Credit

USD Cash Spreads Tighten, Most Significantly in BBs And CCCs, To Lead HY Higher

A decent start to the week for USD Issuance, with Australia's Westpac Banking offering US$ 5.5bn in 5 tranches and Ford Motor $ 2.5 bn in a single tranche

Published ET

A Majority Of HY Funds Are Behind Their Benchmarks YTD | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.12% today, with investment grade down -0.15% and high yield up 0.13%

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.240% today (Month-to-date: 0.87%; Year-to-date: -0.57%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.087% today (Month-to-date: 0.72%; Year-to-date: 4.14%)

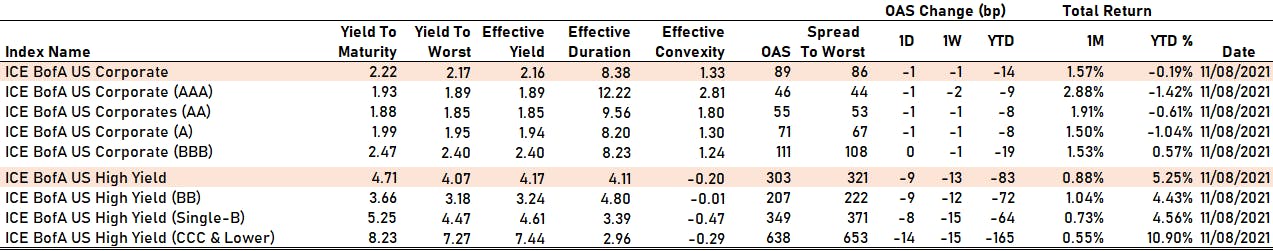

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -7.0 bp, now at 321.0 bp (YTD change: -69.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.09% today (YTD total return: +3.3%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 46 bp

- AA down by -1 bp at 55 bp

- A down by -1 bp at 71 bp

- BBB unchanged at 111 bp

- BB down by -9 bp at 207 bp

- B down by -8 bp at 349 bp

- CCC down by -14 bp at 638 bp

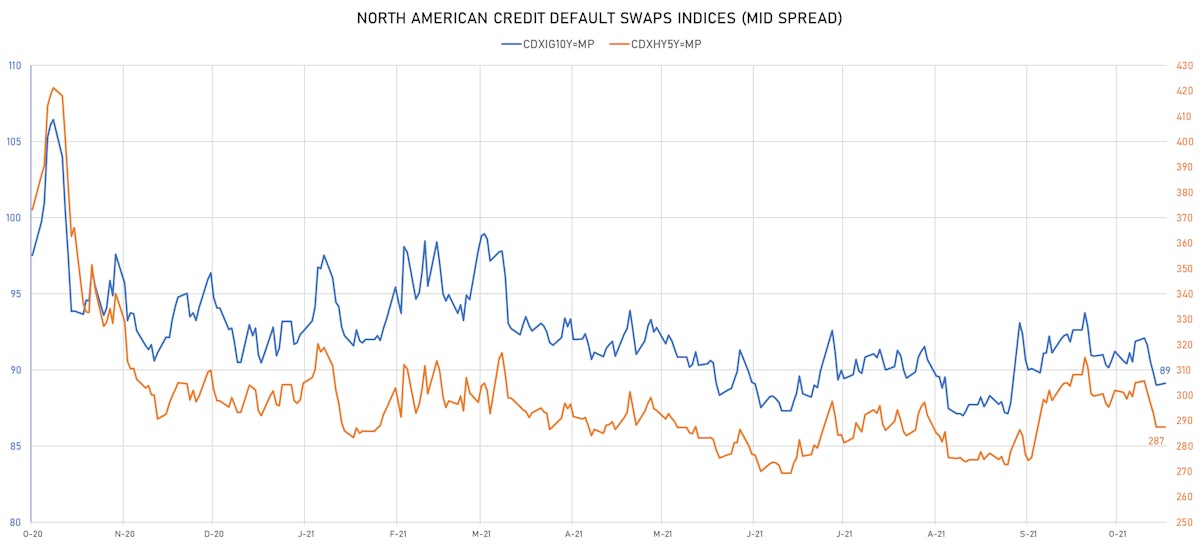

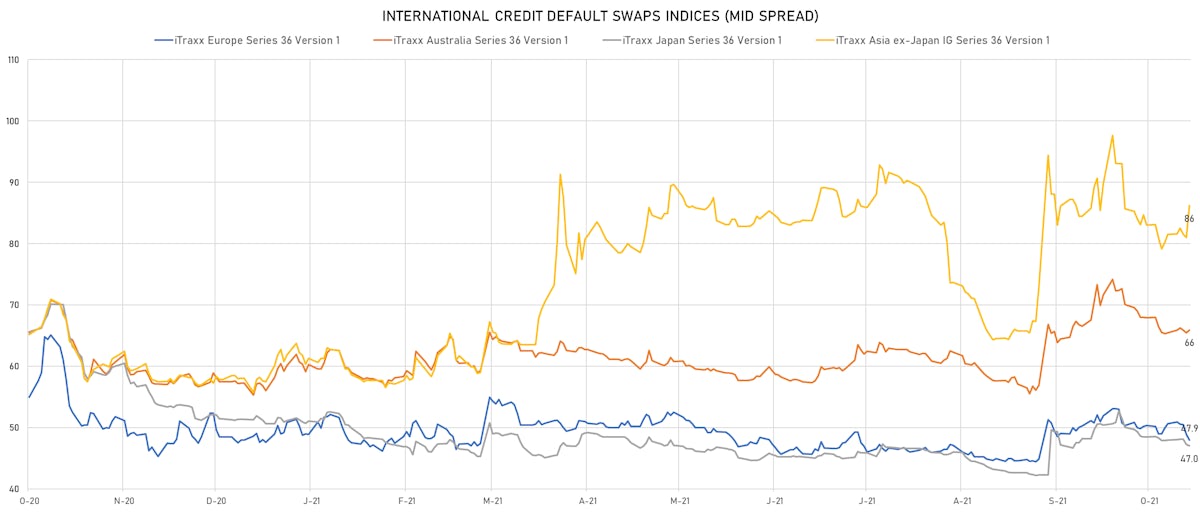

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.1 bp, now at 89bp (YTD change: -1.4bp)

- Markit CDX.NA.HY 5Y up 0.1 bp, now at 288bp (YTD change: -5.6bp)

- Markit iTRAXX Europe down 0.4 bp, now at 48bp (YTD change: -0.4bp)

- Markit iTRAXX Japan down 0.4 bp, now at 47bp (YTD change: -4.8bp)

- Markit iTRAXX Asia Ex-Japan up 5.9 bp, now at 92bp (YTD change: +34.0bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Talen Energy Supply LLC (Country: US; rated: B3): down 452.1 bp to 2,076.8bp (1Y range: 875-5,047bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 87.0 bp to 324.1bp (1Y range: 291-639bp)

- American Airlines Group Inc (Country: US; rated: B2): down 60.3 bp to 639.7bp (1Y range: 596-2,212bp)

- Genworth Holdings Inc (Country: US; rated: B2): down 49.0 bp to 355.2bp (1Y range: 355-681bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): down 45.4 bp to 299.2bp (1Y range: 299-850bp)

- Rite Aid Corp (Country: US; rated: B3): down 43.6 bp to 942.3bp (1Y range: 497-990bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): down 43.1 bp to 481.3bp (1Y range: 363-495bp)

- Macy's Inc (Country: US; rated: Ba2): down 32.7 bp to 215.4bp (1Y range: 190-951bp)

- Gap Inc (Country: US; rated: WR): down 29.9 bp to 157.9bp (1Y range: 132-237bp)

- Nordstrom Inc (Country: US; rated: Ba1): down 28.8 bp to 234.5bp (1Y range: 211-534bp)

- Ford Motor Co (Country: US; rated: LGD4 - 54%): down 26.2 bp to 147.0bp (1Y range: 147-274bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): down 25.8 bp to 403.1bp (1Y range: 336-449bp)

- Transocean Inc (Country: KY; rated: Caa3): up 42.6 bp to 1,683.4bp (1Y range: 941-6,425bp)

- DISH DBS Corp (Country: US; rated: B2): up 47.3 bp to 415.8bp (1Y range: 317-475bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 67.0 bp to 637.4bp (1Y range: 464-802bp)

- TUI AG (Country: DE; rated: B3-PD): down 53.3 bp to 625.8bp (1Y range: 607-946bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 29.7 bp to 385.4bp (1Y range: 333-481bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 26.9 bp to 211.6bp (1Y range: 212-348bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 23.4 bp to 363.7bp (1Y range: 339-674bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 22.9 bp to 178.8bp (1Y range: -179bp)

- Stena AB (Country: SE; rated: B2-PD): down 21.3 bp to 424.6bp (1Y range: 401-728bp)

- Air France KLM SA (Country: FR; rated: B-): down 18.7 bp to 389.1bp (1Y range: 389-901bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): down 17.4 bp to 176.0bp (1Y range: 149-200bp)

- Novafives SAS (Country: FR; rated: Caa1): down 16.1 bp to 755.9bp (1Y range: 660-1,139bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 14.2 bp to 493.8bp (1Y range: 471-784bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 13.1 bp to 244.3bp (1Y range: 206-368bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 12.6 bp to 254.6bp (1Y range: 188-280bp)

- Cable & Wireless Ltd (Country: GB; rated: WR): down 12.2 bp to 49.0bp (1Y range: 49-143bp)

SELECTED RECENT USD BOND ISSUES

- Avalonbay Communities Inc (Real Estate Investment Trust | Arlington, United States | Rating: A-): US$400m Senior Note (US053484AC59), fixed rate (1.90% coupon) maturing on 1 December 2028, priced at 99.87 (original spread of 55 bp), callable (7nc7)

- Cargill Inc (Food Processors | Minneapolis, United States | Rating: A): US$1,000m Unsecured Note (US141781BS20), fixed rate (2.13% coupon) maturing on 10 November 2031, priced at 99.55 (original spread of 68 bp), callable (10nc10)

- Equitable Financial Life Global Funding (Financial - Other | Wilmington, United States | Rating: NR): US$500m Note (US29449WAK36), fixed rate (1.10% coupon) maturing on 12 November 2024, priced at 99.99 (original spread of 38 bp), non callable

- Equitable Financial Life Global Funding (Financial - Other | Wilmington, United States | Rating: NR): US$500m Note (US29449WAL19), fixed rate (1.70% coupon) maturing on 12 November 2026, priced at 99.88 (original spread of 60 bp), non callable

- Ford Motor Co (Automotive Manufacturer | Dearborn, United States | Rating: BB+): US$2,500m Senior Note (US345370DA55), fixed rate (3.25% coupon) maturing on 12 February 2032, priced at 100.00 (original spread of 175 bp), callable (10nc10)

- Host Hotels & Resorts LP (Real Estate Investment Trust | Bethesda, United States | Rating: BBB-): US$450m Senior Note (US44107TBA34), fixed rate (2.90% coupon) maturing on 15 December 2031, priced at 98.53 (original spread of 158 bp), callable (10nc10)

- Northwest Natural Gas Co (Gas Utility - Local Distrib | Portland, United States | Rating: A+): US$130m First Mortgage Bond (US66765RCK05), fixed rate (3.08% coupon) maturing on 1 December 2051, priced at 100.00 (original spread of 120 bp), callable (30nc30)

- OI European Group BV (Containers | Schiedam, United States | Rating: B+): US$400m Senior Note (US67777LAD55), fixed rate (4.75% coupon) maturing on 15 February 2030, priced at 100.00 (original spread of 334 bp), callable (8nc3)

- Sherwin-Williams Co (Industrials - Other | Cleveland, United States | Rating: BBB): US$500m Senior Note (US824348BN55), fixed rate (2.20% coupon) maturing on 15 March 2032, priced at 99.59 (original spread of 76 bp), callable (10nc10)

- Sherwin-Williams Co (Industrials - Other | Cleveland, United States | Rating: BBB): US$500m Senior Note (US824348BP04), fixed rate (2.90% coupon) maturing on 15 March 2052, priced at 99.36 (original spread of 127 bp), callable (30nc30)

- SRS Distribution Inc (Home Builders | Mckinney, United States | Rating: CCC): US$850m Senior Note (US78471RAD89), fixed rate (6.00% coupon) maturing on 1 December 2029, priced at 100.00 (original spread of 462 bp), callable (8nc3)

- Kobe US Midco 2 Inc (Financial - Other | Rating: CCC): US$200m Senior Note (USU50012AA85), fixed rate (9.25% coupon) maturing on 1 November 2026, priced at 99.00 (original spread of 841 bp), callable (5nc1)

- Parkland Corp (Financial - Other | Calgary, Canada | Rating: BB): US$800m Senior Note (US70137WAL28), fixed rate (4.63% coupon) maturing on 1 May 2030, priced at 100.00 (original spread of 335 bp), callable (8nc3)

- Westpac Banking Corp (Banking | Sydney, Australia | Rating: A+): US$1,000m Subordinated Note (US961214EY50), fixed rate (3.13% coupon) maturing on 18 November 2041, priced at 100.00 (original spread of 123 bp), non callable

- Westpac Banking Corp (Banking | Sydney, Australia | Rating: A+): US$1,250m Senior Note (US961214EU39), fixed rate (1.02% coupon) maturing on 18 November 2024, priced at 100.00 (original spread of 30 bp), non callable

- Westpac Banking Corp (Banking | Sydney, Australia | Rating: A+): US$1,250m Subordinated Note (US961214EX77), fixed rate (3.02% coupon) maturing on 18 November 2036, priced at 100.00 (original spread of 153 bp), non callable

- Westpac Banking Corp (Banking | Sydney, Australia | Rating: A+): US$1,250m Senior Note (US961214EW94), fixed rate (1.95% coupon) maturing on 20 November 2028, priced at 100.00 (original spread of 58 bp), non callable

- Westpac Banking Corp (Banking | Sydney, Australia | Rating: A+): US$750m Senior Note (US961214EV12), floating rate (SOFR + 30.0 bp) maturing on 18 November 2024, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Aprr SA (Service - Other | Saint-Apollinaire, France | Rating: A-): €500m Senior Note (FR0014006IV0) zero coupon maturing on 19 June 2028, priced at 98.85 (original spread of 69 bp), callable (7nc6)

- Argan SA (Service - Other | Neuilly-Sur-Seine, France | Rating: BBB-): €500m Bond (FR0014006FB8), fixed rate (1.01% coupon) maturing on 17 November 2026, priced at 100.00 (original spread of 157 bp), callable (5nc5)

- Auckland, City of (Official and Muni | Auckland, New Zealand | Rating: NR): €500m Note (XS2407197545), fixed rate (0.25% coupon) maturing on 17 November 2031, priced at 99.40 (original spread of 57 bp), non callable

- AXA Logistics Europe Master SCA (Financial - Other | Luxembourg | Rating: NR): €500m Senior Note (XS2407019798), fixed rate (0.38% coupon) maturing on 15 November 2026, priced at 99.45 (original spread of 106 bp), callable (5nc5)

- AXA Logistics Europe Master SCA (Financial - Other | Luxembourg | Rating: NR): €300m Senior Note (XS2407019871), fixed rate (0.88% coupon) maturing on 15 November 2029, priced at 99.25 (original spread of 138 bp), callable (8nc8)

- Credit Logement SA (Financial - Other | Paris, France | Rating: AA-): €500m Subordinated Note (FR0014006IG1), fixed rate (1.08% coupon) maturing on 15 February 2034, priced at 100.00 (original spread of 153 bp), callable (12nc7)

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A): €500m Inhaberschuldverschreibung (AT0000A2U543) maturing on 15 November 2032, callable (11nc6)

- Koninklijke KPN NV (Telecommunications | Rotterdam, Netherlands | Rating: BBB): €700m Senior Note (XS2406890066), fixed rate (0.88% coupon) maturing on 15 November 2033, priced at 98.77 (original spread of 124 bp), callable (12nc12)

- Societe Generale SA (Banking | Paris, France | Rating: A): €1,000m Bond (FR0014006IU2), floating rate maturing on 17 November 2026, priced at 99.80 (original spread of 83 bp), callable (5nc4)

- Volvo Treasury AB (Financial - Other | Goeteborg, Vastra Gotalands, Sweden | Rating: NR): €300m Senior Note (XS2407916761), floating rate (EU03MLIB + 75.0 bp) maturing on 15 November 2023, non callable

NEW LOANS

- Tank Holding Corp (B-), signed a US$ 1,685m Term Loan, to be used for general corporate purposes

- Lscs Holdings Inc (CCC), signed a US$ 290m Term Loan, to be used for acquisition financing. It matures on 11/23/29.

- Lscs Holdings Inc (CCC), signed a US$ 690m Term Loan B, to be used for acquisition financing. It matures on 11/23/28.

- Fanatics Inc, signed a US$ 500m Term Loan B, to be used for general corporate purposes.

NEW ISSUES IN SECURITIZED CREDIT

- Radnor Re 2021-2 Ltd issued a floating-rate RMBS in 4 tranches, for a total of US$ 439 m. Highest-rated tranche offering a spread over the floating rate of 185bp, and the lowest-rated tranche a spread of 600bp. Bookrunners: Goldman Sachs & Co, Bank of America Merrill Lynch

- Wells Fargo Mortgage Backed Securities 2021-Inv2 Trust issued a fixed-rate RMBS in 4 tranches, for a total of US$ 316 m. Bookrunners: Wells Fargo Securities LLC

- Navigator Aircraft Dac issued a floating-rate ABS backed by aircraft leases in 2 tranches, for a total of US$ 680 m. Highest-rated tranche offering a spread over the floating rate of 165bp, and the lowest-rated tranche a spread of 245bp. Bookrunners: RBC Capital Markets, Citigroup Global Markets Inc, SG Americas Securities LLC, Credit Agricole Corporate & Investment Bank, Mizuho Securities USA Inc

- 3650r 2021-Pf1 Commercial Mortgage Trust issued a fixed-rate CMBS in 9 tranches, for a total of US$ 821 m. Highest-rated tranche offering a yield to maturity of 1.12%, and the lowest-rated tranche a yield to maturity of 3.21%. Bookrunners: Deutsche Bank Securities Inc, Citigroup Global Markets Inc

- Sound Point Euro Clo VII Designated Activity Co issued a floating-rate CLO in 8 tranches, for a total of € 584 m. Highest-rated tranche offering a spread over the floating rate of 96bp, and the lowest-rated tranche a spread of 886bp. Bookrunners: Barclays Capital Group