Credit

US Corporate Bonds Rose To End The Week, Mostly Helped By The Move Lower In Rates

Total volumes of issuance for US corporate bonds this week (IFR Markets data): US$400m in a single tranche for HY, US$29.0bn in 40 Tranches for IG

Published ET

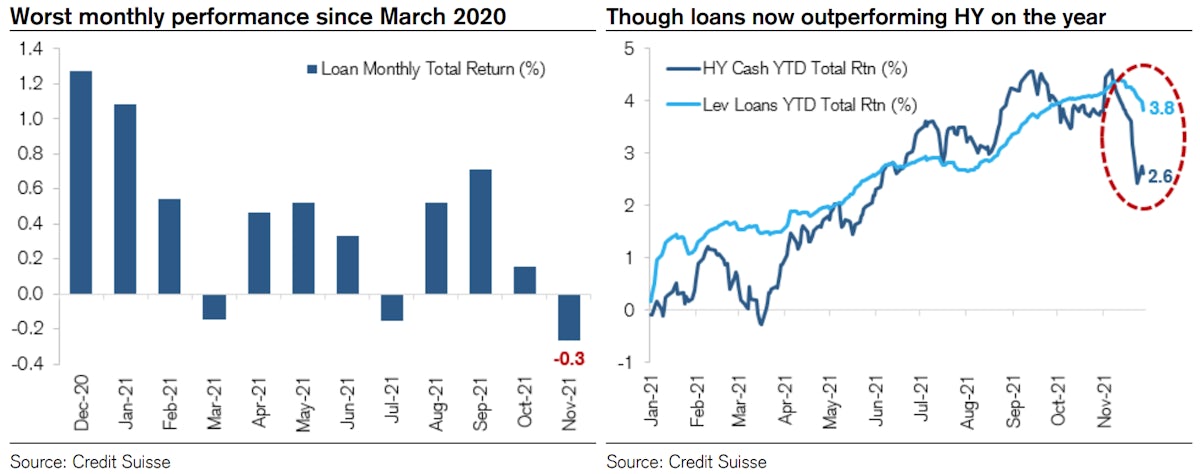

Leveraged Loans Did Better Than High Yield Bonds During The Recent Downturn | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.49% today, with investment grade up 0.52% and high yield up 0.28% (YTD total return: -0.22%)

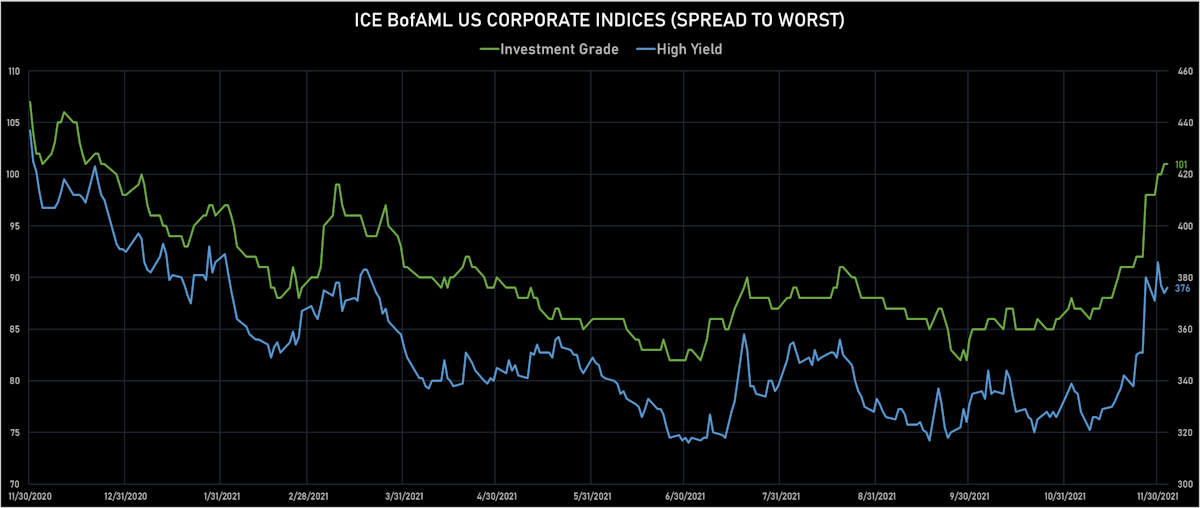

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 101.0 bp (YTD change: +3.0 bp)

- ICE BofA US High Yield Index spread to worst up 2.0 bp, now at 376.0 bp (YTD change: -14.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.11% today (YTD total return: +2.8%)

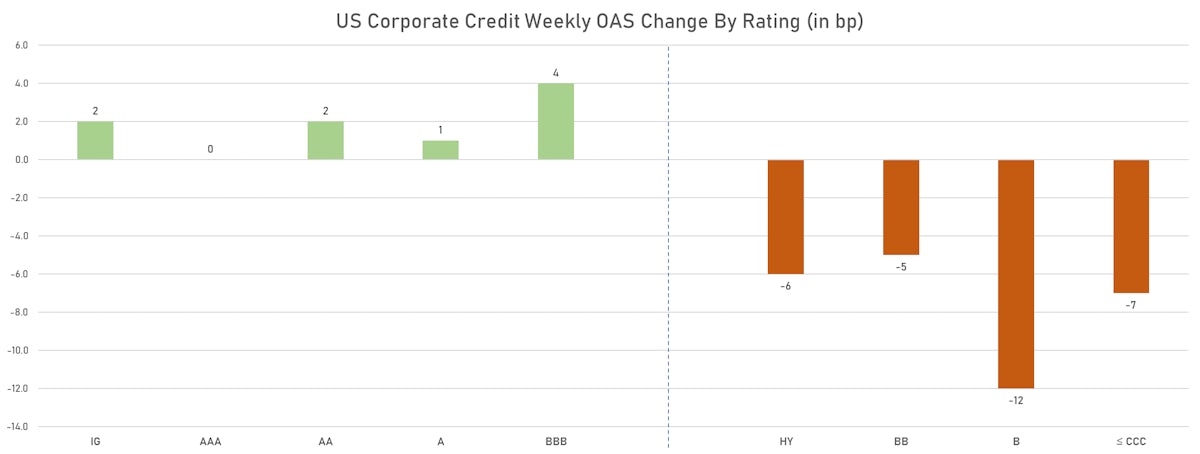

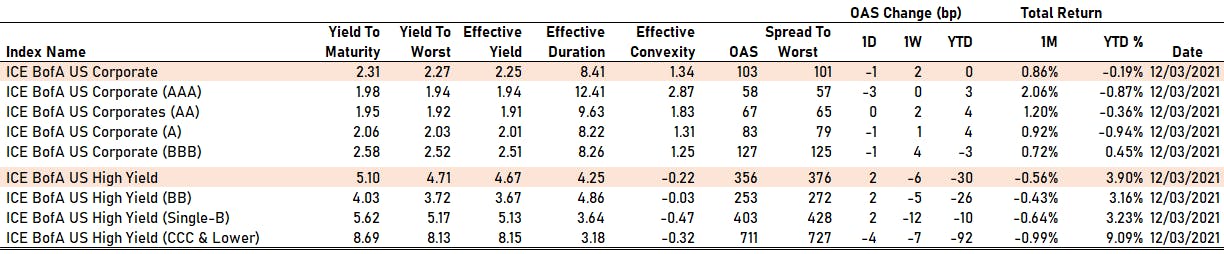

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -3 bp at 58 bp

- AA unchanged at 67 bp

- A down by -1 bp at 83 bp

- BBB down by -1 bp at 127 bp

- BB up by 2 bp at 253 bp

- B up by 2 bp at 403 bp

- CCC down by -4 bp at 711 bp

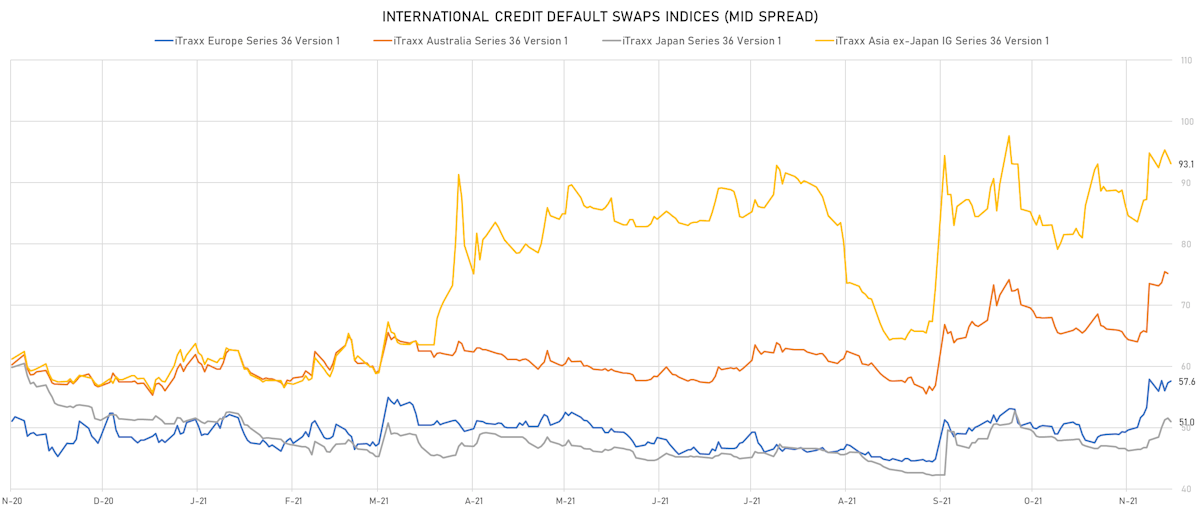

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.0 bp, now at 98bp (YTD change: +7.0bp)

- Markit CDX.NA.HY 5Y up 4.2 bp, now at 329bp (YTD change: +35.9bp)

- Markit iTRAXX Europe up 0.3 bp, now at 58bp (YTD change: +9.7bp)

- Markit iTRAXX Japan down 0.6 bp, now at 51bp (YTD change: -0.3bp)

- Markit iTRAXX Asia Ex-Japan down 1.2 bp, now at 93bp (YTD change: +35.0bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- RR Donnelley & Sons Co (Country: US; rated: B2): down 33.7 bp to 132.8bp (1Y range: 133-712bp)

- Brazil, Federative Republic of (Government) (Country: BR; rated: B): down 19.7 bp to 238.8bp (1Y range: 141-263bp)

- Petroleo Brasileiro SA Petrobras (Country: BR; rated: Ba1): down 18.4 bp to 288.1bp (1Y range: 175-303bp)

- Macy's Inc (Country: US; rated: Ba2): up 17.2 bp to 232.5bp (1Y range: 181-651bp)

- Genworth Holdings Inc (Country: US; rated: B2): up 18.7 bp to 378.7bp (1Y range: 335-681bp)

- iStar Inc (Country: US; rated: BBB-): up 19.2 bp to 309.0bp (1Y range: 199-324bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 20.6 bp to 537.7bp (1Y range: 291-572bp)

- Bombardier Inc (Country: CA; rated: Caa1): up 21.7 bp to 464.2bp (1Y range: 395-1,912bp)

- American Airlines Group Inc (Country: US; rated: B2): up 26.4 bp to 848.0bp (1Y range: 596-1,355bp)

- Turkey, Republic of (Government) (Country: TR; rated: BB): up 38.0 bp to 542.4bp (1Y range: 283-542bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 40.6 bp to 469.3bp (1Y range: 299-726bp)

- Staples Inc (Country: US; rated: B2): up 73.2 bp to 1,209.7bp (1Y range: 652-1,210bp)

- Ghana, Republic of (Government) (Country: GH; rated: B): up 81.1 bp to 840.0bp (1Y range: 646-840bp)

- Transocean Inc (Country: KY; rated: Caa3): up 411.7 bp to 2,726.3bp (1Y range: 941-3,803bp)

- Talen Energy Supply LLC (Country: US; rated: B3): up 1280.3 bp to 4,007.7bp (1Y range: 875-5,047bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Novafives SAS (Country: FR; rated: Caa1): down 74.5 bp to 692.9bp (1Y range: 660-976bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 57.5 bp to 736.7bp (1Y range: 464-779bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 41.5 bp to 152.0bp (1Y range: -152bp)

- TUI AG (Country: DE; rated: B3-PD): down 37.6 bp to 799.6bp (1Y range: 607-946bp)

- Boparan Finance PLC (Country: GB; rated: WR): down 30.4 bp to 1,343.7bp (1Y range: 528-1,564bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): down 21.4 bp to 237.2bp (1Y range: 154-273bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 19.4 bp to 198.4bp (1Y range: 107-227bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): down 19.3 bp to 251.6bp (1Y range: 149-270bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 19.0 bp to 642.6bp (1Y range: 358-661bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 16.9 bp to 301.2bp (1Y range: 209-348bp)

- Cable & Wireless Ltd (Country: GB; rated: WR): down 9.0 bp to 42.3bp (1Y range: 42-143bp)

- Air France KLM SA (Country: FR; rated: B-): down 7.4 bp to 462.5bp (1Y range: 386-699bp)

- Hammerson PLC (Country: GB; rated: Baa3): up 10.3 bp to 200.4bp (1Y range: 166-352bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 11.4 bp to 256.9bp (1Y range: 145-272bp)

- thyssenkrupp AG (Country: DE; rated: B1): up 14.2 bp to 226.9bp (1Y range: 205-300bp)