Credit

Higher Rates, Wider Spreads Take Corporate Bonds Lower Ahead Of Crucial FOMC

US equities have done better than high yield credit this year on a risk-adjusted basis, with the recent rise in front-end rates hurting HY much more than stocks

Published ET

S&P 500 Index vs IBOXX USD Liquid HY Index | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.26% today, with investment grade down -0.27% and high yield down -0.14% (YTD total return: -0.71%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.355% today (Month-to-date: 0.00%; Year-to-date: -1.49%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.148% today (Month-to-date: 1.04%; Year-to-date: 3.37%)

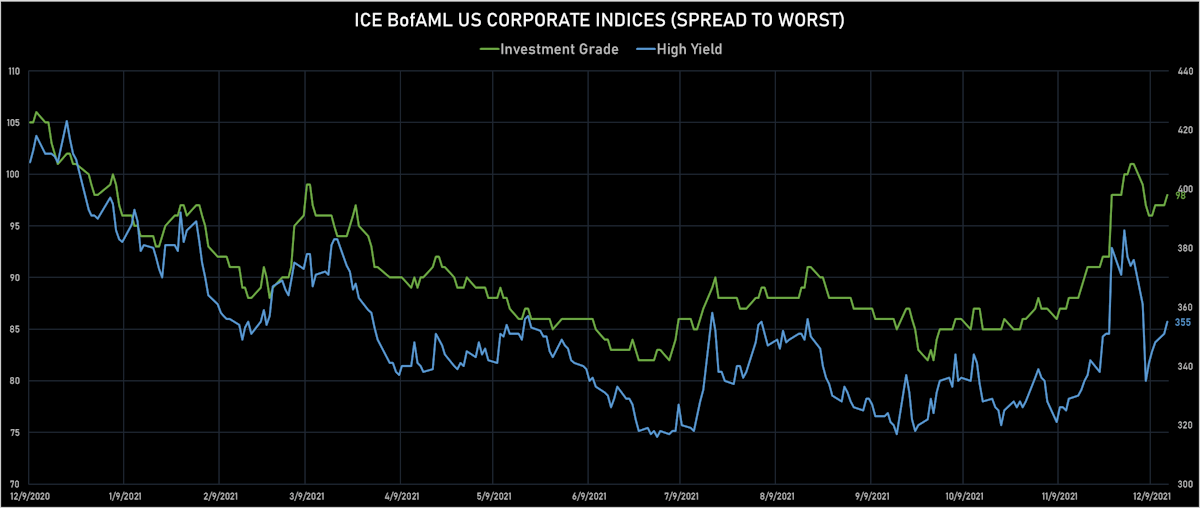

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 98.0 bp (YTD change: .0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 355.0 bp (YTD change: -35.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down 0.00% today (YTD total return: +3.3%)

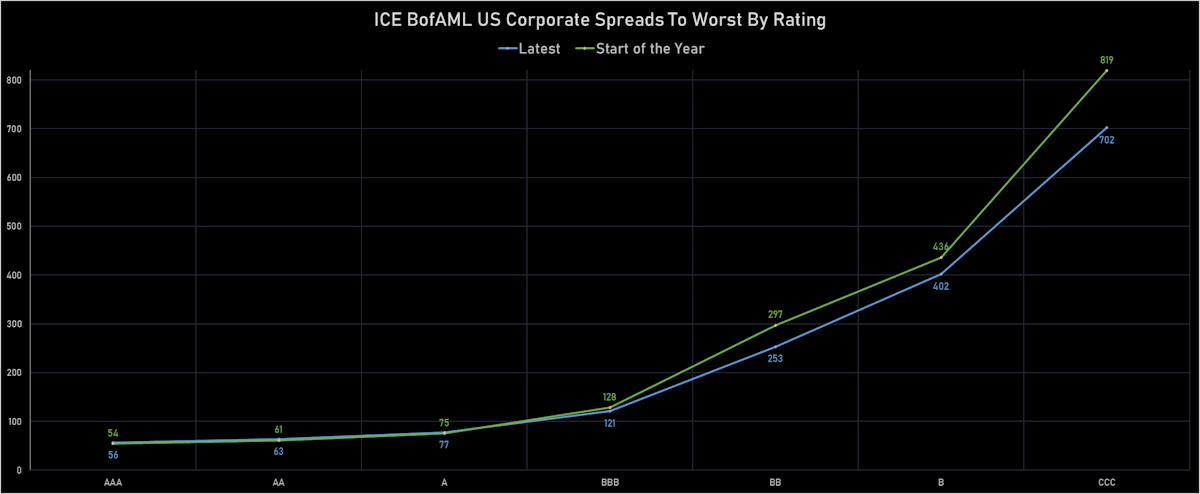

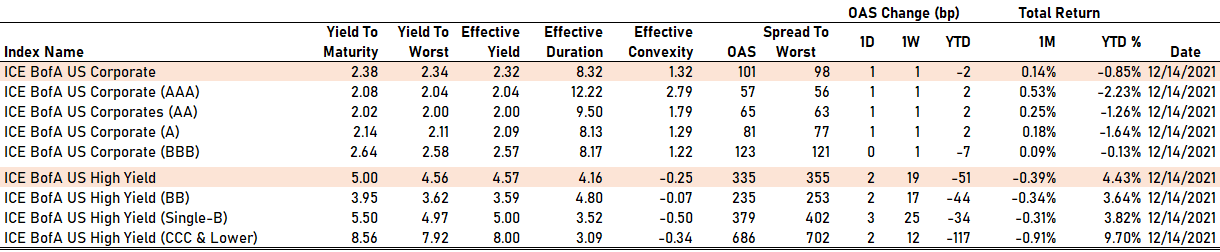

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 57 bp

- AA up by 1 bp at 65 bp

- A up by 1 bp at 81 bp

- BBB unchanged at 123 bp

- BB up by 2 bp at 235 bp

- B up by 3 bp at 379 bp

- CCC up by 2 bp at 686 bp

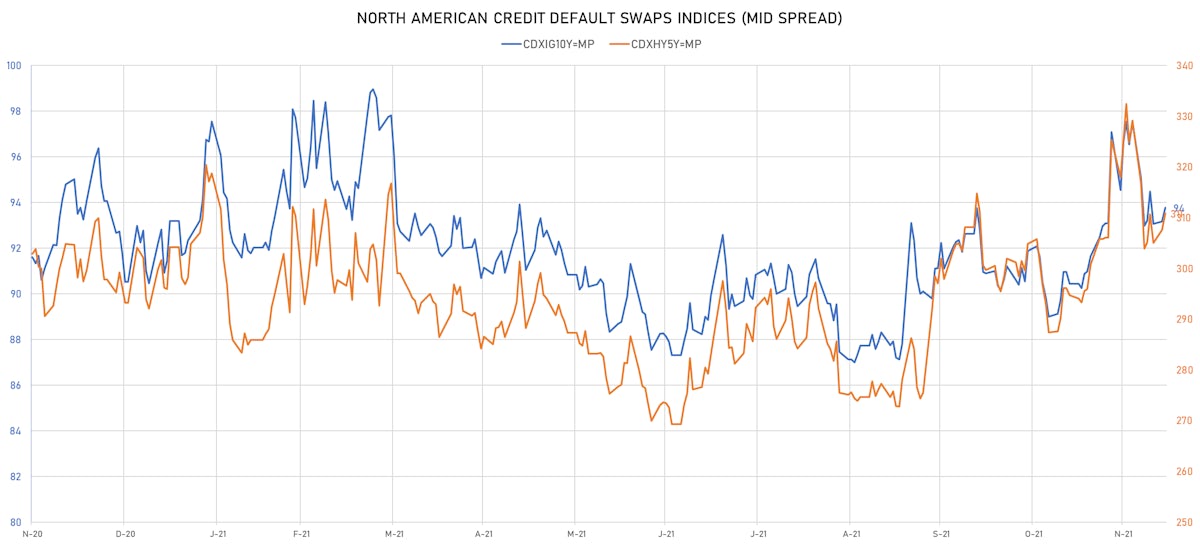

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.6 bp, now at 94bp (YTD change: +3.3bp)

- Markit CDX.NA.HY 5Y up 3.2 bp, now at 311bp (YTD change: +17.6bp)

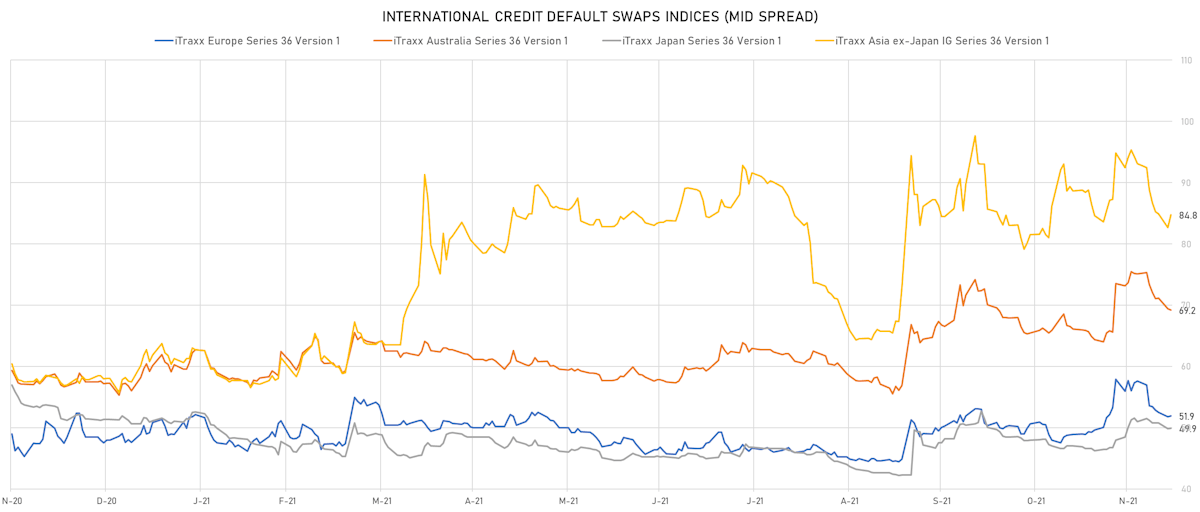

- Markit iTRAXX Europe up 0.2 bp, now at 52bp (YTD change: +4.0bp)

- Markit iTRAXX Japan up 0.0 bp, now at 50bp (YTD change: -1.4bp)

- Markit iTRAXX Asia Ex-Japan up 2.1 bp, now at 85bp (YTD change: +26.7bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): down 122.6 bp to 649.1bp (1Y range: 606-1,202bp)

- Talen Energy Supply LLC (Country: US; rated: B3): down 116.8 bp to 4,625.4bp (1Y range: 875-5,047bp)

- Tegna Inc (Country: US; rated: Ba3): down 15.7 bp to 390.1bp (1Y range: 148-390bp)

- Kohls Corp (Country: US; rated: Baa2): up 15.5 bp to 158.3bp (1Y range: 101-168bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 16.0 bp to 502.6bp (1Y range: 291-572bp)

- CSC Holdings LLC (Country: US; rated: LGD3 - 30%): up 18.3 bp to 379.2bp (1Y range: -379bp)

- Macy's Inc (Country: US; rated: Ba2): up 19.6 bp to 233.6bp (1Y range: 181-651bp)

- Staples Inc (Country: US; rated: B2): up 19.7 bp to 1,184.0bp (1Y range: 652-1,184bp)

- Gap Inc (Country: US; rated: WR): up 20.9 bp to 233.3bp (1Y range: 132-237bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): up 25.6 bp to 487.3bp (1Y range: 363-495bp)

- Nordstrom Inc (Country: US; rated: Ba1): up 27.1 bp to 337.7bp (1Y range: 211-338bp)

- Rite Aid Corp (Country: US; rated: B3): up 32.5 bp to 1,084.3bp (1Y range: 497-1,084bp)

- Turkey, Republic of (Government) (Country: TR; rated: BB): up 40.9 bp to 525.0bp (1Y range: 283-536bp)

- American Airlines Group Inc (Country: US; rated: B2): up 62.0 bp to 816.3bp (1Y range: 596-1,340bp)

- Transocean Inc (Country: KY; rated: Caa3): up 127.9 bp to 2,279.9bp (1Y range: 941-3,154bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 57.2 bp to 633.3bp (1Y range: 464-779bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 32.6 bp to 413.7bp (1Y range: 333-481bp)

- Lagardere SA (Country: FR; rated: B): down 26.2 bp to 115.3bp (1Y range: 115-350bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 8.7 bp to 171.8bp (1Y range: 107-227bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): down 8.1 bp to 211.3bp (1Y range: 154-273bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 7.1 bp to 165.5bp (1Y range: 164-267bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 6.6 bp to 592.2bp (1Y range: 358-661bp)

- Stena AB (Country: SE; rated: B2-PD): down 6.6 bp to 416.3bp (1Y range: 401-728bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): down 5.8 bp to 244.0bp (1Y range: 145-272bp)

- ArcelorMittal SA (Country: LU; rated: F3): down 5.7 bp to 133.3bp (1Y range: 119-159bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): down 5.4 bp to 186.2bp (1Y range: 186-320bp)

- Novafives SAS (Country: FR; rated: Caa1): up 8.8 bp to 663.0bp (1Y range: 649-976bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 13.5 bp to 292.8bp (1Y range: 209-348bp)

- TUI AG (Country: DE; rated: B3-PD): up 16.9 bp to 779.2bp (1Y range: 607-946bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 31.1 bp to 1,360.0bp (1Y range: 538-1,564bp)

SELECTED RECENT USD BOND ISSUES

- Arches Buyer Inc (Financial - Other | United States | Rating: NR): US$250m Note (USU04010AD32), fixed rate (4.25% coupon) maturing on 1 June 2028, priced at 98.51 (original spread of 318 bp), callable (6nc2)

- Fair Isaac Corp (Service - Other | Bozeman, United States | Rating: BB+): US$550m Senior Note (USU2947RAC35), fixed rate (4.00% coupon) maturing on 15 June 2028, priced at 99.75 (original spread of 268 bp), callable (6nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133ENHV56), fixed rate (1.39% coupon) maturing on 22 June 2026, priced at 100.00 (original spread of 18 bp), callable (5nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$575m Bond (US3133ENHR45), fixed rate (0.68% coupon) maturing on 20 December 2023, priced at 100.00 (original spread of 5 bp), non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$105m Bond (US3130AQD429), fixed rate (0.92% coupon) maturing on 28 June 2024, priced at 100.00 (original spread of -5 bp), callable (3nc3m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$130m Bond (US3130AQD262), fixed rate (0.72% coupon) maturing on 29 December 2023, priced at 100.00 (original spread of 66 bp), callable (2nc3m)

- Global Blood Therapeutics Inc (Health Care Facilities | South San Francisco, United States | Rating: NR): US$250m Bond (US37890UAA60), fixed rate (1.38% coupon) maturing on 15 December 2028, priced at 100.00, non callable, convertible

- Luminar Technologies Inc (Industrials - Other | Orlando, United States | Rating: NR): US$500m Bond (US550424AA34), fixed rate (0.75% coupon) maturing on 15 December 2026, priced at 100.00, non callable, convertible

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): US$130m Unsecured Note (XS2423023469), floating rate maturing on 15 January 2030, priced at 100.00, non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): US$430m Unsecured Note (XS2424371958), fixed rate (1.00% coupon) maturing on 15 January 2030, priced at 100.00, non callable

- CALC Bonds Ltd (Financial - Other | Hong Kong, China (Mainland) | Rating: NR): US$300m Unsecured Note (XS2396615481) maturing on 25 October 2024, priced at 100.00, non callable

- CDBL Funding 2 (Financial - Other | George Town, Grand Cayman, China (Mainland) | Rating: NR): US$500m Unsecured Note (XS2423459325) zero coupon maturing on 17 January 2027, non callable

- CDBL Funding 2 (Financial - Other | George Town, Grand Cayman, China (Mainland) | Rating: NR): US$500m Unsecured Note (XS2423459242) zero coupon maturing on 17 January 2025, non callable

- Cooperatieve Rabobank UA (Banking | Utrecht, Netherlands | Rating: A+): US$1,250m Unsecured Note (XS2422531918), fixed rate (1.98% coupon) maturing on 15 December 2027, priced at 100.00, non callable

- Korea Land & Housing Corp (Agency | Jinju, South Korea | Rating: AA-): US$130m Unsecured Note (XS2423922561), fixed rate (1.00% coupon) maturing on 20 December 2023, priced at 100.00 (original spread of 36 bp), non callable

- Korea Land & Housing Corp (Agency | Jinju, South Korea | Rating: AA-): US$130m Unsecured Note (XS2424367683), fixed rate (1.00% coupon) maturing on 20 December 2023, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- British Columbia, Province of (Official and Muni | Victoria, Canada | Rating: AA+): €135m Unsecured Note (XS2424374465), fixed rate (0.59% coupon) maturing on 22 December 2042, priced at 100.00, non callable

- Ferrovie dello Stato Italiane SpA (Agency | Rome, Italy | Rating: BBB-): €350m Unsecured Note (XS2422926001), floating rate maturing on 23 December 2038, priced at 100.00, non callable

NEW LOANS

- Unitil Corp (BBB+), signed a US$ 1,200m Term Loan B, to be used for general corporate purposes. It matures on 12/15/28 and initial pricing is set at LIBOR +400bp