Credit

Good Performance All Around For US Credit Today, With Tighter Spreads And The Tailwind Of Lower Rates

US corporate bonds issuance was fairly modest this week, though it should accelerate until Thanksgiving now that most large companies have reported their earnings; weekly totals (IFR data) at $ 20.6bn in 28 tranches for investment grade, $ 7.375bn in 11 tranches for high yield

Published ET

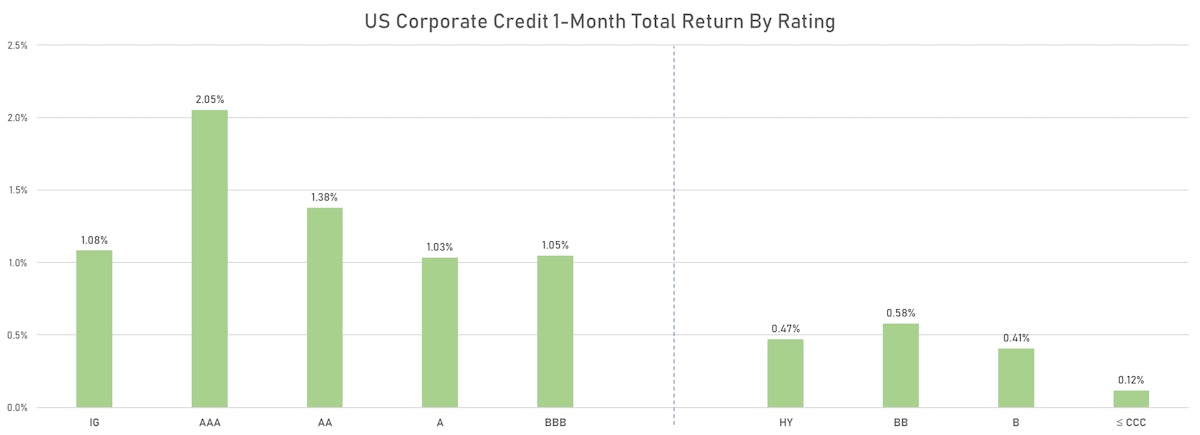

1-month Total Return Performance Of ICE BofAML US Cash Indices | Sources: ϕpost, FactSet data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.57% today, with investment grade up 0.59% and high yield up 0.46% (YTD total return: +0.12%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.748% today (Month-to-date: 1.12%; Year-to-date: -0.33%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.392% today (Month-to-date: 0.63%; Year-to-date: 4.05%)

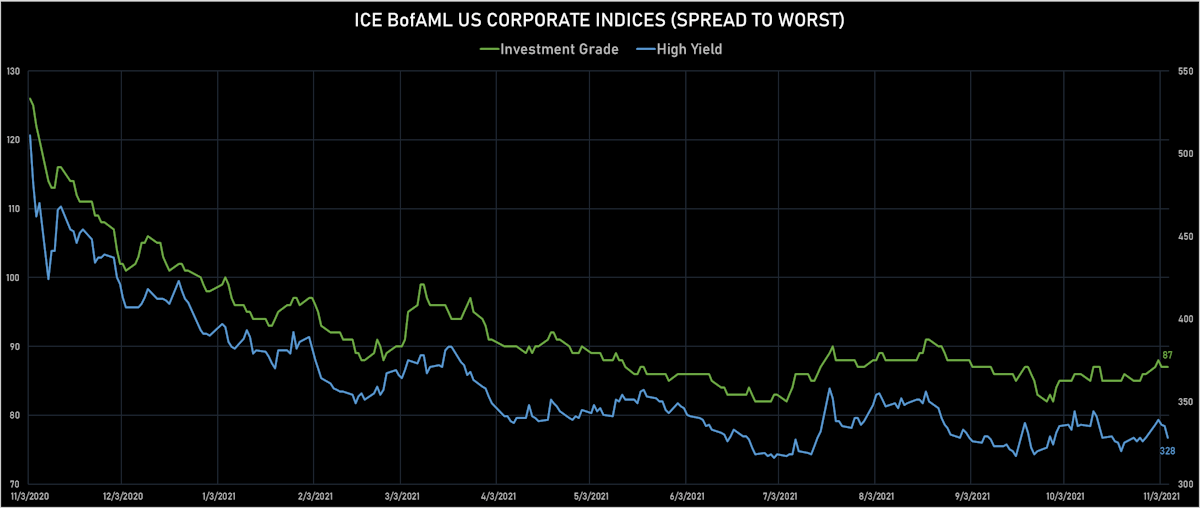

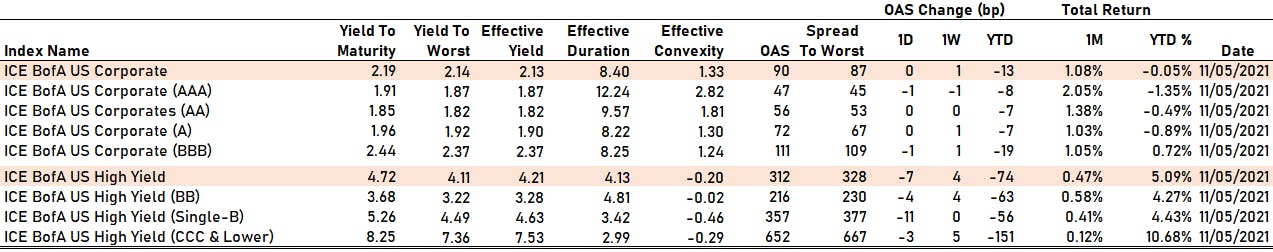

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst down -7.0 bp, now at 328.0 bp (YTD change: -62.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +3.2%)

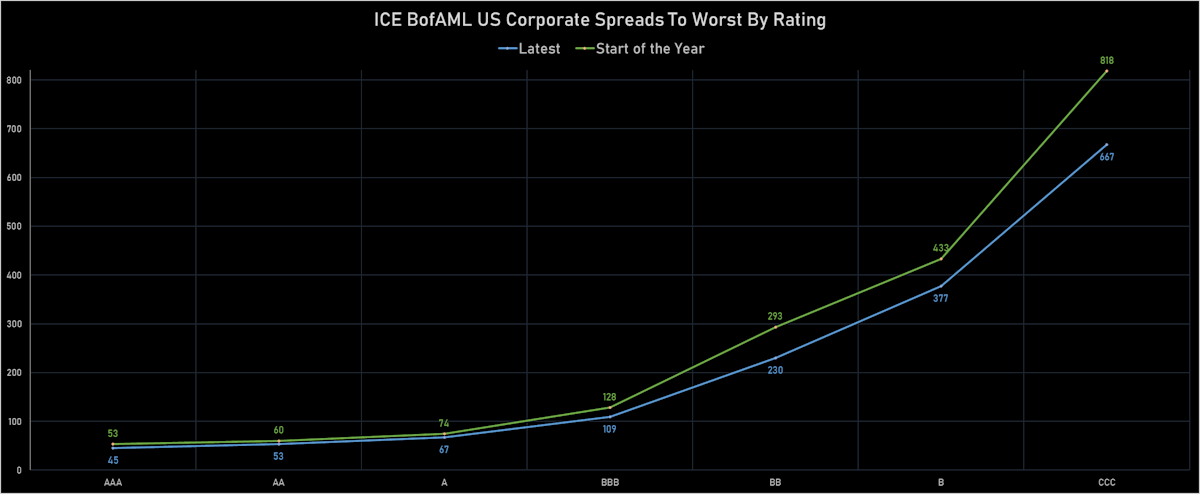

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 47 bp

- AA unchanged at 56 bp

- A unchanged at 72 bp

- BBB down by -1 bp at 111 bp

- BB down by -4 bp at 216 bp

- B down by -11 bp at 357 bp

- CCC down by -3 bp at 652 bp

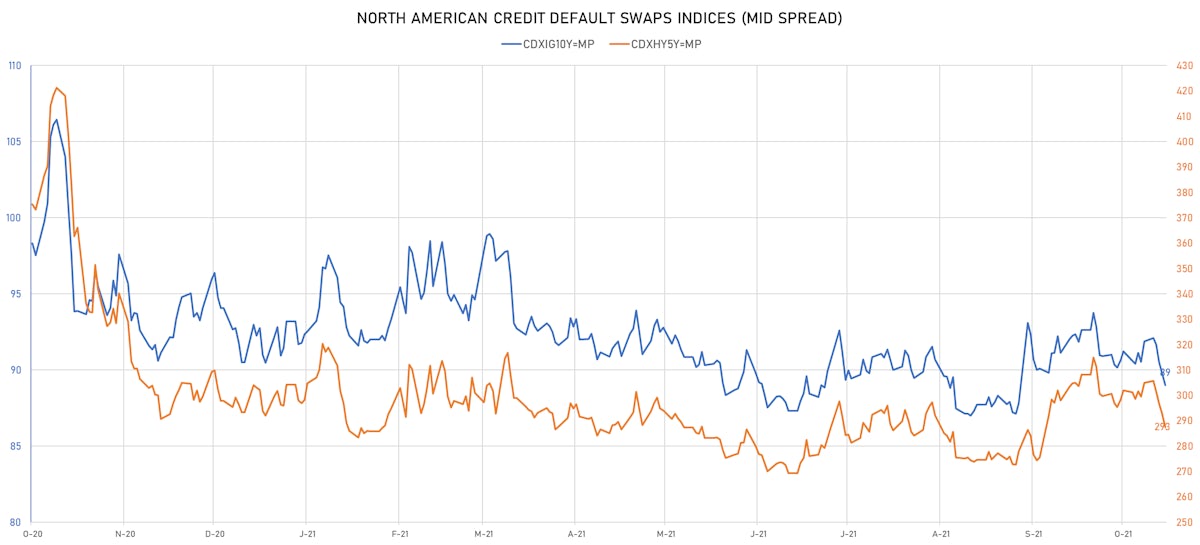

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.8 bp, now at 89bp (YTD change: -1.5bp)

- Markit CDX.NA.HY 5Y down 5.5 bp, now at 287bp (YTD change: -5.8bp)

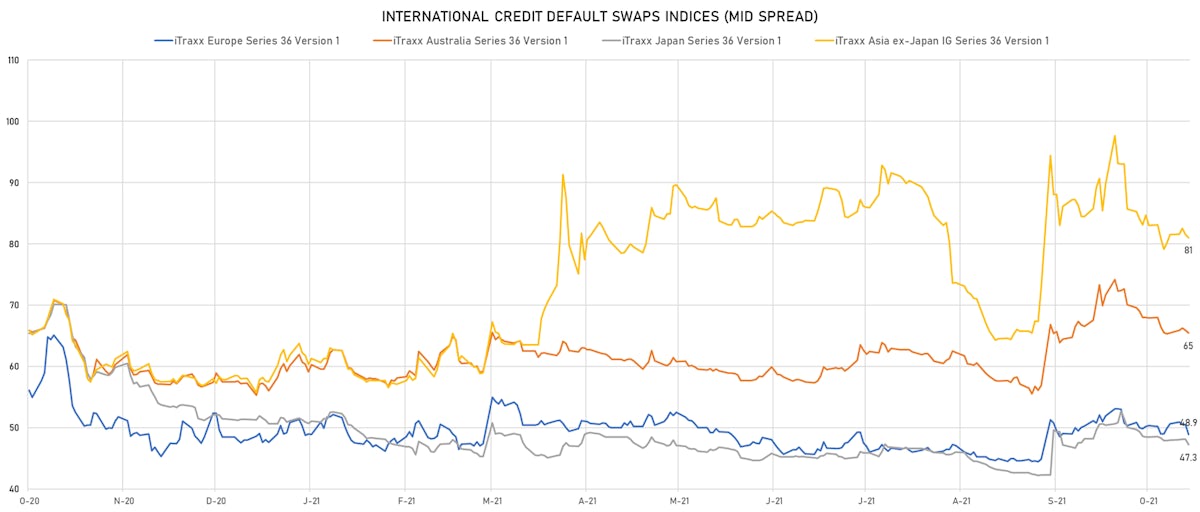

- Markit iTRAXX Europe down 1.0 bp, now at 48bp (YTD change: 0.0bp)

- Markit iTRAXX Japan down 0.3 bp, now at 47bp (YTD change: -4.3bp)

- Markit iTRAXX Asia Ex-Japan up 5.1 bp, now at 86bp (YTD change: +28.1bp)

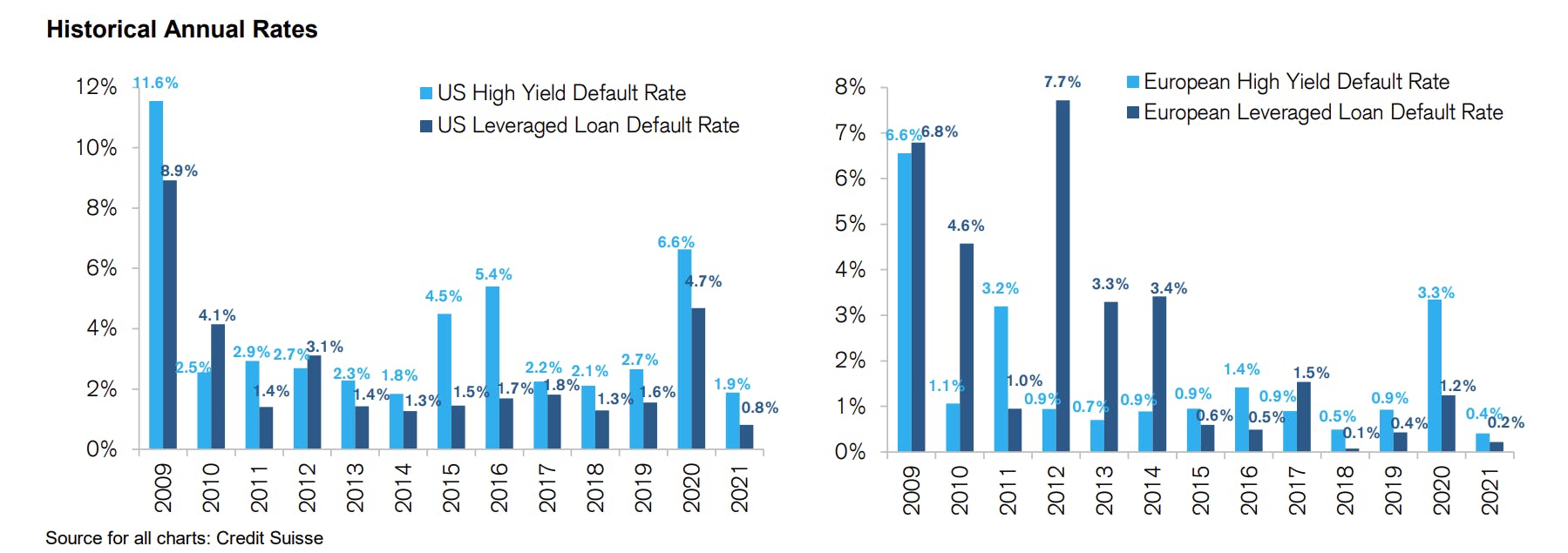

UPDATED HISTORICAL HIGH YIELD DEFAULT RATES

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Z-spread up by 127.0 bp to 1,480.2 bp, with the yield to worst at 15.2% and the bond now trading down to 68.8 cents on the dollar (1Y price range: 56.6-76.3).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 87.6 bp to 880.0 bp, with the yield to worst at 9.3% and the bond now trading down to 97.9 cents on the dollar (1Y price range: 93.5-102.4).

- Issuer: StoneCo Ltd (George Town, Cayman Islands) | Coupon: 3.95% | Maturity: 16/6/2028 | Rating: BB- | ISIN: USG85158AA43 | Z-spread up by 78.8 bp to 456.3 bp, with the yield to worst at 5.6% and the bond now trading down to 89.9 cents on the dollar (1Y price range: 89.0-100.0).

- Issuer: Gemdale Ever Prosperity Investment Ltd (Hong Kong) | Coupon: 4.95% | Maturity: 12/8/2024 | Rating: BB- | ISIN: XS2357443410 | Z-spread up by 71.6 bp to 757.3 bp, with the yield to worst at 7.8% and the bond now trading down to 92.1 cents on the dollar (1Y price range: 93.3-102.0).

- Issuer: JSM Global SARL (Luxembourg, Luxembourg) | Coupon: 4.75% | Maturity: 20/10/2030 | Rating: BB | ISIN: USL5788AAA99 | Z-spread up by 67.7 bp to 418.9 bp, with the yield to worst at 5.4% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 94.1-107.7).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 59.8 bp to 740.9 bp, with the yield to worst at 8.1% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 96.8-105.9).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CCC- | ISIN: USU96217AA99 | Z-spread up by 51.4 bp to 702.3 bp, with the yield to worst at 7.5% and the bond now trading down to 100.3 cents on the dollar (1Y price range: 67.5-104.8).

- Issuer: Ultrapar International SA (Luxembourg, Luxembourg) | Coupon: 5.25% | Maturity: 6/10/2026 | Rating: BB+ | ISIN: USL9412AAA53 | Z-spread up by 47.3 bp to 276.4 bp, with the yield to worst at 3.6% and the bond now trading down to 106.3 cents on the dollar (1Y price range: 106.0-112.3).

- Issuer: JSW Steel Ltd (Mumbai, India) | Coupon: 3.95% | Maturity: 5/4/2027 | Rating: BB- | ISIN: USY44680RV38 | Z-spread up by 45.2 bp to 308.2 bp, with the yield to worst at 4.1% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 94.6-100.8).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 46.7 bp to 178.1 bp, with the yield to worst at 2.0% and the bond now trading up to 104.1 cents on the dollar (1Y price range: 98.4-104.2).

- Issuer: Turkiye Cumhuriyeti Ziraat Bankasi AS (Ankara, Turkey) | Coupon: 5.38% | Maturity: 2/3/2026 | Rating: B | ISIN: XS2274089288 | Z-spread down by 47.5 bp to 501.9 bp, with the yield to worst at 5.7% and the bond now trading up to 97.8 cents on the dollar (1Y price range: 91.8-102.0).

- Issuer: Akbank TAS (Turkey) | Coupon: 6.80% | Maturity: 6/2/2026 | Rating: B | ISIN: XS2131335270 | Z-spread down by 54.6 bp to 473.9 bp (CDS basis: 28.9bp), with the yield to worst at 5.6% and the bond now trading up to 104.1 cents on the dollar (1Y price range: 98.1-108.6).

- Issuer: Ecobank Transnational Incorporated SA (LOME, Togo) | Coupon: 9.50% | Maturity: 18/4/2024 | Rating: B- | ISIN: XS1826862556 | Z-spread down by 82.9 bp to 521.6 bp, with the yield to worst at 5.4% and the bond now trading up to 108.3 cents on the dollar (1Y price range: 106.5-109.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread up by 61.0 bp to 368.4 bp, with the yield to worst at 3.5% and the bond now trading down to 88.0 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: CCC+ | ISIN: XS2270393379 | Z-spread up by 58.7 bp to 233.3 bp, with the yield to worst at 1.9% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 93.7-102.9).

- Issuer: Telecom Italia Finance SA (Luxembourg, Luxembourg) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: BB | ISIN: XS0161100515 | Z-spread up by 42.9 bp to 305.7 bp (CDS basis: -31.1bp), with the yield to worst at 3.0% and the bond now trading down to 142.9 cents on the dollar (1Y price range: 139.1-149.5).

- Issuer: Nemak SAB de CV (San Pedro Garza Garcia, Mexico) | Coupon: 2.25% | Maturity: 20/7/2028 | Rating: BB+ | ISIN: XS2362994068 | Z-spread up by 37.5 bp to 307.0 bp, with the yield to worst at 2.8% and the bond now trading down to 95.5 cents on the dollar (1Y price range: 94.8-100.8).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB- | ISIN: XS2325696628 | Z-spread up by 25.9 bp to 324.6 bp (CDS basis: 61.1bp), with the yield to worst at 3.0% and the bond now trading down to 99.8 cents on the dollar (1Y price range: 98.5-102.9).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.39% | Maturity: 17/2/2026 | Rating: BB | ISIN: XS2013574384 | Z-spread down by 39.9 bp to 160.2 bp (CDS basis: -31.8bp), with the yield to worst at 1.3% and the bond now trading up to 104.1 cents on the dollar (1Y price range: 96.7-105.5).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB- | ISIN: XS2010029663 | Z-spread down by 94.1 bp to 507.8 bp, with the yield to worst at 4.7% and the bond now trading up to 94.7 cents on the dollar (1Y price range: 81.0-105.4).

- Issuer: TechnipFMC PLC (London, United Kingdom) | Coupon: 4.50% | Maturity: 30/6/2025 | Rating: BB | ISIN: XS2197326437 | Z-spread down by 118.0 bp to 199.9 bp (CDS basis: 10.9bp), with the yield to worst at 1.5% and the bond now trading up to 109.0 cents on the dollar (1Y price range: 103.4-109.0).

SELECTED RECENT EUR BOND ISSUES

- Deutsche Apotheker und Aerztebank eG (Banking | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: A+): €216m Note (XS2407542666), floating rate (EU03MLIB + 60.0 bp) maturing on 12 November 2024, priced at 100.52, non callable

- Gamma Bondco SARL (Financial - Other | Luxembourg | Rating: NR): €400m Note (XS2407361109), fixed rate (8.13% coupon) maturing on 15 November 2026, priced at 100.00 (original spread of 868 bp), callable (5nc2)

- Hamburg Commercial Bank AG (Banking | Hamburg, Hamburg, Germany | Rating: BBB): €250m Schiffspfandbrief (Covered Bond) (DE000HCB0BD8), floating rate (EU03MLIB + 33.0 bp) maturing on 11 November 2025, priced at 100.00, non callable

- VIA Outlets BV (Retail Stores - Other | Amsterdam, Noord-Holland, Netherlands | Rating: NR): €600m Senior Note (XS2407027031), fixed rate (1.75% coupon) maturing on 15 November 2028, priced at 99.38 (original spread of 230 bp), callable (7nc7)

NEW LOANS

- Spectacle Gary Holding (B), signed a US$ 415m Term Loan B, to be used for general corporate purposes. It matures on 11/18/28.

- Driven Brands Inc, signed a US$ 500m Term Loan B, to be used for general corporate purposes. It matures on 11/17/28 and initial pricing is set at LIBOR +325bps

- Brooks Automation Inc (BB-), signed a US$ 205m Term Loan, to be used for leveraged buyout. It matures on 11/22/29.

- Brooks Automation Inc (BB-), signed a US$ 825m Term Loan B, to be used for leveraged buyout. It matures on 11/22/28.

- S&S Holdings LLC (B), signed a US$ 150m Term Loan B, to be used for acquisition financing. It matures on 03/11/28 and initial pricing is set at LIBOR +500bps

- TRC Cos Inc (B), signed a US$ 210m Term Loan and a $ 635m Term Loan B.

NEW ISSUES IN SECURITIZED CREDIT

- Morgan Stanley Capital I Trust 2021-Plza issued a fixed-rate CMBS in 3 tranches, for a total of US$ 272 m. Highest-rated tranche offering a yield to maturity of 2.43%, and the lowest-rated tranche a yield to maturity of 2.70%. Bookrunners: Morgan Stanley International Ltd

- STWD Trust 2021-LIH issued a floating-rate CMBS in 9 tranches, for a total of US$ 378 m. Highest-rated tranche offering a spread over the floating rate of 86bp, and the lowest-rated tranche a spread of 570bp. Bookrunners: Goldman Sachs & Co, Barclays Capital Group