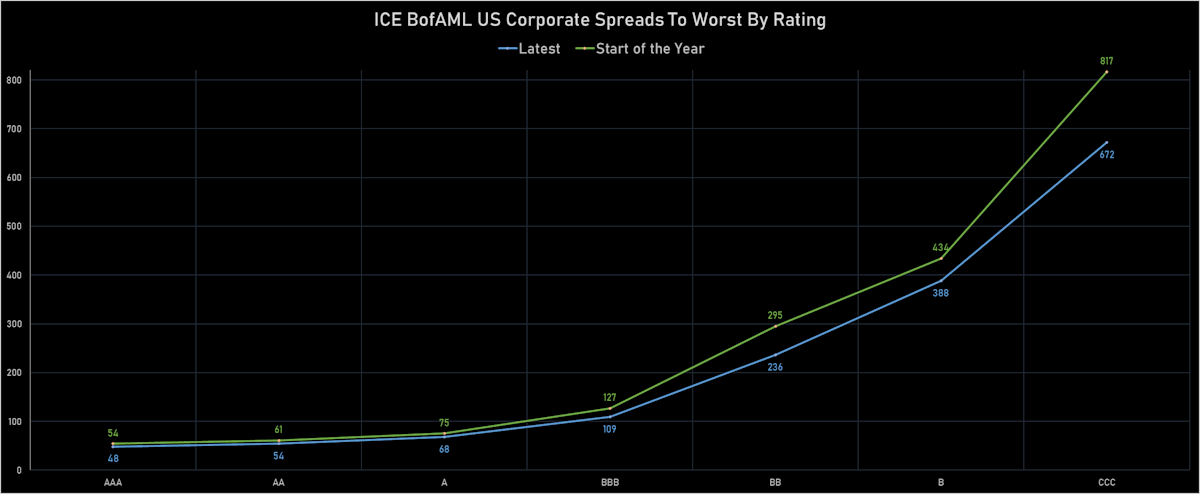

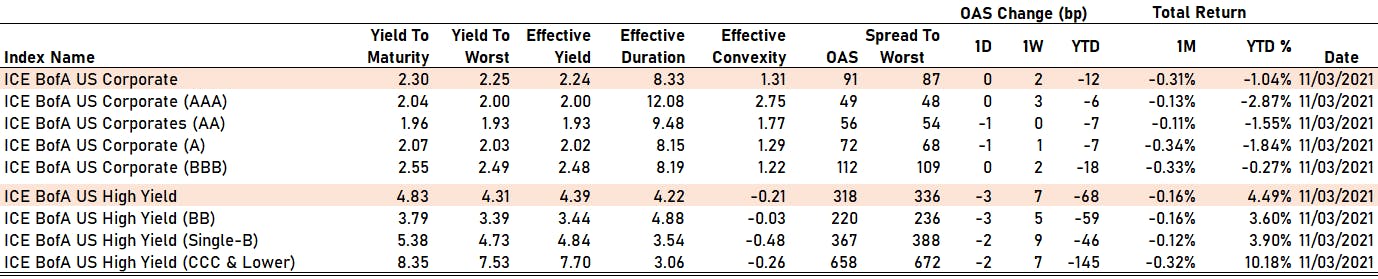

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 49 bp

- AA down by -1 bp at 56 bp

- A down by -1 bp at 72 bp

- BBB unchanged at 112 bp

- BB down by -3 bp at 220 bp

- B down by -2 bp at 367 bp

- CCC down by -2 bp at 658 bp

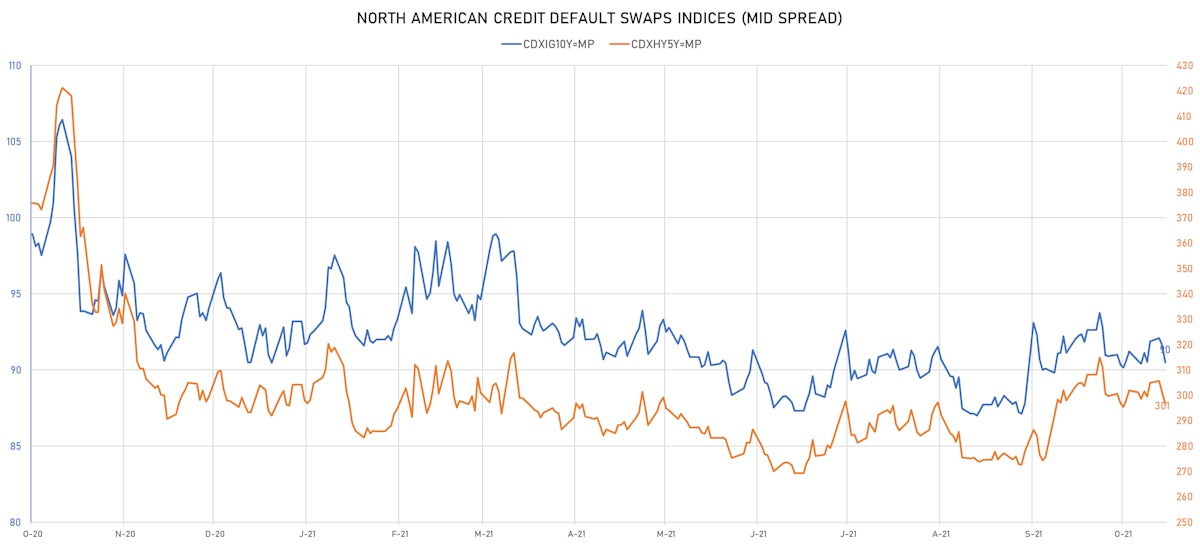

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.2 bp, now at 90bp (YTD change: 0.0bp)

- Markit CDX.NA.HY 5Y down 4.6 bp, now at 297bp (YTD change: +3.4bp)

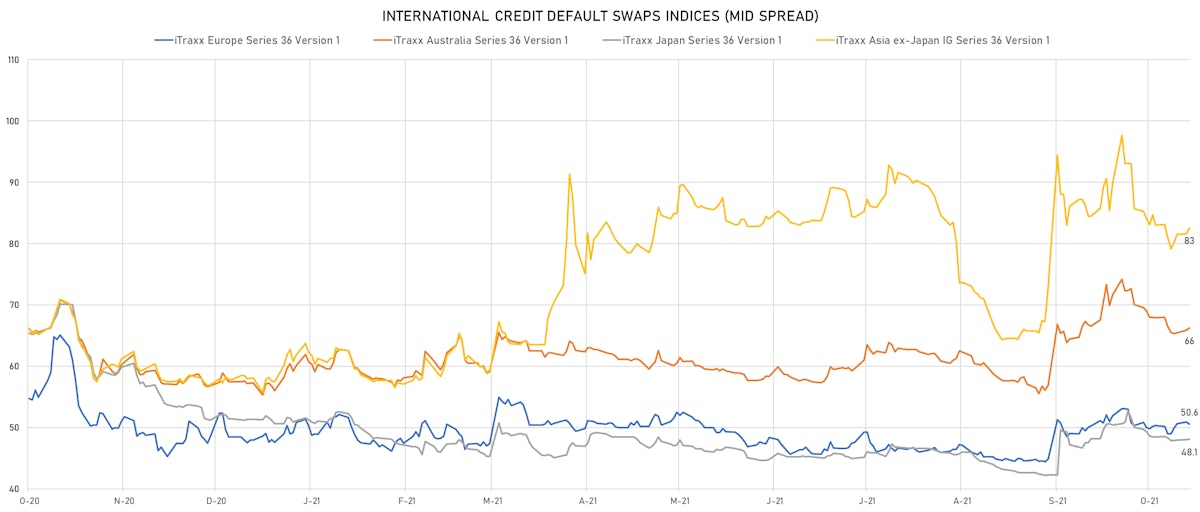

- Markit iTRAXX Europe down 0.1 bp, now at 50bp (YTD change: +2.5bp)

- Markit iTRAXX Japan unchanged at 48bp (YTD change: -3.3bp)

- Markit iTRAXX Asia Ex-Japan down 1.0 bp, now at 82bp (YTD change: +23.5bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Hopson Development Holdings Ltd (Bermuda) | Coupon: 6.80% | Maturity: 28/12/2023 | Rating: B+ | ISIN: XS2353028298 | Z-spread up by 110.7 bp to 1,066.6 bp, with the yield to worst at 10.8% and the bond now trading down to 91.5 cents on the dollar (1Y price range: 83.6-99.9).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Z-spread up by 79.9 bp to 1,442.4 bp, with the yield to worst at 15.0% and the bond now trading down to 69.4 cents on the dollar (1Y price range: 56.6-76.3).

- Issuer: Gemdale Ever Prosperity Investment Ltd (Hong Kong) | Coupon: 4.95% | Maturity: 12/8/2024 | Rating: BB- | ISIN: XS2357443410 | Z-spread up by 66.7 bp to 550.7 bp, with the yield to worst at 5.9% and the bond now trading down to 96.6 cents on the dollar (1Y price range: 93.3-102.0).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CCC- | ISIN: USU96217AA99 | Z-spread up by 51.9 bp to 703.8 bp, with the yield to worst at 7.6% and the bond now trading down to 99.9 cents on the dollar (1Y price range: 67.5-104.8).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 43.6 bp to 837.0 bp, with the yield to worst at 9.0% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 93.5-102.4).

- Issuer: StoneCo Ltd (George Town, Cayman Islands) | Coupon: 3.95% | Maturity: 16/6/2028 | Rating: BB- | ISIN: USG85158AA43 | Z-spread up by 41.9 bp to 456.8 bp, with the yield to worst at 5.8% and the bond now trading down to 89.0 cents on the dollar (1Y price range: 89.0-100.0).

- Issuer: JSW Steel Ltd (Mumbai, India) | Coupon: 3.95% | Maturity: 5/4/2027 | Rating: BB- | ISIN: USY44680RV38 | Z-spread up by 36.0 bp to 288.4 bp, with the yield to worst at 4.1% and the bond now trading down to 98.7 cents on the dollar (1Y price range: 94.6-100.8).

- Issuer: Periama Holdings LLC (Baytown, Texas (US)) | Coupon: 5.95% | Maturity: 19/4/2026 | Rating: BB- | ISIN: XS2224065289 | Z-spread up by 30.7 bp to 307.0 bp, with the yield to worst at 4.0% and the bond now trading down to 107.0 cents on the dollar (1Y price range: 104.1-109.3).

- Issuer: Multibank Inc (PANAMA CITY, Panama) | Coupon: 4.38% | Maturity: 9/11/2022 | Rating: BB+ | ISIN: USP69895AA12 | Z-spread up by 28.2 bp to 255.3 bp, with the yield to worst at 2.7% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 101.5-103.5).

- Issuer: Global Ports Finance PLC (Limassol, Cyprus) | Coupon: 6.50% | Maturity: 22/9/2023 | Rating: BB | ISIN: XS1405775450 | Z-spread down by 38.7 bp to 112.9 bp, with the yield to worst at 1.2% and the bond now trading up to 108.8 cents on the dollar (1Y price range: 107.6-111.0).

- Issuer: Banco Safra SA (Cayman Islands Branch) (George Town, Cayman Islands) | Coupon: 4.13% | Maturity: 8/2/2023 | Rating: BB- | ISIN: US05964TAQ22 | Z-spread down by 46.3 bp to 143.4 bp, with the yield to worst at 1.6% and the bond now trading up to 102.8 cents on the dollar (1Y price range: 102.2-104.8).

- Issuer: Olin Corp (Clayton, Missouri (US)) | Coupon: 9.50% | Maturity: 1/6/2025 | Rating: BB | ISIN: USU67959AA19 | Z-spread down by 50.6 bp to 79.3 bp (CDS basis: 16.0bp), with the yield to worst at 1.7% and the bond now trading up to 124.8 cents on the dollar (1Y price range: 122.6-125.9).

- Issuer: Ecobank Transnational Incorporated SA (LOME, Togo) | Coupon: 9.50% | Maturity: 18/4/2024 | Rating: B- | ISIN: XS1826862556 | Z-spread down by 85.4 bp to 464.3 bp, with the yield to worst at 5.0% and the bond now trading up to 109.4 cents on the dollar (1Y price range: 106.5-109.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: BB | ISIN: XS1419869885 | Z-spread up by 41.7 bp to 190.4 bp (CDS basis: -19.4bp), with the yield to worst at 1.7% and the bond now trading down to 107.8 cents on the dollar (1Y price range: 107.5-111.3).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: BB- | ISIN: XS1731858715 | Z-spread up by 36.1 bp to 531.8 bp, with the yield to worst at 4.9% and the bond now trading down to 93.9 cents on the dollar (1Y price range: 86.6-102.1).

- Issuer: Telecom Italia Finance SA (Luxembourg, Luxembourg) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: BB | ISIN: XS0161100515 | Z-spread up by 27.3 bp to 324.1 bp (CDS basis: -48.5bp), with the yield to worst at 3.1% and the bond now trading down to 139.6 cents on the dollar (1Y price range: 139.2-149.5).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread up by 25.9 bp to 357.7 bp, with the yield to worst at 3.5% and the bond now trading down to 88.0 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Nemak SAB de CV (San Pedro Garza Garcia, Mexico) | Coupon: 2.25% | Maturity: 20/7/2028 | Rating: BB+ | ISIN: XS2362994068 | Z-spread up by 17.6 bp to 290.2 bp, with the yield to worst at 2.8% and the bond now trading down to 95.9 cents on the dollar (1Y price range: 95.0-100.8).

- Issuer: Ceconomy AG (Dusseldorf, Germany) | Coupon: 1.75% | Maturity: 24/6/2026 | Rating: BB+ | ISIN: XS2356316872 | Z-spread up by 16.9 bp to 229.4 bp (CDS basis: -48.1bp), with the yield to worst at 2.1% and the bond now trading down to 97.9 cents on the dollar (1Y price range: 97.7-99.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread up by 14.5 bp to 403.6 bp, with the yield to worst at 4.0% and the bond now trading down to 95.5 cents on the dollar (1Y price range: 93.2-99.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 5.25% | Maturity: 17/3/2055 | Rating: BB | ISIN: XS0214965963 | Z-spread up by 14.5 bp to 417.8 bp (CDS basis: -101.1bp), with the yield to worst at 4.2% and the bond now trading down to 113.2 cents on the dollar (1Y price range: 113.0-126.9).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: BB | ISIN: XS1711584430 | Z-spread up by 13.8 bp to 220.7 bp (CDS basis: 62.8bp), with the yield to worst at 1.9% and the bond now trading down to 101.8 cents on the dollar (1Y price range: 101.6-104.4).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: BB- | ISIN: XS1057659838 | Z-spread up by 13.7 bp to 386.8 bp (CDS basis: -91.1bp), with the yield to worst at 3.6% and the bond now trading down to 99.9 cents on the dollar (1Y price range: 95.9-103.3).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.00% | Maturity: 14/7/2024 | Rating: BB- | ISIN: XS2363244513 | Z-spread down by 15.2 bp to 192.1 bp (CDS basis: -37.2bp), with the yield to worst at 1.5% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 98.0-102.2).

SELECTED RECENT USD BOND ISSUES

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$135m Bond (US3130APT708), fixed rate (2.25% coupon) maturing on 8 May 2034, priced at 100.00, callable (13nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$500m Bond (US3130APT393), fixed rate (1.05% coupon) maturing on 18 February 2025, priced at 100.00, callable (3nc3m)

- China Bohai Bank Co Ltd (Financial - Other | Tianjin, China (Mainland) | Rating: NR): US$300m Senior Note (XS2405490850), fixed rate (1.50% coupon) maturing on 10 November 2024, priced at 99.77, non callable

- Haichuan International Investment Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$150m Unsecured Note (XS2402387992), fixed rate (1.98% coupon) maturing on 10 November 2024, priced at 100.00, non callable

- Jinan Urban Construction International Investment Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$500m Senior Note (XS2403477099), fixed rate (2.30% coupon) maturing on 10 November 2024, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Faurecia SE (Vehicle Parts | Nanterre, France | Rating: BB): €1,200m Senior Note (XS2405483301), fixed rate (2.75% coupon) maturing on 15 February 2027, priced at 100.00 (original spread of 321 bp), with a make whole call

NEW LOANS

- South32 Ltd (BBB+), signed a US$ 1,400m Term Loan, to be used for general corporate purposes. It matures on 11/03/26 and initial pricing is set at LIBOR +65bps

- SK E&S Co Ltd (BBB-), signed a US$ 500m Revolving Credit / Term Loan, to be used for capital expenditures

NEW ISSUES IN SECURITIZED CREDIT

- GPMT 2021-Fl4 Ltd issued a floating-rate CLO in 6 tranches, for a total of US$ 503 m. Highest-rated tranche offering a spread over the floating rate of 135bp, and the lowest-rated tranche a spread of 345bp. Bookrunners: Morgan Stanley International Ltd, JP Morgan & Co Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC

- Freddie Mac Spc Series K-133 issued a fixed-rate Agency CMBS in 3 tranches, for a total of US$ 1,231 m. Highest-rated tranche offering a yield to maturity of 1.51%, and the lowest-rated tranche a yield to maturity of 1.76%. Bookrunners: Morgan Stanley International Ltd, JP Morgan & Co Inc

- CIG Auto Receivables 2021-1 issued a floating-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 165 m. Highest-rated tranche offering a spread over the floating rate of 40bp, and the lowest-rated tranche a spread of 350bp. Bookrunners: Capital One Financial Corp, Deutsche Bank Securities Inc