Spreads Widen Across The Credit Complex, But Lower Rates Keep US Corporate Bonds Rising

USD corporate bond issuance today was led by US$1.6bn in 2 tranches for Continental Resources, $1.5bn in 2 tranches for Canadian company OpenText, and $1.2bn in 3 tranches for Chinese company SF Holding Investment 2021 Ltd

Published ET

iTRAXX Asia Ex Japan 5Y Corporate Credit Index & Chinese Government 5Y USD CDS (Hourly Mid Spreads) | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.40% today, with investment grade up 0.43% and high yield up 0.14% (YTD total return: +0.40%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.384% today (Month-to-date: 1.26%; Year-to-date: -0.19%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.015% today (Month-to-date: 0.70%; Year-to-date: 4.12%)

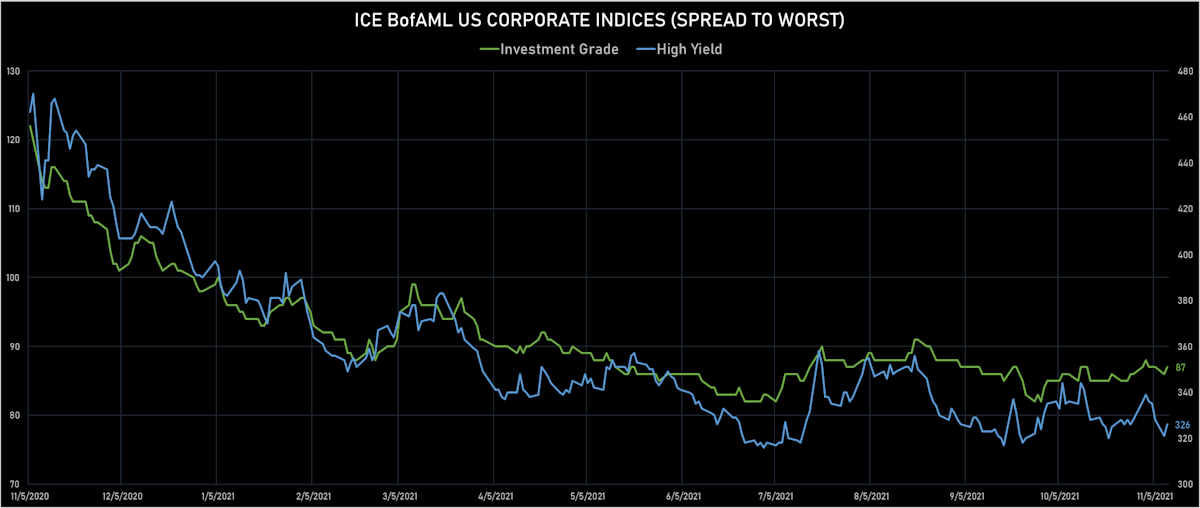

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 326.0 bp (YTD change: -64.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +3.4%)

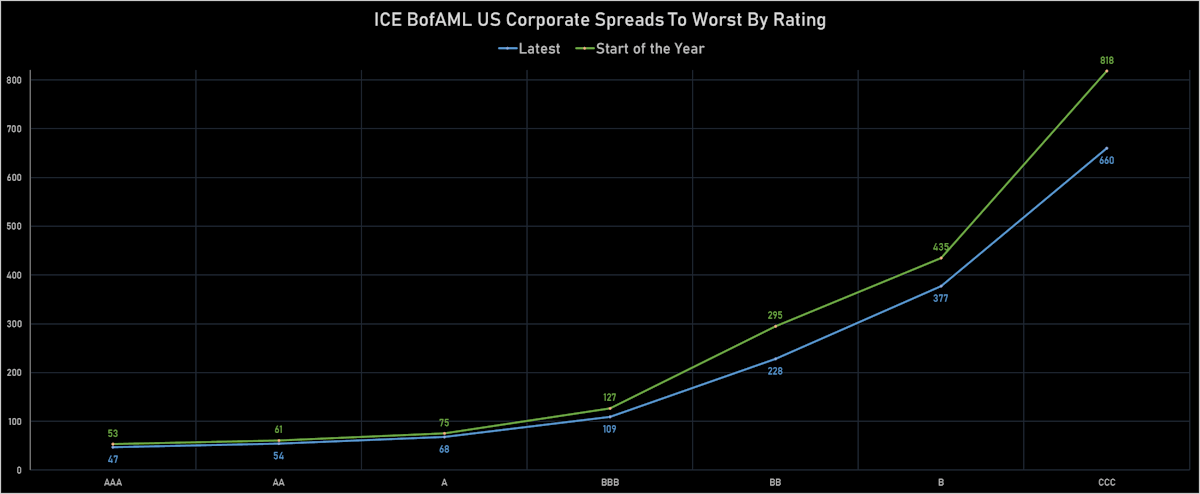

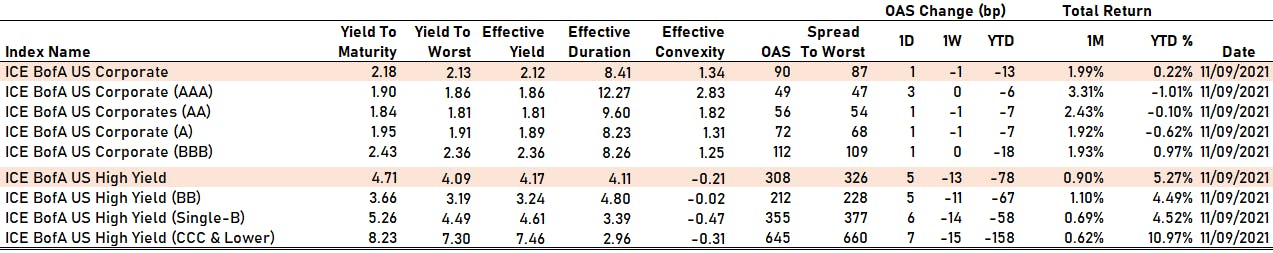

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 3 bp at 49 bp

- AA up by 1 bp at 56 bp

- A up by 1 bp at 72 bp

- BBB up by 1 bp at 112 bp

- BB up by 5 bp at 212 bp

- B up by 6 bp at 355 bp

- CCC up by 7 bp at 645 bp

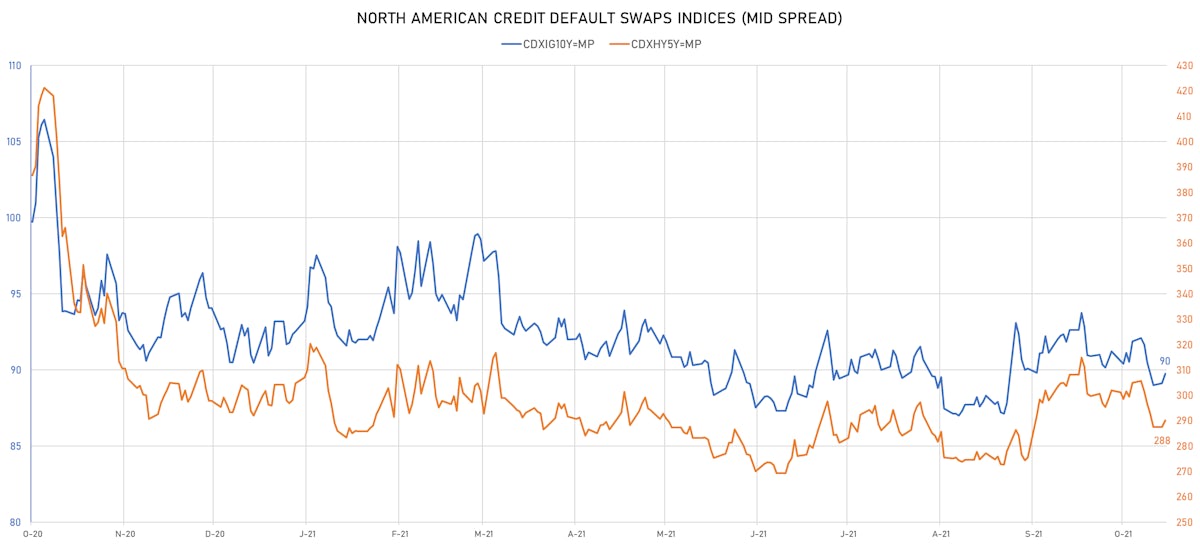

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.6 bp, now at 90bp (YTD change: -0.8bp)

- Markit CDX.NA.HY 5Y up 2.6 bp, now at 290bp (YTD change: -3.0bp)

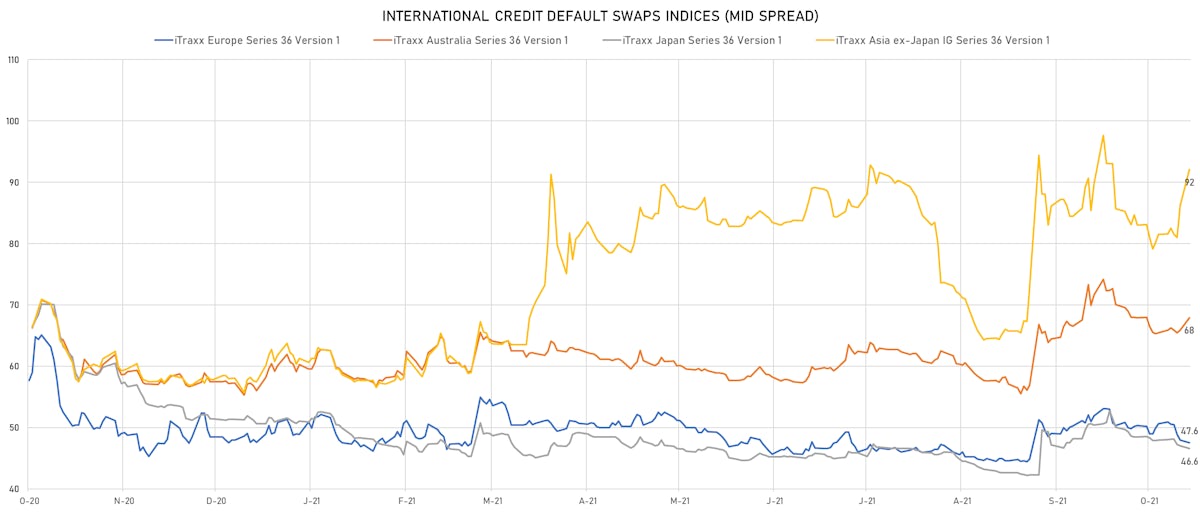

- Markit iTRAXX Europe up 0.9 bp, now at 48bp (YTD change: +0.5bp)

- Markit iTRAXX Japan up 0.1 bp, now at 47bp (YTD change: -4.7bp)

- Markit iTRAXX Asia Ex-Japan up 0.9 bp, now at 93bp (YTD change: +34.9bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

Issuer: Gemdale Ever Prosperity Investment Ltd (Hong Kong) | Coupon: 4.95% | Maturity: 12/8/2024 | Rating: BB- | ISIN: XS2357443410 | Z-spread up by 301.2 bp to 936.4 bp, with the yield to worst at 9.5% and the bond now trading down to 88.3 cents on the dollar (1Y price range: 89.8-102.0).

Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread up by 179.0 bp to 833.1 bp, with the yield to worst at 8.5% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 94.0-103.4).

Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 137.2 bp to 970.4 bp, with the yield to worst at 10.4% and the bond now trading down to 95.4 cents on the dollar (1Y price range: 93.5-102.4).

Issuer: Saka Energi Indonesia PT (Jakarta Selatan, Indonesia) | Coupon: 4.45% | Maturity: 5/5/2024 | Rating: B | ISIN: USY7140VAA80 | Z-spread up by 78.3 bp to 555.1 bp, with the yield to worst at 5.9% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 81.5-98.8).

Issuer: Bonitron DAC (DUBLIN, Ireland) | Coupon: 9.00% | Maturity: 22/10/2025 | Rating: B- | ISIN: XS2243344434 | Z-spread up by 62.7 bp to 717.1 bp, with the yield to worst at 7.7% and the bond now trading down to 103.3 cents on the dollar (1Y price range: 103.3-109.9).

Issuer: Periama Holdings LLC (Baytown, Texas (US)) | Coupon: 5.95% | Maturity: 19/4/2026 | Rating: BB- | ISIN: XS2224065289 | Z-spread up by 60.3 bp to 365.8 bp, with the yield to worst at 4.4% and the bond now trading down to 105.0 cents on the dollar (1Y price range: 104.1-109.3).

Issuer: JSW Steel Ltd (Mumbai, India) | Coupon: 5.05% | Maturity: 5/4/2032 | Rating: BB- | ISIN: USY44680RW11 | Z-spread up by 56.2 bp to 402.2 bp, with the yield to worst at 5.4% and the bond now trading down to 96.1 cents on the dollar (1Y price range: 95.0-100.9).

Issuer: MHP SE (Kiev, Cyprus) | Coupon: 7.75% | Maturity: 10/5/2024 | Rating: B | ISIN: XS1577965004 | Z-spread up by 47.9 bp to 414.8 bp, with the yield to worst at 4.6% and the bond now trading down to 106.8 cents on the dollar (1Y price range: 103.4-110.0).

Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread down by 48.1 bp to 193.7 bp, with the yield to worst at 2.6% and the bond now trading up to 110.0 cents on the dollar (1Y price range: 103.0-110.8).

Issuer: Yapi ve Kredi Bankasi AS (#N/A, Turkey) | Coupon: 6.10% | Maturity: 16/3/2023 | Rating: B | ISIN: XS1788516679 | Z-spread down by 50.5 bp to 296.8 bp, with the yield to worst at 3.2% and the bond now trading up to 103.6 cents on the dollar (1Y price range: 99.0-104.4).

Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 4.25% | Maturity: 1/7/2026 | Rating: B | ISIN: USV7780TAF04 | Z-spread down by 50.7 bp to 320.3 bp (CDS basis: -36.4bp), with the yield to worst at 4.2% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 94.1-100.9).

Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 52.4 bp to 415.5 bp, with the yield to worst at 5.1% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 98.0-105.3).

Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 89.0 bp to 473.0 bp (CDS basis: 73.1bp), with the yield to worst at 5.4% and the bond now trading up to 94.5 cents on the dollar (1Y price range: 71.0-94.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.13% | Maturity: 15/10/2024 | Rating: BB- | ISIN: XS1439749281 | Z-spread up by 42.6 bp to 306.2 bp, with the yield to worst at 2.6% and the bond now trading down to 95.4 cents on the dollar (1Y price range: 92.5-96.8).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB- | ISIN: XS2202907510 | Z-spread up by 28.8 bp to 320.5 bp (CDS basis: 1.8bp), with the yield to worst at 2.9% and the bond now trading down to 101.4 cents on the dollar (1Y price range: 101.1-106.3).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB+ | ISIN: XS2361254597 | Z-spread up by 21.0 bp to 384.0 bp, with the yield to worst at 3.5% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 94.4-100.0).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 19.4 bp to 559.4 bp, with the yield to worst at 5.4% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 92.6-102.1).

- Issuer: Mytilineos Financial Partners SA (Luxembourg, Luxembourg) | Coupon: 2.50% | Maturity: 1/12/2024 | Rating: BB- | ISIN: XS2010038144 | Z-spread up by 16.5 bp to 196.9 bp, with the yield to worst at 1.5% and the bond now trading down to 102.0 cents on the dollar (1Y price range: 101.2-103.5).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread down by 15.0 bp to 345.6 bp, with the yield to worst at 3.1% and the bond now trading up to 108.9 cents on the dollar (1Y price range: 99.6-111.6).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: BB- | ISIN: XS1824424706 | Z-spread down by 15.5 bp to 477.1 bp (CDS basis: -115.0bp), with the yield to worst at 4.6% and the bond now trading up to 100.2 cents on the dollar (1Y price range: 95.6-102.0).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread down by 28.0 bp to 265.2 bp, with the yield to worst at 2.2% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 97.9-101.3).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: BB- | ISIN: XS2283224231 | Z-spread down by 35.9 bp to 497.5 bp, with the yield to worst at 4.6% and the bond now trading up to 89.2 cents on the dollar (1Y price range: 77.0-99.6).

SELECTED RECENT USD BOND ISSUES

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$492m Bond (US3130APUM55), fixed rate (0.96% coupon) maturing on 1 December 2025, priced at 100.00, non callable

- Graphic Packaging International LLC (Conglomerate/Diversified Mfg | Atlanta, United States | Rating: BB): US$400m Senior Note (USU41441AD58), fixed rate (3.75% coupon) maturing on 1 February 2030, priced at 100.00 (original spread of 239 bp), callable (8nc8)

- Northern Oil and Gas Inc (Gas Utility - Local Distrib | Minnetonka, United States | Rating: B-): US$200m Senior Note (USU66499AE14), fixed rate (8.13% coupon) maturing on 1 March 2028, priced at 106.75, callable (6nc2)

- Principal Life Global Funding II (Financial - Other | Wilmington, United States | Rating: NR): US$600m Note (US74256LES43), fixed rate (1.50% coupon) maturing on 17 November 2026, priced at 99.42 (original spread of 55 bp), non callable

- STORE Capital Corp (Real Estate Investment Trust | Scottsdale, United States | Rating: BBB): US$375m Senior Note (US862121AD28), fixed rate (2.70% coupon) maturing on 1 December 2031, priced at 99.88 (original spread of 128 bp), callable (10nc10)

- Aptiv PLC (Vehicle Parts | Dublin, Ireland | Rating: BBB): US$1,500m Senior Note (US03835VAJ52), fixed rate (3.10% coupon) maturing on 1 December 2051, priced at 97.81 (original spread of 163 bp), callable (30nc30)

- CNCBINV 1 (BVI) Ltd (Financial - Other | China (Mainland) | Rating: NR): US$500m Senior Note (XS2400120650), fixed rate (1.75% coupon) maturing on 17 November 2024, priced at 99.89 (original spread of 110 bp), non callable

- ICTSI Treasury BV (Financial - Other | Rotterdam, Philippines | Rating: NR): US$300m Senior Note (XS2407048623), fixed rate (3.50% coupon) maturing on 16 November 2031, priced at 100.00, callable (10nc10)

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$2,500m Unsecured Note (XS2218124845), floating rate maturing on 22 November 2031, priced at 100.00, non callable

- Open Text Corp (Information/Data Technology | Waterloo, Canada | Rating: BB): US$850m Senior Note (US683715AD87), fixed rate (3.88% coupon) maturing on 1 December 2029, priced at 100.00 (original spread of 255 bp), callable (8nc3)

- Open Text Holdings Inc (Financial - Other | San Mateo, Canada | Rating: NR): US$650m Senior Note (US683720AC08), fixed rate (4.13% coupon) maturing on 1 December 2031, priced at 100.00 (original spread of 269 bp), callable (10nc5)

- SF Holding Investment 2021 Ltd (Financial - Other | Shenzhen, China (Mainland) | Rating: NR): US$300m Senior Note (XS2389983284), fixed rate (3.00% coupon) maturing on 17 November 2028, priced at 99.91 (original spread of 170 bp), with a make whole call

- SF Holding Investment 2021 Ltd (Financial - Other | Shenzhen, China (Mainland) | Rating: NR): US$500m Senior Note (XS2389983524), fixed rate (3.13% coupon) maturing on 17 November 2031, priced at 99.08 (original spread of 180 bp), with a make whole call

- SF Holding Investment 2021 Ltd (Financial - Other | Shenzhen, China (Mainland) | Rating: NR): US$400m Senior Note (XS2389983011), fixed rate (2.38% coupon) maturing on 17 November 2026, priced at 99.74 (original spread of 135 bp), with a make whole call

- Swedbank AB (Banking | Sundbyberg, Sweden | Rating: A+): US$1,000m Senior Note (XS2408003650), fixed rate (1.54% coupon) maturing on 16 November 2026, priced at 100.00 (original spread of 47 bp), non callable

- Swedish Export Credit Corp (Agency | Stockholm, Stockholm, Sweden | Rating: AA+): US$1,250m Senior Note (US87031CAD56), fixed rate (0.50% coupon) maturing on 10 November 2023, priced at 99.83 (original spread of 17 bp), non callable

SELECTED RECENT EUR BOND ISSUES

- Deutsche Lufthansa AG (Airline | Cologne, Nordrhein-Westfalen, Germany | Rating: BB-): €900m Senior Note (XS2408458730), fixed rate (2.88% coupon) maturing on 16 May 2027, priced at 99.39 (original spread of 359 bp), callable (5nc5)

- Deutsche Lufthansa AG (Airline | Cologne, Nordrhein-Westfalen, Germany | Rating: BB-): €600m Senior Note (XS2408458227), fixed rate (1.63% coupon) maturing on 16 November 2023, priced at 100.00 (original spread of 241 bp), callable (2nc2)

- Groupe des Assurances du Credit Mutuel SA (Financial - Other | Strasbourg, France | Rating: NR): €750m Bond (FR0014006KD4), fixed rate (1.13% coupon) maturing on 19 November 2031, priced at 99.29 (original spread of 151 bp), non callable

- ING Groep NV (Banking | Amsterdam, Netherlands | Rating: A-): €1,000m Subordinated Note (XS2407529309), fixed rate (1.00% coupon) maturing on 16 November 2032, priced at 99.69 (original spread of 159 bp), callable (11nc6)

- Stedin Holding NV (Utility - Other | Rotterdam, Netherlands | Rating: A-): €500m Senior Note (XS2407985220) zero coupon maturing on 16 November 2026, priced at 99.67 (original spread of 65 bp), callable (5nc5)

- Thermo Fisher Scientific (Finance I) BV (Financial - Other | Breda, United States | Rating: BBB+): €1,700m Senior Note (XS2407911705), floating rate (EU03MLIB + 20.0 bp) maturing on 18 November 2023, priced at 100.74, non callable

- Thermo Fisher Scientific (Finance I) BV (Financial - Other | Breda, United States | Rating: BBB+): €550m Senior Note (XS2407914394) zero coupon maturing on 18 November 2025, priced at 99.87 (original spread of 69 bp), callable (4nc4)

- Thermo Fisher Scientific (Finance I) BV (Financial - Other | Breda, United States | Rating: BBB+): €550m Senior Note (XS2407913586) zero coupon maturing on 18 November 2023, priced at 100.32 (original spread of 62 bp), with a make whole call

- Yorkshire Building Society (Banking | Bradford, United Kingdom | Rating: A-): €500m Covered Bond (Other) (XS2406578059), fixed rate (0.01% coupon) maturing on 16 November 2028, priced at 99.79 (original spread of 51 bp), non callable

NEW LOANS

- Chailease Int'l Finance Corp, signed a US$ 250m Term Loan, to be used for working capital. It matures on 11/09/24 and initial pricing is set at LIBOR +140bps

- US Foods Inc, signed a US$ 900m Term Loan B, to be used for general corporate purposes. It matures on 11/17/28.

NEW ISSUES IN SECURITIZED CREDIT

- Hotwire Funding LLC Series 2021-1 issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 1,340 m. Highest-rated tranche offering a yield to maturity of 2.31%, and the lowest-rated tranche a yield to maturity of 4.46%. Bookrunners: Morgan Stanley International Ltd, Barclays Capital Group

- MVW 2021-2 LLC issued a fixed-rate ABS backed by timeshare loans in 3 tranches, for a total of US$ 425 m. Highest-rated tranche offering a yield to maturity of 1.43%, and the lowest-rated tranche a yield to maturity of 2.23%. Bookrunners: Credit Suisse, Wells Fargo Securities LLC, Bank of America Merrill Lynch

- MFRA 2021-Inv2 issued a fixed-rate RMBS in 5 tranches, for a total of US$ 260 m. Highest-rated tranche offering a yield to maturity of 1.91%, and the lowest-rated tranche a yield to maturity of 4.42%. Bookrunners: Barclays Capital Group, Deutsche Bank Securities Inc, Wells Fargo Securities LLC

- FRESB 2021-Sb92 Mortgage Trust issued a floating-rate Agency CMBS in 4 tranches, for a total of US$ 351 m. Bookrunners: JP Morgan & Co Inc, Wells Fargo Securities LLC

- Toyota Auto Receivables 2021-D Owner Trust issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,482 m. Highest-rated tranche offering a yield to maturity of 0.12%, and the lowest-rated tranche a yield to maturity of 1.02%. Bookrunners: JP Morgan & Co Inc, RBC Capital Markets, BMO Capital Markets, TD Securities (USA) LLC

- Fora Financial Asset Securitization 2021 LLC issued a fixed-rate ABS backed by sm business loan in 4 tranches, for a total of US$ 101 m. Highest-rated tranche offering a yield to maturity of 2.62%, and the lowest-rated tranche a yield to maturity of 5.81%. Bookrunners: Credit Suisse