Credit

Wider Spreads Across The Credit Complex, Higher Yields Take US$ Liquid IG Down 3.58%, HY Down 1.41% YTD

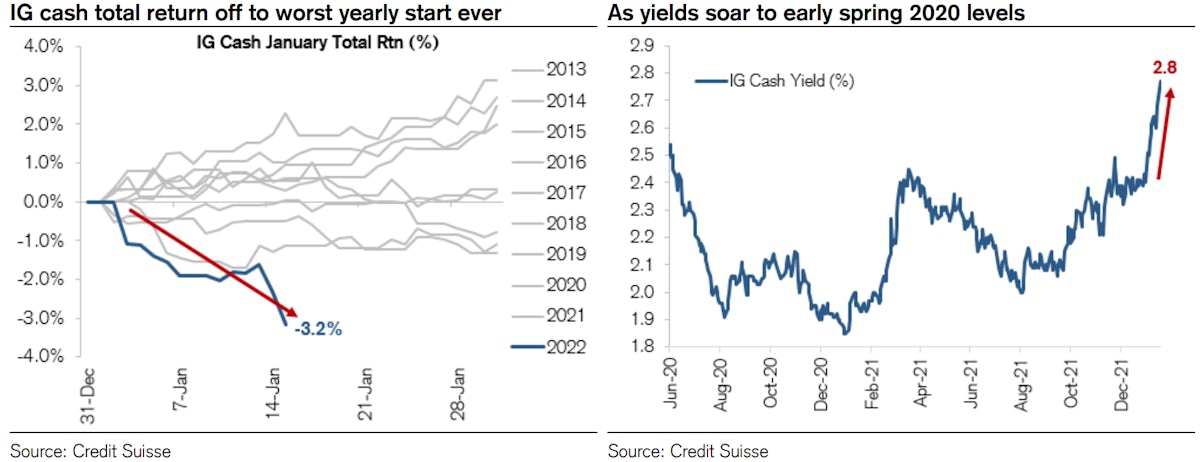

In a note today, Credit Suisse points out that the recent weakness in US$ IG cash (worst yearly start ever) is likely to turn around after the March FOMC: with the first rate hike out of the way, rates volatility should start receding and demand for IG should come back, bringing spreads tighter

Published ET

USD IG Cash Performance YTD | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.72% today, with investment grade down -0.75% and high yield down -0.50% (YTD total return: -2.79%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.876% today (Month-to-date: -3.58%; Year-to-date: -3.58%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.529% today (Month-to-date: -1.41%; Year-to-date: -1.41%)

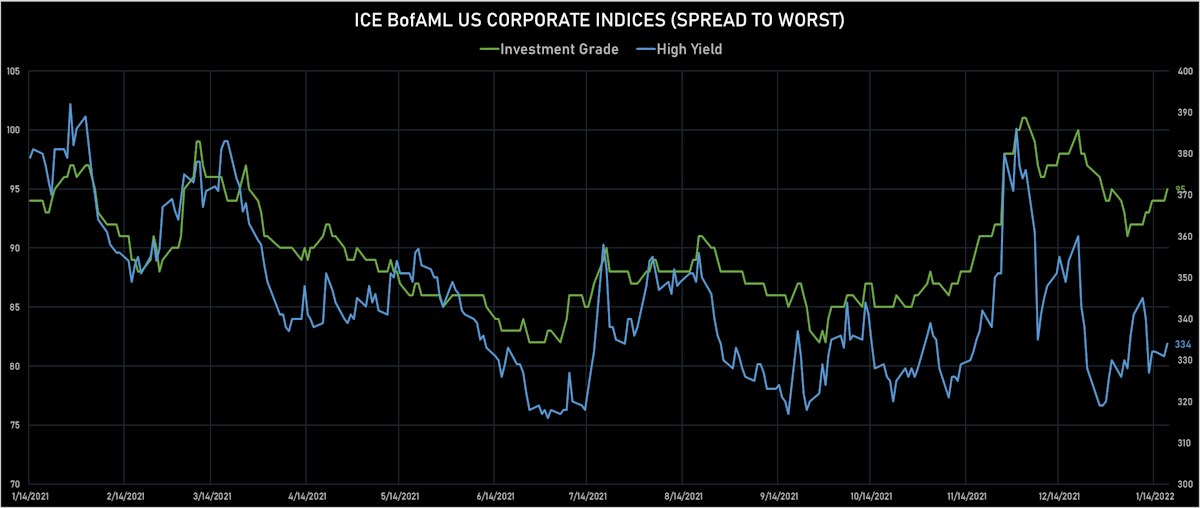

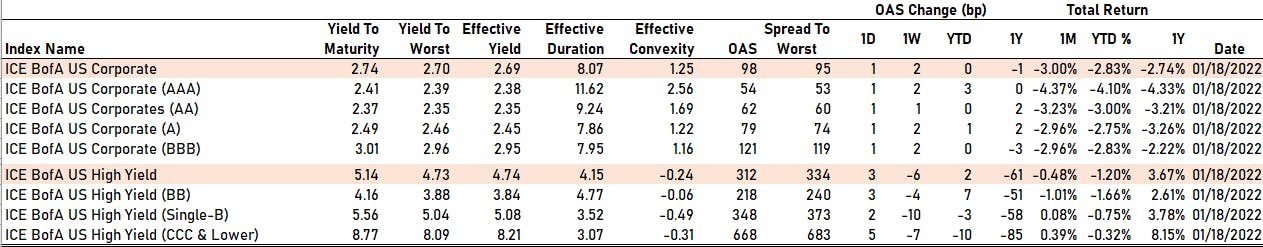

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 95.0 bp

- ICE BofA US High Yield Index spread to worst up 3.0 bp, now at 334.0 bp (YTD change: +4.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +0.6%)

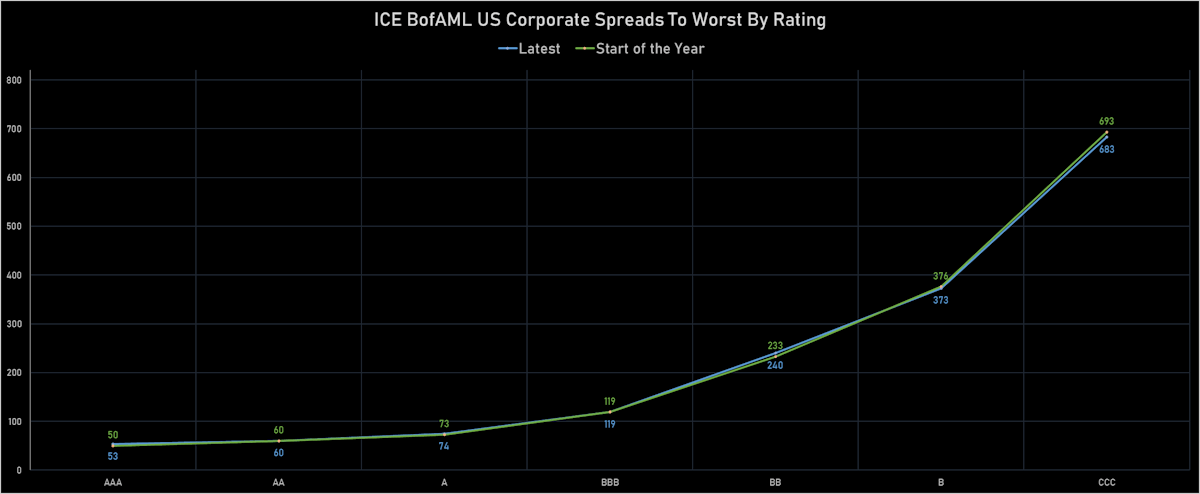

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 54 bp

- AA up by 1 bp at 62 bp

- A up by 1 bp at 79 bp

- BBB up by 1 bp at 121 bp

- BB up by 3 bp at 218 bp

- B up by 2 bp at 348 bp

- CCC up by 5 bp at 668 bp

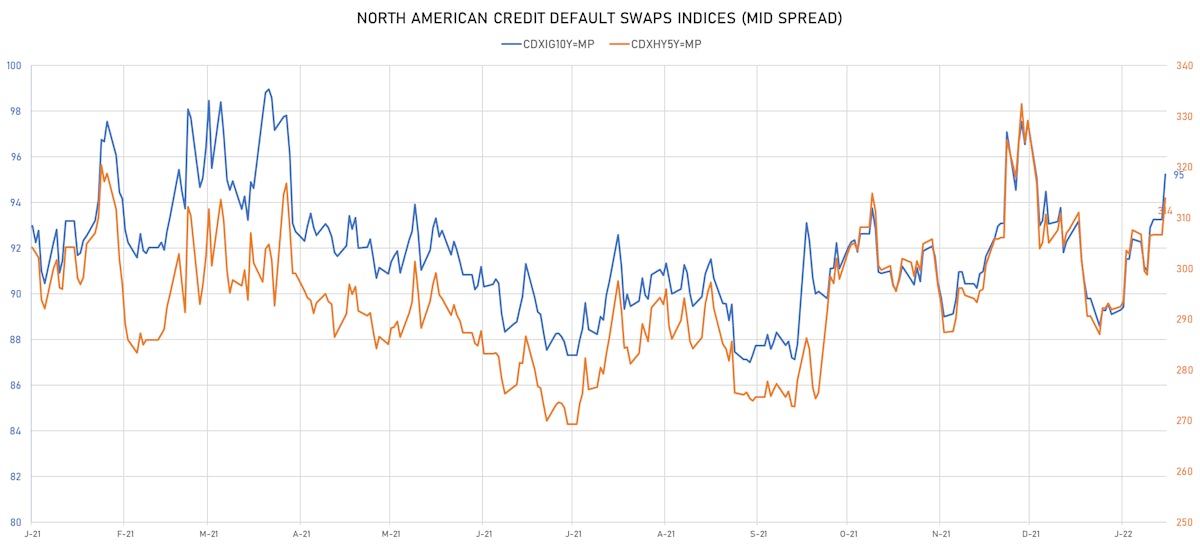

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 2.0 bp, now at 95bp (YTD change: +6.1bp)

- Markit CDX.NA.HY 5Y up 7.3 bp, now at 314bp (YTD change: +21.9bp)

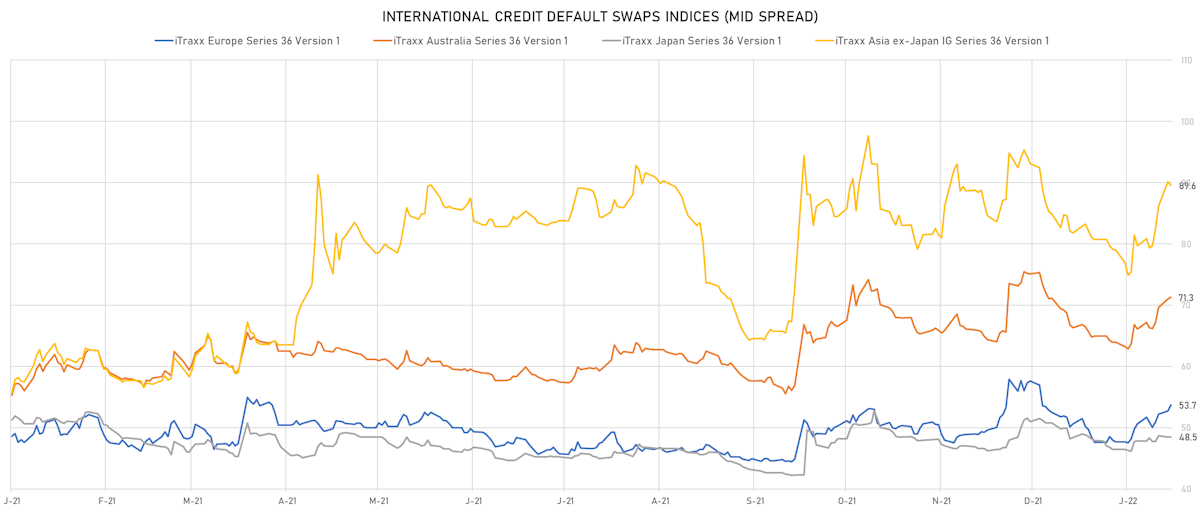

- Markit iTRAXX Europe up 1.0 bp, now at 54bp (YTD change: +6.0bp)

- Markit iTRAXX Japan unchanged at 49bp (YTD change: +2.1bp)

- Markit iTRAXX Asia Ex-Japan down 0.6 bp, now at 90bp (YTD change: +10.5bp)

USD CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Staples Inc (Country: US; rated: B2): down 51.2 bp to 1,066.8bp (1Y range: 662-1,159bp)

- Tegna Inc (Country: US; rated: Ba3): up 18.1 bp to 377.3bp (1Y range: 148-377bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 19.1 bp to 377.9bp (1Y range: 299-688bp)

- Murphy Oil Corp (Country: US; rated: Ba3): up 19.4 bp to 354.6bp (1Y range: 280-564bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): up 20.1 bp to 537.8bp (1Y range: 363-538bp)

- DISH DBS Corp (Country: US; rated: B2): up 20.6 bp to 467.9bp (1Y range: 317-562bp)

- South Africa, Republic of (Government) (Country: ZA; rated: WR): up 21.0 bp to 216.4bp (1Y range: 177-245bp)

- American Airlines Group Inc (Country: US; rated: B2): up 21.5 bp to 742.4bp (1Y range: 596-1,340bp)

- Kohls Corp (Country: US; rated: Baa2): up 21.8 bp to 190.7bp (1Y range: 101-191bp)

- Bath & Body Works Inc (Country: US; rated: Ba2): up 22.5 bp to 192.6bp (1Y range: 124-401bp)

- Gap Inc (Country: US; rated: WR): up 25.1 bp to 245.2bp (1Y range: 132-245bp)

- Macy's Inc (Country: US; rated: Ba2): up 26.2 bp to 272.2bp (1Y range: 181-552bp)

- Russia, Federation of (Government) (Country: RU; rated: P-3): up 63.9 bp to 198.9bp (1Y range: 77-199bp)

- Egypt, Arab Republic of (Government) (Country: EG; rated: Ba2): up 65.3 bp to 571.7bp (1Y range: 319-578bp)

- Rite Aid Corp (Country: US; rated: B3): up 73.6 bp to 1,059.8bp (1Y range: 497-1,060bp)

EURO CDS SINGLE NAMES - LARGEST MOVES IN THE PAST WEEK

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 31.0 bp to 450.1bp (1Y range: 447-694bp)

- J Sainsbury PLC (Country: GB; rated: WR): down 17.9 bp to 126.7bp (1Y range: 61-157bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 8.7 bp to 184.7bp (1Y range: 164-267bp)

- Carrefour SA (Country: FR; rated: Baa1): up 10.8 bp to 110.3bp (1Y range: 45-110bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 11.0 bp to 281.5bp (1Y range: 210-308bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 11.9 bp to 1,390.9bp (1Y range: 582-1,564bp)

- Stena AB (Country: SE; rated: B2-PD): up 13.4 bp to 415.6bp (1Y range: 401-728bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 14.0 bp to 397.4bp (1Y range: 339-493bp)

- Electricite de France SA (Country: FR; rated: BBB-): up 14.1 bp to 65.5bp (1Y range: 40-65bp)

- Elo SA (Country: FR; rated: ): up 16.9 bp to 140.8bp (1Y range: 83-242bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 18.2 bp to 434.2bp (1Y range: 333-481bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 24.5 bp to 614.0bp (1Y range: 358-661bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 26.0 bp to 202.8bp (1Y range: 107-227bp)

- Novafives SAS (Country: FR; rated: Caa1): up 29.6 bp to 677.5bp (1Y range: 618-976bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 51.2 bp to 674.7bp (1Y range: 464-779bp)

SELECTED RECENT USD BOND ISSUES

- Citigroup Inc (Banking | New York City, United States | Rating: BBB+): US$3,000m Senior Note (US17327CAQ69), floating rate maturing on 25 January 2033, priced at 100.00 (original spread of 161 bp), callable (11nc3)

- Citigroup Inc (Banking | New York City, United States | Rating: BBB+): US$2,000m Senior Note (US17327CAN39), floating rate maturing on 25 January 2026, priced at 100.00 (original spread of 67 bp), callable (4nc3)

- Citigroup Inc (Banking | New York City, United States | Rating: BBB+): US$500m Senior Note (US17327CAP86), floating rate (SOFR + 69.3 bp) maturing on 25 January 2026, priced at 100.00, callable (4nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$300m Bond (US3133ENLU28), fixed rate (1.32% coupon) maturing on 21 January 2025, priced at 100.00 (original spread of 2 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133ENLS71), fixed rate (2.32% coupon) maturing on 26 January 2032, priced at 100.00, callable (10nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$155m Bond (US3133ENLR98), fixed rate (2.00% coupon) maturing on 24 January 2029, priced at 100.00, callable (7nc1)

- Huzhou City Investment Development Group Co Ltd (Financial - Other | Huzhou, China (Mainland) | Rating: BBB-): US$300m Senior Note (XS2429785954), fixed rate (2.85% coupon) maturing on 25 January 2025, priced at 100.00, non callable

- Hyundai Capital Services Inc (Financial - Other | Seoul, South Korea | Rating: BBB+): US$300m Bond (USY3815NBF79), fixed rate (2.50% coupon) maturing on 24 January 2027, priced at 99.54 (original spread of 97 bp), non callable

- Hyundai Capital Services Inc (Financial - Other | Seoul, South Korea | Rating: BBB+): US$400m Bond (US44920UAS78), fixed rate (2.13% coupon) maturing on 24 April 2025, priced at 99.74 (original spread of 87 bp), non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$200m Unsecured Note (XS2217989610), floating rate maturing on 20 December 2026, priced at 100.00, non callable

- Xin Yue Co Ltd (Financial - Other | Hong Kong | Rating: NR): US$500m Senior Note (XS2422522685), fixed rate (2.36% coupon) maturing on 25 January 2027, priced at 100.00 (original spread of 75 bp), non callable

SELECTED RECENT EUR BOND ISSUES

- Aktia Bank Abp (Banking | Helsinki, Finland | Rating: A-): €500m Covered Bond (Other) (XS2436153139), fixed rate (0.13% coupon) maturing on 25 October 2028, priced at 99.46 (original spread of 46 bp), non callable

- Autostrade per l'Italia SpA (Transportation - Other | Rome, Roma, Italy | Rating: BB): €500m Senior Note (XS2434701616), fixed rate (1.63% coupon) maturing on 25 January 2028, priced at 99.38, callable (6nc6)

- Autostrade per l'Italia SpA (Transportation - Other | Rome, Italy | Rating: BB): €500m Senior Note (XS2434702853), fixed rate (2.25% coupon) maturing on 25 January 2032, priced at 99.04 (original spread of 241 bp), callable (10nc10)

- Belgium, Kingdom of (Government) (Sovereign | Brussels, Bruxelles-Capitale, Belgium | Rating: AA-): €5,000m Obligation Lineaire (BE0000354630), fixed rate (0.35% coupon) maturing on 22 June 2032, priced at 99.87 (original spread of 38 bp), non callable

- Berlin Hyp AG (Banking | Berlin, Germany | Rating: A+): €500m Note (DE000BHY0GN0), fixed rate (0.38% coupon) maturing on 25 January 2027, priced at 99.82 (original spread of 73 bp), non callable

- Bpce SA (Banking | Paris, France | Rating: A): €1,000m Bond (FR0014007VF4), fixed rate (0.38% coupon) maturing on 2 February 2026, priced at 99.64 (original spread of 86 bp), non callable

- Bper Banca SpA (Banking | Modena, Italy | Rating: BB-): €600m Subordinated Note (XS2433828071), fixed rate (3.88% coupon) maturing on 25 July 2032, priced at 100.00 (original spread of 378 bp), callable (11nc5)

- Ctec II GmbH (Financial - Other | Luxembourg | Rating: CCC+): €515m Bond (XS2434776113) maturing on 2 February 2030, priced at 100.00, non callable

- DVI Deutsche Vermogensund Immobilienverwaltung GmbH (Financial - Other | Rating: BBB-): €350m Senior Note (XS2431964001), fixed rate (2.50% coupon) maturing on 25 January 2027, priced at 99.46 (original spread of 296 bp), callable (5nc5)

- Gecina SA (Real Estate Investment Trust | Paris, France | Rating: A-): €500m Bond (FR0014007VP3), fixed rate (0.88% coupon) maturing on 25 January 2033, priced at 98.21 (original spread of 110 bp), callable (11nc11)

- Islandsbanki hf (Banking | Kopavogur, Iceland | Rating: BBB): €300m Note (XS2411447043), fixed rate (0.75% coupon) maturing on 25 March 2025, priced at 99.88 (original spread of 122 bp), non callable

- Municipality Finance Plc (Agency | Helsinki, Finland | Rating: AA+): €1,000m Senior Note (XS2435663393), fixed rate (0.25% coupon) maturing on 25 February 2032, priced at 98.99 (original spread of 38 bp), non callable

- NRW Bank (Agency | Dusseldorf, Germany | Rating: AA): €500m Senior Note (DE000NWB0AQ0), fixed rate (0.25% coupon) maturing on 26 January 2032, priced at 99.11 (original spread of 43 bp), non callable

- Quebec, Province of (Official and Muni | Quebec City, Quebec, Canada | Rating: AA-): €2,250m Unsecured Note (XS2435787283), fixed rate (0.50% coupon) maturing on 25 January 2032, priced at 99.24 (original spread of 61 bp), non callable

- Royal Bank of Canada (Banking | Toronto, Canada | Rating: A): €2,000m Covered Bond (Other) (XS2436159847), fixed rate (0.13% coupon) maturing on 26 April 2027, priced at 99.68 (original spread of 52 bp), non callable

- Salerno Pompei Napoli SpA (Financial - Other | Rating: NR): €125m Bond (XS2434407420), fixed rate (2.80% coupon) maturing on 19 January 2045, priced at 100.00, non callable

NEW LOANS

- Physician Partners Inc, signed a US$ 600m Term Loan B maturing on 02/02/29, to be used for a leveraged buyout

- NTPC Ltd (BBB-), signed a US$ 500m Term Loan maturing on 01/18/29, to be used for capital expenditures