Credit

Wider Cash Spreads, Higher Rates Make For Another Day Of Poor Performance For US Corporate Bonds

Here's a summary of the record CLO issuance volumes year-to-date (LCD data): $163 bn in the US (vs $75.8 bn YTD last year), €34 bn in Europe (vs €19 bn YTD last year), for a global total of US$ 203.3bn (vs $97.30 bn YTD last year)

Published ET

Telecom Italia & British Telecom 5Y EUR CDS Spreads Have Widened Since September | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.19% today, with investment grade down -0.19% and high yield down -0.14% (YTD total return: -1.34%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.236% today (Month-to-date: -1.06%; Year-to-date: -2.48%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.102% today (Month-to-date: 0.02%; Year-to-date: 3.42%)

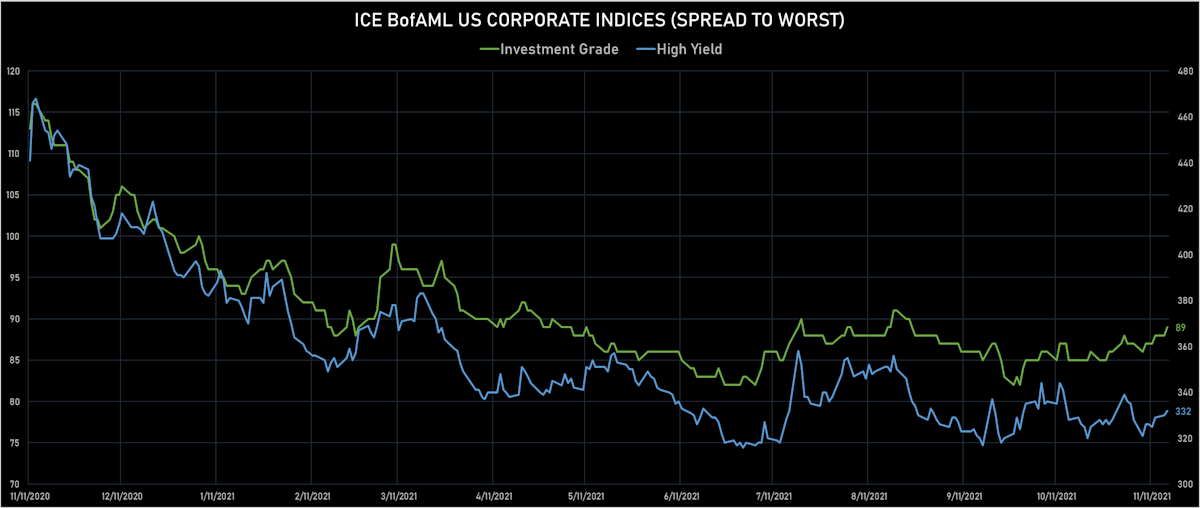

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 89.0 bp (YTD change: -9.0 bp)

- ICE BofA US High Yield Index spread to worst up 2.0 bp, now at 332.0 bp (YTD change: -58.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.00% today (YTD total return: +3.4%)

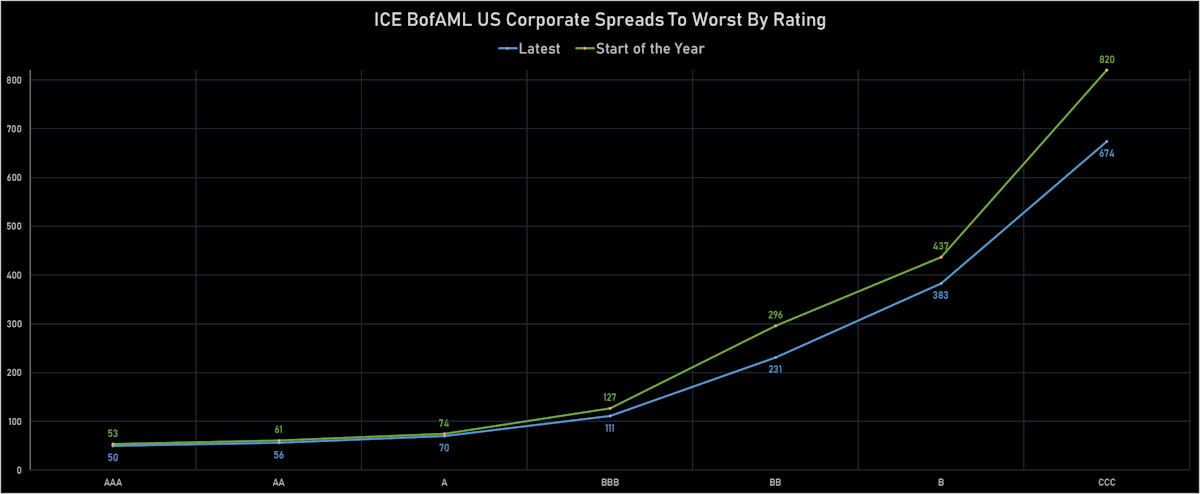

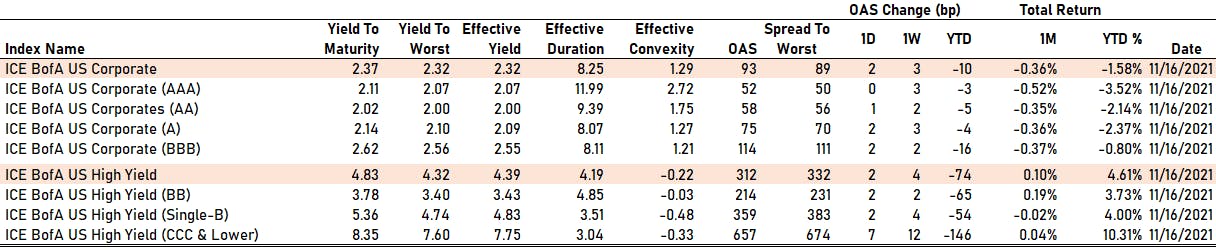

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 52 bp

- AA up by 1 bp at 58 bp

- A up by 2 bp at 75 bp

- BBB up by 2 bp at 114 bp

- BB up by 2 bp at 214 bp

- B up by 2 bp at 359 bp

- CCC up by 7 bp at 657 bp

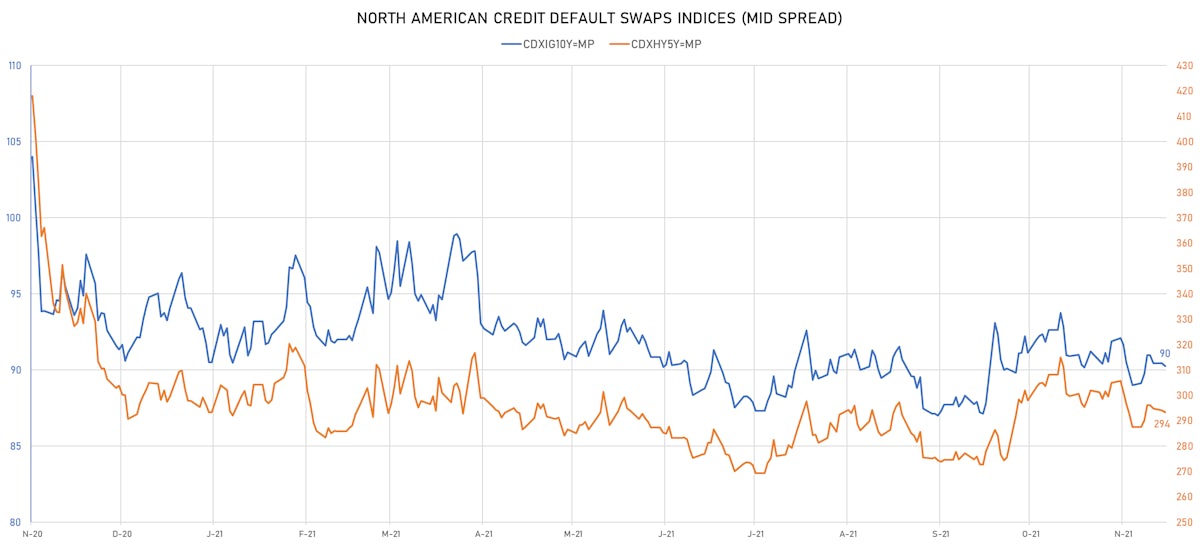

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.2 bp, now at 90bp (YTD change: -0.3bp)

- Markit CDX.NA.HY 5Y down 0.8 bp, now at 293bp (YTD change: +0.1bp)

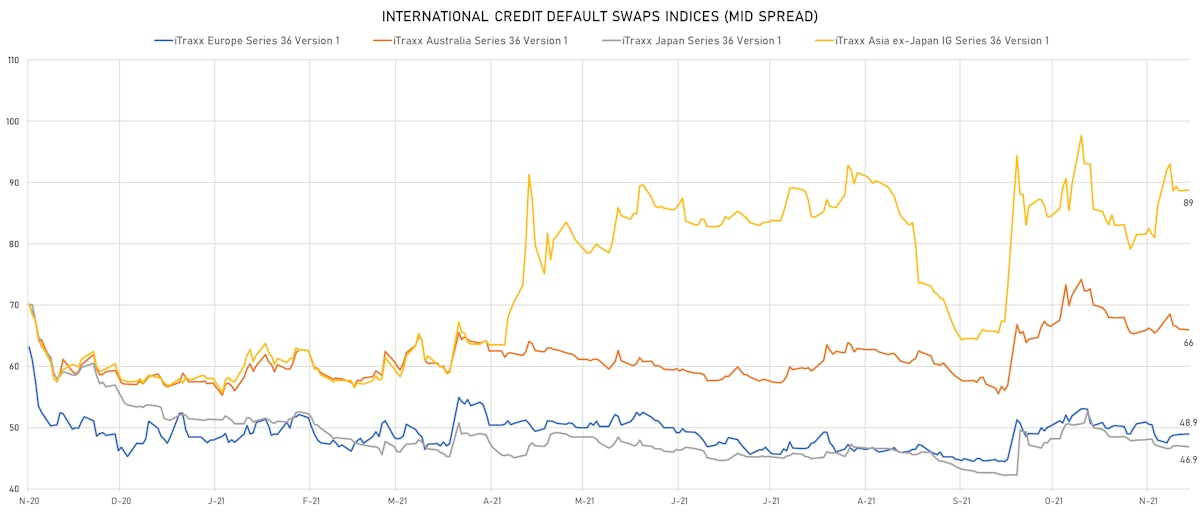

- Markit iTRAXX Europe down 0.1 bp, now at 49bp (YTD change: +0.9bp)

- Markit iTRAXX Japan down 0.3 bp, now at 47bp (YTD change: -4.7bp)

- Markit iTRAXX Asia Ex-Japan down 0.3 bp, now at 88bp (YTD change: +30.4bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- RR Donnelley & Sons Co (Country: US; rated: B2): down 89.4 bp to 162.3bp (1Y range: 162-712bp)

- Beazer Homes USA Inc (Country: US; rated: B2): down 31.2 bp to 318.7bp (1Y range: 231-388bp)

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): down 22.2 bp to 845.4bp (1Y range: 606-1,202bp)

- AngloGold Ashanti Ltd (Country: ZA; rated: ): down 14.7 bp to 163.3bp (1Y range: 163-280bp)

- Mattel Inc (Country: US; rated: Ba2): down 13.5 bp to 168.3bp (1Y range: 168-352bp)

- Genworth Holdings Inc (Country: US; rated: B2): down 12.6 bp to 331.0bp (1Y range: 331-681bp)

- iStar Inc (Country: US; rated: BBB-): up 13.8 bp to 244.2bp (1Y range: 199-324bp)

- DISH DBS Corp (Country: US; rated: B2): up 14.1 bp to 488.7bp (1Y range: 317-489bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 26.3 bp to 341.3bp (1Y range: 299-758bp)

- American Airlines Group Inc (Country: US; rated: B2): up 32.7 bp to 658.2bp (1Y range: 596-2,155bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 57.9 bp to 403.4bp (1Y range: 291-572bp)

- Talen Energy Supply LLC (Country: US; rated: B3): up 62.8 bp to 2,408.5bp (1Y range: 875-5,047bp)

- Transocean Inc (Country: KY; rated: Caa3): up 321.3 bp to 2,062.1bp (1Y range: 941-6,188bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Thyssenkrupp AG (Country: DE; rated: B1): down 18.1 bp to 227.9bp (1Y range: 206-339bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 5.5 bp to 150.6bp (1Y range: 139-266bp)

- Adecco Group AG (Country: CH; rated: A1): up 4.9 bp to 47.1bp (1Y range: 34-62bp)

- Koninklijke Philips NV (Country: NL; rated: A-): up 5.9 bp to 31.1bp (1Y range: 20-31bp)

- Stena AB (Country: SE; rated: B2-PD): up 6.7 bp to 430.6bp (1Y range: 401-728bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 8.3 bp to 209.5bp (1Y range: 154-273bp)

- British Telecommunications PLC (Country: GB; rated: Baa2): up 10.4 bp to 117.7bp (1Y range: 63-118bp)

- Novafives SAS (Country: FR; rated: Caa1): up 10.5 bp to 766.5bp (1Y range: 660-976bp)

- TUI AG (Country: DE; rated: B3-PD): up 14.1 bp to 638.9bp (1Y range: 607-946bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): up 19.1 bp to 208.9bp (1Y range: 149-209bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 20.8 bp to 409.1bp (1Y range: 333-481bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 34.4 bp to 617.4bp (1Y range: 358-646bp)

- Boparan Finance PLC (Country: GB; rated: WR): up 224.1 bp to 1,513.8bp (1Y range: 528-1,514bp)

SELECTED RECENT USD BOND ISSUES

- Arrow Electronics Inc (Electronics | Englewood, United States | Rating: BBB-): US$500m Senior Note (US04273WAC55), fixed rate (2.95% coupon) maturing on 15 February 2032, priced at 99.76 (original spread of 135 bp), callable (10nc10)

- Baxter International Inc (Health Care Supply | Deerfield, United States | Rating: A-): US$1,550m Senior Note (US071813CQ06), fixed rate (2.54% coupon) maturing on 1 February 2032, priced at 100.00 (original spread of 90 bp), callable (10nc10)

- Baxter International Inc (Health Care Supply | Deerfield, United States | Rating: A-): US$1,400m Senior Note (US071813CF41), fixed rate (1.32% coupon) maturing on 29 November 2024, priced at 100.00 (original spread of 45 bp), with a make whole call

- Baxter International Inc (Health Care Supply | Deerfield, United States | Rating: A-): US$800m Senior Note (US071813CC10), fixed rate (0.87% coupon) maturing on 1 December 2023, priced at 100.00 (original spread of 35 bp), with a special call

- Baxter International Inc (Health Care Supply | Deerfield, United States | Rating: A-): US$300m Senior Note (US071813CW73), floating rate (SOFR + 26.0 bp) maturing on 1 December 2023, priced at 100.00, non callable

- Baxter International Inc (Health Care Supply | Deerfield, United States | Rating: A-): US$1,450m Senior Note (US071813CJ62), fixed rate (1.92% coupon) maturing on 1 February 2027, priced at 100.00 (original spread of 65 bp), callable (5nc5)

- Baxter International Inc (Health Care Supply | Deerfield, United States | Rating: A-): US$300m Senior Note (US071813CZ05), floating rate (SOFR + 44.0 bp) maturing on 29 November 2024, priced at 100.00, non callable

- Baxter International Inc (Health Care Supply | Deerfield, United States | Rating: A-): US$750m Senior Note (US071813CT45), fixed rate (3.13% coupon) maturing on 1 December 2051, priced at 100.00 (original spread of 110 bp), callable (30nc30)

- Baxter International Inc (Health Care Supply | Deerfield, United States | Rating: A-): US$1,250m Senior Note (US071813CM91), fixed rate (2.27% coupon) maturing on 1 December 2028, priced at 100.00 (original spread of 75 bp), callable (7nc7)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENER71), fixed rate (1.78% coupon) maturing on 22 February 2028, priced at 100.00 (original spread of 32 bp), callable (6nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$340m Bond (US3133ENEM84), fixed rate (1.43% coupon) maturing on 23 November 2026, priced at 100.00 (original spread of 19 bp), callable (5nc1)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$1,200m Bond (US3130APYA71), fixed rate (1.04% coupon) maturing on 14 June 2024, priced at 100.00, callable (3nc1m)

- Florida Power & Light Co (Utility - Other | Juno Beach, United States | Rating: A): US$1,200m First Mortgage Bond (US341081GE16), fixed rate (2.88% coupon) maturing on 4 December 2051, priced at 99.96 (original spread of 106 bp), callable (30nc30)

- Global Payments Inc (Service - Other | Atlanta, United States | Rating: BBB-): US$500m Senior Note (US37940XAF96), fixed rate (1.50% coupon) maturing on 15 November 2024, priced at 99.93 (original spread of 65 bp), callable (3nc3)

- Interstate Power and Light Co (Utility - Other | Cedar Rapids, United States | Rating: A-): US$300m Senior Debenture (US461070AT14), fixed rate (3.10% coupon) maturing on 30 November 2051, priced at 99.57 (original spread of 110 bp), callable (30nc30)

- Leggett & Platt Inc (Conglomerate/Diversified Mfg | Carthage, United States | Rating: BBB): US$500m Senior Note (US524660BA49), fixed rate (3.50% coupon) maturing on 15 November 2051, priced at 99.71 (original spread of 172 bp), callable (30nc30)

- Primerica Inc (Life Insurance | Duluth, United States | Rating: A-): US$600m Senior Note (US74164MAB46), fixed rate (2.80% coupon) maturing on 19 November 2031, priced at 99.55 (original spread of 122 bp), callable (10nc10)

- Tapestry Inc (Consumer Products | New York City, United States | Rating: BBB-): US$500m Senior Note (US876030AA54), fixed rate (3.05% coupon) maturing on 15 March 2032, priced at 99.71 (original spread of 145 bp), callable (10nc10)

- Tenet Healthcare Corp (Health Care Facilities | Dallas, United States | Rating: B+): US$1,450m Note (US88033GDN79), fixed rate (4.38% coupon) maturing on 15 January 2030, priced at 100.00 (original spread of 284 bp), callable (8nc3)

- US Foods Inc (Restaurants | Rosemont, United States | Rating: B+): US$500m Senior Note (US90290MAE12), fixed rate (4.63% coupon) maturing on 1 June 2030, priced at 100.00 (original spread of 305 bp), callable (9nc4)

- Veritone Inc (Service - Other | Denver, United States | Rating: NR): US$150m Bond (US92347MAA80), fixed rate (1.50% coupon) maturing on 15 November 2026, priced at 100.00, non callable, convertible

- Welltower Inc (Real Estate Investment Trust | Toledo, United States | Rating: BBB+): US$500m Senior Note (US95040QAP90), fixed rate (2.75% coupon) maturing on 15 January 2032, priced at 99.92 (original spread of 112 bp), callable (10nc10)

- DBS Group Holdings Ltd (Banking | Singapore | Rating: AA-): US$700m Senior Note (US24023KAH14), fixed rate (1.17% coupon) maturing on 22 November 2024, priced at 100.00 (original spread of 30 bp), non callable

- DBS Group Holdings Ltd (Banking | Singapore | Rating: AA-): US$300m Senior Note (US24023KAG31), floating rate (SOFR + 30.0 bp) maturing on 22 November 2024, priced at 100.00, non callable

- JBS Finance Luxembourg SARL (Financial - Other | Luxembourg, Brazil | Rating: BB+): US$1,000m Senior Note (US46592QAB59), fixed rate (2.50% coupon) maturing on 15 January 2027, priced at 98.95 (original spread of 145 bp), callable (5nc5)

- Shangyu Urban Construction Hong Kong Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$240m Bond (XS2401037960), fixed rate (3.30% coupon) maturing on 19 November 2026, priced at 100.00, non callable

- Standard Chartered PLC (Banking | London, United Kingdom | Rating: BBB+): US$500m Senior Note (US853254CF55), floating rate (SOFR + 93.0 bp) maturing on 23 November 2025, priced at 100.00, callable (4nc3)

- Standard Chartered PLC (Banking | London, United Kingdom | Rating: BBB+): US$1,000m Senior Note (US853254CE80), fixed rate (1.82% coupon) maturing on 23 November 2025, priced at 100.00 (original spread of 95 bp), callable (4nc3)

SELECTED RECENT EUR BOND ISSUES

- Banca March SA (Banking | Palma De Mallorca, Spain | Rating: NR): €200m Bond (ES0313040075), floating rate maturing on 17 November 2025, non callable

- Hamburg Free and Hanseatic, City of (Official and Muni | Hamburg, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000A2LQPL2), fixed rate (0.40% coupon) maturing on 23 November 2051, priced at 99.35 (original spread of 36 bp), non callable

- Instituto de Credito Oficial (Agency | Madrid, Spain | Rating: A): €500m Senior Note (XS2412060092) zero coupon maturing on 30 April 2025, priced at 101.11 (original spread of 7 bp), non callable

- Landsbankinn hf (Banking | Reykjavik, Iceland | Rating: BBB): €300m Bond (XS2411726438), fixed rate (0.75% coupon) maturing on 25 May 2026, priced at 99.56 (original spread of 146 bp), non callable

- NIBC Bank NV (Banking | S-Gravenhage, United States | Rating: BBB+): €500m Covered Bond (Other) (XS2411638575), fixed rate (0.13% coupon) maturing on 25 November 2030, priced at 99.00 (original spread of 57 bp), non callable

- NN Group NV (Life Insurance | S-Gravenhage, Zuid-Holland, Netherlands | Rating: BBB+): €600m Senior Note (XS2411166973), fixed rate (0.88% coupon) maturing on 23 November 2031, priced at 99.79 (original spread of 114 bp), callable (10nc10)

- Societe du Grand Paris (Agency | Saint-Denis, France | Rating: AA): €1,750m Bond (FR0014006NV0), fixed rate (0.30% coupon) maturing on 25 November 2031, priced at 99.57 (original spread of 23 bp), non callable

- Societe du Grand Paris (Agency | Saint-Denis, France | Rating: AA): €1,250m Bond (FR0014006OB0), fixed rate (1.00% coupon) maturing on 26 November 2051, priced at 99.26 (original spread of 69 bp), non callable

NEW ISSUES IN SECURITIZED CREDIT

- Freddie Mac Spc Series K-F125 issued a floating-rate Agency CMBS in 1 tranche offering a spread over the floating rate of 22bp, for a total of US$ 734 m. Bookrunners: PNC Capital Markets, Bank of America Merrill Lynch

- Honda Auto Receivables 2021-4 Owner Trust issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,500 m. Highest-rated tranche offering a yield to maturity of 0.14%, and the lowest-rated tranche a yield to maturity of 1.14%. Bookrunners: Deutsche Bank Securities Inc, Bank of America Merrill Lynch, Mizuho Securities USA Inc