Credit

Wider Cash Spreads, Higher Rates Send Corporate Bond Prices Sliding, As Fund Managers Lighten Up Risk Ahead Of Thanksgiving

CDW raised $2.5 bn in 3 tranches, the largest corporate bond offering today, as the volume of issuance slowed drastically in a difficult pre-holiday market

Published ET

iBOXX USD Liquid Bonds Total Return Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.62% today, with investment grade down -0.64% and high yield down -0.46% (YTD total return: -1.89%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.794% today (Month-to-date: -1.66%; Year-to-date: -3.07%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.434% today (Month-to-date: -0.61%; Year-to-date: 2.77%)

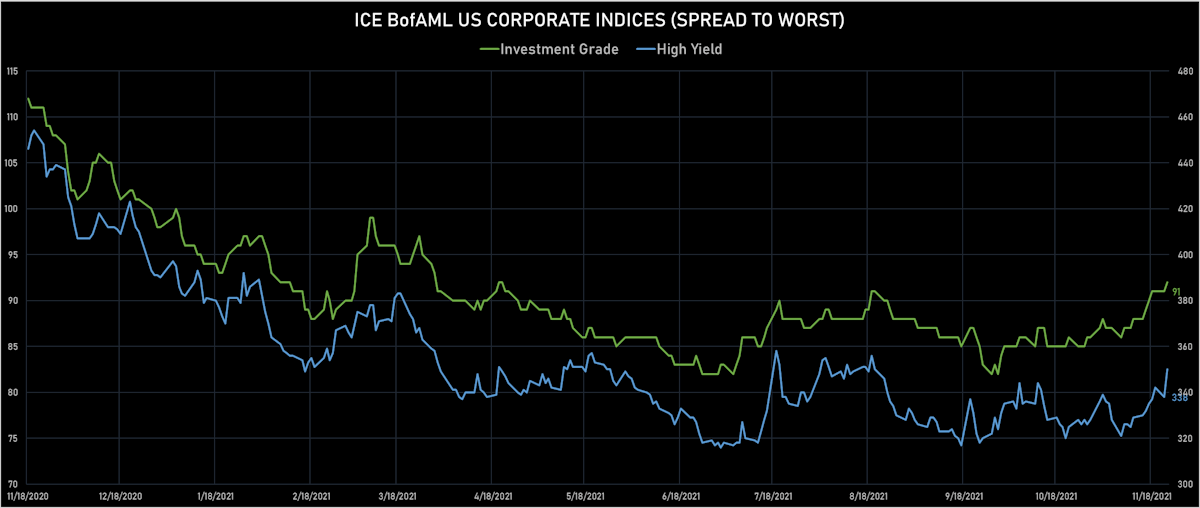

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 92.0 bp (YTD change: -6.0 bp)

- ICE BofA US High Yield Index spread to worst up 12.0 bp, now at 350.0 bp (YTD change: -40.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.06% today (YTD total return: +3.1%)

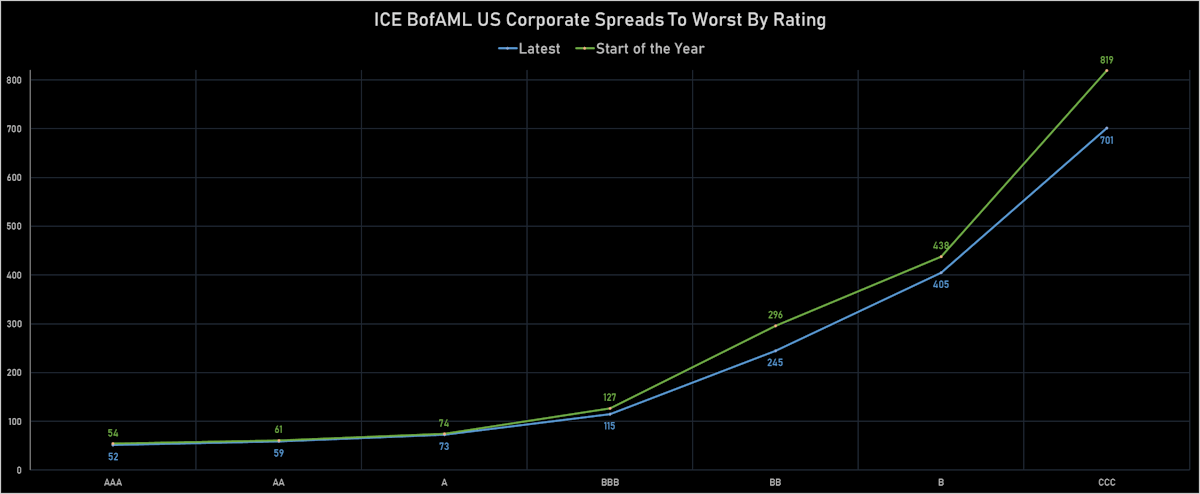

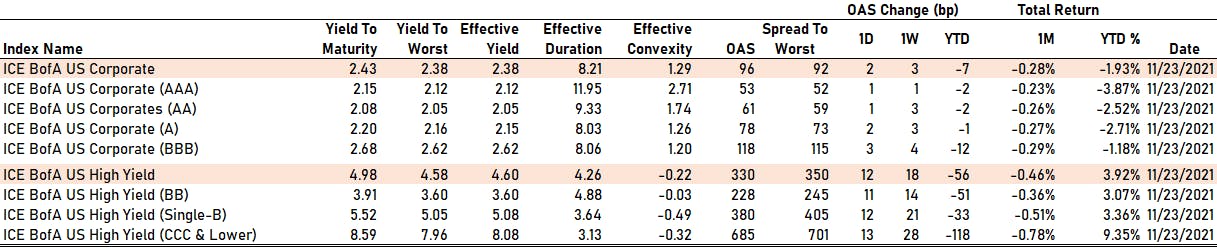

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 53 bp

- AA up by 1 bp at 61 bp

- A up by 2 bp at 78 bp

- BBB up by 3 bp at 118 bp

- BB up by 11 bp at 228 bp

- B up by 12 bp at 380 bp

- CCC up by 13 bp at 685 bp

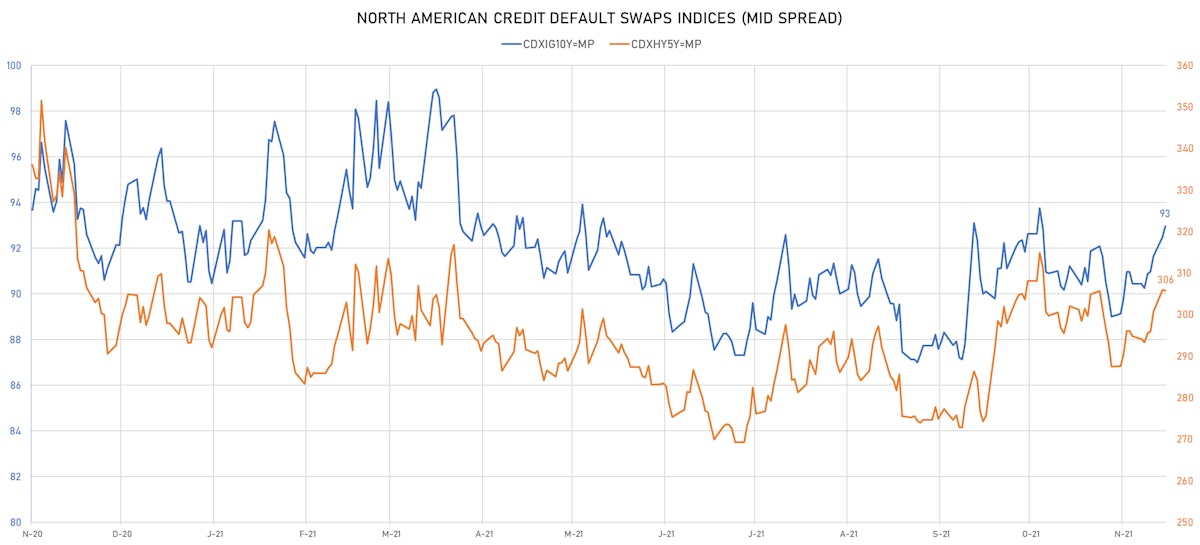

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.5 bp, now at 93bp (YTD change: +2.5bp)

- Markit CDX.NA.HY 5Y down 0.2 bp, now at 306bp (YTD change: +12.5bp)

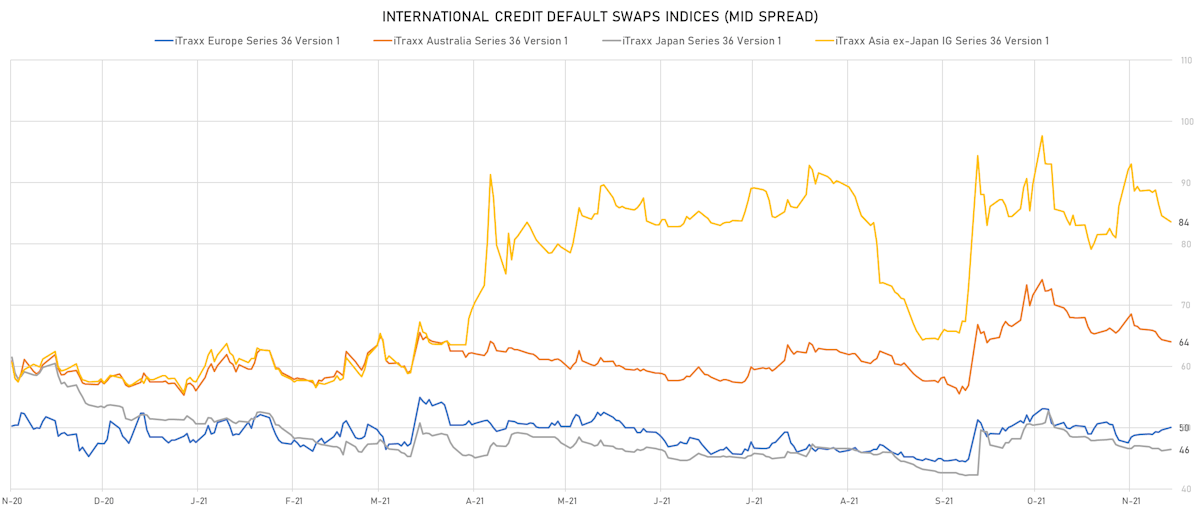

- Markit iTRAXX Europe up 1.6 bp, now at 52bp (YTD change: +3.7bp)

- Markit iTRAXX Japan unchanged at 46bp (YTD change: -4.9bp)

- Markit iTRAXX Asia Ex-Japan up 1.8 bp, now at 85bp (YTD change: +27.3bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): down 37.5 bp to 804.4bp (1Y range: 606-1,202bp)

- Macy's Inc (Country: US; rated: Ba2): down 33.9 bp to 189.8bp (1Y range: 181-749bp)

- Domtar Corp (Country: US; rated: Ba2): up 16.6 bp to 409.5bp (1Y range: 65-409bp)

- Staples Inc (Country: US; rated: B2): up 16.7 bp to 1,083.7bp (1Y range: 652-1,084bp)

- DISH DBS Corp (Country: US; rated: B2): up 20.0 bp to 517.6bp (1Y range: 317-518bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 20.8 bp to 411.8bp (1Y range: 395-1,912bp)

- South Africa, Republic of (Government) (Country: ZA; rated: WR): up 22.4 bp to 222.0bp (1Y range: 177-242bp)

- Petroleos Mexicanos (Country: MX; rated: BBB+): up 25.4 bp to 364.6bp (1Y range: 321-516bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 26.8 bp to 376.7bp (1Y range: 299-726bp)

- Nordstrom Inc (Country: US; rated: Ba1): up 30.7 bp to 262.5bp (1Y range: 211-397bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 34.2 bp to 446.6bp (1Y range: 291-572bp)

- Egypt, Arab Republic of (Government) (Country: EG; rated: Ba2): up 36.3 bp to 488.9bp (1Y range: 319-489bp)

- Turkey, Republic of (Government) (Country: TR; rated: BB): up 60.2 bp to 486.9bp (1Y range: 283-487bp)

- Transocean Inc (Country: KY; rated: Caa3): up 133.7 bp to 2,132.5bp (1Y range: 941-5,670bp)

- Talen Energy Supply LLC (Country: US; rated: B3): up 237.9 bp to 2,654.0bp (1Y range: 875-5,047bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Novafives SAS (Country: FR; rated: Caa1): down 90.5 bp to 682.1bp (1Y range: 660-976bp)

- Boparan Finance PLC (Country: GB; rated: WR): down 56.7 bp to 1,479.5bp (1Y range: 528-1,564bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 15.7 bp to 206.8bp (1Y range: 206-332bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 10.3 bp to 170.4bp (1Y range: -170bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 11.0 bp to 437.1bp (1Y range: 333-481bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 13.9 bp to 630.7bp (1Y range: 358-646bp)

- Accor SA (Country: FR; rated: B): up 16.2 bp to 159.2bp (1Y range: 136-194bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 17.4 bp to 228.5bp (1Y range: 154-273bp)

- Air France KLM SA (Country: FR; rated: B-): up 18.0 bp to 402.8bp (1Y range: 386-699bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): up 22.2 bp to 172.5bp (1Y range: 139-266bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 27.9 bp to 684.7bp (1Y range: 464-756bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 35.3 bp to 191.1bp (1Y range: 107-227bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 35.8 bp to 265.2bp (1Y range: 209-348bp)

- TUI AG (Country: DE; rated: B3-PD): up 52.3 bp to 694.9bp (1Y range: 607-946bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): up 52.9 bp to 263.0bp (1Y range: 149-263bp)

SELECTED RECENT USD BOND ISSUES

- CDW Finance Corp (Financial - Other | Vernon Hills, United States | Rating: BBB-): US$1,000m Senior Note (US12513GBJ76), fixed rate (3.57% coupon) maturing on 1 December 2031, priced at 100.00 (original spread of 190 bp), callable (10nc10)

- CDW LLC (Information/Data Technology | Lincolnshire, United States | Rating: BBB-): US$500m Senior Note (US12513GBH11), fixed rate (3.28% coupon) maturing on 1 December 2028, priced at 100.00 (original spread of 170 bp), callable (7nc7)

- CDW LLC (Information/Data Technology | Lincolnshire, United States | Rating: BBB-): US$1,000m Senior Note (US12513GBG38), fixed rate (2.67% coupon) maturing on 1 December 2026, priced at 100.00 (original spread of 135 bp), callable (5nc5)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$500m Bond (US3130AQ4B64), fixed rate (1.20% coupon) maturing on 23 December 2024, priced at 100.00, callable (3nc3m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$500m Bond (US3130AQ3F87), fixed rate (1.15% coupon) maturing on 10 December 2024, priced at 100.00, callable (3nc3m)

- North-Rhine Westphalia, State of (Official and Muni | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): US$600m Senior Note (XS2415401624), floating rate (SOFR + 100.0 bp) maturing on 1 December 2023, priced at 101.70, non callable

SELECTED RECENT EUR BOND ISSUES

- BNP Paribas SA (Banking | Paris, France | Rating: A+): €1,000m Bond (FR0014006NI7), floating rate maturing on 30 May 2028, priced at 99.36 (original spread of 117 bp), with a regulatory call

- Canary Islands, Autonomous Community of (Official and Muni | Las Palmas De Gran Canaria, Spain | Rating: BBB-): €300m Bond (ES0000093452), fixed rate (0.71% coupon) maturing on 31 October 2031, priced at 100.00 (original spread of 23 bp), non callable

- Electricite de France SA (Agency | Paris, France | Rating: BBB+): €1,750m Bond (FR0014006UO0), fixed rate (1.00% coupon) maturing on 29 November 2033, priced at 97.80 (original spread of 143 bp), callable (12nc12)

- Paris, City of (Official and Muni | Paris, France | Rating: AA): €300m Bond (FR0014006TX3), fixed rate (0.75% coupon) maturing on 30 November 2041, priced at 99.21 (original spread of 37 bp), non callable

- Societe Generale SFH SA (Financial - Other | Puteaux, France | Rating: NR): €1,500m Obligation de Financement de l'Habitat (Covered Bond) (FR0014006UI2), fixed rate (0.01% coupon) maturing on 2 December 2026, priced at 100.63 (original spread of 44 bp), non callable

- Thuringia, State of (Official and Muni | Erfurt, Germany | Rating: AAA): €500m Jumbo Landesobligation (DE000A3H3G17), fixed rate (0.38% coupon) maturing on 1 December 2051, priced at 98.82 (original spread of 37 bp), non callable

NEW ISSUES IN SECURITIZED CREDIT

- Seb Funding LLC 2021-1 issued a fixed-rate ABS backed by business cashflow in 1 tranche, with a yield to maturity of 4.97%, for a total of US$ 485 m. Bookrunners: Barclays Capital Group