Credit

Spreads Wider Across The Credit Complex, Though IG Bonds Rose On Lower Rates

Another good day for corporate bond issuance, with the largest offerings coming from foreign issuers Canadian Pacific Railway (US$ 6.7 bn in 5 tranches) and Barclays Plc ($4bn in 3 tranches)

Published ET

Credit Suisse Sees US HY Default Rates Staying In The 1.0-1.5% Range For 2022 | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.21% today, with investment grade up 0.24% and high yield down -0.05% (YTD total return: -1.13%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.352% today (Month-to-date: -0.71%; Year-to-date: -2.13%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.033% today (Month-to-date: -0.01%; Year-to-date: 3.38%)

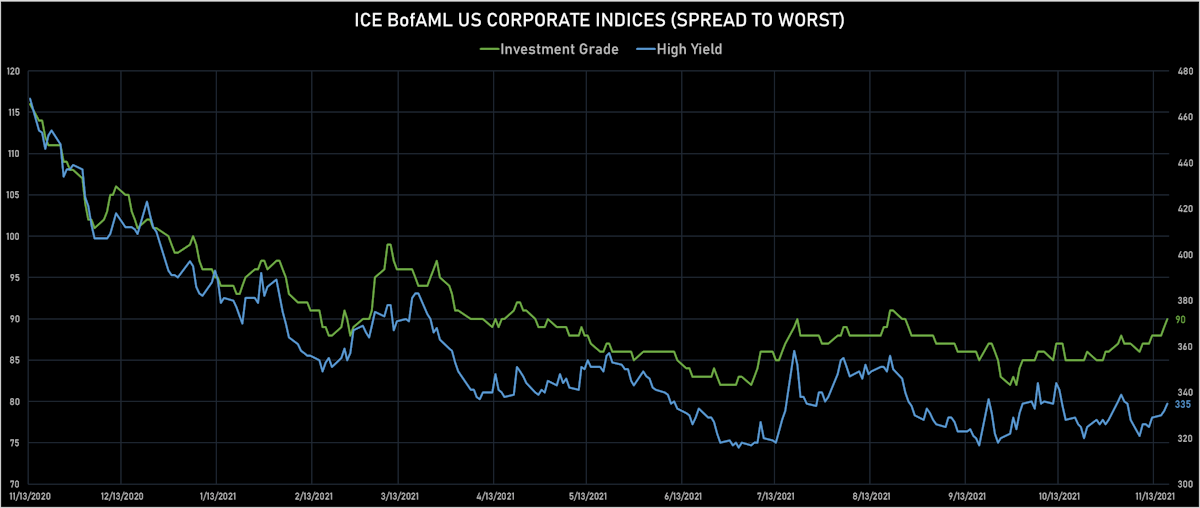

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 90.0 bp (YTD change: -8.0 bp)

- ICE BofA US High Yield Index spread to worst up 3.0 bp, now at 335.0 bp (YTD change: -55.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +3.4%)

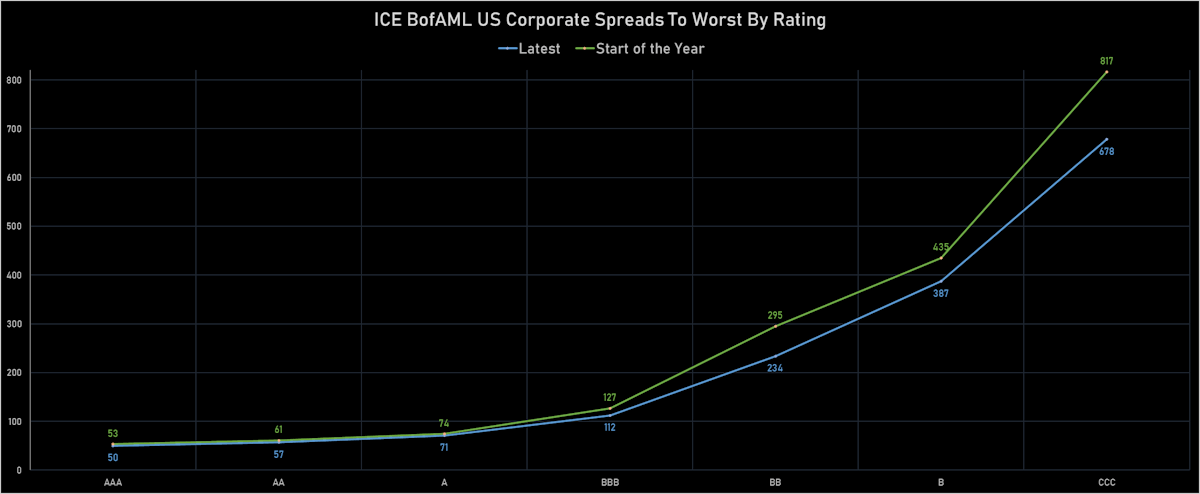

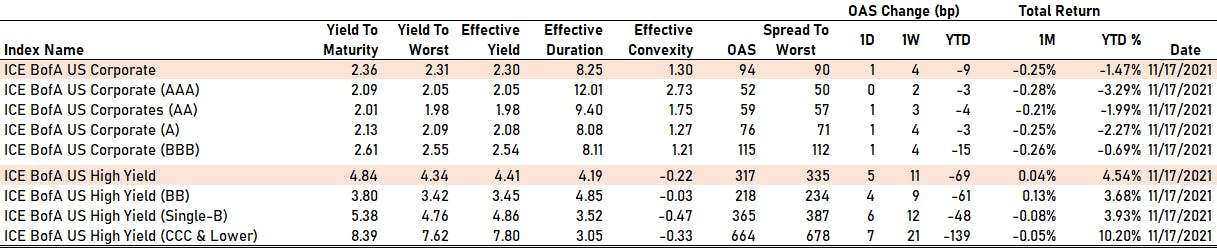

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 52 bp

- AA up by 1 bp at 59 bp

- A up by 1 bp at 76 bp

- BBB up by 1 bp at 115 bp

- BB up by 4 bp at 218 bp

- B up by 6 bp at 365 bp

- CCC up by 7 bp at 664 bp

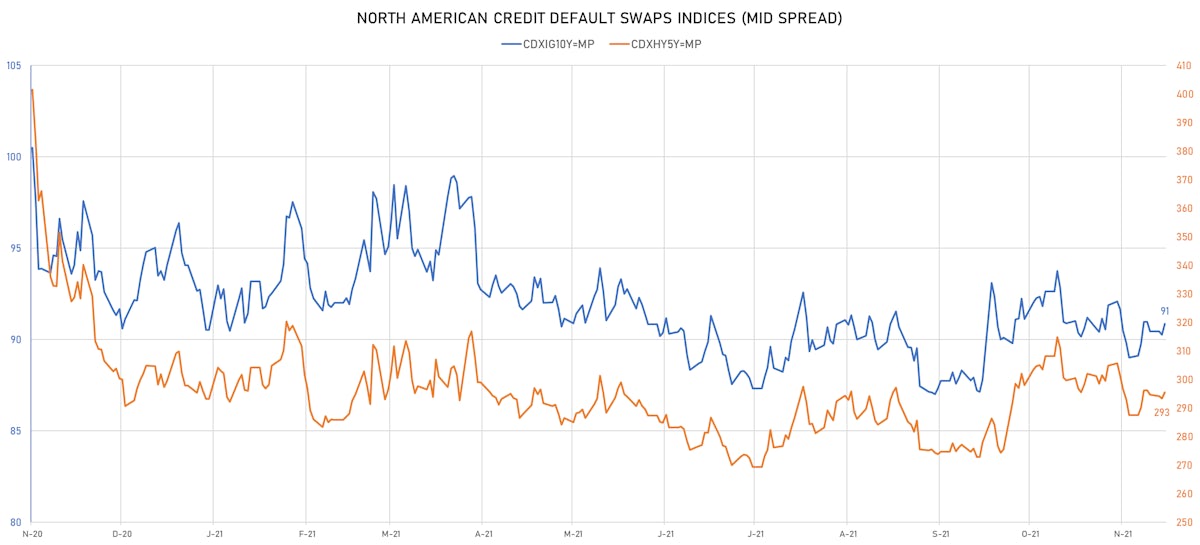

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.6 bp, now at 91bp (YTD change: +0.4bp)

- Markit CDX.NA.HY 5Y up 2.2 bp, now at 296bp (YTD change: +2.3bp)

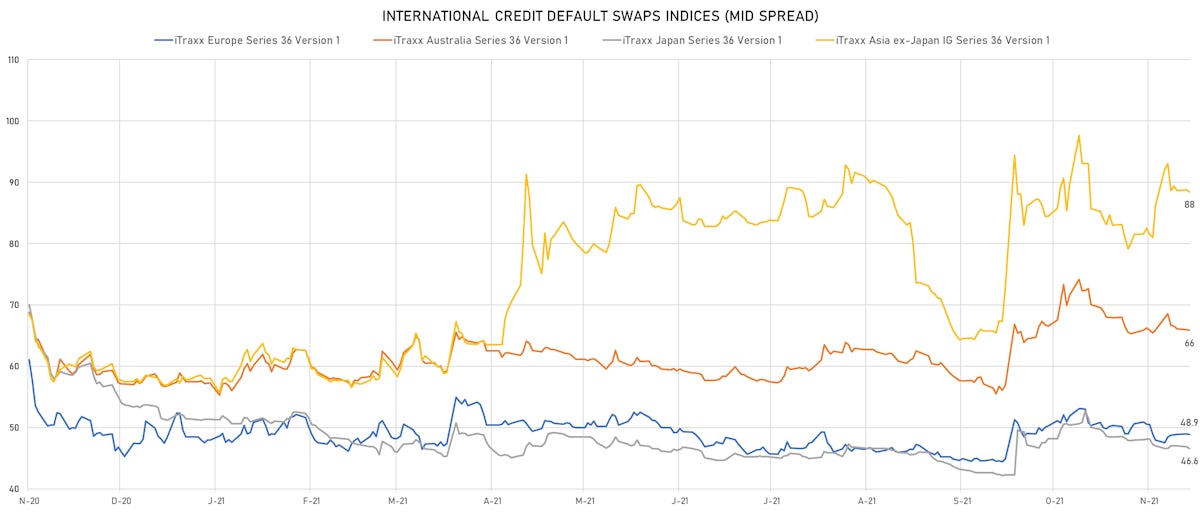

- Markit iTRAXX Europe up 0.4 bp, now at 49bp (YTD change: +1.4bp)

- Markit iTRAXX Japan unchanged at 47bp (YTD change: -4.7bp)

- Markit iTRAXX Asia Ex-Japan up 0.3 bp, now at 89bp (YTD change: +30.7bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Rail Capital Markets PLC (London, United Kingdom) | Coupon: 8.25% | Maturity: 9/7/2024 | Rating: B | ISIN: XS1843433472 | Z-spread up by 94.7 bp to 694.4 bp, with the yield to worst at 7.3% and the bond now trading down to 101.3 cents on the dollar (1Y price range: 100.8-107.0).

- Issuer: Metinvest BV (S-GRAVENHAGE, Netherlands) | Coupon: 8.50% | Maturity: 23/4/2026 | Rating: B+ | ISIN: XS1806400708 | Z-spread up by 93.5 bp to 538.4 bp, with the yield to worst at 6.3% and the bond now trading down to 106.9 cents on the dollar (1Y price range: 105.0-115.1).

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Z-spread up by 92.8 bp to 1,206.7 bp, with the yield to worst at 12.4% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 89.5-107.0).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 84.7 bp to 821.4 bp, with the yield to worst at 9.0% and the bond now trading down to 93.5 cents on the dollar (1Y price range: 92.9-105.9).

- Issuer: MHP SE (Kiev, Cyprus) | Coupon: 7.75% | Maturity: 10/5/2024 | Rating: B | ISIN: XS1577965004 | Z-spread up by 68.0 bp to 492.8 bp, with the yield to worst at 5.5% and the bond now trading down to 104.6 cents on the dollar (1Y price range: 103.4-110.0).

- Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread down by 84.1 bp to 692.4 bp, with the yield to worst at 7.2% and the bond now trading up to 96.8 cents on the dollar (1Y price range: 93.9-103.4).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread down by 116.7 bp to 784.4 bp, with the yield to worst at 8.5% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 93.5-102.4).

- Issuer: Wens Foodstuff Group Co Ltd (Yunfu, China (Mainland)) | Coupon: 2.35% | Maturity: 29/10/2025 | Rating: BB+ | ISIN: XS2239632776 | Z-spread down by 177.8 bp to 599.3 bp, with the yield to worst at 6.7% and the bond now trading up to 84.0 cents on the dollar (1Y price range: 78.5-99.1).

- Issuer: Gemdale Ever Prosperity Investment Ltd (Hong Kong) | Coupon: 4.95% | Maturity: 12/8/2024 | Rating: BB- | ISIN: XS2357443410 | Z-spread down by 351.1 bp to 545.6 bp, with the yield to worst at 5.9% and the bond now trading up to 96.6 cents on the dollar (1Y price range: 88.3-102.0).

- Issuer: Hopson Development Holdings Ltd (Bermuda) | Coupon: 6.80% | Maturity: 28/12/2023 | Rating: B+ | ISIN: XS2353028298 | Z-spread down by 470.4 bp to 892.7 bp, with the yield to worst at 9.1% and the bond now trading up to 94.6 cents on the dollar (1Y price range: 83.6-99.9).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread down by 1,137.6 bp to 1,256.8 bp, with the yield to worst at 12.6% and the bond now trading up to 84.1 cents on the dollar (1Y price range: 66.0-105.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: BB- | ISIN: XS1711584430 | Z-spread up by 43.8 bp to 278.2 bp (CDS basis: 13.4bp), with the yield to worst at 2.4% and the bond now trading down to 100.2 cents on the dollar (1Y price range: 100.1-104.4).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB- | ISIN: XS2010029663 | Z-spread up by 40.4 bp to 608.3 bp, with the yield to worst at 5.8% and the bond now trading down to 91.4 cents on the dollar (1Y price range: 81.0-105.4).

- Issuer: Telecom Italia Finance SA (Luxembourg, Luxembourg) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: BB | ISIN: XS0161100515 | Z-spread up by 28.4 bp to 343.1 bp (CDS basis: -54.5bp), with the yield to worst at 3.5% and the bond now trading down to 137.6 cents on the dollar (1Y price range: 136.6-149.5).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 26.6 bp to 284.7 bp, with the yield to worst at 2.5% and the bond now trading down to 100.2 cents on the dollar (1Y price range: 97.9-101.3).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread up by 20.4 bp to 247.7 bp (CDS basis: -76.5bp), with the yield to worst at 2.1% and the bond now trading down to 101.8 cents on the dollar (1Y price range: 97.9-103.7).

- Issuer: DIC Asset AG (Frankfurt, Germany) | Coupon: 2.25% | Maturity: 22/9/2026 | Rating: BB+ | ISIN: XS2388910270 | Z-spread up by 17.0 bp to 321.1 bp, with the yield to worst at 3.0% and the bond now trading down to 96.2 cents on the dollar (1Y price range: 95.8-99.7).

- Issuer: Teollisuuden Voima Oyj (Eurajoki, Finland) | Coupon: 1.13% | Maturity: 9/3/2026 | Rating: BB | ISIN: XS2049419398 | Z-spread up by 16.4 bp to 126.0 bp, with the yield to worst at 1.0% and the bond now trading down to 99.9 cents on the dollar (1Y price range: 92.8-101.6).

- Issuer: Thyssenkrupp AG (Essen, Germany) | Coupon: 2.88% | Maturity: 22/2/2024 | Rating: B+ | ISIN: DE000A2TEDB8 | Z-spread down by 53.5 bp to 190.1 bp (CDS basis: -26.8bp), with the yield to worst at 1.4% and the bond now trading up to 102.6 cents on the dollar (1Y price range: 100.3-103.7).

SELECTED RECENT USD BOND ISSUES

- Atlanticus Holdings Corp (Financial - Other | Atlanta, United States | Rating: NR): US$135m Senior Note (US04914Y3009), fixed rate (6.13% coupon) maturing on 30 November 2026, priced at 100.00, callable (5nc2)

- Covanta Holding Corp (Service - Other | Morristown, United States | Rating: B+): US$300m Senior Note (US22303XAA37), fixed rate (4.88% coupon) maturing on 1 December 2029, priced at 100.00 (original spread of 339 bp), callable (8nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$500m Bond (US3133ENEX40), fixed rate (0.55% coupon) maturing on 24 November 2023, priced at 100.00 (original spread of 5 bp), non callable

- Hertz Corp (Service - Other | Estero, United States | Rating: BB-): US$1,000m Senior Note (US428040DB25), fixed rate (5.00% coupon) maturing on 1 December 2029, priced at 100.00 (original spread of 351 bp), callable (8nc3)

- Hertz Corp (Service - Other | Estero, United States | Rating: BB-): US$500m Senior Note (US428040DA42), fixed rate (4.63% coupon) maturing on 1 December 2026, priced at 100.00 (original spread of 340 bp), callable (5nc2)

- Jackson Financial Inc (Life Insurance | Lansing, United States | Rating: BBB): US$500m Senior Note (US46817MAM91), fixed rate (4.00% coupon) maturing on 23 November 2051, priced at 98.98 (original spread of 227 bp), callable (30nc30)

- Jackson Financial Inc (Life Insurance | Lansing, United States | Rating: BBB): US$500m Senior Note (US46817MAK36), fixed rate (3.13% coupon) maturing on 23 November 2031, priced at 99.69 (original spread of 156 bp), callable (10nc10)

- Jackson Financial Inc (Life Insurance | Lansing, United States | Rating: BBB): US$600m Senior Note (US46817MAH07), fixed rate (1.13% coupon) maturing on 22 November 2023, priced at 99.94 (original spread of 65 bp), with a make whole call

- Renasant Corp (Banking | Tupelo, United States | Rating: NR): US$200m Subordinated Note (US75970EAE77), floating rate maturing on 1 December 2031, priced at 100.00, callable (10nc5)

- Venture Global Calcasieu Pass LLC (Oil and Gas | Washington Dc, United States | Rating: NR): US$1,250m Note (US92328MAC73), fixed rate (3.88% coupon) maturing on 1 November 2033, priced at 100.00 (original spread of 227 bp), callable (12nc11)

- WMG Acquisition Corp (Electronics | New York City, United States | Rating: BB+): US$540m Note (US92933BAT17), fixed rate (3.75% coupon) maturing on 1 December 2029, priced at 99.15 (original spread of 238 bp), callable (8nc3)

- Arrival SA (Financial - Other | Howald, Luxembourg | Rating: NR): US$200m Bond (), fixed rate (3.25% coupon) maturing on 15 December 2026, priced at 100.00, non callable, convertible

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): US$1,000m Senior Note (US06738EBW49), fixed rate (3.33% coupon) maturing on 24 November 2042, priced at 100.00 (original spread of 130 bp), callable (21nc20)

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): US$1,250m Senior Note (US06738EBV65), fixed rate (2.89% coupon) maturing on 24 November 2032, priced at 100.00 (original spread of 130 bp), callable (11nc10)

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): US$1,750m Senior Note (US06738EBU82), fixed rate (2.28% coupon) maturing on 24 November 2027, priced at 100.00 (original spread of 105 bp), callable (6nc5)

- Canadian Pacific Railway Ltd (Railroads | Calgary, Canada | Rating: BBB+): US$1,400m Senior Note (US13645RBF01), fixed rate (2.45% coupon) maturing on 2 December 2031, priced at 99.97 (original spread of 87 bp), with a make whole call

- Canadian Pacific Railway Ltd (Railroads | Calgary, Canada | Rating: BBB+): US$1,000m Senior Note (US13645RBG83), fixed rate (3.00% coupon) maturing on 2 December 2041, priced at 99.48 (original spread of 102 bp), with a make whole call

- Gabon, Republic of (Government) (Sovereign | Libreville, Gabon | Rating: CCC+): US$800m Senior Note (US362420AE18), fixed rate (7.00% coupon) maturing on 24 November 2031, priced at 100.00 (original spread of 540 bp), non callable

- Hong Kong Special Administrative Region Government (Sovereign | Hong Kong | Rating: AA-): US$1,000m Senior Note (HK0000789823), fixed rate (1.75% coupon) maturing on 24 November 2031, priced at 99.05 (original spread of 23 bp), non callable

- Jinan Hi-tech Holding Group Co Ltd (Financial - Other | Jinan, China (Mainland) | Rating: BBB): US$250m Bond (XS2406890652), fixed rate (2.80% coupon) maturing on 22 November 2024, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Centre Hospitalier Regional et Universitaire de Brest (Health Care Facilities | Brest, France | Rating: AA-): €110m Bond (FR0014006CC3) zero coupon maturing on 19 November 2023, priced at 100.32, non callable

- Commerzbank AG (Banking | Frankfurt, Germany | Rating: BBB+): €700m Inhaberschuldverschreibung (DE000CZ45WX9), floating rate (EU03MLIB + 100.0 bp) maturing on 24 November 2023, priced at 101.53, non callable

- Danske Kiinnitysluottopankki Oyj (Mortgage Banking | Helsinki, Denmark | Rating: NR): €500m Covered Bond (Other) (XS2412105533), fixed rate (0.01% coupon) maturing on 24 November 2026, priced at 100.49 (original spread of 48 bp), non callable

- GN Store Nord A/S (Information/Data Technology | Ballerup, Denmark | Rating: NR): €600m Senior Note (XS2412258522), fixed rate (0.88% coupon) maturing on 25 November 2024, priced at 99.67 (original spread of 172 bp), callable (3nc3)

- Hong Kong Special Administrative Region Government (Sovereign | Hong Kong | Rating: AA-): €1,250m Senior Note (HK0000789849) zero coupon maturing on 24 November 2026, priced at 99.91 (original spread of 60 bp), non callable

- Ile-de-France Mobilites (Transportation - Other | Paris, France | Rating: AA): €500m Bond (FR0014006PN2), fixed rate (0.68% coupon) maturing on 24 November 2036, priced at 99.97 (original spread of 33 bp), non callable

- Pinewood Finco PLC (Financial - Other | Iver, Jersey | Rating: NR): €300m Note (XS2411236859), fixed rate (3.63% coupon) maturing on 15 November 2027, priced at 100.00 (original spread of 292 bp), callable (6nc2)

- Rwe AG (Utility - Other | Essen, Germany | Rating: BBB): €750m Senior Note (XS2412044567), fixed rate (0.50% coupon) maturing on 26 November 2028, priced at 99.81 (original spread of 96 bp), callable (7nc7)

- Rwe AG (Utility - Other | Essen, Germany | Rating: BBB): €600m Senior Note (XS2412044641), fixed rate (1.00% coupon) maturing on 26 November 2033, priced at 99.14 (original spread of 132 bp), callable (12nc12)

- Sirius Real Estate Ltd (Home Builders | Saint Peter Port, Guernsey | Rating: BBB): €300m Senior Note (XS2412732708), fixed rate (1.75% coupon) maturing on 24 November 2028, priced at 99.10 (original spread of 236 bp), callable (7nc7)

NEW ISSUES IN SECURITIZED CREDIT

- Bayview Opportunity Master Fund Vi Trust 2021-Inv6 issued a floating-rate RMBS in 6 tranches, for a total of US$ 325 m. Bookrunners: Wells Fargo Securities LLC