Credit

Mixed Day For US Credit, With Cash Spreads Seeing Modest Widening In IG, Tightening In HY

In the primary bond market, Daimler Trucks Finance painted the curve out to 10 years in the largest offering today, raising US$ 6bn in 8 tranches

Published ET

QUICK SUMMARY

- S&P 500 Bond Index was down -0.14% today, with investment grade down -0.16% and high yield down -0.02% (YTD total return: -0.71%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.090% today (Month-to-date: 0.02%; Year-to-date: -1.47%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.094% today (Month-to-date: 0.36%; Year-to-date: 2.67%)

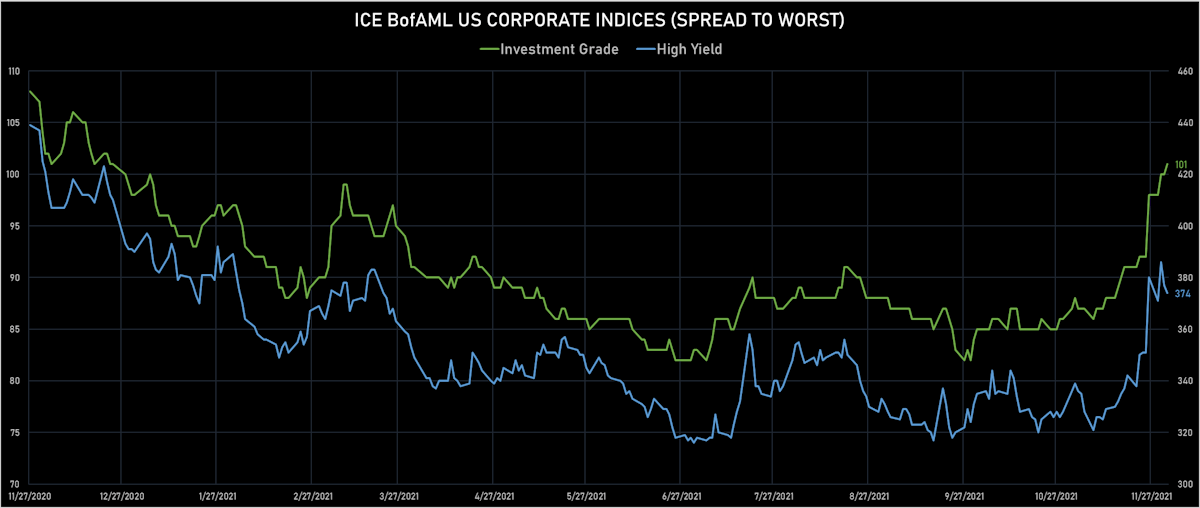

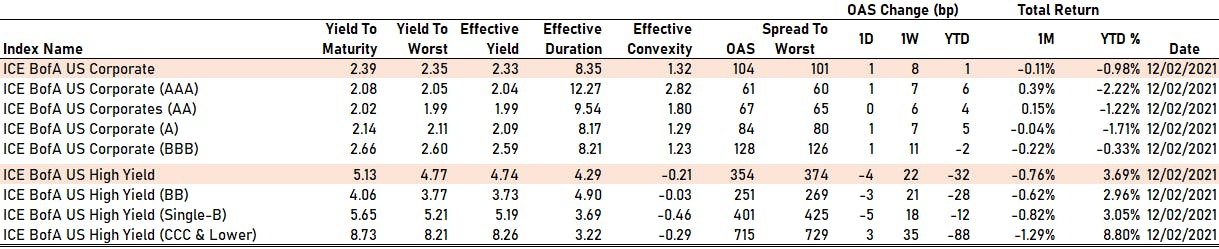

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 101.0 bp (YTD change: +3.0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 374.0 bp (YTD change: -16.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.04% today (YTD total return: +2.7%)

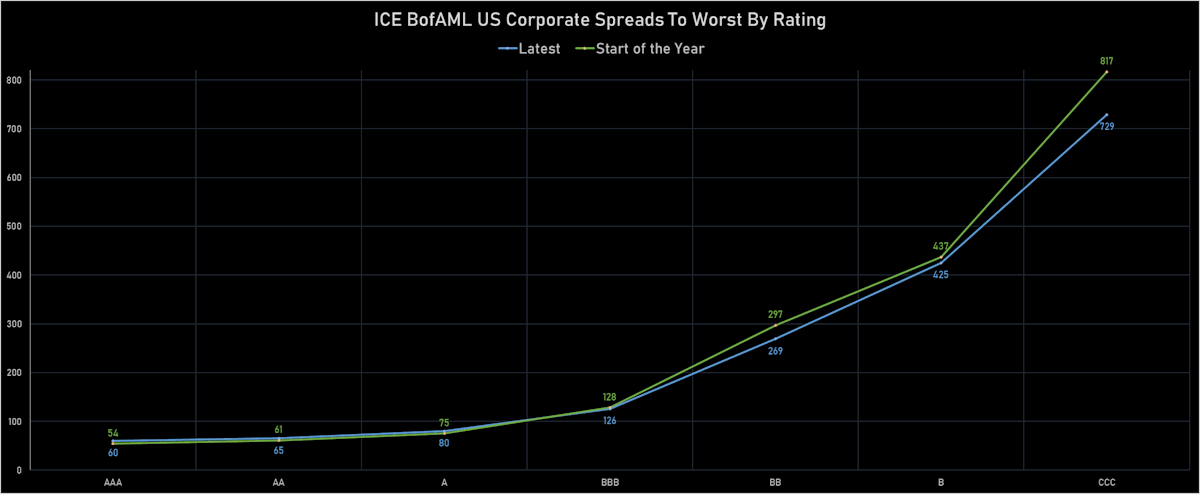

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 61 bp

- AA unchanged at 67 bp

- A up by 1 bp at 84 bp

- BBB up by 1 bp at 128 bp

- BB down by -3 bp at 251 bp

- B down by -5 bp at 401 bp

- CCC up by 3 bp at 715 bp

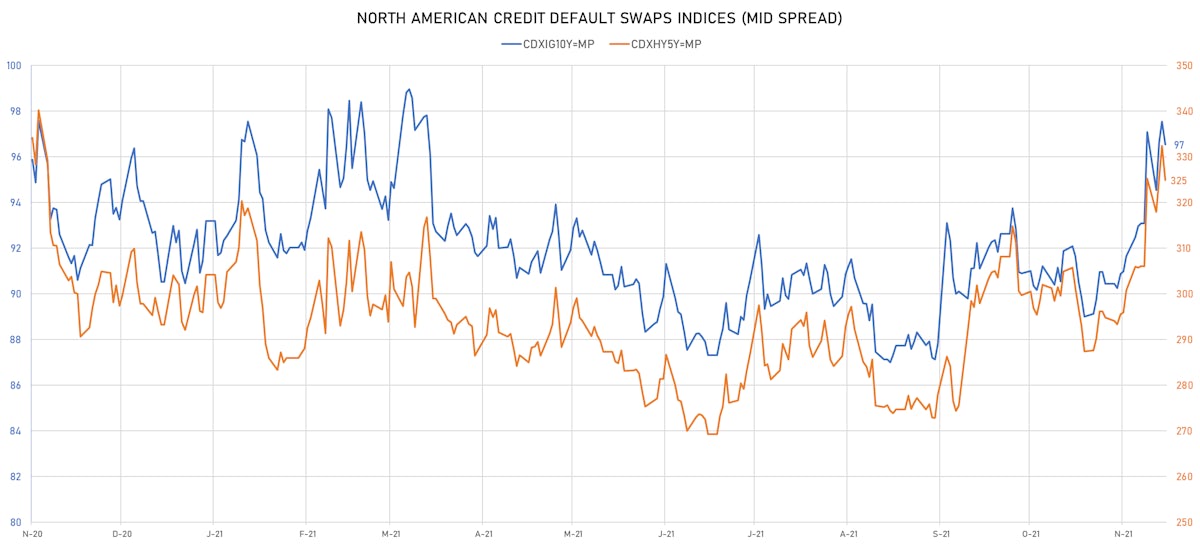

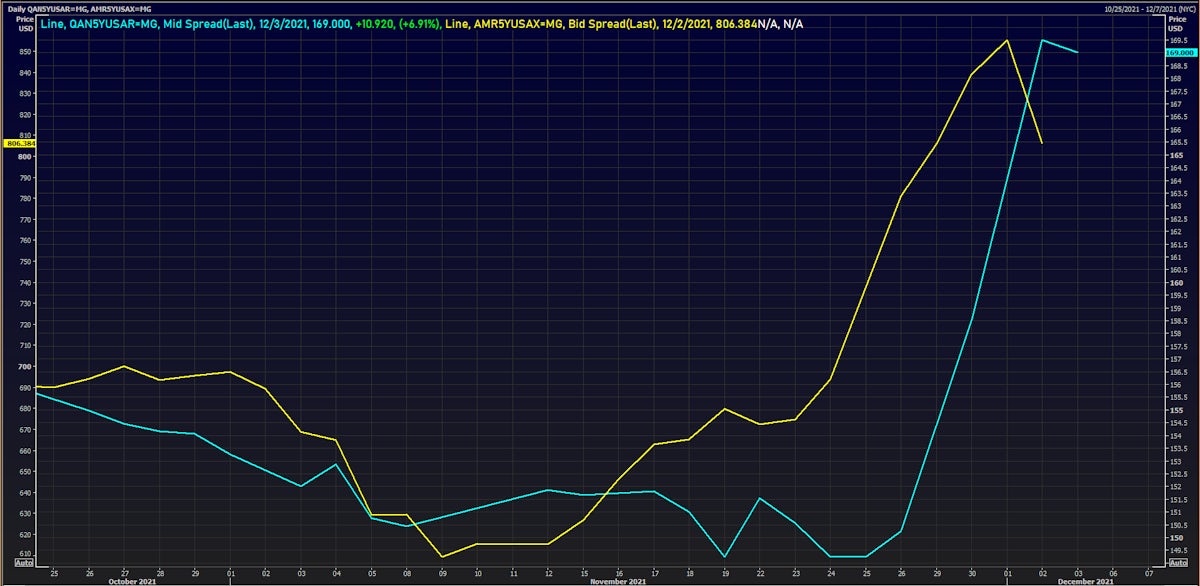

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.0 bp, now at 97bp (YTD change: +6.0bp)

- Markit CDX.NA.HY 5Y down 7.5 bp, now at 325bp (YTD change: +bp)

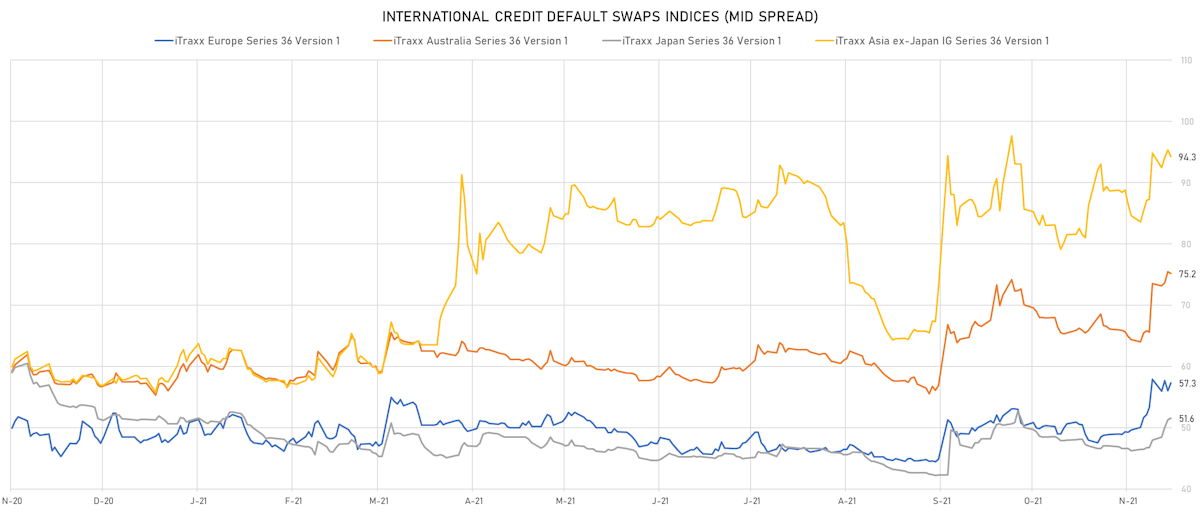

- Markit iTRAXX Europe up 1.3 bp, now at 57bp (YTD change: +9.4bp)

- Markit iTRAXX Japan up 0.3 bp, now at 52bp (YTD change: +0.3bp)

- Markit iTRAXX Asia Ex-Japan down 1.1 bp, now at 94bp (YTD change: +36.2bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Macquarie Bank Ltd (Country: AU; rated: BBB+): up 5.2 bp to 44.4bp (1Y range: 28-44bp)

- Rossiyskiye Zheleznye Dorogi OAO (Country: RU; rated: BBB): up 5.3 bp to 156.5bp (1Y range: -157bp)

- Philippines, Republic of the (Government) (Country: PH; rated: AAA): up 5.3 bp to 69.4bp (1Y range: 36-69bp)

- BHP Group Ltd (Country: AU; rated: A2): up 5.7 bp to 63.8bp (1Y range: 37-64bp)

- Scentre Group Trust 1 (Country: AU; rated: ): up 6.0 bp to 103.0bp (1Y range: 71-111bp)

- Rossel'khozbank AO (Country: RU; rated: Ba1): up 6.2 bp to 141.9bp (1Y range: -142bp)

- Indonesia, Republic of (Government) (Country: ID; rated: A-): up 6.3 bp to 86.8bp (1Y range: 67-94bp)

- South Africa, Republic of (Government) (Country: ZA; rated: WR): up 7.5 bp to 230.5bp (1Y range: 177-245bp)

- Woodside Petroleum Ltd (Country: AU; rated: Baa1): up 8.0 bp to 85.0bp (1Y range: 68-85bp)

- Greece, Republic of (Government) (Country: GR; rated: BB): up 8.5 bp to 115.5bp (1Y range: 69-117bp)

- Colombia, Republic of (Government) (Country: CO; rated: BB+): up 9.4 bp to 206.0bp (1Y range: 85-225bp)

- Qantas Airways Ltd (Country: AU; rated: A2): up 19.8 bp to 169.0bp (1Y range: 146-169bp)

- Akbank TAS (Country: TR; rated: Ba3): up 40.1 bp to 612.2bp (1Y range: 397-612bp)

- Turkiye Is Bankasi AS (Country: TR; rated: WD): up 52.5 bp to 667.9bp (1Y range: 482-725bp)

- Turkey, Republic of (Government) (Country: TR; rated: BB): up 58.8 bp to 535.0bp (1Y range: 283-535bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Novafives SAS (Country: FR; rated: Caa1): down 31.8 bp to 681.8bp (1Y range: 660-976bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): down 16.9 bp to 249.5bp (1Y range: 149-270bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 13.9 bp to 209.2bp (1Y range: 107-227bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 14.3 bp to 546.8bp (1Y range: 471-694bp)

- Accor SA (Country: FR; rated: B): up 14.7 bp to 178.0bp (1Y range: 136-194bp)

- Ceconomy AG (Country: DE; rated: Ba1): up 15.5 bp to 215.9bp (1Y range: 94-216bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 17.0 bp to 461.4bp (1Y range: 333-481bp)

- Leonardo SpA (Country: IT; rated: BBB-): up 18.7 bp to 176.8bp (1Y range: 125-228bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): up 18.9 bp to 195.0bp (1Y range: -195bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 22.6 bp to 292.2bp (1Y range: 189-308bp)

- CMA CGM SA (Country: FR; rated: Ba3): up 23.7 bp to 325.2bp (1Y range: 259-508bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 39.1 bp to 309.0bp (1Y range: 209-348bp)

- Air France KLM SA (Country: FR; rated: B-): up 44.4 bp to 462.4bp (1Y range: 386-699bp)

- Boparan Finance PLC (Country: GB; rated: WR): up 76.3 bp to 1,368.9bp (1Y range: 528-1,564bp)

- TUI AG (Country: DE; rated: B3-PD): up 95.6 bp to 810.7bp (1Y range: 607-946bp)

SELECTED RECENT USD BOND ISSUES

- Capital One Financial Corp (Financial - Other | Mc Lean, Virginia, United States | Rating: BBB): US$350m Senior Note (US14040HCL78), floating rate (SOFR + 69.0 bp) maturing on 6 December 2024, priced at 100.00, callable (3nc2)

- Capital One Financial Corp (Financial - Other | Mc Lean, United States | Rating: BBB): US$1,400m Senior Note (US14040HCK95), floating rate maturing on 6 December 2024, priced at 100.00, callable (3nc2)

- Altera Shuttle Tankers LLC (Financial - Other | Pembroke, Bermuda | Rating: NR): US$150m Bond (NO0011167785), fixed rate (9.50% coupon) maturing on 15 December 2025, priced at 97.00, callable (4nc3)

- Daimler Trucks Finance North America LLC (Financial - Other | Rating: NR): US$350m Senior Note (USU2340BAC10), floating rate (SOFR + 60.0 bp) maturing on 14 December 2023, priced at 100.00, with a special call

- Daimler Trucks Finance North America LLC (Financial - Other | Rating: NR): US$400m Senior Note (US233853AE09), floating rate (SOFR + 75.0 bp) maturing on 13 December 2024, priced at 100.00, with a special call

- Daimler Trucks Finance North America LLC (Financial - Other | Rating: NR): US$750m Senior Note (US233853AH30), fixed rate (2.50% coupon) maturing on 14 December 2031, priced at 99.26 (original spread of 115 bp), with a special call

- Daimler Trucks Finance North America LLC (Financial - Other | Rating: NR): US$750m Senior Note (US233853AG56), fixed rate (2.38% coupon) maturing on 14 December 2028, priced at 99.69 (original spread of 105 bp), with a special call

- Daimler Trucks Finance North America LLC (Financial - Other | Rating: NR): US$1,000m Senior Note (US233853AD26), fixed rate (1.63% coupon) maturing on 13 December 2024, priced at 99.97 (original spread of 75 bp), with a special call

- Daimler Trucks Finance North America LLC (Financial - Other | Rating: NR): US$1,000m Senior Note (US233853AB69), fixed rate (1.13% coupon) maturing on 14 December 2023, priced at 99.77 (original spread of 63 bp), with a special call

- Daimler Trucks Finance North America LLC (Financial - Other | Rating: NR): US$1,250m Senior Note (US233853AF73), fixed rate (2.00% coupon) maturing on 14 December 2026, priced at 99.57 (original spread of 90 bp), with a special call

- Olympus Corp (Machinery | Shinjuku, Tokyo-To, Japan | Rating: BBB): US$500m Senior Note (US68163WAA71), fixed rate (2.14% coupon) maturing on 8 December 2026, priced at 100.00 (original spread of 93 bp), with a make whole call

SELECTED RECENT EUR BOND ISSUES

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U5S4), floating rate maturing on 6 January 2028, priced at 100.00, non callable

- Mediobanca Banca di Credito Finanziario SpA (Banking | Milan, Milano, Italy | Rating: BBB-): €300m Senior Note (XS2418190430), floating rate maturing on 6 December 2023, priced at 100.47, non callable

- Uniqa Insurance Group AG (Property and Casualty Insurance | Wien, Wien, Austria | Rating: A-): €375m Subordinated Note (XS2418392143), floating rate maturing on 9 December 2041, priced at 99.32 (original spread of 283 bp), callable (20nc10)

NEW ISSUES IN SECURITIZED CREDIT

- CPC Asset Securitization I LLC issued a fixed-rate ABS backed by sm business loan in 3 tranches, for a total of US$ 105 m. Highest-rated tranche offering a yield to maturity of 3.58%, and the lowest-rated tranche a yield to maturity of 6.52%. Bookrunners: Guggenheim Securities LLC

- Newtek Small Business Loan Trust 2021-1 issued a floating-rate ABS backed by sm business loan in 2 tranches, for a total of US$ 103 m. Highest-rated tranche offering a spread over the floating rate of 175bp, and the lowest-rated tranche a spread of 250bp. Bookrunners: Capital One Financial Corp, Deutsche Bank Securities Inc

- Freddie Mac Wi-K138 issued a US$ 195 m fixed-rate Agency CMBS in 1 tranche offering a yield to maturity of 1.89%. Bookrunners: Barclays Capital Group, Wells Fargo Securities LLC

- Freddie Mac Spc Series K-1522 issued a fixed-rate Agency CMBS in 2 tranches, for a total of US$ 758 m. Highest-rated tranche offering a yield to maturity of 1.91%, and the lowest-rated tranche a yield to maturity of 2.13%. Bookrunners: Credit Suisse, Goldman Sachs & Co