Credit

Decent December Start For US Credit, With Tighter HY Cash Spreads And Lower Long-Term Rates Helping IG

After days of forced idleness, the primary corporate bond market came back to life today, with a number of large prints, led by Goldman Sachs' US$ 3.25bn offering in 3 tranches and T-Mobile's $ 3bn in 3 tranches

Published ET

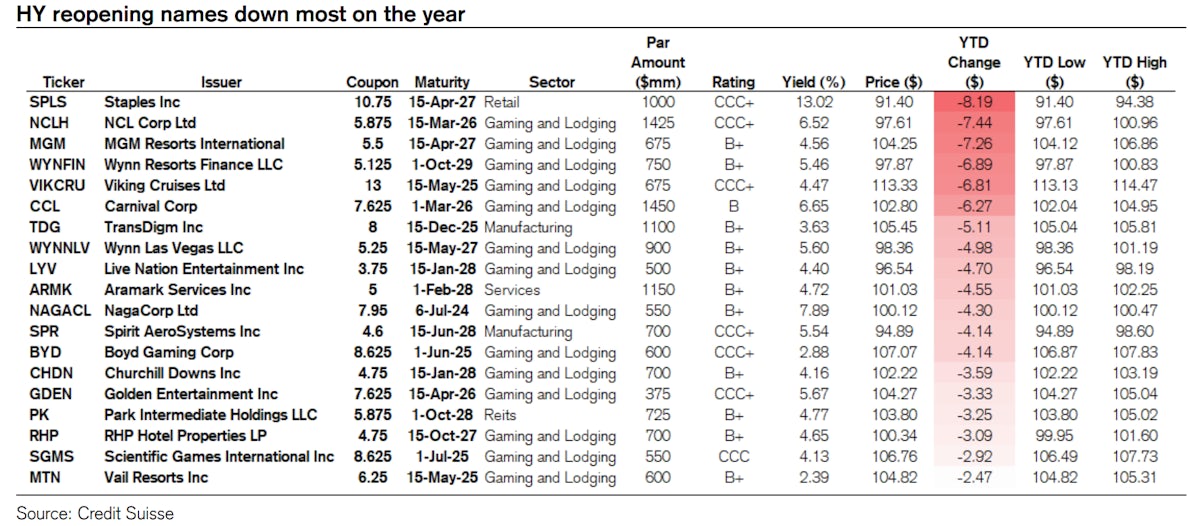

List of High Yield Reopening Names Most Down YTD | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.13% today, with investment grade up 0.11% and high yield up 0.29% (YTD total return: -0.57%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.107% today (Month-to-date: 0.11%; Year-to-date: -1.38%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.263% today (Month-to-date: 0.26%; Year-to-date: 2.57%)

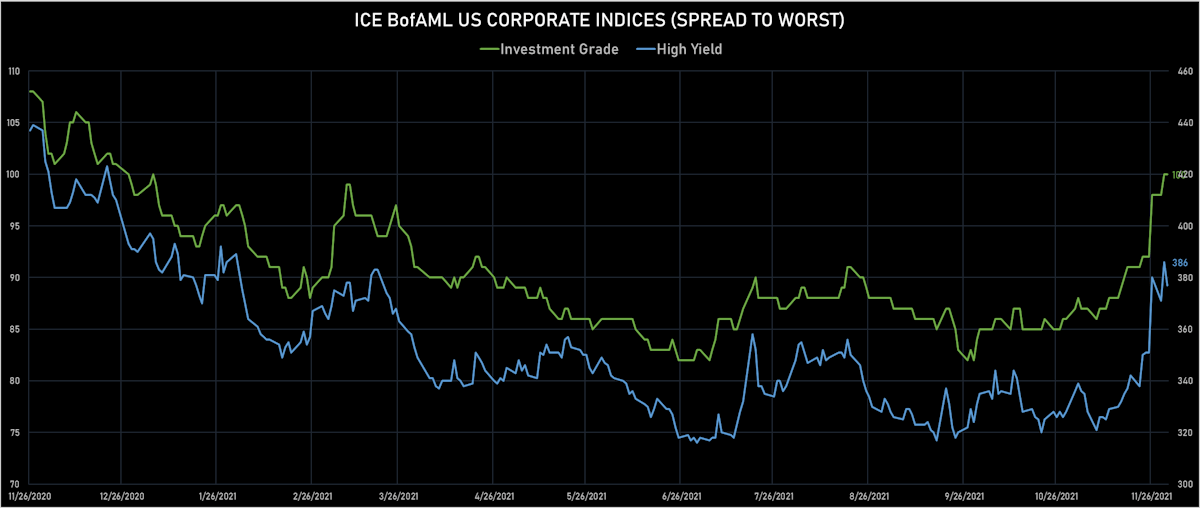

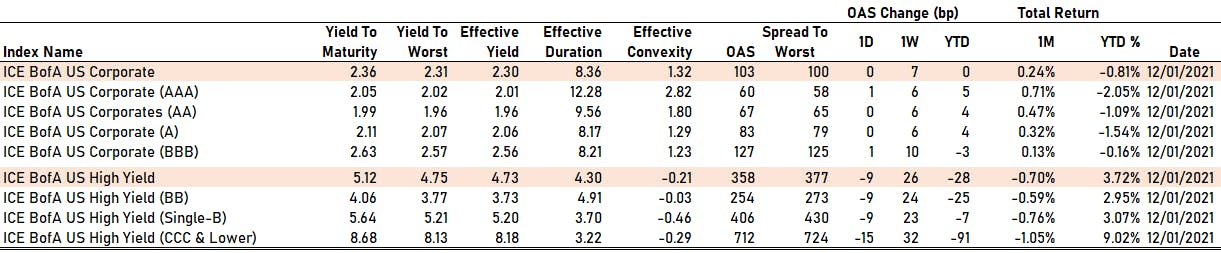

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 100.0 bp (YTD change: +2.0 bp)

- ICE BofA US High Yield Index spread to worst down -9.0 bp, now at 377.0 bp (YTD change: -13.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +2.7%)

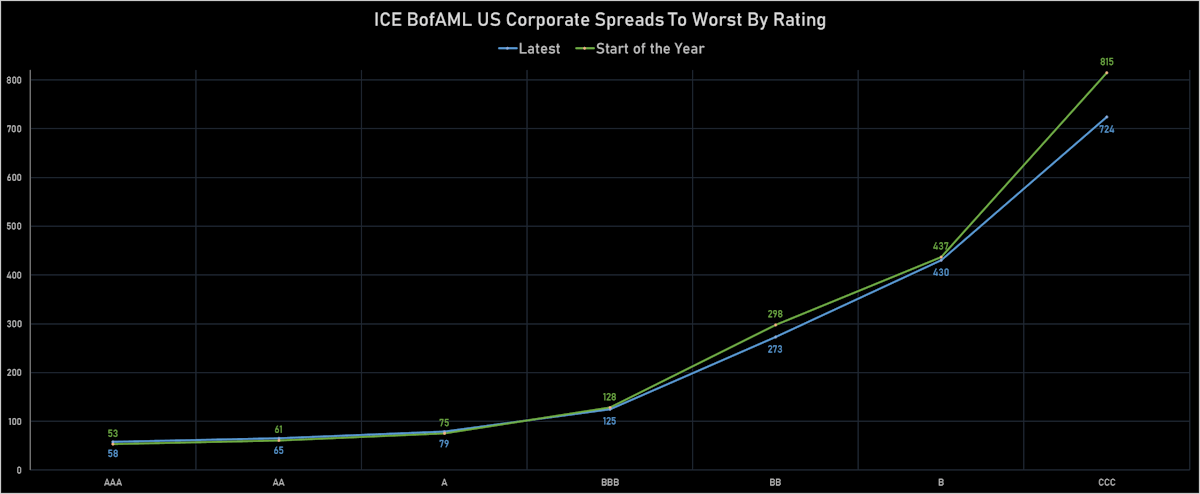

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 60 bp

- AA unchanged at 67 bp

- A unchanged at 83 bp

- BBB up by 1 bp at 127 bp

- BB down by -9 bp at 254 bp

- B down by -9 bp at 406 bp

- CCC down by -15 bp at 712 bp

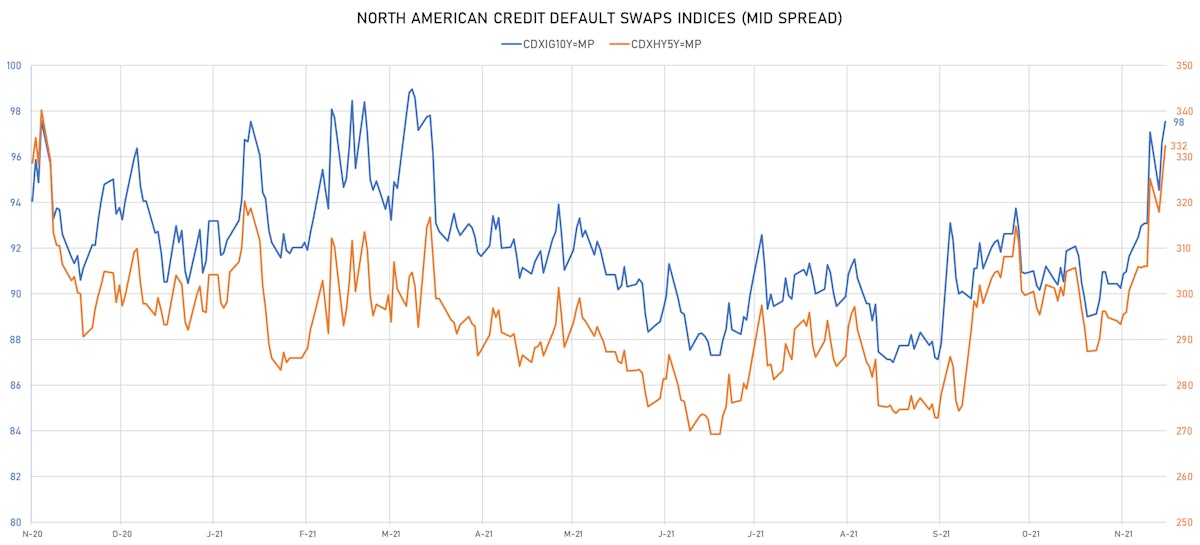

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.9 bp, now at 98bp (YTD change: +7.0bp)

- Markit CDX.NA.HY 5Y up 14.5 bp, now at 332bp (YTD change: +39.2bp)

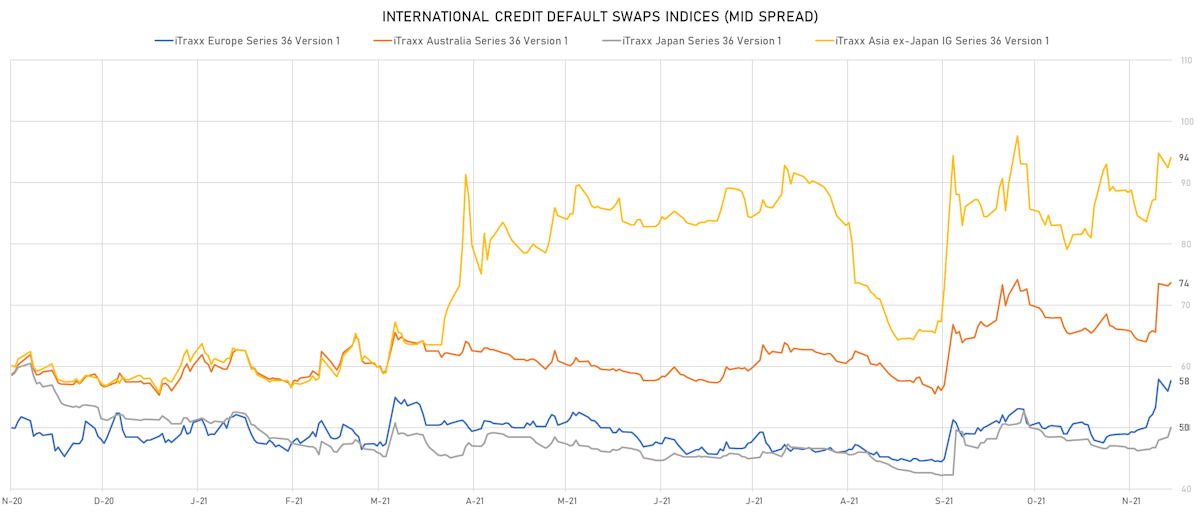

- Markit iTRAXX Europe down 1.7 bp, now at 56bp (YTD change: +8.1bp)

- Markit iTRAXX Japan up 1.2 bp, now at 51bp (YTD change: -0.1bp)

- Markit iTRAXX Asia Ex-Japan up 1.2 bp, now at 95bp (YTD change: +37.3bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Growthpoint Properties International (Pty) Ltd (Johannesburg, South Africa) | Coupon: 5.87% | Maturity: 2/5/2023 | Rating: BB | ISIN: XS1734198051 | Z-spread up by 134.1 bp to 340.8 bp, with the yield to worst at 3.8% and the bond now trading down to 102.6 cents on the dollar (1Y price range: 102.5-107.3).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 109.5 bp to 641.1 bp (CDS basis: 149.2bp), with the yield to worst at 7.2% and the bond now trading down to 89.8 cents on the dollar (1Y price range: 71.0-94.8).

- Issuer: Carnival Corp (Miami, Panama) | Coupon: 5.75% | Maturity: 1/3/2027 | Rating: B | ISIN: USP2121VAL82 | Z-spread up by 89.5 bp to 517.5 bp (CDS basis: -13.9bp), with the yield to worst at 6.2% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 96.5-106.5).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 8.50% | Maturity: 27/6/2029 | Rating: CCC- | ISIN: USP989MJBP50 | Z-spread up by 81.0 bp to 1,368.0 bp (CDS basis: 46.9bp), with the yield to worst at 14.7% and the bond now trading down to 71.1 cents on the dollar (1Y price range: 59.9-81.0).

- Issuer: Metinvest BV (S-GRAVENHAGE, Netherlands) | Coupon: 7.75% | Maturity: 17/10/2029 | Rating: B+ | ISIN: XS2056723468 | Z-spread up by 80.3 bp to 722.2 bp, with the yield to worst at 8.4% and the bond now trading down to 95.3 cents on the dollar (1Y price range: 95.0-114.5).

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 5.50% | Maturity: 1/4/2028 | Rating: B | ISIN: USV7780TAE39 | Z-spread up by 71.1 bp to 464.5 bp (CDS basis: -13.4bp), with the yield to worst at 5.8% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 96.7-105.9).

- Issuer: MHP Lux SA (Luxembourg, Luxembourg) | Coupon: 6.25% | Maturity: 19/9/2029 | Rating: B | ISIN: XS2010044894 | Z-spread up by 70.5 bp to 609.9 bp, with the yield to worst at 7.3% and the bond now trading down to 92.8 cents on the dollar (1Y price range: 92.4-103.3).

- Issuer: Seaspan Corp (Marshall Islands) | Coupon: 6.50% | Maturity: 5/2/2024 | Rating: BB | ISIN: NO0010920952 | Z-spread up by 70.0 bp to 351.1 bp, with the yield to worst at 3.8% and the bond now trading down to 104.5 cents on the dollar (1Y price range: 100.5-106.8).

- Issuer: Ulker Biskuvi Sanayi AS (Istanbul, Turkey) | Coupon: 6.95% | Maturity: 30/10/2025 | Rating: B+ | ISIN: XS2241387500 | Z-spread up by 69.5 bp to 569.7 bp, with the yield to worst at 6.4% and the bond now trading down to 100.8 cents on the dollar (1Y price range: 100.8-109.1).

- Issuer: Turkiye Vakiflar Bankasi TAO (Turkey) | Coupon: 6.50% | Maturity: 8/1/2026 | Rating: B | ISIN: XS2266963003 | Z-spread up by 69.4 bp to 643.5 bp, with the yield to worst at 7.2% and the bond now trading down to 96.5 cents on the dollar (1Y price range: 95.2-105.8).

- Issuer: Turkiye Sinai Kalkinma Bankasi AS (Istanbul, Turkey) | Coupon: 6.00% | Maturity: 23/1/2025 | Rating: B- | ISIN: XS2100270508 | Z-spread up by 67.5 bp to 609.8 bp, with the yield to worst at 6.7% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 96.0-103.5).

- Issuer: Yancoal International Resources Development Co Ltd (Hong Kong) | Coupon: 3.50% | Maturity: 4/11/2023 | Rating: BB+ | ISIN: XS2128388456 | Z-spread up by 66.8 bp to 269.5 bp, with the yield to worst at 2.9% and the bond now trading down to 100.1 cents on the dollar (1Y price range: 99.6-101.3).

- Issuer: NCL Finance Ltd (United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread up by 65.4 bp to 534.8 bp, with the yield to worst at 6.5% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 97.3-105.9).

- Issuer: StoneCo Ltd (George Town, Cayman Islands) | Coupon: 3.95% | Maturity: 16/6/2028 | Rating: BB- | ISIN: USG85158AA43 | Z-spread down by 65.5 bp to 529.0 bp, with the yield to worst at 6.4% and the bond now trading up to 86.0 cents on the dollar (1Y price range: 82.3-100.0).

- Issuer: bijeo jgupi ss (Tbilisi, Georgia) | Coupon: 6.00% | Maturity: 26/7/2023 | Rating: BB- | ISIN: XS1405775880 | Z-spread down by 81.3 bp to 204.9 bp, with the yield to worst at 2.5% and the bond now trading up to 105.2 cents on the dollar (1Y price range: 103.9-106.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB- | ISIN: XS2010029663 | Z-spread up by 117.8 bp to 754.9 bp, with the yield to worst at 7.2% and the bond now trading down to 87.2 cents on the dollar (1Y price range: 81.0-105.4).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.75% | Maturity: 13/11/2026 | Rating: BB- | ISIN: XS2248826294 | Z-spread up by 90.7 bp to 657.7 bp, with the yield to worst at 6.3% and the bond now trading down to 84.7 cents on the dollar (1Y price range: 77.0-103.2).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | Z-spread up by 59.7 bp to 497.9 bp, with the yield to worst at 4.9% and the bond now trading down to 74.4 cents on the dollar (1Y price range: 71.0-83.7).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 47.9 bp to 374.3 bp, with the yield to worst at 3.4% and the bond now trading down to 97.6 cents on the dollar (1Y price range: 95.9-101.3).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 3.10% | Maturity: 21/1/2026 | Rating: BB | ISIN: XS2281299763 | Z-spread up by 41.7 bp to 416.7 bp, with the yield to worst at 3.9% and the bond now trading down to 96.6 cents on the dollar (1Y price range: 96.0-100.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Z-spread up by 41.7 bp to 501.4 bp (CDS basis: -119.4bp), with the yield to worst at 4.8% and the bond now trading down to 90.0 cents on the dollar (1Y price range: 89.3-95.4).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 0.88% | Maturity: 9/5/2024 | Rating: BB- | ISIN: XS1819575066 | Z-spread up by 38.9 bp to 189.4 bp (CDS basis: -41.0bp), with the yield to worst at 1.5% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 93.6-99.7).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread up by 36.8 bp to 472.9 bp, with the yield to worst at 4.6% and the bond now trading down to 91.8 cents on the dollar (1Y price range: 91.3-99.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 19/1/2024 | Rating: BB | ISIN: XS1347748607 | Z-spread down by 80.6 bp to 220.3 bp (CDS basis: -91.0bp), with the yield to worst at 1.8% and the bond now trading up to 103.6 cents on the dollar (1Y price range: 103.3-107.8).

SELECTED RECENT USD BOND ISSUES

- Atlantic Union Bankshares Corp (Banking | Richmond, Virginia, United States | Rating: NR): US$250m Subordinated Note (US04911AAA51), floating rate maturing on 15 December 2031, priced at 100.00, callable (10nc5)

- B Riley Financial Inc (Service - Other | Los Angeles, California, United States | Rating: NR): US$300m Senior Note (US05580M7939), fixed rate (5.00% coupon) maturing on 31 December 2026, priced at 100.00 (original spread of 390 bp), callable (5nc5)

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$2,000m Senior Note (US06051GKE88), floating rate maturing on 6 December 2025, priced at 100.00 (original spread of 31 bp), callable (4nc3)

- BlackRock Inc (Securities | New York City, New York, United States | Rating: AA-): US$1,000m Senior Note (US09247XAS09), fixed rate (2.10% coupon) maturing on 25 February 2032, priced at 99.11 (original spread of 75 bp), callable (10nc10)

- Church & Dwight Co Inc (Conglomerate/Diversified Mfg | Ewing, New Jersey, United States | Rating: BBB+): US$400m Senior Note (US17136MAA09), fixed rate (2.30% coupon) maturing on 15 December 2031, priced at 99.80 (original spread of 88 bp), callable (10nc10)

- Danaher Corp (Vehicle Parts | Washington, United States | Rating: BBB+): US$1,000m Senior Note (US235851AW20), fixed rate (2.80% coupon) maturing on 10 December 2051, priced at 99.40 (original spread of 105 bp), callable (30nc30)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$105m Bond (US3130AQ6E85), fixed rate (0.75% coupon) maturing on 29 December 2023, priced at 100.00 (original spread of 70 bp), callable (2nc3m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$150m Bond (US3130AQ6H17), fixed rate (1.09% coupon) maturing on 27 December 2024, priced at 100.00 (original spread of 99 bp), callable (3nc6m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$125m Bond (US3130AQ6M02), fixed rate (0.78% coupon) maturing on 29 December 2023, priced at 100.00, callable (2nc3m)

- Goldman Sachs Group Inc (Banking | New York City, United States | Rating: BBB+): US$500m Senior Note (US38141GZF44), floating rate (SOFR + 62.0 bp) maturing on 6 December 2023, priced at 100.00, non callable

- Goldman Sachs Group Inc (Banking | New York City, United States | Rating: BBB+): US$1,750m Senior Note (US38141GZE78), fixed rate (1.22% coupon) maturing on 6 December 2023, priced at 100.00 (original spread of 65 bp), callable (2nc1)

- Marsh & McLennan Companies Inc (Property and Casualty Insurance | New York City, New York, United States | Rating: A-): US$350m Senior Note (US571748BQ48), fixed rate (2.90% coupon) maturing on 15 December 2051, priced at 99.76 (original spread of 129 bp), callable (30nc30)

- Marsh & McLennan Companies Inc (Property and Casualty Insurance | New York City, New York, United States | Rating: A-): US$400m Senior Note (US571748BP64), fixed rate (2.38% coupon) maturing on 15 December 2031, priced at 99.88 (original spread of 95 bp), callable (10nc10)

- Pricoa Global Funding I (Financial - Other | Wilmington, United States | Rating: NR): US$500m Note (US74153WCQ06), fixed rate (1.15% coupon) maturing on 6 December 2024, priced at 99.90 (original spread of 9 bp), non callable

- Spire Missouri Inc (Gas Utility - Local Distrib | St. Louis, United States | Rating: A-): US$300m First Mortgage Bond (US84859DAB38), floating rate (SOFR + 50.0 bp) maturing on 2 December 2024, priced at 100.00, callable (3nc6m)

- Starwood Property Trust Inc (Real Estate Investment Trust | Greenwich, Connecticut, United States | Rating: BB-): US$400m Senior Note (US85571BAW54), fixed rate (3.75% coupon) maturing on 31 December 2024, priced at 100.00 (original spread of 291 bp), callable (3nc3)

- Sysco Corp (Food Processors | Houston, United States | Rating: BBB): US$450m Senior Note (US871829BQ93), fixed rate (2.45% coupon) maturing on 14 December 2031, priced at 99.58 (original spread of 105 bp), callable (10nc10)

- Sysco Corp (Food Processors | Houston, Texas, United States | Rating: BBB): US$800m Senior Note (US871829BR76), fixed rate (3.15% coupon) maturing on 14 December 2051, priced at 99.31 (original spread of 166 bp), callable (30nc30)

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): US$500m Note (XS0459870357), fixed rate (1.45% coupon) maturing on 6 January 2027, priced at 100.00, non callable

- T-Mobile USA Inc (Telecommunications | Bellevue, Germany | Rating: NR): US$1,500m Note (USU88868AZ40), fixed rate (3.40% coupon) maturing on 15 October 2052, priced at 99.42 (original spread of 165 bp), callable (31nc30)

- T-Mobile USA Inc (Telecommunications | Bellevue, Germany | Rating: BBB-): US$1,000m Senior Note (US87264ACP84), fixed rate (2.70% coupon) maturing on 15 March 2032, priced at 99.69 (original spread of 130 bp), callable (10nc10)

- T-Mobile USA Inc (Telecommunications | Bellevue, Germany | Rating: BBB-): US$500m Note (US87264ACR41), fixed rate (2.40% coupon) maturing on 15 March 2029, priced at 99.93 (original spread of 105 bp), callable (7nc7)

- Lithium Americas Corp (Metals/Mining | Vancouver, Canada | Rating: NR): US$225m Bond (US53680QAB41), fixed rate (1.75% coupon) maturing on 15 January 2027, priced at 100.00, non callable, convertible

SELECTED RECENT EUR BOND ISSUES

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €477m Bond (FR0014006YJ2), fixed rate (0.39% coupon) maturing on 2 December 2028, priced at 100.00, non callable

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): €750m Senior Note (XS2419364653) zero coupon maturing on 15 November 2027, priced at 101.48 (original spread of 29 bp), non callable

- Ile-de-France Mobilites (Transportation - Other | Paris, Ile-De-France, France | Rating: AA): €125m Bond (FR0014006Y22), fixed rate (1.00% coupon) maturing on 2 December 2043, priced at 100.00, non callable

- ING Bank NV (Banking | Amsterdam Zuidoost, Netherlands | Rating: A+): €1,500m Covered Bond (Other) (XS2418730995), fixed rate (0.13% coupon) maturing on 8 December 2031, priced at 99.60 (original spread of 49 bp), non callable

- Raiffeisen Landesbank Steiermark AG (Banking | Graz, Austria | Rating: A-): €500m Fundierte Schuldverschreibungen (Covered Bond) (AT000B093604), floating rate maturing on 10 December 2029, priced at 100.00, non callable

NEW ISSUES IN SECURITIZED CREDIT

- Greystone CRE Notes 2021-Hc2 issued a floating-rate CLO in 6 tranches, for a total of US$ 344 m. Highest-rated tranche offering a spread over the floating rate of 180bp, and the lowest-rated tranche a spread of 500bp. Bookrunners: Goldman Sachs & Co, UBS Securities Inc, JP Morgan & Co Inc, Wells Fargo Securities LLC

- Fair Oaks Loan Funding IV Designated Activity Company issued a floating-rate CLO in 8 tranches, for a total of € 457 m. Highest-rated tranche offering a spread over the floating rate of 50bp, and the lowest-rated tranche a spread of 925bp. Bookrunners: Barclays Capital Group

- Service Experts Issuer 2021-1 LLC issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 336 m. Highest-rated tranche offering a yield to maturity of 2.70%, and the lowest-rated tranche a yield to maturity of 5.56%. Bookrunners: Citigroup Global Markets Inc