Credit

Risk-On Sentiment Across Credit, With Tighter Spreads In US HY As Well As EM Sovereigns

YTD US$ IG issuance volume is now about $30bn ahead of YTD 2021, with another $15bn+ of deals priced today, led by Societe Generale's US$5bn, 5-tranches offering

Published ET

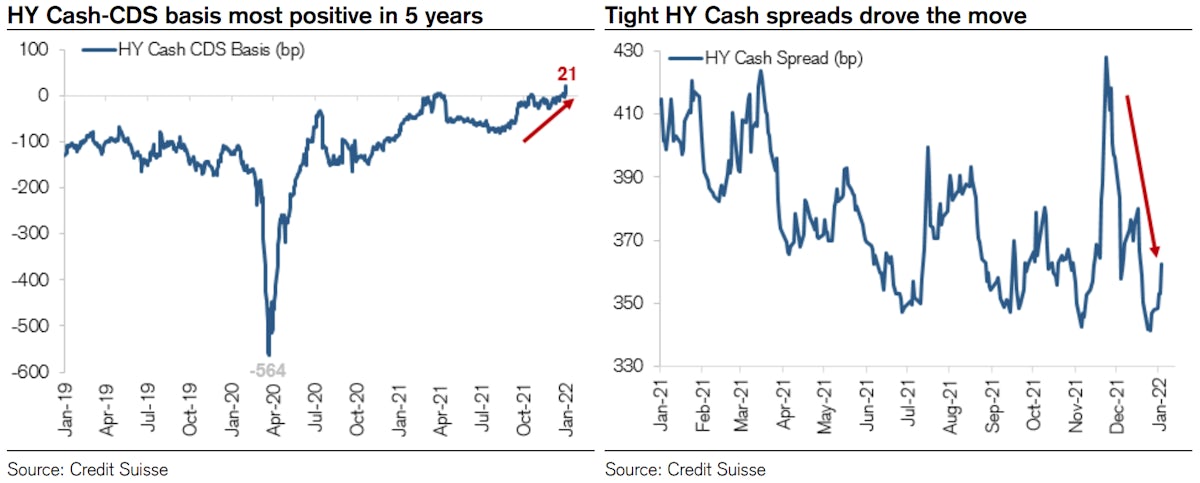

HY CDS Spreads Are Wide Relative To Cash Spreads | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.22% today, with investment grade up 0.21% and high yield up 0.26% (YTD total return: -1.56%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.294% today (Month-to-date: -2.05%; Year-to-date: -2.05%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.418% today (Month-to-date: -0.89%; Year-to-date: -0.89%)

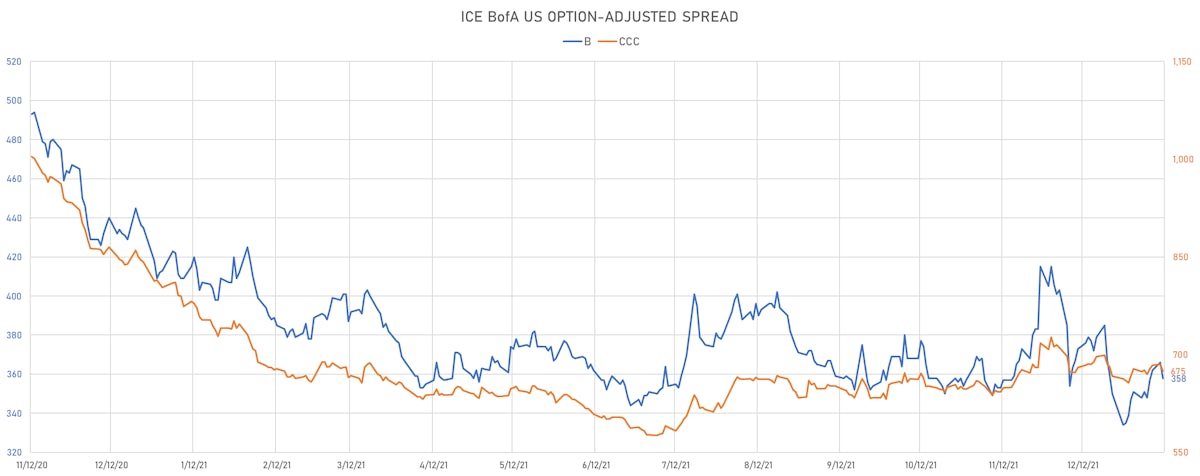

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 93.0 bp (YTD change: -2.0 bp)

- ICE BofA US High Yield Index spread to worst down -5.0 bp, now at 340.0 bp (YTD change: +10.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: +0.4%)

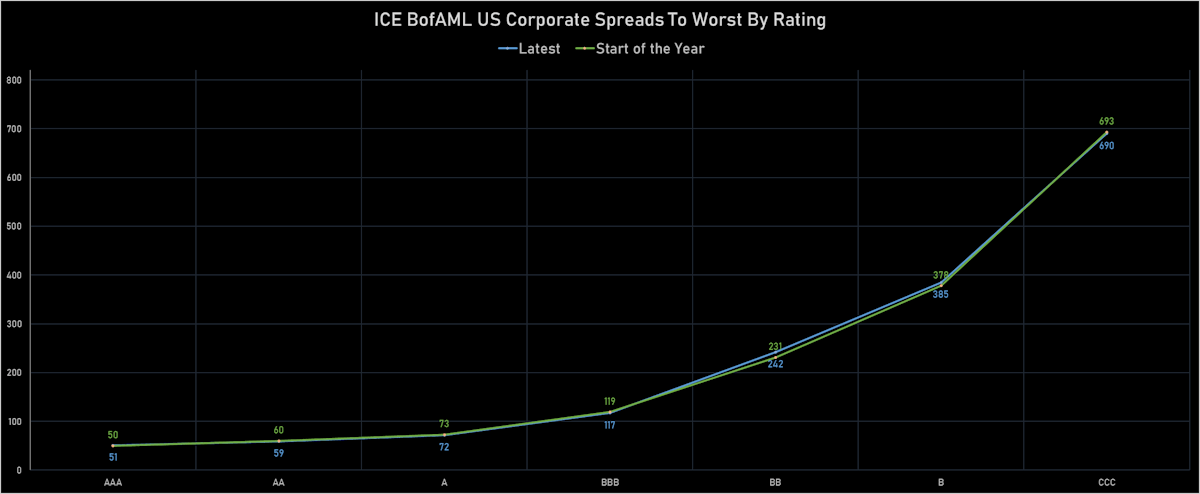

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 52 bp

- AA up by 1 bp at 61 bp

- A up by 1 bp at 77 bp

- BBB up by 1 bp at 119 bp

- BB down by -5 bp at 222 bp

- B down by -8 bp at 358 bp

- CCC down by -10 bp at 675 bp

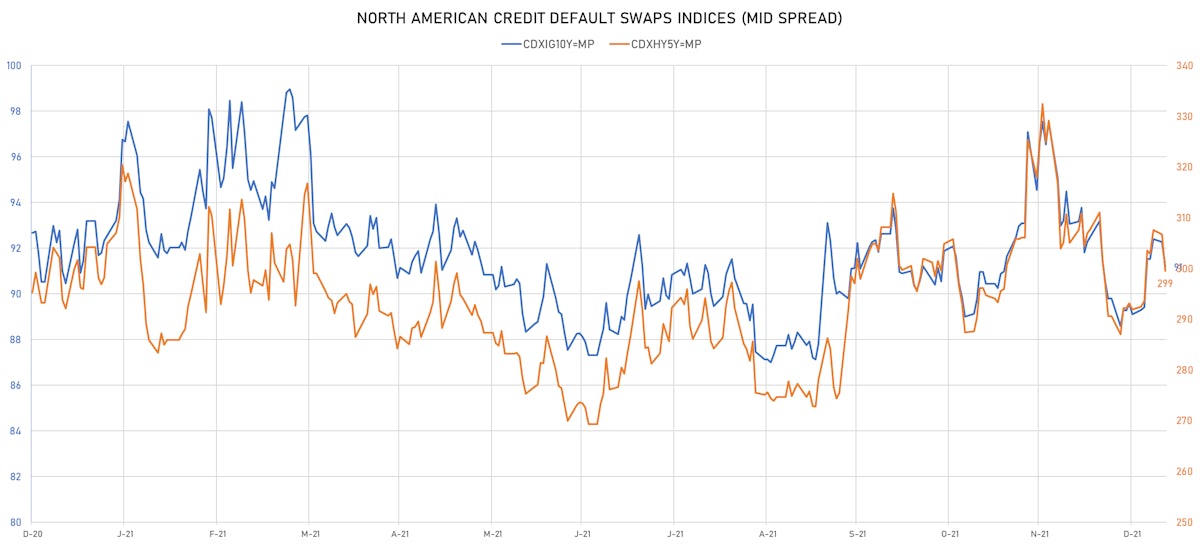

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.1 bp, now at 91bp (YTD change: +2.1bp)

- Markit CDX.NA.HY 5Y down 7.2 bp, now at 299bp (YTD change: +7.5bp)

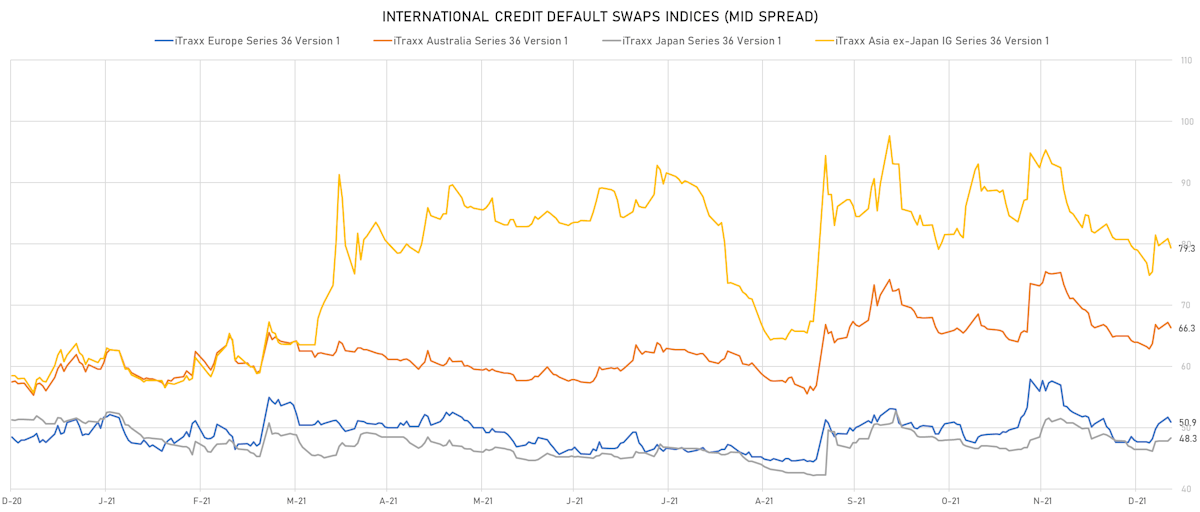

- Markit iTRAXX Europe down 0.8 bp, now at 51bp (YTD change: +3.2bp)

- Markit iTRAXX Japan up 0.5 bp, now at 48bp (YTD change: +1.9bp)

- Markit iTRAXX Asia Ex-Japan down 1.6 bp, now at 79bp (YTD change: +0.3bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Z-spread up by 158.9 bp to 1,557.0 bp, with the yield to worst at 15.9% and the bond now trading down to 83.5 cents on the dollar (1Y price range: 85.0-87.5).

- Issuer: Hopson Development Holdings Ltd (Bermuda) | Coupon: 6.80% | Maturity: 28/12/2023 | Rating: B+ | ISIN: XS2353028298 | Z-spread up by 130.0 bp to 915.0 bp, with the yield to worst at 9.6% and the bond now trading down to 94.1 cents on the dollar (1Y price range: 94.1-96.4).

- Issuer: Rail Capital Markets PLC (London, United Kingdom) | Coupon: 8.25% | Maturity: 9/7/2024 | Rating: B | ISIN: XS1843433472 | Z-spread up by 75.0 bp to 914.7 bp, with the yield to worst at 9.6% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 96.0-98.3).

- Issuer: Mhp Se (Kiev) | Coupon: 7.75% | Maturity: 10/5/2024 | Rating: B | ISIN: XS1577965004 | Z-spread up by 73.9 bp to 679.0 bp, with the yield to worst at 7.6% and the bond now trading down to 99.9 cents on the dollar (1Y price range: 100.6-101.9).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 69.2 bp to 1,084.5 bp, with the yield to worst at 11.7% and the bond now trading down to 84.3 cents on the dollar (1Y price range: 84.3-87.3).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Z-spread up by 56.5 bp to 1,640.6 bp, with the yield to worst at 17.1% and the bond now trading down to 64.3 cents on the dollar (1Y price range: 64.3-65.9).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB | ISIN: USU3230LAA45 | Z-spread up by 48.2 bp to 286.4 bp (CDS basis: -20.0bp), with the yield to worst at 4.1% and the bond now trading down to 106.5 cents on the dollar (1Y price range: 106.6-109.5).

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 4.25% | Maturity: 1/7/2026 | Rating: B | ISIN: USV7780TAF04 | Z-spread up by 47.5 bp to 404.9 bp (CDS basis: -33.1bp), with the yield to worst at 5.3% and the bond now trading down to 94.8 cents on the dollar (1Y price range: 93.8-97.2).

- Issuer: MHP Lux SA (Luxembourg, Luxembourg) | Coupon: 6.95% | Maturity: 3/4/2026 | Rating: B | ISIN: XS1713469911 | Z-spread up by 46.0 bp to 623.8 bp, with the yield to worst at 7.5% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 97.1-99.6).

- Issuer: Wens Foodstuff Group Co Ltd (Yunfu, China (Mainland)) | Coupon: 3.26% | Maturity: 29/10/2030 | Rating: BB+ | ISIN: XS2239632859 | Z-spread down by 48.4 bp to 540.8 bp, with the yield to worst at 6.9% and the bond now trading up to 75.5 cents on the dollar (1Y price range: 71.0-75.5).

- Issuer: Coca-Cola Icecek AS (Istanbul, Turkey) | Coupon: 4.22% | Maturity: 19/9/2024 | Rating: B | ISIN: XS1577950402 | Z-spread down by 60.4 bp to 240.3 bp, with the yield to worst at 3.5% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 100.1-102.1).

- Issuer: Yancoal International Resources Development Co Ltd (Hong Kong) | Coupon: 3.50% | Maturity: 4/11/2023 | Rating: BB+ | ISIN: XS2128388456 | Z-spread down by 61.6 bp to 187.2 bp, with the yield to worst at 2.3% and the bond now trading up to 101.1 cents on the dollar (1Y price range: 100.3-101.6).

- Issuer: GTLK Europe DAC (DUBLIN, Ireland) | Coupon: 5.13% | Maturity: 31/5/2024 | Rating: BB | ISIN: XS1577961516 | Z-spread down by 72.5 bp to 149.0 bp, with the yield to worst at 2.3% and the bond now trading up to 105.6 cents on the dollar (1Y price range: 104.0-105.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 5.63% | Maturity: 17/6/2025 | Rating: B+ | ISIN: XS2056722734 | Z-spread up by 33.0 bp to 648.7 bp, with the yield to worst at 6.1% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 97.8-99.4).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 4.00% | Maturity: 11/4/2024 | Rating: BB | ISIN: XS1935256369 | Z-spread up by 13.4 bp to 198.0 bp (CDS basis: -82.0bp), with the yield to worst at 1.5% and the bond now trading down to 104.4 cents on the dollar (1Y price range: 104.4-105.2).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 3.33% | Maturity: 24/3/2025 | Rating: BB+ | ISIN: XS1523028436 | Z-spread up by 13.4 bp to 89.3 bp, with the yield to worst at 0.7% and the bond now trading down to 107.3 cents on the dollar (1Y price range: 107.3-107.7).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 13.2 bp to 309.0 bp, with the yield to worst at 2.9% and the bond now trading down to 99.1 cents on the dollar (1Y price range: 97.6-99.7).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 3.10% | Maturity: 21/1/2026 | Rating: BB | ISIN: XS2281299763 | Z-spread up by 12.1 bp to 446.2 bp, with the yield to worst at 4.3% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 94.9-96.0).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 0.88% | Maturity: 9/5/2024 | Rating: BB- | ISIN: XS1819575066 | Z-spread down by 11.5 bp to 161.3 bp (CDS basis: -59.0bp), with the yield to worst at 1.3% and the bond now trading up to 98.7 cents on the dollar (1Y price range: 98.5-98.9).

- Issuer: ACS Actividades de Construccion y Servicios SA (Madrid, Spain) | Coupon: 1.38% | Maturity: 17/6/2025 | Rating: BB+ | ISIN: XS2189592616 | Z-spread down by 11.7 bp to 116.9 bp, with the yield to worst at 1.0% and the bond now trading up to 100.7 cents on the dollar (1Y price range: 100.6-101.2).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread down by 12.6 bp to 307.4 bp, with the yield to worst at 2.9% and the bond now trading up to 109.1 cents on the dollar (1Y price range: 108.7-109.2).

- Issuer: Orano SA (Chatillon, France) | Coupon: 2.75% | Maturity: 8/3/2028 | Rating: BB+ | ISIN: FR0013533031 | Z-spread down by 13.0 bp to 182.1 bp, with the yield to worst at 1.8% and the bond now trading up to 104.2 cents on the dollar (1Y price range: 103.6-104.3).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.75% | Maturity: 13/11/2026 | Rating: BB- | ISIN: XS2248826294 | Z-spread down by 14.9 bp to 641.6 bp, with the yield to worst at 6.3% and the bond now trading up to 84.9 cents on the dollar (1Y price range: 83.9-85.3).

- Issuer: Heimstaden AB (Malmo, Sweden) | Coupon: 4.25% | Maturity: 9/3/2026 | Rating: BB+ | ISIN: SE0015657903 | Z-spread down by 17.3 bp to 410.2 bp, with the yield to worst at 3.9% and the bond now trading up to 100.6 cents on the dollar (1Y price range: 100.3-100.7).

- Issuer: thyssenkrupp AG (Essen, Germany) | Coupon: 2.88% | Maturity: 22/2/2024 | Rating: B+ | ISIN: DE000A2TEDB8 | Z-spread down by 18.2 bp to 165.1 bp (CDS basis: -22.8bp), with the yield to worst at 1.2% and the bond now trading up to 102.8 cents on the dollar (1Y price range: 102.6-103.1).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | Z-spread down by 33.7 bp to 266.8 bp, with the yield to worst at 2.6% and the bond now trading up to 104.0 cents on the dollar (1Y price range: 103.5-104.0).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: BB- | ISIN: XS1713464524 | Z-spread down by 37.3 bp to 470.4 bp, with the yield to worst at 4.6% and the bond now trading up to 93.4 cents on the dollar (1Y price range: 91.5-93.6).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.50% | Maturity: 26/7/2024 | Rating: BB- | ISIN: XS1652965085 | Z-spread down by 41.1 bp to 654.0 bp, with the yield to worst at 6.1% and the bond now trading up to 88.9 cents on the dollar (1Y price range: 87.1-89.0).

SELECTED RECENT USD BOND ISSUES

- Pike Corp (Financial - Other | Mount Airy, United States | Rating: B): US$225m Senior Note (USU72064AB10), fixed rate (5.50% coupon) maturing on 1 September 2028, priced at 98.51 (original spread of 408 bp), callable (7nc2)

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$3,500m Senior Note (US045167FH18), fixed rate (1.50% coupon) maturing on 20 January 2027, priced at 99.43 (original spread of 9 bp), non callable

- Canadian Imperial Bank of Commerce (Banking | Toronto, Canada | Rating: A+): US$2,500m Senior Note (US13607GRZ99), fixed rate (1.85% coupon) maturing on 19 January 2027, priced at 100.00 (original spread of 48 bp), non callable

- DBS Bank Ltd (Banking | Singapore | Rating: AA-): US$115m Unsecured Note (XS2309278807) zero coupon maturing on 27 January 2057, priced at 100.00, non callable

- HKT Capital No.6 Ltd (Financial - Other | Rating: BBB): US$650m Senior Note (XS2414130711), fixed rate (3.00% coupon) maturing on 18 January 2032, priced at 99.92, callable (10nc10)

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$5,000m Senior Note (US500769JR67), fixed rate (1.25% coupon) maturing on 31 January 2025, priced at 99.85 (original spread of 8 bp), non callable

- Link Finance (Cayman) 2009 Ltd (Financial - Other | Hong Kong | Rating: A): US$600m Senior Note (XS2417084030), fixed rate (2.75% coupon) maturing on 19 January 2032, priced at 99.05 (original spread of 110 bp), non callable

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$1,300m Senior Note (US606822CC61), fixed rate (2.34% coupon) maturing on 19 January 2028, priced at 100.00 (original spread of 83 bp), callable (6nc5)

- Natixis SA (Banking | Paris, Ile-De-France, France | Rating: A): US$220m Unsecured Note (XS2321033610) zero coupon maturing on 26 January 2052, priced at 100.00, non callable

- Prosus NV (Financial - Other | Amsterdam, South Africa | Rating: BBB-): US$1,000m Senior Note (US74365PAG37), fixed rate (3.26% coupon) maturing on 19 January 2027, priced at 100.00 (original spread of 175 bp), callable (5nc5)

- Societe Generale SA (Banking | Paris, France | Rating: A-): US$750m Note (US83368RBK77), fixed rate (4.03% coupon) maturing on 21 January 2043, priced at 100.00 (original spread of 190 bp), callable (21nc20)

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A-): US$220m Unsecured Note (XS2347740008) zero coupon maturing on 20 January 2052, priced at 100.00, non callable

- Societe Generale SA (Banking | Paris, France | Rating: A-): US$1,250m Note (US83368RBH49), fixed rate (2.80% coupon) maturing on 19 January 2028, priced at 100.00 (original spread of 130 bp), callable (6nc5)

- Societe Generale SA (Banking | Paris, France | Rating: A-): US$1,000m Note (US83368TBJ60), fixed rate (3.34% coupon) maturing on 21 January 2033, priced at 100.00 (original spread of 160 bp), callable (11nc10)

- Triton Container International Ltd (Transportation - Other | Purchase, Bermuda | Rating: BBB-): US$600m Senior Note (US89681LAA08), fixed rate (3.25% coupon) maturing on 15 March 2032, priced at 99.60 (original spread of 155 bp), callable (10nc10)

SELECTED RECENT EUR BOND ISSUES

- Aareal Bank AG (Banking | Wiesbaden, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000AAR0322), fixed rate (0.75% coupon) maturing on 18 April 2028, priced at 99.25 (original spread of 116 bp), non callable

- Amadeus IT Group SA (Information/Data Technology | Madrid, Madrid, Spain | Rating: BBB-): €500m Bond (XS2432941008), floating rate (EU03MLIB + 50.0 bp) maturing on 25 January 2024, priced at 100.10, non callable

- Balder Finland Oyj (Financial - Other | Helsinki, Etela-Suomen, Sweden | Rating: NR): €500m Senior Note (XS2432565005), fixed rate (1.00% coupon) maturing on 18 January 2027, priced at 99.49 (original spread of 146 bp), callable (5nc5)

- Balder Finland Oyj (Financial - Other | Helsinki, Sweden | Rating: NR): €500m Senior Note (XS2432565187), fixed rate (2.00% coupon) maturing on 18 January 2031, priced at 99.67 (original spread of 219 bp), callable (9nc5)

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): €1,250,000m Bond (FR0014007PW1), fixed rate (1.13% coupon) maturing on 19 January 2032, priced at 99.52 (original spread of 126 bp), non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): €750m Bond (FR0014007PV3), fixed rate (0.63% coupon) maturing on 19 November 2027, priced at 99.35 (original spread of 107 bp), non callable

- Caisse Francaise de Financement Local SA (Financial - Other | Issy-Les-Moulineaux, France | Rating: NR): €750m Obligation Fonciere (Covered Bond) (FR0014007PX9), fixed rate (0.38% coupon) maturing on 20 January 2032, priced at 99.83 (original spread of 42 bp), non callable

- Caisse Francaise de Financement Local SA (Financial - Other | Issy-Les-Moulineaux, France | Rating: NR): €500m Obligation Fonciere (Covered Bond) (FR0014007PY7), fixed rate (0.63% coupon) maturing on 20 January 2042, priced at 99.22 (original spread of 58 bp), non callable

- Credit Mutuel Arkea SA (Banking | Le Relecq-Kerhuon, France | Rating: AA-): €500m Note (FR0014007Q96), fixed rate (0.75% coupon) maturing on 18 January 2030, priced at 99.40 (original spread of 101 bp), non callable

- DNB Bank ASA (Banking | Oslo, Norway | Rating: AA-): €1,000m Note (XS2432567555), floating rate maturing on 18 January 2028, priced at 99.75 (original spread of 78 bp), callable (6nc5)

- E.ON SE (Utility - Other | Essen, Nordrhein-Westfalen, Germany | Rating: BBB): €800m Senior Note (XS2433244246), fixed rate (0.88% coupon) maturing on 18 October 2034, priced at 98.22 (original spread of 106 bp), callable (13nc13)

- E.ON SE (Utility - Other | Essen, Nordrhein-Westfalen, Germany | Rating: BBB): €500m Senior Note (XS2433244089), fixed rate (0.13% coupon) maturing on 18 January 2026, priced at 99.47 (original spread of 70 bp), callable (4nc4)

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): €4,000m Senior Note (XS2433363509), fixed rate (0.25% coupon) maturing on 20 January 2032, priced at 100.00 (original spread of 32 bp), non callable

- International Development Association (Supranational | Washington, United States | Rating: AAA): €2,000m Senior Note (XS2432629504), fixed rate (0.70% coupon) maturing on 17 January 2042, priced at 99.15 (original spread of 67 bp), non callable

- Israel, State of (Government) (Sovereign | Jerusalem, Israel | Rating: A+): €1,500m Senior Note (XS2433136194), fixed rate (0.63% coupon) maturing on 18 January 2032, priced at 99.37 (original spread of 76 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: A-): €1,250m Hypothekenpfandbrief Jumbo (Covered Bond) (XS2433126807), fixed rate (0.01% coupon) maturing on 19 July 2027, priced at 99.58 (original spread of 43 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: A-): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (XS2433240764), fixed rate (0.50% coupon) maturing on 19 January 2037, priced at 98.60 (original spread of 46 bp), non callable

- Nederlandse Waterschapsbank NV (Agency | S-Gravenhage, Netherlands | Rating: AAA): €1,750m Bond (XS2433385650), fixed rate (0.25% coupon) maturing on 19 January 2032, priced at 99.02 (original spread of 37 bp), non callable

- Spain, Kingdom of (Government) (Sovereign | Madrid, Spain | Rating: BBB+): €10,000m Obligacion del Estado (ES0000012K20) maturing on 30 April 2032 (original spread of 10 bp), non callable

- Unicaja Banco SA (Banking | Malaga, Malaga, Spain | Rating: NR): €300m Bond (ES0280907025), floating rate maturing on 19 July 2032, priced at 99.71 (original spread of 352 bp), callable (11nc5)

- UniCredit SpA (Banking | Milan, Italy | Rating: BBB): €1,250m Note (XS2433139966), floating rate maturing on 18 January 2028, priced at 99.84 (original spread of 129 bp), callable (6nc5)

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB): €500m Note (XS2433141947), fixed rate (1.63% coupon) maturing on 18 January 2032, priced at 99.81 (original spread of 171 bp), non callable

NEW LOANS

- Summit Behavioral Healthcare, signed a US$ 150m Term Loan B, to be used for acquisition financing. It matures on 11/24/28 and initial pricing is set at LIBOR +475bps

- XLerate Group, signed a US$ 180m Term Loan, to be used for acquisition financing.

- XLerate Group, signed a US$ 570m Term Loan B, to be used for acquisition financing.

- Liberty Tire Recycling Llc, signed a US$ 150m Term Loan B, to be used for acquisition financing.

- Take-Two Interactive Software, signed a US$ 2,700m Bridge Loan, to be used for acquisition financing. It matures on 01/25/23 and initial pricing is set at Term SOFR +150bps

- Tropicana Products Inc, signed a US$ 150m Delayed Draw Term Loan, to be used for leveraged buyout. It matures on 01/25/29.

- Tropicana Products Inc, signed a US$ 1,750m Term Loan B, to be used for leveraged buyout. It matures on 01/25/29.

- Tropicana Products Inc, signed a US$ 520m Term Loan, to be used for leveraged buyout. It matures on 01/25/30.

- Dianchi Intl Hldg Ltd, signed a US$ 150m Term Loan, to be used for general corporate purposes. It matures on 01/11/25 and initial pricing is set at LIBOR +185bps