Credit

The Selloff In Rates Takes Down US Corporate Bonds, Most Notably In Longer-Duration IG

Good start for the USD IG primary market, with several issuers on deck today, including a $2bn, 3-tranche offering from Caterpillar; the first week of the year is expected to see about $40bn in total new volume

Published ET

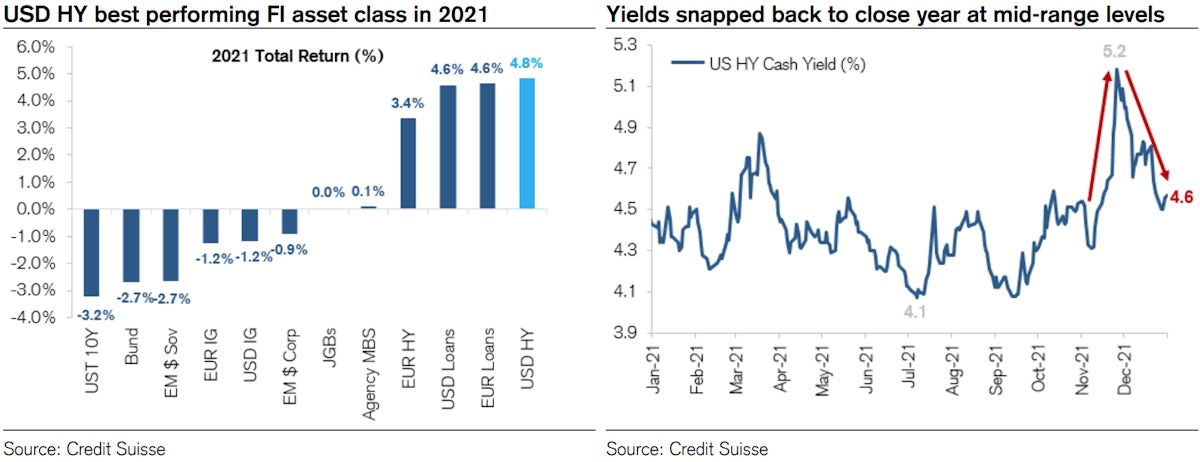

US$ High Yield Bonds Were The Best Performing Fixed Income Asset Class In 2021 | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.72% today, with investment grade down -0.77% and high yield down -0.25% (YTD total return: -0.72%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -1.224% today (Month-to-date: -1.22%; Year-to-date: -1.22%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.188% today (Month-to-date: -0.19%; Year-to-date: -0.19%)

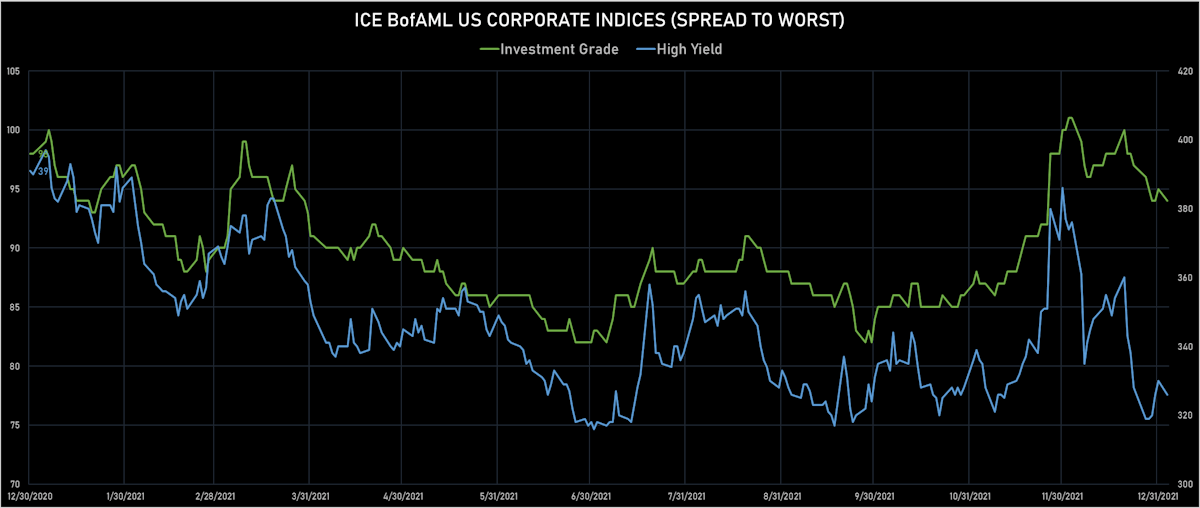

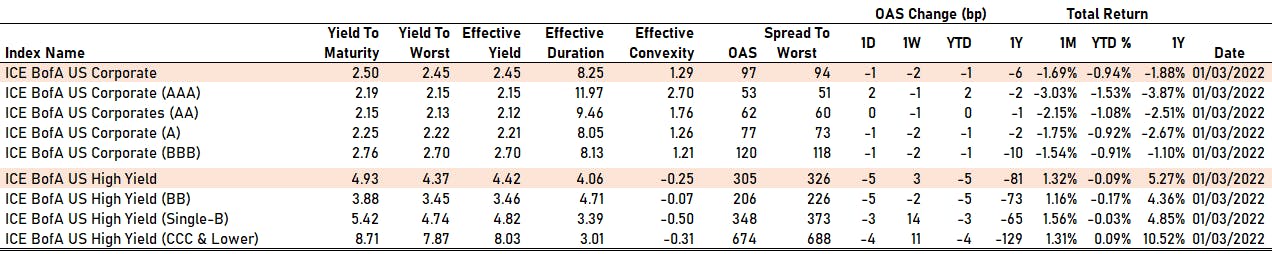

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 94.0 bp (YTD change: -1.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 326.0 bp (YTD change: -4.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.13% today (YTD total return: +0.1%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

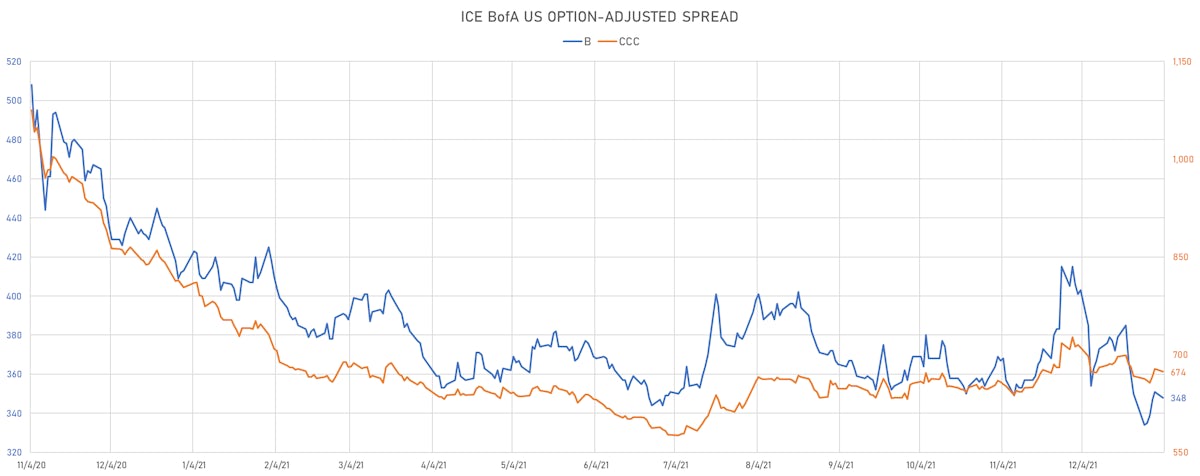

- AAA up by 2 bp at 53 bp

- AA unchanged at 62 bp

- A down by -1 bp at 77 bp

- BBB down by -1 bp at 120 bp

- BB down by -5 bp at 206 bp

- B down by -3 bp at 348 bp

- CCC down by -4 bp at 674 bp

CDS INDICES (mid-spreads)

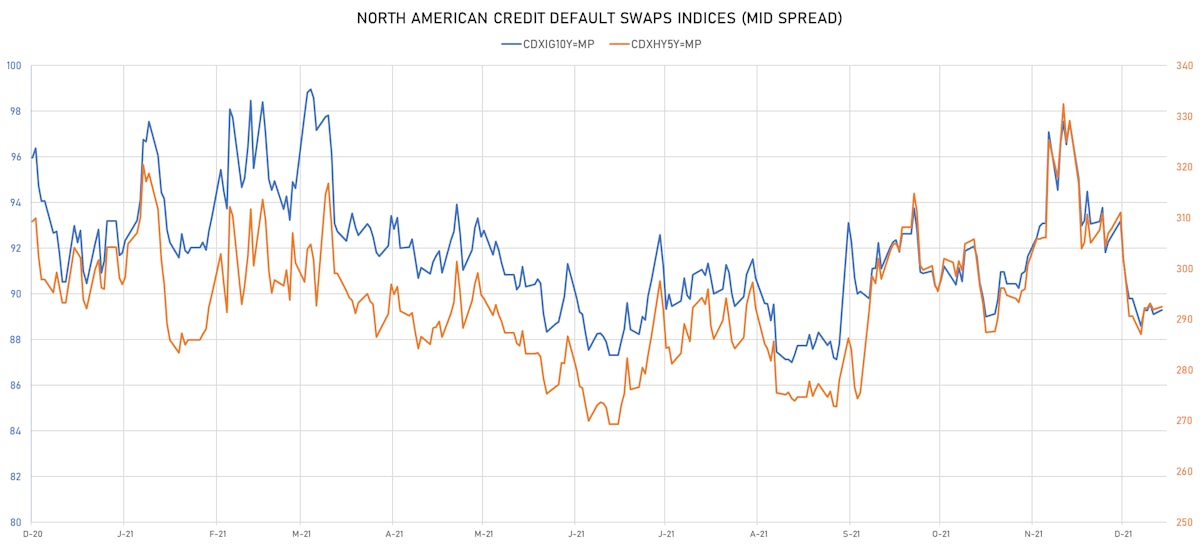

- Markit CDX.NA.IG 5Y up 0.2 bp, now at 89bp

- Markit CDX.NA.HY 5Y up 0.5 bp, now at 292bp

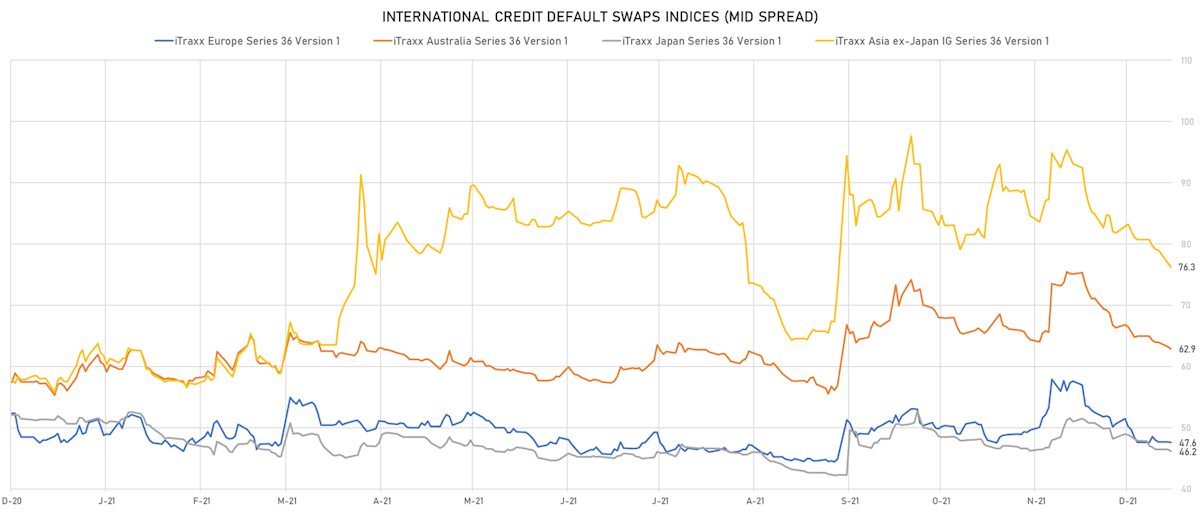

- Markit iTRAXX Europe down 0.1 bp, now at 48bp (YTD change: -0.1bp)

- Markit iTRAXX Japan down 0.2 bp, now at 46bp (YTD change: -0.2bp)

- Markit iTRAXX Asia Ex-Japan down 0.6 bp, now at 76bp

SELECTED RECENT USD BOND ISSUES

- Blackstone Holdings Finance Co LLC (Financial - Other | New York City, United States | Rating: A+): US$500m Senior Note (US09261BAG59), fixed rate (2.55% coupon) maturing on 30 March 2032, priced at 99.75 (original spread of 95 bp), callable (10nc10)

- Blackstone Holdings Finance Co LLC (Financial - Other | New York City, United States | Rating: A+): US$1,000m Senior Note (US09261BAH33), fixed rate (3.20% coupon) maturing on 30 January 2052, priced at 99.71 (original spread of 120 bp), callable (30nc30)

- Caterpillar Financial Services Corp (Leasing | Nashville, United States | Rating: A): US$300m Senior Note (US14913R2T32), floating rate (SOFR + 17.0 bp) maturing on 10 January 2024, priced at 100.00, non callable

- Caterpillar Financial Services Corp (Leasing | Nashville, United States | Rating: A): US$500m Senior Note (US14913R2U05), fixed rate (1.70% coupon) maturing on 8 January 2027, priced at 99.95 (original spread of 35 bp), with a make whole call

- Caterpillar Financial Services Corp (Leasing | Nashville, United States | Rating: A): US$1,200m Senior Note (US14913R2S58), fixed rate (0.95% coupon) maturing on 10 January 2024, priced at 99.98 (original spread of 18 bp), with a make whole call

- CNO Global Funding (Financial - Other | Wilmington, United States | Rating: NR): US$500m Note (US18977W2C32), fixed rate (2.65% coupon) maturing on 6 January 2029, priced at 99.85, non callable

- CNO Global Funding (Financial - Other | Wilmington, United States | Rating: NR): US$400m Note (US18977W2B58), fixed rate (1.65% coupon) maturing on 6 January 2025, priced at 99.94 (original spread of 65 bp), non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$111m Bond (US3130AQHU02), fixed rate (1.00% coupon) maturing on 19 January 2027, priced at 100.00 (original spread of 22 bp), callable (5nc2)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$150m Bond (US3130AQHY24), fixed rate (1.00% coupon) maturing on 19 January 2027, priced at 100.00 (original spread of 22 bp), callable (5nc2)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$300m Bond (US3130AQHS55), fixed rate (1.70% coupon) maturing on 28 January 2027, priced at 100.00, callable (5nc1m)

- Ga Global Funding Trust (Financial - Other | Wilmington, United States | Rating: NR): US$550m Note (US36143L2G95), fixed rate (2.25% coupon) maturing on 6 January 2027, priced at 99.97 (original spread of 90 bp), non callable

- Ga Global Funding Trust (Financial - Other | Wilmington, United States | Rating: NR): US$550m Note (US36143M2J17), fixed rate (2.90% coupon) maturing on 6 January 2032, priced at 99.84 (original spread of 130 bp), non callable

- Metlife Global Funding Inc (Financial - Other | United States | Rating: NR): US$600m Note (US59217GET22), fixed rate (2.40% coupon) maturing on 11 January 2032, priced at 99.89 (original spread of 78 bp), non callable

- Metropolitan Life Global Funding I (Financial - Other | Wilmington, United States | Rating: NR): US$900m Note (US59217GER65), fixed rate (1.88% coupon) maturing on 11 January 2027, priced at 99.89 (original spread of 53 bp), non callable

- Deutsche Bank Luxembourg SA (Banking | Luxembourg, Germany | Rating: A-): US$400m Unsecured Note (XS2412151644), floating rate maturing on 16 January 2025, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Lower Saxony, State of (Official and Muni | Hannover, Germany | Rating: AAA): €1,000m Jumbo Landesschatzanweisung (DE000A3MQNG3), fixed rate (0.13% coupon) maturing on 9 January 2032, priced at 99.06 (original spread of 39 bp), non callable