Credit

Positive Day For USD Bonds With Slightly Tighter Cash Spreads And Lower Rates

It's been a very slow week in the primary bond market, and today was no different, with just a few deals priced including Public Storage's US$ 1.75bn 3-tranche offering

Published ET

Yield Pickup On USD Investment Grade vs 10Y Bunds And JGBs | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.47% today, with investment grade up 0.49% and high yield up 0.29% (YTD total return: -0.45%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.514% today (Month-to-date: 0.37%; Year-to-date: -1.07%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.217% today (Month-to-date: 0.24%; Year-to-date: 3.64%)

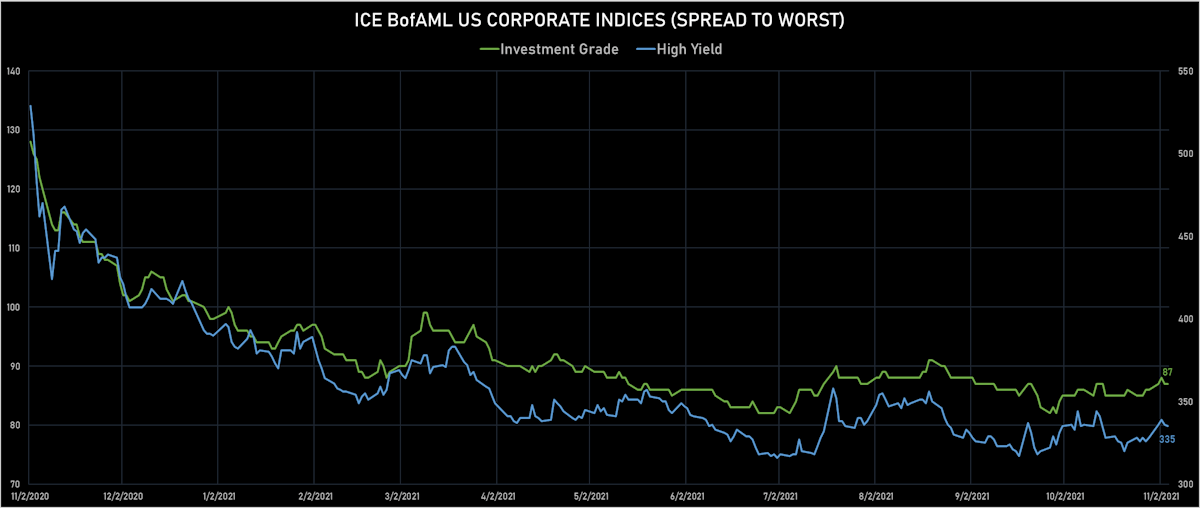

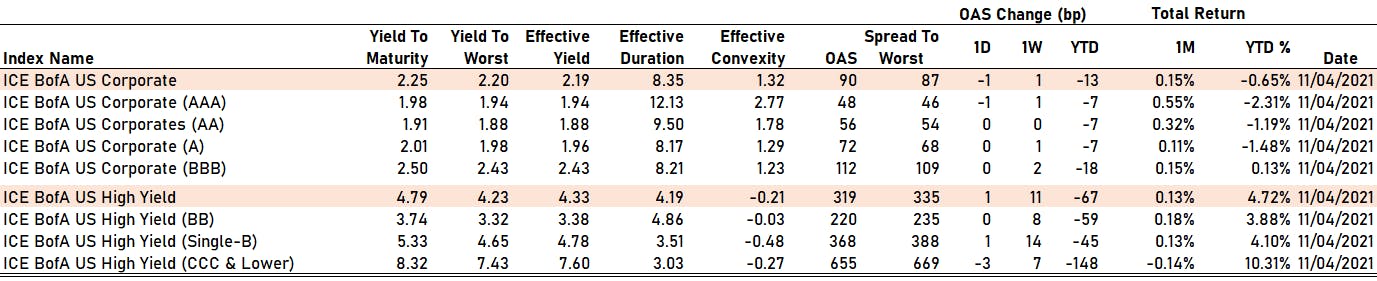

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 335.0 bp (YTD change: -55.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +3.2%)

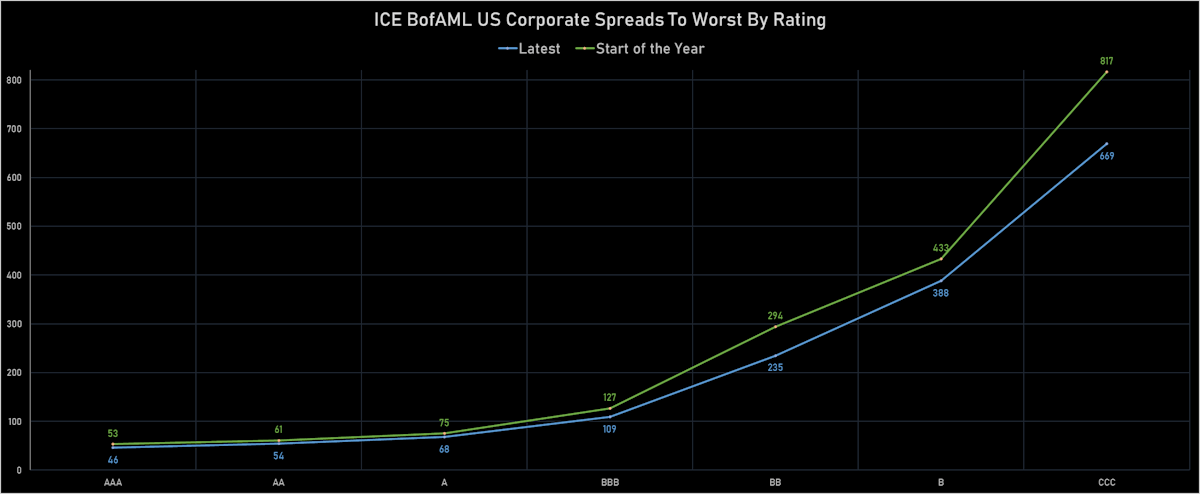

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 48 bp

- AA unchanged at 56 bp

- A unchanged at 72 bp

- BBB unchanged at 112 bp

- BB unchanged at 220 bp

- B up by 1 bp at 368 bp

- CCC down by -3 bp at 655 bp

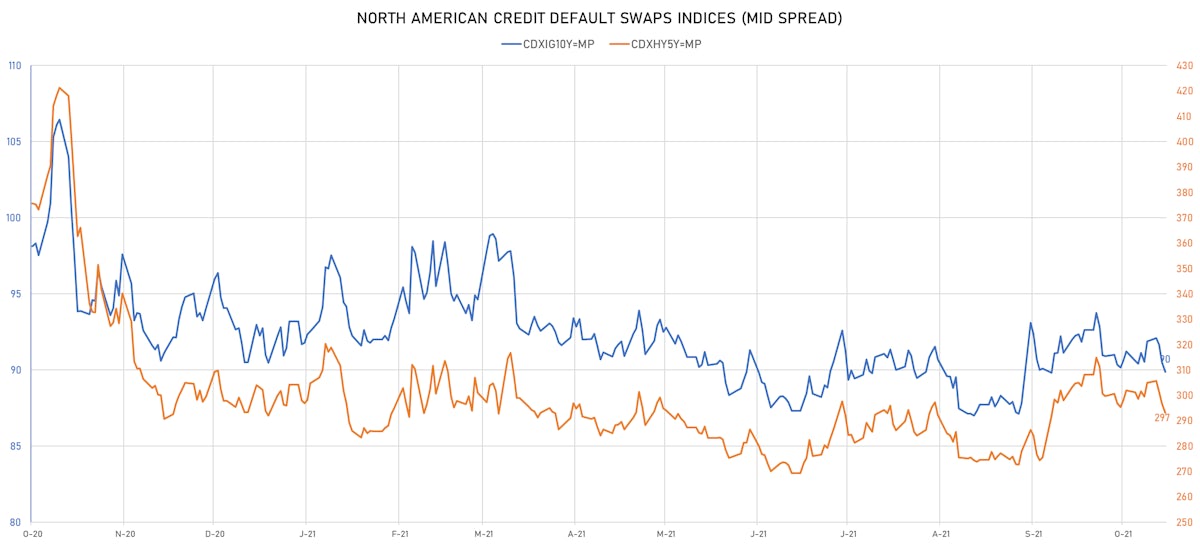

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.6 bp, now at 90bp (YTD change: -0.6bp)

- Markit CDX.NA.HY 5Y down 3.5 bp, now at 293bp (YTD change: -0.1bp)

- Markit iTRAXX Europe down 1.6 bp, now at 49bp (YTD change: +0.9bp)

- Markit iTRAXX Japan down 0.8 bp, now at 47bp (YTD change: -4.1bp)

- Markit iTRAXX Asia Ex-Japan down 0.5 bp, now at 81bp (YTD change: +23.0bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Genworth Holdings Inc (Country: US; rated: B2): down 39.2 bp to 382.3bp (1Y range: 382-681bp)

- American Airlines Group Inc (Country: US; rated: B2): down 36.2 bp to 675.4bp (1Y range: 596-2,645bp)

- Macy's Inc (Country: US; rated: Ba2): down 32.1 bp to 228.9bp (1Y range: 190-1,123bp)

- Rite Aid Corp (Country: US; rated: B3): down 31.7 bp to 957.2bp (1Y range: 497-990bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): down 31.7 bp to 490.6bp (1Y range: 363-495bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 29.1 bp to 386.5bp (1Y range: 291-1,050bp)

- Nordstrom Inc (Country: US; rated: Ba1): down 26.3 bp to 247.8bp (1Y range: 211-645bp)

- Gap Inc (Country: US; rated: Ba2): down 26.1 bp to 168.4bp (1Y range: 132-237bp)

- Ford Motor Co (Country: US; rated: Ba2): down 22.6 bp to 157.8bp (1Y range: 158-295bp)

- Avis Budget Group Inc (Country: US; rated: CCC): down 20.8 bp to 182.9bp (1Y range: 183-601bp)

- Kohls Corp (Country: US; rated: WD): down 19.9 bp to 134.2bp (1Y range: 101-302bp)

- Ford Motor Credit Company LLC (Country: US; rated: NP): down 18.8 bp to 136.9bp (1Y range: 137-270bp)

- Transocean Inc (Country: KY; rated: Caa3): up 90.9 bp to 1,723.7bp (1Y range: 941-6,980bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 35.1 bp to 373.6bp (1Y range: 339-806bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 24.6 bp to 218.0bp (1Y range: 217-388bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 20.5 bp to 674.3bp (1Y range: 464-1,072bp)

- Stena AB (Country: SE; rated: B2-PD): down 12.8 bp to 437.2bp (1Y range: 401-745bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 11.6 bp to 401.1bp (1Y range: 333-481bp)

- TUI AG (Country: DE; rated: B3-PD): down 11.5 bp to 665.8bp (1Y range: 607-1,549bp)

- Ineos Group Holdings SA (Country: LU; rated: Ba2-PD): down 10.2 bp to 124.6bp (1Y range: 125-428bp)

- Air France KLM SA (Country: FR; rated: B-): down 10.1 bp to 399.2bp (1Y range: 390-1,136bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 9.4 bp to 160.3bp (1Y range: 160-267bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 8.5 bp to 499.5bp (1Y range: 471-897bp)

- Accor SA (Country: FR; rated: B): down 7.4 bp to 147.2bp (1Y range: 136-251bp)

- Cable & Wireless Ltd (Country: GB; rated: WR): down 7.0 bp to 56.9bp (1Y range: 57-143bp)

- Novafives SAS (Country: FR; rated: Caa1): up 12.8 bp to 758.6bp (1Y range: 660-1,201bp)

SELECTED RECENT USD BOND ISSUES

- Asbury Automotive Group Inc (Retail Stores - Other | Duluth, United States | Rating: BB): US$800m Senior Note (US043436AW48), fixed rate (4.63% coupon) maturing on 15 November 2029, priced at 100.00 (original spread of 323 bp), callable (8nc3)

- Asbury Automotive Group Inc (Retail Stores - Other | Duluth, United States | Rating: BB): US$600m Senior Note (US043436AX21), fixed rate (5.00% coupon) maturing on 15 February 2032, priced at 100.00 (original spread of 347 bp), callable (10nc5)

- DCP Midstream Operating LP (Oil and Gas | Denver, Colorado, United States | Rating: BB+): US$400m Senior Note (US23311VAK35), fixed rate (3.25% coupon) maturing on 15 February 2032, priced at 100.00 (original spread of 173 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: NR): US$500m Bond (US3133ENDR80), fixed rate (0.40% coupon) maturing on 9 November 2023, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: NR): US$300m Bond (US3133ENDP25), floating rate (SOFR + 5.0 bp) maturing on 9 November 2023, priced at 100.00, non callable

- Fossil Group Inc (Consumer Products | Richardson, Texas, United States | Rating: B): US$140m Senior Note (US34988V3042), fixed rate (7.00% coupon) maturing on 30 November 2026, priced at 100.00, callable (5nc2)

- Lear Corp (Vehicle Parts | Southfield, Michigan, United States | Rating: BBB): US$350m Senior Note (US521865BC87), fixed rate (2.60% coupon) maturing on 15 January 2032, priced at 99.78 (original spread of 110 bp), callable (10nc10)

- Lear Corp (Vehicle Parts | Southfield, Michigan, United States | Rating: BBB): US$350m Unsecured Note (US521865BD60), fixed rate (3.55% coupon) maturing on 15 January 2052, priced at 99.85 (original spread of 160 bp), callable (30nc30)

- Public Service Enterprise Group Inc (Utility - Other | Newark, New Jersey, United States | Rating: BBB+): US$750m Senior Note (US744573AU04), fixed rate (2.45% coupon) maturing on 15 November 2031, priced at 99.81 (original spread of 95 bp), callable (10nc10)

- Public Service Enterprise Group Inc (Utility - Other | Newark, New Jersey, United States | Rating: BBB+): US$750m Senior Note (US744573AT31), fixed rate (0.84% coupon) maturing on 8 November 2023, priced at 100.00 (original spread of 43 bp), callable (2nc6m)

- Public Storage (Real Estate Investment Trust | Glendale, United States | Rating: A): US$650m Senior Note (US74460DAG43), fixed rate (1.50% coupon) maturing on 9 November 2026, priced at 99.85 (original spread of 45 bp), callable (5nc5)

- Public Storage (Real Estate Investment Trust | Glendale, United States | Rating: A): US$550m Senior Note (US74460DAJ81), fixed rate (2.25% coupon) maturing on 9 November 2031, priced at 99.97 (original spread of 73 bp), callable (10nc10)

- Public Storage (Real Estate Investment Trust | Glendale, United States | Rating: A): US$550m Senior Note (US74460DAH26), fixed rate (1.95% coupon) maturing on 9 November 2028, priced at 99.95 (original spread of 58 bp), callable (7nc7)

- Railworks Holdings LP (Financial - Other | United States | Rating: B): US$325m Note (US75079MAA71), fixed rate (8.25% coupon) maturing on 15 November 2028, priced at 98.05 (original spread of 725 bp), callable (7nc3)

- Alphanotes Etp DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): US$120m Unsecured Note (XS1749046428), floating rate maturing on 18 January 2028, priced at 100.00, non callable

- PECF USS Intermediate Holding III Corp (Financial - Other | Rating: B-): US$550m Senior Note (US69291HAA32), fixed rate (8.00% coupon) maturing on 15 November 2029, priced at 100.00 (original spread of 661 bp), callable (8nc3)

- Zhejiang Xinchang Investment Development Group Co Ltd (Financial - Other | Shaoxing, China (Mainland) | Rating: NR): US$200m Bond (XS2393946392), fixed rate (3.60% coupon) maturing on 10 November 2024, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Atos SE (Information/Data Technology | Bezons, Ile-De-France, France | Rating: BBB-): €800m Bond (FR0014006G24), fixed rate (1.00% coupon) maturing on 12 November 2029, priced at 99.17 (original spread of 148 bp), callable (8nc8)

- Berlin, State of (Official and Muni | Berlin, Berlin, Germany | Rating: AA+): €300m Landesschatzanweisung (DE000A3H2Y65), floating rate maturing on 14 July 2028, priced at 104.99, non callable

- Danske Bank A/S (Banking | Koebenhavn K, Denmark | Rating: A-): €1,250m Note (XS2406549464), fixed rate (0.01% coupon) maturing on 10 November 2024, priced at 100.24 (original spread of 66 bp), callable (3nc2)

- Highland Holdings SARL (Financial - Other | Luxembourg, United States | Rating: NR): €600m Senior Note (XS2406914346), fixed rate (0.32% coupon) maturing on 15 December 2026, priced at 100.00, callable (5nc5)

- Highland Holdings SARL (Financial - Other | Luxembourg, United States | Rating: NR): €500m Senior Note (XS2406915236), fixed rate (0.93% coupon) maturing on 15 December 2031, priced at 100.00, callable (10nc10)

- Highland Holdings SARL (Financial - Other | Luxembourg, United States | Rating: NR): €500m Senior Note (XS2406913884), fixed rate (0.00% coupon) maturing on 15 December 2023, priced at 100.23, callable (2nc2)

- Lune Holdings SARL (Financial - Other | Luxembourg | Rating: NR): €450m Note (XS2406727409), fixed rate (5.63% coupon) maturing on 15 November 2028, priced at 100.00 (original spread of 604 bp), callable (7nc3)

- SIG PLC (Building Products | Sheffield, United Kingdom | Rating: B+): €300m Note (XS2404291010), fixed rate (5.25% coupon) maturing on 30 November 2026, priced at 100.00 (original spread of 580 bp), callable (5nc2)

NEW LOANS

- Koninklijke Ten Cate BV, signed a € 315m Term Loan B, to be used for 126. It matures on and initial pricing is set at EURIBOR +500bps

- Hunting PLC, signed a US$ 200m Term Loan, to be used for general corporate purposes.

- Howden Group Holdings Ltd (B), signed a US$ 550m Term Loan B, to be used for acquisition financing. It matures on 11/12/27 and initial pricing is set at LIBOR +325bps

NEW ISSUES IN SECURITIZED CREDIT

- Ford Credit Auto Owner Trust 2021-Rev2 issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,110 m. Highest-rated tranche offering a yield to maturity of 1.53%, and the lowest-rated tranche a yield to maturity of 2.60%. Bookrunners: Credit Suisse, JP Morgan & Co Inc, Barclays Capital Group, SG Americas Securities LLC, BNP Paribas Securities Corp