Credit

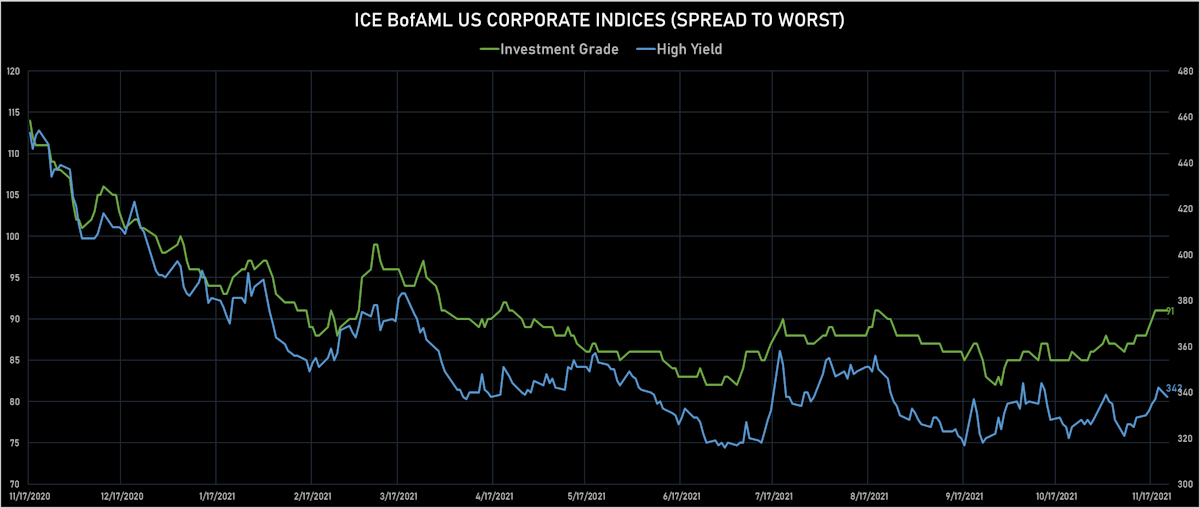

Price Action In US Corporate Bonds Dominated By Rates, Though Spreads On Cash Indices Were Unchanged In IG, Tighter In HY

Very little report in the primary market today, with the level of volatility in rates keeping most issuers on the sidelines; of note was Shell International Finance's US$ 1.5bn offering in 2 tranches

Published ET

3s5s and 5s10s Spread Compression As Higher Rates Out To The Belly Translate Into Higher Expected Default Rates | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.54% today, with investment grade down -0.57% and high yield down -0.21% (YTD total return: -1.28%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.675% today (Month-to-date: -0.87%; Year-to-date: -2.29%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.110% today (Month-to-date: -0.17%; Year-to-date: 3.22%)

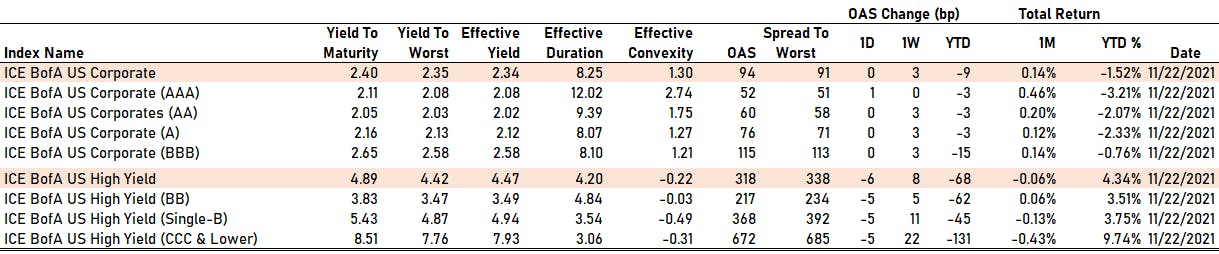

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 91.0 bp (YTD change: -7.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 338.0 bp (YTD change: -52.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.09% today (YTD total return: +3.2%)

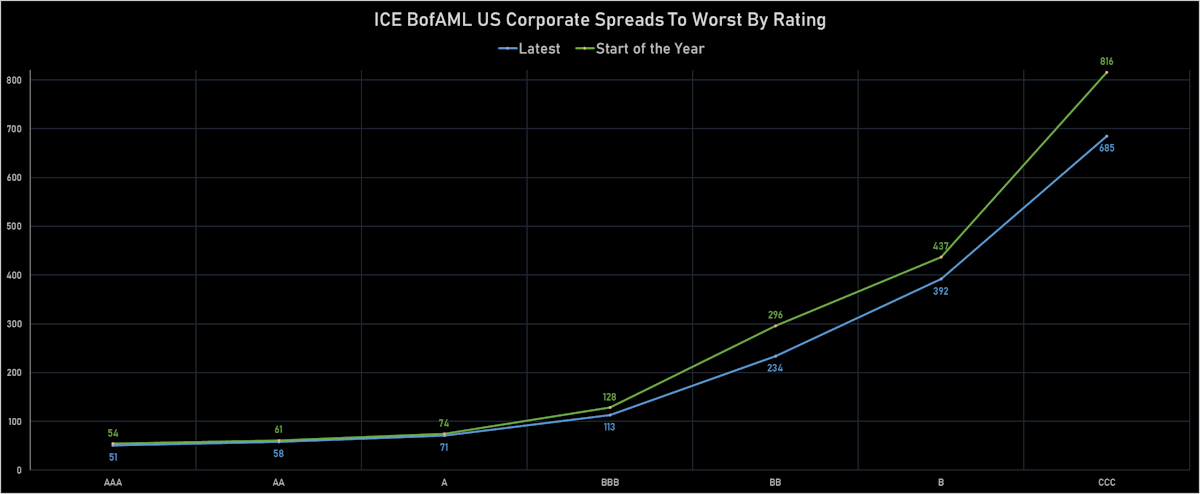

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 52 bp

- AA unchanged at 60 bp

- A unchanged at 76 bp

- BBB unchanged at 115 bp

- BB down by -5 bp at 217 bp

- B down by -5 bp at 368 bp

- CCC down by -5 bp at 672 bp

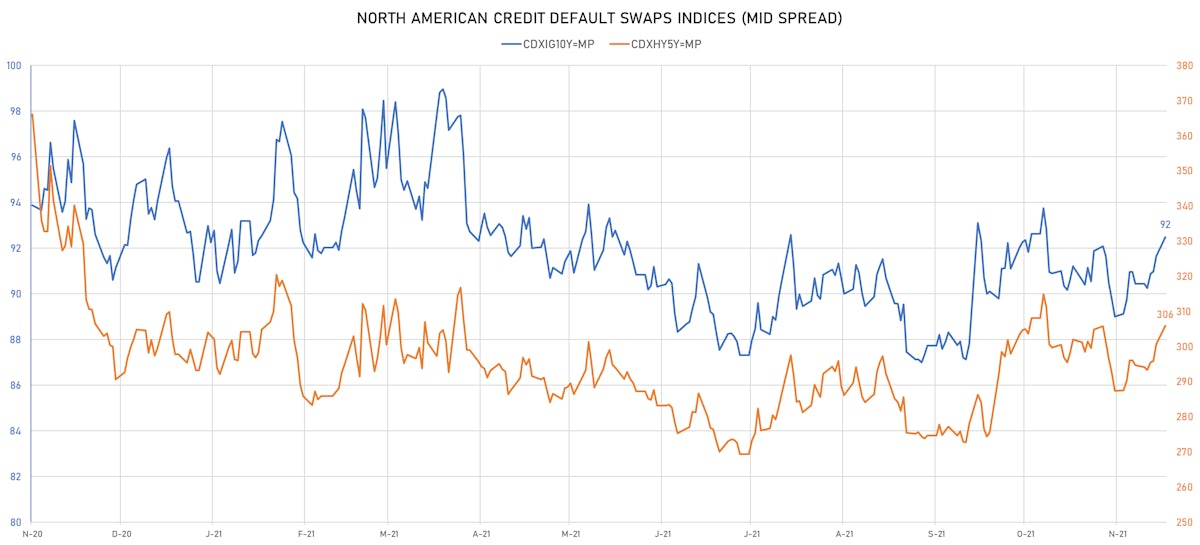

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.8 bp, now at 92bp (YTD change: +2.0bp)

- Markit CDX.NA.HY 5Y up 5.2 bp, now at 306bp (YTD change: +12.7bp)

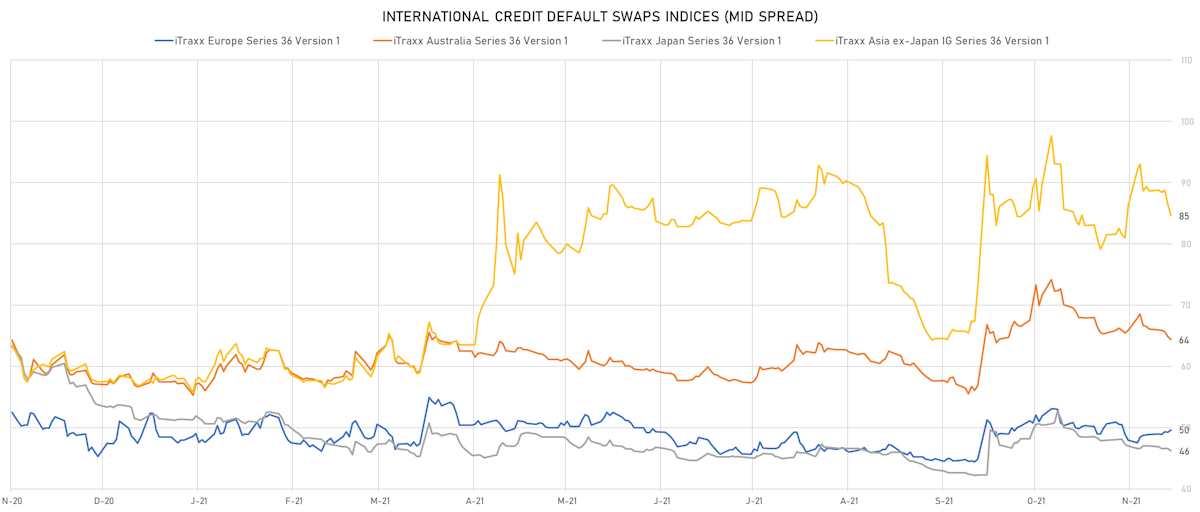

- Markit iTRAXX Europe up 0.4 bp, now at 50bp (YTD change: +2.1bp)

- Markit iTRAXX Japan up 0.2 bp, now at 46bp (YTD change: -4.9bp)

- Markit iTRAXX Asia Ex-Japan down 1.0 bp, now at 84bp (YTD change: +25.6bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Bank razvitiya Respubliki Belarus' OAO (MINSK, Belarus) | Coupon: 6.75% | Maturity: 2/5/2024 | Rating: B | ISIN: XS1904731129 | Z-spread up by 121.8 bp to 1,044.8 bp, with the yield to worst at 11.0% and the bond now trading down to 90.8 cents on the dollar (1Y price range: 90.8-102.5).

- Issuer: StoneCo Ltd (George Town, Cayman Islands) | Coupon: 3.95% | Maturity: 16/6/2028 | Rating: BB- | ISIN: USG85158AA43 | Z-spread up by 106.1 bp to 535.0 bp, with the yield to worst at 6.7% and the bond now trading down to 84.8 cents on the dollar (1Y price range: 84.8-100.0).

- Issuer: Compass Minerals International Inc (Overland Park, Kansas (US)) | Coupon: 4.88% | Maturity: 15/7/2024 | Rating: B+ | ISIN: USU2036YAC04 | Z-spread up by 85.7 bp to 292.6 bp, with the yield to worst at 3.5% and the bond now trading down to 102.1 cents on the dollar (1Y price range: 102.0-104.5).

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Z-spread up by 61.6 bp to 1,216.0 bp, with the yield to worst at 12.6% and the bond now trading down to 91.5 cents on the dollar (1Y price range: 89.5-107.0).

- Issuer: Global Ports Finance PLC (Limassol, Cyprus) | Coupon: 6.50% | Maturity: 22/9/2023 | Rating: BB | ISIN: XS1405775450 | Z-spread up by 59.1 bp to 176.3 bp, with the yield to worst at 1.8% and the bond now trading down to 107.1 cents on the dollar (1Y price range: 107.1-111.0).

- Issuer: Turkiye Vakiflar Bankasi TAO (Turkey) | Coupon: 6.50% | Maturity: 8/1/2026 | Rating: B | ISIN: XS2266963003 | Z-spread up by 48.0 bp to 527.6 bp, with the yield to worst at 6.1% and the bond now trading down to 100.3 cents on the dollar (1Y price range: 95.2-105.8).

- Issuer: Turk Telekomunikasyon AS (Ankara, Turkey) | Coupon: 4.88% | Maturity: 19/6/2024 | Rating: BB- | ISIN: XS1028951264 | Z-spread up by 42.5 bp to 315.2 bp, with the yield to worst at 3.7% and the bond now trading down to 101.8 cents on the dollar (1Y price range: 99.8-105.0).

- Issuer: Turkiye Cumhuriyeti Ziraat Bankasi AS (Ankara, Turkey) | Coupon: 5.13% | Maturity: 29/9/2023 | Rating: B | ISIN: XS1691349010 | Z-spread up by 42.3 bp to 382.6 bp, with the yield to worst at 4.0% and the bond now trading down to 101.0 cents on the dollar (1Y price range: 97.5-103.3).

- Issuer: NCL Finance Ltd (United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread up by 41.7 bp to 456.3 bp, with the yield to worst at 5.9% and the bond now trading down to 100.3 cents on the dollar (1Y price range: 98.3-105.9).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 41.0 bp to 836.9 bp, with the yield to worst at 9.3% and the bond now trading down to 92.6 cents on the dollar (1Y price range: 92.6-105.9).

- Issuer: Banco Safra SA (Cayman Islands Branch) (George Town, Cayman Islands) | Coupon: 4.13% | Maturity: 8/2/2023 | Rating: BB- | ISIN: US05964TAQ22 | Z-spread down by 41.8 bp to 159.5 bp, with the yield to worst at 1.9% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 102.0-104.8).

- Issuer: Gemdale Ever Prosperity Investment Ltd (Hong Kong) | Coupon: 4.95% | Maturity: 12/8/2024 | Rating: BB- | ISIN: XS2357443410 | Z-spread down by 45.1 bp to 594.0 bp, with the yield to worst at 6.3% and the bond now trading up to 95.6 cents on the dollar (1Y price range: 88.3-102.0).

- Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread down by 54.1 bp to 645.5 bp, with the yield to worst at 6.9% and the bond now trading up to 97.5 cents on the dollar (1Y price range: 93.9-103.4).

- Issuer: Wens Foodstuff Group Co Ltd (Yunfu, China (Mainland)) | Coupon: 2.35% | Maturity: 29/10/2025 | Rating: BB+ | ISIN: XS2239632776 | Z-spread down by 81.1 bp to 556.1 bp, with the yield to worst at 6.4% and the bond now trading up to 85.0 cents on the dollar (1Y price range: 78.5-99.1).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread down by 101.4 bp to 1,104.5 bp, with the yield to worst at 11.3% and the bond now trading up to 86.9 cents on the dollar (1Y price range: 66.0-105.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: BB | ISIN: XS1419869885 | Z-spread up by 58.2 bp to 278.3 bp (CDS basis: -93.1bp), with the yield to worst at 2.5% and the bond now trading down to 104.2 cents on the dollar (1Y price range: 104.0-111.3).

- Issuer: Telecom Italia Finance SA (Luxembourg, Luxembourg) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: BB | ISIN: XS0161100515 | Z-spread up by 58.0 bp to 395.9 bp (CDS basis: -103.5bp), with the yield to worst at 4.0% and the bond now trading down to 132.3 cents on the dollar (1Y price range: 132.3-149.5).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread up by 38.5 bp to 289.2 bp (CDS basis: -92.6bp), with the yield to worst at 2.4% and the bond now trading down to 100.6 cents on the dollar (1Y price range: 97.9-103.7).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | Z-spread up by 37.9 bp to 444.2 bp (CDS basis: -187.5bp), with the yield to worst at 4.3% and the bond now trading down to 77.2 cents on the dollar (1Y price range: 71.0-83.7).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 30.0 bp to 320.7 bp, with the yield to worst at 2.7% and the bond now trading down to 99.2 cents on the dollar (1Y price range: 97.9-101.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 5.25% | Maturity: 17/3/2055 | Rating: BB | ISIN: XS0214965963 | Z-spread up by 27.1 bp to 455.0 bp (CDS basis: -122.1bp), with the yield to worst at 4.7% and the bond now trading down to 107.3 cents on the dollar (1Y price range: 105.2-126.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Z-spread up by 24.9 bp to 428.0 bp (CDS basis: -93.9bp), with the yield to worst at 4.1% and the bond now trading down to 93.2 cents on the dollar (1Y price range: 89.3-95.4).

- Issuer: Thyssenkrupp AG (Essen, Germany) | Coupon: 2.50% | Maturity: 25/2/2025 | Rating: B+ | ISIN: DE000A14J587 | Z-spread down by 39.7 bp to 165.0 bp (CDS basis: 11.4bp), with the yield to worst at 1.2% and the bond now trading up to 103.4 cents on the dollar (1Y price range: 100.1-103.9).

SELECTED RECENT USD BOND ISSUES

- RGA Global Funding (Financial - Other | Wilmington, United States | Rating: NR): US$500m Note (US76209PAA12), fixed rate (2.00% coupon) maturing on 30 November 2026, priced at 99.95 (original spread of 70 bp), non callable

- Shell International Finance BV (Financial - Other | S-Gravenhage, Netherlands | Rating: NR): US$1,000m Senior Note (US822582CL48), fixed rate (3.00% coupon) maturing on 26 November 2051, priced at 99.76 (original spread of 122 bp), callable (30nc30)

- Shell International Finance BV (Financial - Other | S-Gravenhage, Netherlands | Rating: NR): US$500m Senior Note (US822582CK64), fixed rate (2.88% coupon) maturing on 26 November 2041, priced at 98.78 (original spread of 112 bp), callable (20nc20)

SELECTED RECENT EUR BOND ISSUES

- ING Groep NV (Banking | Amsterdam, Netherlands | Rating: A-): €1,250m Senior Note (XS2413696761), floating rate maturing on 29 November 2025, priced at 99.84 (original spread of 98 bp), callable (4nc3)

- ING Groep NV (Banking | Amsterdam, Netherlands | Rating: A-): €750m Senior Note (XS2413697140), floating rate maturing on 29 November 2030, priced at 99.72 (original spread of 137 bp), callable (9nc8)

- Raiffeisen landesbank Tirol AG (Banking | Innsbruck, Austria | Rating: A-): €400m Fundierte Schuldverschreibungen (Covered Bond) (AT0000A2UFK2), floating rate (EU03MLIB + 0.0 bp) maturing on 9 December 2026, priced at 100.00, non callable