Credit

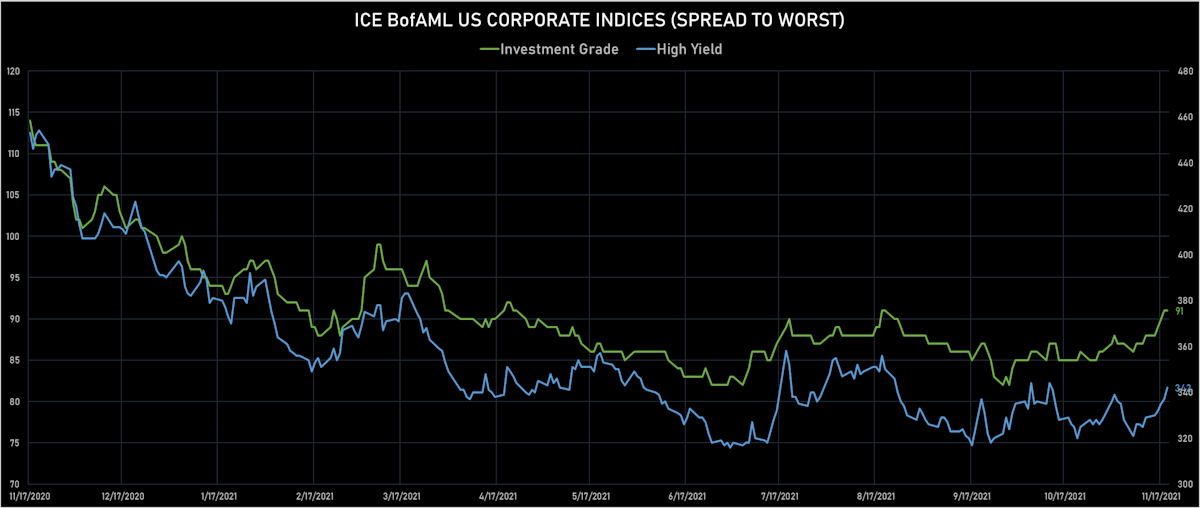

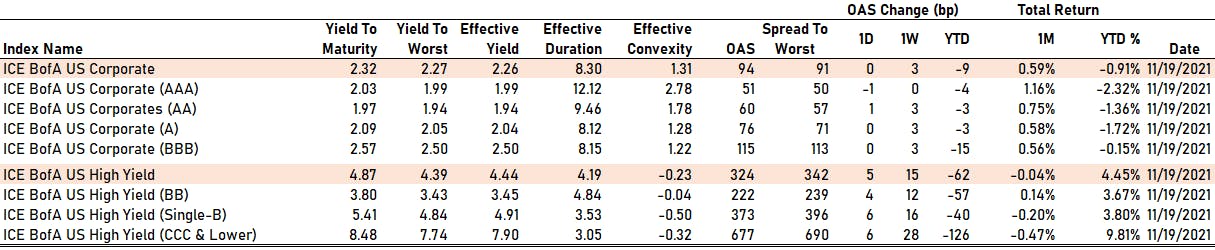

US Cash OAS Wider This Week (IG: +3bp , HY: + 15bp), With Lower Rates Taking IG Prices Higher On Friday

Weekly volumes of USD bond issuance (IFR data): US$ 56.5bn in 71 tranches for IG (2021 YTD volume at US$ 1,410 bn vs 2020 YTD $ 1,745 bn), US$ 9.19 bn in 15 tranches for HY (2021 YTD volume at $ 451.7 bn vs 2020 YTD $ 402.8 bn)

Published ET

US Corporate Cash Indices 1-Month Total Returns By Credit Rating | Sources: ϕpost, FactSet data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.27% today, with investment grade up 0.29% and high yield up 0.07% (YTD total return: -0.75%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.305% today (Month-to-date: -0.20%; Year-to-date: -1.63%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.054% today (Month-to-date: -0.06%; Year-to-date: 3.33%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 91.0 bp (YTD change: -7.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 342.0 bp (YTD change: -48.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.04% today (YTD total return: +3.3%)

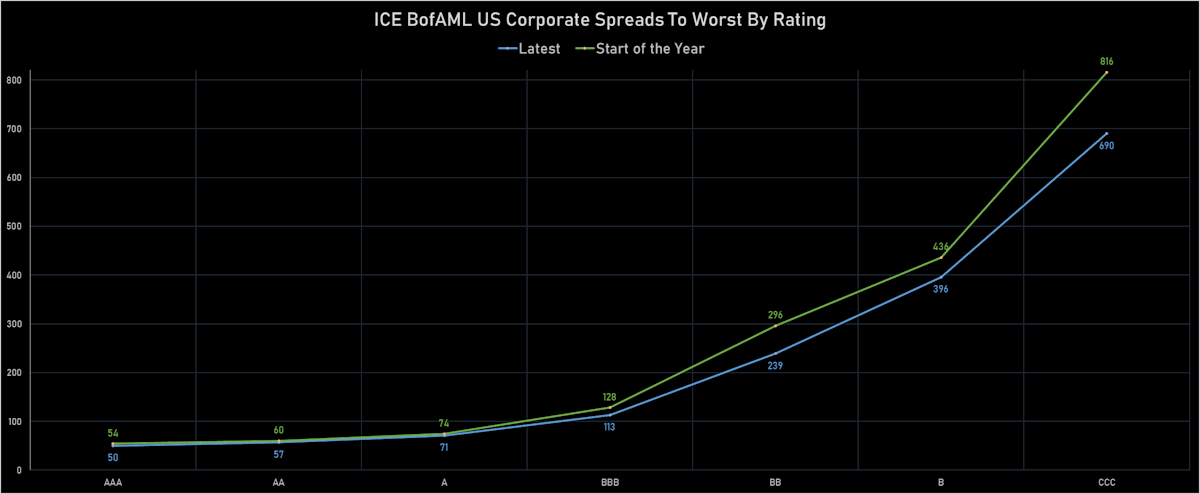

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 51 bp

- AA up by 1 bp at 60 bp

- A unchanged at 76 bp

- BBB unchanged at 115 bp

- BB up by 4 bp at 222 bp

- B up by 6 bp at 373 bp

- CCC up by 6 bp at 677 bp

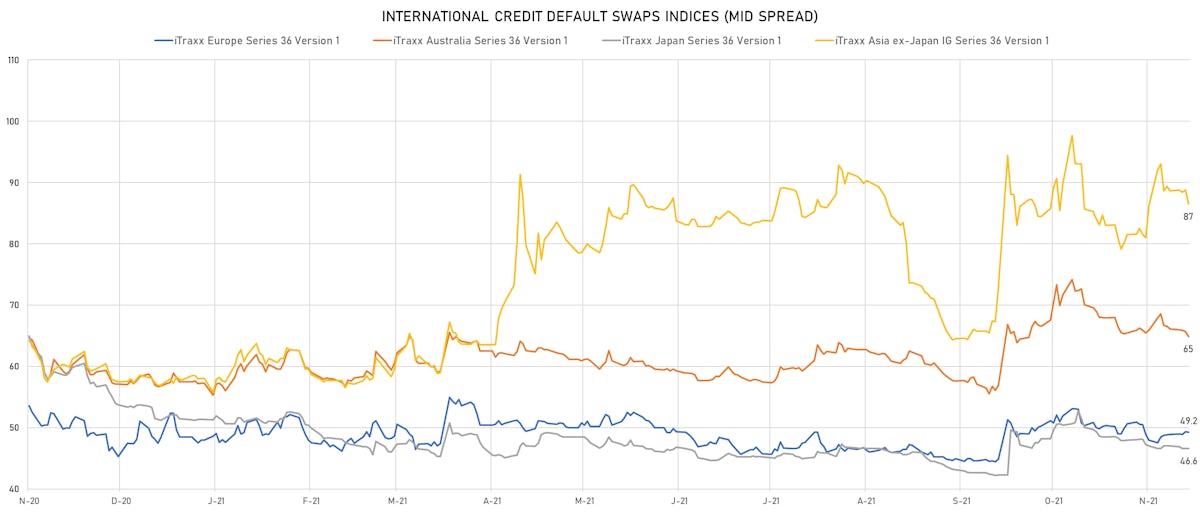

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.7 bp, now at 92bp (YTD change: +1.1bp)

- Markit CDX.NA.HY 5Y up 4.7 bp, now at 301bp (YTD change: +7.5bp)

- Markit iTRAXX Europe up 0.4 bp, now at 50bp (YTD change: +1.7bp)

- Markit iTRAXX Japan down 0.4 bp, now at 46bp (YTD change: -5.1bp)

- Markit iTRAXX Asia Ex-Japan down 1.9 bp, now at 85bp (YTD change: +26.5bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): down 52.1 bp to 804.8bp (1Y range: 606-1,202bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): down 46.9 bp to 169.7bp (1Y range: 170-712bp)

- Macy's Inc (Country: US; rated: Ba2): down 30.7 bp to 190.1bp (1Y range: 190-823bp)

- Beazer Homes USA Inc (Country: US; rated: B2): down 27.7 bp to 303.0bp (1Y range: 231-388bp)

- Mattel Inc (Country: US; rated: Ba2): down 18.7 bp to 155.1bp (1Y range: 155-352bp)

- Rite Aid Corp (Country: US; rated: B3): up 18.4 bp to 985.1bp (1Y range: 497-990bp)

- DISH DBS Corp (Country: US; rated: B2): up 25.9 bp to 508.7bp (1Y range: 317-509bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 30.0 bp to 369.0bp (1Y range: 299-726bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 30.1 bp to 405.1bp (1Y range: 395-1,912bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 53.6 bp to 439.5bp (1Y range: 291-572bp)

- American Airlines Group Inc (Country: US; rated: B2): up 53.6 bp to 692.2bp (1Y range: 596-2,104bp)

- Transocean Inc (Country: KY; rated: Caa3): up 109.5 bp to 2,029.2bp (1Y range: 941-5,853bp)

- Talen Energy Supply LLC (Country: US; rated: B3): up 332.6 bp to 2,584.5bp (1Y range: 875-5,047bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Monitchem Holdco 3 SA (Country: LU; rated: B2): down 41.8 bp to 193.4bp (1Y range: 193-326bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 36.0 bp to 205.0bp (1Y range: 205-339bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): down 14.6 bp to 192.9bp (1Y range: 154-273bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 8.5 bp to 172.6bp (1Y range: -173bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 8.5 bp to 356.8bp (1Y range: 339-654bp)

- CMA CGM SA (Country: FR; rated: Ba3): down 7.8 bp to 286.7bp (1Y range: 259-562bp)

- Air France KLM SA (Country: FR; rated: B-): up 7.5 bp to 388.6bp (1Y range: 386-699bp)

- Novafives SAS (Country: FR; rated: Caa1): up 8.0 bp to 776.8bp (1Y range: 660-976bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 9.3 bp to 657.8bp (1Y range: 464-763bp)

- British Telecommunications PLC (Country: GB; rated: BB+): up 11.5 bp to 124.4bp (1Y range: 63-126bp)

- Accor SA (Country: FR; rated: B): up 13.6 bp to 155.3bp (1Y range: 136-194bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 20.4 bp to 249.0bp (1Y range: 209-348bp)

- Boparan Finance PLC (Country: GB; rated: WR): up 31.7 bp to 1,490.9bp (1Y range: 528-1,564bp)

- TUI AG (Country: DE; rated: B3-PD): up 32.1 bp to 670.5bp (1Y range: 607-946bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 35.5 bp to 427.0bp (1Y range: 333-481bp)

SELECTED RECENT USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133ENFG08), fixed rate (2.35% coupon) maturing on 29 November 2033, priced at 100.00 (original spread of 219 bp), callable (12nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133ENFJ47), fixed rate (2.15% coupon) maturing on 1 December 2031, priced at 100.00 (original spread of 210 bp), callable (10nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$175m Bond (US3133ENFF25), fixed rate (2.04% coupon) maturing on 1 December 2031, priced at 100.00 (original spread of 188 bp), callable (10nc1)

- Warrior Met Coal Inc (Metals/Mining | Brookwood, United States | Rating: BB): US$350m Note (USU93537AC97), fixed rate (7.88% coupon) maturing on 1 December 2028, priced at 99.34 (original spread of 658 bp), callable (7nc3)

NEW ISSUES IN SECURITIZED CREDIT

- Palmer Square European CLO 2022-1 Designated Activity Co issued a floating-rate CLO in 8 tranches, for a total of € 484 m. Highest-rated tranche offering a spread over the floating rate of 97bp, and the lowest-rated tranche a spread of 885bp. Bookrunners: Goldman Sachs & Co

- Capital One Multi-Asset Execution Trust Series 2021-A3 issued a fixed-rate ABS backed by receivables in 1 tranche offering a yield to maturity of 1.04%, for a total of US$ 2,000 m. Bookrunners: Barclays Capital Group, Citigroup Global Markets Inc, Wells Fargo Securities LLC, Bank of America Merrill Lynch

- Verus Securitization Trust 2021-7 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 624 m. Highest-rated tranche offering a coupon of 2.14%, and the lowest-rated tranche a yield to maturity of 4.37%. Bookrunners: Credit Suisse, Barclays Capital Group, Deutsche Bank Securities Inc

- OBX 2021-Nqm4 Trust issued a fixed-rate RMBS in 3 tranches, for a total of US$ 495 m. Highest-rated tranche offering a yield to maturity of 1.96%, and the lowest-rated tranche a yield to maturity of 2.37%. Bookrunners: Nomura Securities Co Ltd, Morgan Stanley International Ltd

- BX Trust 2021-Rise issued a floating-rate CMBS in 9 tranches, for a total of US$ 1,198 m. Highest-rated tranche offering a spread over the floating rate of 85bp, and the lowest-rated tranche a spread of 485bp. Bookrunners: Goldman Sachs & Co, SG Americas Securities LLC, Bank of America Merrill Lynch

- Flagship Credit Auto Trust 2021-4 issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 294 m. Highest-rated tranche offering a yield to maturity of 0.81%, and the lowest-rated tranche a yield to maturity of 4.03%. Bookrunners: Wells Fargo Bank NA, Barclays Capital Group

- Commercial Equipment Finance 2021-A LLC issued a fixed-rate ABS backed by equipment leases in 4 tranches, for a total of US$ 91 m. Highest-rated tranche offering a yield to maturity of 2.05%, and the lowest-rated tranche a yield to maturity of 6.49%. Bookrunners: KeyBanc Capital Markets Inc

- Fannie Mae Multifamily Remic Trust 2021-M2s issued a fixed-rate Agency CMBS in 5 tranches, for a total of US$ 641 m. Highest-rated tranche offering a coupon of 1.63%, and the lowest-rated tranche a yield to maturity of 2.29%. Bookrunners: BMO Capital Markets