Credit

Lower Rates At The Front End Of The Curve, A Dip In Rates Volatility And Tighter Spreads Bring Nice Bounce In High Yield Bonds

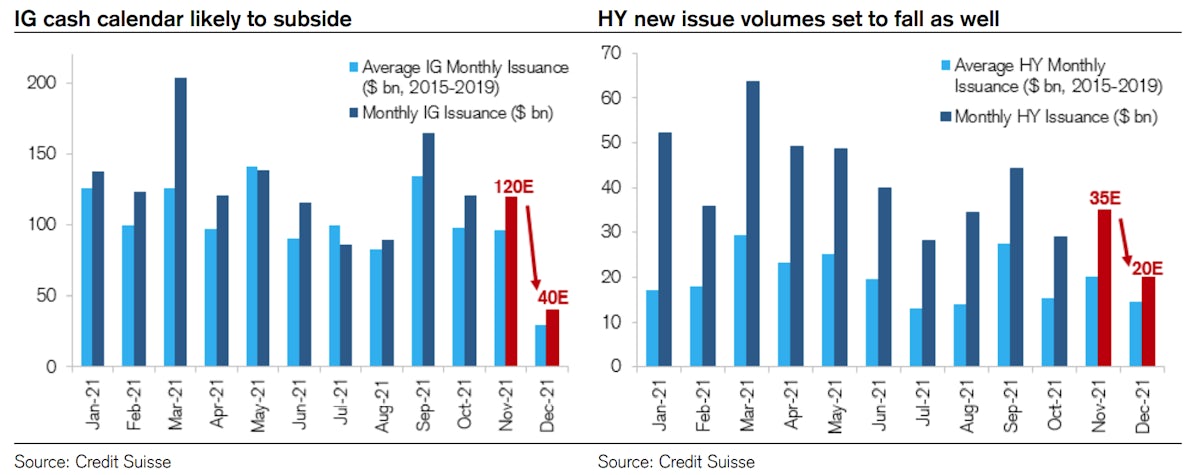

In a new note, Credit Suisse analysts point out that December should be a good month for US credit, with positive seasonality and reduced supply helping prices higher

Published ET

Favorable Calendar Should Help US Credit End The Year Higher | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.29% today, with investment grade down -0.34% and high yield up 0.11% (YTD total return: -1.11%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.166% today (Month-to-date: -0.46%; Year-to-date: -1.89%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.421% today (Month-to-date: -0.95%; Year-to-date: 2.42%)

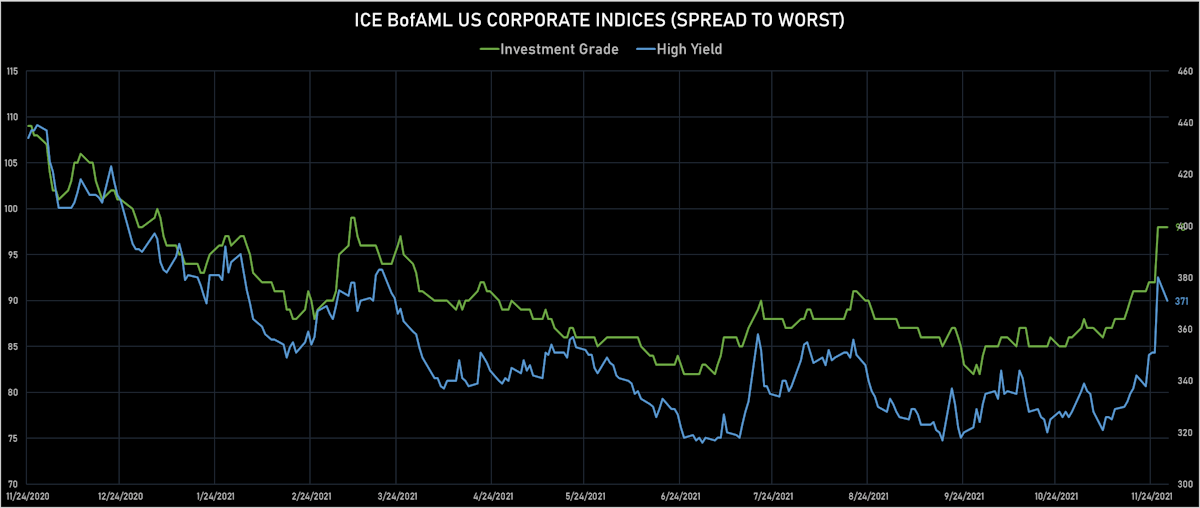

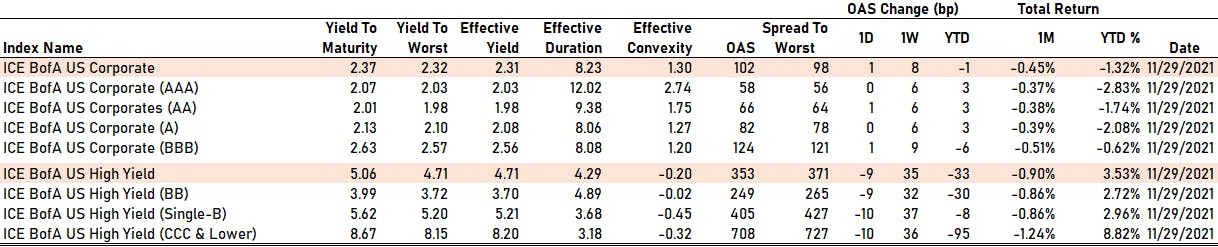

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged 0.0 bp, now at 98.0 bp (YTD change: .0 bp)

- ICE BofA US High Yield Index spread to worst down -9.0 bp, now at 371.0 bp (YTD change: -19.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.16% today (YTD total return: +2.8%)

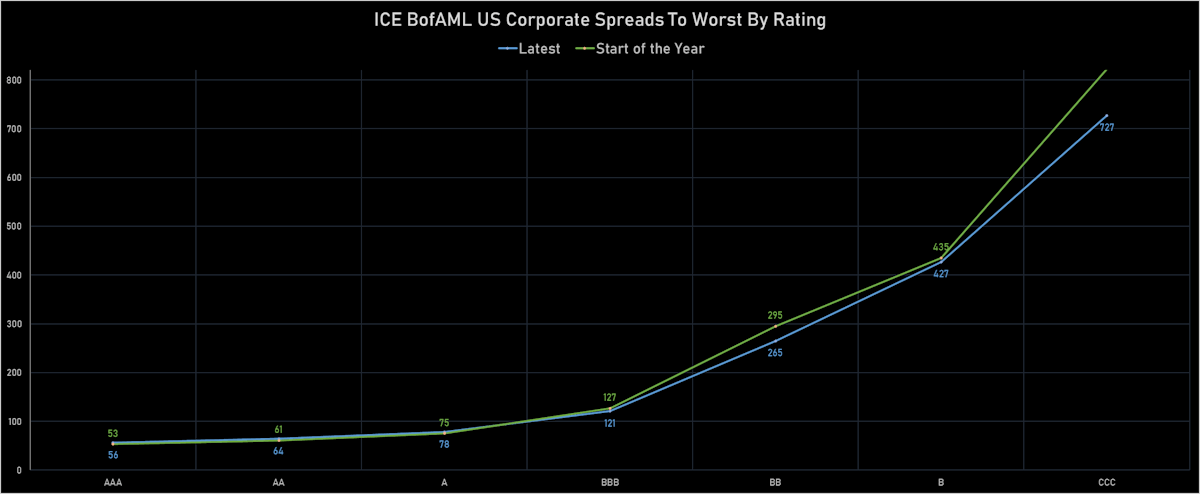

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 58 bp

- AA up by 1 bp at 66 bp

- A unchanged at 82 bp

- BBB up by 1 bp at 124 bp

- BB down by -9 bp at 249 bp

- B down by -10 bp at 405 bp

- CCC down by -10 bp at 708 bp

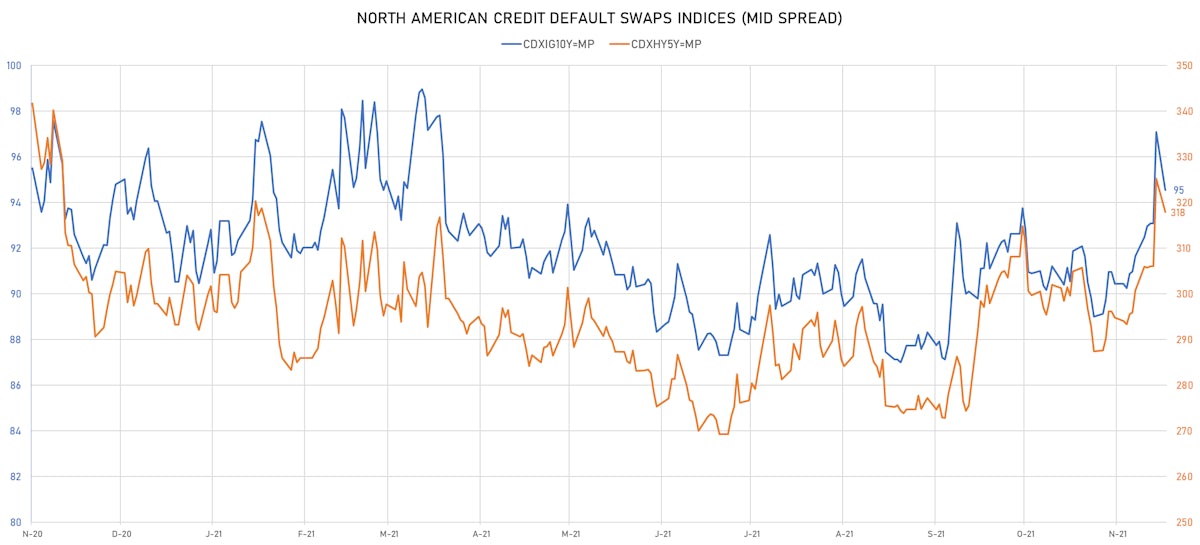

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.5 bp, now at 95bp (YTD change: +4.0bp)

- Markit CDX.NA.HY 5Y down 7.3 bp, now at 318bp (YTD change: +24.7bp)

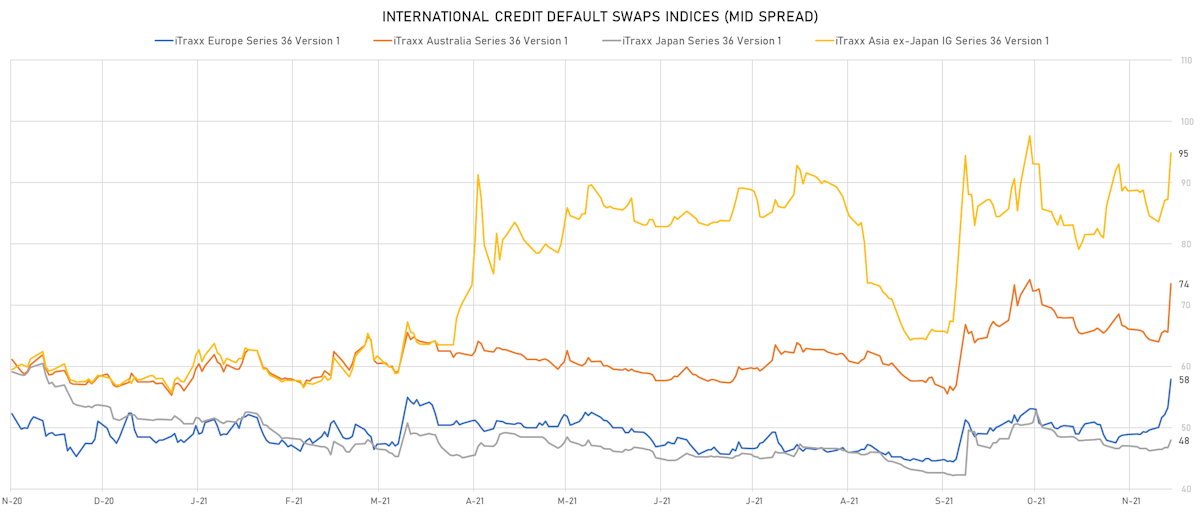

- Markit iTRAXX Europe down 2.0 bp, now at 56bp (YTD change: +8.0bp)

- Markit iTRAXX Japan up 0.5 bp, now at 49bp (YTD change: -2.8bp)

- Markit iTRAXX Asia Ex-Japan down 2.3 bp, now at 92bp (YTD change: +34.4bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 109.3 bp to 634.2 bp (CDS basis: 86.6bp), with the yield to worst at 7.1% and the bond now trading down to 90.0 cents on the dollar (1Y price range: 71.0-94.8).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 8.50% | Maturity: 27/6/2029 | Rating: CCC- | ISIN: USP989MJBP50 | Z-spread up by 99.7 bp to 1,361.5 bp (CDS basis: 48.5bp), with the yield to worst at 14.7% and the bond now trading down to 71.1 cents on the dollar (1Y price range: 59.9-81.0).

- Issuer: Turkiye Sinai Kalkinma Bankasi AS (Istanbul, Turkey) | Coupon: 6.00% | Maturity: 23/1/2025 | Rating: B- | ISIN: XS2100270508 | Z-spread up by 75.8 bp to 622.9 bp, with the yield to worst at 6.8% and the bond now trading down to 96.9 cents on the dollar (1Y price range: 96.0-103.5).

- Issuer: Yancoal International Resources Development Co Ltd (Hong Kong) | Coupon: 3.50% | Maturity: 4/11/2023 | Rating: BB+ | ISIN: XS2128388456 | Z-spread up by 74.9 bp to 282.9 bp, with the yield to worst at 3.0% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 99.6-101.3).

- Issuer: Metinvest BV (S-GRAVENHAGE, Netherlands) | Coupon: 7.75% | Maturity: 17/10/2029 | Rating: B+ | ISIN: XS2056723468 | Z-spread up by 69.9 bp to 681.4 bp, with the yield to worst at 8.1% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 97.1-114.5).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B+ | ISIN: USU98347AK05 | Z-spread up by 62.6 bp to 414.3 bp, with the yield to worst at 4.9% and the bond now trading down to 100.8 cents on the dollar (1Y price range: 100.3-108.3).

- Issuer: StoneCo Ltd (George Town, Cayman Islands) | Coupon: 3.95% | Maturity: 16/6/2028 | Rating: BB- | ISIN: USG85158AA43 | Z-spread up by 59.8 bp to 594.8 bp, with the yield to worst at 7.1% and the bond now trading down to 82.6 cents on the dollar (1Y price range: 82.3-100.0).

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 5.50% | Maturity: 1/4/2028 | Rating: B | ISIN: USV7780TAE39 | Z-spread up by 59.1 bp to 438.1 bp (CDS basis: -0.8bp), with the yield to worst at 5.6% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 97.7-105.9).

- Issuer: JSW Steel Ltd (Mumbai, India) | Coupon: 3.95% | Maturity: 5/4/2027 | Rating: BB- | ISIN: USY44680RV38 | Z-spread up by 56.0 bp to 322.9 bp, with the yield to worst at 4.4% and the bond now trading down to 97.2 cents on the dollar (1Y price range: 94.6-100.8).

- Issuer: Coca-Cola Icecek AS (Istanbul, Turkey) | Coupon: 4.22% | Maturity: 19/9/2024 | Rating: B | ISIN: XS1577950402 | Z-spread up by 54.6 bp to 243.2 bp, with the yield to worst at 3.2% and the bond now trading down to 102.0 cents on the dollar (1Y price range: 101.3-105.4).

- Issuer: Turkiye Vakiflar Bankasi TAO (Turkey) | Coupon: 6.50% | Maturity: 8/1/2026 | Rating: B | ISIN: XS2266963003 | Z-spread up by 53.4 bp to 612.3 bp, with the yield to worst at 6.8% and the bond now trading down to 97.6 cents on the dollar (1Y price range: 95.2-105.8).

- Issuer: MTN (Mauritius) Investments Ltd (Port Louis, Mauritius) | Coupon: 4.76% | Maturity: 11/11/2024 | Rating: BB- | ISIN: XS1128996425 | Z-spread up by 53.3 bp to 271.7 bp, with the yield to worst at 3.5% and the bond now trading down to 103.0 cents on the dollar (1Y price range: 103.0-107.6).

- Issuer: Ulker Biskuvi Sanayi AS (Istanbul, Turkey) | Coupon: 6.95% | Maturity: 30/10/2025 | Rating: B+ | ISIN: XS2241387500 | Z-spread up by 51.5 bp to 533.6 bp, with the yield to worst at 6.1% and the bond now trading down to 102.0 cents on the dollar (1Y price range: 102.0-109.1).

- Issuer: bijeo jgupi ss (Tbilisi, Georgia) | Coupon: 6.00% | Maturity: 26/7/2023 | Rating: BB- | ISIN: XS1405775880 | Z-spread down by 57.4 bp to 210.7 bp, with the yield to worst at 2.5% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 103.9-106.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 0.25% | Maturity: 6/9/2024 | Rating: BB- | ISIN: XS2049726990 | Z-spread up by 92.4 bp to 233.0 bp (CDS basis: 16.3bp), with the yield to worst at 1.8% and the bond now trading down to 95.2 cents on the dollar (1Y price range: 90.2-98.4).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 86.2 bp to 404.4 bp, with the yield to worst at 3.7% and the bond now trading down to 96.8 cents on the dollar (1Y price range: 96.7-101.3).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | Z-spread up by 72.6 bp to 507.3 bp, with the yield to worst at 5.0% and the bond now trading down to 73.8 cents on the dollar (1Y price range: 71.0-83.7).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread up by 64.8 bp to 400.8 bp, with the yield to worst at 3.7% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 95.4-99.4).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Z-spread up by 62.9 bp to 508.2 bp (CDS basis: -124.4bp), with the yield to worst at 4.8% and the bond now trading down to 89.7 cents on the dollar (1Y price range: 89.3-95.4).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB- | ISIN: XS2010029663 | Z-spread up by 51.7 bp to 677.4 bp, with the yield to worst at 6.4% and the bond now trading down to 89.5 cents on the dollar (1Y price range: 81.0-105.4).

SELECTED RECENT USD BOND ISSUES

- American Transmission Systems Inc (Utility - Other | Akron, United States | Rating: BBB): US$600m Senior Note (US030288AC89), fixed rate (2.65% coupon) maturing on 15 January 2032, priced at 99.72, callable (10nc10)

- Burlington Northern Santa Fe LLC (Railroads | Fort Worth, United States | Rating: A-): US$625m Senior Note (US12189LBH33), fixed rate (2.88% coupon) maturing on 15 June 2052, priced at 99.44 (original spread of 102 bp), callable (31nc30)

- Consolidated Edison Company of New York Inc (Utility - Other | New York City, United States | Rating: BBB+): US$600m Senior Debenture (US209111GC11), fixed rate (3.20% coupon) maturing on 1 December 2051, priced at 100.00 (original spread of 132 bp), callable (30nc30)

- Dollar Tree Inc (Retail Stores - Other | Chesapeake, United States | Rating: BBB): US$400m Senior Note (US256746AK45), fixed rate (3.38% coupon) maturing on 1 December 2051, priced at 99.89 (original spread of 169 bp), callable (30nc30)

- Dollar Tree Inc (Retail Stores - Other | Chesapeake, United States | Rating: BBB): US$800m Senior Note (US256746AJ71), fixed rate (2.65% coupon) maturing on 1 December 2031, priced at 99.73 (original spread of 115 bp), callable (10nc10)

- Duke Energy Florida LLC (Utility - Other | St. Petersburg, United States | Rating: BBB+): US$500m First Mortgage Note (US26444HAL50), fixed rate (3.00% coupon) maturing on 15 December 2051, priced at 99.43, callable (30nc30)

- Duke Energy Florida LLC (Utility - Other | St. Petersburg, United States | Rating: BBB+): US$650m First Mortgage Note (US26444HAK77), fixed rate (2.40% coupon) maturing on 15 December 2031, priced at 99.85 (original spread of 90 bp), callable (10nc10)

- First Majestic Silver Corp (Metals/Mining | Vancouver, British Columbia, Canada | Rating: NR): US$200m Bond (US32076VAC72), fixed rate (0.13% coupon) maturing on 15 January 2027, priced at 100.00, non callable, convertible

SELECTED RECENT EUR BOND ISSUES

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €250m Bond (IT0005469322), floating rate (EU03MLIB + 140.0 bp) maturing on 3 December 2027, priced at 100.00, non callable

- UniCredit Bulbank AD (Banking | Sofia, Sofia, Italy | Rating: BBB-): €160m Bond (XS2417110132), floating rate maturing on 6 December 2027, priced at 100.00, non callable

NEW ISSUES IN SECURITIZED CREDIT

- Service Experts Issuer 2021-1 LLC issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 336 m. Highest-rated tranche offering a yield to maturity of 2.70%, and the lowest-rated tranche a yield to maturity of 5.56%. Bookrunners: Citigroup Global Markets Inc