Credit

Not Much Movement In USD Cash Markets Today, With Modestly Wider Spreads Counterbalanced By Lower Rates

US weekly issuance volumes (IFR data): 40 tranches for US$ 39.5 bn in IG (2021 YTD volume $ 1.48 trillion vs 2020 YTD $ 1.79 tn), 8 tranches for $ 5.45 bn in HY (2021 YTD volume $ 458.1 bn vs 2020 YTD $ 424.3 bn)

Published ET

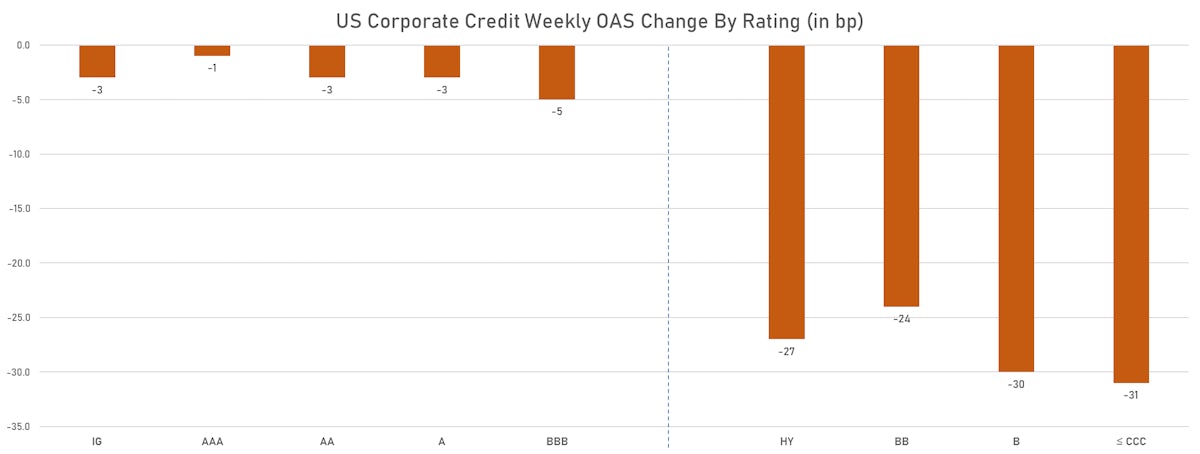

Weekly Change In Option-Adjusted Spreads By Rating | Sources: ϕpost, FactSet data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.05% today, with investment grade down -0.05% and high yield down -0.11% (YTD total return: -0.91%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.048% today (Month-to-date: -0.22%; Year-to-date: -1.71%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.022% today (Month-to-date: 1.17%; Year-to-date: 3.50%)

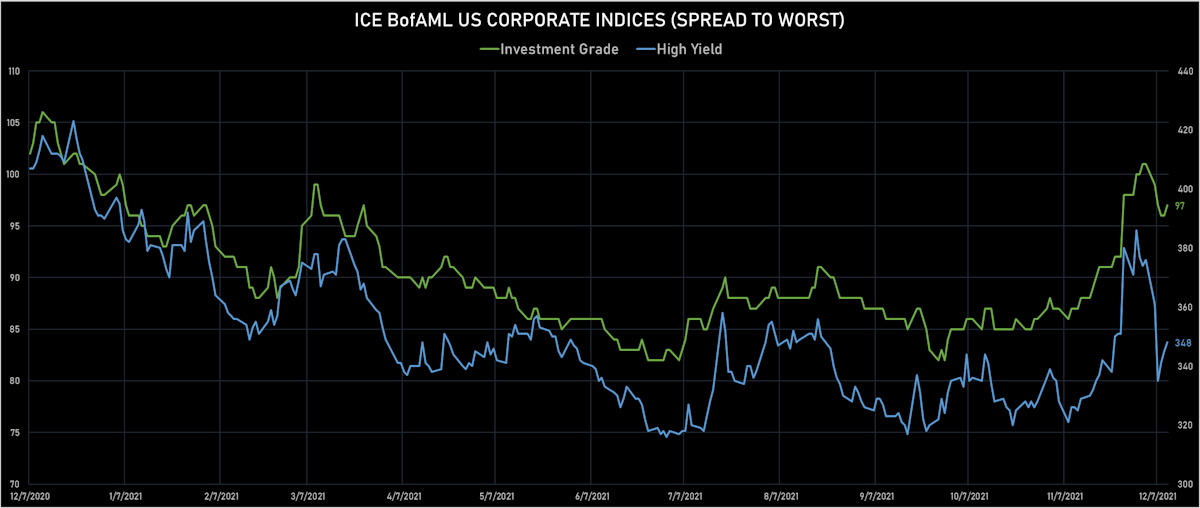

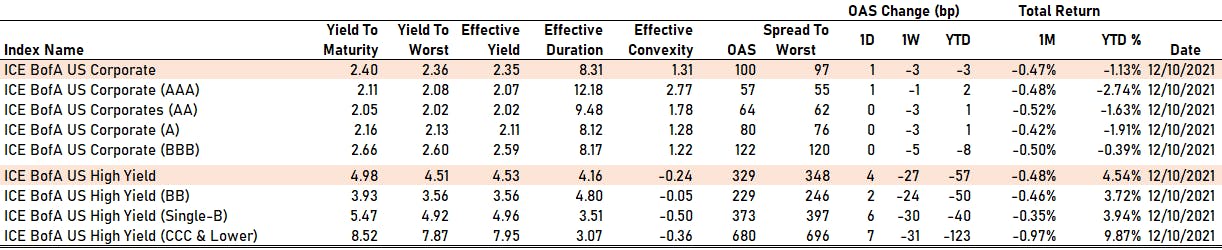

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 97.0 bp (YTD change: -1.0 bp)

- ICE BofA US High Yield Index spread to worst up 3.0 bp, now at 348.0 bp (YTD change: -42.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: +3.2%)

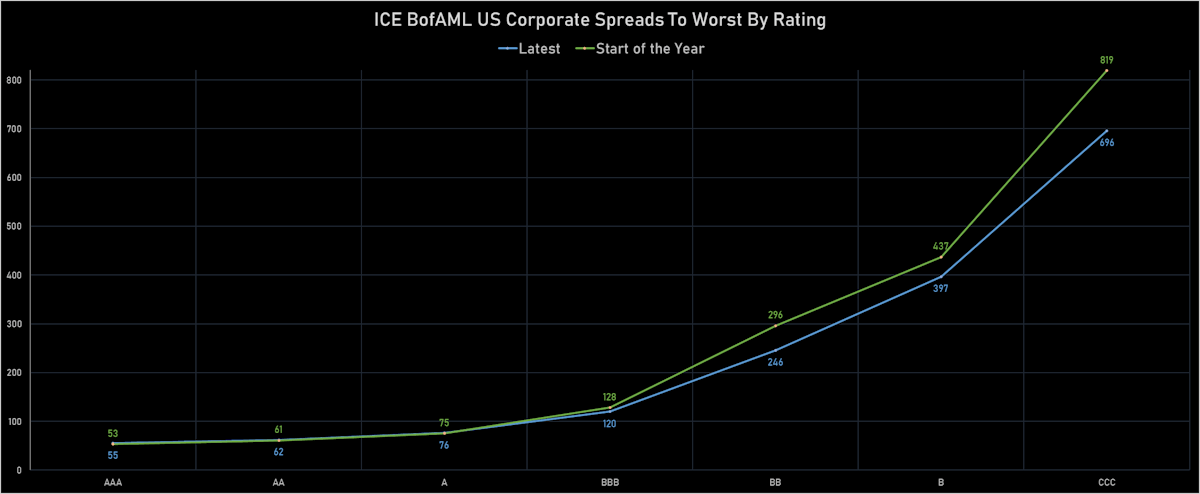

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 57 bp

- AA unchanged at 64 bp

- A unchanged at 80 bp

- BBB unchanged at 122 bp

- BB up by 2 bp at 229 bp

- B up by 6 bp at 373 bp

- CCC up by 7 bp at 680 bp

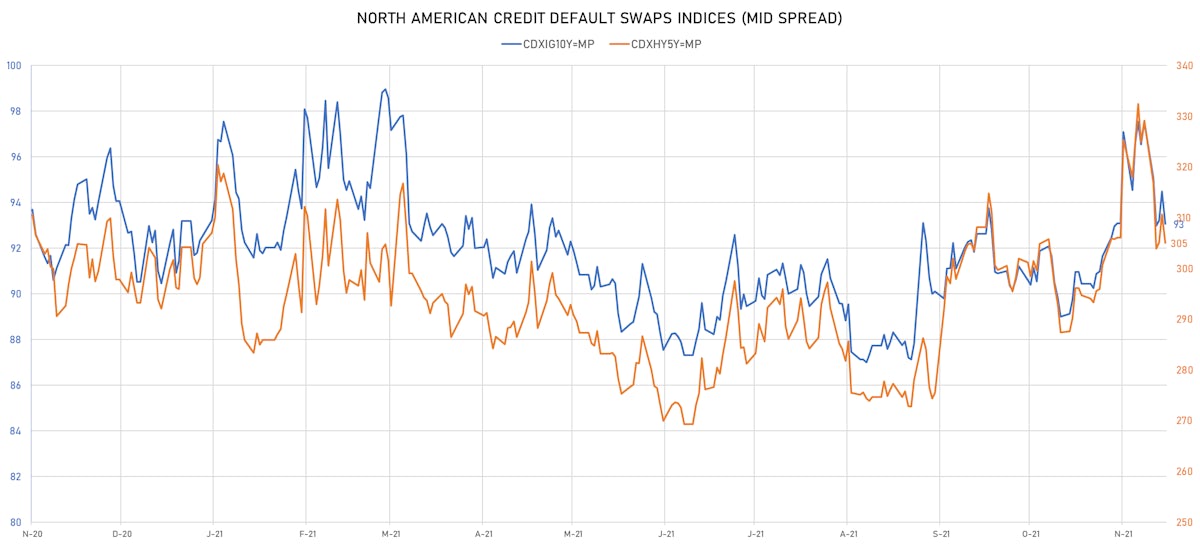

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.4 bp, now at 93bp (YTD change: +2.6bp)

- Markit CDX.NA.HY 5Y down 5.6 bp, now at 305bp (YTD change: +11.8bp)

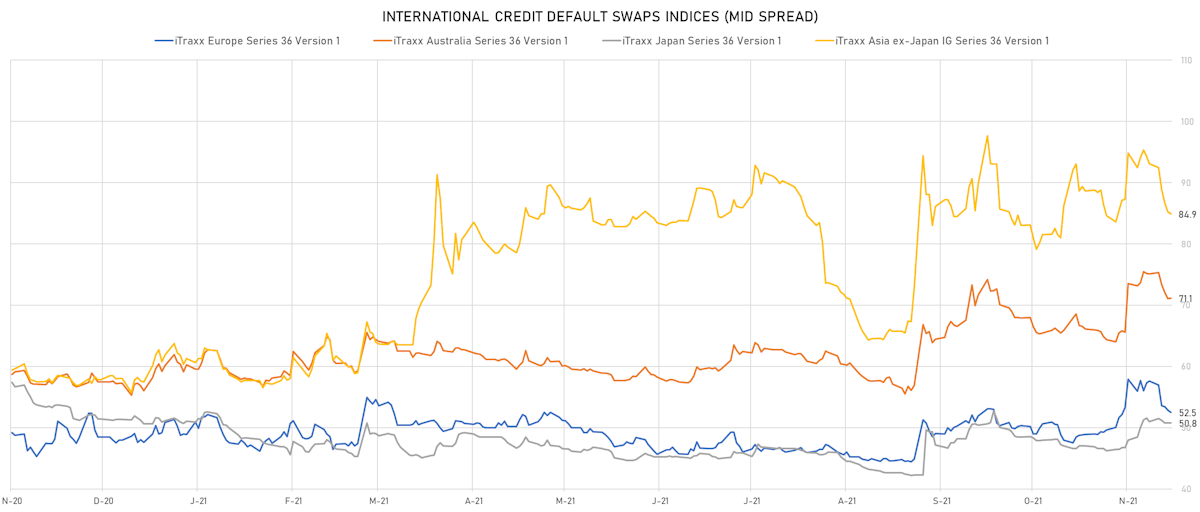

- Markit iTRAXX Europe down 0.3 bp, now at 53bp (YTD change: +4.5bp)

- Markit iTRAXX Japan unchanged at 51bp (YTD change: -0.6bp)

- Markit iTRAXX Asia Ex-Japan down 0.4 bp, now at 85bp (YTD change: +26.8bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Talen Energy Supply LLC (Country: US; rated: B3): down 987.9 bp to 4,179.2bp (1Y range: 875-5,047bp)

- Transocean Inc (Country: KY; rated: Caa3): down 382.4 bp to 2,111.6bp (1Y range: 941-3,274bp)

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): down 102.1 bp to 701.2bp (1Y range: 606-1,202bp)

- Turkiye Is Bankasi AS (Country: TR; rated: WD): down 50.7 bp to 628.5bp (1Y range: 482-738bp)

- NRG Energy Inc (Country: US; rated: Ba1): down 35.6 bp to 197.3bp (1Y range: 108-253bp)

- Turkey, Republic of (Government) (Country: TR; rated: BB): down 33.9 bp to 501.6bp (1Y range: 283-536bp)

- Akbank TAS (Country: TR; rated: Ba3): down 30.6 bp to 604.8bp (1Y range: 397-628bp)

- Bombardier Inc (Country: CA; rated: Caa1): down 30.0 bp to 432.8bp (1Y range: 395-1,912bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 29.2 bp to 487.9bp (1Y range: 291-572bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): down 26.9 bp to 440.8bp (1Y range: 299-726bp)

- Tegna Inc (Country: US; rated: Ba3): down 25.8 bp to 396.3bp (1Y range: 148-396bp)

- Louisiana-Pacific Corp (Country: US; rated: Ba1): down 25.3 bp to 116.2bp (1Y range: 93-173bp)

- Staples Inc (Country: US; rated: B2): down 23.0 bp to 1,171.3bp (1Y range: 652-1,171bp)

- Vale SA (Country: BR; rated: WR): down 22.1 bp to 180.2bp (1Y range: 126-209bp)

- Central Bank of Tunisia (Country: TN; rated: ): up 34.0 bp to 934.2bp (1Y range: 300-934bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 55.9 bp to 674.9bp (1Y range: 464-779bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 47.3 bp to 598.7bp (1Y range: 358-661bp)

- TUI AG (Country: DE; rated: B3-PD): down 45.6 bp to 761.9bp (1Y range: 607-946bp)

- Lagardere SA (Country: FR; rated: B): down 35.4 bp to 111.6bp (1Y range: 112-350bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 34.8 bp to 171.1bp (1Y range: 107-227bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 26.0 bp to 436.3bp (1Y range: 333-481bp)

- Novafives SAS (Country: FR; rated: Caa1): down 25.8 bp to 667.6bp (1Y range: 649-976bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): down 21.1 bp to 215.9bp (1Y range: 154-273bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 20.1 bp to 131.1bp (1Y range: -131bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 18.8 bp to 277.9bp (1Y range: 209-348bp)

- Stena AB (Country: SE; rated: B2-PD): down 17.1 bp to 420.5bp (1Y range: 401-728bp)

- Air France KLM SA (Country: FR; rated: B-): down 13.8 bp to 449.2bp (1Y range: 386-699bp)

- Leonardo SpA (Country: IT; rated: BBB-): down 13.5 bp to 162.8bp (1Y range: 125-228bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 13.4 bp to 544.2bp (1Y range: 471-694bp)

- Unibail-Rodamco-Westfield SE (Country: FR; rated: BBB-): down 12.5 bp to 125.0bp (1Y range: 46-125bp)

SELECTED RECENT USD BOND ISSUES

- JPMorgan Chase Bank NA (Banking | Columbus, United States | Rating: A+): US$206m Unsecured Note (XS1450785552) zero coupon maturing on 10 December 2026, non callable

- South Street Securities Funding LLC (Financial - Other | United States | Rating: NR): US$107m Senior Note (US84046SAF56), fixed rate (6.00% coupon) maturing on 15 December 2026, priced at 100.00, callable (5nc2)

SELECTED RECENT EUR BOND ISSUES

- Aktia Bank Abp (Banking | Helsinki, Etela-Suomen, Finland | Rating: A-): €150m Senior Note (XS2422536552) zero coupon maturing on 27 March 2025, non callable

- GEK TERNA Holdings Real Estate Construction SA (Home Builders | Athina, Attiki, Greece | Rating: NR): €300m Bond (GRC145121CD2) maturing on 14 December 2028, priced at 100.00, non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €150m Inhaberschuldverschreibung (DE000NWB2QF5), fixed rate (0.61% coupon) maturing on 14 December 2033, priced at 100.00, callable (12nc1)

- Societe d'Infrastructures Gazieres SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €403m Bond (FR00140075I6), fixed rate (1.91% coupon) maturing on 7 December 2033, priced at 100.00, non callable

- Societe Generale Securities Services SpA (Banking | Milan, France | Rating: NR): €125m Bond (IT0005472698), floating rate maturing on 10 December 2027, priced at 100.00, non callable

NEW ISSUES IN SECURITIZED CREDIT

- Freddie Mac Wi-K748 issued a fixed-rate Agency CMBS in 1 tranche, for a total of US$ 175 m. Highest-rated tranche offering a yield to maturity of 1.75%, and the lowest-rated tranche a yield to maturity of 1.75%. Bookrunners: Goldman Sachs & Co, Barclays Capital Group

- Bsprt 2021-Fl7 Issuer Ltd issued a floating-rate CLO in 6 tranches, for a total of US$ 722 m. Highest-rated tranche offering a spread over the floating rate of 132bp, and the lowest-rated tranche a spread of 340bp. Bookrunners: Barclays Capital Group, Wells Fargo Securities LLC