Credit

Good Day For US Credit As Lower Benchmark Yields Offset Modestly Wider HY Spreads

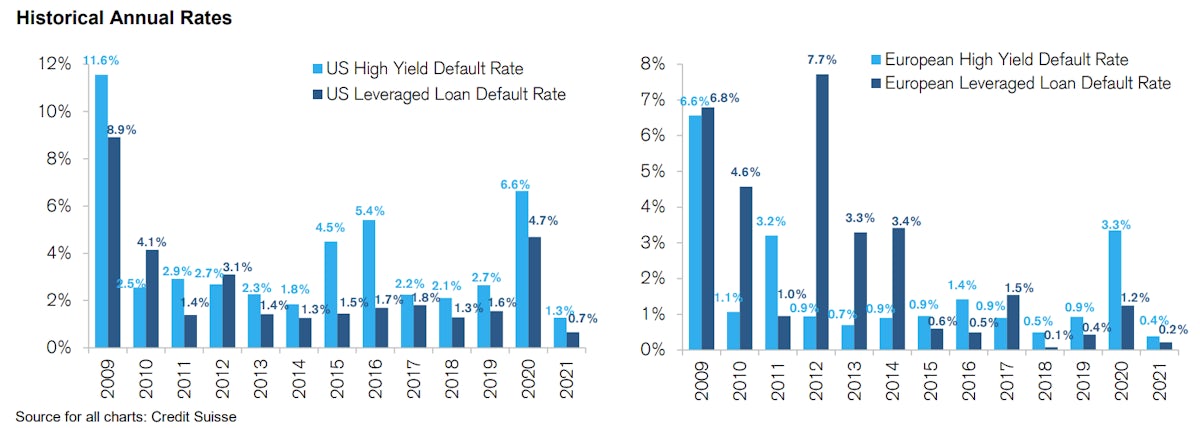

Looking at historical HY default rates, it's hard to see them going anywhere but up: as higher Fed Funds rates tend to bring higher default rates, we're likely to see a bear flattening of the HY credit spreads curve going forward

Published ET

US and European High Yield & Leveraged Loans Default Rates | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.46% today, with investment grade up 0.49% and high yield up 0.14% (YTD total return: -0.46%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.579% today (Month-to-date: 0.36%; Year-to-date: -1.14%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.022% today (Month-to-date: 1.19%; Year-to-date: 3.53%)

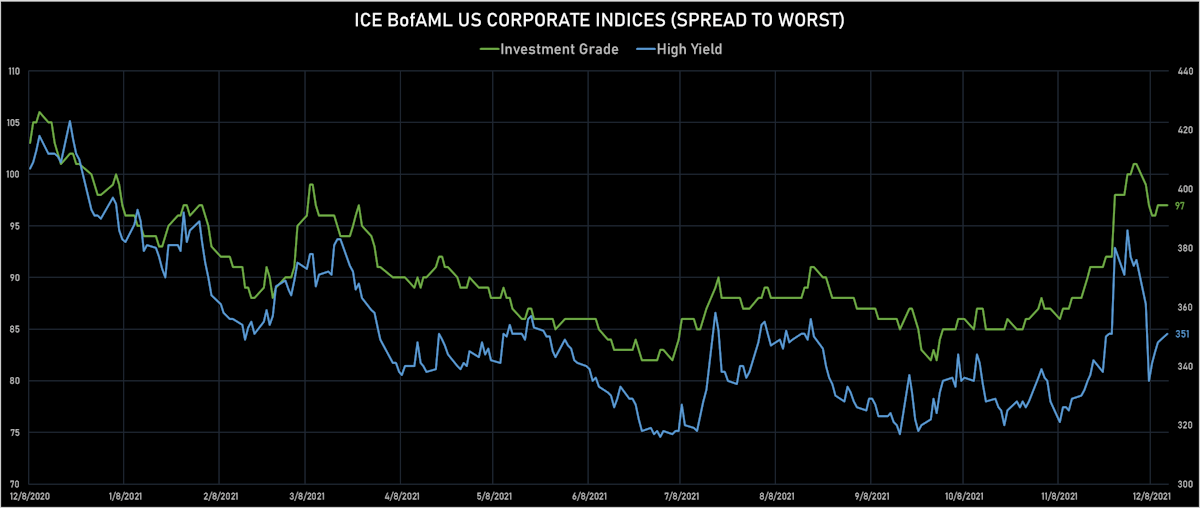

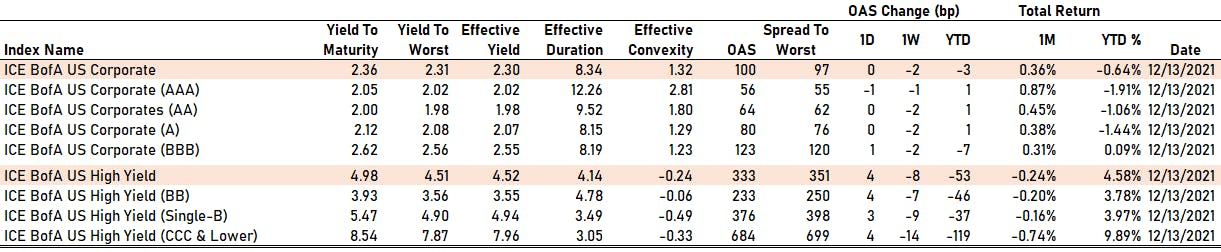

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 97.0 bp (YTD change: -1.0 bp)

- ICE BofA US High Yield Index spread to worst up 3.0 bp, now at 351.0 bp (YTD change: -39.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: +3.3%)

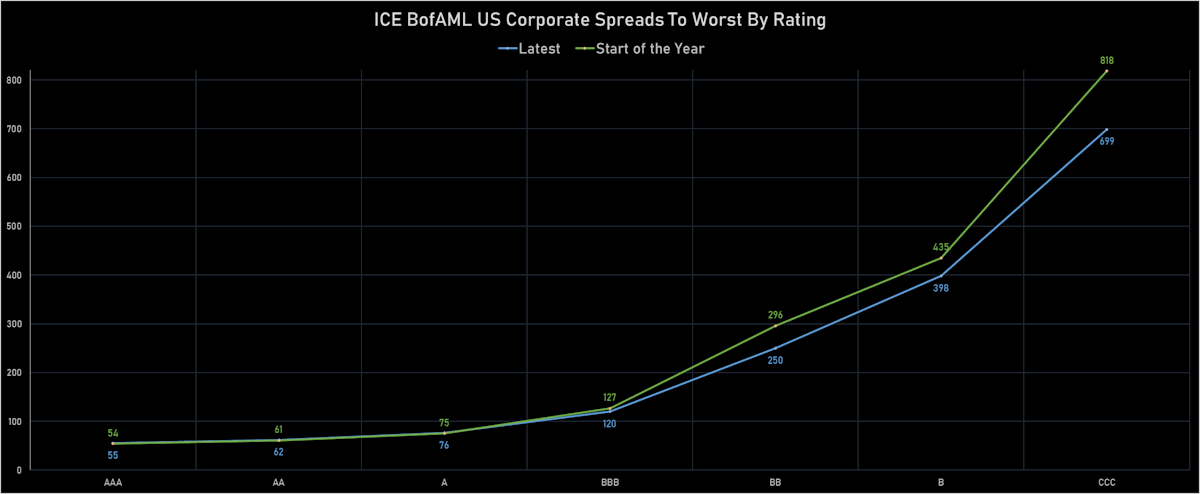

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 56 bp

- AA unchanged at 64 bp

- A unchanged at 80 bp

- BBB up by 1 bp at 123 bp

- BB up by 4 bp at 233 bp

- B up by 3 bp at 376 bp

- CCC up by 4 bp at 684 bp

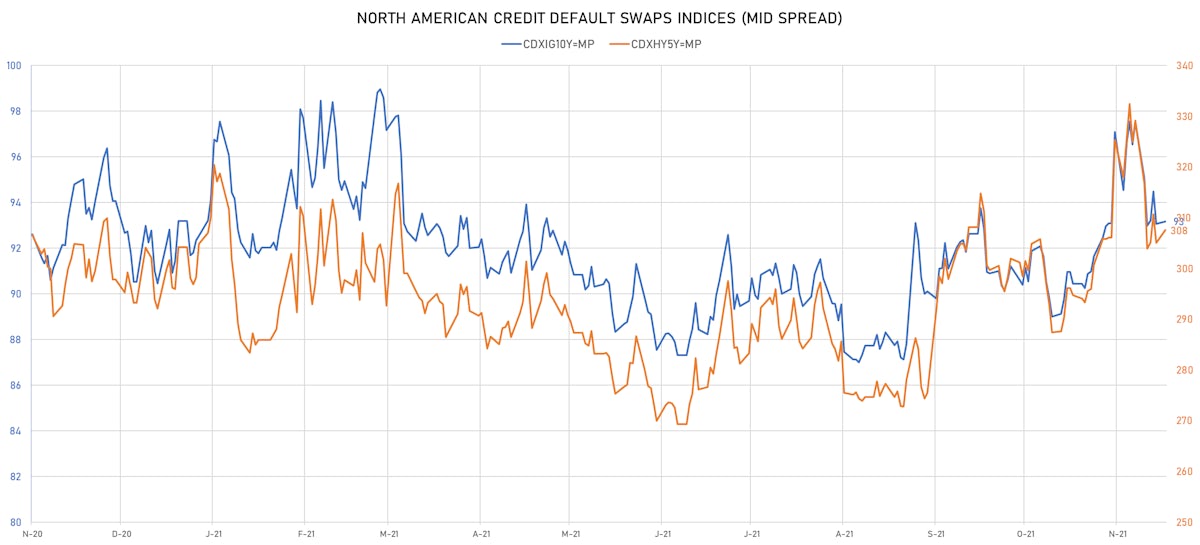

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.1 bp, now at 93bp (YTD change: +2.7bp)

- Markit CDX.NA.HY 5Y up 2.6 bp, now at 308bp (YTD change: +14.4bp)

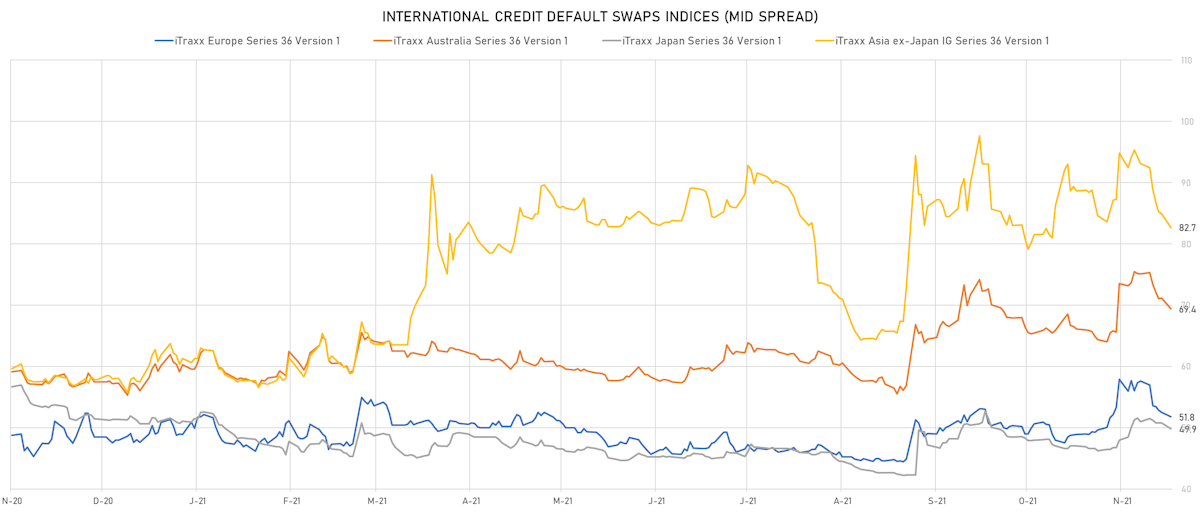

- Markit iTRAXX Europe down 0.7 bp, now at 52bp (YTD change: +3.8bp)

- Markit iTRAXX Japan down 0.9 bp, now at 50bp (YTD change: -1.5bp)

- Markit iTRAXX Asia Ex-Japan down 2.2 bp, now at 83bp (YTD change: +24.6bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Georgia Capital JSC (Tbilisi, Georgia) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: XS1778929478 | Z-spread up by 91.0 bp to 313.4 bp, with the yield to worst at 3.7% and the bond now trading down to 100.2 cents on the dollar (1Y price range: 98.4-104.2).

- Issuer: Turkiye Is Bankasi AS (Ankara, Turkey) | Coupon: 9.75% | Maturity: 15/7/2024 | Rating: B- | ISIN: XS1578203462 | Z-spread up by 65.5 bp to 1,153.8 bp, with the yield to worst at 12.0% and the bond now trading down to 94.0 cents on the dollar (1Y price range: 94.0-99.8).

- Issuer: Globo Comunicacoes e Participacoes SA (Rio de Janeiro, Brazil) | Coupon: 2.75% | Maturity: 10/12/2025 | Rating: BB+ | ISIN: USP47773AN93 | Z-spread up by 64.8 bp to 213.9 bp, with the yield to worst at 3.1% and the bond now trading down to 97.6 cents on the dollar (1Y price range: 96.8-100.3).

- Issuer: Banco Do Brasil SA (Cayman Islands Branch) (GEORGE TOWN, Cayman Islands) | Coupon: 4.00% | Maturity: 14/7/2027 | Rating: BB+ | ISIN: USP2000TAA36 | Z-spread up by 60.9 bp to 262.8 bp, with the yield to worst at 3.9% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 99.3-108.9).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 6.95% | Maturity: 30/10/2025 | Rating: B+ | ISIN: USU75111AK72 | Z-spread up by 54.0 bp to 628.0 bp, with the yield to worst at 7.1% and the bond now trading down to 98.6 cents on the dollar (1Y price range: 98.6-109.1).

- Issuer: VEON Holdings BV (Amsterdam, Netherlands) | Coupon: 5.88% | Maturity: 15/8/2023 | Rating: B- | ISIN: XS0889401724 | Z-spread down by 49.5 bp to 220.8 bp, with the yield to worst at 2.3% and the bond now trading up to 104.8 cents on the dollar (1Y price range: 104.0-108.6).

- Issuer: Jaguar Land Rover Automotive PLC (COVENTRY, United Kingdom) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | ISIN: USG5002FAM89 | Z-spread down by 55.0 bp to 195.9 bp, with the yield to worst at 3.2% and the bond now trading up to 102.8 cents on the dollar (1Y price range: 99.0-106.4).

- Issuer: sakartvelos rk'inigza ss (Tbilisi, Georgia) | Coupon: 4.50% | Maturity: 22/1/2030 | Rating: BB | ISIN: XS2340149439 | Z-spread down by 55.2 bp to 353.1 bp, with the yield to worst at 4.9% and the bond now trading up to 96.6 cents on the dollar (1Y price range: 92.4-104.9).

- Issuer: Bank razvitiya Respubliki Belarus' OAO (MINSK, Belarus) | Coupon: 4.95% | Maturity: 12/8/2024 | Rating: BB- | ISIN: XS1904731129 | Z-spread down by 80.5 bp to 470.8 bp, with the yield to worst at 5.3% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 88.3-102.0).

- Issuer: Power Best Global Investments Ltd (Road Town, British Virgin Islands) | Coupon: 5.88% | Maturity: 16/3/2023 | Rating: B | ISIN: XS2256858197 | Z-spread down by 84.1 bp to 408.7 bp, with the yield to worst at 4.4% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 100.0-105.4).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 8.50% | Maturity: 23/4/2026 | Rating: B+ | ISIN: USN78840AL45 | Z-spread down by 86.0 bp to 621.1 bp, with the yield to worst at 7.2% and the bond now trading up to 103.6 cents on the dollar (1Y price range: 100.3-115.1).

- Issuer: Rakuten Group Inc (Setagaya, Japan) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: XS2080765154 | Z-spread down by 110.6 bp to 809.8 bp, with the yield to worst at 8.9% and the bond now trading up to 99.1 cents on the dollar (1Y price range: 93.5-102.4).

- Issuer: Growthpoint Properties International (Pty) Ltd (Johannesburg, South Africa) | Coupon: 4.88% | Maturity: 18/1/2024 | Rating: BB- | ISIN: XS1734198051 | Z-spread down by 113.0 bp to 191.6 bp (CDS basis: 6.8bp), with the yield to worst at 2.3% and the bond now trading up to 104.3 cents on the dollar (1Y price range: 101.0-105.6).

- Issuer: Saka Energi Indonesia PT (Jakarta Selatan, Indonesia) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: USY7140VAA80 | Z-spread down by 158.7 bp to 1,062.7 bp, with the yield to worst at 10.9% and the bond now trading up to 88.0 cents on the dollar (1Y price range: 66.0-105.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: MAS Securities BV (S-Gravenhage, Netherlands) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: BB | ISIN: XS1419869885 | Z-spread down by 19.6 bp to 245.6 bp (CDS basis: -36.4bp), with the yield to worst at 2.1% and the bond now trading up to 105.6 cents on the dollar (1Y price range: 102.9-111.3).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: BB | ISIN: XS1846631049 | Z-spread down by 20.4 bp to 237.6 bp (CDS basis: -59.1bp), with the yield to worst at 2.0% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 100.4-107.2).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | Z-spread down by 21.0 bp to 379.7 bp (CDS basis: -47.6bp), with the yield to worst at 3.3% and the bond now trading up to 103.3 cents on the dollar (1Y price range: 93.9-106.4).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 2.75% | Maturity: 15/4/2025 | Rating: BB | ISIN: XS1982819994 | Z-spread down by 21.5 bp to 209.7 bp (CDS basis: -69.3bp), with the yield to worst at 1.7% and the bond now trading up to 102.6 cents on the dollar (1Y price range: 101.1-106.2).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread down by 21.6 bp to 375.8 bp, with the yield to worst at 3.5% and the bond now trading up to 91.7 cents on the dollar (1Y price range: 90.1-95.4).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread down by 22.7 bp to 346.3 bp (CDS basis: -49.2bp), with the yield to worst at 3.3% and the bond now trading up to 102.0 cents on the dollar (1Y price range: 97.3-105.6).

- Issuer: Transportes Aereos Portugueses SA (Lisbon, Portugal) | Coupon: 2.63% | Maturity: 7/1/2025 | Rating: BB- | ISIN: XS1711584430 | Z-spread down by 23.3 bp to 282.5 bp (CDS basis: 29.5bp), with the yield to worst at 2.4% and the bond now trading up to 100.2 cents on the dollar (1Y price range: 98.9-104.4).

- Issuer: Cellnex Finance Company SA (Madrid, Spain) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: BB | ISIN: XS0161100515 | Z-spread down by 23.5 bp to 375.7 bp (CDS basis: -53.7bp), with the yield to worst at 3.7% and the bond now trading up to 134.6 cents on the dollar (1Y price range: 129.4-149.5).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.00% | Maturity: 14/7/2024 | Rating: BB- | ISIN: XS2363244513 | Z-spread down by 24.1 bp to 249.4 bp (CDS basis: -40.2bp), with the yield to worst at 2.1% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 96.9-102.2).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: BB | ISIN: XS1497606365 | Z-spread down by 25.1 bp to 235.2 bp (CDS basis: -58.9bp), with the yield to worst at 2.1% and the bond now trading up to 103.0 cents on the dollar (1Y price range: 101.4-108.0).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 19/1/2024 | Rating: BB | ISIN: XS1347748607 | Z-spread down by 26.7 bp to 195.9 bp (CDS basis: -83.0bp), with the yield to worst at 1.6% and the bond now trading up to 104.1 cents on the dollar (1Y price range: 103.3-107.8).

- Issuer: Arcelik AS (Turkey) | Coupon: 3.00% | Maturity: 29/5/2026 | Rating: BB- | ISIN: XS2265369657 | Z-spread down by 30.1 bp to 299.6 bp (CDS basis: -44.9bp), with the yield to worst at 2.7% and the bond now trading up to 100.6 cents on the dollar (1Y price range: 95.7-103.3).

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: BB- | ISIN: XS1824424706 | Z-spread down by 41.7 bp to 501.9 bp (CDS basis: -141.9bp), with the yield to worst at 4.9% and the bond now trading up to 98.7 cents on the dollar (1Y price range: 94.6-102.0).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 5.50% | Maturity: 24/2/2025 | Rating: BB- | ISIN: XS0213101073 | Z-spread down by 43.8 bp to 294.4 bp (CDS basis: -60.0bp), with the yield to worst at 2.5% and the bond now trading up to 108.5 cents on the dollar (1Y price range: 104.9-110.4).

- Issuer: PPF Telecom Group BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: BB- | ISIN: XS1057659838 | Z-spread down by 46.7 bp to 395.0 bp (CDS basis: -114.5bp), with the yield to worst at 3.6% and the bond now trading up to 99.9 cents on the dollar (1Y price range: 95.9-103.3).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: BB- | ISIN: XS1568888777 | Z-spread down by 47.4 bp to 489.0 bp (CDS basis: -151.9bp), with the yield to worst at 4.7% and the bond now trading up to 100.4 cents on the dollar (1Y price range: 95.7-103.3).

- Issuer: Autostrade per l'Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 24/11/2025 | Rating: BB- | ISIN: XS1824425182 | Z-spread down by 49.9 bp to 345.7 bp (CDS basis: -80.8bp), with the yield to worst at 3.1% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 92.5-102.1).

- Issuer: Cellnex Telecom SA (Barcelona, Spain) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Z-spread down by 51.0 bp to 433.5 bp (CDS basis: -117.8bp), with the yield to worst at 4.1% and the bond now trading up to 93.1 cents on the dollar (1Y price range: 89.3-95.4).

SELECTED RECENT USD BOND ISSUES

- Iron Mountain Information Management Services Inc (Financial - Other | Boston, United States | Rating: NR): US$750m Senior Note (US46285MAA80), fixed rate (5.00% coupon) maturing on 15 July 2032, priced at 100.00 (original spread of 357 bp), callable (11nc6)

- Post Holdings Inc (Food Processors | St. Louis, United States | Rating: B+): US$500m Senior Note (USU7318UAU61), fixed rate (5.50% coupon) maturing on 15 December 2029, priced at 103.50 (original spread of 386 bp), callable (8nc3)

- BOCI Financial Products Ltd (Financial - Other | China (Mainland) | Rating: NR): US$121m Unsecured Note (XS2420118056) zero coupon maturing on 14 May 2025, priced at 100.27, non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): US$130m Unsecured Note (XS2423023469), floating rate maturing on 15 January 2030, priced at 100.00, non callable

- CDBL Funding 2 (Financial - Other | George Town, Grand Cayman, China (Mainland) | Rating: NR): US$500m Unsecured Note (XS2423459242) zero coupon maturing on 17 January 2025, non callable

- CDBL Funding 2 (Financial - Other | George Town, Grand Cayman, China (Mainland) | Rating: NR): US$500m Unsecured Note (XS2423459325) zero coupon maturing on 17 January 2027, non callable

- China Construction Bank Corp (Macau Branch) (Banking | China (Mainland) | Rating: NR): US$500m Senior Note (XS2422720305), floating rate (SOFR + 50.0 bp) maturing on 21 December 2024, priced at 100.00, non callable

- Palladium Global Investments SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): US$1,000m Unsecured Note (XS2423737746) zero coupon maturing on 15 December 2026, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- European Bank for Reconstruction and Development (Supranational | London, United Kingdom | Rating: AAA): €153m Unsecured Note (XS2423389365) zero coupon maturing on 14 January 2030, priced at 100.00, non callable

NEW ISSUES IN SECURITIZED CREDIT

- Woodmont 2021-8 issued a floating-rate CLO in 6 tranches, for a total of US$ 528 m. Bookrunners: Wells Fargo Securities LLC