Credit

The Rise In Rates And Moderate Widening In HY Spreads Took US$ Bonds Down Today

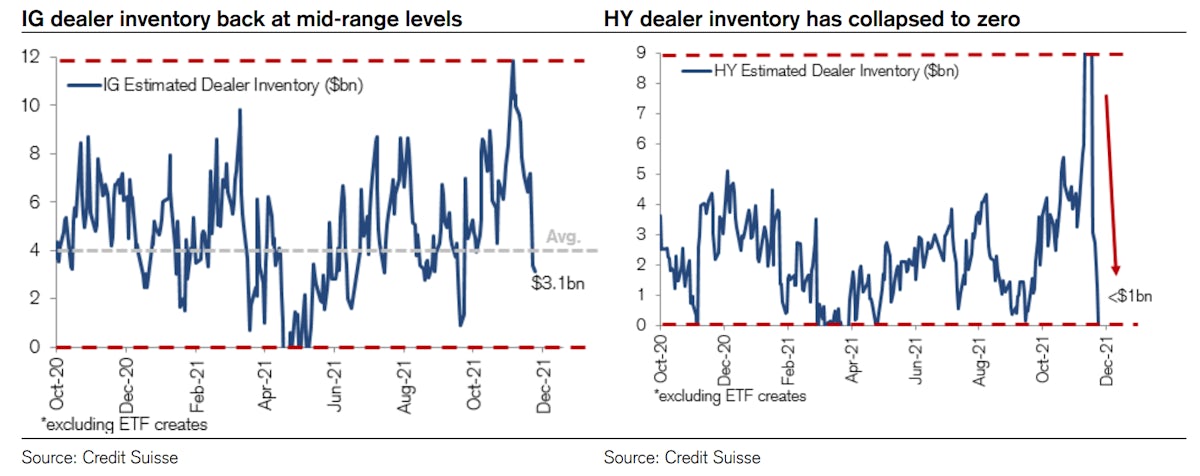

The huge tightening in US HY cash spreads at the beginning of the week (OAS down 37bp w/w) was amplified by the lack of dealer inventory, as the CS chart below shows

Published ET

Dealer Inventories For US IG & HY Bonds | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.49% today, with investment grade down -0.52% and high yield down -0.19% (YTD total return: -0.97%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.691% today (Month-to-date: -0.28%; Year-to-date: -1.77%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.110% today (Month-to-date: 1.32%; Year-to-date: 3.65%)

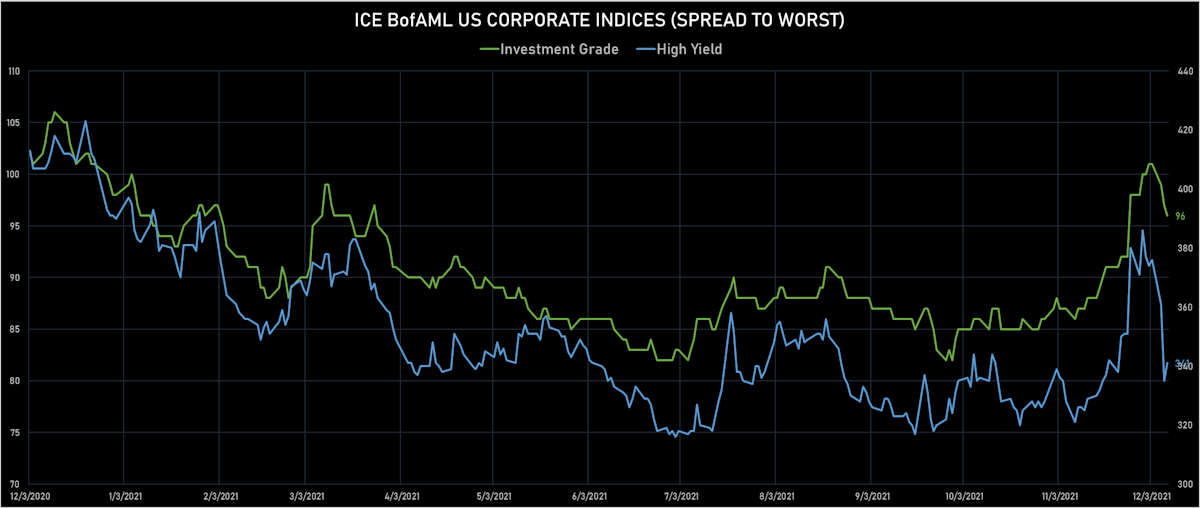

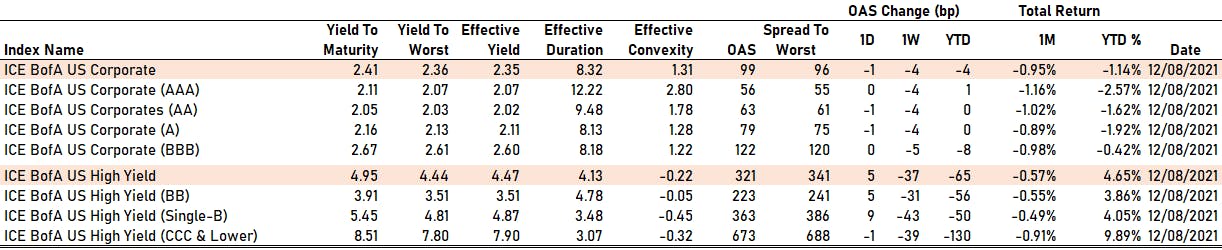

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 96.0 bp (YTD change: -2.0 bp)

- ICE BofA US High Yield Index spread to worst up 6.0 bp, now at 341.0 bp (YTD change: -49.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.08% today (YTD total return: +3.2%)

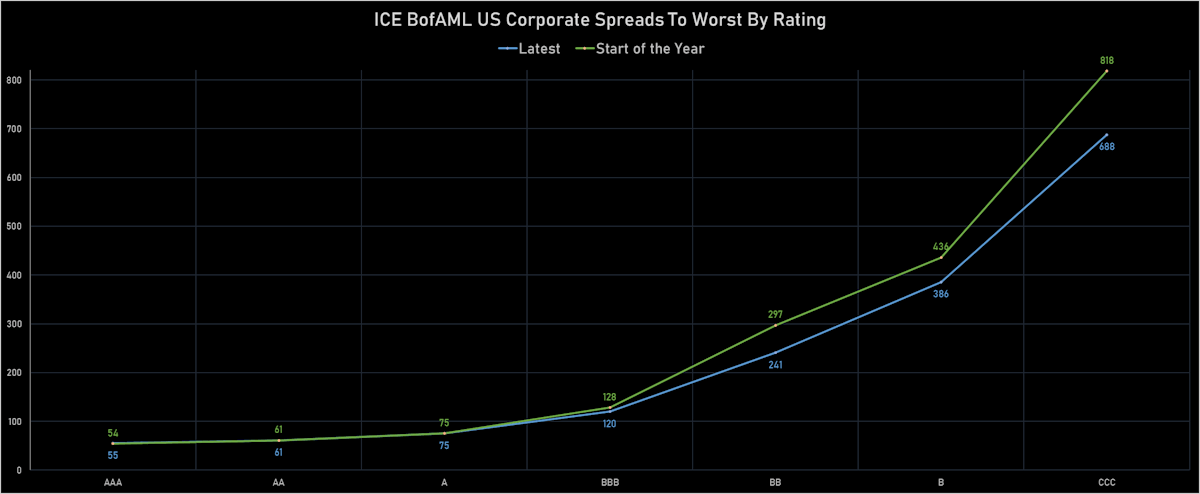

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 56 bp

- AA down by -1 bp at 63 bp

- A down by -1 bp at 79 bp

- BBB unchanged at 122 bp

- BB up by 5 bp at 223 bp

- B up by 9 bp at 363 bp

- CCC down by -1 bp at 673 bp

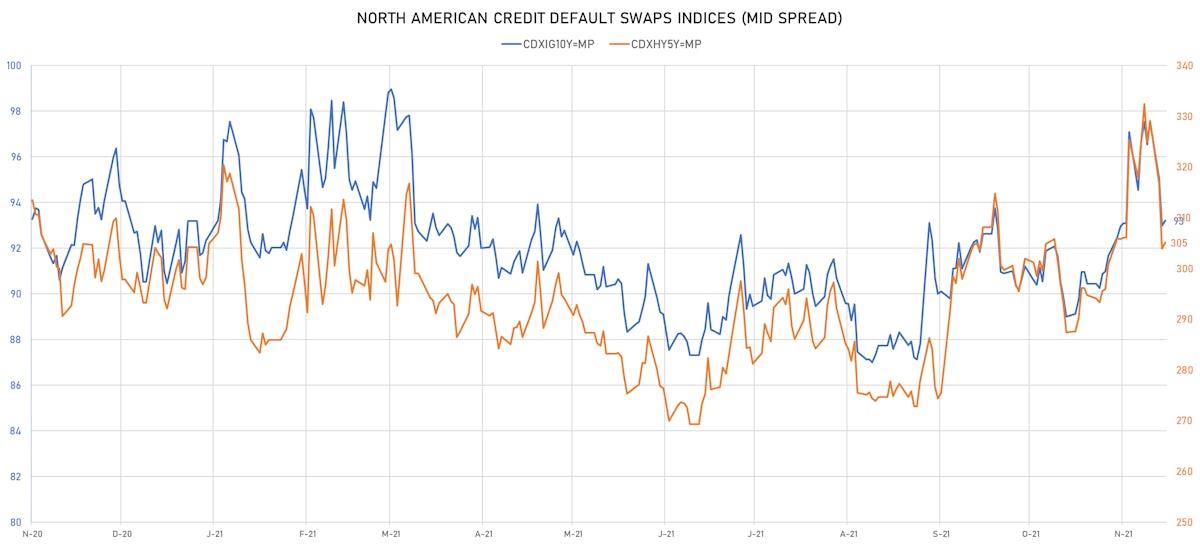

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.2 bp, now at 93bp (YTD change: +2.7bp)

- Markit CDX.NA.HY 5Y up 1.2 bp, now at 305bp (YTD change: +11.9bp)

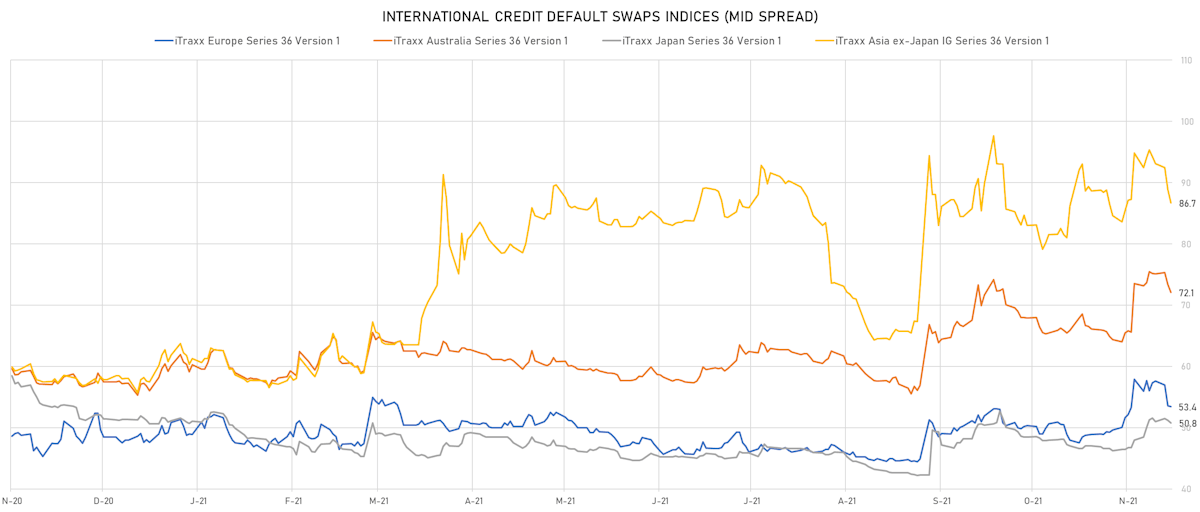

- Markit iTRAXX Europe down 0.1 bp, now at 53bp (YTD change: +5.4bp)

- Markit iTRAXX Japan down 0.4 bp, now at 51bp (YTD change: -0.6bp)

- Markit iTRAXX Asia Ex-Japan down 2.2 bp, now at 87bp (YTD change: +28.7bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Petroleos Mexicanos (Country: MX; rated: BBB+): down 63.4 bp to 322.8bp (1Y range: 320-454bp)

- American Airlines Group Inc (Country: US; rated: B2): down 59.1 bp to 763.1bp (1Y range: 596-1,340bp)

- Turkey, Republic of (Government) (Country: TR; rated: BB): down 50.9 bp to 484.1bp (1Y range: 283-536bp)

- Turkiye Is Bankasi AS (Country: TR; rated: WD): down 42.7 bp to 625.2bp (1Y range: 482-738bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 39.4 bp to 486.6bp (1Y range: 291-572bp)

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): down 39.2 bp to 771.7bp (1Y range: 606-1,202bp)

- NRG Energy Inc (Country: US; rated: Ba1): down 33.6 bp to 199.9bp (1Y range: 108-253bp)

- DISH DBS Corp (Country: US; rated: B2): down 31.0 bp to 520.6bp (1Y range: 317-562bp)

- Staples Inc (Country: US; rated: B2): down 30.9 bp to 1,164.3bp (1Y range: 652-1,164bp)

- Bombardier Inc (Country: CA; rated: Caa1): down 29.4 bp to 434.4bp (1Y range: 395-1,912bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): down 25.9 bp to 439.4bp (1Y range: 299-726bp)

- Brazil, Federative Republic of (Government) (Country: BR; rated: B): down 23.5 bp to 214.8bp (1Y range: 141-263bp)

- Lumen Technologies Inc (Country: US; rated: Ba3): down 23.0 bp to 331.7bp (1Y range: 195-533bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 62.1 bp to 132.9bp (1Y range: -133bp)

- TUI AG (Country: DE; rated: B3-PD): down 48.4 bp to 762.3bp (1Y range: 607-946bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 47.3 bp to 598.8bp (1Y range: 358-661bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 46.0 bp to 690.4bp (1Y range: 464-779bp)

- Boparan Finance PLC (Country: GB; rated: WR): down 40.0 bp to 1,328.9bp (1Y range: 528-1,564bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): down 31.5 bp to 219.4bp (1Y range: 154-273bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 29.8 bp to 279.2bp (1Y range: 209-348bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 28.7 bp to 180.4bp (1Y range: 107-227bp)

- Novafives SAS (Country: FR; rated: Caa1): down 27.6 bp to 654.2bp (1Y range: 654-976bp)

- Unibail-Rodamco-Westfield SE (Country: FR; rated: BBB-): down 19.5 bp to 127.5bp (1Y range: 46-128bp)

- Stena AB (Country: SE; rated: B2-PD): down 17.0 bp to 422.9bp (1Y range: 401-728bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 15.1 bp to 446.3bp (1Y range: 333-481bp)

- Air France KLM SA (Country: FR; rated: B-): down 14.9 bp to 447.5bp (1Y range: 386-699bp)

SELECTED RECENT USD BOND ISSUES

- Dun & Bradstreet Corp (Service - Other | Short Hills, United States | Rating: B-): US$460m Senior Note (US26483EAL48), fixed rate (5.00% coupon) maturing on 15 December 2029, priced at 100.00 (original spread of 357 bp), callable (8nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$250m Bond (US3133ENGZ79), floating rate (SOFR + 7.0 bp) maturing on 14 December 2023, priced at 100.00, callable (2nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$230m Bond (US3133ENHB92), fixed rate (1.84% coupon) maturing on 14 December 2028, priced at 100.00 (original spread of 40 bp), callable (7nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$185m Bond (US3133ENHC75), fixed rate (1.60% coupon) maturing on 14 December 2026, priced at 100.00 (original spread of 154 bp), callable (5nc3m)

- II-VI Inc (Electronics | Saxonburg, Pennsylvania, United States | Rating: B+): US$990m Senior Note (US902104AC24), fixed rate (5.00% coupon) maturing on 15 December 2029, priced at 100.00 (original spread of 360 bp), callable (8nc3)

- NextEra Energy Capital Holdings Inc (Financial - Other | Juno Beach, United States | Rating: A-): US$500m Senior Debenture (US65339KCA60), fixed rate (3.00% coupon) maturing on 15 January 2052, priced at 99.78 (original spread of 131 bp), callable (30nc30)

- South Street Securities Funding LLC (Financial - Other | United States | Rating: NR): US$107m Senior Note (US84046SAF56), fixed rate (6.00% coupon) maturing on 15 December 2026, priced at 100.00, callable (5nc2)

- Southwestern Energy Co (Gas Utility - Local Distrib | Spring, United States | Rating: BB): US$1,150m Senior Note (US845467AT68), fixed rate (4.75% coupon) maturing on 1 February 2032, priced at 100.00 (original spread of 324 bp), callable (10nc5)

- Standard Industries Inc (Building Products | Parsippany, United States | Rating: BB+): US$500m Senior Note (USU85343AL21), fixed rate (4.38% coupon) maturing on 15 July 2030, priced at 99.38 (original spread of 300 bp), callable (9nc4)

- Athene Holding Ltd (Life Insurance | Hamilton, Bermuda | Rating: BBB+): US$500m Senior Note (US04686JAE10), fixed rate (3.45% coupon) maturing on 15 May 2052, priced at 99.98 (original spread of 175 bp), callable (30nc30)

- Cooperatieve Rabobank UA (Banking | Utrecht, Netherlands | Rating: A+): US$1,250m Note (US74977RDL50), fixed rate (1.98% coupon) maturing on 15 December 2027, priced at 100.00 (original spread of 73 bp), callable (6nc5)

- Sagicor Financial Company Ltd (Life Insurance | Saint Michael, Canada | Rating: NR): US$150m Senior Note (USG7777BAB02), fixed rate (5.30% coupon) maturing on 13 May 2028, priced at 101.50, callable (6nc2)

- Toronto-Dominion Bank (Banking | Toronto, Canada | Rating: A): US$500m Senior Note (US89114TZK14), fixed rate (1.25% coupon) maturing on 13 December 2024, priced at 99.93 (original spread of 33 bp), with a make whole call

SELECTED RECENT EUR BOND ISSUES

- Alpha Bank Societe Anonyme (Financial - Other | Athens, Greece | Rating: B+): €300m Bond (XS2416958598), fixed rate (2.88% coupon) maturing on 13 February 2024, priced at 100.00, non callable

- Bank of Nova Scotia (Banking | Toronto, Canada | Rating: A): €1,750m Covered Bond (Other) (XS2421186268), fixed rate (0.01% coupon) maturing on 15 December 2027, priced at 100.08 (original spread of 54 bp), non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: AA-): €700m Hypothekenpfandbrief (Covered Bond) (DE000LB2WAE5), floating rate (EU03MLIB + 80.0 bp) maturing on 18 April 2029, priced at 105.39, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: AA-): €400m Hypothekenpfandbrief (Covered Bond) (DE000LB2WAB1), floating rate (EU03MLIB + 80.0 bp) maturing on 17 April 2024, priced at 101.77, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: AA-): €400m Hypothekenpfandbrief (Covered Bond) (DE000LB2WAC9), floating rate (EU03MLIB + 80.0 bp) maturing on 17 April 2025, priced at 102.50, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: AA-): €350m Hypothekenpfandbrief (Covered Bond) (DE000LB2WAD7), floating rate (EU03MLIB + 80.0 bp) maturing on 18 April 2028, priced at 104.64, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: AA-): €300m Hypothekenpfandbrief (Covered Bond) (DE000LB2WAF2), floating rate (EU03MLIB + 80.0 bp) maturing on 18 April 2030, priced at 106.11, non callable

- NRW Bank (Agency | Dusseldorf, Germany | Rating: AA): €150m Inhaberschuldverschreibung (DE000NWB2QF5), fixed rate (0.61% coupon) maturing on 14 December 2033, priced at 100.00, callable (12nc1)

- UniCredit Bank Czech Republic and Slovakia as (Banking | Praha, Italy | Rating: NR): €1,000m Covered Bond (Other) (XS2419387357), floating rate (EU03MLIB + 15.0 bp) maturing on 15 December 2026, priced at 100.00, non callable

NEW LOANS

- SS&C Technologies Inc (B+), signed a US$ 1,680m Term Loan B, to be used for acquisition financing. It matures on 12/21/28 and initial pricing is set at LIBOR +200bps

- WIRB-Copernicus Grp Inc, signed a US$ 200m Term Loan B, to be used for general corporate purposes. It matures on 01/08/27 and initial pricing is set at LIBOR +400bps

- Mercuria Energy Trading Inc, signed a US$ 2,200m Revolving Credit Facility, to be used for working capital. It matures on 12/07/23.

- Convergeone Holdings Corp (BB-), signed a US$ 150m Term Loan B, to be used for acquisition financing. It matures on 03/06/26 and initial pricing is set at LIBOR +500bps

NEW ISSUES IN SECURITIZED CREDIT

- Acres 2021-Fl2 issued a floating-rate CLO in 6 tranches, for a total of US$ 567 m. Highest-rated tranche offering a spread over the floating rate of 140bp, and the lowest-rated tranche a spread of 400bp. Bookrunners: Morgan Stanley International Ltd, JP Morgan & Co Inc, Barclays Capital Group

- Volkswagen Auto Loan Enhanced Trust 2021-1 issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,750 m. Highest-rated tranche offering a yield to maturity of 0.16%, and the lowest-rated tranche a yield to maturity of 1.26%. Bookrunners: JP Morgan & Co Inc, Santander Investment Securities Inc, Wells Fargo Securities LLC, TD Securities (USA) LLC

- Freddie Mac Spc Series K-J36 issued a fixed-rate Agency CMBS in 2 tranches, for a total of US$ 219 m. Highest-rated tranche offering a yield to maturity of 1.30%, and the lowest-rated tranche a yield to maturity of 1.98%. Bookrunners: Morgan Stanley International Ltd, Wells Fargo Securities LLC

- Sequoia Mortgage Trust 2021-9 issued a fixed-rate RMBS in 5 tranches, for a total of US$ 490 m. Highest-rated tranche offering a yield to maturity of 2.00%, and the lowest-rated tranche a yield to maturity of 2.50%. Bookrunners: Wells Fargo Securities LLC

- Freddie Mac Spc Series K-F126 issued a floating-rate Agency CMBS in 1 tranche offering a spread over the floating rate of 24bp, for a total of US$ 760 m. Bookrunners: Morgan Stanley International Ltd, PNC Capital Markets