Credit

Spreads Tighten Significantly Across The US Credit Complex, Though IG Bonds Still Fall On Higher Rates

Good start to the week for corporate bond issuance, with the largest offerings coming from Roche Holdings Inc (US$ 6 bn in 3 tranches) and Ecolab ($ 2.5 bn in 4 tranches)

Published ET

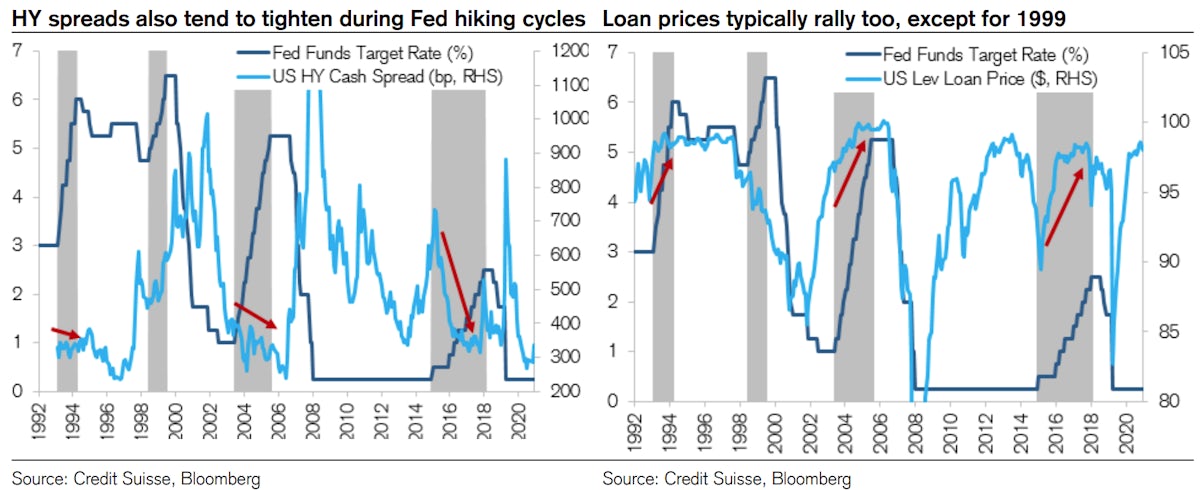

Credit Suisse Shows That USD HY Spreads Tend To Tighten With Rate Hikes | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.26% today, with investment grade down -0.29% and high yield up 0.09% (YTD total return: -0.48%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.352% today (Month-to-date: 0.51%; Year-to-date: -0.98%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.346% today (Month-to-date: 0.85%; Year-to-date: 3.18%)

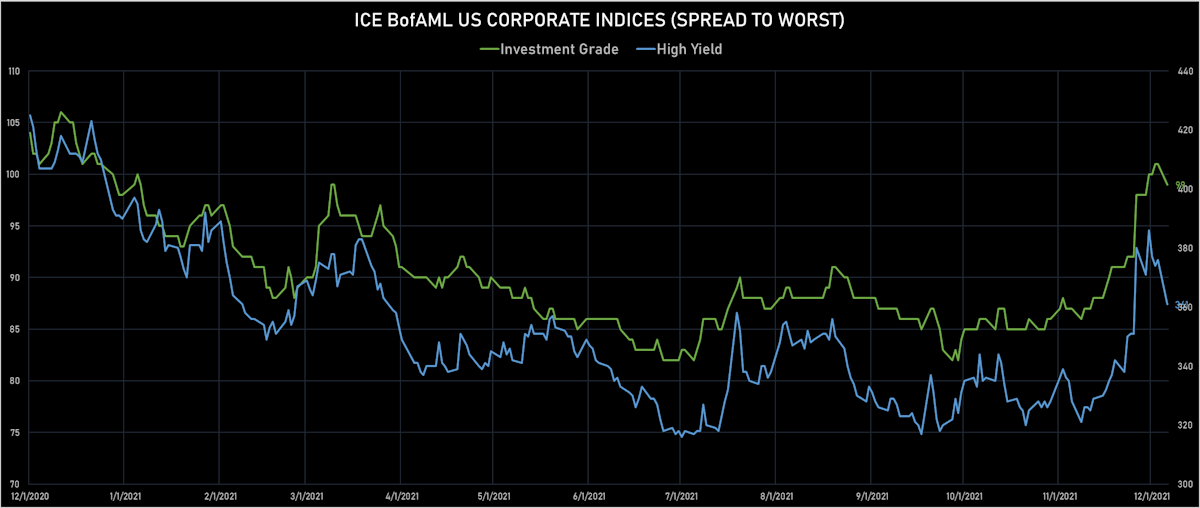

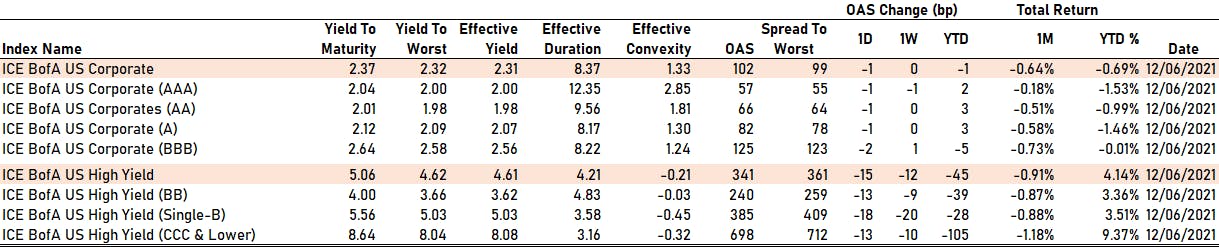

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 99.0 bp (YTD change: +1.0 bp)

- ICE BofA US High Yield Index spread to worst down -15.0 bp, now at 361.0 bp (YTD change: -29.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.12% today (YTD total return: +2.9%)

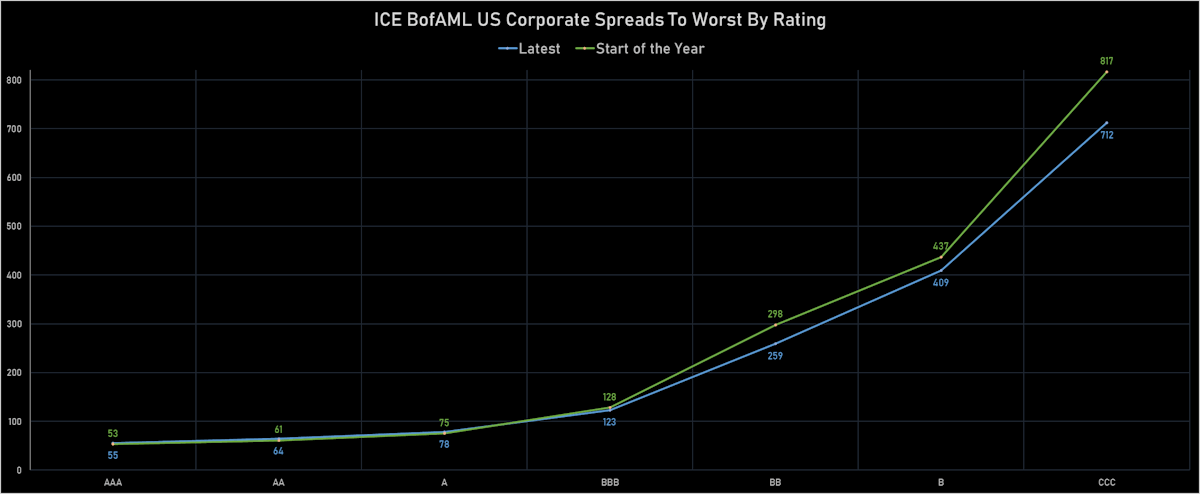

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 57 bp

- AA down by -1 bp at 66 bp

- A down by -1 bp at 82 bp

- BBB down by -2 bp at 125 bp

- BB down by -13 bp at 240 bp

- B down by -18 bp at 385 bp

- CCC down by -13 bp at 698 bp

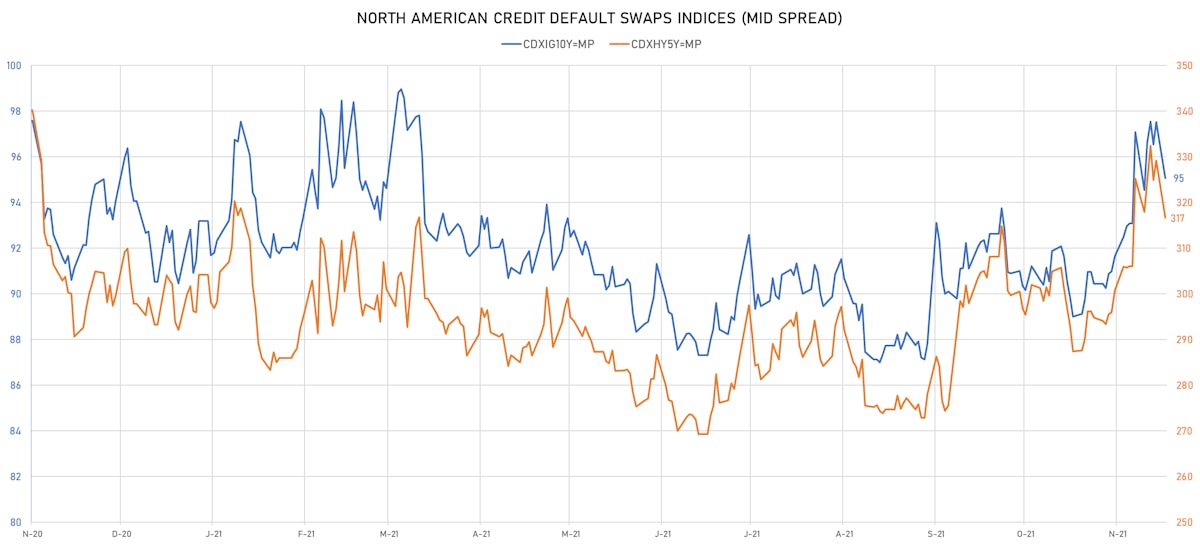

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.5 bp, now at 95bp (YTD change: +4.6bp)

- Markit CDX.NA.HY 5Y down 12.4 bp, now at 317bp (YTD change: +23.5bp)

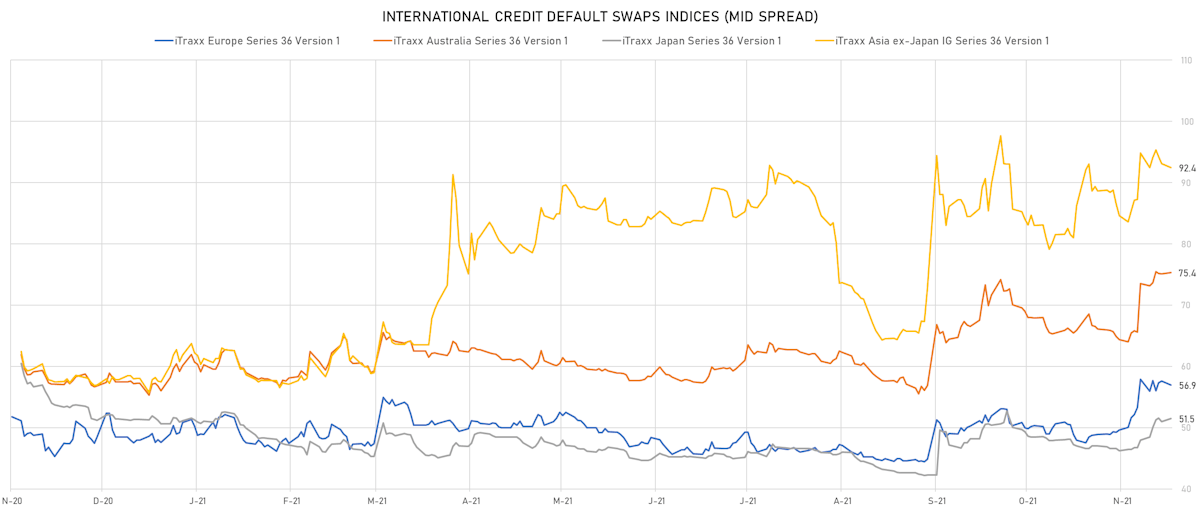

- Markit iTRAXX Europe down 0.7 bp, now at 57bp (YTD change: +9.0bp)

- Markit iTRAXX Japan up 0.5 bp, now at 52bp (YTD change: +0.2bp)

- Markit iTRAXX Asia Ex-Japan down 0.7 bp, now at 92bp (YTD change: +34.4bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 166.2 bp to 2,483.3bp (1Y range: 941-3,452bp)

- Petroleos Mexicanos (Country: MX; rated: BBB+): down 63.1 bp to 333.9bp (1Y range: 321-454bp)

- American Airlines Group Inc (Country: US; rated: B2): down 51.1 bp to 804.1bp (1Y range: 596-1,340bp)

- Xerox Corp (Country: US; rated: LGD4 - 56%): down 34.4 bp to 254.4bp (1Y range: 158-297bp)

- Brazil, Federative Republic of (Government) (Country: BR; rated: B): down 26.3 bp to 233.5bp (1Y range: 141-263bp)

- Occidental Petroleum Corp (Country: US; rated: Ba2): down 25.7 bp to 185.4bp (1Y range: 161-446bp)

- DISH DBS Corp (Country: US; rated: B2): down 25.3 bp to 536.7bp (1Y range: 317-562bp)

- Petroleo Brasileiro SA Petrobras (Country: BR; rated: Ba1): down 24.5 bp to 283.0bp (1Y range: 175-303bp)

- Colombia, Republic of (Government) (Country: CO; rated: BB+): down 23.3 bp to 205.4bp (1Y range: 87-225bp)

- Turkey, Republic of (Government) (Country: TR; rated: BB): up 25.5 bp to 535.5bp (1Y range: 283-536bp)

- Akbank TAS (Country: TR; rated: Ba3): up 27.1 bp to 635.5bp (1Y range: 397-635bp)

- Staples Inc (Country: US; rated: B2): up 31.7 bp to 1,194.3bp (1Y range: 652-1,194bp)

- Interval Acquisition Corp (Country: US; rated: WR): up 41.6 bp to 427.6bp (1Y range: 328-428bp)

- Turkiye Is Bankasi AS (Country: TR; rated: WD): up 56.3 bp to 679.2bp (1Y range: 482-733bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- TUI AG (Country: DE; rated: B3-PD): down 61.4 bp to 807.5bp (1Y range: 607-946bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 61.1 bp to 730.8bp (1Y range: 464-779bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 45.4 bp to 151.2bp (1Y range: -151bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 42.0 bp to 296.7bp (1Y range: 209-348bp)

- Novafives SAS (Country: FR; rated: Caa1): down 38.4 bp to 693.3bp (1Y range: 660-976bp)

- Air France KLM SA (Country: FR; rated: B-): down 27.0 bp to 463.0bp (1Y range: 386-699bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): down 23.0 bp to 237.0bp (1Y range: 154-273bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): down 17.4 bp to 247.7bp (1Y range: 149-270bp)

- Unibail-Rodamco-Westfield SE (Country: FR; rated: BBB-): down 15.0 bp to 137.5bp (1Y range: 46-138bp)

- Boparan Finance PLC (Country: GB; rated: WR): down 14.8 bp to 1,340.0bp (1Y range: 528-1,564bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 11.8 bp to 645.9bp (1Y range: 358-661bp)

- Cable & Wireless Ltd (Country: GB; rated: WR): down 9.6 bp to 41.8bp (1Y range: 42-143bp)

- Hammerson PLC (Country: GB; rated: Baa3): up 8.2 bp to 200.2bp (1Y range: 166-352bp)

- Corus Group Ltd (Country: GB; rated: WR): up 10.2 bp to 358.2bp (1Y range: 358-394bp)

SELECTED RECENT USD BOND ISSUES

- Baker Hughes Co-Obligor Inc (Financial - Other | Houston, United States | Rating: A-): US$600m Senior Note (US05724BAD10), fixed rate (2.06% coupon) maturing on 15 December 2026, priced at 100.00 (original spread of 85 bp), callable (5nc5)

- Baker Hughes Co-Obligor Inc (Financial - Other | Houston, United States | Rating: A-): US$650m Senior Note (US05724BAB53), fixed rate (1.23% coupon) maturing on 15 December 2023, priced at 100.00 (original spread of 60 bp), with a make whole call

- Dell International LLC (Financial - Other | Round Rock, United States | Rating: NR): US$1,250m Senior Note (US24703DBG51), fixed rate (3.45% coupon) maturing on 15 December 2051, priced at 99.96 (original spread of 188 bp), callable (30nc30)

- Dell International LLC (Financial - Other | Round Rock, United States | Rating: NR): US$1,000m Senior Note (US24703DBE04), fixed rate (3.38% coupon) maturing on 15 December 2041, priced at 99.67 (original spread of 176 bp), callable (20nc20)

- Directv Financing LLC (Financial - Other | United States | Rating: NR): US$1,400m Senior Note (USU2541MAB64), fixed rate (5.88% coupon) maturing on 15 August 2027, priced at 101.75 (original spread of 425 bp), callable (6nc2)

- Ecolab Inc (Chemicals | Saint Paul, Minnesota, United States | Rating: A-): US$850m Senior Note (US278865BN99), fixed rate (2.70% coupon) maturing on 15 December 2051, priced at 99.76 (original spread of 95 bp), callable (30nc30)

- Ecolab Inc (Chemicals | Saint Paul, United States | Rating: A-): US$500m Senior Note (US278865BL34), fixed rate (1.65% coupon) maturing on 1 February 2027, priced at 99.97 (original spread of 45 bp), callable (5nc5)

- Ecolab Inc (Chemicals | Saint Paul, United States | Rating: A-): US$500m Senior Note (US278865BK50), fixed rate (0.90% coupon) maturing on 15 December 2023, priced at 99.93 (original spread of 30 bp), callable (2nc1)

- Newmont Corporation (Metals/Mining | Denver, United States | Rating: BBB): US$1,000m Senior Note (US651639AZ99), fixed rate (2.60% coupon) maturing on 15 July 2032, priced at 99.90 (original spread of 117 bp), callable (11nc10)

- WEC Energy Group Inc (Utility - Other | Milwaukee, United States | Rating: BBB+): US$500m Senior Note (US92939UAG13), fixed rate (2.20% coupon) maturing on 15 December 2028, priced at 99.76 (original spread of 85 bp), callable (7nc7)

- ABN Amro Bank NV (Banking | Amsterdam, Netherlands | Rating: A): US$1,000m Note (XS2415400147), fixed rate (2.47% coupon) maturing on 13 December 2029, priced at 100.00 (original spread of 110 bp), callable (8nc7)

- ABN Amro Bank NV (Banking | Amsterdam, Netherlands | Rating: A): US$1,000m Subordinated Note (US00084DAV29), fixed rate (3.32% coupon) maturing on 13 March 2037, priced at 100.00 (original spread of 190 bp), callable (15nc10)

- MingYang Smart Energy BVI Company Ltd (Financial - Other | Rating: NR): US$200m Bond (MO000A3KYVP5), fixed rate (1.60% coupon) maturing on 14 December 2024, priced at 100.00, non callable

- Roche Holdings Inc (Pharmaceuticals | Wilmington, Switzerland | Rating: NR): US$2,000m Senior Note (US771196BW19), fixed rate (1.93% coupon) maturing on 13 December 2028, priced at 100.00 (original spread of 55 bp), callable (7nc7)

- Roche Holdings Inc (Pharmaceuticals | Wilmington, Switzerland | Rating: NR): US$2,000m Senior Note (US771196BX91), fixed rate (2.08% coupon) maturing on 13 December 2031, priced at 100.00 (original spread of 65 bp), callable (10nc10)

- Roche Holdings Inc (Pharmaceuticals | Wilmington, Switzerland | Rating: NR): US$2,000m Senior Note (US771196BY74), fixed rate (2.61% coupon) maturing on 13 December 2051, priced at 100.00 (original spread of 85 bp), callable (30nc30)

SELECTED RECENT EUR BOND ISSUES

- FMS Wertmanagement AoeR (Agency | Muenchen, Bayern, Germany | Rating: AAA): €1,000m Inhaberschuldverschreibung (DE000A2YPED8), floating rate (EU03MLIB + 0.0 bp) maturing on 11 December 2023, priced at 100.00, non callable

- NTT Finance Corp (Financial - Other | Minato-Ku, Tokyo-To, Japan | Rating: A): €850m Senior Note (XS2411311652), fixed rate (0.40% coupon) maturing on 13 December 2028, priced at 100.00 (original spread of 93 bp), callable (7nc7)

- NTT Finance Corp (Financial - Other | Minato-Ku, Tokyo-To, Japan | Rating: A): €650m Senior Note (XS2411311579), fixed rate (0.08% coupon) maturing on 13 December 2025, priced at 100.00 (original spread of 78 bp), callable (4nc4)

NEW LOANS

- CPI Property Group SA (BBB), signed a € 2,500m Bridge Loan, to be used for 126. It matures on 12/03/22.

- Anticimex AB, signed a US$ 350m Term Loan B, to be used for general corporate purposes. It matures on 11/16/28 and initial pricing is set at LIBOR +425bps

- CIRCOR International Inc (B-), signed a US$ 530m Term Loan, to be used for general corporate purposes. It matures on 12/17/28.

- Petrobras Global Trading Bv, signed a US$ 5,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/08/26.

- PMI Trading, Ltd, signed a US$ 664m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/03/25 and initial pricing is set at LIBOR +205bps

NEW ISSUES IN SECURITIZED CREDIT

- Jersey Mikes Funding LLC Series 2021-1 issued a fixed-rate ABS backed by business cashflow in 1 tranche offering a yield to maturity of 2.89%, for a total of US$ 250 m. Bookrunners: Guggenheim Partners LLC

- Prkcm 2021-Afc2 issued a fixed-rate RMBS in 5 tranches, for a total of US$ 385 m. Highest-rated tranche offering a yield to maturity of 2.07%, and the lowest-rated tranche a yield to maturity of 3.94%. Bookrunners: Credit Suisse

- GS Mortgage-Backed Securities 2021-PJ11 issued a floating-rate RMBS in 5 tranches, for a total of US$ 511 m. Bookrunners: Goldman Sachs & Co

- Arbour CLO X Designated Activity Co issued a floating-rate CLO in 7 tranches, for a total of € 421 m. Highest-rated tranche offering a spread over the floating rate of 97bp, and the lowest-rated tranche a spread of 895bp. Bookrunners: JP Morgan & Co Inc