Credit

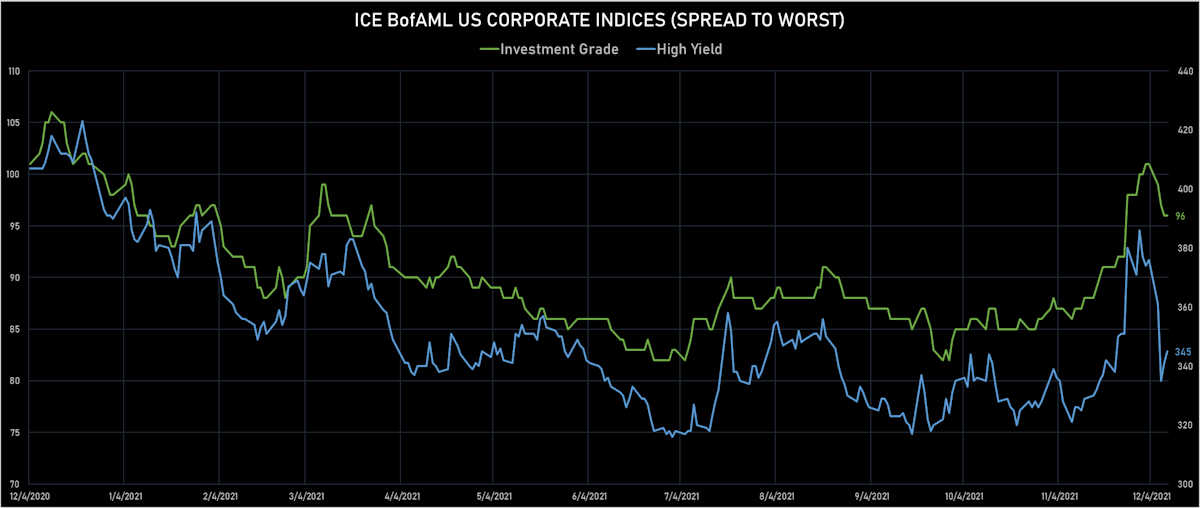

Decent Performance Of Credit Relative To Equities Today, With US Corporate Cash Spreads Stable In IG And Modestly Wider In HY

Not a great deal of action in the primary market today, with the largest offerings coming from Nextera Energy ($600m in 1 tranche) and WeWork ($550m in 1 tranche)

Published ET

Royal Caribbean Cruises (USV7780TAE39) & Carnival (USP2121VAL82) bonds have both seen their spreads tighten in the past week | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.11% today, with investment grade up 0.13% and high yield down -0.07% (YTD total return: -0.86%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.107% today (Month-to-date: -0.17%; Year-to-date: -1.66%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.119% today (Month-to-date: 1.19%; Year-to-date: 3.53%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 96.0 bp (YTD change: -2.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 345.0 bp (YTD change: -45.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: +3.2%)

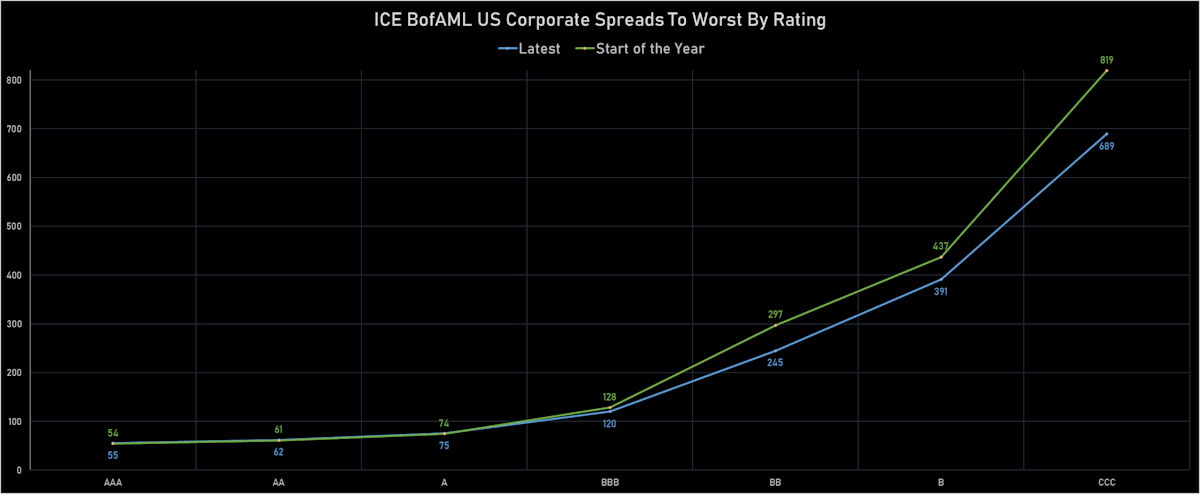

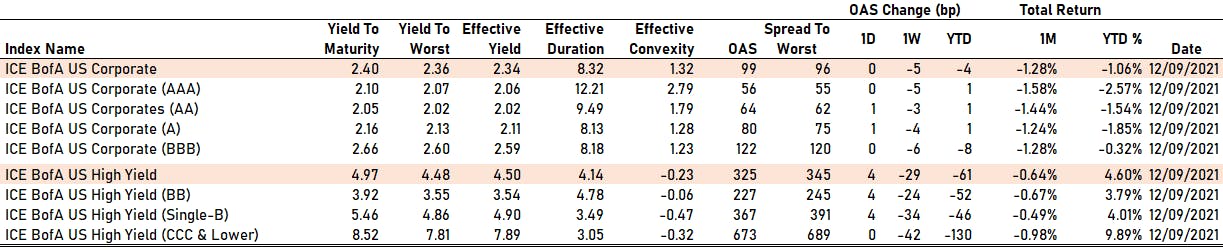

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 56 bp

- AA up by 1 bp at 64 bp

- A up by 1 bp at 80 bp

- BBB unchanged at 122 bp

- BB up by 4 bp at 227 bp

- B up by 4 bp at 367 bp

- CCC unchanged at 673 bp

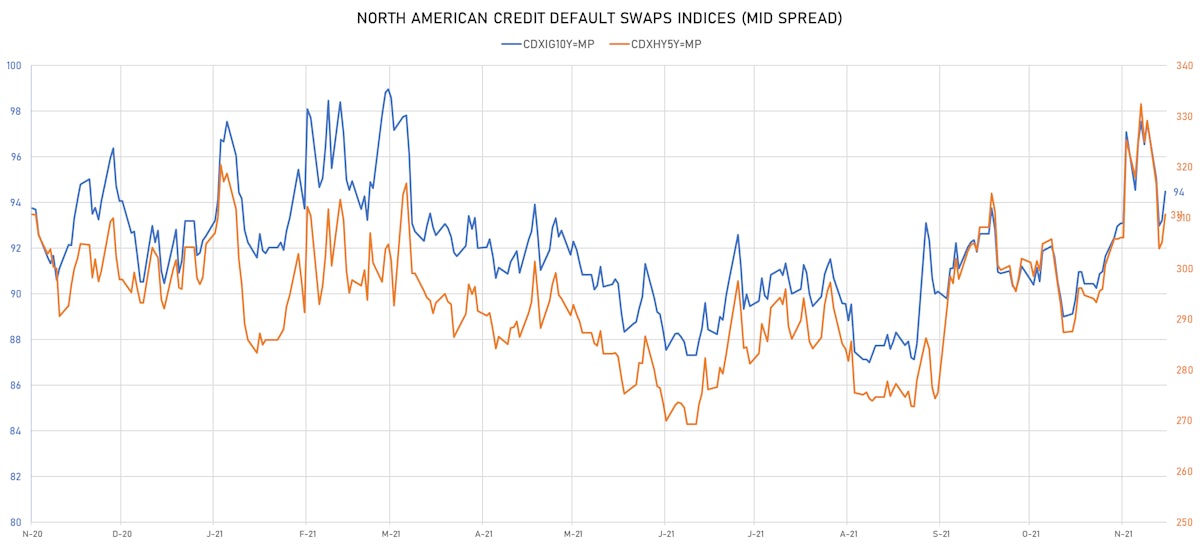

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.3 bp, now at 94bp (YTD change: +4.0bp)

- Markit CDX.NA.HY 5Y up 5.5 bp, now at 311bp (YTD change: +17.4bp)

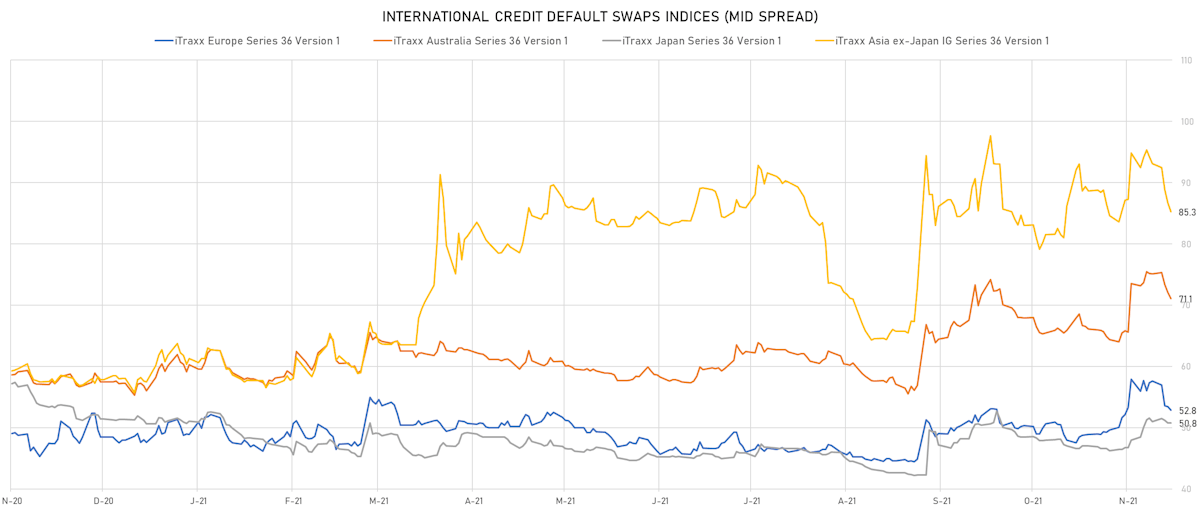

- Markit iTRAXX Europe down 0.6 bp, now at 53bp (YTD change: +4.9bp)

- Markit iTRAXX Japan unchanged 0.0 bp, now at 51bp (YTD change: -0.6bp)

- Markit iTRAXX Asia Ex-Japan down 1.5 bp, now at 85bp (YTD change: +27.2bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread up by 88.1 bp to 311.6 bp, with the yield to worst at 3.7% and the bond now trading down to 100.1 cents on the dollar (1Y price range: 98.4-104.2).

- Issuer: CTR Partnership LP (San Clemente, California (US)) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | ISIN: USU1268FAB41 | Z-spread down by 57.8 bp to 194.6 bp, with the yield to worst at 3.2% and the bond now trading up to 102.7 cents on the dollar (1Y price range: 99.0-106.4).

- Issuer: EnLink Midstream LLC (Dallas, Texas (US)) | Coupon: 5.63% | Maturity: 15/1/2028 | Rating: BB | ISIN: USU26790AB82 | Z-spread down by 58.3 bp to 342.0 bp, with the yield to worst at 4.6% and the bond now trading up to 103.8 cents on the dollar (1Y price range: 96.8-108.3).

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 5.50% | Maturity: 1/4/2028 | Rating: B | ISIN: USV7780TAE39 | Z-spread down by 59.7 bp to 425.3 bp (CDS basis: 16.4bp), with the yield to worst at 5.5% and the bond now trading up to 98.9 cents on the dollar (1Y price range: 96.0-105.9).

- Issuer: Xerox Holdings Corp (Norwalk, Connecticut (US)) | Coupon: 5.00% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU98401AA75 | Z-spread down by 60.8 bp to 247.5 bp, with the yield to worst at 3.4% and the bond now trading up to 104.3 cents on the dollar (1Y price range: 102.1-107.0).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.25% | Maturity: 15/7/2024 | Rating: BB | ISIN: USU6500TAF22 | Z-spread down by 70.0 bp to 162.1 bp, with the yield to worst at 2.5% and the bond now trading up to 103.6 cents on the dollar (1Y price range: 101.9-106.9).

- Issuer: Yankuang Group (Cayman) Ltd (Cayman Islands) | Coupon: 4.00% | Maturity: 16/7/2023 | Rating: BB+ | ISIN: XS2201820706 | Z-spread down by 71.1 bp to 231.3 bp, with the yield to worst at 2.4% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 99.5-101.5).

- Issuer: Carnival Corp (Miami, Panama) | Coupon: 5.75% | Maturity: 1/3/2027 | Rating: B | ISIN: USP2121VAL82 | Z-spread down by 74.0 bp to 468.1 bp (CDS basis: 0.1bp), with the yield to worst at 5.8% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 96.0-106.5).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 75.9 bp to 535.7 bp (CDS basis: 163.8bp), with the yield to worst at 6.3% and the bond now trading up to 92.3 cents on the dollar (1Y price range: 71.0-94.8).

- Issuer: Banco Continental SAECA (Asuncion, Paraguay) | Coupon: 2.75% | Maturity: 10/12/2025 | Rating: BB+ | ISIN: USP09110AB65 | Z-spread down by 79.9 bp to 144.7 bp, with the yield to worst at 2.5% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 96.8-100.3).

- Issuer: Gemdale Ever Prosperity Investment Ltd (Hong Kong) | Coupon: 4.95% | Maturity: 12/8/2024 | Rating: BB- | ISIN: XS2357443410 | Z-spread down by 98.0 bp to 464.9 bp, with the yield to worst at 5.3% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 88.3-102.0).

- Issuer: Petroleos Mexicanos (MIGUEL HIDALGO, Mexico) | Coupon: 6.88% | Maturity: 16/10/2025 | Rating: BB- | ISIN: USP7S08VBZ31 | Z-spread down by 109.7 bp to 270.9 bp (CDS basis: -7.9bp), with the yield to worst at 3.9% and the bond now trading up to 110.1 cents on the dollar (1Y price range: 105.7-111.8).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread down by 110.0 bp to 1,101.2 bp, with the yield to worst at 11.3% and the bond now trading up to 87.1 cents on the dollar (1Y price range: 66.0-105.8).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread down by 116.4 bp to 791.0 bp, with the yield to worst at 8.7% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 93.5-102.4).

SELECTED RECENT USD BOND ISSUES

- Babcock & Wilcox Enterprises Inc (Electronics | Akron, Ohio, United States | Rating: NR): US$140m Senior Note (US05614L5066), fixed rate (6.50% coupon) maturing on 31 December 2026, priced at 100.00 (original spread of 566 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$145m Bond (US3133ENHG89), fixed rate (2.62% coupon) maturing on 16 December 2036, priced at 100.00 (original spread of 97 bp), callable (15nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$120m Bond (US3130AQC686), fixed rate (1.15% coupon) maturing on 13 December 2024, priced at 100.00 (original spread of 109 bp), callable (3nc1m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$200m Bond (US3130AQC926), fixed rate (0.75% coupon) maturing on 30 December 2026, priced at 100.00 (original spread of 6 bp), callable (5nc1)

- FirstCash Inc (Financial - Other | Fort Worth, United States | Rating: BB): US$550m Senior Note (US31944TAA88), fixed rate (5.63% coupon) maturing on 1 January 2030, priced at 100.00 (original spread of 413 bp), callable (8nc3)

- Howard Midstream Energy Partners LLC (Gas Utility - Pipelines | San Antonio, United States | Rating: B): US$400m Senior Note (US442722AA25), fixed rate (6.75% coupon) maturing on 15 January 2027, priced at 100.00 (original spread of 552 bp), non callable

- NextEra Energy Capital Holdings Inc (Financial - Other | Juno Beach, United States | Rating: A-): US$600m Junior Subordinated Debenture (US65339KCB44), fixed rate (3.80% coupon) maturing on 15 March 2082, priced at 100.00, callable (60nc5)

- Qorvo Inc (Electronics | Greensboro, United States | Rating: BBB-): US$500m Senior Note (US74739DAA28), fixed rate (1.75% coupon) maturing on 15 December 2024, priced at 99.81 (original spread of 85 bp), callable (3nc1)

- Wework Companies LLC (Financial - Other | New York City, United States | Rating: NR): US$550m Senior Note (US96209BAA08), fixed rate (5.00% coupon) maturing on 10 July 2025, priced at 85.99 (original spread of 864 bp), callable (4nc3)

- Pingdu City State-owned Assets Management Co Ltd (Financial - Other | Qingdao, China (Mainland) | Rating: NR): US$200m Senior Note (XS2416972581), fixed rate (5.00% coupon) maturing on 16 December 2024, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Hamburg Commercial Bank AG (Banking | Hamburg, Hamburg, Germany | Rating: BBB): €250m Schiffspfandbrief (Covered Bond) (DE000HCB0BF3) zero coupon maturing on 16 December 2023, priced at 100.42, non callable

- Jingming Yuantong Development Investment BVI CoLtd (Financial - Other | Rating: NR): €165m Senior Note (XS2416416514), fixed rate (2.90% coupon) maturing on 14 December 2024, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €250m Oeffenlicher Pfandbrief (Covered Bond) (DE000LB2WAP1), floating rate (EU03MLIB + 80.0 bp) maturing on 15 May 2034, priced at 109.08, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €200m Oeffenlicher Pfandbrief (Covered Bond) (DE000LB2WAG0), floating rate (EU03MLIB + 80.0 bp) maturing on 15 May 2024, priced at 101.83, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €200m Oeffenlicher Pfandbrief (Covered Bond) (DE000LB2WAQ9), floating rate (EU03MLIB + 80.0 bp) maturing on 15 May 2037, priced at 111.34, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €150m Oeffenlicher Pfandbrief (Covered Bond) (DE000LB2WAJ4), floating rate (EU03MLIB + 80.0 bp) maturing on 15 July 2027, priced at 104.07, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €150m Oeffenlicher Pfandbrief (Covered Bond) (DE000LB2WAH8), floating rate (EU03MLIB + 80.0 bp) maturing on 15 May 2026, priced at 103.25, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Germany | Rating: A-): €150m Oeffenlicher Pfandbrief (Covered Bond) (DE000LB2WAN6), floating rate (EU03MLIB + 80.0 bp) maturing on 15 July 2033, priced at 108.48, non callable

NEW LOANS

- Metso Outotec Oyj (BBB-), signed a € 100m Term Loan, to be used for general corporate purposes

- Fairbanks Morse LLC, signed a US$ 240m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 06/23/28 and initial pricing is set at LIBOR +475bps

- CWGS Grp Llc (BB-), signed a US$ 300m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 06/03/28 and initial pricing is set at LIBOR +250bps

- FleetCor Technologies Inc (BB+), signed a US$ 1,000m Term Loan B, to be used for general corporate purposes. It matures on 04/30/28 and initial pricing is set at LIBOR +175bps

NEW ISSUES IN SECURITIZED CREDIT

- Bsprt 2021-Fl7 Issuer Ltd issued a floating-rate CLO in 6 tranches, for a total of US$ 722 m. Highest-rated tranche offering a spread over the floating rate of 132bp, and the lowest-rated tranche a spread of 340bp. Bookrunners: Barclays Capital Group, Wells Fargo Securities LLC