Credit

Mixed Total Returns For US$ Liquid Corporate Bonds This Week, With IG Down 0.62% and HY Up 0.17%

Summary of US$ corporate bond issuance this week (IFR data): 12 Tranches for US$6.8bn in HY (2022 YTD volume US$11.815bn vs 2021 YTD US$22.61bn), 61 Tranches for US$44.601bn in IG (2022 YTD volume US$107.001bn vs 2021 YTD US$79.585bn)

Published ET

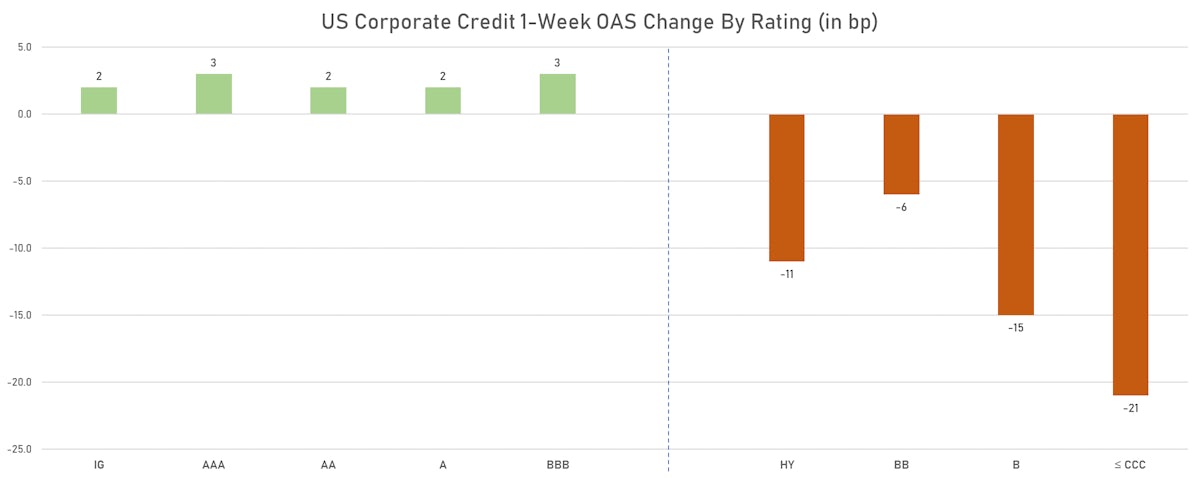

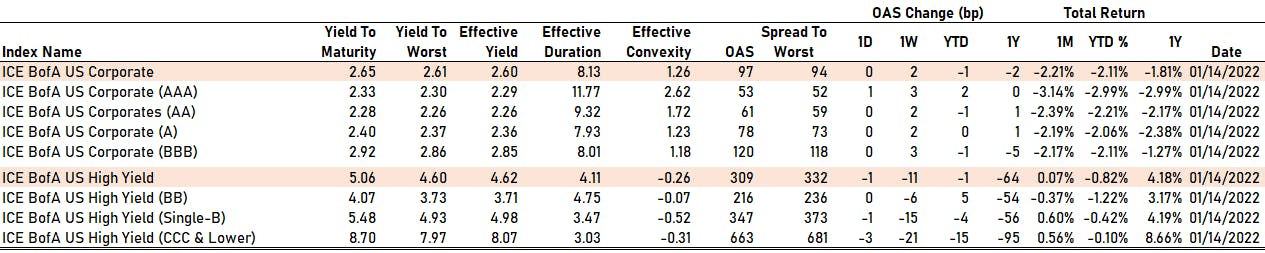

1W Change In US$ Corporate Bonds Options-Adjusted Spreads | Sources: ϕpost, FactSet data

QUICK SUMMARY

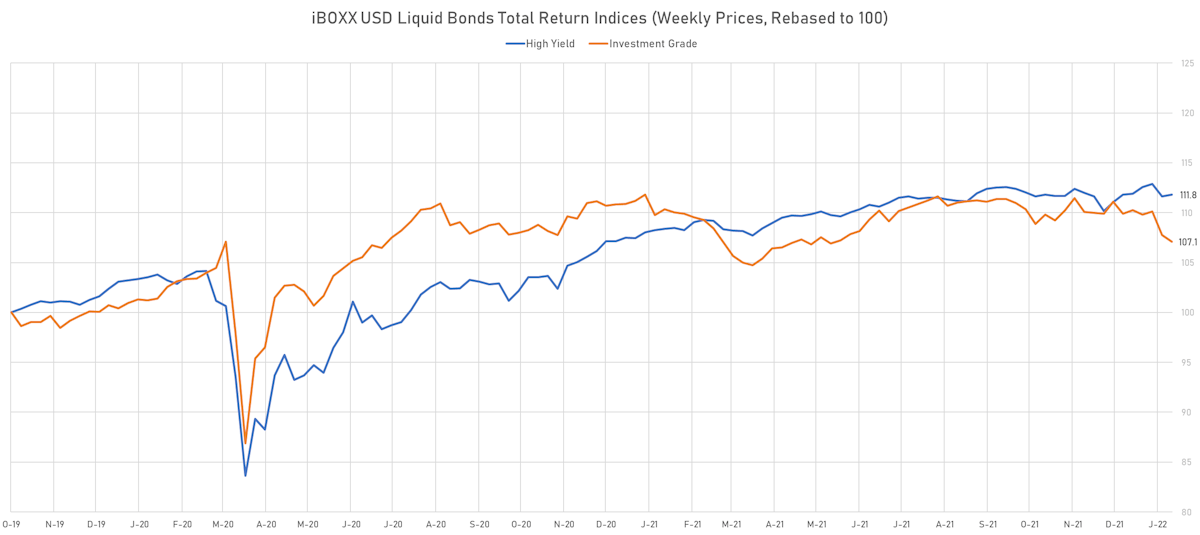

- S&P 500 Bond Index was down -0.68% today, with investment grade down -0.72% and high yield down -0.36% (YTD total return: -2.08%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.823% today (Month-to-date: -2.75%; Year-to-date: -2.75%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.209% today (Month-to-date: -0.93%; Year-to-date: -0.93%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged 0.0 bp, now at 94.0 bp (YTD change: -1.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged 0.0 bp, now at 332.0 bp (YTD change: +2.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: +0.5%)

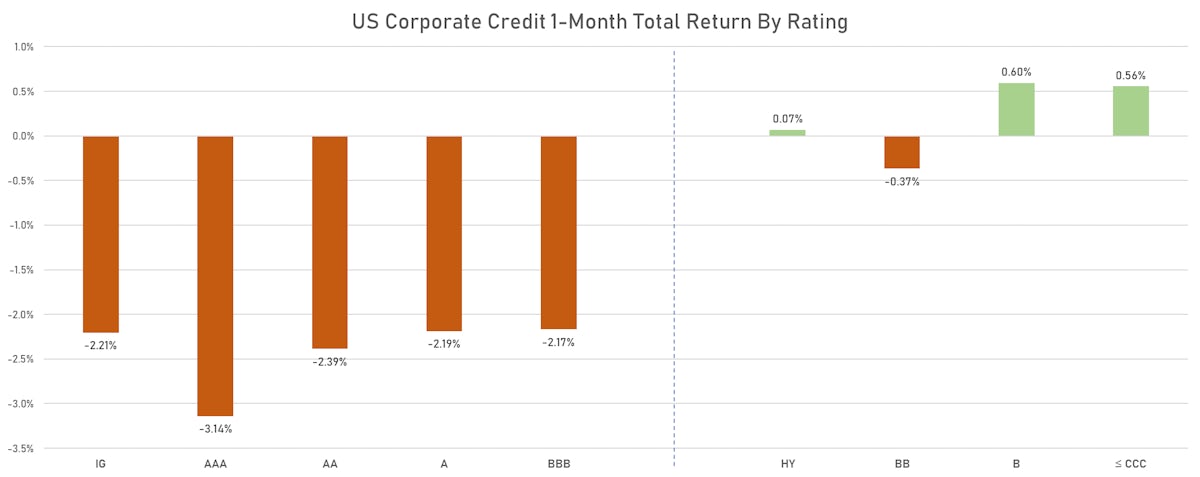

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 53 bp

- AA unchanged at 61 bp

- A unchanged at 78 bp

- BBB unchanged at 120 bp

- BB unchanged at 216 bp

- B down by -1 bp at 347 bp

- CCC down by -3 bp at 663 bp

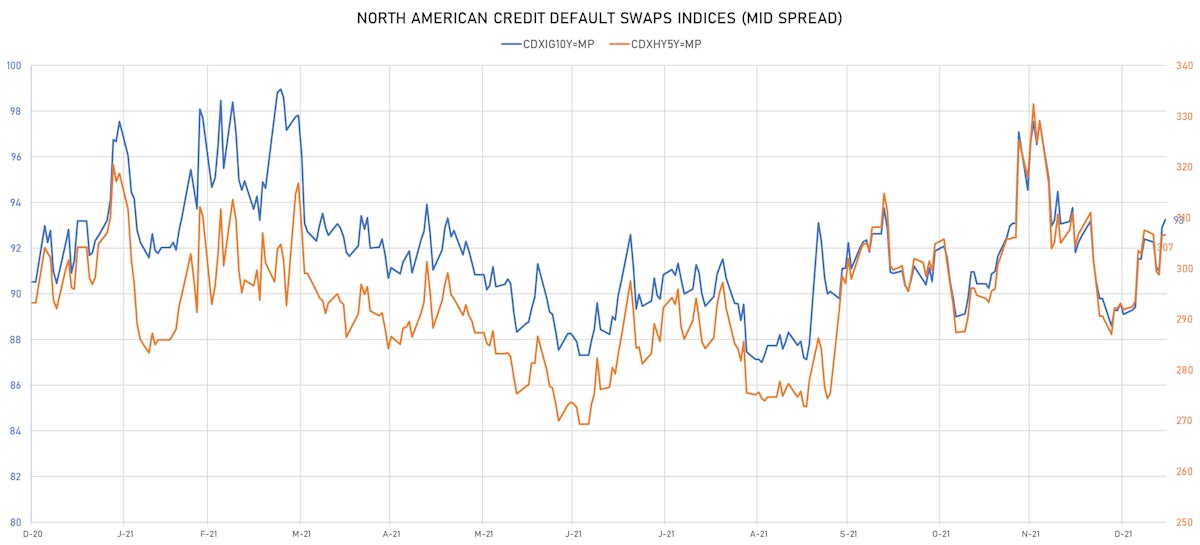

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.3 bp, now at 93bp (YTD change: +4.1bp)

- Markit CDX.NA.HY 5Y unchanged at 307bp (YTD change: +14.6bp)

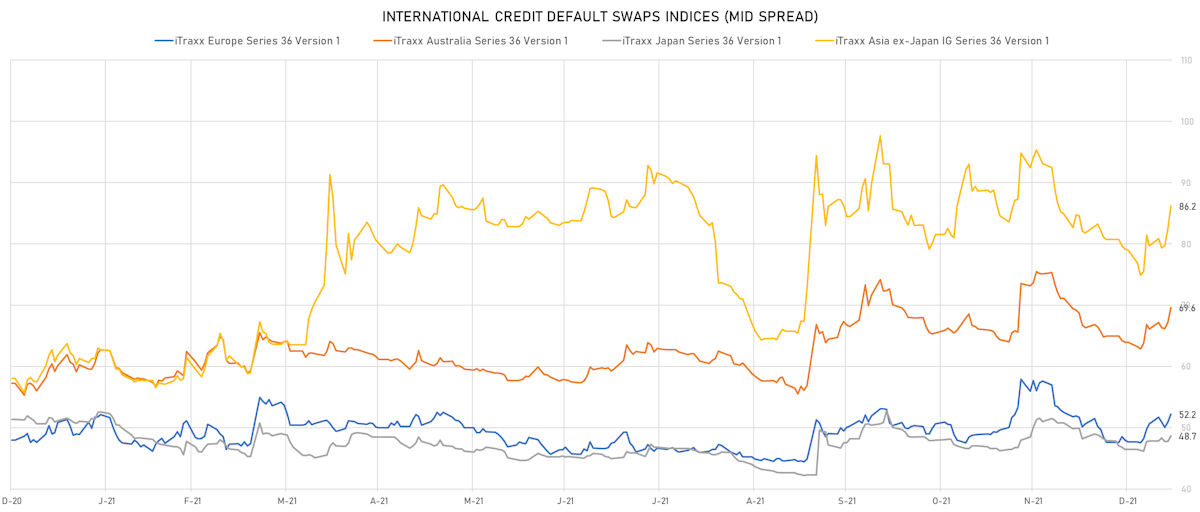

- Markit iTRAXX Europe up 1.2 bp, now at 52bp (YTD change: +4.5bp)

- Markit iTRAXX Japan up 0.9 bp, now at 49bp (YTD change: +2.3bp)

- Markit iTRAXX Asia Ex-Japan up 3.7 bp, now at 86bp (YTD change: +7.2bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 140.2 bp to 1,675.3bp (1Y range: 941-2,445bp)

- Staples Inc (Country: US; rated: B2): down 131.2 bp to 1,068.6bp (1Y range: 662-1,159bp)

- DISH DBS Corp (Country: US; rated: B2): down 51.6 bp to 454.8bp (1Y range: 317-562bp)

- Central Bank of Tunisia (Country: TN; rated: ): down 27.1 bp to 914.4bp (1Y range: 300-914bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 27.0 bp to 420.0bp (1Y range: 291-572bp)

- American Airlines Group Inc (Country: US; rated: B2): down 25.9 bp to 722.9bp (1Y range: 596-1,340bp)

- Bombardier Inc (Country: CA; rated: Caa1): down 21.5 bp to 409.5bp (1Y range: 395-823bp)

- Turkey, Republic of (Government) (Country: TR; rated: BB): down 21.1 bp to 559.6bp (1Y range: 283-620bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): down 18.7 bp to 369.3bp (1Y range: 299-699bp)

- Genworth Holdings Inc (Country: US; rated: B2): down 16.6 bp to 343.8bp (1Y range: 335-676bp)

- MBIA Inc (Country: US; rated: Ba3): down 15.9 bp to 298.3bp (1Y range: 298-565bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): up 17.4 bp to 186.2bp (1Y range: 124-401bp)

- Russia, Federation of (Government) (Country: RU; rated: P-3): up 47.5 bp to 177.5bp (1Y range: 77-178bp)

- Rite Aid Corp (Country: US; rated: B3): up 49.0 bp to 1,018.7bp (1Y range: 497-1,019bp)

- Egypt, Arab Republic of (Government) (Country: EG; rated: Ba2): up 64.0 bp to 566.7bp (1Y range: 319-567bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 50.7 bp to 455.4bp (1Y range: 455-694bp)

- J Sainsbury PLC (Country: GB; rated: WR): down 23.4 bp to 131.6bp (1Y range: 61-157bp)

- TUI AG (Country: DE; rated: B3-PD): down 16.5 bp to 682.4bp (1Y range: 607-946bp)

- Air France KLM SA (Country: FR; rated: B-): down 14.8 bp to 404.4bp (1Y range: 386-699bp)

- thyssenkrupp AG (Country: DE; rated: B1): down 7.3 bp to 216.3bp (1Y range: 205-300bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): down 7.2 bp to 250.6bp (1Y range: 145-272bp)

- Leonardo SpA (Country: IT; rated: BBB-): down 6.3 bp to 151.6bp (1Y range: 125-228bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 6.6 bp to 185.1bp (1Y range: 107-227bp)

- Electricite de France SA (Country: FR; rated: A3): up 8.2 bp to 60.8bp (1Y range: 40-61bp)

- Carrefour SA (Country: FR; rated: Baa1): up 8.8 bp to 110.0bp (1Y range: 45-110bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 9.5 bp to 1,374.9bp (1Y range: 561-1,564bp)

- Novafives SAS (Country: FR; rated: Caa1): up 12.0 bp to 662.2bp (1Y range: 618-976bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 15.8 bp to 384.9bp (1Y range: 339-493bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 20.4 bp to 600.9bp (1Y range: 358-661bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 29.4 bp to 650.6bp (1Y range: 464-779bp)

SELECTED RECENT USD BOND ISSUES

- BNP Paribas SA (Banking | Paris, Ile-De-France, France | Rating: A+): US$355m Note (FR0014007LU4) zero coupon maturing on 18 January 2052, non-callable

- BNP Paribas SA (Banking | Paris, Ile-De-France, France | Rating: A+): US$230m Note (FR0014007MN7) zero coupon maturing on 19 January 2052, non-callable

SELECTED RECENT EUR BOND ISSUES

- Digital Knight Finance SARL (Financial - Other | Luxembourg, United States | Rating: NR): €105m Inhaberschuldverschreibung (DE000A3K0PB5), fixed rate (4.50% coupon) maturing on 15 February 2027, priced at 100.00, non-callable

- Wendel SE (Financial - Other | Paris, Ile-De-France, France | Rating: BBB): €300m Bond (FR0014006VH2), fixed rate (1.38% coupon) maturing on 18 January 2034, priced at 99.44 (original spread of 150 bp), callable (12nc12)