Credit

US IG Cash Spreads Stable, High Yield Spreads Widen Further (Now Up 15bp YTD)

Good start for the US$ investment grade primary market: nearly $14bn priced today after $62bn raised by corporates last week (2022 YTD IG volume at US$76.1bn vs 2021 YTD US$54.85bn according to IFR data)

Published ET

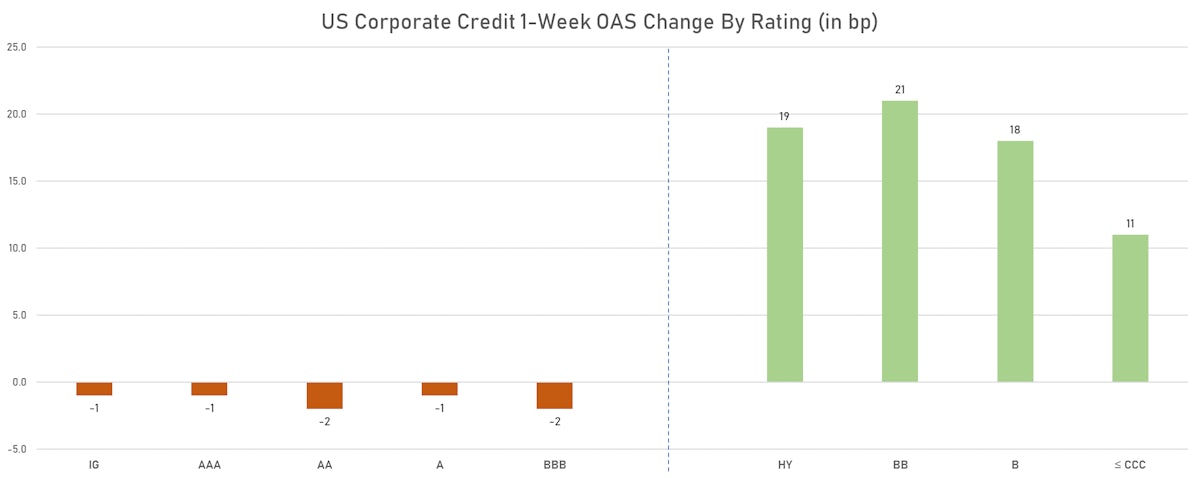

1-Week Changes In USD Corporate Option-Adjusted Spreads | Source: ϕpost, ICE BofAML, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.13% today, with investment grade down -0.11% and high yield down -0.33% (YTD total return: -1.78%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.192% today (Month-to-date: -2.33%; Year-to-date: -2.33%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.199% today (Month-to-date: -1.30%; Year-to-date: -1.30%)

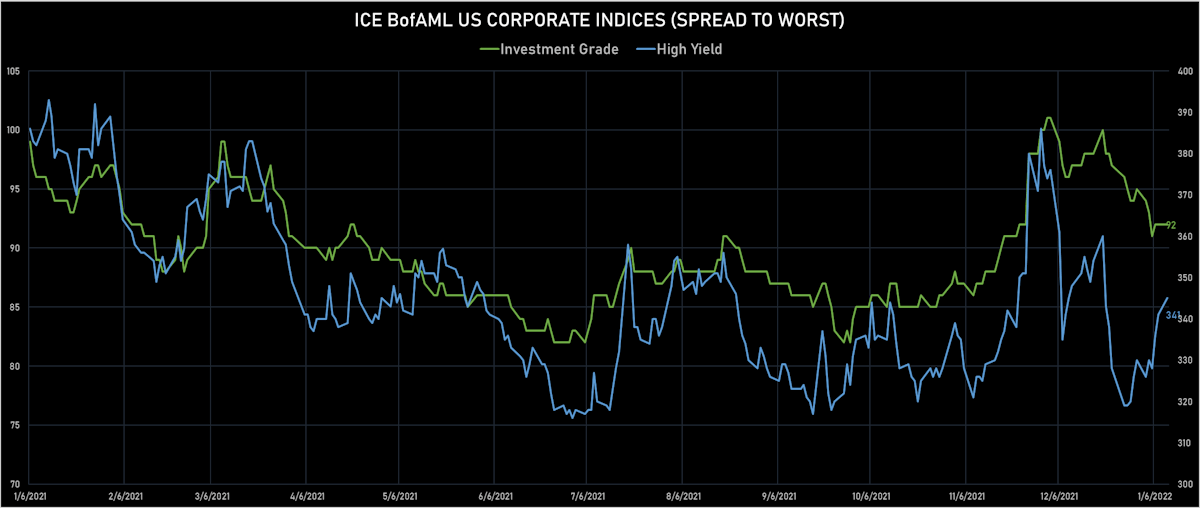

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 92.0 bp (YTD change: -3.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 345.0 bp (YTD change: +15.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.03% today (YTD total return: +0.4%)

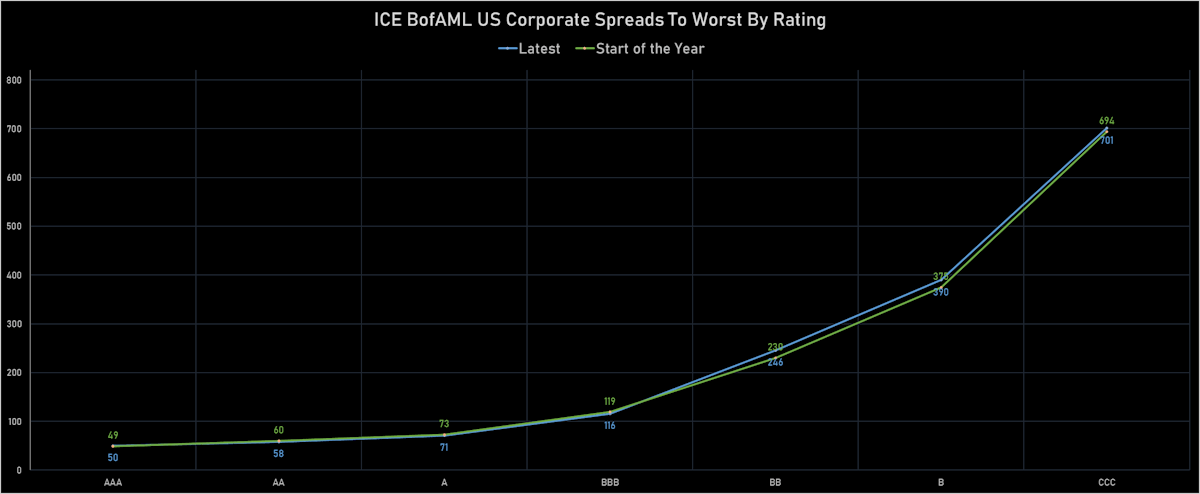

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 2 bp at 52 bp

- AA up by 1 bp at 60 bp

- A unchanged at 76 bp

- BBB up by 1 bp at 118 bp

- BB up by 5 bp at 227 bp

- B up by 4 bp at 366 bp

- CCC up by 1 bp at 685 bp

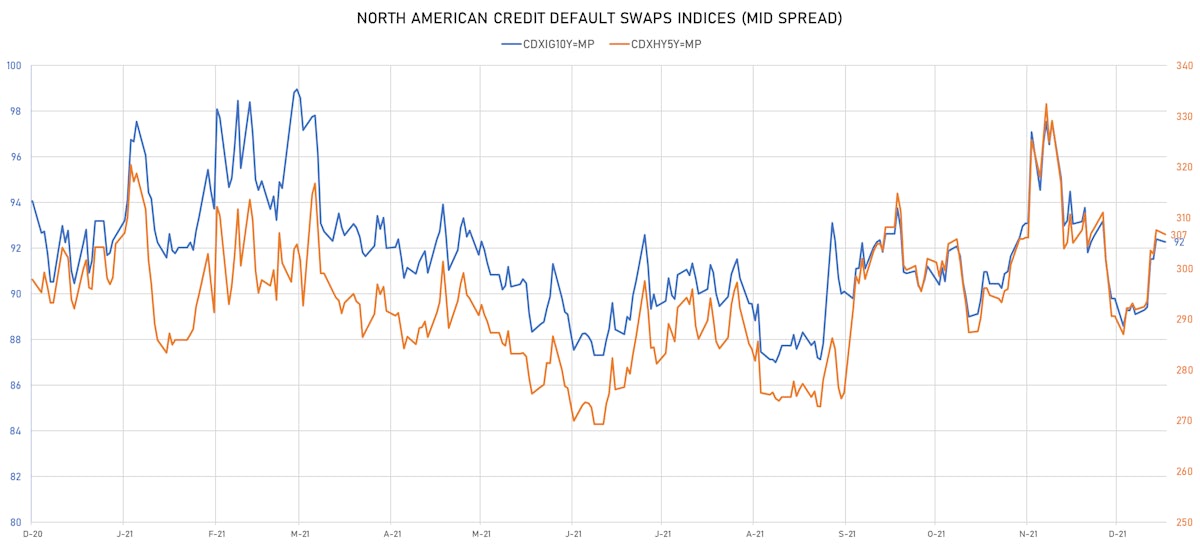

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.1 bp, now at 92bp (YTD change: +3.2bp)

- Markit CDX.NA.HY 5Y down 0.9 bp, now at 307bp (YTD change: +14.8bp)

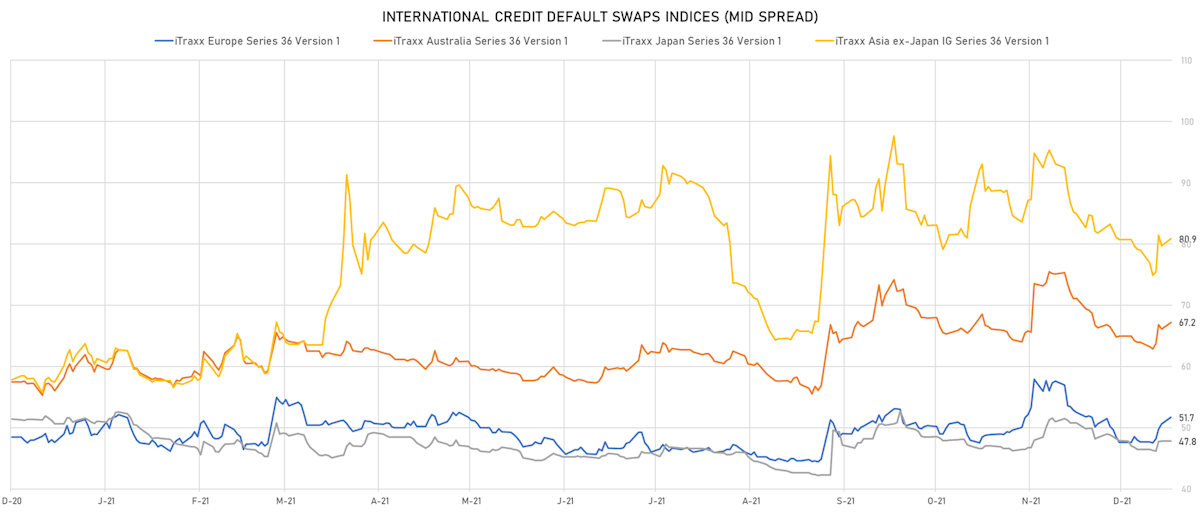

- Markit iTRAXX Europe up 1.0 bp, now at 52bp (YTD change: +4.0bp)

- Markit iTRAXX Japan unchanged at 48bp (YTD change: +1.4bp)

- Markit iTRAXX Asia Ex-Japan up 1.2 bp, now at 81bp (YTD change: +1.9bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 31.3 bp to 1,815.5bp (1Y range: 941-2,657bp)

- MBIA Inc (Country: US; rated: Ba3): down 28.6 bp to 314.2bp (1Y range: 314-565bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): up 19.9 bp to 168.7bp (1Y range: 124-401bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): up 23.2 bp to 151.8bp (1Y range: 119-610bp)

- Avis Budget Group Inc (Country: US; rated: CCC): up 23.5 bp to 224.5bp (1Y range: 183-420bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): up 25.7 bp to 524.5bp (1Y range: 363-525bp)

- Macy's Inc (Country: US; rated: Ba2): up 26.1 bp to 248.0bp (1Y range: 181-552bp)

- Rite Aid Corp (Country: US; rated: B3): up 26.9 bp to 969.7bp (1Y range: 497-997bp)

- Beazer Homes USA Inc (Country: US; rated: B2): up 28.0 bp to 298.1bp (1Y range: 231-388bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 30.0 bp to 387.8bp (1Y range: 299-726bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 36.5 bp to 446.9bp (1Y range: 291-572bp)

- Domtar Corp (Country: US; rated: LGD3 - 42%): up 86.7 bp to 467.0bp (1Y range: 65-467bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- TUI AG (Country: DE; rated: B3-PD): down 26.9 bp to 698.9bp (1Y range: 607-946bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 25.7 bp to 506.1bp (1Y range: 471-694bp)

- Boparan Finance PLC (Country: GB; rated: B3): down 24.2 bp to 1,365.4bp (1Y range: 551-1,564bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 19.5 bp to 621.2bp (1Y range: 464-779bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): up 10.7 bp to 260.7bp (1Y range: 149-270bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 11.4 bp to 174.3bp (1Y range: 164-267bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 13.0 bp to 369.1bp (1Y range: 339-545bp)

- ThyssenKrupp AG (Country: DE; rated: B1): up 14.2 bp to 223.6bp (1Y range: 205-300bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 18.2 bp to 257.8bp (1Y range: 145-272bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 18.8 bp to 178.6bp (1Y range: 107-227bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 23.2 bp to 419.1bp (1Y range: 333-481bp)

- Cable & Wireless Ltd (Country: GB; rated: WR): up 25.5 bp to 56.5bp (1Y range: 57-143bp)

- Novafives SAS (Country: FR; rated: Caa1): up 32.5 bp to 650.2bp (1Y range: 618-976bp)

- Carrefour SA (Country: FR; rated: Baa1): up 38.7 bp to 101.2bp (1Y range: 45-101bp)

- Elo SA (Country: FR): up 45.2 bp to 127.6bp (1Y range: 83-242bp)

SELECTED RECENT USD BOND ISSUES

- Blackstone Private Credit Fund (Financial - Other | New York City, New York, United States | Rating: BBB-): US$650m Senior Note (US09261HAQ02), fixed rate (4.00% coupon) maturing on 15 January 2029, priced at 99.30 (original spread of 240 bp), callable (7nc7)

- Blackstone Private Credit Fund (Financial - Other | New York City, United States | Rating: BBB-): US$500m Senior Note (US09261HAN70), fixed rate (2.70% coupon) maturing on 15 January 2025, priced at 99.99 (original spread of 150 bp), with a make whole call

- DICK'S Sporting Goods Inc (Retail Stores - Other | Coraopolis, Pennsylvania, United States | Rating: BBB): US$750m Senior Note (US253393AG77), fixed rate (4.10% coupon) maturing on 15 January 2052, priced at 99.76 (original spread of 217 bp), callable (30nc30)

- DICK'S Sporting Goods Inc (Retail Stores - Other | Coraopolis, Pennsylvania, United States | Rating: BBB): US$750m Senior Note (US253393AF94), fixed rate (3.15% coupon) maturing on 15 January 2032, priced at 99.80 (original spread of 140 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$300m Bond (US3133ENKX75), floating rate (SOFR + 11.0 bp) maturing on 17 January 2025, priced at 100.00, non callable

- Southern California Edison Co (Utility - Other | Rosemead, United States | Rating: BBB+): US$700m First Mortgage Bond (US842400HN64), fixed rate (3.45% coupon) maturing on 1 February 2052, priced at 99.66 (original spread of 135 bp), callable (30nc30)

- Southern California Edison Co (Utility - Other | Rosemead, United States | Rating: BBB+): US$500m First Mortgage Bond (US842400HM81), fixed rate (2.75% coupon) maturing on 1 February 2032, priced at 99.96 (original spread of 98 bp), callable (10nc10)

- Starwood Property Trust Inc (Real Estate Investment Trust | Greenwich, Connecticut, United States | Rating: BB-): US$500m Senior Note (US85571BAY11), fixed rate (4.38% coupon) maturing on 15 January 2027, priced at 100.00 (original spread of 284 bp), callable (5nc4)

- Bpce SA (Banking | Paris, France | Rating: A): US$400m Note (US05578AAW80), floating rate (SOFR + 57.0 bp) maturing on 15 January 2025, priced at 100.00, non callable

- Bpce SA (Banking | Paris, France | Rating: A): US$850m Note (US05578AAV08), fixed rate (1.63% coupon) maturing on 14 January 2025, priced at 99.69 (original spread of 55 bp), non callable

- Bpce SA (Banking | Paris, France | Rating: A): US$800m Subordinated Note (US05578QAH65), fixed rate (3.65% coupon) maturing on 14 January 2037, priced at 100.00 (original spread of 190 bp), callable (15nc10)

- Korea National Oil Corp (Agency | Ulsan, South Korea | Rating: AA-): US$400m Senior Note (US50066RAT32), fixed rate (2.63% coupon) maturing on 18 April 2032, priced at 99.51 (original spread of 109 bp), non callable

- Korea National Oil Corp (Agency | Ulsan, Ulsan, South Korea | Rating: AA-): US$550m Senior Note (US50066RAS58), fixed rate (2.13% coupon) maturing on 18 April 2027, priced at 99.47 (original spread of 70 bp), non callable

- Korea National Oil Corp (Agency | Ulsan, South Korea | Rating: AA-): US$550m Senior Note (US50066RAR75), fixed rate (1.75% coupon) maturing on 18 April 2025, priced at 99.87 (original spread of 60 bp), non callable

- Natixis SA (Banking | Paris, France | Rating: A): US$220m Unsecured Note (XS2321033610) zero coupon maturing on 26 January 2052, priced at 100.00, non callable

- Royal Bank of Canada (London branch) (Banking | London, Canada | Rating: NR): US$465m Unsecured Note (XS1192971411) zero coupon maturing on 26 January 2052, non callable

- Royal Bank of Canada (London branch) (Banking | London, Canada | Rating: AA): US$125m Unsecured Note (XS1192971502) zero coupon maturing on 24 January 2052, non callable

- SF Holding Investment 2021 Ltd (Financial - Other | Shenzhen, Guangdong, China (Mainland) | Rating: NR): US$400m Senior Note (XS2425430506), fixed rate (2.38% coupon) maturing on 17 November 2026, priced at 98.37 (original spread of 120 bp), with a make whole call

- SF Holding Investment 2021 Ltd (Financial - Other | Shenzhen, Guangdong, China (Mainland) | Rating: NR): US$300m Senior Note (XS2425433948), fixed rate (3.13% coupon) maturing on 17 November 2031, priced at 97.93, with a make whole call

- Shriram Transport Finance Company Ltd (Financial - Other | Mumbai, Maharashtra, India | Rating: BB-): US$475m Note (US825547AE20), fixed rate (4.15% coupon) maturing on 18 July 2025, priced at 100.00, callable (3nc3)

- Toyota Motor Credit Corp (Financial - Other | Plano, Japan | Rating: A+): US$750m Senior Note (US89236TJV89), fixed rate (1.90% coupon) maturing on 13 January 2027, priced at 99.90 (original spread of 40 bp), with a make whole call

- Toyota Motor Credit Corp (Financial - Other | Plano, Japan | Rating: A+): US$1,150m Senior Note (US89236TJT34), fixed rate (1.45% coupon) maturing on 13 January 2025, priced at 99.87 (original spread of 30 bp), non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$300m Senior Note (US89236TJU07), floating rate (SOFR + 32.0 bp) maturing on 13 January 2025, priced at 100.00, non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Japan | Rating: A+): US$400m Senior Note (US89236TJW62), fixed rate (2.40% coupon) maturing on 13 January 2032, priced at 99.63 (original spread of 68 bp), with a make whole call

SELECTED RECENT EUR BOND ISSUES

- CPI Property Group SA (Financial - Other | Luxembourg, Luxembourg | Rating: BBB): €700m Senior Note (XS2432162654), fixed rate (1.75% coupon) maturing on 14 January 2030, priced at 98.05 (original spread of 224 bp), callable (8nc8)

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: NR): €1,250m Senior Note (XS2432293673), fixed rate (0.25% coupon) maturing on 17 November 2025, priced at 99.83 (original spread of 76 bp), callable (4nc4)

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: NR): €750m Senior Note (XS2432293756), fixed rate (0.88% coupon) maturing on 17 January 2031, priced at 98.70 (original spread of 114 bp), callable (9nc9)

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: NR): €750m Senior Note (XS2432293913), fixed rate (1.25% coupon) maturing on 17 January 2035, priced at 99.33 (original spread of 138 bp), callable (13nc13)

- European Financial Stability Facility SA (Supranational | Luxembourg, Luxembourg | Rating: NR): €3,000m Senior Note (EU000A1G0EP6), fixed rate (0.13% coupon) maturing on 18 March 2030, priced at 99.81 (original spread of 33 bp), non callable

- European Financial Stability Facility SA (Supranational | Luxembourg, Luxembourg | Rating: NR): €2,500m Senior Note (EU000A2SCAA6), fixed rate (0.70% coupon) maturing on 17 January 2053, priced at 99.89 (original spread of 41 bp), non callable

- LEG Immobilien SE (Home Builders | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: BBB+): €500m Senior Note (DE000A3MQNN9), fixed rate (0.38% coupon) maturing on 17 January 2026, priced at 99.44 (original spread of 97 bp), callable (4nc4)

- LEG Immobilien SE (Home Builders | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: BBB+): €500m Senior Note (DE000A3MQNQ2), fixed rate (1.50% coupon) maturing on 17 January 2034, priced at 99.18 (original spread of 164 bp), callable (12nc12)

- LEG Immobilien SE (Home Builders | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: BBB+): €500m Senior Note (DE000A3MQNP4), fixed rate (0.88% coupon) maturing on 17 January 2029, priced at 99.05 (original spread of 127 bp), callable (7nc7)

- Mediobanca Banca di Credito Finanziario SpA (Banking | Milan, Milano, Italy | Rating: BBB): €500m Senior Note (XS2431320378), fixed rate (1.00% coupon) maturing on 17 January 2029, priced at 99.47, callable (7nc7)

- Santander Consumer Finance SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A): €750m Note (XS2432530637), fixed rate (0.50% coupon) maturing on 14 January 2027, priced at 99.58 (original spread of 95 bp), non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A+): €1,000m Senior Note (XS2432502008), fixed rate (0.50% coupon) maturing on 18 January 2027, priced at 99.93 (original spread of 88 bp), non callable

- UniCredit Bank AG (Banking | Muenchen, Bayern, Italy | Rating: BBB+): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000HV2AYS3), fixed rate (0.38% coupon) maturing on 17 January 2033, priced at 99.67 (original spread of 46 bp), non callable

- VGP NV (Service - Other | Antwerp, Belgium | Rating: NR): €500m Senior Note (BE6332786449), fixed rate (1.63% coupon) maturing on 17 January 2027, priced at 99.71 (original spread of 206 bp), callable (5nc5)

- VGP NV (Service - Other | Antwerp, Belgium | Rating: NR): €500m Senior Note (BE6332787454), fixed rate (2.25% coupon) maturing on 17 January 2030, priced at 99.48 (original spread of 254 bp), callable (8nc8)

NEW LOANS

- Western Digital Corp (BB+), signed a US$ 2,250m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/10/27 and initial pricing is set at Term SOFR +112.500bps

- Western Digital Corp (BB+), signed a US$ 3,000m Term Loan, to be used for general corporate purposes. It matures on 01/10/27 and initial pricing is set at Term SOFR +112.500bps

- NAB Holdings (B+), signed a US$ 300m Term Loan B, to be used for acquisition financing. It matures on 11/23/28 and initial pricing is set at Term SOFR +300.000bps

- Biscuit International SAS (B-), signed a € 205m Term Loan B, to be used for acquisition financing. It matures on 02/21/27 and initial pricing is set at EURIBOR +400.000bps