Credit

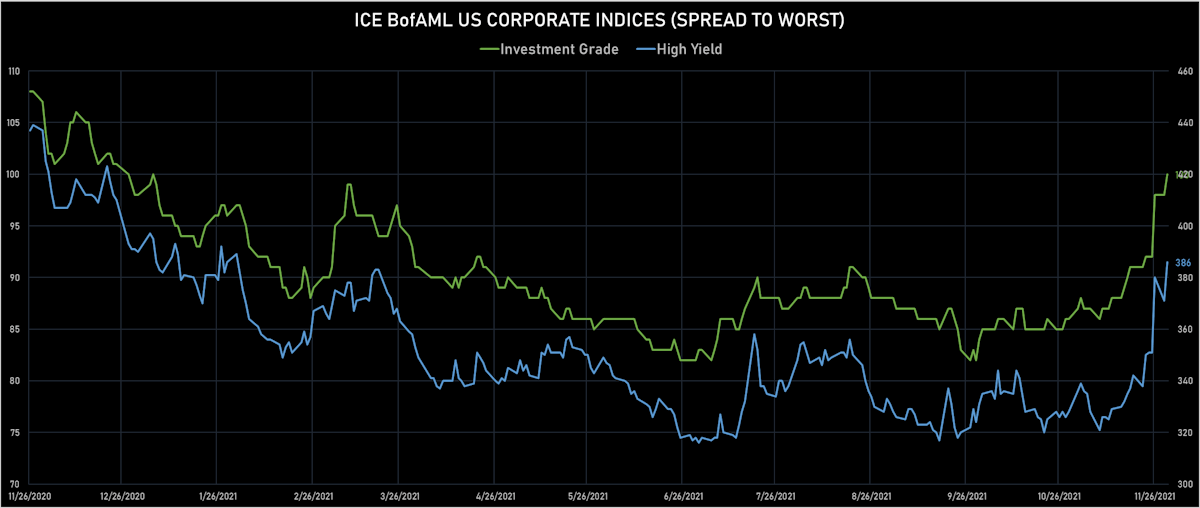

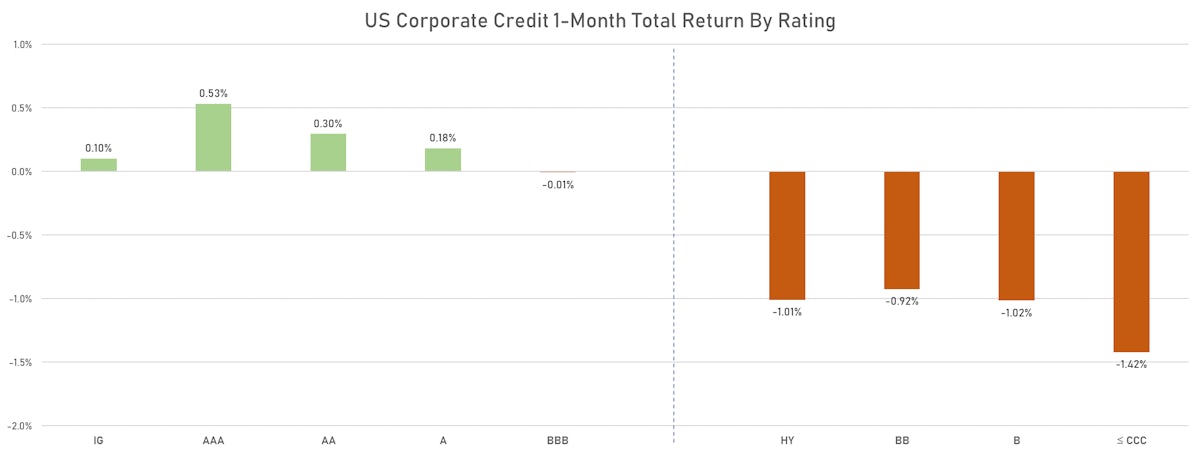

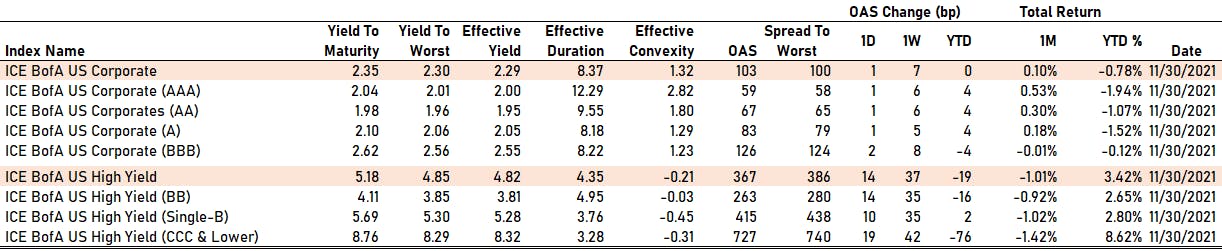

Spreads Wider Across The Credit Complex, ICE BofA US Cash Indices End November Up 0.1% For IG, Down 1% For HY

The primary corporate bond market was virtually closed today in the US, with rates volatility and much wider spreads keeping issuers on the sidelines

Published ET

1-Month Performance Of ICE BofA US Corporate Indices By Rating | Sources: ϕpost, FactSet data

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.408% today (Month-to-date: -0.05%; Year-to-date: -1.49%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.112% today (Month-to-date: -1.06%; Year-to-date: 2.31%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 100.0 bp (YTD change: +2.0 bp)

- ICE BofA US High Yield Index spread to worst up 15.0 bp, now at 386.0 bp (YTD change: -4.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.14% today (YTD total return: +2.7%)

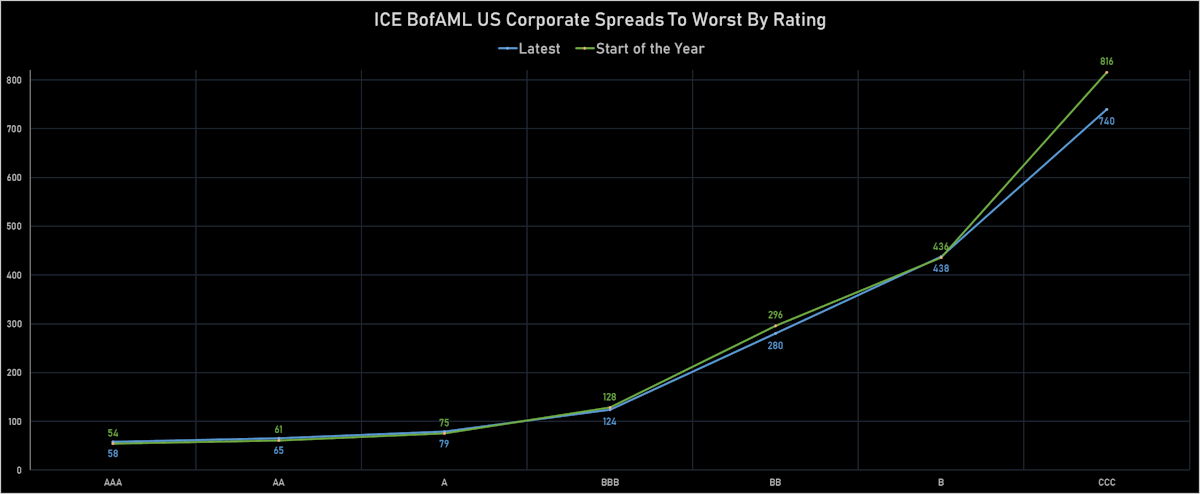

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 59 bp

- AA up by 1 bp at 67 bp

- A up by 1 bp at 83 bp

- BBB up by 2 bp at 126 bp

- BB up by 14 bp at 263 bp

- B up by 10 bp at 415 bp

- CCC up by 19 bp at 727 bp

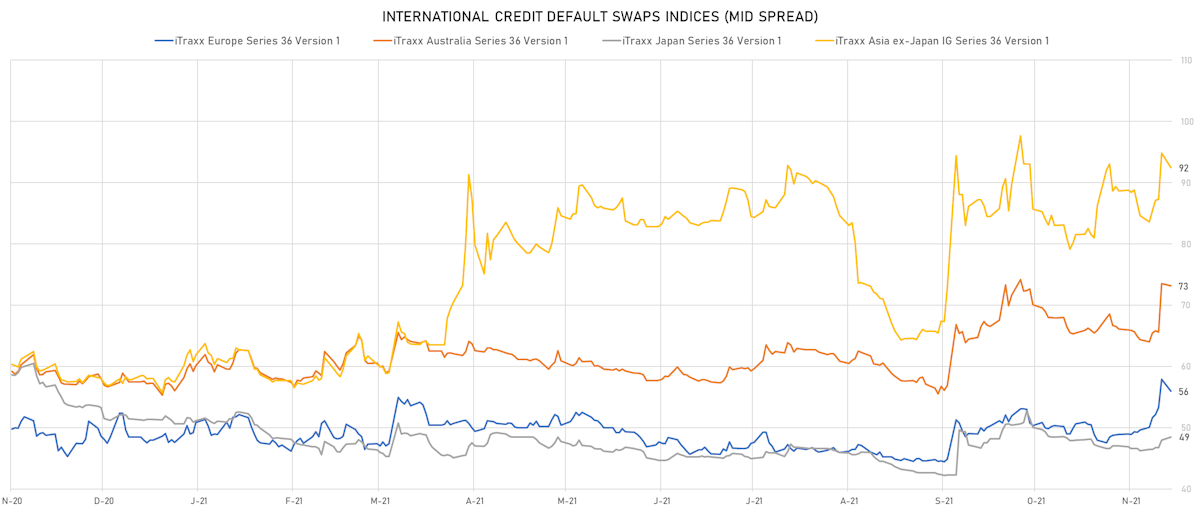

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 2.1 bp, now at 97bp (YTD change: +6.1bp)

- Markit CDX.NA.HY 5Y up 9.6 bp, now at 328bp (YTD change: +34.3bp)

- Markit iTRAXX Europe up 1.7 bp, now at 58bp (YTD change: +9.7bp)

- Markit iTRAXX Japan up 1.6 bp, now at 50bp (YTD change: -1.3bp)

- Markit iTRAXX Asia Ex-Japan up 1.7 bp, now at 94bp (YTD change: +36.1bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Gap Inc (Country: US; rated: WR): up 31.1 bp to 231.3bp (1Y range: 132-237bp)

- Colombia, Republic of (Government) (Country: CO; rated: BB+): up 31.1 bp to 227.4bp (1Y range: 85-227bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): up 31.2 bp to 528.0bp (1Y range: 337-528bp)

- Turkey, Republic of (Government) (Country: TR; rated: BB): up 32.5 bp to 510.0bp (1Y range: 283-510bp)

- Petroleos Mexicanos (Country: MX; rated: BBB+): up 33.0 bp to 401.2bp (1Y range: 321-478bp)

- Lumen Technologies Inc (Country: US; rated: Ba3): up 33.1 bp to 356.0bp (1Y range: 195-533bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 39.5 bp to 454.5bp (1Y range: 395-1,912bp)

- DISH DBS Corp (Country: US; rated: B2): up 44.0 bp to 563.3bp (1Y range: 317-563bp)

- Rite Aid Corp (Country: US; rated: B3): up 60.6 bp to 1,067.5bp (1Y range: 497-1,067bp)

- Talen Energy Supply LLC (Country: US; rated: B3): up 73.8 bp to 2,634.7bp (1Y range: 875-5,047bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 75.1 bp to 452.0bp (1Y range: 299-726bp)

- Staples Inc (Country: US; rated: B2): up 78.7 bp to 1,171.7bp (1Y range: 652-1,172bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 94.5 bp to 534.7bp (1Y range: 291-572bp)

- American Airlines Group Inc (Country: US; rated: B2): up 143.6 bp to 848.1bp (1Y range: 596-1,591bp)

- Transocean Inc (Country: KY; rated: Caa3): up 482.7 bp to 2,596.7bp (1Y range: 941-3,865bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Boparan Finance PLC (Country: GB; rated: WR): down 126.7 bp to 1,354.8bp (1Y range: 528-1,564bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 18.6 bp to 213.6bp (1Y range: 107-227bp)

- Unibail-Rodamco-Westfield SE (Country: FR; rated: BBB-): up 19.2 bp to 152.5bp (1Y range: 46-153bp)

- Accor SA (Country: FR; rated: B): up 19.8 bp to 182.0bp (1Y range: 136-194bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): up 22.7 bp to 196.5bp (1Y range: -197bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 23.8 bp to 465.8bp (1Y range: 333-481bp)

- Novafives SAS (Country: FR; rated: Caa1): up 24.0 bp to 731.7bp (1Y range: 660-976bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 25.3 bp to 260.0bp (1Y range: 154-273bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 28.4 bp to 298.0bp (1Y range: 189-305bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 28.7 bp to 326.6bp (1Y range: 259-508bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 33.8 bp to 561.8bp (1Y range: 471-694bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 70.4 bp to 338.6bp (1Y range: 209-348bp)

- Air France KLM SA (Country: FR; rated: B-): up 75.2 bp to 490.0bp (1Y range: 386-699bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 77.0 bp to 791.9bp (1Y range: 464-792bp)

- TUI AG (Country: DE; rated: B3-PD): up 165.0 bp to 868.8bp (1Y range: 607-946bp)

SELECTED RECENT USD BOND ISSUES

- ChengDu Jingkai GuoTou Investment Group Co Ltd (Financial - Other | Chengdu, China (Mainland) | Rating: BB): US$300m Senior Note (XS2406896428), fixed rate (5.30% coupon) maturing on 7 December 2024, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Rimini BidCo SpA (Financial - Other | Milan, Luxembourg | Rating: B): €445m Note (XS2417486771), floating rate (Euro 3M LIBOR + 525 bp) maturing on 14 December 2026, priced at 98.50, callable (5nc1)

- Unedic (Service - Other | Paris, France | Rating: AA): €150m Bond (FR0014006WY5) zero coupon maturing on 5 March 2030, priced at 99.20 (original spread of 43 bp), non callable