Credit

Positive Risk Environment, With Much Tighter Credit Spreads Across Both DM & EM

Issuers took advantage of the tighter spreads to launch large new offerings today: Merck took home US$ 8bn in 5 tranches and Emerson Electric raised $ 3bn in 3 tranches

Published ET

5Y USD CDS Spreads On Mexican and Brazilian Oil Companies | Source: Refinitiv

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.099% today (Month-to-date: 0.41%; Year-to-date: -1.08%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.572% today (Month-to-date: 1.43%; Year-to-date: 3.76%)

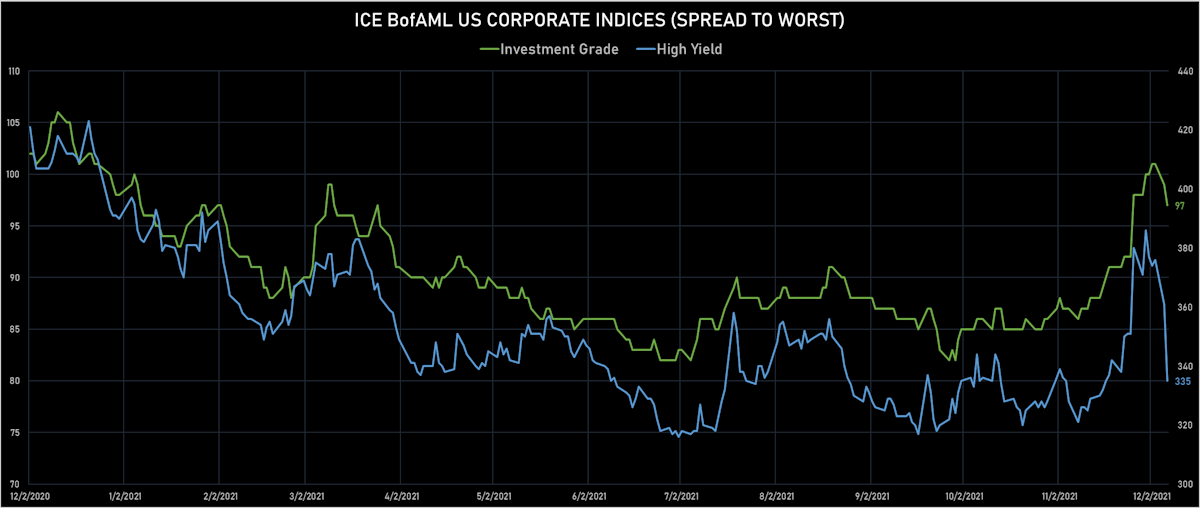

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 97.0 bp (YTD change: -1.0 bp)

- ICE BofA US High Yield Index spread to worst down -26.0 bp, now at 335.0 bp (YTD change: -55.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.29% today (YTD total return: +3.1%)

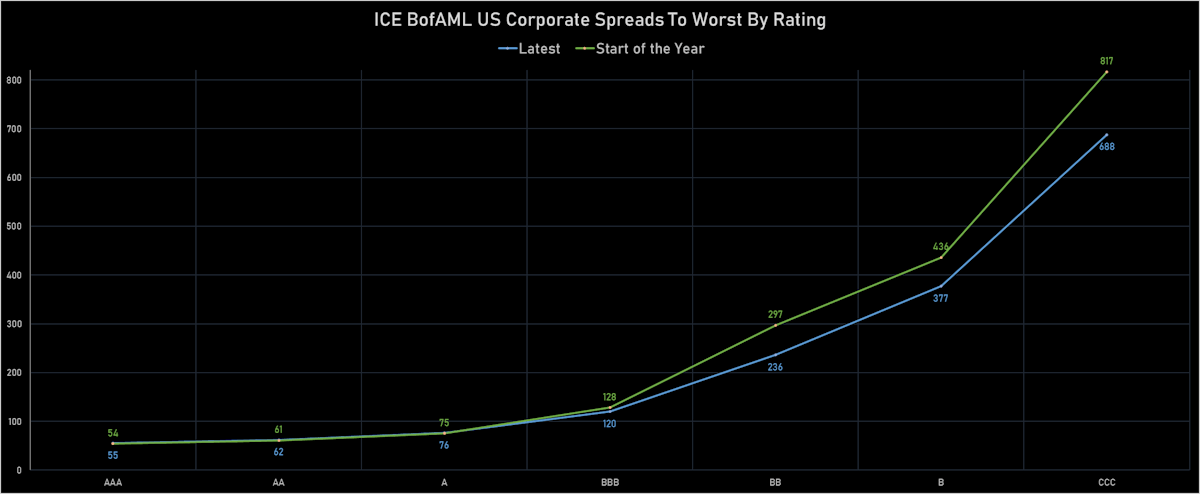

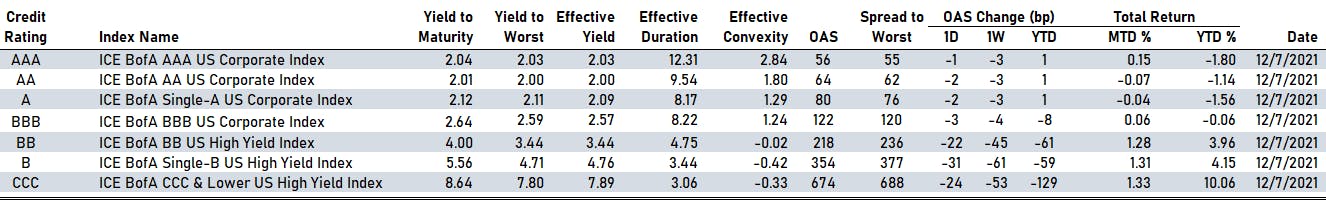

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 56 bp

- AA down by -2 bp at 64 bp

- A down by -2 bp at 80 bp

- BBB down by -3 bp at 122 bp

- BB down by -22 bp at 218 bp

- B down by -31 bp at 354 bp

- CCC down by -24 bp at 674 bp

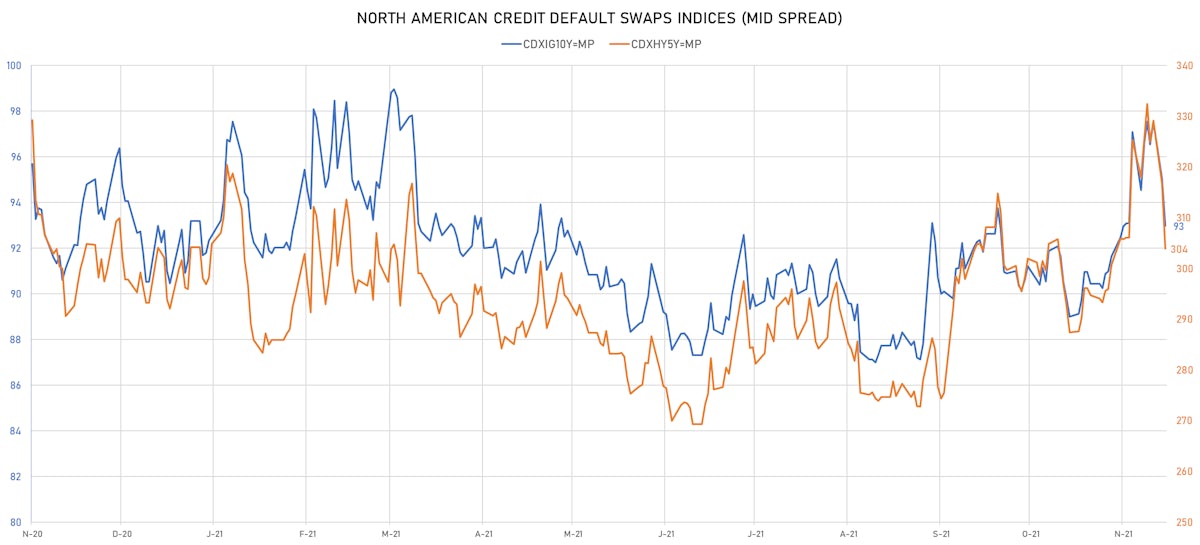

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.1 bp, now at 93bp (YTD change: +2.5bp)

- Markit CDX.NA.HY 5Y down 12.8 bp, now at 304bp (YTD change: +10.7bp)

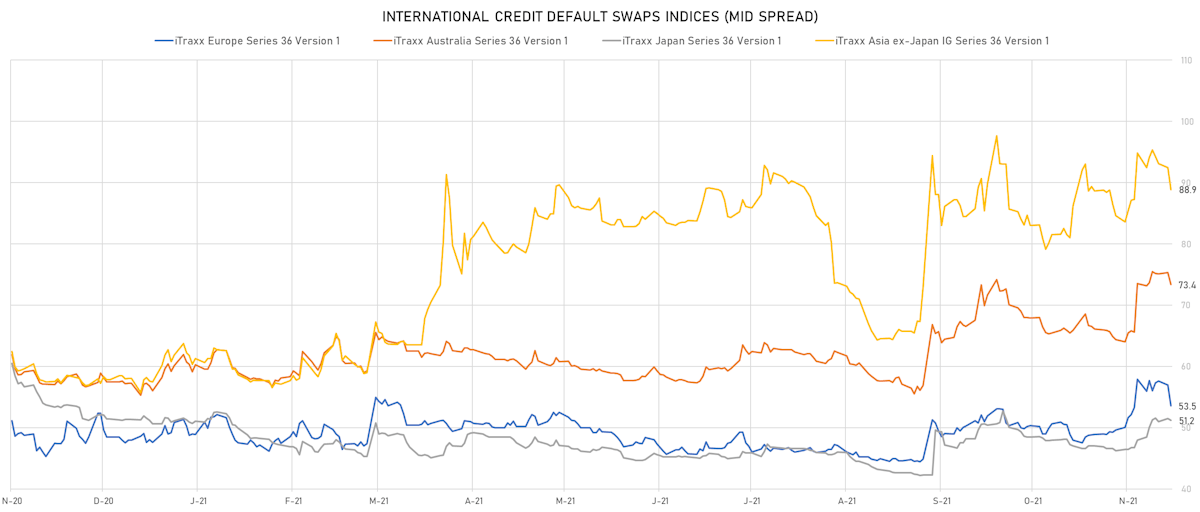

- Markit iTRAXX Europe down 3.4 bp, now at 54bp (YTD change: +5.6bp)

- Markit iTRAXX Japan down 0.3 bp, now at 51bp (YTD change: -0.2bp)

- Markit iTRAXX Asia Ex-Japan down 3.5 bp, now at 89bp (YTD change: +30.8bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CCC- | ISIN: USU96217AA99 | Z-spread up by 162.3 bp to 924.5 bp, with the yield to worst at 9.8% and the bond now trading down to 93.5 cents on the dollar (1Y price range: 67.5-104.8).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread up by 88.3 bp to 310.5 bp, with the yield to worst at 3.7% and the bond now trading down to 100.2 cents on the dollar (1Y price range: 98.4-104.2).

- Issuer: Mongolian Mortgage Corp HFC LLC (Mongolia) | Coupon: 8.85% | Maturity: 8/2/2024 | Rating: B- | ISIN: USY6142GAB96 | Z-spread up by 49.1 bp to 975.1 bp, with the yield to worst at 9.9% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 97.0-99.4).

- Issuer: BRF SA (ITAJAI, Brazil) | Coupon: 3.95% | Maturity: 22/5/2023 | Rating: BB- | ISIN: USP1905CAD22 | Z-spread down by 49.4 bp to 223.5 bp, with the yield to worst at 2.5% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 99.9-104.6).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B+ | ISIN: USU98347AK05 | Z-spread down by 55.0 bp to 363.0 bp, with the yield to worst at 4.5% and the bond now trading up to 101.9 cents on the dollar (1Y price range: 100.3-108.3).

- Issuer: Hopson Development Holdings Ltd (Bermuda) | Coupon: 6.80% | Maturity: 28/12/2023 | Rating: B+ | ISIN: XS2353028298 | Z-spread down by 56.8 bp to 822.5 bp, with the yield to worst at 8.6% and the bond now trading up to 95.8 cents on the dollar (1Y price range: 83.6-99.9).

- Issuer: Arcelik AS (Turkey) | Coupon: 5.00% | Maturity: 3/4/2023 | Rating: BB+ | ISIN: XS0910932788 | Z-spread down by 58.5 bp to 337.6 bp, with the yield to worst at 3.8% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 99.9-104.5).

- Issuer: Buckeye Partners LP (Houston, Texas (US)) | Coupon: 4.13% | Maturity: 1/3/2025 | Rating: B+ | ISIN: USU05638AB41 | Z-spread down by 58.9 bp to 213.0 bp, with the yield to worst at 3.0% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 100.5-104.4).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread down by 62.6 bp to 244.1 bp, with the yield to worst at 3.5% and the bond now trading up to 104.4 cents on the dollar (1Y price range: 102.1-107.0).

- Issuer: Carnival Corp (Miami, Panama) | Coupon: 5.75% | Maturity: 1/3/2027 | Rating: B | ISIN: USP2121VAL82 | Z-spread down by 62.9 bp to 454.9 bp (CDS basis: 38.6bp), with the yield to worst at 5.7% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 96.0-106.5).

- Issuer: FMG Resources (August 2006) Pty Ltd (Australia) | Coupon: 5.13% | Maturity: 15/5/2024 | Rating: BB+ | ISIN: USQ3919KAK71 | Z-spread down by 63.4 bp to 111.6 bp, with the yield to worst at 1.6% and the bond now trading up to 106.5 cents on the dollar (1Y price range: 105.0-109.6).

- Issuer: Banco Continental SAECA (Asuncion, Paraguay) | Coupon: 2.75% | Maturity: 10/12/2025 | Rating: BB+ | ISIN: USP09110AB65 | Z-spread down by 76.2 bp to 145.6 bp, with the yield to worst at 2.5% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 96.8-100.3).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.25% | Maturity: 15/7/2024 | Rating: BB | ISIN: USU6500TAF22 | Z-spread down by 82.4 bp to 157.6 bp, with the yield to worst at 2.5% and the bond now trading up to 103.8 cents on the dollar (1Y price range: 101.9-106.9).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 122.3 bp to 517.2 bp (CDS basis: 231.5bp), with the yield to worst at 6.1% and the bond now trading up to 92.8 cents on the dollar (1Y price range: 71.0-94.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Telecom Italia Finance SA (Luxembourg, Luxembourg) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: BB | ISIN: XS0161100515 | Z-spread down by 26.1 bp to 376.8 bp (CDS basis: -48.1bp), with the yield to worst at 3.7% and the bond now trading up to 134.7 cents on the dollar (1Y price range: 129.4-149.5).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: BB- | ISIN: XS1711584430 | Z-spread down by 26.4 bp to 283.1 bp (CDS basis: 40.4bp), with the yield to worst at 2.4% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 98.9-104.4).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: BB | ISIN: XS1419869885 | Z-spread down by 28.3 bp to 251.6 bp (CDS basis: -34.9bp), with the yield to worst at 2.2% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 102.9-111.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.13% | Maturity: 15/10/2024 | Rating: BB- | ISIN: XS1439749281 | Z-spread down by 31.8 bp to 277.9 bp, with the yield to worst at 2.3% and the bond now trading up to 96.2 cents on the dollar (1Y price range: 92.5-96.8).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread down by 32.4 bp to 344.1 bp, with the yield to worst at 3.1% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 95.9-101.3).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread down by 52.9 bp to 281.4 bp (CDS basis: -37.5bp), with the yield to worst at 2.3% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 97.1-103.7).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 5.50% | Maturity: 24/2/2025 | Rating: BB- | ISIN: XS0213101073 | Z-spread down by 60.7 bp to 292.8 bp (CDS basis: -66.3bp), with the yield to worst at 2.5% and the bond now trading up to 108.5 cents on the dollar (1Y price range: 104.9-110.4).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.63% | Maturity: 24/11/2025 | Rating: BB- | ISIN: XS1824425182 | Z-spread down by 70.1 bp to 346.1 bp (CDS basis: -85.6bp), with the yield to worst at 3.1% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 92.5-102.1).

SELECTED RECENT USD BOND ISSUES

- Emerson Electric Co (Machinery | St. Louis, United States | Rating: A): US$1,000m Senior Note (US291011BR42), fixed rate (2.20% coupon) maturing on 21 December 2031, priced at 99.69 (original spread of 75 bp), callable (10nc10)

- Emerson Electric Co (Machinery | St. Louis, United States | Rating: A): US$1,000m Senior Note (US291011BS25), fixed rate (2.80% coupon) maturing on 21 December 2051, priced at 99.78 (original spread of 100 bp), callable (30nc30)

- Emerson Electric Co (Machinery | St. Louis, United States | Rating: A): US$1,000m Senior Note (US291011BQ68), fixed rate (2.00% coupon) maturing on 21 December 2028, priced at 99.78 (original spread of 60 bp), callable (7nc7)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$850m Bond (US3133ENGX22), floating rate (SOFR + 6.0 bp) maturing on 13 December 2023, priced at 100.00, non callable

- Ga Global Funding Trust (Financial - Other | Wilmington, United States | Rating: NR): US$600m Note (US36143L2F13), fixed rate (1.25% coupon) maturing on 8 December 2023, priced at 99.93 (original spread of 60 bp), non callable

- GLP Capital LP (Financial - Other | Wyomissing, United States | Rating: NR): US$800m Senior Note (US361841AR08), fixed rate (3.25% coupon) maturing on 15 January 2032, priced at 99.38 (original spread of 185 bp), callable (10nc10)

- JPMorgan Chase & Co (Banking | New York City, United States | Rating: A-): US$400m Senior Note (US46647PCS39), floating rate (SOFR + 60.0 bp) maturing on 10 December 2025, priced at 100.00, callable (4nc4)

- JPMorgan Chase & Co (Banking | New York City, United States | Rating: A-): US$2,350m Senior Note (US46647PCT12), floating rate maturing on 10 December 2025, priced at 100.00, callable (4nc4)

- Merck & Co Inc (Pharmaceuticals | Kenilworth, United States | Rating: A+): US$2,000m Senior Note (US58933YBF16), fixed rate (2.75% coupon) maturing on 10 December 2051, priced at 99.76 (original spread of 95 bp), callable (30nc30)

- Merck & Co Inc (Pharmaceuticals | Kenilworth, United States | Rating: A+): US$1,500m Senior Note (US58933YBG98), fixed rate (2.90% coupon) maturing on 10 December 2061, priced at 99.72 (original spread of 110 bp), callable (40nc40)

- Merck & Co Inc (Pharmaceuticals | Kenilworth, United States | Rating: A+): US$1,000m Senior Note (US58933YBD67), fixed rate (1.90% coupon) maturing on 10 December 2028, priced at 99.82 (original spread of 50 bp), callable (7nc7)

- Merck & Co Inc (Pharmaceuticals | Kenilworth, United States | Rating: A+): US$1,500m Senior Note (US58933YBC84), fixed rate (1.70% coupon) maturing on 10 June 2027, priced at 99.96 (original spread of 45 bp), callable (6nc5)

- Merck & Co Inc (Pharmaceuticals | Kenilworth, United States | Rating: A+): US$2,000m Senior Note (US58933YBE41), fixed rate (2.15% coupon) maturing on 10 December 2031, priced at 99.79 (original spread of 70 bp), callable (10nc10)

- Patrick Industries Inc (Building Products | Elkhart, United States | Rating: BB-): US$225m Bond (US703343AF08), fixed rate (1.75% coupon) maturing on 1 December 2028, priced at 100.00, non callable, convertible

- Western Digital Corp (Information/Data Technology | San Jose, United States | Rating: BB+): US$500m Senior Note (US958102AQ89), fixed rate (2.85% coupon) maturing on 1 February 2029, priced at 99.82 (original spread of 145 bp), callable (7nc7)

- Western Digital Corp (Information/Data Technology | San Jose, United States | Rating: BB+): US$500m Senior Note (US958102AR62), fixed rate (3.10% coupon) maturing on 1 February 2032, priced at 99.73 (original spread of 165 bp), callable (10nc10)

- Petroleos Mexicanos (Oil and Gas | Miguel Hidalgo, Mexico | Rating: BB-): US$1,000m Senior Note (US71643VAA35), fixed rate (6.70% coupon) maturing on 16 February 2032, priced at 99.98, callable (10nc10)

- Ritchie Bros Holdings Inc (Financial - Other | Lincoln, Canada | Rating: BB): US$600m Senior Note (US76774LAA52), fixed rate (4.75% coupon) maturing on 15 December 2031, priced at 100.00 (original spread of 328 bp), callable (10nc3)

- Xihui Haiwai I Investment Holdings Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$300m Senior Note (XS2416568702), fixed rate (1.95% coupon) maturing on 14 December 2024, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Landeskreditbank Baden Wuerttemberg Foerderbank (Agency | Karlsruhe, Germany | Rating: AA+): €150,000m Senior Note (XS2420971736), fixed rate (0.51% coupon) maturing on 13 December 2031, priced at 100.00, callable (10nc1)

- NGE SAS (Building Products | Tarascon, France | Rating: NR): €115m Bond (FR0014006WA5), fixed rate (3.40% coupon) maturing on 8 December 2029, priced at 100.00, non callable

- Orange SA (Telecommunications | Issy-Les-Moulineaux, France | Rating: BBB+): €1,000m Bond (FR0014006ZC4), fixed rate (0.63% coupon) maturing on 16 December 2033, priced at 98.74 (original spread of 111 bp), callable (12nc12)

- Westpac Securities NZ Ltd (London Branch) (Financial - Other | London, Australia | Rating: NR): €750m Senior Note (XS2421006201), fixed rate (0.43% coupon) maturing on 14 December 2026, priced at 100.00 (original spread of 103 bp), non callable

NEW LOANS

- RealPage Inc (B), signed a US$ 260m Term Loan B, to be used for acquisition financing. It matures on 04/22/28 and initial pricing is set at LIBOR +325bps

- Metronet Holdings LLC (B-), signed a US$ 125m Term Loan B, to be used for general corporate purposes. It matures on 06/02/28 and initial pricing is set at LIBOR +375bps

NEW ISSUES IN SECURITIZED CREDIT

- Sequoia Mortgage Trust 2021-9 issued a fixed-rate RMBS in 5 tranches, for a total of US$ 490 m. Highest-rated tranche offering a yield to maturity of 2.00%, and the lowest-rated tranche a yield to maturity of 2.50%. Bookrunners: Wells Fargo Securities LLC

- Freddie Mac Spc Series K-F126 issued a floating-rate Agency CMBS in 1 tranche, for a total of US$ 760 m. Highest-rated tranche offering a spread over the floating rate of 24bp, and the lowest-rated tranche a spread of 24bp. Bookrunners: Morgan Stanley International Ltd, PNC Capital Markets