Credit

Spreads Widen Across The Credit Complex, Though IG Bonds Rose On Lower Yields

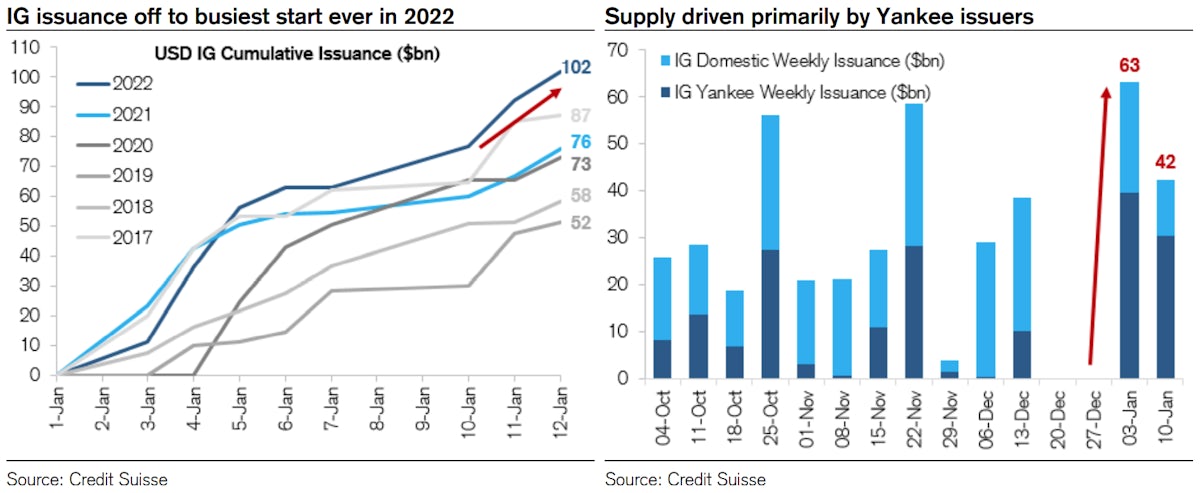

US$ Investment grade issuance is off to the fastest pace ever, with $102 bn already raised since the beginning of the year according to a Credit Suisse analysis

Published ET

Fastest start ever for IG issuance | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.20% today, with investment grade up 0.22% and high yield up 0.02% (YTD total return: -1.41%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.183% today (Month-to-date: -1.94%; Year-to-date: -1.94%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.065% today (Month-to-date: -0.73%; Year-to-date: -0.73%)

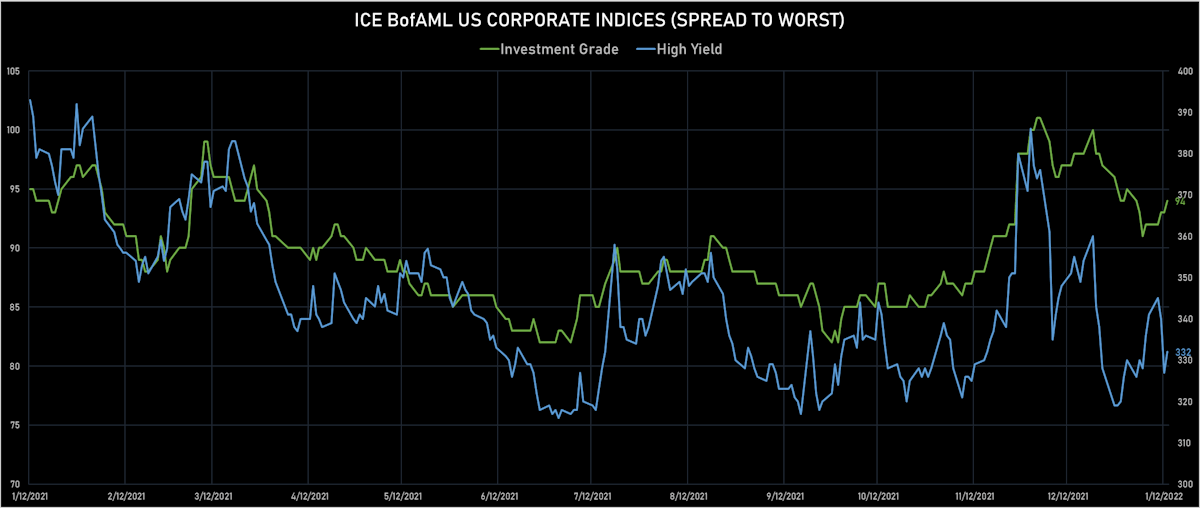

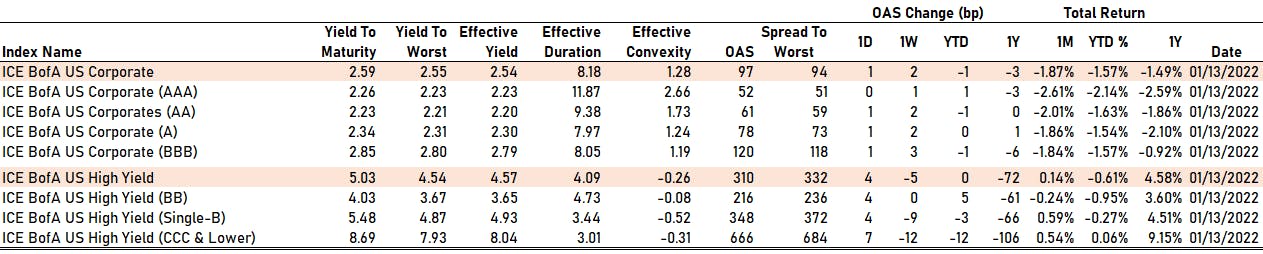

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 94.0 bp (YTD change: -1.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 332.0 bp (YTD change: +2.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.06% today (YTD total return: +0.5%)

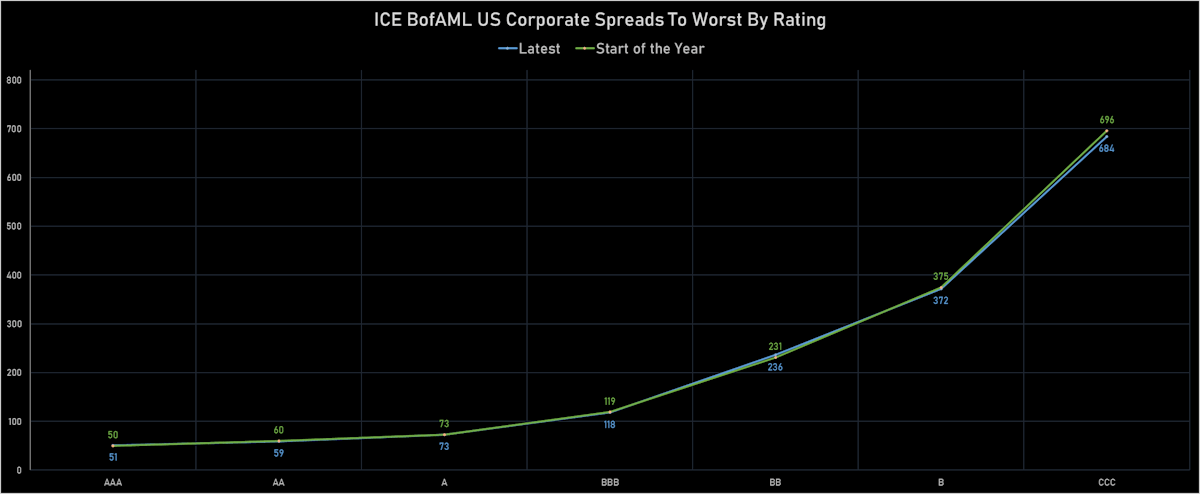

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 52 bp

- AA up by 1 bp at 61 bp

- A up by 1 bp at 78 bp

- BBB up by 1 bp at 120 bp

- BB up by 4 bp at 216 bp

- B up by 4 bp at 348 bp

- CCC up by 7 bp at 666 bp

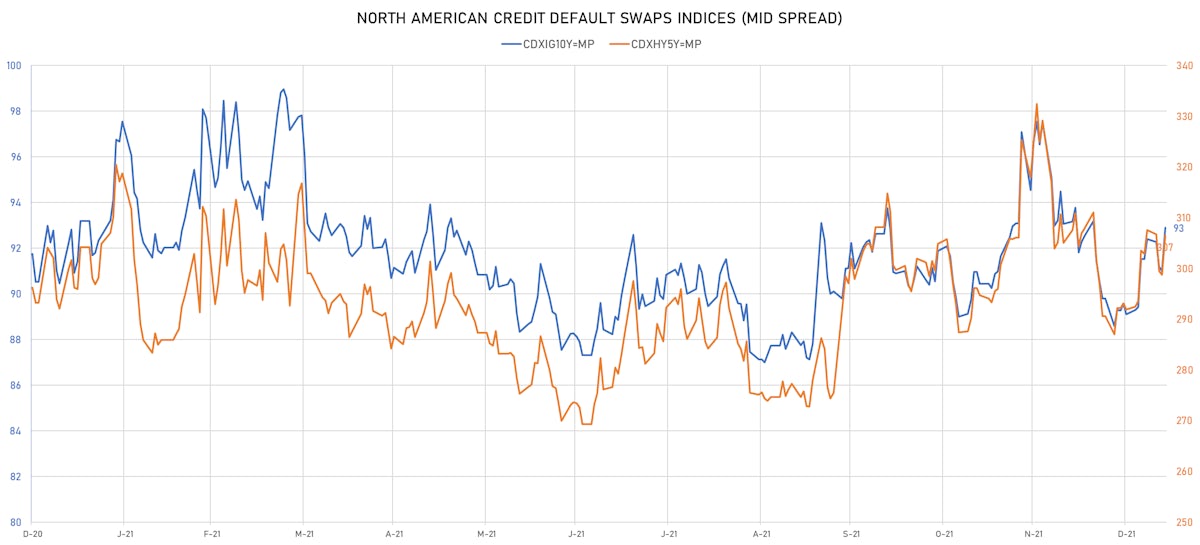

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.9 bp, now at 93bp (YTD change: +3.8bp)

- Markit CDX.NA.HY 5Y up 7.8 bp, now at 307bp (YTD change: +14.6bp)

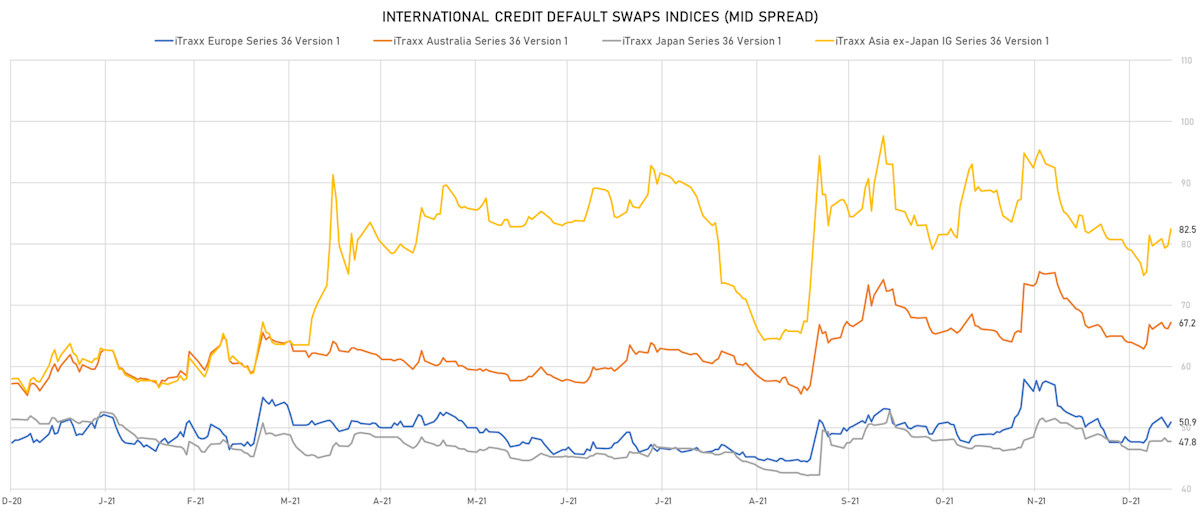

- Markit iTRAXX Europe up 0.9 bp, now at 51bp (YTD change: +3.2bp)

- Markit iTRAXX Japan unchanged at 48bp (YTD change: +1.3bp)

- Markit iTRAXX Asia Ex-Japan up 2.8 bp, now at 82bp (YTD change: +3.4bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Hopson Development Holdings Ltd (Bermuda) | Coupon: 6.80% | Maturity: 28/12/2023 | Rating: B+ | ISIN: XS2353028298 | Z-spread up by 214.3 bp to 1,031.5 bp, with the yield to worst at 10.7% and the bond now trading down to 92.3 cents on the dollar (1Y price range: 92.3-96.4).

- Issuer: Wanda Properties International Co Ltd (British Virgin Islands) | Coupon: 7.25% | Maturity: 29/1/2024 | Rating: BB- | ISIN: XS1023280271 | Z-spread up by 136.6 bp to 1,209.7 bp, with the yield to worst at 12.2% and the bond now trading down to 90.4 cents on the dollar (1Y price range: 92.1-94.9).

- Issuer: Mhp Se (Kiev, Cyprus) | Coupon: 7.75% | Maturity: 10/5/2024 | Rating: B | ISIN: XS1577965004 | Z-spread up by 135.2 bp to 754.2 bp, with the yield to worst at 8.3% and the bond now trading down to 98.4 cents on the dollar (1Y price range: 98.4-101.9).

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 8.50% | Maturity: 23/4/2026 | Rating: B+ | ISIN: XS1806400708 | Z-spread up by 120.2 bp to 700.7 bp, with the yield to worst at 8.2% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 100.0-104.5).

- Issuer: Rail Capital Markets PLC (London, United Kingdom) | Coupon: 7.88% | Maturity: 15/7/2026 | Rating: B | ISIN: XS2365120885 | Z-spread up by 116.4 bp to 959.2 bp, with the yield to worst at 10.8% and the bond now trading down to 88.5 cents on the dollar (1Y price range: 88.3-93.5).

- Issuer: MHP Lux SA (Luxembourg, Luxembourg) | Coupon: 6.25% | Maturity: 19/9/2029 | Rating: B | ISIN: XS2010044894 | Z-spread up by 101.9 bp to 680.3 bp, with the yield to worst at 8.3% and the bond now trading down to 87.6 cents on the dollar (1Y price range: 87.7-93.9).

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Z-spread up by 92.9 bp to 1,583.1 bp, with the yield to worst at 16.1% and the bond now trading down to 83.0 cents on the dollar (1Y price range: 83.0-87.5).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 92.6 bp to 1,121.8 bp, with the yield to worst at 12.0% and the bond now trading down to 83.3 cents on the dollar (1Y price range: 81.5-87.3).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 85.2 bp to 912.9 bp, with the yield to worst at 10.1% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 95.9-99.4).

- Issuer: bijeo jgupi ss (Tbilisi, Georgia) | Coupon: 6.00% | Maturity: 26/7/2023 | Rating: BB- | ISIN: XS1405775880 | Z-spread down by 64.2 bp to 142.7 bp, with the yield to worst at 2.1% and the bond now trading up to 105.5 cents on the dollar (1Y price range: 104.0-105.5).

- Issuer: QNB Finansbank AS (#N/A, Turkey) | Coupon: 6.88% | Maturity: 7/9/2024 | Rating: B | ISIN: XS1959391019 | Z-spread down by 67.5 bp to 432.1 bp (CDS basis: -390.4bp), with the yield to worst at 5.4% and the bond now trading up to 103.2 cents on the dollar (1Y price range: 101.1-103.3).

- Issuer: Aag FH LP (#N/A, #N/A) | Coupon: 9.75% | Maturity: 15/7/2024 | Rating: B- | ISIN: USC33027AA82 | Z-spread down by 258.9 bp to 948.0 bp, with the yield to worst at 10.2% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 93.0-98.0).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 5.63% | Maturity: 17/6/2025 | Rating: B+ | ISIN: XS2056722734 | Z-spread up by 135.2 bp to 673.8 bp, with the yield to worst at 6.3% and the bond now trading down to 97.2 cents on the dollar (1Y price range: 97.2-99.4).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 3.10% | Maturity: 21/1/2026 | Rating: BB | ISIN: XS2281299763 | Z-spread up by 35.2 bp to 467.4 bp, with the yield to worst at 4.5% and the bond now trading down to 94.4 cents on the dollar (1Y price range: 94.2-96.0).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread up by 21.5 bp to 427.8 bp, with the yield to worst at 4.1% and the bond now trading down to 94.5 cents on the dollar (1Y price range: 93.8-95.1).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | Z-spread up by 20.1 bp to 388.3 bp (CDS basis: -14.7bp), with the yield to worst at 3.7% and the bond now trading down to 112.6 cents on the dollar (1Y price range: 112.6-113.4).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 4.00% | Maturity: 11/4/2024 | Rating: BB | ISIN: XS1935256369 | Z-spread up by 19.6 bp to 198.8 bp (CDS basis: -82.0bp), with the yield to worst at 1.5% and the bond now trading down to 104.4 cents on the dollar (1Y price range: 104.4-105.2).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.00% | Maturity: 28/11/2025 | Rating: BB | ISIN: FR0013299435 | Z-spread up by 17.0 bp to 122.8 bp (CDS basis: 9.7bp), with the yield to worst at 1.1% and the bond now trading down to 99.2 cents on the dollar (1Y price range: 98.6-99.4).

- Issuer: Telecom Italia Finance SA (Luxembourg, Luxembourg) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: BB | ISIN: XS0161100515 | Z-spread up by 16.6 bp to 383.4 bp (CDS basis: -35.4bp), with the yield to worst at 4.0% and the bond now trading down to 131.4 cents on the dollar (1Y price range: 131.0-133.2).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 3.00% | Maturity: 23/10/2029 | Rating: BB+ | ISIN: XS2010039894 | Z-spread up by 15.7 bp to 244.6 bp, with the yield to worst at 2.5% and the bond now trading down to 102.3 cents on the dollar (1Y price range: 102.1-103.4).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 14.7 bp to 281.3 bp, with the yield to worst at 2.9% and the bond now trading down to 96.7 cents on the dollar (1Y price range: 96.5-97.6).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.88% | Maturity: 6/7/2032 | Rating: BB+ | ISIN: XS2362416617 | Z-spread up by 13.3 bp to 425.8 bp, with the yield to worst at 4.8% and the bond now trading down to 92.3 cents on the dollar (1Y price range: 91.8-93.5).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 3.38% | Maturity: 16/4/2026 | Rating: BB+ | ISIN: XS2154325489 | Z-spread down by 14.2 bp to 103.6 bp, with the yield to worst at 0.9% and the bond now trading up to 109.2 cents on the dollar (1Y price range: 108.8-109.3).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: BB- | ISIN: XS2283225477 | Z-spread down by 14.5 bp to 481.1 bp, with the yield to worst at 4.8% and the bond now trading up to 84.2 cents on the dollar (1Y price range: 82.4-84.9).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: BB- | ISIN: XS1731858715 | Z-spread down by 37.5 bp to 568.3 bp, with the yield to worst at 5.3% and the bond now trading up to 93.7 cents on the dollar (1Y price range: 91.9-94.0).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.50% | Maturity: 26/7/2024 | Rating: BB- | ISIN: XS1652965085 | Z-spread down by 83.8 bp to 553.1 bp, with the yield to worst at 5.1% and the bond now trading up to 91.1 cents on the dollar (1Y price range: 87.1-91.1).

SELECTED RECENT USD BOND ISSUES

- CCO Holdings LLC (Cable/Media | St. Louis, Missouri, United States | Rating: BB): US$1,200m Senior Note (US1248EPCQ45), fixed rate (4.75% coupon) maturing on 1 February 2032, priced at 100.00 (original spread of 304 bp), callable (10nc5)

- Commercial Metals Co (Metals/Mining | Irving, United States | Rating: BB+): US$300m Senior Note (US201723AR41), fixed rate (4.38% coupon) maturing on 15 March 2032, priced at 100.00, callable (10nc5)

- Commercial Metals Co (Metals/Mining | Irving, United States | Rating: BB+): US$300m Senior Note (US201723AQ67), fixed rate (4.13% coupon) maturing on 15 January 2030, priced at 100.00, callable (8nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$375m Bond (US3133ENLK46), floating rate (SOFR + 5.0 bp) maturing on 18 January 2024, priced at 100.00, non callable

- Home BancShares Inc (Banking | Conway, United States | Rating: NR): US$300m Subordinated Note (US436893AC51), floating rate maturing on 30 January 2032, priced at 100.00, callable (10nc5)

- Range Resources Corp (Oil and Gas | Fort Worth, United States | Rating: BB-): US$500m Senior Note (US75281ABK43), fixed rate (4.75% coupon) maturing on 15 February 2030, priced at 100.00, callable (8nc3)

- Ares Finance Co. IV LLC (Financial - Other | Rating: BBB+): US$500m Senior Note (US039936AA70), fixed rate (3.65% coupon) maturing on 1 February 2052, priced at 97.78 (original spread of 190 bp), callable (30nc30)

- Compania Cervecerias Unidas SA (Beverage/Bottling | Las Condes, Santiago, Chile | Rating: BBB): US$600m Senior Note (US204429AA25), fixed rate (3.35% coupon) maturing on 21 January 2032, priced at 99.87 (original spread of 165 bp), callable (10nc10)

- Indian Railway Finance Corp Ltd (Financial - Other | New Delhi, India | Rating: BBB-): US$500m Senior Note (US45434M2H45), fixed rate (3.57% coupon) maturing on 21 January 2032, priced at 100.00 (original spread of 203 bp), non callable

- JSW Infrastructure Ltd (Industrials - Other | Mumbai, Maharashtra, India | Rating: BB+): US$400m Note (US46654XAA72), fixed rate (4.95% coupon) maturing on 29 January 2029, priced at 100.00, callable (7nc7)

- Ontario, Province of (Official and Muni | Toronto, Ontario, Canada | Rating: A+): US$1,500m Bond (US683234AU21), fixed rate (2.13% coupon) maturing on 21 January 2032, priced at 99.86 (original spread of 41 bp), non callable

- Singapore Airlines Ltd (Airline | Singapore | Rating: NR): US$600m Senior Note (XS2405871570), fixed rate (3.38% coupon) maturing on 19 January 2029, priced at 99.27 (original spread of 180 bp), callable (7nc7)

- Sweihan PV Power Company PJSC (Financial - Other | Abu Dhabi, United Arab Emirates | Rating: NR): US$701m Note (XS2382853641), fixed rate (3.63% coupon) maturing on 31 January 2049, priced at 100.00 (original spread of 191 bp), non callable

- Virgin Galactic Holdings Inc (Vehicle Parts | Las Cruces, New Mexico, British Virgin Islands | Rating: NR): US$425m Bond (US92766KAA43), fixed rate (2.00% coupon) maturing on 1 February 2027, priced at 100.00, non callable, convertible

SELECTED RECENT EUR BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: A): €1,000m Note (XS2434787235), fixed rate (1.25% coupon) maturing on 20 January 2034, priced at 99.88 (original spread of 135 bp), non callable

- Agence France Locale SA (Agency | Lyon, Auvergne-Rhone-Alpes, France | Rating: AA-): €500m Bond (FR0014007RX5), fixed rate (0.20% coupon) maturing on 20 March 2029, priced at 99.85, non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): €375m Bond () zero coupon maturing on 24 January 2025, priced at 111.00, non callable, convertible

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: NR): €500m Oeffenlicher Pfandbrief (Covered Bond) (DE000BLB6JM4), fixed rate (0.20% coupon) maturing on 20 May 2030, priced at 99.69 (original spread of 44 bp), non callable

- Caixabank SA (Banking | Valencia, Valencia, Spain | Rating: BBB+): €1,000m Senior Note (XS2434702424), floating rate maturing on 21 January 2028, priced at 99.77 (original spread of 107 bp), callable (6nc5)

- Ctp NV (Service - Other | Amsterdam, Noord-Holland, Netherlands | Rating: BBB-): €700m Senior Note (XS2434791690), fixed rate (0.88% coupon) maturing on 20 January 2026, callable (4nc4)

- Cyprus, Republic of (Government) (Sovereign | Nicosia, Cyprus | Rating: BB+): €1,000m Senior Note (XS2434393968), fixed rate (0.95% coupon) maturing on 20 January 2032, priced at 99.58 (original spread of 108 bp), non callable

- Deutsche Apotheker und Aerztebank eG (Banking | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: A+): €275m Hypothekenpfandbrief (Covered Bond) (XS2433141608), floating rate (EU03MLIB + 60.0 bp) maturing on 9 February 2026, priced at 102.16, non callable

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9U5Y2), floating rate maturing on 10 February 2028, priced at 100.00, non callable

- Icade SA (Home Builders | Issy-Les-Moulineaux, France | Rating: BBB+): €500m Bond (FR0014007NF1), fixed rate (1.00% coupon) maturing on 19 January 2030, priced at 99.57 (original spread of 129 bp), callable (8nc8)

- National Grid North America Inc (Utility - Other | Brooklyn, New York, United Kingdom | Rating: BBB+): €500m Senior Note (XS2434710872), fixed rate (1.05% coupon) maturing on 20 January 2031, priced at 100.00 (original spread of 126 bp), callable (9nc9)

- National Grid North America Inc (Utility - Other | Brooklyn, New York, United Kingdom | Rating: BBB+): €500m Senior Note (XS2434710799), fixed rate (0.41% coupon) maturing on 20 January 2026, priced at 100.00 (original spread of 37 bp), callable (4nc4)

- NE Property BV (Securities | Amsterdam, Noord-Holland, Isle Of Man | Rating: NR): €500m Senior Note (XS2434763483), fixed rate (2.00% coupon) maturing on 20 January 2030, priced at 98.71 (original spread of 244 bp), callable (8nc8)

- Sparebank 1 Boligkreditt As (Mortgage Banking | Stavanger, Norway | Rating: A): €1,250m Covered Bond (Other) (XS2434677998), fixed rate (0.13% coupon) maturing on 20 January 2028, priced at 99.99 (original spread of 46 bp), non callable

- Sparebanken Vest Boligkreditt AS (Banking | Bergen, Norway | Rating: NR): €750m Covered Bond (Other) (XS2434412859), fixed rate (0.38% coupon) maturing on 20 January 2032, priced at 99.65 (original spread of 52 bp), non callable

- United Group BV (Cable/Media | Hoofddorp, Noord-Holland, Guernsey | Rating: B): €500m Note (XS2434786260), fixed rate (5.25% coupon) maturing on 1 February 2030, priced at 100.00 (original spread of 5 bp), callable (8nc3)

- United Group BV (Cable/Media | Hoofddorp, Guernsey | Rating: B): €480m Senior Note (XS2434794363), floating rate (EU03MLIB + 4.9 bp) maturing on 2 January 2029, priced at 100.00, with a make whole call

NEW LOANS

- Planet Home Lending LLC, signed a US$ 300m Term Loan B, to be used for general corporate purposes. It matures on 02/01/27 and initial pricing is set at Term SOFR +450bps

- Virtu Financial LLC, signed a US$ 1,800m Term Loan B, to be used for general corporate purposes and stock repurchase. It matures on 01/13/29 and initial pricing is set at Term SOFR +300bps

- Virtu Financial LLC, signed a US$ 250m Revolving Credit Facility maturing on 01/13/25, to be used for general corporate purposes and stock repurchase.

- Fluidra Svcs Sa, signed a € 450m Revolving Credit Facility maturing on 01/21/27, to be used for general corporate purposes

- Fluidra Svcs Sa, signed a US$ 744m Term Loan B, to be used for general corporate purposes. It matures on 01/21/29 and initial pricing is set at Term SOFR +225bps

- Fluidra Svcs Sa, signed a € 450m Term Loan B, to be used for general corporate purposes. It matures on 01/21/29 and initial pricing is set at EURIBOR +225bps

NEW ISSUES IN SECURITIZED CREDIT

- Sumit 2022-Bvue Mortgage Trust issued a fixed-rate CMBS in 5 tranches, for a total of US$ 228 m. Highest-rated tranche offering a yield to maturity of 2.64%, and the lowest-rated tranche a yield to maturity of 3.05%. Bookrunners: Goldman Sachs & Co, Barclays Capital Group

- NYMT Loan Trust 2022-Cp1 issued a fixed-rate RMBS in 4 tranches, for a total of US$ 288 m. Highest-rated tranche offering a yield to maturity of 2.04%, and the lowest-rated tranche a yield to maturity of 3.51%. Bookrunners: Credit Suisse, Morgan Stanley International Ltd, Deutsche Bank Securities Inc

- Comm 2022-Hc Mortgage Trust issued a fixed-rate CMBS in 7 tranches, for a total of US$ 478 m. Highest-rated tranche offering a yield to maturity of 3.02%, and the lowest-rated tranche a yield to maturity of 4.77%. Bookrunners: Deutsche Bank Securities Inc