Credit

Good Day For US$ Bond Issuance, Led By $12BN Offering From Goldman, $6BN From Morgan Stanley

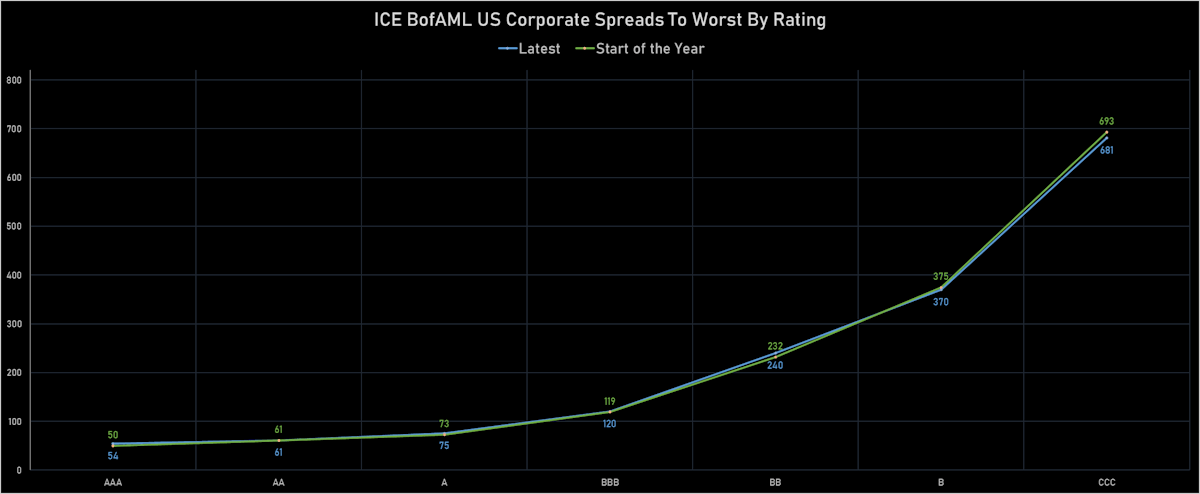

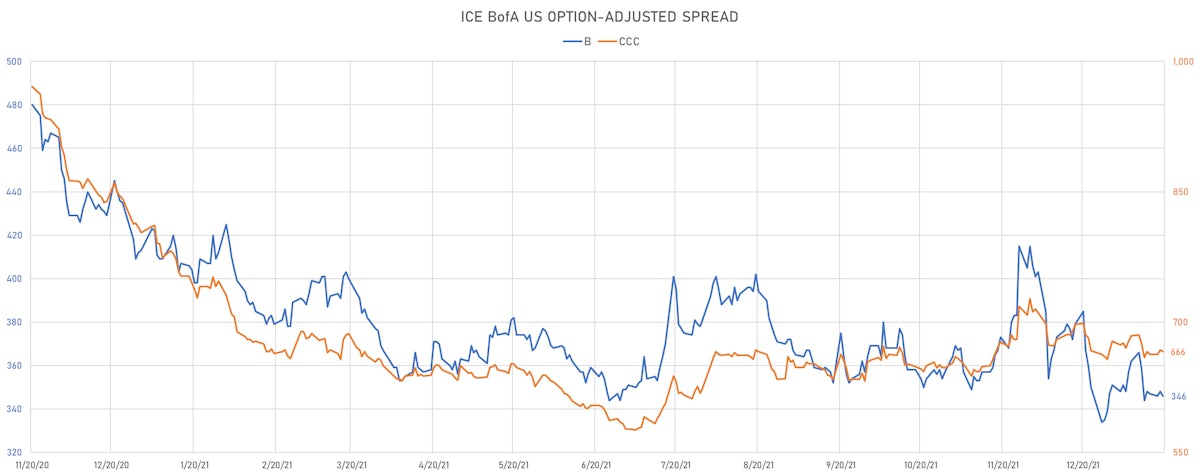

We could have expected the lowest-rated issuers to be hit the hardest by rising yields, but looking at USD cash indices, only single-Bs and CCCs have seen spread compression year-to-date (OAS down 5bp and 12bp respectively)

Published ET

ICE BofAML US Corporate OAS For Single-Bs & CCCs | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.25% today, with investment grade up 0.27% and high yield up 0.08% (YTD total return: -2.55%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.387% today (Month-to-date: -3.20%; Year-to-date: -3.20%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.161% today (Month-to-date: -1.26%; Year-to-date: -1.26%)

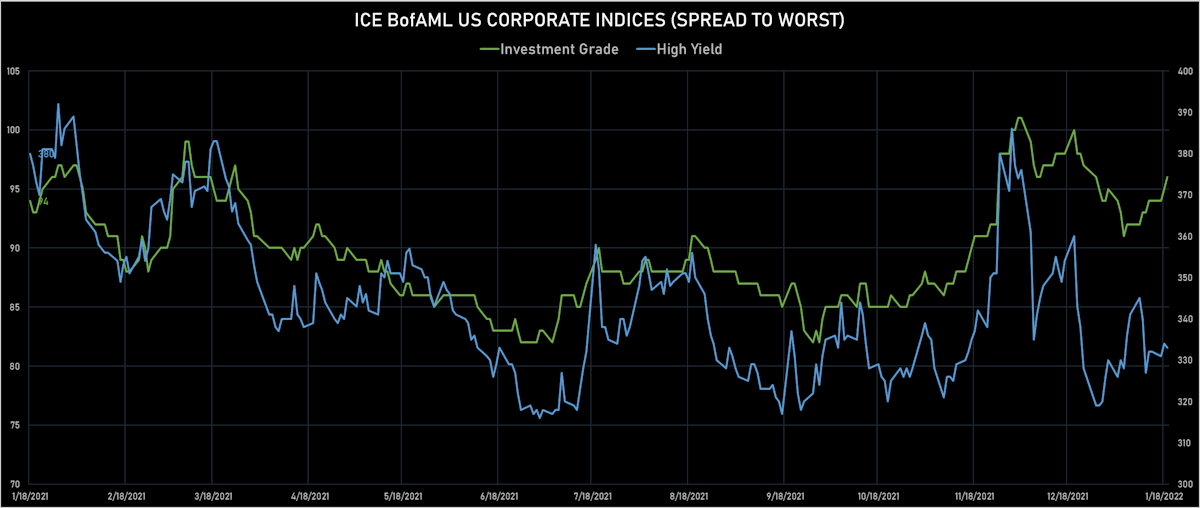

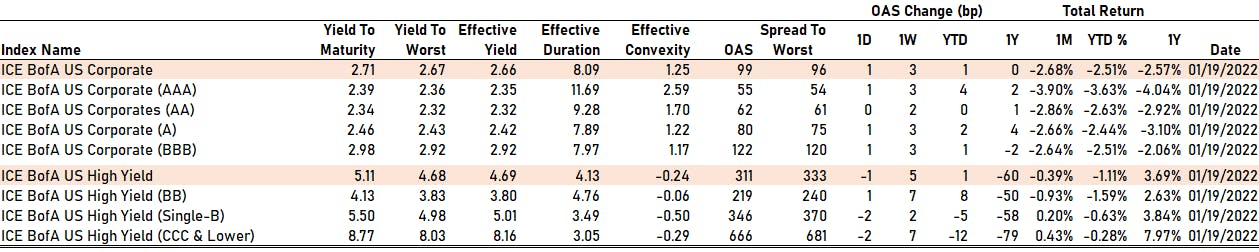

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 96.0 bp (YTD change: +1.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 333.0 bp (YTD change: +3.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.03% today (YTD total return: +0.6%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 55 bp

- AA unchanged at 62 bp

- A up by 1 bp at 80 bp

- BBB up by 1 bp at 122 bp

- BB up by 1 bp at 219 bp

- B down by -2 bp at 346 bp

- CCC down by -2 bp at 666 bp

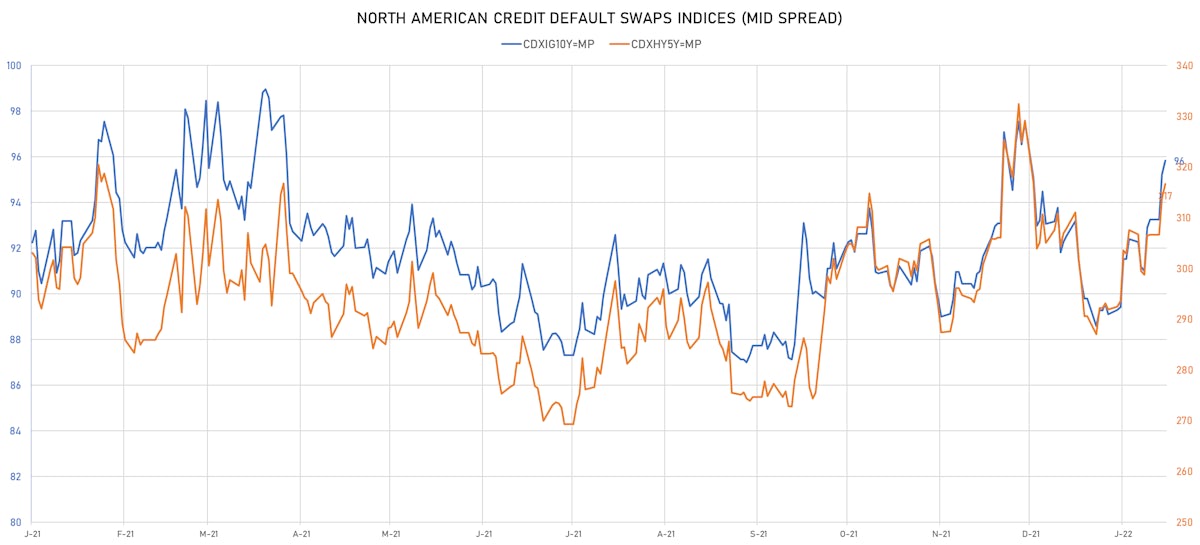

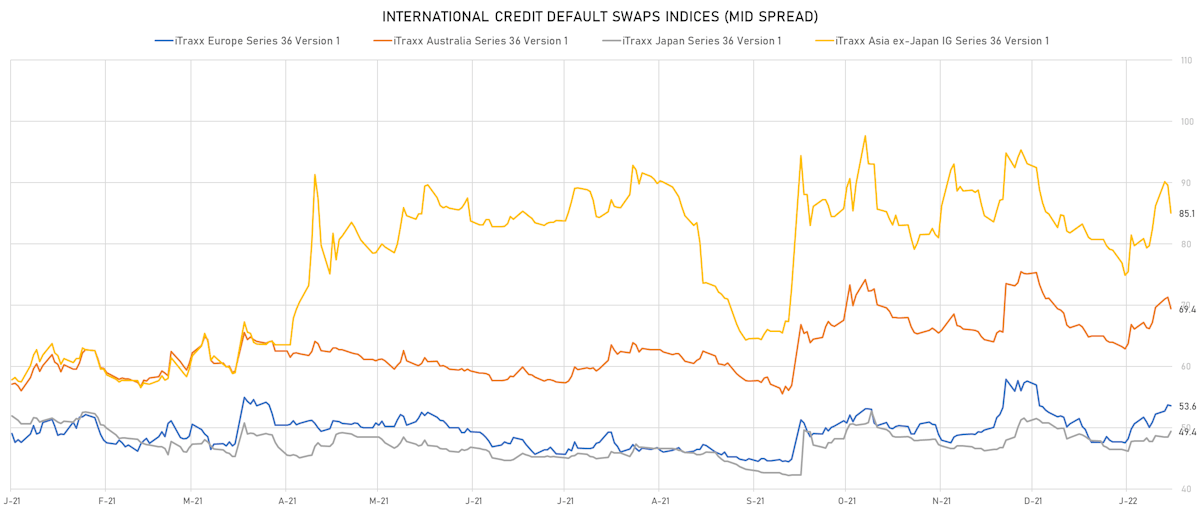

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.6 bp, now at 96bp (YTD change: +6.7bp)

- Markit CDX.NA.HY 5Y up 2.8 bp, now at 317bp (YTD change: +24.7bp)

- Markit iTRAXX Europe down 0.1 bp, now at 54bp (YTD change: +5.9bp)

- Markit iTRAXX Japan up 0.9 bp, now at 49bp (YTD change: +3.0bp)

- Markit iTRAXX Asia Ex-Japan down 4.5 bp, now at 85bp (YTD change: +6.0bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Wanda Properties International Co Ltd (British Virgin Islands) | Coupon: 7.25% | Maturity: 29/1/2024 | Rating: BB- | ISIN: XS1023280271 | Z-spread up by 436.1 bp to 1,402.7 bp, with the yield to worst at 14.1% and the bond now trading down to 87.4 cents on the dollar (1Y price range: 85.1-94.9).

- Issuer: Mhp Se (Kiev, Cyprus) | Coupon: 7.75% | Maturity: 10/5/2024 | Rating: B | ISIN: XS1577965004 | Z-spread up by 332.2 bp to 1,082.5 bp, with the yield to worst at 11.5% and the bond now trading down to 92.0 cents on the dollar (1Y price range: 91.8-101.9).

- Issuer: MHP Lux SA (Luxembourg, Luxembourg) | Coupon: 6.95% | Maturity: 3/4/2026 | Rating: B | ISIN: XS1713469911 | Z-spread up by 243.5 bp to 902.5 bp, with the yield to worst at 10.4% and the bond now trading down to 87.6 cents on the dollar (1Y price range: 87.6-99.6).

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 7.65% | Maturity: 1/10/2027 | Rating: B+ | ISIN: XS2233227516 | Z-spread up by 222.0 bp to 931.0 bp, with the yield to worst at 10.5% and the bond now trading down to 87.0 cents on the dollar (1Y price range: 87.0-100.0).

- Issuer: Rail Capital Markets PLC (London, United Kingdom) | Coupon: 8.25% | Maturity: 9/7/2024 | Rating: B | ISIN: XS1843433472 | Z-spread up by 178.5 bp to 1,114.7 bp, with the yield to worst at 11.7% and the bond now trading down to 91.9 cents on the dollar (1Y price range: 90.6-98.3).

- Issuer: CBOM Finance PLC (DUBLIN, Ireland) | Coupon: 3.88% | Maturity: 21/9/2026 | Rating: BB | ISIN: XS2384475930 | Z-spread up by 121.5 bp to 537.5 bp, with the yield to worst at 6.8% and the bond now trading down to 87.5 cents on the dollar (1Y price range: 87.2-95.0).

- Issuer: CALC Bond 3 Ltd (#N/A, British Virgin Islands) | Coupon: 5.50% | Maturity: 8/3/2024 | Rating: BB | ISIN: XS1574821143 | Z-spread up by 111.1 bp to 1,020.2 bp, with the yield to worst at 10.6% and the bond now trading down to 89.5 cents on the dollar (1Y price range: 87.1-91.5).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 99.8 bp to 1,217.0 bp, with the yield to worst at 13.1% and the bond now trading down to 80.0 cents on the dollar (1Y price range: 78.0-87.3).

- Issuer: Yapi ve Kredi Bankasi AS (Turkey) | Coupon: 5.85% | Maturity: 21/6/2024 | Rating: B | ISIN: XS1634372954 | Z-spread down by 111.1 bp to 504.4 bp, with the yield to worst at 6.2% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 96.2-99.1).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Metinvest BV (Amsterdam, Netherlands) | Coupon: 5.63% | Maturity: 17/6/2025 | Rating: B+ | ISIN: XS2056722734 | Z-spread up by 298.4 bp to 1,077.4 bp, with the yield to worst at 10.3% and the bond now trading down to 86.4 cents on the dollar (1Y price range: 86.0-99.4).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 3.10% | Maturity: 21/1/2026 | Rating: BB | ISIN: XS2281299763 | Z-spread up by 87.6 bp to 563.6 bp, with the yield to worst at 5.5% and the bond now trading down to 91.0 cents on the dollar (1Y price range: 90.6-96.0).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 69.7 bp to 591.9 bp, with the yield to worst at 5.9% and the bond now trading down to 92.1 cents on the dollar (1Y price range: 90.2-95.0).

- Issuer: Atrium Finance Issuer BV (Amsterdam, Netherlands) | Coupon: 2.63% | Maturity: 5/9/2027 | Rating: BB | ISIN: XS2294495838 | Z-spread up by 54.6 bp to 358.1 bp, with the yield to worst at 3.5% and the bond now trading down to 94.4 cents on the dollar (1Y price range: 94.4-97.7).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 3.63% | Maturity: 28/1/2027 | Rating: BB- | ISIN: XS2102392276 | Z-spread up by 47.8 bp to 319.3 bp, with the yield to worst at 3.1% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 101.2-104.2).

- Issuer: Atrium European Real Estate Ltd (Saint Helier, Jersey) | Coupon: 3.00% | Maturity: 11/9/2025 | Rating: BB | ISIN: XS1829325239 | Z-spread up by 41.2 bp to 262.4 bp, with the yield to worst at 2.5% and the bond now trading down to 101.1 cents on the dollar (1Y price range: 101.1-102.9).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 2.13% | Maturity: 6/2/2024 | Rating: BB- | ISIN: XS1731858715 | Z-spread up by 40.2 bp to 525.3 bp, with the yield to worst at 4.9% and the bond now trading down to 94.5 cents on the dollar (1Y price range: 91.9-94.6).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread up by 39.3 bp to 336.7 bp, with the yield to worst at 3.2% and the bond now trading down to 108.0 cents on the dollar (1Y price range: 107.9-109.5).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 3.63% | Maturity: 24/9/2024 | Rating: CCC+ | ISIN: XS2055091784 | Z-spread up by 33.8 bp to 334.6 bp (CDS basis: 0.2bp), with the yield to worst at 3.0% and the bond now trading down to 101.0 cents on the dollar (1Y price range: 100.8-101.9).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: BB- | ISIN: XS2283225477 | Z-spread up by 29.7 bp to 510.7 bp, with the yield to worst at 5.2% and the bond now trading down to 82.4 cents on the dollar (1Y price range: 81.8-84.9).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 26.6 bp to 307.8 bp, with the yield to worst at 3.2% and the bond now trading down to 94.9 cents on the dollar (1Y price range: 94.9-97.6).

- Issuer: Heimstaden AB (Malmo, Sweden) | Coupon: 4.25% | Maturity: 9/3/2026 | Rating: BB+ | ISIN: SE0015657903 | Z-spread up by 25.2 bp to 417.5 bp, with the yield to worst at 4.0% and the bond now trading down to 100.2 cents on the dollar (1Y price range: 100.1-100.7).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | Z-spread up by 24.5 bp to 289.6 bp, with the yield to worst at 2.9% and the bond now trading down to 96.6 cents on the dollar (1Y price range: 96.6-98.3).

- Issuer: Autostrade per l'Italia SpA (Rome, Italy) | Coupon: 2.00% | Maturity: 15/1/2030 | Rating: BB | ISIN: XS2278566299 | Z-spread up by 23.3 bp to 168.4 bp (CDS basis: -36.5bp), with the yield to worst at 1.9% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 99.9-103.6).

SELECTED RECENT USD BOND ISSUES

- Builders FirstSource Inc (Building Products | Dallas, United States | Rating: BB): US$300m Senior Note (US12008RAQ02), fixed rate (4.25% coupon) maturing on 1 February 2032, priced at 100.50 (original spread of 236 bp), callable (10nc5)

- Claremont Mckenna College (Service - Other | Claremont, United States | Rating: NR): US$300m Bond (US18013RAB33), fixed rate (3.78% coupon) maturing on 1 January 2122, priced at 100.00 (original spread of 160 bp), with a make whole call

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$350m Bond (US3133ENLY40), fixed rate (1.04% coupon) maturing on 25 January 2024, priced at 100.00 (original spread of 3 bp), callable (2nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$295m Bond (US3133ENLW83), floating rate (SOFR + 4.0 bp) maturing on 25 January 2024, priced at 100.00, non callable

- Goldman Sachs Group Inc (Banking | New York City, United States | Rating: BBB+): US$600m Unsecured Note (XS1970494487) zero coupon maturing on 10 February 2062, non callable

- JPMorgan Chase & Co (Banking | New York City, United States | Rating: A-): US$285m Unsecured Note (XS1450779233) zero coupon maturing on 14 February 2057, priced at 100.00, non callable

- Morgan Stanley (Banking | New York City, United States | Rating: BBB+): US$1,250m Senior Note (US61747YEJ01), floating rate (SOFR + 62.5 bp) maturing on 24 January 2025, priced at 100.00, callable (3nc2)

- Morgan Stanley (Banking | New York City, United States | Rating: BBB+): US$2,250m Senior Note (US61747YEK73), floating rate maturing on 21 January 2028, priced at 100.00 (original spread of 88 bp), callable (6nc5)

- Morgan Stanley (Banking | New York City, United States | Rating: BBB+): US$2,500m Senior Note (US61747YEL56), floating rate maturing on 21 January 2033, priced at 100.00 (original spread of 113 bp), callable (11nc10)

- Target Corp (Retail Stores - Other | Minneapolis, United States | Rating: A): US$1,000m Senior Note (US87612EBM75), fixed rate (1.95% coupon) maturing on 15 January 2027, priced at 99.83 (original spread of 38 bp), callable (5nc5)

- US Acute Care Solutions LLC (Financial - Other | Canton, United States | Rating: NR): US$225m Note (US90367UAC53), fixed rate (6.38% coupon) maturing on 1 March 2026, priced at 101.50 (original spread of 430 bp), callable (4nc1)

- Caisse Amortissement de la Dette Sociale (Agency | Paris, Ile-De-France, France | Rating: AA): US$3,000m Senior Note (US12802D2H82), fixed rate (2.13% coupon) maturing on 26 January 2032, priced at 99.87, non callable

- Henan Railway Construction Investment Group Co Ltd (Financial - Other | Zhengzhou, Henan, China (Mainland) | Rating: A): US$400m Senior Note (XS2406547765), fixed rate (2.20% coupon) maturing on 26 January 2025, priced at 100.00, non callable

- Huzhou Mogan Mountain High tech Group Co Ltd (Service - Other | Huzhou, China (Mainland) | Rating: NR): US$210m Senior Note (XS2427994889), fixed rate (3.40% coupon) maturing on 24 January 2025, priced at 100.00, non callable

- Japan Finance Organization for Municipalities (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): US$750m Senior Note (XS2432358393), fixed rate (1.50% coupon) maturing on 27 January 2025, priced at 99.93 (original spread of 21 bp), non callable

- Nederlandse Waterschapsbank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): US$1,250m Senior Note (US63983TEF84), fixed rate (1.13% coupon) maturing on 15 March 2024, priced at 99.80 (original spread of 21 bp), non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$200m Unsecured Note (XS2217989610), floating rate maturing on 20 December 2026, priced at 100.00, non callable

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A-): US$220m Senior Note (XS2347740008) zero coupon maturing on 20 January 2052, priced at 100.00 (original spread of 157 bp), callable (30nc5)

- Societe Generale SA (Banking | Paris, France | Rating: A-): US$220m Unsecured Note (XS2347738366) zero coupon maturing on 26 January 2052, priced at 100.00, non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$150m Unsecured Note (XS2024989654) zero coupon maturing on 9 February 2052, priced at 100.00, non callable

SELECTED RECENT EUR BOND ISSUES

- Acciona Energia Financiacion Filiales SA (Financial - Other | Alcobendas, Madrid, Spain | Rating: NR): €500m Senior Note (XS2436160183), fixed rate (1.38% coupon) maturing on 26 January 2032, priced at 99.89 (original spread of 144 bp), non callable

- Austria, Republic of (Government) (Sovereign | Wien, Wien, Austria | Rating: AA+): €3,500m Bundesanleihe (AT0000A2VB47) zero coupon maturing on 20 October 2028, priced at 99.83 (original spread of 25 bp), non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A+): €1,500m Note (XS2436160779), fixed rate (0.10% coupon) maturing on 26 January 2025, priced at 99.96 (original spread of 69 bp), callable (3nc2)

- Bank of Montreal (Banking | Montreal, Quebec, Canada | Rating: A+): €2,750m Covered Bond (Other) (XS2430951744), fixed rate (0.13% coupon) maturing on 26 January 2027, priced at 99.71 (original spread of 50 bp), non callable

- Berlin, State of (Official and Muni | Berlin, Berlin, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000A3H2Y73), fixed rate (0.63% coupon) maturing on 26 January 2052, priced at 99.62 (original spread of 36 bp), non callable

- Bpce SA (Banking | Paris, France | Rating: BBB): €1,000m Bond (FR0014007VJ6), floating rate maturing on 2 February 2034, priced at 99.60 (original spread of 179 bp), callable (12nc7)

- Ctec II GmbH (Financial - Other | Muenchen, Bayern, Luxembourg | Rating: CCC+): €465m Senior Note (XS2434776113), fixed rate (5.25% coupon) maturing on 15 February 2030, priced at 100.00 (original spread of 540 bp), callable (8nc3)

- Edreams Odigeo SA (Service - Other | Madrid, Madrid, Spain | Rating: CCC+): €375m Note (XS2435555821), fixed rate (5.50% coupon) maturing on 15 July 2027, priced at 100.00 (original spread of 580 bp), callable (5nc2)

- Muenchener Hypothekenbank eG (Banking | Muenchen, Bayern, Germany | Rating: AA-): €750m Hypothekenpfandbrief (Covered Bond) (DE000MHB29J3), fixed rate (0.13% coupon) maturing on 1 February 2029, priced at 99.35 (original spread of 44 bp), non callable

- P3 Group SARL (Financial - Other | Luxembourg | Rating: BBB): €500m Senior Note (XS2436807866), fixed rate (0.88% coupon) maturing on 26 January 2026, priced at 99.33 (original spread of 148 bp), callable (4nc4)

- Raiffeisen Bank International AG (Banking | Wien, Wien, Austria | Rating: A-): €500m Covered Bond (Other) (XS2435783613), fixed rate (0.13% coupon) maturing on 26 January 2028, priced at 99.50 (original spread of 49 bp), non callable

NEW LOANS

- Addison Group, signed a US$ 525m Term Loan B, to be used for leveraged buyout. It matures on 01/19/29 and initial pricing is set at Term SOFR +425.000bps

- Athenahealth Inc, signed a US$ 1,000m Delayed Draw Term Loan, to be used for general corporate purposes, working capital and a leveraged buyout. It matures on 01/26/29 and initial pricing is set at Term SOFR +400bp

- Athenahealth Inc, signed a US$ 5,750m Term Loan B, to be used for general corporate purposes, working capital and a leveraged buyout. It matures on 01/26/29 and initial pricing is set at Term SOFR +400bp

- Tempo Acquisition LLC (BB-), signed a US$ 523m Term Loan B, to be used for general corporate purposes. It matures on 08/31/28 and initial pricing is set at Term SOFR +300bp

- Precisely Hldg Llc, signed a US$ 200m Term Loan B, to be used for acquisition financing. It matures on 04/23/28 and initial pricing is set at LIBOR +400bp

- Bakelite AG, signed a US$ 485m Term Loan B, to be used for general corporate purposes and acquisition financing.

- AssuredPartners Inc (CCC+), signed a US$ 500m Term Loan B maturing on 02/13/27, to be used for general corporate purposes and acquisition financing.

- Vietinbank, signed a US$ 1,000m Revolving Credit / Term Loan, to be used for general corporate purposes

- Tempo Acquisition LLC (BB-), signed a US$ 1,956m Term Loan B, to be used for general corporate purposes. It matures on 08/31/28 and initial pricing is set at Term SOFR +300bp

NEW ISSUES IN SECURITIZED CREDIT

- FREED ABS Trust 2022-1FP issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 233 m. Highest-rated tranche offering a yield to maturity of 0.94%, and the lowest-rated tranche a yield to maturity of 3.35%. Bookrunners: Credit Suisse, Jefferies & Co Inc, Truist Securities Inc