Credit

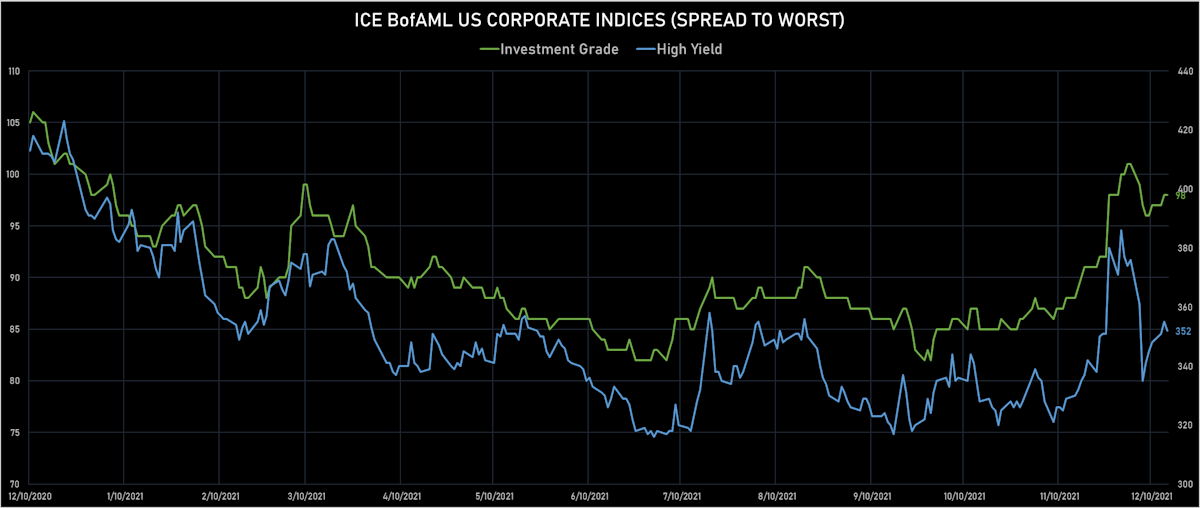

High Yield Spreads Tighten As Risk-On Sentiment Returns Once FOMC Out Of The Way

Very little happening this week in the primary bond market, with only a handful of US$ deals pricing, including Skillz' $300m high yield senior note (10.25% coupon, priced below par)

Published ET

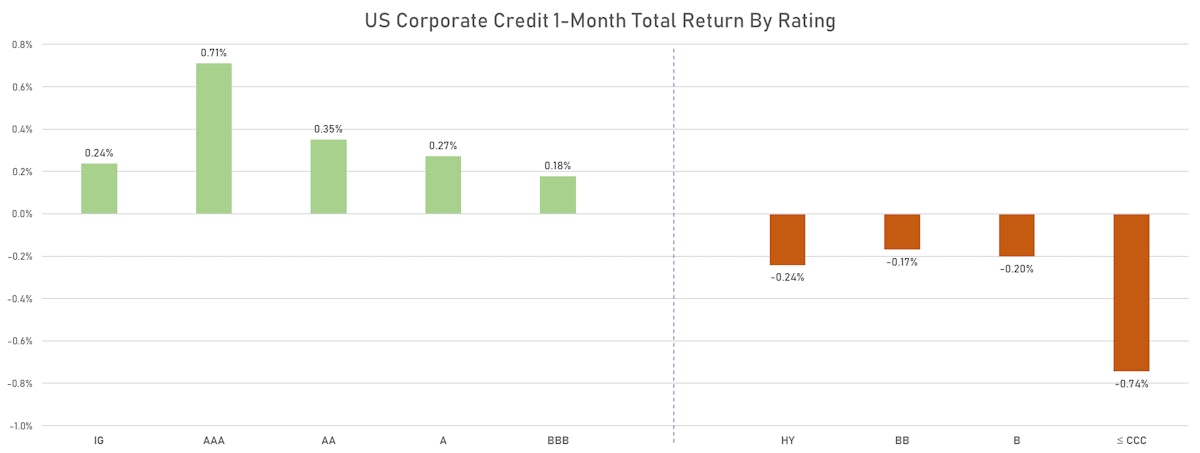

1-Month Total Returns For ICE BofA US Cash Indices | Sources: ϕpost, FactSet data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.32% today, with investment grade down -0.33% and high yield down -0.16% (YTD total return: -1.03%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.308% today (Month-to-date: -0.31%; Year-to-date: -1.79%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.068% today (Month-to-date: 1.11%; Year-to-date: 3.44%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 98.0 bp (YTD change: .0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 352.0 bp (YTD change: -38.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.04% today (YTD total return: +3.2%)

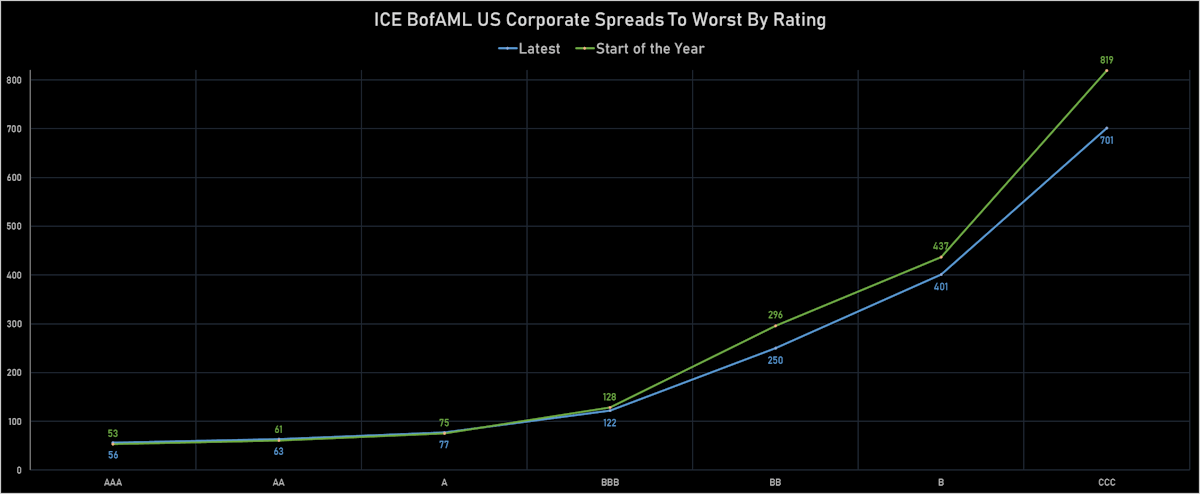

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 58 bp

- AA unchanged at 65 bp

- A unchanged at 81 bp

- BBB up by 1 bp at 124 bp

- BB down by -2 bp at 233 bp

- B down by -2 bp at 377 bp

- CCC down by -1 bp at 685 bp

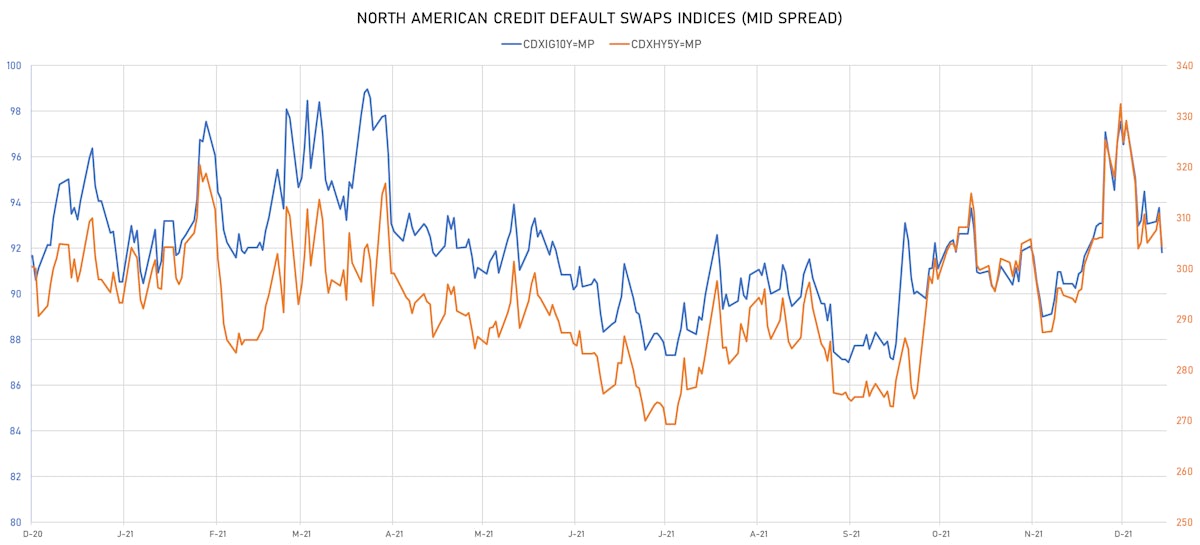

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.0 bp, now at 92bp (YTD change: +bp)

- Markit CDX.NA.HY 5Y down 6.4 bp, now at 304bp (YTD change: +bp)

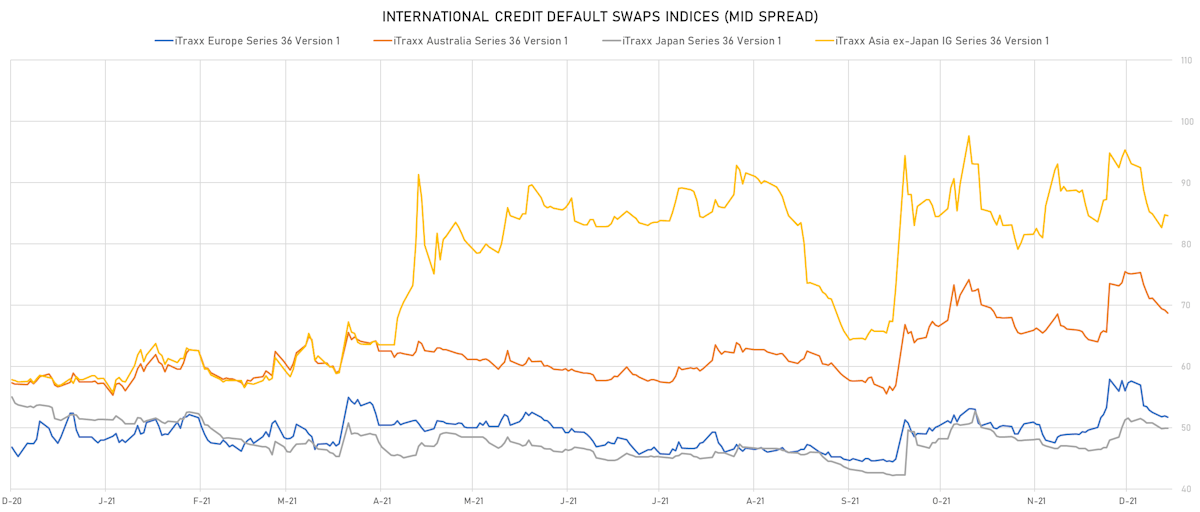

- Markit iTRAXX Europe down 0.2 bp, now at 52bp (YTD change: +3.7bp)

- Markit iTRAXX Japan up 0.0 bp, now at 50bp (YTD change: -1.4bp)

- Markit iTRAXX Asia Ex-Japan down 0.2 bp, now at 85bp (YTD change: +26.6bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Ulker Biskuvi Sanayi AS (Istanbul, Turkey) | Coupon: 6.95% | Maturity: 30/10/2025 | Rating: B+ | ISIN: XS2241387500 | Z-spread up by 73.9 bp to 679.1 bp, with the yield to worst at 7.6% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 96.9-109.1).

- Issuer: Banco Continental SAECA (Asuncion, Paraguay) | Coupon: 2.75% | Maturity: 10/12/2025 | Rating: BB+ | ISIN: USP09110AB65 | Z-spread up by 71.1 bp to 216.2 bp, with the yield to worst at 3.2% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 96.8-100.3).

- Issuer: Shangrao City Construction Investment Development Group Co Ltd (Shangrao, China (Mainland)) | Coupon: 4.38% | Maturity: 21/10/2023 | Rating: BB+ | ISIN: XS2232375928 | Z-spread up by 62.7 bp to 318.1 bp, with the yield to worst at 3.5% and the bond now trading down to 100.8 cents on the dollar (1Y price range: 100.0-102.3).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread up by 62.2 bp to 1,164.2 bp, with the yield to worst at 11.8% and the bond now trading down to 86.0 cents on the dollar (1Y price range: 66.0-105.8).

- Issuer: Rail Capital Markets PLC (London, United Kingdom) | Coupon: 8.25% | Maturity: 9/7/2024 | Rating: B | ISIN: XS1843433472 | Z-spread up by 59.3 bp to 829.9 bp, with the yield to worst at 8.7% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 97.0-107.0).

- Issuer: Grupo de Inversiones Suramericana SA (Medellin, Colombia) | Coupon: 5.50% | Maturity: 29/4/2026 | Rating: BB+ | ISIN: USG42036AB25 | Z-spread up by 55.8 bp to 257.4 bp, with the yield to worst at 3.6% and the bond now trading down to 106.3 cents on the dollar (1Y price range: 105.9-114.6).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 51.7 bp to 588.8 bp (CDS basis: 173.5bp), with the yield to worst at 6.8% and the bond now trading down to 91.0 cents on the dollar (1Y price range: 71.0-94.8).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 46.7 bp to 923.8 bp, with the yield to worst at 10.0% and the bond now trading down to 90.0 cents on the dollar (1Y price range: 89.4-105.9).

- Issuer: Akbank TAS (Turkey) | Coupon: 6.80% | Maturity: 6/2/2026 | Rating: B | ISIN: XS2131335270 | Z-spread up by 46.1 bp to 602.3 bp (CDS basis: -2.8bp), with the yield to worst at 6.8% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 98.1-108.6).

- Issuer: Metinvest BV (S-GRAVENHAGE, Netherlands) | Coupon: 8.50% | Maturity: 23/4/2026 | Rating: B+ | ISIN: XS1806400708 | Z-spread down by 49.5 bp to 609.1 bp, with the yield to worst at 7.1% and the bond now trading up to 104.0 cents on the dollar (1Y price range: 100.3-115.1).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 74.7 bp to 241.8 bp, with the yield to worst at 3.0% and the bond now trading up to 101.7 cents on the dollar (1Y price range: 98.4-104.2).

- Issuer: Wanda Properties International Co Ltd (#N/A, British Virgin Islands) | Coupon: 7.25% | Maturity: 29/1/2024 | Rating: BB- | ISIN: XS1023280271 | Z-spread down by 157.1 bp to 975.2 bp, with the yield to worst at 9.9% and the bond now trading up to 94.1 cents on the dollar (1Y price range: 79.5-103.0).

- Issuer: CALC Bond 3 Ltd (British Virgin Islands) | Coupon: 5.50% | Maturity: 8/3/2024 | Rating: BB | ISIN: XS1574821143 | Z-spread down by 165.3 bp to 772.9 bp, with the yield to worst at 8.0% and the bond now trading up to 94.0 cents on the dollar (1Y price range: 79.0-95.3).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 16/5/2027 | Rating: BB- | ISIN: XS2408458730 | Z-spread up by 26.2 bp to 346.6 bp (CDS basis: -48.9bp), with the yield to worst at 3.2% and the bond now trading down to 97.6 cents on the dollar (1Y price range: 94.5-100.2).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 25.3 bp to 370.2 bp, with the yield to worst at 3.3% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 95.9-101.3).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB- | ISIN: XS2010029663 | Z-spread up by 25.2 bp to 782.5 bp, with the yield to worst at 7.5% and the bond now trading down to 86.6 cents on the dollar (1Y price range: 81.0-105.4).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: BB- | ISIN: XS2283225477 | Z-spread up by 19.1 bp to 527.2 bp, with the yield to worst at 5.1% and the bond now trading down to 82.7 cents on the dollar (1Y price range: 75.0-98.9).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 17.7 bp to 538.4 bp, with the yield to worst at 5.2% and the bond now trading down to 94.8 cents on the dollar (1Y price range: 92.6-102.1).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: BB | ISIN: XS2288109676 | Z-spread up by 15.2 bp to 279.3 bp (CDS basis: 11.3bp), with the yield to worst at 2.7% and the bond now trading down to 92.8 cents on the dollar (1Y price range: 90.5-100.1).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 3.10% | Maturity: 21/1/2026 | Rating: BB | ISIN: XS2281299763 | Z-spread up by 13.8 bp to 441.8 bp, with the yield to worst at 4.1% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 95.5-100.3).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: BB- | ISIN: XS1713464524 | Z-spread up by 13.1 bp to 532.2 bp, with the yield to worst at 5.0% and the bond now trading down to 91.7 cents on the dollar (1Y price range: 84.6-105.6).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread down by 17.1 bp to 413.9 bp, with the yield to worst at 3.8% and the bond now trading up to 95.5 cents on the dollar (1Y price range: 95.2-99.4).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.13% | Maturity: 19/9/2025 | Rating: BB- | ISIN: XS1684385161 | Z-spread down by 26.7 bp to 341.6 bp, with the yield to worst at 3.0% and the bond now trading up to 99.7 cents on the dollar (1Y price range: 98.4-105.5).

SELECTED RECENT USD BOND ISSUES

- Skillz Inc (Information/Data Technology | San Francisco, United States | Rating: B-): US$300m Note (US83067LAA70), fixed rate (10.25% coupon) maturing on 15 December 2026, priced at 95.00 (original spread of 1,033 bp), callable (5nc2)

- BOCI Financial Products Ltd (Financial - Other | China (Mainland) | Rating: NR): US$101m Unsecured Note (XS2424435605) zero coupon maturing on 24 September 2025, priced at 105.08, non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): US$430m Unsecured Note (XS2424371958), fixed rate (1.00% coupon) maturing on 15 January 2030, priced at 100.00, non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): US$130m Unsecured Note (XS2423023469), floating rate maturing on 15 January 2030, priced at 100.00, non callable

- Greentown China Holdings Ltd (Service - Other | Hangzhou, Zhejiang, China (Mainland) | Rating: BB-): US$150m Senior Note (XS2390472202), fixed rate (5.95% coupon) maturing on 22 December 2024, priced at 100.00, callable (3nc2)

NEW LOANS

- Mills Fleet Farm Group LLC, signed a US$ 365m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/21/26 and initial pricing is set at LIBOR +150bps

- Fenway Sports Group LLC, signed a US$ 175m Revolving Credit Facility, to be used for acquisition financing. It matures on 11/01/22.

- Jo-Ann Stores LLC (B), signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/21/26 and initial pricing is set at LIBOR +125bps

- Interplex Holdings Ltd, signed a US$ 473m Revolving Credit / Term Loan, to be used for a leveraged buyout. It matures on 12/15/26.

- First Solar Inc, signed a US$ 500m Revolving Credit / Term Loan, to be used for capital expenditures.

- Central Garden & Pet Co (BB), signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 12/31/26 and initial pricing is set at LIBOR +100bp

- ShawCor Ltd, signed a US$ 268m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/21/25.

NEW ISSUES IN SECURITIZED CREDIT

- Connecticut Avenue Securities Trust 2021-R03 issued a floating-rate Agency RMBS in 4 tranches, for a total of US$ 909 m. Highest-rated tranche offering a spread over the floating rate of 85bp, and the lowest-rated tranche a spread of 550bp. Bookrunners: Barclays Capital Group, Bank of America Merrill Lynch

- Freddie Mac Spc Series K-F127 issued a floating-rate Agency CMBS in 1 tranche, for a total of US$ 754 m. Highest-rated tranche offering a spread over the floating rate of 21bp, and the lowest-rated tranche a spread of 21bp. Bookrunners: PNC Capital Markets, Wells Fargo Securities LLC

- Cologix Series 2021-1 issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 1,036 m. Highest-rated tranche offering a yield to maturity of 3.30%, and the lowest-rated tranche a yield to maturity of 5.99%. Bookrunners: Deutsche Bank Securities Inc, RBC Capital Markets, Citigroup Global Markets Inc

- Starwood Mortgage Residential Trust (Star) 2021-6 issued a floating-rate RMBS in 6 tranches, for a total of US$ 439 m. Highest-rated tranche offering a spread over the floating rate of 100bp, and the lowest-rated tranche a spread of 400bp. Bookrunners: Credit Suisse, Deutsche Bank Securities Inc